Professional Documents

Culture Documents

08 Int'l Biz Trade Barriers Sess 13

Uploaded by

Vivek Adate0 ratings0% found this document useful (0 votes)

1 views14 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views14 pages08 Int'l Biz Trade Barriers Sess 13

Uploaded by

Vivek AdateCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

INTERNATIONAL BUSINESS

Trade Barriers

Prof Bharat Nadkarni

International Business

Trade Barriers

Trade Barriers are the artificial restrictions imposed by the

governments on free flow of goods and services between countries.

Tariffs, quotas, taxes, duties, foreign exchange restrictions, trade

agreements and trading blocs are the techniques used for

restricting free movement of goods from one country to the other.

Trade barriers can be broadly classified into two categories:

1. Tariff barriers or Fiscal controls

2. Non-tariff barriers or quantitative restrictions

International Business

Objectives of Trade Barriers

1. To protect home industries from foreign competition

2. To promote new industries and Research & Development

3. To conserve Foreign exchange reserves

4. To maintain favourable Balance of Payment

5. To protect economy from dumping

6. To curb conspicuous consumption

7. To make economy self reliant

8. To mobilise public revenue

9. To counteract Trade barriers imposed by other countries

International Business

Types of Tariff Trade Barriers

1. Classification of Tariffs on the Basis of Origin

a. Export Duty

b. Import Duty

c. Transit Duty

2. Classification on the Basis of Purpose

a. Revenue Tariff

b. Protective Tariff

c. Anti-Dumping Duty

d. Countervailing Duty

International Business

Anti – Dumping Policy

Dumping is defined as the act of a manufacturer in one

country exporting a product to another country (1) at a price

which is either below the price it charges in its home market

or (2) it is less than normal manufacturing cost in another

country or (3) if it can be proven that there has been a

substantial increase of a specific good; dumping large

surpluses into a market will substantially lower the market

price as will introducing lower than market priced goods. The

term has a negative connotation as advocates of free markets

see “Dumping” as a form of protectionism.

Anti-dumping action means charging extra import duty on a

particular product from the particular exporting country in order

to bring its price closer to the “normal value” or to remove the

injury to domestic industry in the importing country.

International Business

Types of Non-Tariff Trade Barriers

1. Quota

2. Import Licensing

3. Consular formalities

4. Trading Blocs

5. Customs Regulation

6. State Trading

7. Export Obligation

8. Exchange Control

9. Boycott

International Business

Foreign Exchange

Prof Bharat Nadkarni

International Business

Theories for Determining Foreign Exchange Rates

1. Purchasing Power Parity

Purchasing power parity is a theory about exchange rate

determination based on a plain idea that the two currencies

involved in the calculation of the exchange rate have the same

purchasing power for the same good sold in the two countries.

2. Interest Rate Parity

The determination of exchange rate in a forward market finds

an important place in the theory of Interest Rate Parity (IRP).

The IRP theory states that equilibrium is achieved when the

forward rate differential is approximately equal to the interest

rate differential. In other words, the forward rate differs from

the spot rate by an amount that represents the interest rate

differential. In this process, the currency of a country with a

lower interest rate should be

International Business

at a forward premium in relation to the currency of a

country with a higher interest rate.

• Interest Rate Arbitrage

This is borrowing a currency in one country, transferring in

to another (at spot rate), investing it in the converted

currency, and converting it back to original currency at

forward rate, repaying loan and making profit.

Profit depends upon spot-forward rate and interest rate

difference in two countries.

In perfect market there should not be any arbitrage

opportunity. But in practice such opportunities exist and as

arbitrageurs spot it and use it, these opportunities vanish

and equilibrium is established.

International Business

3. The Fisher effect

According to Fisher, the interest rate has two components

viz., a real return and adjustment for price level changes.

The formula given by Fisher is :

Nominal Interest Rate = Real Interest Rate + Expected

Inflation Rate.

International Business

Factors influencing Exchange Rates fluctuations

1. Change in the demand and supply of foreign exchange.

2. State of International trade.

3. Monetary policy – regulation of money supply and frequent

changes.

4. Capital movement.- FDI, Borrowings and Aid etc.

5. Industrial factors. – GDP growth

6. Inflation in domestic markets

7. Political conditions.

8. Capital markets and Stock exchange condition.

9. Banking condition.

10. National Income

11. Psychological factors.

12. Market factors – Seasonal variations etc.

International Business

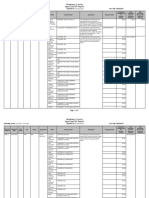

Documents for Letter of Credit

1. Copy of Contract / Purchase Order

2. Certificate of Origin

3. Certificate of Quality

4. Certificate of Quantity

5. Proforma Invoice

6. Packing List

7. Insurance Certificate

8. Bill of Lading / Airway Bill

Terms in Logistics

1. Draft

2. Unloading operations and quantity certificates

3. Inner and outer anchorage

4. Ship to Ship transfer

5. Tide Table

6. Ballasting

7. Demurrage

8. Ullage

9. Solid cargo

10. L N G

INCOTERMS ( Int’l commercial terms)

11. Ex-Works

12. F A S

13. F O B

14. C & F

15. C I F

Thank you

You might also like

- IFM Assignment On International Business Finance 2009Document10 pagesIFM Assignment On International Business Finance 2009Melese ewnetie89% (9)

- Quizzes International Business and TradeDocument2 pagesQuizzes International Business and TradeRonald SaludesNo ratings yet

- Mark SPitznagel - Different Black SwanDocument14 pagesMark SPitznagel - Different Black SwanVinny Sareen100% (4)

- Pile cp12Document46 pagesPile cp12casarokarNo ratings yet

- International Financial ManagementDocument3 pagesInternational Financial ManagementSandeep Patil100% (2)

- Co Ope MarketingDocument16 pagesCo Ope MarketingRavi Sundar RajaNo ratings yet

- International Financial Management Notes Unit-1Document15 pagesInternational Financial Management Notes Unit-1Geetha aptdcNo ratings yet

- Unit 1 IfmDocument19 pagesUnit 1 IfmMohammed HussainNo ratings yet

- Group 6 International Trade Written ReportDocument6 pagesGroup 6 International Trade Written ReportFionalyn Mel ValenzuelaNo ratings yet

- NN 7Document11 pagesNN 7Ngan DoanNo ratings yet

- International Trade & Multinational CorporationsDocument14 pagesInternational Trade & Multinational CorporationsOjan MayaNo ratings yet

- Điền từDocument4 pagesĐiền từMai ĐàoNo ratings yet

- ITB 7th SemDocument7 pagesITB 7th SemSweta BastiaNo ratings yet

- Definition of International TradeDocument7 pagesDefinition of International TradeSinta YuliawatiNo ratings yet

- International Business Economics 3Document7 pagesInternational Business Economics 3Md YusufNo ratings yet

- International Economics NotesDocument34 pagesInternational Economics NotesAshrith SabhanamNo ratings yet

- Maseco 3 ReviewerDocument54 pagesMaseco 3 ReviewerMiaNo ratings yet

- Module 1 IfmDocument17 pagesModule 1 IfmAYISHA BEEVI UNo ratings yet

- Q1) Factors Affecting Exchange Rates: Interest and Inflation RatesDocument7 pagesQ1) Factors Affecting Exchange Rates: Interest and Inflation RatesMandar SangleNo ratings yet

- IF Internals 1Document11 pagesIF Internals 1Amith AlphaNo ratings yet

- 8 International Aspect of FM - Jan 2012Document10 pages8 International Aspect of FM - Jan 2012Moud KhalfaniNo ratings yet

- AP Macroeconomics Introducing Macroeconomics Focus Sheets: Unit 7, International EconomicsDocument3 pagesAP Macroeconomics Introducing Macroeconomics Focus Sheets: Unit 7, International EconomicsHansamita MajeeNo ratings yet

- International Business Trade Chapter 1Document8 pagesInternational Business Trade Chapter 1Danae CaballeroNo ratings yet

- Capital BudgetingDocument15 pagesCapital BudgetingAishvarya PujarNo ratings yet

- Chapter 5Document22 pagesChapter 5Manjunath BVNo ratings yet

- Foreign Trade University: VocabularyDocument32 pagesForeign Trade University: VocabularyVũ Như NgọcNo ratings yet

- International TheaDocument4 pagesInternational TheaJhon Lloyd QuintanaNo ratings yet

- IFM Question Bank Solved FinalDocument34 pagesIFM Question Bank Solved FinalRavindra BabuNo ratings yet

- Economy of PakistanDocument24 pagesEconomy of PakistanImad AliNo ratings yet

- International FinanceDocument8 pagesInternational Financesarah IsharatNo ratings yet

- Economics: International TradeDocument5 pagesEconomics: International TradeGavin LeeNo ratings yet

- Elements of International BusinessDocument7 pagesElements of International Businesstania leonelaNo ratings yet

- Assignment of International FinanceDocument15 pagesAssignment of International FinancesunnyNo ratings yet

- International FinanceDocument83 pagesInternational Financesamrulezzz100% (1)

- School of Business & Economics (SBE) : North South UniversityDocument50 pagesSchool of Business & Economics (SBE) : North South UniversityShahida Rashid 2125518690No ratings yet

- International Trade and Risk ManagementDocument21 pagesInternational Trade and Risk Managementsubha_bkp50% (2)

- TMIF Chapter ThreeDocument40 pagesTMIF Chapter ThreeYibeltal AssefaNo ratings yet

- Import Expor Policy and Procedure AssignmentDocument6 pagesImport Expor Policy and Procedure AssignmentTsinatNo ratings yet

- MK0018Document8 pagesMK0018Ganesh ShindeNo ratings yet

- International Trade: Difference Between Trade and CommerceDocument22 pagesInternational Trade: Difference Between Trade and CommerceAfad KhanNo ratings yet

- ADVANTAGES OF M-WPS OfficeDocument17 pagesADVANTAGES OF M-WPS Officejav1965No ratings yet

- Quiz - Aggregate Supply and DemandDocument4 pagesQuiz - Aggregate Supply and DemandnaitoreNo ratings yet

- International Trade: IntroductionDocument17 pagesInternational Trade: IntroductionDevyani RathoreNo ratings yet

- Lesson 2 International Financial ManagementDocument4 pagesLesson 2 International Financial ManagementEloysa CarpoNo ratings yet

- International TradeDocument14 pagesInternational TradeSoham DeNo ratings yet

- Chapter 7 Exchange ControlsDocument15 pagesChapter 7 Exchange ControlsMiko DimaandalNo ratings yet

- Q.3. What Are The Assumptions and Criticism Relating To The Theory of Comparative Advantage?Document11 pagesQ.3. What Are The Assumptions and Criticism Relating To The Theory of Comparative Advantage?Moiez AliNo ratings yet

- Chapter 9-Pricing and FinancingDocument22 pagesChapter 9-Pricing and FinancingcchukeeNo ratings yet

- Week 2 (CBM 321) - ReportDocument40 pagesWeek 2 (CBM 321) - ReportDianne PañoNo ratings yet

- 2ND Term S1 CommerceDocument21 pages2ND Term S1 CommerceJudith NgeneNo ratings yet

- International BusinessDocument12 pagesInternational BusinessVivek CVNo ratings yet

- Chapter 1 SolutionDocument2 pagesChapter 1 SolutionRicha Joshi100% (1)

- IFM Question Bank SolvedDocument11 pagesIFM Question Bank SolvedRavindra Babu100% (1)

- A) Measuring Exchange Rate MovementsDocument9 pagesA) Measuring Exchange Rate MovementsjobinNo ratings yet

- Iifm AssignmentDocument3 pagesIifm Assignmentashu1286No ratings yet

- Multination Finance Butler 5th EditionDocument3 pagesMultination Finance Butler 5th EditionUnostudent2014No ratings yet

- International FinanceDocument48 pagesInternational FinanceAizik Lessik AreveNo ratings yet

- SDFSDFSDocument2 pagesSDFSDFSAntonio HerguetaNo ratings yet

- Import and ExportDocument5 pagesImport and ExportMarinela DaumarNo ratings yet

- MF0006 International Financial Management Fall 2010Document5 pagesMF0006 International Financial Management Fall 2010jhaavinashNo ratings yet

- BVIMSR - OR - 2023 - Class Notes - 2Document62 pagesBVIMSR - OR - 2023 - Class Notes - 2Vivek AdateNo ratings yet

- Chapter 6 Capacity and Aggregate PlanningDocument11 pagesChapter 6 Capacity and Aggregate PlanningVivek AdateNo ratings yet

- Chapter 5 Inventory ManagementDocument11 pagesChapter 5 Inventory ManagementVivek AdateNo ratings yet

- MMS 2021-2023 SEM II QP FORMAT 60marks - ORDocument2 pagesMMS 2021-2023 SEM II QP FORMAT 60marks - ORVivek AdateNo ratings yet

- Chapter 3 Facility LocationDocument14 pagesChapter 3 Facility LocationVivek AdateNo ratings yet

- Chapter 4 Facility LayoutDocument5 pagesChapter 4 Facility LayoutVivek AdateNo ratings yet

- 02 Intl Biz Environ Challenges Session 4 & 5Document43 pages02 Intl Biz Environ Challenges Session 4 & 5Akshay ChavanNo ratings yet

- CH - No.3 Gender Bias Women Entrepreneur 25723Document10 pagesCH - No.3 Gender Bias Women Entrepreneur 25723Vivek AdateNo ratings yet

- Rbi IntroductionDocument22 pagesRbi IntroductionVivek AdateNo ratings yet

- Rbi IntroductionDocument22 pagesRbi IntroductionVivek AdateNo ratings yet

- Sample Makemytrip Flight TicketDocument3 pagesSample Makemytrip Flight TicketVivek AdateNo ratings yet

- Eticket: Itinerary and Reservation DetailsDocument3 pagesEticket: Itinerary and Reservation DetailsVivek AdateNo ratings yet

- RbbiDocument14 pagesRbbiVivek AdateNo ratings yet

- CH - No.2 Types of EntrepreneurshipDocument13 pagesCH - No.2 Types of EntrepreneurshipVivek AdateNo ratings yet

- CH - No 9 Business PlanDocument13 pagesCH - No 9 Business PlanVivek AdateNo ratings yet

- Transfer Pricing Methods and Selection of Most Appropriate MethodDocument60 pagesTransfer Pricing Methods and Selection of Most Appropriate MethodVivek AdateNo ratings yet

- Unit2 3 SOCIO-CULTURE ENVIRONMENT OF BUSINESSDocument31 pagesUnit2 3 SOCIO-CULTURE ENVIRONMENT OF BUSINESSVivek AdateNo ratings yet

- Unit 9 Macro - 10 - Money - Banking - and - Credit - CreationDocument42 pagesUnit 9 Macro - 10 - Money - Banking - and - Credit - CreationVivek AdateNo ratings yet

- Unit11 LPGDocument15 pagesUnit11 LPGVivek AdateNo ratings yet

- Unit 12 Balance of PaymentsDocument13 pagesUnit 12 Balance of PaymentsVivek AdateNo ratings yet

- InflationDocument22 pagesInflationCarlos DavidNo ratings yet

- Unit 10 Macro - 11-12 - Fiscal - PolicyDocument33 pagesUnit 10 Macro - 11-12 - Fiscal - PolicyVivek AdateNo ratings yet

- The Impact of Technology On SocietyDocument5 pagesThe Impact of Technology On SocietyVivek AdateNo ratings yet

- Word PracticeDocument6 pagesWord PracticeVivek AdateNo ratings yet

- Types of O.D InterventionDocument1 pageTypes of O.D InterventionVivek AdateNo ratings yet

- Standard DeviationDocument1 pageStandard DeviationVivek AdateNo ratings yet

- InsyncDocument6 pagesInsyncVivek AdateNo ratings yet

- Material CostDocument12 pagesMaterial CostVivek AdateNo ratings yet

- Managerial Eco Project 1Document11 pagesManagerial Eco Project 1Vivek AdateNo ratings yet

- HRM NotesDocument5 pagesHRM NotesVivek AdateNo ratings yet

- Art. Internationalization Processes of Emerging Economy MNEs PDFDocument23 pagesArt. Internationalization Processes of Emerging Economy MNEs PDFjcgarriazoNo ratings yet

- Astm A490m-93Document5 pagesAstm A490m-93NadhiraNo ratings yet

- Health Economic Evaluation 1675505163Document42 pagesHealth Economic Evaluation 1675505163dzszndvkp4No ratings yet

- July Allegheny County Employee Executive ActionsDocument71 pagesJuly Allegheny County Employee Executive ActionsAllegheny JOB WatchNo ratings yet

- The Case For Small and Medium Enterprises in Afghanistan PDFDocument34 pagesThe Case For Small and Medium Enterprises in Afghanistan PDFNomanNo ratings yet

- Birzeit University Department of Economics Public Finance, ECON 434Document2 pagesBirzeit University Department of Economics Public Finance, ECON 434Dina OdehNo ratings yet

- Poa T - 13Document3 pagesPoa T - 13SHEVENA A/P VIJIANNo ratings yet

- Installment Payment Agreement With Penalty InterestDocument2 pagesInstallment Payment Agreement With Penalty InterestAmado III VallejoNo ratings yet

- Determinants of Interest Rate Spreads Among Licensed Commercial Banks in KenyaDocument8 pagesDeterminants of Interest Rate Spreads Among Licensed Commercial Banks in KenyaViverNo ratings yet

- Gs170 Document Contacts&OpportunitiesDocument20 pagesGs170 Document Contacts&OpportunitiesAna BergonziNo ratings yet

- Needs Assessments, Impacts, Financing and Performance IndicatorsDocument91 pagesNeeds Assessments, Impacts, Financing and Performance IndicatorsPenelope Malilwe100% (1)

- HCO 615 Module 6 - Episode 1 TranscriptDocument2 pagesHCO 615 Module 6 - Episode 1 TranscriptAnanyaBandyopadhyayNo ratings yet

- Some Simple Economics of BlockchainDocument39 pagesSome Simple Economics of BlockchainVijay KumarNo ratings yet

- Guidance For The 2023 Reporting of Capital and Financial Condition Testing For Life and Health, P&C and Mortgage InsurersDocument19 pagesGuidance For The 2023 Reporting of Capital and Financial Condition Testing For Life and Health, P&C and Mortgage InsurersCalvinNo ratings yet

- Goods and Services Tax - GSTR-2BDocument48 pagesGoods and Services Tax - GSTR-2BR.Roshini RNo ratings yet

- Guest Reservation Form and Details (Bamba)Document13 pagesGuest Reservation Form and Details (Bamba)Angel BambaNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- Geda Corrugated Iron Sheet Manufacturing (Pas - Iron)Document38 pagesGeda Corrugated Iron Sheet Manufacturing (Pas - Iron)Sabrina Abdurahman100% (1)

- Tma Members List South Circle 2022-2023Document15 pagesTma Members List South Circle 2022-2023acube.printerNo ratings yet

- Chapter 4 Time Value of Money (Part 2b) 2020Document36 pagesChapter 4 Time Value of Money (Part 2b) 2020Nur HazwaniNo ratings yet

- Instance VRB 2021-22.xmlDocument147 pagesInstance VRB 2021-22.xmlSarah AliceNo ratings yet

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet

- Account Must Do List!! Nov - 2022 - 220911 - 200510Document259 pagesAccount Must Do List!! Nov - 2022 - 220911 - 200510KartikNo ratings yet

- Masteral Thesis Proposal ProgramDocument5 pagesMasteral Thesis Proposal ProgramAN NUR EMPALNo ratings yet

- Finance InstrumentsDocument28 pagesFinance InstrumentsThanh Hằng NgôNo ratings yet

- GP Cheat SheetDocument4 pagesGP Cheat SheetAmna KashifNo ratings yet

- Global Development Issues Ass 1Document8 pagesGlobal Development Issues Ass 1amelie.deangelis17No ratings yet

- List No 1286 - 17 - Site No. 02 of Neelakanta Agrahara Village - MalurDocument2 pagesList No 1286 - 17 - Site No. 02 of Neelakanta Agrahara Village - MalurBabu ReddyNo ratings yet