Professional Documents

Culture Documents

Form No. 2E Naya Saral Its - 2E: Verification

Form No. 2E Naya Saral Its - 2E: Verification

Uploaded by

alphabeetaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 2E Naya Saral Its - 2E: Verification

Form No. 2E Naya Saral Its - 2E: Verification

Uploaded by

alphabeetaCopyright:

Available Formats

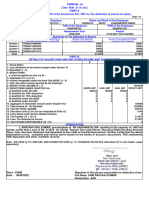

Form No.

2E

NAYA SARAL

ITS - 2E

[INCOME - TAX RETURN FORM FOR RESIDENT INDIVIDUAL/HINDU UNDIVIDED FAMILY NOT HAVING INCOME FROM BUSINESS OR PROFESSION OR CAPITAL GAINS OR AGRICULTURAL INCOME .] [See second proviso to rule 12(1)(b)(iii)]

1. NAME 2. ADDRESS(in case of change) PIN 3. Permanent Account Number : 4. Date of Birth : 5. Status : Individual/Hindu undivided family : 6. Ward/Circle/Special Range : Name of the Bank MICR Code 7. SEX M/F : TELEPHONE 8. Assessment Year : 9. Return : Original or Revised : 10. Particulars of Bank Account : (for payment of refund) Address of Bank Branch Type of Account Account Number

COMPUTATION OF INCOME 1. Income chargeable under the head "Salaries" [Attach Form 16] 2. Annual value / Higher of Annual rent received or receivable / Reduced 307 annual rent received or receivable because of vacancy : 312 3. Taxes actually paid to local authority 313 4. Annual value of property (2-3) : 5. Less : Deductions claimed u/s 24 : 321 (a) Thirty percent of annual value : (b) Interest payable on borrowed capital 322 325 6. Total of 5 above : 7. Income chargeable under the head "Income from House Property"(4-6) Gross Amount Amount Exempted 8. Gross income from other sources : 460 454 (a) Dividends from companies 463 455 (b) Dividends from units 461 456 (c) Interest 462 457 (d) Rental Income from machinary, plant etc. 464 458 (e) Others : 465 459 Total : 470 9. Total of 8 above (Gross amount minus Amount exempt) 10. Deduction u/s 57 : (a) Depreciation (b) (c) 471 11. Total of 10 above 12. Income chargeable under the head "Income from Other Sources" (9-11): 13. Gross Total Income (1+7+12) AMOUNT AMOUNT 14. Deductions u/s Ch VIA 235 242 (a) 80CCC (d) 80G (g) 80RRB 282 236 260 (b) 80D (e) 80L (h) Sec. 239 (c) 80E (f) 80QQB 275 15. Total of 14 above : 16. Total Income (13-15) 17. Tax on total Income : AMOUNT AMOUNT 18. Less Rebate : (a) Sec. 88 812 (c) Sec. 88C 814 (b) Sec. 88B 813 19. Total of 18 above 20. Balance Tax payable (17-19) 21. Add Surcharge 22. Tax payable (20+21) 23. Relief u/s 89. 24. Balance Tax Payable (22-23) 25. Tax deducted at source (a) Salaries 868 (b) Others : 872 26. Total of 25 above : 27. Advance Tax paid (Attach copy of challans) Date 858 (a) Upto 15/9 (b) 16/9 to 15/12 859 28. Total of 27 above 29. Tax paid during the previous year (26+28) 30. Interest payable : Amount 842 (a) Section 234A : 843 (b) Section 234B : Amount (c) 16/12 to 15/03 (d) 16/03 to 31/03

860 861

AMOUNT

701

AMOUNT

702

706 746

747 760 810

820 827 828 832 837 841

873

Date

Amount

862 892

Amount (c) Section 234C : 844 (d) Total Interest (a+b+c)

846 875 891

31. Less : Self assessment tax paid (Attach copy of challan) 32. Tax payable / refundable (24-29+30-31)

Verification

I................................(name in full and in block letters), son/daughter of ........................solemnly declare that to the best of my knowledge and belief, the information given in this return and the annexures and statements accompanying it are correct, complete and truly stated and in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for the previous year relevant to the assessment year................

Receipt no...................Date............... Seal Signature of the receiving official Signature Date : Place :

INSTRUCTIONS FOR FILLING UP NAYA SARAL (These instructions are non-statutory) 1. NAYA SARAL Form may be filled up by a resident individual / Hindu Undivided Family, having income only from salary, house property and other sources. The form should be filled up in duplicate. One copy will be returned to the assessee after being duly acknowledged. The acknowledgement itself is deemed to be the intimation. No intimation is separately given unless there is a demand or a refund. 2. All items should be filled in capital letters. 3. Status (Item no.5 )- Please strike out whichever is not applicable. 4. Details of bank account may be furnished (item no.10) for direct crediting of any amount refundable to you - state the name, address of the bank, the MICR code and the account number. 5. Income from Salary (item no. 1)- State the net taxable salary as per the Form no. 16(salary certificate) provided by the employer and enclose the Form No.16. 6. Income from House Property (Item no. 2 )- In item no.2, please indicate the annual letting value or the rent received / receivable whichever is higher. While calculating the rent received/ receivable deduction as per section 23 in respect of vacancy etc. may also be taken into account. In Item No.3 state the taxes actually paid to local authority (not on accrual basis). 7. Income from other sources (item no. 8 )- Gross income from other sources such as interest, income from units etc. should be shown against this item. Details of such amounts of income from other sources, as exempt, if any, should be given alongside in the columns. Deductions claimed u/s 57 in respect of income chargeable under the head income from other sources should be mentioned in item no. 10. Thereafter, net income from other sources should be mentioned in item no. 12. 8. Deductions under chapter VI-A (item no. 14 )- Chapter VI-A provides for various deductions, e.g. for donations (80G), medical insurance premia (80D), contribution to certain pension funds (80CCC), repayment of loan taken for higher studies(80E), interest on certain securities, dividends (80L). Deductions under section 80QQB and 80RRB are available from assessment year 2004-05. Total amount of deductions claimed should be shown section-wise. 9. Tax on total income (item no. 17) Please calculate the tax on total income at the applicable rates for the relevant assessment year and mention in item no. 17. 10. Rebate (item no.18 )- Please indicate the tax rebate available as per section 88 of the Income Tax Act. For individuals who are aged 65 years or more, tax rebate is available under section 88B. For women who are aged less than 65 years, tax rebate is available under section 88C.

11. Relief (item no.23 )- Relief is available under section 89 in cases where salary is paid in arrears or in advance. 12. Proof of taxes paid (item no. 25, 27 ) - Against item no. 25 fill in the amount of tax deducted at source, both in respect of income from salaries and otherwise. Also attach proof of tax deducted at source. In respect of item no. 27 fill in the amounts of advance tax paid in each instalment. Also attach copy of challans for the advance tax paid. 13. Interest payable (item no.30)- Interest is charged under section 234A for late filing of return, under section 234B for shortfall in payment of advance tax and under section 234C for deferment of instalments of advance tax. Please indicate such interest separately. 14. Item no. 32 Please fill in the amount of tax payable / refundable.

You might also like

- Guarding Against Pandemics 2022 Tax FilingDocument30 pagesGuarding Against Pandemics 2022 Tax FilingTeddy SchleiferNo ratings yet

- Completed 1040-FormDocument6 pagesCompleted 1040-Formapi-464285260No ratings yet

- Form No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )Document2 pagesForm No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )NeethinathanNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument4 pagesDetails of Salary Paid and Any Other Income and Tax Deductedmurthy66No ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryShantru RautNo ratings yet

- Method of Calculation of Relief U/s 89 (I)Document3 pagesMethod of Calculation of Relief U/s 89 (I)ssvrNo ratings yet

- Bensingh Form 16 - SignedDocument2 pagesBensingh Form 16 - SignedGloryNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Amit Singh-Payslip - Apr-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Apr-2021-Unlocked PDFamitNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Amit Singh-Payslip - Jun-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Jun-2021-Unlocked PDFamitNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- 031508996Document2 pages031508996Lokesh KumarNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form PDF 525292250230922Document12 pagesForm PDF 525292250230922Vikash KumarNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Bmypp3076q Partb 2021-22 1Document4 pagesBmypp3076q Partb 2021-22 1KALIA PRADHANNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Tan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Document1 pageTan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Bhairab PrasadNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- U.S. Information Return Trust Accumulation of Charitable AmountsDocument4 pagesU.S. Information Return Trust Accumulation of Charitable AmountsIRSNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Challan 282Document2 pagesChallan 282api-3854061No ratings yet

- Challan 281Document2 pagesChallan 281Paymaster ServicesNo ratings yet

- Challan 280Document2 pagesChallan 280api-3854061No ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2Dapi-3854061No ratings yet