Professional Documents

Culture Documents

Findings Conclusion Arefeen

Uploaded by

Tridib Debnath0 ratings0% found this document useful (0 votes)

21 views6 pagesOriginal Title

Findings-conclusion-arefeen

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views6 pagesFindings Conclusion Arefeen

Uploaded by

Tridib DebnathCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

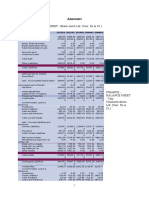

Corporate governance and procyclicality in a banking financial factors: Empirical study on

the banks of Bangladesh 2016-2017

Abstract

Findings & Analysis

Banking scenario in Bangladesh always had its ups & downs throughout the years. There

have always been many significant factors that plays important role upon the fluctuation of

banks assets. The study has been done on 15 registered banks in Bangladesh. The data

variables consist of;

Loan Capitalizatio Liquidit Asset Political Tenur Board Fraction

Growth n y s Dependence e Size female

AB Bank 0.04 0.7 0.062 10.28 0 1 12 0.083

Al arafa 0.232 0.188 0.123 26.88 0 1 20 0

Bank asia 0.199 -0.457 0.063 28.73 0 4 13 0.154

Jamuna 0.342 0.96 0.06 10.62 0 2 20 0.05

Bank

National 0.128 -1 0 8.44 0 2 14 0.142

Bank

Mercantile 0.195 1 0.07 12.14 0 2 11 0

Bank

Trust Bank 0.087 0.9637 0.012 9.41 0 1 12 0

UCB 0.1842 0.9151 0.0503 10.16 0 1 20 0.1

Uttara Bank 0.099 1 0.0552 23.4 0 3 16 0

Dutch 0.052 0.79 0.68 37.6 0 1 7 0

Bangla

Eastern 0.168 0.833 0.066 32.8 0 1 11 0.091

Bank

IFIC Bank 0.112 0.76 0.051 29.8 0 1 8 0

Brac Bank 0.178 0.522 0.0636 34.99 0 3 7 0.1428

City Bank 0.0605 0.189 0.0961 29.09 0 0 11 0.1818

Dhaka Bank -0.0754 -0.013 0.0734 29.55 0 1 17 0.0588

Table 1: Data set for the year 2016

Loan Capitalization Liquidity Assets Political Tenure Board Fraction

Growth Dependence Size female

AB Bank 0.072 0.12 0.056 10.05 0 2 12 0.083

Al arafa 0.103 0.019 0.1245 32.11 0 2 20 0

Bank asia 0.207 0.113 0.062 29.27 0 4 10 0.2

Jamuna 0.215 0.67 0.05 12.81 0 3 20 0.05

Bank

National 0.184 -1 0 8.69 0 3 14 0.142

Bank

Mercantile 0.323 1 0.07 14.8 0 3 11 0

Bank

Trust Bank 0.2964 0.9851 0.046 8.61 0 2 11 0

UCB 0.1668 0.94341 0.0202 10.16 0 1 20 0.05

Uttara Bank 0.2641 1 0.0154 23.89 0 4 15 0

Dutch 0.105 0.83 0.7 40.2 0 2 7 0

Bangla

Eastern 0.172 0.85 0.0625 36.2 0 2 11 0.091

Bank

IFIC Bank 0.307 0.78 0.066 31.9 0 1 8 0.125

Brac Bank 0.18 0.337 0.0631 33.85 0 4 8 0.125

City Bank 0.0543 0.033 0.0863 29.88 0 1 5 0

Dhaka Bank -0.1059 0.007 0.0513 31.95 0 2 17 0.0588

Table 2: Data set for the year 2017

Loan Growth Growth rate of loans and advances.

Capitalization Percentage of net income that has been added to

capital as retained earnings after all the

adjustments and appropriations.

Liquidity Percentage of liquid assets to total assets.

Assets Percentage of total assets to paid up capital.

Table 3: Explanation of financial factors

Political Dependence Political influence of the chairman.

Tenure Tenure of board chairman as per the year.

Board Size Size of the board of directors.

Female Fraction Percentage of female directors in the board.

Table 4: Explanation of governance factors

Here the values on table 1 and table 2 has been calculated and analyzed by the members from

the annual reports of the respective banks.

Loan Capitalizatio Liquidit Asset Political Tenur Board Fraction

Growth n y s Dependency e Size Female

Mean 0.133 0.49 0.102 23.62 0 1.6 13.27 0.07

Median 0.128 0.76 0.063 29.27 0 1 12 0.06

SD 0.098 0.599 0.163 11.42 0 1.06 4.5 0.07

Min -0.0754 -1 0 8.61 0 4 7 0

Max 0.342 1 0.68 40.2 0 15 20 0.18

Table 1.1: Descriptive statistics of the year 2016

Loan Capitalizatio Liquidit Asset Political Tenur Board Fraction

Growth n y s Dependency e Size Female

Mean 0.18 0.45 0.1 23.62 0 2.4 12.6 0.062

Median 0.182 0.67 0.062 29.27 0 2 11 0.05

SD 0.121 0.566 0.169 11.42 0 1.06 4.91 0.06

Min -0.1059 -1 0 8.61 0 1 5 0

Max 0.323 1 0.7 40.2 0 4 20 0.2

Table 2.1: Descriptive statistics of the year 2017

Loan Capitalization Liquidity Assets

Growth

Multiple R 0.504540642 0.721145976 0.488858 0.576087

R Square 0.254561259 0.520051519 0.238982 0.331876

Adjusted R -0.04361424 0.328072126 -0.06543 0.064627

Square

Standard Error 0.10038555 0.491026279 0.167808 0.382953

Observations 15 15 15 15

Table 1.2: Regression Statistics for the year 2016

Loan Capitalization Liquidity Assets

Growth

Multiple R 0.343337304 0.636945059 0.490612 0.52509

R Square 0.117880504 0.405699009 0.2407 0.27572

Adjusted R -0.23496729 0.167978612 -0.06302 -0.01399

Square

Standard Error 0.125495288 0.516558758 0.174332 0.50389

Observations 15 15 15 15

Table 2.2: Regression Statistics for the year 2017

For the regression statistical analysis the financial factors (Table 3) have been considered as

the dependent variable and the governance factors (Table 4) has been considered as the

independent variable. As the data value stands there was seen no relationship or political

dependence of the chairman has been observed. Thus, a dummy variable (0) has been input to

interpret the scenario. As per table 1.2 and 2.2 the multiple R analysis suggests that the

independent variables had significant relationship with capitalization, and rather moderate

relationship with the other financial factors. The data set that has been considered for the

analysis moderately fits with the dependent variables. There has been significant standard

error in the analyzed observations which can be from both human error and also from

different factors that has been kept unchecked in the reports of the observations.

Coefficients Standard t Stat P-value Lower 95% Upper 95%

Error

Intercept -0.01496858 0.096816482 -0.15460784 0.88020641 -0.230689152 0.20075197

4 8

Political 0 0 65535 #NUM! 0 0

Dependence

Tenure 0.03610980 0.025745162 1.40258614 #NUM! -0.02125398 0.09347360

8 5 4

Board Size 0.00701742 0.005986467 1.17221412 0.26828016 -0.00632125 0.02035610

1 6 2 1

Fraction female -0.03714711 0.41185718 -0.09019415 0.92991391 -0.95482209 0.88052787

4 4

Table 1.3: Regression Stat of loan growth for the year 2016

Coefficients Standard t Stat P-value Lower 95% Upper 95%

Error

Intercept 1.17347000 0.473568525 2.47793073 0.03265834 0.11829357 2.22864643

4 8 7 5 4

Political 0 0 65535 #NUM! 0 0

Dependence

Tenure -0.07499557 0.125929989 -0.59553388 #NUM! -0.35558507 0.20559392

6

Board Size -0.01647023 0.029282229 -0.56246533 0.58618593 -0.08171511 0.04877463

7 3

Fraction female -5.15624752 2.014559851 -2.55949086 0.02839795 -9.6449666 -0.66752845

9

Table 1.4: Regression stat on capitalization for the year 2016

Coefficients Standard Error t Stat P-value Lower Upper

95% 95%

Intercept 0.363305327 0.161841752 2.244818303 0.048605237 0.002699 0.723911

Political Dependence 0 0 65535 #NUM! 0 0

Tenure -0.02247241 0.043036496 -0.52217106 #NUM! -0.11836 0.073419

Board Size -0.01345793 0.010007184 -1.34482753 0.208387192 -0.03576 0.008839

Fraction female -0.70411869 0.688474589 -1.02272284 0.33054294 -2.23814 0.829898

Table 1.5: Regression stat on liquidity for the year 2016

Coefficients Standard t Stat P-value Lower 95% Upper 95%

Error

Intercept 36.0611702 10.01380114 3.60114703 0.00483868 13.74903088 58.3733096

5 2 4 2

Political 0 0 65535 #NUM! 0 0

Dependence

Tenure 0.22666868 2.662841389 0.08512286 #NUM! -5.70651674 6.15984903

2 3 7

Board Size -1.09269635 0.619184766 -1.76473358 0.10807148 -2.47232578 0.28693349

6 8

Fraction female 4.96205773 42.59869621 0.11648379 0.90957525 -89.9537523 99.8778678

9 4 9

Table 1.6: Regression stat of assets for the year 2016

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 0.142130986 0.119970471 1.184716413 0.263521696 -0.125179881 0.409441853

Political Dependence 0 0 65535 #NUM! 0 0

Tenure 0.033292015 0.033568423 0.991765818 #NUM! -0.041503093 0.108087122

Board Size -0.00363566 0.006934531 -0.52427711 0.611508572 -0.019086714 0.011815482

Fraction female -0.10774858 0.556483115 -0.19362473 0.850346569 -1.347670232 1.132173066

Table 2.3: Regression Stat of loan growth for the year 2017

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 0.813303954 0.493817724 1.646971976 0.130584546 -0.28699504 1.913598411

Political Dependence 0 0 65535 #NUM! 0 0

Tenure 0.025867169 0.13817302 0.187208538 #NUM! -0.28201506 0.333735844

Board Size -0.01382466 0.028543644 -0.48355654 0.639114042 -0.07741669 0.049796737

Fraction female -4.14641475 2.290573869 -1.81026399 0.1003685 -9.25012806 0.957305157

Table 2.4: Regression stat on capitalization for the year 2017

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 0.333346433 0.166656855 2.000196348 0.073364027 -0.037988181 0.704681046

Political Dependence 0 0 65535 #NUM! 0 0

Tenure -0.00353151 0.04663154 -0.07573227 #NUM! -0.107433059 0.100370034

Board Size -0.01348568 0.009633097 -1.39993167 0.191785235 -0.034949554 0.0079782

Fraction female -0.92016558 0.773037941 -1.19032395 0.261409392 -2.642601419 0.802270322

Table 2.5: Regression stat on liquidity for the year 2017

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 35.51865748 10.99744172 3.22972 0.009025233 11.01483031 60.02248465

Political Dependence 0 0 65535 #NUM! 0 0

Tenure -0.07796056 3.077147019 -0.02533538 #NUM! -6.934271386 6.778350267

Board Size -0.93045666 0.63567395 -1.46373254 0.173979832 -2.34682647 0.485913179

Fraction female 0.273598603 51.01164131 0.005363454 0.995826092 -113.3874213 113.9346185

Table 2.6: Regression stat of assets for the year 2017

The analysis suggests that there was a major study limitation since the variables do not

completely interpret the dependents and there are other major factors which plays in terms of

determining the relationship. In completion of the study the team recognized there to be a

significant non-disclosure issue regarding the annual reports where many relevant

information are not to be found. There is an inconsistency present regarding the valuation

methods among the observations. The data set itself isn’t sufficient enough to reflect the

relationship of the variables. But the analysis also suggests that changes in the independent

variables will also bring in significant changes in terms of the financial factors.

Conclusion

The paper was conceptualized from the paper “Corporate governance and procyclicality in a

banking crisis: Empirical evidence and implications” which was provided by the respected

faculty. In the formation of this paper a major factor that was missing from the parent paper

was the bailout of banks. Bangladesh has not seen many bailout scenarios and the

observations taken for the study did not consist of such scenario, which was a major gap for

the formulation. Despite the team has worked to bring out the relationship that was shown in

the prime study. The existence of the errors are due to the lack of human experience

regarding such works but the study has given a realistic view of how such factors play major

role regarding the observations.

You might also like

- Concentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpFrom EverandConcentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpNo ratings yet

- Mean STD DeviationDocument14 pagesMean STD DeviationRitesh shresthaNo ratings yet

- Group 6Document8 pagesGroup 6Akash hossainNo ratings yet

- NSDL Payment Bank by YunikShopDocument4 pagesNSDL Payment Bank by YunikShoprahul dev varunNo ratings yet

- Peer ComparisonDocument1 pagePeer ComparisonRahul DesaiNo ratings yet

- HDFC by IshanDocument14 pagesHDFC by IshanIshan MalikNo ratings yet

- Annex 258 AU1514Document4 pagesAnnex 258 AU1514madhavjadhav2018No ratings yet

- B-Analysis of HBLDocument14 pagesB-Analysis of HBLhassan.danishNo ratings yet

- Balance Sheet: StandaloneDocument9 pagesBalance Sheet: StandaloneKabita BuragohainNo ratings yet

- CMI Presentation G12Document19 pagesCMI Presentation G12aryaman chakrabortyNo ratings yet

- Chapter-4 Impact of Fdi On Indian Banking IndustryDocument20 pagesChapter-4 Impact of Fdi On Indian Banking IndustryMagudesh RajendranNo ratings yet

- Assignment S1 2023 PDFDocument13 pagesAssignment S1 2023 PDFDuy Trung BuiNo ratings yet

- 2010 DVB1 BC 2016 Al 2017Document80 pages2010 DVB1 BC 2016 Al 2017Adrian HidalgoNo ratings yet

- VN Card Statistic - 6M2022Document47 pagesVN Card Statistic - 6M2022Jonathan BautistaNo ratings yet

- 2020 10 01 - 2020 12 31 - 20022023134410 PDFDocument2 pages2020 10 01 - 2020 12 31 - 20022023134410 PDFbhavya shahNo ratings yet

- Indexing Techniques For Cubic Materials - Limbaga, Laguna, Heramis, Silas, JabienDocument24 pagesIndexing Techniques For Cubic Materials - Limbaga, Laguna, Heramis, Silas, JabienEDISON LIMBAGANo ratings yet

- Annexure: FINANCE - BALANCE SHEET - Bharti Airtel LTD (Curr: Rs in CR.)Document26 pagesAnnexure: FINANCE - BALANCE SHEET - Bharti Airtel LTD (Curr: Rs in CR.)Daman Deep Singh ArnejaNo ratings yet

- 2020 Statistical Bulletin - Financial Sector - FinalDocument81 pages2020 Statistical Bulletin - Financial Sector - FinalMuhammed GbagbaNo ratings yet

- The Balance Sheet Items For CIBDocument1 pageThe Balance Sheet Items For CIBKhalid Al SanabaniNo ratings yet

- Annex 262 AU223Document4 pagesAnnex 262 AU223rajautoprincNo ratings yet

- FM Report - Group 2 - Section EDocument7 pagesFM Report - Group 2 - Section EVenkateswaran SNo ratings yet

- New - Sheet 3 MPPGCL FinalDocument21 pagesNew - Sheet 3 MPPGCL Finalfilesend681No ratings yet

- Dow Engineering InformationDocument29 pagesDow Engineering InformationbenakiaNo ratings yet

- Kelas SitusDocument3 pagesKelas Situsdwi prasetyoNo ratings yet

- Data FirdaDocument7 pagesData FirdaFirdahmad SabyNo ratings yet

- 2021 Statistical Bulletin - Financial SectorDocument81 pages2021 Statistical Bulletin - Financial SectorIbeh CosmasNo ratings yet

- Ratio Analysis of BRAC Bank LTDDocument20 pagesRatio Analysis of BRAC Bank LTDSABRINA SULTANA100% (1)

- No Kode Nama Perusahaan 2014 2015 2016Document2 pagesNo Kode Nama Perusahaan 2014 2015 2016Chairunnisa ManurungNo ratings yet

- CMA Data Analysis - BranchDocument9 pagesCMA Data Analysis - BranchKunal SinghNo ratings yet

- Financial Transaction Report For: Bank of IndiaDocument7 pagesFinancial Transaction Report For: Bank of IndiaSURAJ GUPTANo ratings yet

- 20171021194503spc Week2Document3 pages20171021194503spc Week2Sunil KumarNo ratings yet

- Banks Market Cap Weight Debt Equity D/EDocument2 pagesBanks Market Cap Weight Debt Equity D/Eakshay_kapNo ratings yet

- Nmims Narsee Monjee Solved Assignments 2Document10 pagesNmims Narsee Monjee Solved Assignments 2Yash MittalNo ratings yet

- Bessel Table: Ngu N: K60 - ĐTVT ĐH Bách Khoa Hà N IDocument1 pageBessel Table: Ngu N: K60 - ĐTVT ĐH Bách Khoa Hà N ILộc LýNo ratings yet

- Company AnalysisDocument30 pagesCompany AnalysisVipin UniyalNo ratings yet

- Nikita Patil: Ipo: Shriram Transport Finance Co)Document17 pagesNikita Patil: Ipo: Shriram Transport Finance Co)Visal SasidharanNo ratings yet

- Measurement Areacode 2020Document13 pagesMeasurement Areacode 2020insafaNo ratings yet

- Blue Bus485 FinalDocument13 pagesBlue Bus485 FinalTamzid Ahmed AnikNo ratings yet

- Titan Co LTD (TTAN IN) - LiquidityDocument2 pagesTitan Co LTD (TTAN IN) - LiquiditySambit SarkarNo ratings yet

- FM 2 ProjectDocument7 pagesFM 2 ProjectNiket AmanNo ratings yet

- BCS-CRM 204 - 6 Sep2017Document4 pagesBCS-CRM 204 - 6 Sep2017Ishmael WoolooNo ratings yet

- Market Share of Top 5 Banks in IndiaDocument6 pagesMarket Share of Top 5 Banks in Indiamayank shridharNo ratings yet

- Balance Sep 2019Document3 pagesBalance Sep 2019Kevis MartinezNo ratings yet

- BCS-CRM 203 - 6 Feb2019Document4 pagesBCS-CRM 203 - 6 Feb2019Ishmael WoolooNo ratings yet

- M/S. M/S. Sai Internet and ServicesDocument8 pagesM/S. M/S. Sai Internet and ServicesAkhil JamadarNo ratings yet

- Analytic Hierarchy Process: The Following Criteria Are Helps To Predicting Kind of ManufacturingDocument5 pagesAnalytic Hierarchy Process: The Following Criteria Are Helps To Predicting Kind of ManufacturingpavanNo ratings yet

- 22012024-1111 Grafic RambursareDocument9 pages22012024-1111 Grafic Rambursarewatchface192No ratings yet

- Worksheet PerbaikanDocument76 pagesWorksheet PerbaikannoveadjaniNo ratings yet

- Most Local Cited DocumentsDocument4 pagesMost Local Cited DocumentsAnil KumarNo ratings yet

- Foreignsecbanks 3806Document8 pagesForeignsecbanks 3806sanjay_1234No ratings yet

- Agreement No:: Description of Work No. Length Breadth Depth Qty Amount Sl. NoDocument8 pagesAgreement No:: Description of Work No. Length Breadth Depth Qty Amount Sl. NoinsafaNo ratings yet

- Determinants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaDocument22 pagesDeterminants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaPooja SinghNo ratings yet

- Loan LDR Trading and Investment SecurityDocument5 pagesLoan LDR Trading and Investment SecurityKaren AlonsagayNo ratings yet

- Accounting For ManagementDocument26 pagesAccounting For Managementdheivayani kNo ratings yet

- Measurement MorayurDocument9 pagesMeasurement MorayurAssistant Engineer PWD Bridges Section, MannarkkadNo ratings yet

- Data Pengamatan Praktikum Teknik Digital Jurusan Teknik Elektro Fakultas Teknik Universitas TidarDocument2 pagesData Pengamatan Praktikum Teknik Digital Jurusan Teknik Elektro Fakultas Teknik Universitas TidarMukhammad Agung RakhmawanNo ratings yet

- Research Hypothesis:: Dependent VariablesDocument5 pagesResearch Hypothesis:: Dependent VariablesHafiz Saddique MalikNo ratings yet

- CMADocument12 pagesCMADhruv ChandwaniNo ratings yet

- Daily 27 December 2019Document2 pagesDaily 27 December 2019hope mfungweNo ratings yet

- Pola Pemakaian (Pattern)Document9 pagesPola Pemakaian (Pattern)Befridita Ayu NastitiNo ratings yet

- Termpapaer ASI PDFDocument14 pagesTermpapaer ASI PDFTridib DebnathNo ratings yet

- Loan Growth Capitalisation Liquidity Assets Political Dependence Tenure Brac Bank City Bank Dhaka BankDocument2 pagesLoan Growth Capitalisation Liquidity Assets Political Dependence Tenure Brac Bank City Bank Dhaka BankTridib DebnathNo ratings yet

- Termpapaer ASI PDFDocument14 pagesTermpapaer ASI PDFTridib DebnathNo ratings yet

- Assignment On Dealing With The Problems of Failing Banks: Date of Submission: 1 April, 2020Document4 pagesAssignment On Dealing With The Problems of Failing Banks: Date of Submission: 1 April, 2020Tridib DebnathNo ratings yet

- Unilever Annual Report and Accounts 2019 - tcm244 547893 - en PDFDocument183 pagesUnilever Annual Report and Accounts 2019 - tcm244 547893 - en PDFSaksham TehriNo ratings yet

- Monetary PolicyDocument29 pagesMonetary PolicyTridib DebnathNo ratings yet

- Nistas Bhai PDFDocument31 pagesNistas Bhai PDFTridib DebnathNo ratings yet

- Alvan Feinstein - Multivariable Analysis - An Introduction-Yale University Press (1996)Document629 pagesAlvan Feinstein - Multivariable Analysis - An Introduction-Yale University Press (1996)Maria Gabriela AponteNo ratings yet

- (Art) Serial Pattern Learning by Event ObservationDocument11 pages(Art) Serial Pattern Learning by Event ObservationPriss SaezNo ratings yet

- L5DOL Student Handbook-V1-Mar 2021Document37 pagesL5DOL Student Handbook-V1-Mar 2021karanNo ratings yet

- Of Learning, Not Simply The: - Deep Learning: Engage The World Change The World, P. 26Document7 pagesOf Learning, Not Simply The: - Deep Learning: Engage The World Change The World, P. 26dairalizNo ratings yet

- The Archaeology of Accounting Systems Anthony G Hopwood 1987Document4 pagesThe Archaeology of Accounting Systems Anthony G Hopwood 1987neomilanNo ratings yet

- Domain 2 Communication and Interpersonal SkillsDocument4 pagesDomain 2 Communication and Interpersonal SkillsLip StickNo ratings yet

- 5 Investment Books For 2021Document4 pages5 Investment Books For 2021Yassine MafraxNo ratings yet

- 8 Project Quality TermsDocument4 pages8 Project Quality TermskelmonroeNo ratings yet

- Sample 8 - Airlines PDFDocument17 pagesSample 8 - Airlines PDFkaiserousterNo ratings yet

- Marketing Scales HandbookDocument27 pagesMarketing Scales Handbookhasib_ahsanNo ratings yet

- Applied StatisticsDocument5 pagesApplied StatisticsAmelieNo ratings yet

- 1 s2.0 S095965261600038X Main PDFDocument10 pages1 s2.0 S095965261600038X Main PDFAyoub SOUAINo ratings yet

- ProblemSet Notebook17-18Document97 pagesProblemSet Notebook17-18ALİ CAN ERTÜRK100% (1)

- Design, Fabrication, and Testing of Active Solar Still For Water DesalinationDocument48 pagesDesign, Fabrication, and Testing of Active Solar Still For Water DesalinationJean LardiNo ratings yet

- BGC 410 Tutorial 2 S1 2023 MEMODocument5 pagesBGC 410 Tutorial 2 S1 2023 MEMOCailin Van RoooyenNo ratings yet

- Stats Chapter 8 Hypoth TestingDocument24 pagesStats Chapter 8 Hypoth TestingMadison HartfieldNo ratings yet

- Rosca Ciprian Application Form EB 11-12Document20 pagesRosca Ciprian Application Form EB 11-12Ciprian RoscaNo ratings yet

- Topic 7 - Building Powerful Marketing PlanDocument42 pagesTopic 7 - Building Powerful Marketing PlanAgnes TeoNo ratings yet

- Week 6 Stakeholder Expectations - Scenario Building and ForecastingDocument26 pagesWeek 6 Stakeholder Expectations - Scenario Building and Forecastinguzo akanoNo ratings yet

- Software Development Life CycleDocument3 pagesSoftware Development Life CycleSriharsha Kotamarthy100% (1)

- Weerakoon Sitara ResumeDocument1 pageWeerakoon Sitara ResumeSitara WeerakoonNo ratings yet

- Part 4 Statistical Process of How To Describe Data or VariablesDocument29 pagesPart 4 Statistical Process of How To Describe Data or Variablescarla guban-oñesNo ratings yet

- Pacific Gas and Electric Company: ProgramDocument140 pagesPacific Gas and Electric Company: ProgramzsakosNo ratings yet

- Customer Relationship Management in Hotel IndustryDocument64 pagesCustomer Relationship Management in Hotel Industrymeenxiricha100% (3)

- ML Studio OverviewDocument1 pageML Studio OverviewFulga BogdanNo ratings yet

- Vision of The Department: Programme OutcomesDocument3 pagesVision of The Department: Programme OutcomesPradeep Uday K UNo ratings yet

- Health Care Service in MyanmarDocument6 pagesHealth Care Service in MyanmarSaw He Nay Blut100% (1)

- Emocionalna Inteligencija, Makijavelizam I Emocionalna ManipulacijaDocument11 pagesEmocionalna Inteligencija, Makijavelizam I Emocionalna ManipulacijaBiserka RajkovicNo ratings yet

- The Common Base of Social Work: PracticeDocument11 pagesThe Common Base of Social Work: PracticeChinie DomingoNo ratings yet

- Best Capstone SampleDocument25 pagesBest Capstone SampleVienna Jane FloresNo ratings yet