Professional Documents

Culture Documents

Matriks Valuasi Saham 11 May 2020

Matriks Valuasi Saham 11 May 2020

Uploaded by

hendarwinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matriks Valuasi Saham 11 May 2020

Matriks Valuasi Saham 11 May 2020

Uploaded by

hendarwinCopyright:

Available Formats

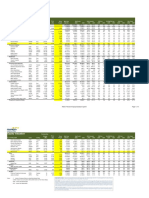

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE

As of 8 May 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Mandiri Universe 3,292,256.9 257,673.7 291,388.7 -1.7% 13.1% 12.8 11.3 11.1 10.1 1.7 1.6 3.8% 3.9%

Banking 1,174,623.7 116,063.7 130,303.6 15.3% 12.3% 10.1 9.0 N.A. N.A. 1.6 1.4 3.4% 3.9%

BCA BBCA Neutral 24,655 26,225 31,000 646,577.6 31,768.8 34,326.6 10.5% 8.1% 20.4 18.8 N.A. N.A. 3.4 3.0 1.5% 1.8%

BNI BBNI Neutral 18,649 3,800 9,000 70,864.9 18,878.9 20,915.0 13.4% 10.8% 3.8 3.4 N.A. N.A. 0.6 0.5 10.6% 12.0%

BRI BBRI Buy 123,299 2,590 5,050 319,343.2 41,393.0 47,216.8 17.3% 14.1% 7.7 6.8 N.A. N.A. 1.4 1.3 5.5% 6.5%

BTN BBTN Buy 10,590 845 2,500 8,948.6 3,389.2 4,030.8 1296.3% 18.9% 2.6 2.2 N.A. N.A. 0.4 0.3 6.3% 8.1%

Danamon BDMN Neutral 9,773 2,490 4,900 24,336.0 4,698.0 5,824.7 -19.7% 24.0% 5.1 4.1 N.A. N.A. 0.5 0.5 8.4% 6.8%

Bank BJB BJBR Neutral 9,839 770 1,770 7,743.4 1,838.3 2,183.1 27.4% 18.8% 4.2 3.5 N.A. N.A. 0.6 0.6 10.3% 10.3%

Bank Jatim BJTM Buy 14,918 496 790 7,441.2 1,553.8 1,744.7 12.9% 12.3% 4.8 4.3 N.A. N.A. 0.7 0.7 9.6% 10.2%

CIMB Niaga BNGA Buy 25,132 620 1,300 15,581.6 4,297.8 4,832.3 18.3% 12.4% 3.6 3.2 N.A. N.A. 0.3 0.3 4.7% 5.5%

BNLI BNLI Neutral 28,016 1,225 1,490 34,352.4 1,528.1 1,629.9 5.6% 6.7% 22.5 21.1 N.A. N.A. 1.4 1.3 0.0% 0.0%

Panin PNBN Buy 24,088 715 1,630 17,222.7 3,466.0 3,829.4 9.1% 10.5% 5.0 4.5 N.A. N.A. 0.4 0.4 0.0% 0.0%

BTPS BTPS Buy 7,704 2,320 4,200 17,872.6 1,719.7 2,096.1 28.5% 21.9% 10.4 8.5 N.A. N.A. 2.6 2.1 1.5% 1.9%

BFI Finance BFIN Buy 15,967 290 900 4,339.7 1,532.3 1,674.1 6.4% 9.2% 2.8 2.6 N.A. N.A. 0.5 0.5 10.0% 10.6%

Construction & materials 138,294.4 12,589.4 16,350.2 -0.2% 29.9% 11.0 8.5 9.4 7.7 1.0 0.9 2.8% 2.4%

Indocement INTP Buy 3,681 10,600 21,600 39,021.1 2,312.8 2,759.1 32.7% 19.3% 16.9 14.1 7.9 6.5 1.6 1.5 1.6% 2.1%

Semen Indonesia SMGR Buy 5,932 7,450 16,100 44,189.8 4,066.9 4,913.4 92.0% 20.8% 10.9 9.0 6.4 5.6 1.3 1.1 2.8% 1.9%

Adhi Karya ADHI Neutral 3,561 530 1,120 1,887.3 618.8 592.6 -6.8% -4.2% 3.1 3.2 3.8 4.0 0.3 0.3 7.0% 6.6%

Pembangunan Perumahan PTPP Buy 6,200 665 2,050 4,122.9 980.6 1,320.0 2.4% 34.6% 4.2 3.1 4.5 4.3 0.4 0.3 7.0% 7.1%

Wijaya Karya WIKA Buy 8,960 935 2,500 8,377.8 1,670.8 1,871.3 -17.2% 12.0% 5.0 4.5 4.3 3.0 0.5 0.5 4.0% 4.5%

Waskita Karya WSKT Buy 13,381 600 1,660 8,028.6 1,245.4 1,440.0 -21.7% 15.6% 6.4 5.6 14.6 12.6 0.4 0.4 3.1% 3.6%

Wijaya Karya Beton WTON Buy 8,715 236 700 2,056.9 585.5 677.5 14.3% 15.7% 3.5 3.0 2.8 2.5 0.6 0.5 7.5% 8.5%

Waskita Beton WSBP Buy 26,361 159 360 4,191.4 842.4 954.5 4.5% 13.3% 5.0 4.4 5.0 4.4 0.5 0.5 9.6% 10.0%

Jasa Marga JSMR Buy 7,258 3,640 5,900 26,418.7 266.1 1,821.7 -87.9% 584.6% 99.3 14.5 22.6 12.0 1.4 1.3 1.7% 0.2%

Consumer staples 906,310.8 45,308.2 50,497.6 -7.6% 11.5% 20.0 17.9 12.8 11.6 4.6 4.3 3.9% 3.9%

Indofood CBP ICBP Buy 11,662 9,625 12,350 112,245.9 5,413.9 5,888.6 7.4% 8.8% 20.7 19.1 12.7 11.6 4.2 3.7 2.4% 2.6%

Indofood INDF Buy 8,781 6,625 9,750 58,167.2 4,929.3 5,271.9 6.9% 6.9% 11.8 11.0 7.4 7.0 1.5 1.5 5.1% 5.4%

Mayora MYOR Neutral 22,359 2,130 2,850 47,624.7 2,152.4 2,476.0 15.5% 15.0% 22.1 19.2 11.9 10.5 4.3 3.8 1.5% 1.7%

Unilever UNVR Neutral 38,150 8,050 9,650 307,107.5 8,027.2 8,978.0 8.3% 11.8% 38.3 34.2 26.4 23.7 47.7 41.5 2.4% 2.6%

Gudang Garam GGRM Buy 1,924 44,050 63,450 84,756.1 7,512.4 8,962.6 -22.1% 19.3% 11.3 9.5 7.1 6.2 1.5 1.4 3.4% 5.9%

HM. Sampoerna HMSP Buy 116,318 1,640 2,450 190,761.6 12,297.4 13,378.7 -22.6% 8.8% 15.5 14.3 11.6 10.6 5.5 5.3 8.2% 6.3%

Kalbe Farma KLBF Buy 46,875 1,400 1,950 65,625.2 2,741.8 3,026.5 7.2% 10.4% 23.9 21.7 15.1 13.6 3.8 3.4 2.1% 2.3%

Sido Muncul SIDO Buy 15,000 1,260 1,450 18,900.0 914.1 1,022.6 12.8% 11.9% 20.7 18.5 14.8 13.1 5.0 4.6 4.2% 4.7%

Multi Bintang MLBI Buy 2,107 10,025 19,450 21,122.7 1,319.8 1,492.6 10.4% 13.1% 16.0 14.2 10.3 9.1 14.0 11.7 5.1% 5.6%

Healthcare 46,149.5 1,142.6 1,325.1 18.3% 16.0% 40.4 34.8 14.3 12.4 3.4 3.2 0.8% 0.9%

Mitra Keluarga MIKA Buy 14,551 1,990 3,100 28,956.0 793.9 869.9 15.1% 9.6% 36.5 33.3 23.4 21.1 6.0 5.4 1.0% 1.2%

Siloam Hospital SILO Buy 1,625 5,275 7,150 8,571.9 44.4 100.1 107.0% 125.6% 193.2 85.6 7.1 5.7 1.3 1.3 0.0% 0.0%

Hermina HEAL Buy 2,973 2,900 5,200 8,621.7 304.3 355.2 19.4% 16.7% 28.3 24.3 10.7 9.4 3.8 3.3 0.8% 1.0%

Consumer discretionary 230,345.8 18,209.0 25,232.8 -39.6% 38.6% 12.7 9.1 7.6 6.9 1.2 1.1 5.5% 3.8%

Ace Hardware Indonesia ACES Neutral 17,150 1,360 1,500 23,324.0 710.8 1,055.3 -31.0% 48.5% 32.8 22.1 24.9 17.7 4.7 4.2 2.2% 1.5%

Matahari Department Store LPPF Buy 2,918 1,250 1,800 3,647.4 50.4 496.7 -96.3% 884.6% 72.3 7.3 5.9 2.3 2.0 1.6 0.0% 0.4%

MAP Aktif MAPA Buy 2,850 2,340 3,850 6,669.9 54.4 606.1 -92.1% ####### 122.5 11.0 16.8 5.7 2.2 1.8 0.0% 0.2%

Mitra Adiperkasa MAPI Buy 16,600 695 1,000 11,537.0 (1,704.4) 543.3 N/M N/M -6.8 21.2 -112.9 7.1 2.7 2.4 1.8% 0.0%

Ramayana RALS Buy 7,096 565 700 4,009.2 (131.9) 142.9 N/M N/M -30.4 28.1 -45.7 9.6 1.1 1.1 9.5% -2.1%

Erajaya Swasembada ERAA Buy 3,190 1,235 1,500 3,939.7 140.3 355.3 -52.5% 153.2% 28.1 11.1 12.7 8.2 0.8 0.8 0.7% 1.8%

Astra International ASII Buy 40,484 3,740 5,000 151,408.5 14,709.9 17,215.6 -32.2% 17.0% 10.3 8.8 7.2 7.3 1.0 0.9 6.5% 4.4%

REDS- Research Equity Database System Page 1 of 6

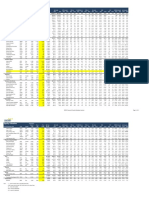

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE

As of 8 May 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Surya Citra Media SCMA Buy 14,622 790 1,800 11,634.9 1,565.6 1,693.2 35.7% 8.1% 7.4 6.9 5.2 4.9 2.0 1.8 9.4% 10.2%

Media Nusantara Citra MNCN Buy 13,047 845 2,200 10,481.2 2,427.2 2,593.1 24.1% 6.8% 4.3 4.0 3.3 2.8 0.8 0.7 3.5% 3.7%

MNC Studios MSIN Buy 5,202 318 650 1,654.2 267.2 315.5 16.3% 18.1% 6.2 5.2 3.6 3.4 1.1 1.0 8.1% 9.5%

Sarimelati Kencana PZZA Buy 3,022 675 900 2,039.8 119.4 215.7 -40.3% 80.6% 17.1 9.5 6.5 4.7 1.5 1.3 4.9% 2.9%

Commodities 205,337.8 23,551.5 24,722.8 -6.8% 5.0% 8.7 8.3 3.5 3.1 0.9 0.8 4.4% 4.4%

United Tractors UNTR Buy 3,730 15,825 22,500 59,029.4 8,961.5 9,194.8 -20.8% 2.6% 6.6 6.4 2.9 2.4 0.9 0.8 4.6% 4.7%

Adaro (USD) ADRO Neutral 31,986 1,025 1,350 32,785.6 372.2 353.0 -7.9% -5.2% 6.2 6.6 2.6 2.5 0.6 0.6 5.7% 5.3%

Harum Energy (USD) HRUM Neutral 2,661 1,270 1,300 3,259.6 17.4 13.6 -5.9% -21.7% 13.1 16.9 0.6 0.4 0.7 0.7 4.2% 3.3%

Indika Energy (USD) INDY Neutral 5,210 740 910 3,855.5 1.6 6.4 N/M 286.9% 163.5 42.6 1.5 1.2 0.3 0.3 0.2% 0.6%

Indo Tambangraya Megah (USD) ITMG Neutral 1,108 7,875 10,450 8,635.4 100.2 101.0 -20.8% 0.9% 6.0 6.0 1.8 1.6 0.7 0.7 14.1% 14.1%

Bukit Asam PTBA Neutral 11,523 2,060 2,350 23,736.4 3,481.8 3,496.3 -18.3% 0.4% 6.8 6.8 4.2 4.1 1.3 1.2 11.0% 11.0%

Antam ANTM Buy 24,031 535 1,100 12,856.5 959.3 1,319.5 5.5% 37.6% 13.4 9.7 7.4 6.8 0.6 0.6 2.6% 3.6%

Vale Indonesia (USD) INCO IJ Buy 9,936 3,090 4,000 30,703.3 111.1 166.2 93.6% 49.6% 19.3 13.0 6.2 4.8 1.0 1.0 0.0% 0.0%

Timah TINS Neutral 7,448 505 870 3,761.1 394.0 428.6 N/M 8.8% 9.5 8.8 5.3 5.0 0.6 0.6 3.7% 4.0%

Merdeka Copper Gold (USD) MDKA Buy 21,360 1,220 1,450 26,715.1 79.8 85.1 9.9% 6.6% 23.4 22.2 8.5 7.8 3.3 2.9 0.0% 0.0%

Property & Industrial Estate 72,121.9 10,122.3 8,797.7 -8.0% -13.1% 7.1 8.2 6.9 6.8 0.5 0.6 2.8% 2.7%

Alam Sutera Realty ASRI Neutral 19,649 116 310 2,279.3 467.8 947.7 -29.4% 102.6% 4.9 2.4 9.4 6.5 0.2 0.2 1.7% 1.7%

Bumi Serpong Damai BSDE Buy 19,247 665 1,650 12,799.1 2,086.0 2,119.3 -14.5% 1.6% 6.1 6.0 5.8 6.0 0.4 0.4 0.0% 0.8%

Ciputra Development CTRA Buy 18,560 515 1,550 9,558.6 1,128.4 1,365.6 17.0% 21.0% 8.5 7.0 7.0 6.7 0.6 0.6 1.6% 1.9%

Jaya Real Property JRPT Buy 13,750 408 1,050 5,610.0 949.4 1,034.7 -6.0% 9.0% 5.9 5.4 5.1 4.2 0.7 0.7 4.1% 5.1%

Pakuwon Jati PWON Buy 48,160 356 800 17,144.8 2,531.6 2,532.3 0.3% 0.0% 6.8 6.8 5.3 5.1 1.0 0.9 1.7% 1.7%

Summarecon Agung SMRA Neutral 14,427 432 1,330 6,232.4 550.4 721.5 54.4% 31.1% 11.3 8.6 7.7 7.0 0.8 0.7 1.2% 1.2%

Lippo Karawaci LPKR Buy 70,592 145 360 10,235.8 860.7 811.7 -54.0% -5.7% 11.9 12.6 11.0 10.8 0.3 0.3 0.7% 0.7%

Puradelta Lestari DMAS Buy 48,198 150 390 7,229.7 1,441.4 1,085.7 81.9% -24.7% 5.0 6.7 4.5 6.3 1.0 1.0 15.9% 13.5%

Bekasi Fajar BEST Neutral 9,647 107 130 1,032.3 106.6 121.8 -72.0% 14.2% 9.7 8.5 5.6 8.2 0.2 0.2 3.3% 0.9%

Telco 429,392.6 23,251.8 25,821.1 -10.4% 11.1% 18.5 16.6 6.1 5.7 2.7 2.6 4.5% 4.6%

EXCEL EXCL Buy 10,688 2,380 3,400 25,437.3 2,037.3 912.4 185.9% -55.2% 12.5 27.9 5.7 5.5 1.2 1.2 0.8% 2.4%

Telkom TLKM Buy 99,062 3,190 3,800 316,008.5 18,519.6 20,942.4 -5.0% 13.1% 17.1 15.1 5.8 5.3 3.0 2.9 5.3% 5.3%

Indosat ISAT Buy 5,434 2,050 3,000 11,139.6 (1,760.4) (1,027.0) N/M 41.7% -6.3 -10.8 4.9 4.3 1.0 1.1 0.0% 0.0%

Link Net LINK Buy 3,043 2,650 5,500 7,716.1 979.9 1,017.3 -3.3% 3.8% 8.0 7.7 3.6 3.4 1.5 1.3 6.3% 6.6%

Tower Bersama TBIG Buy 22,657 1,140 1,250 24,659.4 1,007.6 1,193.5 23.0% 18.4% 24.5 20.7 11.2 10.6 4.6 4.1 2.4% 2.4%

Sarana Menara TOWR Buy 51,015 885 1,070 44,431.7 2,467.7 2,782.5 0.1 0.1 18.0 16.0 10.3 9.4 4.4 3.8 0.0 2.7%

Chemical 1,238.9 135.7 163.2 29.5% 20.3% 9.1 7.6 5.3 4.7 0.4 0.4 0.0% 0.0%

Aneka Gas AGII Buy 3,067 404 700 1,238.9 135.7 163.2 29.5% 20.3% 9.1 7.6 5.3 4.7 0.4 0.4 0.0% 0.0%

Airlines 2,371.6 539.7 836.7 30.0% 55.0% 4.4 2.8 4.1 2.5 0.4 0.4 0.0% 0.0%

GMF AeroAsia (USD) GMFI Neutral 28,234 84 275 2,371.6 37.8 59.0 26.1% 56.3% 4.4 2.8 4.1 2.5 0.4 0.4 0.0% 0.0%

Transportation 2,402.0 199.0 393.7 -36.7% 97.8% 12.1 6.1 3.8 3.1 0.4 0.4 3.4% 6.6%

Blue Bird BIRD Buy 2,502 960 2,575 2,402.0 199.0 393.7 -36.7% 97.8% 12.1 6.1 3.8 3.1 0.4 0.4 3.4% 6.6%

Poultry 83,667.8 6,560.8 6,944.3 16.7% 5.8% 12.8 12.0 7.9 7.2 2.1 1.9 2.2% 2.6%

Charoen Pokphand Indonesia CPIN Neutral 16 4,370 4,950 71,659.3 4,218.8 4,490.1 16.4% 6.4% 17.0 16.0 10.6 9.8 3.0 2.6 1.9% 2.2%

Japfa Comfeed JPFA Buy 12 920 1,950 10,788.5 2,042.4 2,126.8 19.0% 4.1% 5.3 5.1 4.3 3.7 0.9 0.8 4.4% 5.2%

Malindo Feedmill MAIN Buy 2 545 1,150 1,220.1 299.6 327.4 7.1% 9.3% 4.1 3.7 3.4 3.1 0.5 0.4 3.1% 3.4%

Note : - *) means Company Data is using Bloomberg Data

- (USD) means Account under USD (USD Cents for Per Share Data)

- N/M means Not Meaningful

REDS- Research Equity Database System Page 2 of 6

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE

As of 8 May 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

- N.A. means Not Applicable

REDS- Research Equity Database System Page 3 of 6

Equity Valuation

ROE PCF EBITDA Growth Net Gearing

As of 8 May 2020 2020 2021 2020 2021 2020 2021 2020 2021

Mandiri Universe 14.0% 15.0% 12.4 13.7 -2.4% 8.9% 23.7% 21.2%

Banking 15.8% 16.3% N.A. N.A. N.A. N.A. N.A. N.A.

BCA 17.5% 17.0% N.A. N.A. N.A. N.A. N.A. N.A.

BNI 15.6% 15.9% N.A. N.A. N.A. N.A. N.A. N.A.

BRI 19.2% 20.0% N.A. N.A. N.A. N.A. N.A. N.A.

BTN 14.8% 16.9% N.A. N.A. N.A. N.A. N.A. N.A.

Danamon 10.0% 11.7% N.A. N.A. N.A. N.A. N.A. N.A.

Bank BJB 14.8% 16.6% N.A. N.A. N.A. N.A. N.A. N.A.

Bank Jatim 16.2% 16.6% N.A. N.A. N.A. N.A. N.A. N.A.

CIMB Niaga 9.8% 10.4% N.A. N.A. N.A. N.A. N.A. N.A.

BNLI 6.3% 6.4% N.A. N.A. N.A. N.A. N.A. N.A.

Panin 8.4% 8.8% N.A. N.A. N.A. N.A. N.A. N.A.

BTPS 28.4% 27.3% N.A. N.A. N.A. N.A. N.A. N.A.

BFI Finance 19.8% 18.8% N.A. N.A. N.A. N.A. N.A. N.A.

Construction & materials 8.9% 11.0% 13.5 7.1 8.5% 23.1% 136.7% 131.2%

Indocement 9.7% 10.8% 11.0 9.8 20.8% 12.6% -39.4% -45.2%

Semen Indonesia 12.1% 13.3% 6.3 5.9 24.2% 7.9% 68.9% 52.2%

Adhi Karya 9.4% 9.1% 5.8 1.9 -2.2% -5.4% 68.0% 66.4%

Pembangunan Perumahan 8.1% 11.5% 1.4 4.6 11.4% 14.2% 59.6% 69.1%

Wijaya Karya 10.6% 11.7% 2.6 4.2 13.9% 20.6% 33.5% 14.8%

Waskita Karya 6.5% 7.3% 4.0 5.8 14.8% 18.2% 445.9% 445.4%

Wijaya Karya Beton 16.6% 16.9% 1.4 4.4 2.5% 14.1% 23.1% 21.2%

Waskita Beton 10.3% 11.0% 1.4 3.7 8.4% 11.4% 54.7% 50.1%

Jasa Marga 1.4% 9.4% -2.0 21.4 -26.6% 101.0% 385.2% 408.4%

Consumer staples 23.8% 24.8% 16.5 17.5 -5.8% 11.0% 0.8% 1.1%

Indofood CBP 21.2% 20.7% 17.4 15.9 3.5% 9.8% -12.5% -10.6%

Indofood 13.4% 13.6% 8.4 8.0 8.6% 8.3% 41.7% 45.3%

Mayora 20.9% 20.9% 23.2 20.0 13.1% 12.6% 14.3% 9.3%

Unilever 130.9% 129.8% 34.0 30.2 8.5% 11.1% 16.1% -2.3%

Gudang Garam 13.9% 15.4% 7.0 14.6 -17.4% 15.8% 16.7% 18.1%

HM. Sampoerna 33.9% 38.0% 14.1 14.3 -24.8% 9.4% -46.7% -49.5%

Kalbe Farma 16.4% 16.6% 23.3 21.4 7.5% 9.7% -20.8% -22.6%

Sido Muncul 25.4% 25.9% 20.6 18.4 11.7% 11.5% -39.4% -41.4%

Multi Bintang 95.5% 90.1% 19.4 12.7 8.5% 11.6% -22.1% -35.0%

Healthcare 8.8% 9.5% 22.0 19.4 16.3% 13.0% -11.1% -16.6%

Mitra Keluarga 17.4% 17.2% 30.8 27.8 15.4% 9.8% -26.7% -30.8%

Siloam Hospital 0.7% 1.6% 14.1 12.5 16.6% 13.9% -16.0% -25.9%

Hermina 14.1% 14.6% 15.7 13.3 17.3% 16.2% 36.4% 37.5%

Consumer discretionary 9.3% 12.2% 3.8 9.0 -18.2% 11.2% 19.8% 17.8%

Ace Hardware Indonesia 14.7% 20.0% 19.0 41.4 -31.7% 40.4% -39.6% -38.1%

Matahari Department Store 2.8% 24.4% 52.3 4.4 -78.5% 116.9% -58.8% -70.2%

MAP Aktif 1.8% 18.0% 11.6 32.5 -71.2% 193.3% -35.8% -33.0%

Mitra Adiperkasa -32.8% 12.1% -12.9 14.5 N/M N/M 39.5% 52.1%

Ramayana -3.5% 3.9% -32.1 11.1 N/M N/M -45.9% -54.3%

Erajaya Swasembada 2.9% 7.0% -88.5 6.9 -25.5% 52.7% 52.2% 47.6%

Astra International 9.8% 10.9% 2.8 8.8 -9.3% -0.5% 25.5% 24.5%

REDS- Research Equity Database System Page 4 of 6

Equity Valuation

ROE PCF EBITDA Growth Net Gearing

As of 8 May 2020 2020 2021 2020 2021 2020 2021 2020 2021

Surya Citra Media 28.6% 27.4% 7.3 6.3 29.8% 2.8% -13.6% -16.3%

Media Nusantara Citra 19.7% 18.0% 4.4 3.9 16.9% 3.6% 16.7% 2.5%

MNC Studios 18.5% 19.8% 4.6 7.8 15.9% 13.8% -5.7% 1.9%

Sarimelati Kencana 8.8% 15.0% 9.6 5.3 -23.7% 43.5% 7.8% 12.9%

Commodities 10.4% 10.2% 4.2 4.6 -5.9% 1.2% -1.0% -9.7%

United Tractors 14.6% 13.6% 5.2 4.2 -14.7% 1.3% -8.8% -20.1%

Adaro (USD) 9.7% 8.7% 3.1 3.1 -6.9% -4.1% 4.2% -4.7%

Harum Energy (USD) 5.5% 4.2% 6.3 9.3 -2.4% -13.7% -93.3% -96.3%

Indika Energy (USD) 0.2% 0.7% 0.7 1.0 -14.4% 2.4% 27.6% 9.0%

Indo Tambangraya Megah (USD) 11.4% 11.4% 2.2 3.8 -16.1% 0.9% -29.8% -32.5%

Bukit Asam 18.8% 18.3% 5.1 6.5 -12.6% 1.5% -21.7% -21.2%

Antam 4.7% 6.2% 6.1 4.9 5.6% 5.4% 46.2% 40.5%

Vale Indonesia (USD) 5.6% 7.8% 8.5 9.1 27.5% 20.8% -20.0% -24.7%

Timah 6.3% 6.4% 0.7 4.1 130.5% 5.2% 59.7% 55.0%

Merdeka Copper Gold (USD) 15.0% 13.8% 18.6 10.9 4.6% 1.9% 25.4% -5.3%

Property & Industrial Estate 7.8% 8.1% 8.3 10.8 -0.5% -12.5% 23.5% 26.8%

Alam Sutera Realty 4.6% 8.7% 12.7 18.0 -19.0% 54.0% 84.2% 85.3%

Bumi Serpong Damai 7.1% 6.7% 26.3 13.4 7.5% 5.9% 8.8% 12.3%

Ciputra Development 7.2% 8.2% 4.4 9.4 6.0% 8.4% 18.4% 19.0%

Jaya Real Property 12.9% 12.8% 6.0 3.5 -6.1% 7.9% -4.7% -12.2%

Pakuwon Jati 15.9% 13.9% 5.4 6.2 -0.9% 1.0% -4.4% -9.3%

Summarecon Agung 7.4% 9.0% 7.7 11.8 18.0% 15.2% 95.8% 93.9%

Lippo Karawaci 2.7% 2.5% -16.0 -23.6 -27.4% 6.9% 30.6% 32.6%

Puradelta Lestari 20.8% 15.2% 6.9 8.0 91.2% -25.5% -9.7% -6.6%

Bekasi Fajar 2.4% 2.6% 2.0 8.7 -25.6% -26.1% 26.0% 29.1%

Telco 15.0% 16.2% 6.0 5.4 4.1% 9.4% 102.6% 102.5%

EXCEL 10.2% 4.3% 4.5 4.3 19.5% 8.4% 211.5% 215.2%

Telkom 17.9% 19.7% 6.1 5.4 1.4% 8.6% 38.4% 37.3%

Indosat -14.9% -9.8% 1.9 1.7 0.7% 18.6% 303.5% 367.3%

Link Net 19.3% 18.2% 4.1 3.8 4.9% 4.6% 9.4% 5.3%

Tower Bersama 19.4% 20.9% 12.6 12.4 7.3% 6.7% 444.5% 411.3%

Sarana Menara 26.4% 25.8% 10.4 10.8 11.6% 8.1% 185.3% 155.0%

Chemical 4.2% 4.8% 3.5 3.2 4.4% 6.3% 69.9% 60.4%

Aneka Gas 4.2% 4.8% 3.5 3.2 4.4% 6.3% 69.9% 60.4%

Airlines 10.1% 13.9% 4.0 1.1 29.4% 20.4% 65.0% 32.3%

GMF AeroAsia (USD) 10.1% 13.9% 4.0 1.1 25.5% 21.4% 65.0% 32.3%

Transportation 3.7% 7.1% 2.5 2.5 -7.8% 34.6% 12.2% 17.7%

Blue Bird 3.7% 7.1% 2.5 2.5 -7.8% 34.6% 12.2% 17.7%

Poultry 17.9% 16.7% 12.1 11.1 11.5% 7.1% 23.1% 13.5%

Charoen Pokphand Indonesia 18.5% 17.5% 17.1 16.5 13.3% 5.3% 2.1% -5.4%

Japfa Comfeed 17.6% 16.1% 4.9 4.0 9.8% 10.3% 56.7% 43.6%

Malindo Feedmill 12.7% 12.4% 2.4 2.6 5.6% 5.7% 59.5% 47.5%

Note : - *) means Company Data is using Bloomberg Data

- (USD) means Account under USD (USD Cents for Per Share Data)

- N/M means Not Meaningful

REDS- Research Equity Database System Page 5 of 6

Equity Valuation

ROE PCF EBITDA Growth Net Gearing

As of 8 May 2020 2020 2021 2020 2021 2020 2021 2020 2021

- N.A. means Not Applicable

REDS- Research Equity Database System Page 6 of 6

You might also like

- CB Chapter 16Document4 pagesCB Chapter 16Sim Pei YingNo ratings yet

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (2)

- Homework PDFDocument3 pagesHomework PDFSyed AliNo ratings yet

- Summary A Survey of Corporate Governance by Shleifer VishnyDocument61 pagesSummary A Survey of Corporate Governance by Shleifer VishnyAlayou Tefera100% (1)

- MFRS 132 Financial InstrumentDocument3 pagesMFRS 132 Financial InstrumentThineswaran David BillaNo ratings yet

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- Matriks Valuasi Saham 18 May 2020Document2 pagesMatriks Valuasi Saham 18 May 2020hendarwinNo ratings yet

- Matriks Valuasi Saham 22 Juni 2020 PDFDocument2 pagesMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Kadek ArdianaNo ratings yet

- Matriks Valuasi Saham 21 Juli 2020Document2 pagesMatriks Valuasi Saham 21 Juli 2020jnn sNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiNo ratings yet

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2srijokoNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Matriks Valuasi Saham Sharia 18 May 2020Document1 pageMatriks Valuasi Saham Sharia 18 May 2020hendarwinNo ratings yet

- Matriks Valuasi Saham Syariah 23112020Document2 pagesMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Matrix Valuasi Saham Syariah 1 Mar 21Document1 pageMatrix Valuasi Saham Syariah 1 Mar 21haji atinNo ratings yet

- BRI Danareksa Equity Snapshot 29 Jan 2024 FY23 BBNI, AVIA, CLEODocument7 pagesBRI Danareksa Equity Snapshot 29 Jan 2024 FY23 BBNI, AVIA, CLEOfinancialshooterNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanNo ratings yet

- Portfolio SnapshotDocument63 pagesPortfolio Snapshotgurudev21No ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Malaysia Banking 070322Document31 pagesMalaysia Banking 070322yennielimclNo ratings yet

- TS - MSCI Indonesia Nov-21 Rebalancing PreviewDocument6 pagesTS - MSCI Indonesia Nov-21 Rebalancing PreviewAdri KhosasihNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Antm Tins Ptba 070529 LGDocument1 pageAntm Tins Ptba 070529 LGCristiano DonzaghiNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Reino Unido - AlexisDocument8 pagesReino Unido - AlexisAalexiis Ignacio TorresNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Analisa Agen No RepeatDocument1 pageAnalisa Agen No Repeatirfan edisonNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideMoises The Way of Water TubigNo ratings yet

- Bma eDocument2 pagesBma ealisaeed81No ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Portflio 2Document51 pagesPortflio 2gurudev21No ratings yet

- Long Term SIP Picks Jan 23Document15 pagesLong Term SIP Picks Jan 23sbvaNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Ambuja Cements: NeutralDocument8 pagesAmbuja Cements: Neutral张迪No ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- Estimari Dividende 2019 22.11.2019Document4 pagesEstimari Dividende 2019 22.11.2019Bogdan BoicuNo ratings yet

- Equity AutoDocument33 pagesEquity AutoHashith SNo ratings yet

- Stock Screener203025Document5 pagesStock Screener203025Sde BdrNo ratings yet

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersDocument1 pageFigure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersEno CasmiNo ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesNo ratings yet

- NAG FijiDocument20 pagesNAG Fijiwilliamlord8No ratings yet

- Proyeksi Laba Rugi Aktual Estimasi ProjectionDocument3 pagesProyeksi Laba Rugi Aktual Estimasi ProjectionkwakwikwekNo ratings yet

- ExecutivesummaryDocument4 pagesExecutivesummaryMayurNo ratings yet

- Coal Heat RateDocument38 pagesCoal Heat Rateanon_116184023No ratings yet

- Gen MIX2Document4 pagesGen MIX2Lerma AdvinculaNo ratings yet

- Valuation ModelsDocument11 pagesValuation ModelsPIYA THAKURNo ratings yet

- 2006 2007 2008 Sales Net Sales Less CogsDocument17 pages2006 2007 2008 Sales Net Sales Less CogsMohammed ArifNo ratings yet

- Bronch AdDocument23 pagesBronch AdAbdelrahman NazmiNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Financial Management SyllabusDocument7 pagesFinancial Management SyllabusAireen Rose Rabino Manguiran0% (1)

- Limited Liabality Partnership Act 2017Document8 pagesLimited Liabality Partnership Act 2017Kashir ZamanNo ratings yet

- SAP06Document24 pagesSAP06Kamran YounasNo ratings yet

- 8524Document8 pages8524Ghulam MurtazaNo ratings yet

- Chapter 22 - Business Finance - Needs and SourcesDocument3 pagesChapter 22 - Business Finance - Needs and SourcesKhoa DaoNo ratings yet

- Friend Ice FactoryDocument25 pagesFriend Ice FactoryHafizAhmadNo ratings yet

- Organogram of Accounts Department: Head of Accounts Md. Bashir Uddin Ahmed, FVPDocument1 pageOrganogram of Accounts Department: Head of Accounts Md. Bashir Uddin Ahmed, FVPjasim khanNo ratings yet

- Solutions For Non-Constant Growth Stock ValuationsDocument2 pagesSolutions For Non-Constant Growth Stock ValuationsNguyễn Bá Khánh TùngNo ratings yet

- On January 1 2017 Mcilroy Inc Acquired A 60 PercentDocument1 pageOn January 1 2017 Mcilroy Inc Acquired A 60 PercentAmit PandeyNo ratings yet

- Financial Accounting: Welingkar's Distance Learning DivisionDocument29 pagesFinancial Accounting: Welingkar's Distance Learning Divisionahmed100% (1)

- Bylaws of Mekapay Solution, IncDocument17 pagesBylaws of Mekapay Solution, IncHerbertNo ratings yet

- Intacc 1 NotesDocument19 pagesIntacc 1 NotesLouiseNo ratings yet

- CF Week11 12 STDocument57 pagesCF Week11 12 STPol 馬魄 MattostarNo ratings yet

- Acc Module 2 Classification of AccountsDocument3 pagesAcc Module 2 Classification of AccountsEbina WhiteNo ratings yet

- Notes in Law Week 4Document11 pagesNotes in Law Week 4idkdumpagainNo ratings yet

- Instant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF Scribdrobert.gourley486100% (50)

- Directors': Maithan Alloys LimitedDocument9 pagesDirectors': Maithan Alloys LimitedAnshuman RoutNo ratings yet

- 2019 20 CFA Level I Curriculum ChangesDocument20 pages2019 20 CFA Level I Curriculum ChangesNadia JNo ratings yet

- Appendix 1 To 5Document13 pagesAppendix 1 To 5Adil SaleemNo ratings yet

- Topic 5 - Intangibles and Impairment - NotesDocument30 pagesTopic 5 - Intangibles and Impairment - NotesAsh ChandNo ratings yet

- BBFH 202 Business Finance 1Document4 pagesBBFH 202 Business Finance 1tawandaNo ratings yet

- IF Ppt-28069Document7 pagesIF Ppt-28069Rishibha SinglaNo ratings yet

- Unit 2 Illustration ProblemDocument1 pageUnit 2 Illustration ProblemCharlene RodrigoNo ratings yet

- Title Xii (Close Corporatons)Document4 pagesTitle Xii (Close Corporatons)Princess Ann MendegorinNo ratings yet