Professional Documents

Culture Documents

JD FTE - Analytics - EDA & CFR - MT, AM

Uploaded by

Tarun SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JD FTE - Analytics - EDA & CFR - MT, AM

Uploaded by

Tarun SinghCopyright:

Available Formats

Job Description – Management Trainee/Assistant Manager, Analytics

About American Express

American Express is a global services company that provides consumers and businesses with exceptional access to products,

insights and experiences that enrich lives and build business success.

Working at American Express

What you choose to do for a living is one of the most meaningful decisions you can make. At American Express, our job is to

help you excel at yours. We provide experiences to become a great leader, a world of opportunities to grow your career, and an

inclusive culture to help you thrive. Because the best way to back our customers is to back our people.

With a career at American Express you get

• An iconic global brand, where you can grow as a leader

• Meaningful and rewarding work that is performed with integrity

• A culture of learning in collaboration with great colleagues and leaders

• A unique career journey shaped by your talent and curiosity

• Support and trust to thrive in your career and life

Overview of the Business

A single decision can have many outcomes. And when that decision affects hundreds of thousands of customers and employees,

it needs to be the right one. T hat’s where our Enterprise Credit & Fraud Risk Management and Enterprise Digital & Analytics

teams comes in. ECFRM & EDA are the backbone of all financial services operations at American Express—it impacts every

aspect of the company. As a part of this team, you’ll work with the industry’s top ECFRM & EDA teams to create smart but

innovative strategies that advance our market share and the way we do business. If you’re interested in getting to know all a reas

of our business and can translate our business needs into remarkable solutions, you should consider a career in ECFRM & EDA.

Job responsibilities:

T here are three Job families within Enterprise Credit & Fraud Risk Management and Enterprise Digital & Analytics teams.

Specific job responsibilities vary as per the Job family.

Decision Sciences:

Development, deployment and validation of predictive model(s) and supporting use of models in economic logic to enable

profitable decisions across risk, fraud and marketing

Business and Analytical Solutions :

Development, review and/or execution of economic logic & analytical solutions to drive profitable marketing or credit busines s

actions.

Big Data Labs:

Develop Big Data capabilities, tools and techniques to enhance Credit and Fraud Risk, and Information M anagement functions

Generally, the role will entail the following responsibilities:

• Analyze large amounts of data to derive business insights and create innovative solutions

• Leverage the power of closed loop through Amex network to make decisions more intelligent and relevant

• Innovate with a focus on developing newer and better approach es using big data & machine learning solution

Qualifications and Skills Required:

• Ability to drive project deliverables to achieve business results

• Ability to work effectively in a team environment

• Strong communication and interpersonal skills

• Ability to learn quickly and work independently with complex, unstructured initiatives

• Ability to Integrate With Cross-Functional Business Partners Worldwide

• Good Programming skills are a must

• Knowledge of SAS, Java, Hive, Pig, Python, SQL is a plus

• Knowledge of MS Office – PowerPoint, Excel

AXP Internal 1

You might also like

- Job Description – Assistant Manager II - AnalyticsDocument1 pageJob Description – Assistant Manager II - AnalyticsJohn DoeNo ratings yet

- Amex Campus (JD) - CFR - InternshipDocument1 pageAmex Campus (JD) - CFR - InternshipVipparthy Sai EsvarNo ratings yet

- Job Description: Risk Capabilities: 2019: Intern Hiring About American ExpressDocument2 pagesJob Description: Risk Capabilities: 2019: Intern Hiring About American ExpressDeepak GoswamiNo ratings yet

- Campus (JD) - Capabilities AnalyticsDocument2 pagesCampus (JD) - Capabilities AnalyticsKenny SNo ratings yet

- JD Data ScientistDocument3 pagesJD Data Scientistpremsai96400No ratings yet

- Amex Job DescriptionDocument1 pageAmex Job DescriptionPulokesh GhoshNo ratings yet

- Analytics - Senior Business Analyst - EclerxDocument2 pagesAnalytics - Senior Business Analyst - EclerxGrimoire HeartsNo ratings yet

- Amex - Campus JD - GSG - MIS - Management Trainee - Full TimeDocument3 pagesAmex - Campus JD - GSG - MIS - Management Trainee - Full TimeparvaswaniNo ratings yet

- We Create A Better World by Helping Companies Become Great WorkplacesDocument3 pagesWe Create A Better World by Helping Companies Become Great WorkplacesabrahamNo ratings yet

- Data Scientist JDDocument2 pagesData Scientist JDHarsh RaghuwanshiNo ratings yet

- Junior Automation ConsultantDocument3 pagesJunior Automation ConsultantSnehasish PatraNo ratings yet

- Management Consulting Resume ExamplesDocument5 pagesManagement Consulting Resume Examplesafjwfoffvlnzyy100% (2)

- Capital One DataLabs Business Analyst Role (39Document2 pagesCapital One DataLabs Business Analyst Role (39vivek gandhariNo ratings yet

- Resume Objective For Leadership PositionDocument7 pagesResume Objective For Leadership Positionafmsjfofdkkvdz100% (1)

- CIB R&a Banking Junior Analyst Academic Intern FinTechDocument2 pagesCIB R&a Banking Junior Analyst Academic Intern FinTechJodNo ratings yet

- Database Administration LeadDocument3 pagesDatabase Administration LeadRandomNo ratings yet

- Ey-Strategy and Transactions (Sat) - Dna Assistant ManagerDocument2 pagesEy-Strategy and Transactions (Sat) - Dna Assistant ManagerrohitNo ratings yet

- How To End A ResumeDocument8 pagesHow To End A Resumeafmrdrpsbbxuag100% (1)

- EY - Consulting - RISK Internal Audit - ManagerDocument2 pagesEY - Consulting - RISK Internal Audit - ManagermadhuNo ratings yet

- Job Description - BDRDocument3 pagesJob Description - BDRJacob NavaNo ratings yet

- Campus Recruitment - Management Trainee Role in SABEDocument2 pagesCampus Recruitment - Management Trainee Role in SABEInnocent worldNo ratings yet

- XqtdjuarfxpdfDocument3 pagesXqtdjuarfxpdfsobersabre04No ratings yet

- Data Science Manager-Artificial Intelligence: at ZSDocument3 pagesData Science Manager-Artificial Intelligence: at ZSankithornyNo ratings yet

- Job Description - Graduate CTRM Technical AnalystDocument2 pagesJob Description - Graduate CTRM Technical AnalystVIKASH KUMARNo ratings yet

- Data Modeler ResumeDocument7 pagesData Modeler Resumebzmf6nm1100% (1)

- 5 CPPZM KZ6 SCZyr 62 G BNJC WGJJK GCOj HAs 4 EAJG7 LDocument2 pages5 CPPZM KZ6 SCZyr 62 G BNJC WGJJK GCOj HAs 4 EAJG7 LRahul me20b145No ratings yet

- Data Product LeaderDocument3 pagesData Product Leadersem4bctNo ratings yet

- Business Analyst Job Description at SprinklrDocument2 pagesBusiness Analyst Job Description at SprinklrvickyNo ratings yet

- Techno Functional ConsultantDocument3 pagesTechno Functional ConsultantSnehasish PatraNo ratings yet

- Senior Manager ResumeDocument6 pagesSenior Manager Resumec2q5bm7q100% (1)

- Agile Business Analyst ResumeDocument8 pagesAgile Business Analyst Resumeimpalayhf100% (1)

- Business Analyst ProductsDocument2 pagesBusiness Analyst ProductsTanishq BhatiaNo ratings yet

- SFDC Technical ArchitectDocument2 pagesSFDC Technical ArchitectjakharjiNo ratings yet

- Intern - Management Intelligence - Job DescriptionDocument2 pagesIntern - Management Intelligence - Job Descriptionbhawaniganesh80No ratings yet

- Data Analysis and Reporting ResumeDocument7 pagesData Analysis and Reporting Resumegvoimsvcf100% (2)

- Thesis Operational ExcellenceDocument6 pagesThesis Operational ExcellenceNeedHelpWriteMyPaperCanada100% (2)

- Instructional Designer ResumeDocument8 pagesInstructional Designer Resumezehlobifg100% (2)

- HR-Analyst JDDocument2 pagesHR-Analyst JDSunil Kumar ChettiarNo ratings yet

- Cloud Data Engineer@mercerDocument6 pagesCloud Data Engineer@mercerluca_123No ratings yet

- Dissertation On Competency MappingDocument4 pagesDissertation On Competency MappingPaperWritingServiceCollegeBuffalo100% (1)

- B2C Inside RoleDocument2 pagesB2C Inside RoleSERIN SAJ (RA2011003010965)No ratings yet

- Management Trainee MIS Full Time JobDocument2 pagesManagement Trainee MIS Full Time JobInnocent worldNo ratings yet

- Business Analyst at Fast Growing SaaS CompanyDocument2 pagesBusiness Analyst at Fast Growing SaaS CompanyAbhik AggarwalNo ratings yet

- Marketing and Communication Specialist: Our CompanyDocument2 pagesMarketing and Communication Specialist: Our CompanyAdam AldulaimiNo ratings yet

- Summer Intern EY-P TSEDocument4 pagesSummer Intern EY-P TSESARTHAK SHARMANo ratings yet

- Resume ExpertsDocument5 pagesResume Expertsbcqxqha3100% (2)

- Digital Marketer Remote Job Marketing Full TimeDocument3 pagesDigital Marketer Remote Job Marketing Full TimeJoel SadhanandNo ratings yet

- Process Alchemy: Using Employee-Driven Solutions To Achieve Operational ExcellenceFrom EverandProcess Alchemy: Using Employee-Driven Solutions To Achieve Operational ExcellenceNo ratings yet

- IAM and Cyber Security AnalystDocument3 pagesIAM and Cyber Security AnalystBhavika KauraNo ratings yet

- The Irreverent Guide to Project Management: An Agile Approach to Enterprise Project Management, Version 5.0From EverandThe Irreverent Guide to Project Management: An Agile Approach to Enterprise Project Management, Version 5.0No ratings yet

- Manage customer success as a graduate trainee at MINDDocument3 pagesManage customer success as a graduate trainee at MINDR K RishiRaj Jaipuria CONo ratings yet

- Pre Sales Consultant Australia Epsilon DEP 05022009Document3 pagesPre Sales Consultant Australia Epsilon DEP 05022009samNo ratings yet

- Resume Writing SoftwareDocument7 pagesResume Writing Softwarebcr57nbx100% (2)

- RL Math Jobs June 2015Document12 pagesRL Math Jobs June 2015api-284565592No ratings yet

- Leaving Addie for SAM: An Agile Model for Developing the Best Learning ExperiencesFrom EverandLeaving Addie for SAM: An Agile Model for Developing the Best Learning ExperiencesNo ratings yet

- Associate Pre SalesDocument3 pagesAssociate Pre SalesSnehasish PatraNo ratings yet

- Frontend Lead - Skuad - JDDocument2 pagesFrontend Lead - Skuad - JDShivam DwivediNo ratings yet

- Understanding The LIBOR Scandal: The Historical, The Ethical, and The TechnologicalDocument49 pagesUnderstanding The LIBOR Scandal: The Historical, The Ethical, and The TechnologicalTarun SinghNo ratings yet

- News Alerts 14th - 7th FebDocument4 pagesNews Alerts 14th - 7th FebTarun SinghNo ratings yet

- Study: People Matter, Results CountDocument3 pagesStudy: People Matter, Results CountTarun SinghNo ratings yet

- Corporate Governance in The Wake of The Financial CrisisDocument185 pagesCorporate Governance in The Wake of The Financial CrisisTarun SinghNo ratings yet

- The Corporate Governance Lessons From The CrisisDocument30 pagesThe Corporate Governance Lessons From The CrisisadontsNo ratings yet

- ProjectDocument13 pagesProjectsandhya parimalaNo ratings yet

- Corporate Governance Implications From The 2008 FiDocument14 pagesCorporate Governance Implications From The 2008 FiTarun SinghNo ratings yet

- Corporate Governance and Financial Crises: What Have We MissedDocument15 pagesCorporate Governance and Financial Crises: What Have We MissedTarun SinghNo ratings yet

- Global Trade Finance GrowthDocument20 pagesGlobal Trade Finance GrowthTarun SinghNo ratings yet

- Presentation 1Document1 pagePresentation 1Tarun SinghNo ratings yet

- Job Description - Management Trainee, GSG: About American ExpressDocument1 pageJob Description - Management Trainee, GSG: About American ExpressTarun SinghNo ratings yet

- Tarun Singh: 11000 From The School Management For Topping The CBSE XII Board ExaminationsDocument1 pageTarun Singh: 11000 From The School Management For Topping The CBSE XII Board ExaminationsTarun SinghNo ratings yet

- Anarock - Irf Report 2018Document40 pagesAnarock - Irf Report 2018Tarun SinghNo ratings yet

- BG CaseDocument23 pagesBG CaseTarun SinghNo ratings yet

- Deal Edge India 2017Document14 pagesDeal Edge India 2017Tarun SinghNo ratings yet

- Business Studies Project: Made By: Rahil JainDocument29 pagesBusiness Studies Project: Made By: Rahil JainChirag KothariNo ratings yet

- TheoryDocument34 pagesTheoryPrashant SahNo ratings yet

- Impact of MusicDocument15 pagesImpact of MusicSterling GrayNo ratings yet

- Sun Temple, Modhera: Gudhamandapa, The Shrine Hall Sabhamandapa, The AssemblyDocument11 pagesSun Temple, Modhera: Gudhamandapa, The Shrine Hall Sabhamandapa, The AssemblyShah PrachiNo ratings yet

- Research Project On Capital PunishmentDocument6 pagesResearch Project On Capital PunishmentNitwit NoddyNo ratings yet

- Asian Studies Vol 49 No 2 - 2013Document218 pagesAsian Studies Vol 49 No 2 - 2013Ari Dodol100% (1)

- Popular Telugu Novel "Prema DeepikaDocument2 pagesPopular Telugu Novel "Prema Deepikasindhu60% (5)

- Importance of family history and learning about ancestorsDocument2 pagesImportance of family history and learning about ancestorsKei ArceñoNo ratings yet

- RFC Mantis II Reader Data Sheet (2005)Document2 pagesRFC Mantis II Reader Data Sheet (2005)Tim BresienNo ratings yet

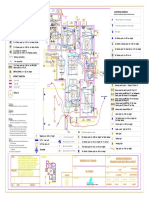

- Varun Valanjeri Electrical Layout-3Document1 pageVarun Valanjeri Electrical Layout-3ANOOP R NAIRNo ratings yet

- Detailed 200L Course OutlineDocument8 pagesDetailed 200L Course OutlineBoluwatife OloyedeNo ratings yet

- International Organizations and RelationsDocument3 pagesInternational Organizations and RelationsPachie MoloNo ratings yet

- Below Is A List of Offices For India - PWCDocument10 pagesBelow Is A List of Offices For India - PWCAnonymous xMYE0TiNBcNo ratings yet

- Barrett Preliminary Injunction in 'Heartbeat Bill' CaseDocument12 pagesBarrett Preliminary Injunction in 'Heartbeat Bill' CaseCincinnatiEnquirerNo ratings yet

- Manocha Icile Feasibility StudyDocument95 pagesManocha Icile Feasibility StudyAlmadin KeñoraNo ratings yet

- ITC Gardenia LavendreriaDocument6 pagesITC Gardenia LavendreriaMuskan AgarwalNo ratings yet

- Body PlanesDocument32 pagesBody PlanesStefanny Paramita EupenaNo ratings yet

- 1.1.5.a Elisa-3Document3 pages1.1.5.a Elisa-3Zainab DioufNo ratings yet

- ADL Report "Attacking" Press TVDocument20 pagesADL Report "Attacking" Press TVGordon DuffNo ratings yet

- B.sc. Microbiology 1Document114 pagesB.sc. Microbiology 1nasitha princeNo ratings yet

- CECB School Profile 23122020 1Document6 pagesCECB School Profile 23122020 1Anas SaadaNo ratings yet

- Stock Market Course ContentDocument12 pagesStock Market Course ContentSrikanth SanipiniNo ratings yet

- Theory of Machines Kinematics FundamentalsDocument31 pagesTheory of Machines Kinematics FundamentalsmungutiNo ratings yet

- How To Comp For A Vocalist - Singer - The Jazz Piano SiteDocument5 pagesHow To Comp For A Vocalist - Singer - The Jazz Piano SiteMbolafab RbjNo ratings yet

- Oscillator Types and CharacteristicsDocument4 pagesOscillator Types and Characteristicspriyadarshini212007No ratings yet

- Indigenous Peoples SyllabusDocument9 pagesIndigenous Peoples Syllabusapi-263787560No ratings yet

- Gateway A2 Test 1BDocument3 pagesGateway A2 Test 1BNewteacher29100% (6)

- KCIS 2nd Semester Science Fair ProjectsDocument2 pagesKCIS 2nd Semester Science Fair ProjectsCaT BlAcKNo ratings yet

- 1 The Importance of Business ProcessesDocument17 pages1 The Importance of Business ProcessesFanny- Fan.nyNo ratings yet

- Ice Hockey BrochureDocument2 pagesIce Hockey BrochurekimtranpatchNo ratings yet