Professional Documents

Culture Documents

May 8 Graham FAQ

Uploaded by

Graham Files0 ratings0% found this document useful (0 votes)

4 views2 pagesAllerton Hill article supporting Graham Local School Levy - obtained by public record request

Original Title

May8GrahamFAQ

Copyright

© Public Domain

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAllerton Hill article supporting Graham Local School Levy - obtained by public record request

Copyright:

Public Domain

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesMay 8 Graham FAQ

Uploaded by

Graham FilesAllerton Hill article supporting Graham Local School Levy - obtained by public record request

Copyright:

Public Domain

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

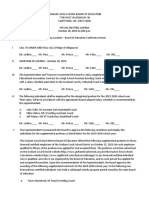

GRAHAM FAQs – MAY 8 INCOME TAX

What is on the Tuesday, May 8 ballot?

Graham is on the ballot for a modest 1% earned income tax.

What qualifies as “earned” income?

**USE LANGUAGE FROM BEFORE

What type of income is exempt from the earned income tax?

*USE LANGUAGE FROM BEFORE

Why are we on ballot?

Graham is on the ballot because our fiscal situation is serious. Our district has gone more than 24

years without additional operating dollars and during that time we have made deep cuts in order

to make things work. Now, that is no longer enough. If the May 8 earned income tax levy does

not pass then we will have to make even deeper cuts.

Weren’t we just on the November ballot?

Yes, and for the same exact ballot issue. The need to secure funding for our district did not go

away with failure; It only worsened.

What happens if it passes?

If it passes, then we can protect and maintain what we have in our schools right now. No frills.

What happens if it fails?

If it does not pass, we must enact deep cuts and reductions districtwide. Moreover, the need does

not go away with failure and the district will need to return for additional operating dollars.

Is there a list of cuts that will occur if the levy fails?

Yes. In order to be open and transparent about the serious financial situation facing our schools,

the board approved a list of cuts that will occur if the levy does not pass. The cuts would go into

effect if the levy does not pass on May 8. A full list can be accessed here <<HOTLINK IT>>.

More cuts are not going to hurt anything, are they?

Cuts hurt. The last time we made deep cuts student test scores dropped significantly on state

tests. We cannot continue cutting, reducing and slashing our budget and expect the same quality

of education.

Our schools are falling behind. Enacting further cuts would only worsen this divide. Our teachers

need more resources so that our Graham students do not fall behind. Resources like up-to-date

technology, classrooms, textbooks and lab materials along with additional science, technology

and academic programs.

How does our tax rate compare with other school systems around us?

Our tax rate is lower than every district in a seven county area, including: Champaign, Clark

Logan, Madison and Miami Counties.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Strader ApplicationDocument3 pagesStrader ApplicationGraham FilesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- May 8 Graham Key PointsDocument1 pageMay 8 Graham Key PointsGraham FilesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Superintendent OpDocument1 pageSuperintendent OpGraham FilesNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Agenda 11-13-2019 Regular MeetingDocument6 pagesAgenda 11-13-2019 Regular MeetingGraham FilesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Agenda 10-28-2019 Special MeetingDocument2 pagesAgenda 10-28-2019 Special MeetingGraham FilesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Judy Nws LT R ArticleDocument1 pageJudy Nws LT R ArticleGraham FilesNo ratings yet

- Graham ResolutionDocument1 pageGraham ResolutionGraham FilesNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- GrahamSuperLetter8 15 17Document1 pageGrahamSuperLetter8 15 17Graham FilesNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- GrahamTreasurerOpEd8 21 17Document1 pageGrahamTreasurerOpEd8 21 17Graham FilesNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- GrahamTeacher1 22 18Document1 pageGrahamTeacher1 22 18Graham FilesNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Op EdDocument1 pageOp EdGraham FilesNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- GrahamPressRelease4!12!17 3Document2 pagesGrahamPressRelease4!12!17 3Graham FilesNo ratings yet

- Parent LetterDocument1 pageParent LetterGraham FilesNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- GrahamFailRelease10 19 17Document1 pageGrahamFailRelease10 19 17Graham FilesNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Kirk Letter To StaffDocument1 pageKirk Letter To StaffGraham FilesNo ratings yet

- District Facing Critical Need in May 8 ElectionDocument4 pagesDistrict Facing Critical Need in May 8 ElectionGraham FilesNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- GrahamOpEds2 22 18Document2 pagesGrahamOpEds2 22 18Graham FilesNo ratings yet

- Board President OpedDocument2 pagesBoard President OpedGraham FilesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 8117 Telegraham Article KirkDocument2 pages8117 Telegraham Article KirkGraham FilesNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GrahamPassRelease10 19 17Document1 pageGrahamPassRelease10 19 17Graham FilesNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Graham Letter To Parents 4-2018Document1 pageGraham Letter To Parents 4-2018Graham FilesNo ratings yet

- GrahamPASS FAILMay8Document2 pagesGrahamPASS FAILMay8Graham FilesNo ratings yet

- Agenda 7-30-2019Document7 pagesAgenda 7-30-2019Graham FilesNo ratings yet

- 8117 Board Telegraham ArticleDocument1 page8117 Board Telegraham ArticleGraham FilesNo ratings yet

- Agenda 9-18-2019Document7 pagesAgenda 9-18-2019Graham FilesNo ratings yet

- Agenda 8-14-2019Document3 pagesAgenda 8-14-2019Graham FilesNo ratings yet

- Transportation Model Breakdown After Nov 18Document4 pagesTransportation Model Breakdown After Nov 18Graham FilesNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Kirk Koennecke Resume and ApplicationDocument15 pagesKirk Koennecke Resume and ApplicationGraham FilesNo ratings yet

- Graham L - ElectionHistoryDocument1 pageGraham L - ElectionHistoryGraham FilesNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)