Professional Documents

Culture Documents

Margin Concerns Should Take Precedence Over Improved Outlook

Uploaded by

ashok yadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Margin Concerns Should Take Precedence Over Improved Outlook

Uploaded by

ashok yadavCopyright:

Available Formats

Infosys

India Equity Research | Information Technology

October 16, 2018

Result Update Emkay

Your success is our success

©

Refer to important disclosures at the end of this report

CMP Target Price

Margin concerns should take Rs 695

as of (October 16, 2018)

Rs 580 (▲)

12 months

precedence over improved outlook Rating

SELL (■)

Upside

(16.6) %

Change in Estimates

Infosys’s Q2FY19 growth of 4.2% in CC terms was above our/Street expectations of

2.5%/3.0%. While overall pricing is expected to remain stable going ahead, qoq realization EPS Chg FY19E/FY20E (%) (1.5)/0.7

improvement of 0.9% in Q2FY19 came in as a surprise. Target Price change (%) 5.5

Target Period (Months) 12

EBIT margins of 23.7% remained flat qoq despite significant currency tailwinds (80bps)

Previous Reco SELL

and pricing improvement (70bps) due to an increase in sub-contractor costs, wage hikes,

Emkay vs Consensus

and compensation increases to curb increasing attrition (22.2% vs. 10.9% for TCS).

EPS Estimates

While the order book increased substantially (US$2.0bn in Q2 vs. US$1.1bn in Q1),

FY19E FY20E

revenue growth guidance remains unchanged at 6-8% due to new deal revenue lag and

Emkay 36.1 39.9

H2 seasonality. We expect margins to drift toward the lower end of the margin band (22-

Consensus 37.6 41.7

24%) in FY19 as planned investments (H2 heavy) and new deal ramp-up costs kick in.

Mean Consensus TP (12M) Rs 768

Revenue outlook for FY20 improved slightly on good Q2 growth, better commentary Stock Details

overall, and large-deal TCV, but weaker margin estimates could lead to street’s EPS

Bloomberg Code INFO IN

downgrades. We maintain a Sell rating, with a TP of Rs580 (based on 14xSep’20E EPS).

Face Value (Rs) 5

Shares outstanding (mn) 4,368

Growth outlook improves but at the cost of margins 52 Week H/L 755 / 454

Commentary turned incrementally positive across regions and verticals (except the M Cap (Rs bn/USD bn) 3,037 / 41.23

Healthcare segment – 6.5% of revenues), with strong large-deal wins (US$2.0bn in TCV in Daily Avg Volume (nos.) 9,117,705

Q2 vs. 1.2bn in Q1; ~60%+ coming from net new deals and well spread across

Daily Avg Turnover (US$ mn) 87.0

markets/verticals). However, profitability continues to remain a concern as Infosys reinvested

150bps gains from currency/offshore mix advantage back into the business to fund higher Shareholding Pattern Sep '18

salary hikes to curb attrition (80bps) and increased sub-contracting charges (up 70bps qoq) Promoters 12.8%

in Q2FY19. Going ahead, we believe that H2 heavy planned investments in

FIIs 35.1%

Digital/Training/Sales/Local hiring and incremental costs related to new deal ramp-ups in

DIIs 22.1%

H2FY19 should further drift margins toward the lower end of the guided range of 22%-24%

for FY19 (H1FY19 OPM stood at 23.7%). Public and Others 30.0%

Price Performance

Imminent margin concerns to bring down consensus EPS estimates;

maintain Sell (%) 1M 3M 6M 12M

Absolute (5) 4 24 49

With no upward revision in revenue growth and margin band guidance despite improved

outlook and the significant INR depreciation in FY19, we expect a cut in consensus earnings Rel. to Nifty 3 8 23 44

estimates which could further lead to a consensus de-rating of the stock. While our FY19 Relative price chart

revenue outlook improves slightly on the back of good Q2, our earnings estimates remain flat 750 Rs % 60

due to the uninspiring commentary on margin improvement. We believe that our lower multiple 690 46

for Infosys is justified (14x vs. 21x for TCS) given the growth differential of ~30% and the

630 32

expected decline (-100bps) in margins for Infosys vs. margin improvement (100-150bps) for

TCS. Maintain Sell rating, with a TP of Rs580 (based on Sep’20E EPS). 570 18

510 4

450 -10

Financial Snapshot (Consolidated) Oct-17 Dec-17 Feb-18 Apr-18 Jun-18 Aug-18 Oct-18

Infosys (LHS) Rel to Nifty (RHS)

(Rs mn) FY17 FY18 FY19E FY20E FY21E

Source: Bloomberg

Revenue 684,840 705,220 819,677 905,639 969,460

EBITDA 186,040 189,248 210,958 232,977 249,398 This report is solely produced by Emkay Global. The

following person(s) are responsible for the production

EBITDA Margin (%) 27.2 26.8 25.7 25.7 25.7 of the recommendation:

APAT 143,530 145,970 157,063 173,731 184,949 Rahul Jain

EPS (Rs) 31.3 33.5 36.1 39.9 42.5 rahul.jain@emkayglobal.com

EPS (% chg) 6.4 7.0 7.6 10.6 6.5 +91-022-266121253

ROE (%) 22.0 21.8 23.0 22.9 21.8 Devanshu Bansal

P/E (x) 22.2 20.7 19.3 17.4 16.4 devanshu.bansal@emkayglobal.com

EV/EBITDA (x) 15.9 15.0 13.5 12.2 11.4 +91-22-66121385

P/BV (x) 4.6 4.7 4.2 3.8 3.4

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer

to the last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA

Infosys (INFO IN) India Equity Research | Result Update

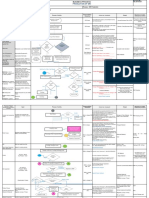

Exhibit 1: Actual vs. Estimates

Estimate % variation

(in Rs mn) Actual Comment

Emkay Consensus Emkay Consensus

Revenues (in US$ mn) 2,921 2,860 2,737 2.1% 6.7%

Sales 2,06,090 2,00,199 2,03,186 2.9% 1.4%

Infosys’s Q2FY19 revenue growth was better

EBIT 48,940 48,448 49,447 1.0% -1.0% than our/Street expectations, but lower-than-

expected margins led to in-line profits.

EBIT, margin 23.7% 24.2% 24.3% -50 bps -60 bps

PAT 41,100 41,016 40,485 0.2% 1.5%

Source: Company, Emkay Research

Exhibit 2: Quarterly snapshot

Rs mn Q2FY18 Q1FY19 Q2FY19 YoY (%) QoQ (%) YTD FY18 YTD FY19 YoY (%)

Revenues(in US$ mn) 2,728 2,831 2,921 7.1 3.2 5,379 5,752 6.9

Revenue 1,75,670 1,91,280 2,06,090 17.3 7.7 3,46,450 3,97,370 14.7

Operating Expenditure 1,33,210 1,45,910 1,57,150 18.0 7.7 2,62,880 3,03,061 15.3

Cost of revenues 1,12,270 1,22,880 1,32,810 18.3 8.1 2,21,270 2,55,690 15.6

as % of sales 63.9 64.2 64.4 63.9 64.3

SG&A expenses 20,940 23,030 24,340 16.2 5.7 41,610 47,371 13.8

as % of sales 11.9 12.0 11.8 12.0 11.9

EBIT 42,460 45,370 48,940 15.3 7.9 83,570 94,309 12.9

Other Income 8,830 4,560 7,390 (16.3) 62.1 16,260 11,950 (26.5)

PBT 51,290 49,930 56,329.58 9.8 12.8 99,830 1,06,259 6.4

Total Tax 14,030 13,810 15,230 8.6 10.3 27,740 29,040 4.7

Adjusted PAT 37,260 36,120 41,100 10.3 13.8 72,090 77,219 7.1

APAT after MI 37,260 36,120 41,100 10.3 13.8 72,090 77,219 7.1

Reported PAT 37,260 36,120 41,100 10.3 13.8 72,090 77,219 7.1

Reported EPS 8.6 8.3 9.5 10.3 13.8 16.2 17.8 9.7

Margins (%) (bps) (bps) (bps)

EBIT 24.2 23.7 23.7 (42) 3 24.1 23.7 (39)

EBT 29.2 26.1 27.3 (186) 123 28.8 26.7 (207)

PAT 21.2 18.9 19.9 (127) 106 20.8 19.4 (138)

Effective Tax rate 27.4 27.7 27.0 (32) (62) 27.8 27.3 (46)

Source: Company, Emkay Research

Exhibit 3: Change in Estimates

(All fig in Rs mn FY19E FY20E FY21E

except EPS) Old New % Chg. Old New % Chg. Introducing

Revenues(US$ mn) 11,592 11,700 0.9% 12,476 12,578 0.8% 13,465

YoY growth, % 6.0% 7.0% 7.6% 7.5% 7.0%

Revenues 8,10,471 8,19,677 1.1% 898271 9,05,639 0.8% 9,69,460

EBIT 1,93,118 1,90,167 -1.5% 208204 2,09,920 0.8% 2,24,717

EBIT margins, % 23.8 23.2 23.2 23.2 23.2

Net profits 1,59,133 1,56,686 -1.5% 171801 1,72,933 0.7% 1,84,887

EPS 36.6 36.0 -1.5% 39.5 39.7 0.7% 42.5

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 2

Infosys (INFO IN) India Equity Research | Result Update

Outlook improves at the cost of profitability

Digital growth healthy but relatively larger peer growing at a significant higher rate:

Digital (~31% of sales) grew by ~32% yoy (vs. ~60% yoy growth for TCS) and overall

revenue grew by ~8% yoy in CC terms (vs. 11.5% for TCS). Infosys stated that it is seeing

traction in Cloud, Data Analytics, IOT and Customer Experience areas, with the help of its

three recent acquisitions –Brilliant Basics, Wongdoody, and Fluido.

Exhibit 4: Digital – Quarterly revenue and growth trends

1000 906 14

804 12

719 752

800 687 12.6

634 10

600 8

8.5

400 4.6 7.0 6

4.5 4

200

2

0 0

Jun'17 Sep'17 Dec'17 Mar'18 Jun'18 Sep'18

Digital Revenues Growth qoq %

Source: Company, Emkay Research

Commentary improves on broad-based improvement in large-deal TCV: Infosys had

12 large deal wins during the quarter, of which 7 were in Americas and 4 in Europe, and 1

in RoW. Among the verticals, 3 large deal wins were in Financial Services and

Manufacturing each, 2 in Hi-Tech and 1 each in Retail, Telecom and other vertical. Around

60% of the total large-deal TCV came from net new deals (vs. 47% in Q1FY19). On the

uptick in large deal wins, Infosys stated that it is trying to improve deal originations by

increasing engagements with deal advisors, tapping best talent within Infosys and

incentivizing people to increase large deal wins. However, the company stated that such

deal wins are competitive at the start and the margin profile of such deals improve only

gradually with the help of Automation and AI.

Exhibit 5: Large Deal TCV see a sudden uptick but management indicates quarterly lumpiness

2000

2500

2000

1227

1207

1116

1500

983

962

905

809

806

779

731

700

700

688

664

657

600

550

1000

500

450

414

213

500

0

Jun'15

Jun'17

Jun'18

Mar'14

Mar'15

Mar'16

Mar'17

Mar'18

Dec'14

June'13

Sep'13

Dec'13

June'14

Sep'14

Sep'15

Dec'15

June'16

Sep'16

Dec'16

Sep'17

Dec'17

Sep'18

TCV (in USD mn)

Source: Company, Emkay Research

Future Outlook remains intact despite improved outlook and INR depreciation: Outlook

remains unchanged with revenue growth (6-8% CC growth in FY19) and margin band (22-24%)

guidance despite improved outlook and the significant INR depreciation in FY19. H2FY19

seasonality and the expected lag in revenue outflow for large deals, coupled with heavy planned

investments in H2FY19 were stated to be the reason behind unchanged outlook.

BFSI (up 5.8% qoq in CC terms; 33.1% of sales) and Retail (up 5.9% qoq in CC terms;

~16% of sales) commentary improves but Infosys indicates H2FY19 seasonality:

While it re-iterated that momentum in Regional Banks, Insurance and Europe continues to

be strong, it also indicated that spends in the US and certain top accounts have started to

improve. While its outlook improved due to improved macros leading to improved spending,

it expects H2FY19 seasonality to affect BFSI growth. For platforms, it indicated that while

demand for large-scale platform implementations is limited, lot of interest is emerging in

Digital and Blockchain surrounding these platforms (Finnacle and Mc-Camish). For Retail,

it expects growth revival on the increased focus on modernization and strong deal pipeline.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 3

Infosys (INFO IN) India Equity Research | Result Update

Exhibit 6: Top 10 yoy clients' growth in USD terms (%) improved slightly on yoy basis

519 545 544 533 555 564 513 519 530 532 529 539 544 567

600 15.0%

400 10.0%

200 5.0%

- 0.0%

(200) -5.0%

(400) -10.0%

Dec'15

Dec'16

Dec'17

Mar'16

Mar'17

Mar'18

Jun'15

Jun'17

Jun'18

Sep'15

June'16

Sep'16

Sep'17

Sep'18

US$ revenues from top 10 clients YoY growth, %

Source: Company, Emkay Research

EBIT margin at 23.7% remained flat on a qoq basis due to wage hikes (15% of Sr. level

employees got hikes effective Jul’18), increased variable pay and compensation to curb

high attrition, and increase in sub-contractor expenses (overall 150bps negative impact)

despite significant currency tailwinds (+80bps) and pricing improvement (+70bps). On

future margin levers, management stated that with the increase in Digital contribution

(~200bps higher gross margin business), improvement in productivity of the FP projects

and onsite pyramid rationalization, margins can remain in the guided range despite planned

investments.

Increase in sub-contractor costs: Sub-contractor expenses stood at 7.4% sales in

Q2FY19 vs. 6.7% in Q1FY19. Infosys stated that with its increasing focus on localization

and greater onsite demand for Digital work, sub-contractor expenses are expected to

remain elevated at current levels.

HR metrics: ~19,700 employees were added on a gross basis. Total headcount stood at

~218,000 (up ~4.0% qoq). The utilization rate remains stretched at 85.6%.

Exhibit 7: Utilisations stretched

84.7%

84.9%

84.7%

85.7%

85.6%

84.0%

88.0%

82.5%

82.0%

81.9%

86.0%

81.3%

80.6%

80.5%

80.2%

80.1%

84.0%

82.0%

80.0%

78.0%

76.0%

June'16

Mar'16

Mar'17

Mar'18

Dec'17

Jun'15

Sep'15

Dec'15

Dec'16

Jun'17

Jun'18

Sep'16

Sep'17

Sep'18

Utilization excluding trainees

Source: Company, Emkay Research

Exhibit 8: Employee additions quarterly trends - Gross and Net

25

19.7

20 17.6 17.7

14.0 13.3 12.7 12.6

15 11.9 12.3

9.1 9.1 10.5

8.5 9.0 8.6

10 5.4 7.8

5.8

3.3 2.8 3.3

5 0.7 3.0 2.4

0.6

0

-0.1 -0.1

-5 -1.8

Mar'16

Mar'17

Mar'18

Jun'17

Jun'15

Sep'15

Dec'15

June'16

Sep'16

Dec'16

Sep'17

Dec'17

Jun'18

Sep'18

Gross Additions ('000) Net Additions ('000)

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 4

Infosys (INFO IN) India Equity Research | Result Update

Attrition: Infosys acknowledged an increase in its attrition (stated to be largely led by

employees with 3-5 years of experience). It stated that it has rewarded good candidates

with promotions and compensation increases to curb high attritions. However, no signal of

pullback of such investments was provided, which, we believe, will continue to exert

pressure on margins. Higher attrition has also led to more gross additions than usual.

Exhibit 9: Attrition alarming

24 23.0

22.2

21.0 21.0 21.4

22

19.9 20.0

19.2 19.5

20 18.4 18.7

18.1

17.3 17.1

18

16

14

Mar'16

Mar'17

Mar'18

June'16

Dec'17

Jun'15

Sep'15

Dec'15

Sep'16

Dec'16

Jun'17

Sep'17

Jun'18

Sep'18

Attrition % (Consolidated)

Source: Company, Emkay Research

Other Key Highlights

The company issued ~2.2bn additional equity shares (face value- Rs5) each during

Q2FY19 related to bonus issue. The bonus shares were issued to celebrate its 25th year

of public listing in India and to further increase the liquidity of its shares. Bonus share of

one equity share for every equity share held, and a bonus issue, viz., a stock dividend of

one American Depositary Share (ADS) for every ADS held, respectively, has been allotted.

Acquisitions: during Q2FY19, Infosys acquired a 60% stake in Singapore-based IT services

company Trusted Source for a total consideration of up to SGD 12mn (~Rs630mn).

On October 11, 2018, Infosys acquired 100% interest in Fluido, a Nordic-based salesforce

advisor and consulting partner in cloud consulting, implementation and training services for

a total consideration of up to EUR65mn (~Rs5.5bn), comprising a cash consideration of

EUR45mn (~Rs3.8bn), contingent consideration of up to EUR12mn (~Rs1.0bn), and

retention payouts of up to EUR8mn (~0.7bn), payable to the employees of Fluido over the

next three years, subject to their continuous employment with the group.

Capital payouts: For FY19, it has already distributed US$400mn as special dividend and

balance (US$1.6bn) will be paid in a manner yet to be decided by its board. Infosys declared

an interim dividend of Rs7/share.

Utilization remains stretched at 85.6% in Q2FY19 vs. 85.7% in Q1FY19.

Onsite mix at 28.4% decreased further in this quarter (vs. 28.6% in Q1FY19 and now lowest

in the last 15 quarters).

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 5

Infosys (INFO IN) India Equity Research | Result Update

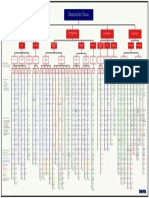

Valuation/PE performance

Our FY19 revenue outlook improves slightly on the back of good Q2, our earnings estimates

remain flat due to the uninspiring commentary on margin improvement. We believe that our lower

multiple for Infosys is justified (14x vs. 21x for TCS) given the growth differential of ~30% and

the expected decline (-100bps) in margins for Infosys vs. margin improvement (100-150bps) for

TCS. Maintain Sell rating, with a TP of Rs580 (based on Sep’20E EPS).

Exhibit 10: 5-Yr Historical 1-Yr fwd PE chart Exhibit 11: 3-Yr Historical 1-Yr fwd PE chart

20 20

18 18

16 16

14 14

12 12

10 10

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Oct-13

Apr-14

Oct-14

Apr-15

Oct-15

Apr-16

Oct-16

Apr-17

Oct-17

Apr-18

Oct-18

Jul-16

Jul-17

Jul-18

Jan-16

Jan-17

Jan-18

Oct-15

Apr-17

Apr-16

Oct-16

Oct-17

Apr-18

Oct-18

5 Yr Mean Plus1SD Minus1SD 1yr fwd PE 3 Yr Mean Plus1SD Minus1SD 1yr fwd PE

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 12: Infosys’ 1-Yr forward PE discount to TCS (%)

10

-10

-20

-30

-40

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Oct-13

Apr-14

Oct-14

Apr-15

Oct-15

Apr-16

Oct-16

Apr-17

Oct-17

Apr-18

Oct-18

Infosys 1-Yr fwd PE discount to TCS (%) -25%

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 6

Infosys (INFO IN) India Equity Research | Result Update

Key Financials (Consolidated)

Income Statement

Y/E Mar (Rs mn) FY17 FY18 FY19E FY20E FY21E

Revenue 684,840 705,220 819,677 905,639 969,460

Expenditure 498,800 515,972 608,719 672,662 720,062

EBITDA 186,040 189,248 210,958 232,977 249,398

Depreciation 17,030 17,768 20,790 23,057 24,680

EBIT 169,010 171,480 190,168 209,921 224,718

Other Income 30,800 31,220 24,721 26,447 26,914

Interest expenses 0 0 0 0 0

PBT 199,810 202,700 214,890 236,368 251,632

Tax 55,980 56,730 57,827 62,637 66,682

Extraordinary Items 0 14,320 0 0 0

Minority Int./Income from Assoc. 300 0 0 0 0

Reported Net Income 143,530 160,290 157,063 173,731 184,949

Adjusted PAT 143,530 145,970 157,063 173,731 184,949

Balance Sheet

Y/E Mar (Rs mn) FY17 FY18 FY19E FY20E FY21E

Equity share capital 11,440 10,880 21,760 21,760 21,760

Reserves & surplus 678,380 638,360 695,761 778,099 871,655

Net worth 689,820 649,240 717,521 799,859 893,415

Minority Interest 0 0 0 0 0

Loan Funds 3,600 8,610 8,610 8,610 8,610

Net deferred tax liability 0 0 0 0 0

Total Liabilities 693,420 657,850 726,131 808,469 902,025

Net block 214,940 241,170 267,670 296,670 325,670

Investment 167,610 142,390 160,390 182,390 204,390

Current Assets 437,350 415,340 457,621 511,958 577,513

Cash & bank balance 226,250 198,180 192,239 191,412 201,803

Other Current Assets 87,880 43,130 63,852 90,516 117,180

Current liabilities & Provision 140,130 141,050 159,550 182,549 205,548

Net current assets 297,220 274,290 298,071 329,409 371,965

Misc. exp 0 0 0 0 0

Total Assets 693,420 657,850 726,131 808,469 902,025

Cash Flow

Y/E Mar (Rs mn) FY17 FY18 FY19E FY20E FY21E

PBT (Ex-Other income) (NI+Dep) 169,010 171,480 190,168 209,921 224,718

Other Non-Cash items 0 0 0 0 0

Chg in working cap (16,470) (5,140) (29,722) (32,165) (32,165)

Operating Cashflow 113,590 127,378 123,410 138,175 150,551

Capital expenditure (88,230) (12,580) (26,500) (29,000) (29,000)

Free Cash Flow 25,360 114,798 96,910 109,175 121,551

Investments (76,130) 25,220 (18,000) (22,000) (22,000)

Other Investing Cash Flow 0 0 0 0 0

Investing Cashflow (133,560) 43,860 (19,779) (24,553) (24,086)

Equity Capital Raised 0 (560) 10,880 0 0

Loans Taken / (Repaid) 3,600 5,010 0 0 0

Dividend paid (incl tax) (70,699) (113,587) (88,781) (91,392) (91,392)

Other Financing Cash Flow (13,651) (90,171) (31,672) (23,057) (24,681)

Financing Cashflow (80,750) (199,308) (109,573) (114,449) (116,073)

Net chg in cash (100,720) (28,070) (5,942) (827) 10,392

Opening cash position 326,970 226,250 198,180 192,239 191,412

Closing cash position 226,250 198,180 192,238 191,412 201,803

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 7

Infosys (INFO IN) India Equity Research | Result Update

Key Ratios

Profitability (%) FY17 FY18 FY19E FY20E FY21E

EBITDA Margin 27.2 26.8 25.7 25.7 25.7

EBIT Margin 24.7 24.3 23.2 23.2 23.2

Effective Tax Rate 28.0 28.0 26.9 26.5 26.5

Net Margin 21.0 20.7 19.2 19.2 19.1

ROCE 30.6 30.0 31.1 30.8 29.4

ROE 22.0 21.8 23.0 22.9 21.8

RoIC 71.7 56.9 55.1 51.9 48.3

Per Share Data (Rs) FY17 FY18 FY19E FY20E FY21E

EPS 31.3 33.5 36.1 39.9 42.5

CEPS 35.1 37.6 40.9 45.2 48.2

BVPS 150.6 149.2 164.9 183.8 205.3

DPS 12.9 21.8 17.0 17.5 17.5

Valuations (x) FY17 FY18 FY19E FY20E FY21E

PER 22.2 20.7 19.3 17.4 16.4

P/CEPS 19.8 18.5 17.0 15.4 14.4

P/BV 4.6 4.7 4.2 3.8 3.4

EV / Sales 4.3 4.0 3.5 3.1 2.9

EV / EBITDA 15.9 15.0 13.5 12.2 11.4

Dividend Yield (%) 1.9 3.1 2.4 2.5 2.5

Gearing Ratio (x) FY17 FY18 FY19E FY20E FY21E

Net Debt/ Equity (0.3) (0.3) (0.3) (0.2) (0.2)

Net Debt/EBIDTA (1.2) (1.0) (0.9) (0.8) (0.8)

Working Cap Cycle (days) 37.8 39.4 47.1 55.6 64.1

Growth (%) FY17 FY18 FY19E FY20E FY21E

Revenue 9.7 3.0 16.2 10.5 7.0

EBITDA 8.9 1.7 11.5 10.4 7.0

EBIT 8.2 1.5 10.9 10.4 7.0

PAT 6.4 11.7 (2.0) 10.6 6.5

Quarterly (Rs mn) Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q2FY19

Revenue 175,670 177,940 180,830 191,280 206,090

EBITDA 42,460 43,190 44,720 45,370 48,940

EBITDA Margin (%) 24.2 24.3 24.7 23.7 23.7

PAT 37,260 36,970 36,900 36,120 41,100

EPS (Rs) 8.6 8.5 8.5 8.3 9.5

Source: Company, Emkay Research

Shareholding Pattern (%) Dec-17 Mar-18 Jun-18 Sep-18

Promoters 12.9 12.9 12.9 12.8

FIIs 35.0 35.2 34.9 35.1

DIIs 21.8 21.6 22.5 22.1

Public and Others 30.3 30.3 29.7 30.0

Source: Capitaline

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 8

Infosys (INFO IN) India Equity Research | Result Update

RECOMMENDATION HISTORY TABLE RECOMMENDATION HISTORY CHART

Closing Period

Date TP Rating Analyst BUY Hold Sell

Price (months) Accumulate Reduce Price

Target Price

5-Oct-18 725 550 12m Sell Rahul Jain 750

18-Aug-18 715 520 12m Sell Rahul Jain

686

13-Jul-18 659 520 12m Sell Rahul Jain

622

10-Jul-18 651 520 12m Sell Rahul Jain

558

6-Jul-18 642 520 12m Sell Rahul Jain

13-Apr-18 586 485 12m Reduce Rahul Jain 494

5-Apr-18 574 485 12m Reduce Rahul Jain 430

8-Oct-18

16-Apr-16

13-Apr-17

10-Apr-18

18-Oct-15

14-Oct-16

11-Oct-17

28-Mar-18 566 485 12m Reduce Rahul Jain

12-Jan-18 539 485 12m Reduce Rahul Jain

8-Jan-18 518 475 12m Hold Rahul Jain Source: Bloomberg, Company, Emkay Research

4-Dec-17 493 470 12m Hold Rahul Jain

24-Oct-17 463 470 12m Hold Rahul Jain

4-Oct-17 450 480 12m Hold Rahul Jain

20-Sep-17 456 475 12m Hold Rahul Jain

18-Aug-17 462 455 12m Reduce Rahul Jain

14-Jul-17 486 490 12m Hold Rahul Jain

10-Jul-17 479 500 12m Accumulate Manik Taneja

13-Apr-17 466 500 12m Accumulate Manik Taneja

13-Jan-17 488 540 12m Accumulate Manik Taneja

1-Nov-16 495 540 12m Accumulate Manik Taneja

14-Oct-16 514 550 12m Hold Manik Taneja

29-Aug-16 511 550 12m Hold Manik Taneja

16-Aug-16 526 580 12m Hold Manik Taneja

18-Jul-16 541 580 12m Hold Manik Taneja

21-Jun-16 603 620 12m Hold Manik Taneja

15-Apr-16 586 620 12m Hold Manik Taneja

15-Jan-16 570 610 12m Hold Manik Taneja

4-Jan-16 539 600 12m Hold Manik Taneja

5-Nov-15 561 600 12m Hold Manik Taneja

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018 | 9

Infosys (INFO IN) India Equity Research | Result Update

Emkay Rating Distribution

BUY Expected total return (%) (Stock price appreciation and dividend yield) of over 25% within the next 12-18 months.

ACCUMULATE Expected total return (%) (Stock price appreciation and dividend yield) of over 10% within the next 12-18 months.

HOLD Expected total return (%) (Stock price appreciation and dividend yield) of upto 10% within the next 12-18 months.

REDUCE Expected total return (%) (Stock price depreciation) of upto (-) 10% within the next 12-18 months.

SELL The stock is believed to underperform the broad market indices or its related universe within the next 12-18 months.

Completed Date: 17 Oct 2018 02:01:31 (SGT)

Dissemination Date: 17 Oct 2018 02:02:31 (SGT)

Sources for all charts and tables are Emkay Research unless otherwise specified.

GENERAL DISCLOSURE/DISCLAIMER BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL):

Emkay Global Financial Services Limited (CIN-L67120MH1995PLC084899) and its affiliates are a full-service, brokerage, investment banking, investment

management and financing group. Emkay Global Financial Services Limited (EGFSL) along with its affiliates are participants in virtually all securities trading

markets in India. EGFSL was established in 1995 and is one of India's leading brokerage and distribution house. EGFSL is a corporate trading member of

Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), MCX Stock Exchange Limited (MCX-SX). EGFSL along with its

subsidiaries offers the most comprehensive avenues for investments and is engaged in the businesses including stock broking (Institutional and retail),

merchant banking, commodity broking, depository participant, portfolio management, insurance broking and services rendered in connection with

distribution of primary market issues and financial products like mutual funds, fixed deposits. Details of associates are available on our website i.e.

www.emkayglobal.com

EGFSL is registered as Research Analyst with SEBI bearing registration Number INH000000354 as per SEBI (Research Analysts) Regulations, 2014.

EGFSL hereby declares that it has not defaulted with any stock exchange nor its activities were suspended by any stock exchange with whom it is registered

in last five years, except that NSE had disabled EGFSL from trading on October 05, October 08 and October 09, 2012 for a manifest error resulting into a

bonafide erroneous trade on October 05, 2012. However, SEBI and Stock Exchanges have conducted the routine inspection and based on their

observations have issued advice letters or levied minor penalty on EGFSL for certain operational deviations in ordinary/routine course of business. EGFSL

has not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has its certificate of registration been cancelled

by SEBI at any point of time.

EGFSL offers research services to clients as well as prospects. The analyst for this report certifies that all of the views expressed in this report accurately

reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will

be, directly or indirectly related to specific recommendations or views expressed in this report.

Other disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations,

2014 with reference to the subject company(s) covered in this report

EGFSL and/or its affiliates may seek investment banking or other business from the company or companies that are the subject of this material. Our

salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that

are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that may be

inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing, among other

things, may give rise to real or potential conflicts of interest including but not limited to those stated herein. Additionally, other important information

regarding our relationships with the company or companies that are the subject of this material is provided herein. This report is not directed to, or intended

for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such

distribution, publication, availability or use would be contrary to law or regulation or which would subject EGFSL or its group companies to any registration

or licensing requirement within such jurisdiction. Specifically, this document does not constitute an offer to or solicitation to any U.S. person for the purchase

or sale of any financial instrument or as an official confirmation of any transaction to any U.S. person. Unless otherwise stated, this message should not

be construed as official confirmation of any transaction. No part of this document may be used by private customers in United Kingdom. All material

presented in this report, unless specifically indicated otherwise, is under copyright to Emkay. None of the material, nor its content, nor any copy of it, may

be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of EGFSL . All trademarks,

service marks and logos used in this report are trademarks or registered trademarks of EGFSL or its Group Companies. The information contained herein

is not intended for publication or distribution or circulation in any manner whatsoever and any unauthorized reading, dissemination, distribution or copying

of this communication is prohibited unless otherwise expressly authorized. Please ensure that you have read “Risk Disclosure Document for Capital Market

and Derivatives Segments” as prescribed by Securities and Exchange Board of India before investing in Indian Securities Market. In so far as this report

includes current or historic information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

This publication has not been reviewed or authorized by any regulatory authority. There is no planned schedule or frequency for updating research

publication relating to any issuer.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets

Disclaimer for U.S. persons only: This research report is a product of Emkay Global Financial Services Limited (Emkay), which is the employer of the

research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States

(U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-

dealer, and is/are not required to satisfy the regulatory licensing requirements of Financial Institutions Regulatory Authority (FINRA) or required to otherwise

comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities

held by a research analyst account. This report is intended for distribution to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S.

Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on

Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the

same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional

Investor. In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to

conduct certain business with Major Institutional Investors.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 10

Infosys (INFO IN) India Equity Research | Result Update

GENERAL DISCLOSURE/DISCLAIMER BY DBS BANK LTD AS DISTRIBUTOR OF THE RESEARCH REPORT

This report is solely intended for the clients of DBS Bank Ltd,its respective connected and associated corporations and affiliates only and no part of this

document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank

Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively, the “DBS

Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other factors which we

may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or warranty as to the accuracy,

completeness or correctness of the research set out in this report. Opinions expressed are subject to change without notice. This research is prepared for

general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and

the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the

exercise of judgement by addressees, who should obtain separate independent legal or financial advice. The DBS Group accepts no liability whatsoever

for any direct, indirect and/or consequential loss (including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or

further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any

securities. The DBS Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities

mentioned in this document. The DBS Group, may have positions in, and may effect transactions in securities mentioned herein and may also perform or

seek to perform broking, investment banking and other banking services for these companies. Any valuations, opinions, estimates, forecasts, ratings or

risk assessments herein constitutes a judgment as of the date of this report, and there can be no assurance that future results or events will be consistent

with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The information in this document is subject to change without notice,

its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain all material information concerning the company (or companies)

referred to in this report and the DBS Group is under no obligation to update the information in this report. This publication has not been reviewed or

authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned schedule or frequency for updating research publication

relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the

valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results.

Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as

a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that: (a) such valuations, opinions,

estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and (b) there is any assurance that future results or

events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein. Please contact the primary

analyst for valuation methodologies and assumptions associated with the covered companies or price targets. Any assumptions made in this report that

refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned herein. They are not to be construed as

recommendations to trade in the physical commodity or in the futures contract relating to the commodity referred to in this report.

DBSVUSA, a US-registered broker-dealer, does not have its own investment banking or research department, has not participated in any public offering

of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months and does not engage in market-

making.

ANALYST CERTIFICATION BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL)

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies and

their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her compensation was, is,

or will be, directly or indirectly, related to specific recommendations or views expressed in the report. The research analyst (s) primarily responsible of the

content of this research report, in part or in whole, certifies that he or his associate 1 does not serve as an officer, director or employee of the issuer or the

new listing applicant (which includes in the case of a real estate investment trust, an officer of the management company of the real estate investment

trust; and in the case of any other entity, an officer or its equivalent counterparty of the entity who is responsible for the management of the issuer or the

new listing applicant). The research analyst(s) primarily responsible for the content of this research report or his associate does not have financial interests2

in relation to an issuer or a new listing applicant that the analyst reviews. EGFSL has procedures in place to eliminate, avoid and manage any potential

conflicts of interests that may arise in connection with the production of research reports. The research analyst(s) responsible for this report operates as

part of a separate and independent team to the investment banking function of the EGFSL and procedures are in place to ensure that confidential

information held by either the research or investment banking function is handled appropriately. There is no direct link of EGFSL compensation to any

specific investment banking function of the EGFSL.

1

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse,

minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions

or instructions of the analyst.

2

Financial interest is defined as interest that are commonly known financial interest, such as investment in the securities in respect of an issuer or a new listing applicant, or

financial accommodation arrangement between the issuer or the new listing applicant and the firm or analysis. This term does not include commercial lending conducted at the

arm’s length, or investments in any collective investment scheme other than an issuer or new listing applicant notwithstanding the fact that the scheme has investments in

securities in respect of an issuer or a new listing applicant.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 11

Infosys (INFO IN) India Equity Research | Result Update

COMPANY-SPECIFIC / REGULATORY DISCLOSURES BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL):

Disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations, 2014

with reference to the subject company(s) covered in this report-:

1. EGFSL, its subsidiaries and/or other affiliates do not have a proprietary position in the securities recommended in this report as of October 16,

2018

2. EGFSL, and/or Research Analyst does not market make in equity securities of the issuer(s) or company(ies) mentioned in this Research Report

Disclosure of previous investment recommendation produced:

3. EGFSL may have published other investment recommendations in respect of the same securities / instruments recommended in this research

report during the preceding 12 months. Please contact the primary analyst listed in the first page of this report to view previous investment

recommendations published by EGFSL in the preceding 12 months.

4. EGFSL , its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have any material conflict of interest in the

securities recommended in this report as of October 16, 2018.

5. EGFSL, its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have actual/beneficial ownership of 1% or more

securities of the subject company at the end of the month immediately preceding the October 16, 2018

6. EGFSL, its subsidiaries and/or other affiliates and Research Analyst have not received any compensation in whatever form including

compensation for investment banking or merchant banking or brokerage services or for products or services other than investment banking or

merchant banking or brokerage services from securities recommended in this report (subject company) in the past 12 months.

7. EGFSL, its subsidiaries and/or other affiliates and/or and Research Analyst have not received any compensation or other benefits from securities

recommended in this report (subject company) or third party in connection with the research report.

8. Securities recommended in this report (Subject Company) has not been client of EGFSL, its subsidiaries and/or other affiliates and/or and

Research Analyst during twelve months preceding the October 16, 2018

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 12

Infosys (INFO IN) India Equity Research | Result Update

COMPANY-SPECIFIC / REGULATORY DISCLOSURES BY DBS BANK LTD AS DISTRIBUTOR OF THE RESEARCH REPORT

1. DBS Bank Ltd., DBS HK, DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”) or their subsidiaries and/or other affiliates do not have a proprietary

position in the securities recommended in this report as of 30 Apr 2018.

2. Neither DBS Bank Ltd nor DBS HK market makes in equity securities of the issuer(s) or company(ies) mentioned in this Research Report.

Compensation for investment banking services:

3. DBSVUSA, does not have its own investment banking or research department, nor has it participated in any public offering of securities as a manager

or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further information, including

any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA

exclusively.

Disclosure of previous investment recommendation produced:

4. DBS Bank Ltd. DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”), their subsidiaries and/or other affiliates may have published other investment

recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12 months. Please contact

the primary analyst listed in the first page of this report to view previous investment recommendations published by DBS Bank Ltd. DBS Vickers Securities

(Singapore) Pte Ltd (“DBSVS”), their subsidiaries and/or other affiliates in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

General located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be

contrary to law or regulation.

Australia This report is not for distribution into Australia.

Hong Kong This report is not for distribution into Hong Kong.

Indonesia This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia.

Malaysia This report is not for distribution into Malaysia.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 16800306E) or DBSVS (Company Regn. No.

1860024G) both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary

Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign entities,

Singapore

affiliates or other foreign research houses pursuant to an agreement under Regulation 32C of the financial Advisers

Regulations. Singapore recipients should contact DBS Bank Ltd at 6327 2288 for matters arising from, or in connection with

the report.

Thailand This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd.

This report is disseminated in the United Kingdom by DBS Vickers Securities (UK) Ltd, ("DBSVUK"). DBSVUK is authorised

and regulated by the Financial Conduct Authority in the United Kingdom.

In respect of the United Kingdom, this report is solely intended for the clients of DBSVUK, its respective connected and

United Kingdom associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any

form or by any means or (ii) redistributed without the prior written consent of DBSVUK. This communication is directed at

persons having professional experience in matters relating to investments. Any investment activity following from this

communication will only be engaged in with such persons. Persons who do not have professional experience in matters relating

to investments should not rely on this communication.

This research report is being distributed by DBS Bank Ltd., (DIFC Branch) having its office at units 608-610, 6th Floor, Gate

Dubai International

Precinct Building 5, PO Box 506538, Dubai International Financial Centre (DIFC), Dubai, United Arab Emirates. DBS Bank

Financial Centre

Ltd., (DIFC Branch) is regulated by The Dubai Financial Services Authority. This research report is intended only for

professional clients (as defined in the DFSA rulebook) and no other person may act upon it.

This report is provided by DBS Bank Ltd (Company Regn. No. 196800306E) which is an Exempt Financial Adviser as defined

in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. This report is for information purposes

only and should not be relied upon or acted on by the recipient or considered as a solicitation or inducement to buy or sell any

financial product. It does not constitute a personal recommendation or take into account the particular investment objectives,

United Arab Emirates

financial situation, or needs of individual clients. You should contact your relationship manager or investment adviser if you

need advice on the merits of buying, selling or holding a particular investment. You should note that the information in this

report may be out of date and it is not represented or warranted to be accurate, timely or complete. This report or any portion

thereof may not be reprinted, sold or redistributed without our written consent.

DBSVUSA did not participate in its preparation. The research analyst(s) named on this report are not registered as research

analysts with FINRA and are not associated persons of DBSVUSA. The research analyst(s) are not subject to FINRA Rule

2241 restrictions on analyst compensation, communications with a subject company, public appearances and trading securities

United States held by a research analyst. This report is being distributed in the United States by DBSVUSA, which accepts responsibility for

its contents. This report may only be distributed to Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to

such other institutional investors and qualified persons as DBSVUSA may authorize. Any U.S. person receiving this report

who wishes to effect transactions in any securities referred to herein should contact DBSVUSA directly and not its affiliate.

In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified,

Other jurisdictions

professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions.

Emkay Global Financial Services Ltd.

CIN - L67120MH1995PLC084899

7th Floor, The Ruby, Senapati Bapat Marg, Dadar - West, Mumbai - 400028. India

Tel: +91 22 66121212 Fax: +91 22 66121299 Web: www.emkayglobal.com

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 13

Infosys (INFO IN) India Equity Research | Result Update

SINGAPORE

DBS Bank Ltd

Contact: Janice Chua

12 Marina Boulevard, Marina Bay Financial Centre Tower 3

Singapore 018982

Tel. 65-6878 8888

Fax: 65 65353 418

e-mail: equityresearch@dbs.com

Company Regn. No. 196800306E

THAILAND

DBS Vickers Securities (Thailand) Co Ltd

Contact: Chanpen Sirithanarattanakul

989 Siam Piwat Tower Building,

9th, 14th-15th Floor

Rama 1 Road, Pathumwan,

Nagkok Thailand 10330

Tel. 66 2 857 7831

Fax: 66 2 658 1269

e-mail: research@th.dbs.com

Company Regn. No 0105539127012

Securities and Exchange Commission, Thailand

INDONESIA

PT DBS Vickers Sekuritas (Indonesia)

Contact: Maynard Priajaya Arif

DBS Bank Tower

Ciputra World 1, 32/F

JI. Prof. Dr. Satrio Kav. 3-5

Jakarta 12940, Indonesia

Tel. 62 21 3003 4900

Fax: 62 21 3003 4943

e-mail: research@id.dbsvickers.com

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 14

Infosys (INFO IN) India Equity Research | Result Update

Rahul Jain, BCOM, CFA (ICFAI)

rahul.jain@emkayglobal.com

+91-022-266121253

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: ANISH MATHEW SA: DHANANJAY SINHA October 16, 2018| 15

You might also like

- DH 847Document13 pagesDH 847rishab agarwalNo ratings yet

- Emkay-Eicher Motors Company Update - Feb 19Document13 pagesEmkay-Eicher Motors Company Update - Feb 19Blue RunnerNo ratings yet

- Pain Not Coming To An End Cut To Reduce: Bharti AirtelDocument17 pagesPain Not Coming To An End Cut To Reduce: Bharti AirtelAshokNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Horlicks Buy Provides Upsides: Hindustan UnileverDocument12 pagesHorlicks Buy Provides Upsides: Hindustan UnileversheetalNo ratings yet

- Dixon 1QFY22 Result Update - OthersDocument14 pagesDixon 1QFY22 Result Update - OthersjoycoolNo ratings yet

- Care Ratings-Paints Industry Analysis-2017Document12 pagesCare Ratings-Paints Industry Analysis-2017rchawdhry123No ratings yet

- Real Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsDocument4 pagesReal Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsAshwet JadhavNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- Berger Paints (India) Limited 21 QuarterUpdateDocument7 pagesBerger Paints (India) Limited 21 QuarterUpdatevikasaggarwal01No ratings yet

- United Breweries Q4FY21 Result Update - OthersDocument10 pagesUnited Breweries Q4FY21 Result Update - OthersYash MehtaNo ratings yet

- Raymond Initiating CoverageDocument20 pagesRaymond Initiating Coveragenarayanan_rNo ratings yet

- Stellar Show To ContinueDocument11 pagesStellar Show To Continueravi285No ratings yet

- 2017 Yamaha AR All enDocument38 pages2017 Yamaha AR All enHarshitNo ratings yet

- Basf Buy Emkay 06.10.17Document28 pagesBasf Buy Emkay 06.10.17Harshal PatilNo ratings yet

- Emkey On Shriram FinanceDocument18 pagesEmkey On Shriram FinanceamsukdNo ratings yet

- Weekly Mutual Fund Update 9th June 2019Document5 pagesWeekly Mutual Fund Update 9th June 2019Aslam HossainNo ratings yet

- Study GuideDocument2 pagesStudy GuideEmeli ReynosoNo ratings yet

- ApPipes EMDocument13 pagesApPipes EMdarshanmadeNo ratings yet

- SAP Joint Venture Accounting: S/4HANA On-Premise EditionDocument43 pagesSAP Joint Venture Accounting: S/4HANA On-Premise Editionpepe2000No ratings yet

- Investor Day: 13 October 2009Document134 pagesInvestor Day: 13 October 2009tilak52No ratings yet

- Lean Management: Business ExcellenceDocument68 pagesLean Management: Business Excellencesharma301100% (3)

- 2021 Business PerformanceDocument22 pages2021 Business PerformanceSebastian SinclairNo ratings yet

- Production/ Producer's & Construction Sector's Index: Base Year: 2017/18 100Document2 pagesProduction/ Producer's & Construction Sector's Index: Base Year: 2017/18 100Akash AjayNo ratings yet

- Indo Premier BISI - A Good Start This YearDocument6 pagesIndo Premier BISI - A Good Start This YearKPH BaliNo ratings yet

- Business Process DRI V4 14-Apr-21Document5 pagesBusiness Process DRI V4 14-Apr-21PRANAV KUMAR GAUTAMNo ratings yet

- AM Integrated Report 2020Document72 pagesAM Integrated Report 2020Lê Tố NhưNo ratings yet

- Redeye FingerprintDocument16 pagesRedeye FingerprintPatrik BackNo ratings yet

- 2018 Schindler Annual Report GR eDocument76 pages2018 Schindler Annual Report GR eTri NhanNo ratings yet

- Value-Map TM DeloitteDocument1 pageValue-Map TM DeloitteHugo SalazarNo ratings yet

- I-GIO-631-104128-PL-C-205 - 1 Bermas y Diques de PK 43+335 A 43+484.fase I-H1Document1 pageI-GIO-631-104128-PL-C-205 - 1 Bermas y Diques de PK 43+335 A 43+484.fase I-H1Pablo AguadoNo ratings yet

- I-GIO-631-104128-PL-C-204 - 2 Bermas y Diques de PK 41+477 A 41+665.fase I-H1Document1 pageI-GIO-631-104128-PL-C-204 - 2 Bermas y Diques de PK 41+477 A 41+665.fase I-H1Pablo AguadoNo ratings yet

- Base Enterprise Value Map PDFDocument1 pageBase Enterprise Value Map PDFjvr001100% (1)

- CEAT Investor Presentation Q1FY18Document33 pagesCEAT Investor Presentation Q1FY18Sandeep RapakaNo ratings yet

- Value Stream Improvement Plan TemplateDocument4 pagesValue Stream Improvement Plan TemplatemilandivacNo ratings yet

- Edelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280Document19 pagesEdelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280chatuuuu123No ratings yet

- Agenda: Nainital Bank - Company ProfileDocument4 pagesAgenda: Nainital Bank - Company ProfileArunima ChatterjeeNo ratings yet

- Steady Outlook With Focus On Execution: InfosysDocument10 pagesSteady Outlook With Focus On Execution: Infosyssaran21No ratings yet

- Semiconductor Sector Update: Kick Starting The NKEA-15/10/2010Document2 pagesSemiconductor Sector Update: Kick Starting The NKEA-15/10/2010Rhb InvestNo ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Emkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsDocument6 pagesEmkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsRonak JajooNo ratings yet

- Dubai BIM RoadmapDocument1 pageDubai BIM RoadmapZÄkãrîãêÊlJêmLîNo ratings yet

- 18 Annual ReportDocument87 pages18 Annual ReportAlin IoanNo ratings yet

- Operations Projects Service Performance: Financial Snapshot Project Resource Hours Service OfferingsDocument1 pageOperations Projects Service Performance: Financial Snapshot Project Resource Hours Service OfferingsEdd AguaNo ratings yet

- Your CFO Guy - 7 Chart TemplatesDocument6 pagesYour CFO Guy - 7 Chart TemplatesOaga GutierrezNo ratings yet

- Danfoss at a Glance: Core & Clear Digital Transformation JourneyDocument1 pageDanfoss at a Glance: Core & Clear Digital Transformation JourneyAvronNo ratings yet

- Profile of a Sales ProfessionalDocument7 pagesProfile of a Sales Professionaldazunj919No ratings yet

- WegnerTrevor 2020 FrontCover AppliedBusinessStatisDocument5 pagesWegnerTrevor 2020 FrontCover AppliedBusinessStatisPolitcioNo ratings yet

- I-GIO-631-104128-PL-C-201 - 5 Bermas y Diques de PK 35+140 A 36+690.fase I-H1Document1 pageI-GIO-631-104128-PL-C-201 - 5 Bermas y Diques de PK 35+140 A 36+690.fase I-H1Pablo AguadoNo ratings yet

- (A) Background (D) Target Setting: Phase-Wise Growth AnalysisDocument4 pages(A) Background (D) Target Setting: Phase-Wise Growth AnalysisHafsa MarufNo ratings yet

- AnnualReport_2011Document144 pagesAnnualReport_2011maryjanetNo ratings yet

- CAN Slim Method To Pick StocksDocument1 pageCAN Slim Method To Pick StocksSiddhartha Goenka33% (3)

- ExxonMobil 2018 Financial and Operating ReviewDocument118 pagesExxonMobil 2018 Financial and Operating ReviewManish KuamrNo ratings yet

- PT ASTRA INTERNATIONAL TBK 2018 RESULTS PRESENTATIONDocument34 pagesPT ASTRA INTERNATIONAL TBK 2018 RESULTS PRESENTATIONgajah ngupingNo ratings yet

- 3P BrochureDocument4 pages3P Brochureusman saleemNo ratings yet

- Whirlpool Q3FY21 Result Update - OthersDocument11 pagesWhirlpool Q3FY21 Result Update - OthersRanjan BeheraNo ratings yet

- US BN: Key Findings: Pe DealsDocument1 pageUS BN: Key Findings: Pe DealsethernalxNo ratings yet

- Logistic Support Analysis (LSA) : TitleDocument26 pagesLogistic Support Analysis (LSA) : Titlenebodepa lyftNo ratings yet

- Company Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive ValuationDocument4 pagesCompany Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive Valuationkrisyanto krisyantoNo ratings yet

- Hua Hong Semiconductor: Lower Target Price To HK$20.00 On Expected Macro Slowdown in 2019Document10 pagesHua Hong Semiconductor: Lower Target Price To HK$20.00 On Expected Macro Slowdown in 2019ashok yadavNo ratings yet

- Reduce: Beauty Community Beauty TBDocument12 pagesReduce: Beauty Community Beauty TBashok yadavNo ratings yet

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Avenue Supermarts LTDDocument11 pagesAvenue Supermarts LTDashok yadavNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- Hindustan Zinc Companyname: The Silver' LiningDocument11 pagesHindustan Zinc Companyname: The Silver' Liningashok yadavNo ratings yet

- ICICI Securities maintains Buy on Dish TV with revised target price of Rs71Document8 pagesICICI Securities maintains Buy on Dish TV with revised target price of Rs71ashok yadavNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- Hua Hong Semiconductor: Lower Target Price To HK$20.00 On Expected Macro Slowdown in 2019Document10 pagesHua Hong Semiconductor: Lower Target Price To HK$20.00 On Expected Macro Slowdown in 2019ashok yadavNo ratings yet

- Avenue Supermarts LTDDocument11 pagesAvenue Supermarts LTDashok yadavNo ratings yet

- Hindustan Zinc Companyname: The Silver' LiningDocument11 pagesHindustan Zinc Companyname: The Silver' Liningashok yadavNo ratings yet

- Reduce: Beauty Community Beauty TBDocument12 pagesReduce: Beauty Community Beauty TBashok yadavNo ratings yet

- Jyothy Laboratories (JYOLAB) : Dishwashing & Fabric Care Support GrowthDocument10 pagesJyothy Laboratories (JYOLAB) : Dishwashing & Fabric Care Support Growthashok yadavNo ratings yet

- Healthia Limited: Fill Your Boots!Document31 pagesHealthia Limited: Fill Your Boots!ashok yadavNo ratings yet

- PC Partner: (01263.HK/1263 HK)Document6 pagesPC Partner: (01263.HK/1263 HK)ashok yadavNo ratings yet

- Wipro LTD (WIPRO) : Growth and Margin Visibility Improving..Document13 pagesWipro LTD (WIPRO) : Growth and Margin Visibility Improving..ashok yadavNo ratings yet

- Encana Corp.: San Juan Sale Further Improves Balance SheetDocument6 pagesEncana Corp.: San Juan Sale Further Improves Balance Sheetashok yadavNo ratings yet

- L&T Infotech: Strong Operational PerformanceDocument12 pagesL&T Infotech: Strong Operational Performanceashok yadavNo ratings yet

- Reduce: Bharti Infratel Bhin inDocument11 pagesReduce: Bharti Infratel Bhin inashok yadavNo ratings yet

- Blackberry: Margins Strong Maintain Market PerformDocument11 pagesBlackberry: Margins Strong Maintain Market Performashok yadavNo ratings yet

- Oceanagold Corporation: Sepq Report - First LookDocument5 pagesOceanagold Corporation: Sepq Report - First Lookashok yadavNo ratings yet

- Encana Corp.: San Juan Sale Further Improves Balance SheetDocument6 pagesEncana Corp.: San Juan Sale Further Improves Balance Sheetashok yadavNo ratings yet

- Far LTD: SNE Development Plan SubmittedDocument6 pagesFar LTD: SNE Development Plan Submittedashok yadavNo ratings yet

- Medifast, Inc.: October 8, 2018 Med - NasdaqDocument8 pagesMedifast, Inc.: October 8, 2018 Med - Nasdaqashok yadavNo ratings yet

- Seaport Global Morning Notes: TopicalDocument11 pagesSeaport Global Morning Notes: Topicalashok yadavNo ratings yet

- Blackberry: Margins Strong Maintain Market PerformDocument11 pagesBlackberry: Margins Strong Maintain Market Performashok yadavNo ratings yet

- 3 Stages ECLDocument4 pages3 Stages ECLPappy TresNo ratings yet

- Debit Note TitleDocument6 pagesDebit Note TitleBhavesh Dinesh GohilNo ratings yet

- ĐÀO PHƯƠNG TH O - K174040469 - Analysis of Financial Statement VINHOMES Vs NOVALANDDocument41 pagesĐÀO PHƯƠNG TH O - K174040469 - Analysis of Financial Statement VINHOMES Vs NOVALANDHuế ThùyNo ratings yet

- Ketan Parekh Scam MergedDocument48 pagesKetan Parekh Scam MergedKaushal RautNo ratings yet

- Business Law and RegulationsDocument5 pagesBusiness Law and RegulationsLoida Joy AvellanaNo ratings yet

- Nippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportDocument36 pagesNippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportRahiNo ratings yet

- Shyam Metalics and Energy Limited - DRHP PDFDocument602 pagesShyam Metalics and Energy Limited - DRHP PDFsuprit jariwalNo ratings yet

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (35)

- Stock Markiet.Document87 pagesStock Markiet.deepti singhalNo ratings yet

- Kolehiyo NG Subic: ZambalesDocument3 pagesKolehiyo NG Subic: ZambalesRodeliza DuncanNo ratings yet

- Dse 2009 SolutionsDocument3 pagesDse 2009 Solutionss05xoNo ratings yet

- Al-Arafah Islami Bank LimitedDocument1 pageAl-Arafah Islami Bank LimitedfgfdghfNo ratings yet

- Accounting for Tax Amnesty Assets and LiabilitiesDocument13 pagesAccounting for Tax Amnesty Assets and LiabilitiesHeriyanto MonmonNo ratings yet

- Order in The Matter of Pailan Agro India Limited and Its DirectorsDocument14 pagesOrder in The Matter of Pailan Agro India Limited and Its DirectorsShyam SunderNo ratings yet

- Thesis-1 13Document29 pagesThesis-1 13Beige TanNo ratings yet

- IBA Karachi Course Outlines PDFDocument38 pagesIBA Karachi Course Outlines PDFDr. Abdullah0% (1)

- Prime Bank LimitedDocument29 pagesPrime Bank LimitedShouravNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Derivatives in India Blackbook Project TYBFM 2015 2016Document55 pagesDerivatives in India Blackbook Project TYBFM 2015 2016TYBMS-A 3001 Ansh AgarwalNo ratings yet

- SEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)Document3 pagesSEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)judy jace thaddeus AlejoNo ratings yet

- Export-Import: Module - 5 RiskDocument18 pagesExport-Import: Module - 5 RiskabhanidharaNo ratings yet

- Acumen's Vision for the Future of Impact InvestingDocument51 pagesAcumen's Vision for the Future of Impact InvestingBassel HassanNo ratings yet

- عتماد مستنديDocument1 pageعتماد مستنديNassar Al-shabiNo ratings yet

- Marketing AgreementDocument6 pagesMarketing AgreementdcdavisNo ratings yet

- SkriptaDocument4 pagesSkriptaIvana BalijaNo ratings yet

- Project On Sharekhan Investors Behavior For Investing in Equity Market in Various SectorDocument120 pagesProject On Sharekhan Investors Behavior For Investing in Equity Market in Various Sectorashish88% (26)

- Merger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityDocument6 pagesMerger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityLawal Idris AdesholaNo ratings yet

- China's Growing Online Interior Design Platform MarketDocument2 pagesChina's Growing Online Interior Design Platform MarketSon HaNo ratings yet

- Capital Investment Decision, Project Planning and ControlDocument16 pagesCapital Investment Decision, Project Planning and ControlAnuj JoshiNo ratings yet

- Nedai, Abbas (562-388-900) and Hosseini Ssayadnavard, MaryamDocument122 pagesNedai, Abbas (562-388-900) and Hosseini Ssayadnavard, Maryamirajiraj77No ratings yet