Professional Documents

Culture Documents

933 - 5 Policy 1 Lakh (18-22) PDF

Uploaded by

Amit UpalekarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

933 - 5 Policy 1 Lakh (18-22) PDF

Uploaded by

Amit UpalekarCopyright:

Available Formats

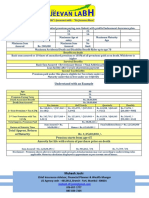

Lakshya

Education

Package

Premium Amount Details of Jeevan Lakshya Policy

Age YLY HLY QLY NACH ★ Jeevan Lakshya 5 Polices of Rs. 1 Laksh each as a Package

25 30,434 15,369 7,761 2,587 ★ Policy Term : 18 years to 22 Years

26 30,472 15,388 7,771 2,591 ★ Premium Paying Term : Policy Term Less 3 Years

27 30,520 15,412 7,784 2,595 ★ Death Benebit : 110% Sum Assured + Bounus + FAB

28 30,571 14,439 7,796 2,599 ★ Disability Benebit : Waiver of Future Premium &

29 30,639 15,473 7,814 2,605 Rs. 4,166 pm payable for next 10 Years

30 30,709 15,507 7,830 2,609 ★ Loan, Nominatin, Assignment, Surrender Facility available

31 30,796 15,553 7,854 2,618 ★ Best for Children's Professional Education + Marriage + Income Tax Benebit

32 30,904 15,606 7,880 2,626

33 31,022 15,665 7,912 2,638 MATURITY BENEFITS

34 31,149 15,730 7,944 2,649 S.No Plan Term PPT SA Maturity Amount Child Age

35 31,311 15,811 7,984 2,663 1 933 18 15 1,00,000 1st Year 1,83,500 19 yrs

36 31,477 15,896 8,029 2,676 2 933 19 16 1,00,000 2nd Year 1,88,500 20 yrs

37 31,678 15,997 8,078 2,692 3 933 20 17 1,00,000 3rd Year 1,94,000 21 yrs

38 31,902 16,112 8,138 2,713 4 933 21 18 1,00,000 4th Year 2,07,900 22 yrs

39 32,148 16,235 8,197 2,732 5 933 22 19 1,00,000 5th Year 2,15,800 23 yrs

40 32,421 16,372 8,296 2,756 Total Sum Assured 5,00,000 Total Amt 9,89,700

DEATH BENEFITS

*Assume Claim arises after 3 Years

Future Premium Waived 4,13,126

Annual Income Benebit till end of Policy Term ( 10% SA ) 8,50,000

Maturity amount payable at end ( Even for Death) 10,39,700

IF Death due to Accident, Additional S.A for DAB 5,00,000

Total Death Benefits 28,02,826

Underwriting SUC : Rs. 5,00,000/-

RISK COVER to the PARENT and Without Medical : up to 50 Years for NMS, NMP and up to 45 Years for NMG

BENEFITS to the CHILD Training Material for Agent (For internal Circulation only)

You might also like

- 1888 - Mast ABCDocument6 pages1888 - Mast ABCjdchandrapal4980No ratings yet

- 945 MP 12 Pack 2L MP 2023Document1 page945 MP 12 Pack 2L MP 2023AYUSHI JAINNo ratings yet

- Combination of Umang & AnandDocument3 pagesCombination of Umang & AnandsatyakamNo ratings yet

- J Care Rate Card Revamped - 23Document6 pagesJ Care Rate Card Revamped - 23zemmyNo ratings yet

- Presentation 28Document6 pagesPresentation 28Padma RamenNo ratings yet

- For The Modern Indian Woman A Customized Life Insurance OfferingDocument9 pagesFor The Modern Indian Woman A Customized Life Insurance OfferingPrakash ANo ratings yet

- LIC Jeevan LabhDocument1 pageLIC Jeevan LabhMukesh JoshiNo ratings yet

- PremCal - 18-06-2020 184836 PMDocument7 pagesPremCal - 18-06-2020 184836 PMLeenaNo ratings yet

- Letter of Intent - Vinod Kumar N JDocument2 pagesLetter of Intent - Vinod Kumar N JshajuNo ratings yet

- Step by Step Procedure To Solve Pension ProblemDocument5 pagesStep by Step Procedure To Solve Pension ProblemgcrajasekaranNo ratings yet

- PLAN-836 by NVMDocument33 pagesPLAN-836 by NVMharsh201092No ratings yet

- Afyaimara BrochureDocument16 pagesAfyaimara BrochureJoenathan EbenezerNo ratings yet

- 0 Aayush - Rajendra JainDocument10 pages0 Aayush - Rajendra JainDrJd ChandrapalNo ratings yet

- AIS JAKARTA SCHOOL FEES 2023 Terms and Conditions - 10oct2022 - Approved RevisionDocument3 pagesAIS JAKARTA SCHOOL FEES 2023 Terms and Conditions - 10oct2022 - Approved RevisionRini PertyNo ratings yet

- Report - Mr. - MR - 936 - 25 - 16 - Age - 30 - SA - 1250000Document5 pagesReport - Mr. - MR - 936 - 25 - 16 - Age - 30 - SA - 1250000swarnalata0110No ratings yet

- "Insure & Be Secure": Mr. DhairyaDocument5 pages"Insure & Be Secure": Mr. DhairyaDrJd ChandrapalNo ratings yet

- XUGS Discounted Tuition & Fees SY 2021-2022Document1 pageXUGS Discounted Tuition & Fees SY 2021-2022dave valcarcelNo ratings yet

- Golden Endowment PlanDocument2 pagesGolden Endowment PlanchqaiserNo ratings yet

- Health Assurance BrochureDocument2 pagesHealth Assurance BrochureDhaval PatelNo ratings yet

- Niva HA SS v2Document2 pagesNiva HA SS v2Phunsukh WangduNo ratings yet

- C Endowment 25 YrsDocument5 pagesC Endowment 25 YrsSaurabh GargNo ratings yet

- As 936 16 10 Age 44 SA 200000Document5 pagesAs 936 16 10 Age 44 SA 200000SUMIT KUMARNo ratings yet

- Romases Inc. Orporate Lawyer: ObjectivesDocument11 pagesRomases Inc. Orporate Lawyer: ObjectivesZyreen Silva GiduquioNo ratings yet

- Payment Plan For ASIT 2017 2018 1 003Document12 pagesPayment Plan For ASIT 2017 2018 1 003Phephisa MethulaNo ratings yet

- Retire Happy BIDocument17 pagesRetire Happy BIJsey TanNo ratings yet

- Rs. 3,00,000/-Assurance Policies: LIC New Money Back Policy (20 Years But Pay Only For 15 Yrs)Document3 pagesRs. 3,00,000/-Assurance Policies: LIC New Money Back Policy (20 Years But Pay Only For 15 Yrs)enakta13No ratings yet

- OLORUNTOBA OPEYEMI MAUTIN - Mar - 2023Document1 pageOLORUNTOBA OPEYEMI MAUTIN - Mar - 2023Oloruntoba opeyemiNo ratings yet

- HealthAssist Application.189006Document5 pagesHealthAssist Application.189006Souryo Das GuptaNo ratings yet

- 0 Neel - Rajendra JainDocument11 pages0 Neel - Rajendra JainDrJd ChandrapalNo ratings yet

- KRP00755297406 - Elioth Rozar Maji MarakDocument5 pagesKRP00755297406 - Elioth Rozar Maji MarakElioth rozar M marakNo ratings yet

- AckoPolicy C t4 IuBC4TkhCqFY4P6HQDocument5 pagesAckoPolicy C t4 IuBC4TkhCqFY4P6HQAmeer KpNo ratings yet

- Plan 914 RR 20240218081935Document4 pagesPlan 914 RR 20240218081935Battleground CommandosNo ratings yet

- BW00000028817927 Acko 15Document3 pagesBW00000028817927 Acko 15srinidhigoskulaNo ratings yet

- Mr. Bhatta: An Innovative Retirement Solution ForDocument8 pagesMr. Bhatta: An Innovative Retirement Solution ForTapan DuttaNo ratings yet

- Onby Pa Adp 133rd BatchDocument53 pagesOnby Pa Adp 133rd BatchSreemon P VNo ratings yet

- LIC Jeevan Utsav PlanDocument3 pagesLIC Jeevan Utsav PlanphotonxcomNo ratings yet

- 19c157c7-bb83-4fab-8d2d-5c792c1af156Document7 pages19c157c7-bb83-4fab-8d2d-5c792c1af156vonamal985No ratings yet

- Pension Slip PDFDocument2 pagesPension Slip PDFRamniwas TetarwalNo ratings yet

- Vasantham Magics: Jeevan Lakshaya - Plan No: 833Document4 pagesVasantham Magics: Jeevan Lakshaya - Plan No: 833Prasanna KupwadeNo ratings yet

- Divi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)Document3 pagesDivi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)cjagath725No ratings yet

- ae573e3d-8d8b-4612-8024-d3ccccbe3906Document3 pagesae573e3d-8d8b-4612-8024-d3ccccbe3906Vineet ShuklaNo ratings yet

- Plan 869 - DHAN VRIDDHIDocument43 pagesPlan 869 - DHAN VRIDDHIgirishNo ratings yet

- 1181221-Annex-II Consent Form Policy B 2022-23Document4 pages1181221-Annex-II Consent Form Policy B 2022-23MaverickRohanNo ratings yet

- Lic Pension Policy - Retire & Enjoy PresentationDocument57 pagesLic Pension Policy - Retire & Enjoy PresentationK.N. BabujeeNo ratings yet

- Lic of India LTDDocument4 pagesLic of India LTDAnish PenmahaleNo ratings yet

- Report - Mr. - Amit Verma - 936 - 25 - 16 - Age - 31 - SA - 650000 PDFDocument5 pagesReport - Mr. - Amit Verma - 936 - 25 - 16 - Age - 31 - SA - 650000 PDFBhagat VermaNo ratings yet

- JEEVAN LABH 5k-10k 21-15Document1 pageJEEVAN LABH 5k-10k 21-15suku_mcaNo ratings yet

- Gip 202212021333106Document3 pagesGip 202212021333106gaurav sharmaNo ratings yet

- Complete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceDocument2 pagesComplete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceChiranjit SahaNo ratings yet

- Dear Uppuluri Venkata Sri Harsha: Congratulations!Document8 pagesDear Uppuluri Venkata Sri Harsha: Congratulations!Ravi PrakashNo ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- Dhivagar Govindharaj - Offer Letter PDFDocument3 pagesDhivagar Govindharaj - Offer Letter PDFDhivakar GNo ratings yet

- Benefits Info Term Insurance Annual Benefit Limit at Maturity at Age 60 at Age 65Document2 pagesBenefits Info Term Insurance Annual Benefit Limit at Maturity at Age 60 at Age 65Edward AloNo ratings yet

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- PensionPlus - 27-11-2023 7.40.8Document5 pagesPensionPlus - 27-11-2023 7.40.8VENUGOPAL VNo ratings yet

- Triple Cover AnandDocument4 pagesTriple Cover AnandDeepak KumarNo ratings yet

- Fees - 2020/2021: Early YearsDocument3 pagesFees - 2020/2021: Early YearsgustiNo ratings yet

- 945 - Jeevan UmangDocument6 pages945 - Jeevan UmangSaro SaravananNo ratings yet

- Jeevan Labh - Investment and PensionDocument1 pageJeevan Labh - Investment and PensionbradburywillsNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Brexit and The Border: An Overview of Possible Outcomes: Sinn Féin SDLPDocument20 pagesBrexit and The Border: An Overview of Possible Outcomes: Sinn Féin SDLPViktória SzalmaNo ratings yet

- Criminal Law: Joel SamahaDocument30 pagesCriminal Law: Joel Samahakayle callowayNo ratings yet

- Oro & Oro Catalogue 07Document56 pagesOro & Oro Catalogue 07Chaitanya KrishnaNo ratings yet

- EHI 01 EnglishDocument4 pagesEHI 01 EnglishRohitKumarNo ratings yet

- Marketing For Hospitality and Tourism 6th Edition Kotler Solutions ManualDocument10 pagesMarketing For Hospitality and Tourism 6th Edition Kotler Solutions ManualMatthewMossfnak100% (44)

- Acknowledgement PageDocument3 pagesAcknowledgement PageNieva Marie EstenzoNo ratings yet

- Commissioner of Internal Revenue vs. Avon Products Manufacturing, IncDocument3 pagesCommissioner of Internal Revenue vs. Avon Products Manufacturing, IncFrancis PunoNo ratings yet

- TOPIC-06-Social Classes in India: Agrarian Class StructureDocument9 pagesTOPIC-06-Social Classes in India: Agrarian Class Structurerishabkumarmp3No ratings yet

- Underground To Canada BookletDocument54 pagesUnderground To Canada Bookletapi-496609111100% (1)

- Brasil vs. Court of AppealsDocument2 pagesBrasil vs. Court of AppealsRoslyn RestorNo ratings yet

- What Is Quasi ContractDocument14 pagesWhat Is Quasi Contractchirayu goyalNo ratings yet

- Module 7Document12 pagesModule 7James Jemar Jimenez CastorNo ratings yet

- International Treaty Ilo-Convention-C155 1981 EngDocument9 pagesInternational Treaty Ilo-Convention-C155 1981 EngAlketa ZakaNo ratings yet

- Compilation of Relevant Guidelines and Guidance Documents - April 2021Document3 pagesCompilation of Relevant Guidelines and Guidance Documents - April 2021Sethu RajNo ratings yet

- IndiaDocument35 pagesIndialitonhumayunNo ratings yet

- Certificate of Assumed Name.Document4 pagesCertificate of Assumed Name.Chris LecceNo ratings yet

- One LinerDocument80 pagesOne LinerHarsh PrakashNo ratings yet

- Chapter 3 - Contracts in The Infotech WorldDocument35 pagesChapter 3 - Contracts in The Infotech WorldShubham BhaleraoNo ratings yet

- Acknowledgement ReceiptDocument8 pagesAcknowledgement ReceiptMary Ann MendozaNo ratings yet

- Mohd Faridzhuan Firdaus Bin Mohd Nanyan IIM 160037Document13 pagesMohd Faridzhuan Firdaus Bin Mohd Nanyan IIM 160037Nur AfiqahNo ratings yet

- Kiarra Nicel R. de Torres - Ecoweek3and4Document5 pagesKiarra Nicel R. de Torres - Ecoweek3and4Kiarra Nicel De TorresNo ratings yet

- Perdev Night SpielDocument6 pagesPerdev Night SpielChristy BorjaNo ratings yet

- Elias Dorendo Work Sheet Module 1Document5 pagesElias Dorendo Work Sheet Module 1Maica Angelica OcampoNo ratings yet

- MR - Syed Wajih Hassan Mr. Tanveer Ahmed Magoon MR - Ammad JamalDocument3 pagesMR - Syed Wajih Hassan Mr. Tanveer Ahmed Magoon MR - Ammad JamalHassan SamNo ratings yet

- Consumer Protection Act 2019Document6 pagesConsumer Protection Act 2019Prisha BauskarNo ratings yet

- Judicial Service Exams Question and Answers MCQs Based On LatDocument20 pagesJudicial Service Exams Question and Answers MCQs Based On LatPragya BansalNo ratings yet

- Vietnam War Notes With TimelineDocument27 pagesVietnam War Notes With TimelineLuNo ratings yet

- Kalle McWhorter, Prestigious Pets v. Duchouquette: DocketDocument2 pagesKalle McWhorter, Prestigious Pets v. Duchouquette: DocketDefiantly.netNo ratings yet

- Cerere Cazier Auto (m34mv7z9xp46)Document2 pagesCerere Cazier Auto (m34mv7z9xp46)Catalina DulgheruNo ratings yet

- 3RD Quarter-G5Document32 pages3RD Quarter-G5Louie De PedroNo ratings yet