Professional Documents

Culture Documents

Case Study

Uploaded by

akash advisorsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study

Uploaded by

akash advisorsCopyright:

Available Formats

Ind AS 38 Intangible Assets

Software developed for internal use

Question:36

The Hy-Tech Services Corporation employs researchers based in countries around the world.

Employee time is the basis upon which charges to many customers are made. The geographically

dispersed nature of its operations makes it extremely difficult for the payroll staff to collect time

records, so the management team authorizes the design of an in-house, Web-based timekeeping

system. The project team incurs the following costs:

Cost type CU

Concept design 2,500

Evaluation of design alternatives 3,700

Determination of required technology 8,100

Final selection of alternatives 1,400

Software design 28,000

Software coding 42,000

Quality assurance testing 30,000

Data conversion costs 3,900

Training 14,000

Overhead allocation 6,900

General and administrative costs 11,200

Ongoing maintenance costs 6,000

Totals 157,700

The estimated useful life of the timekeeping system is five years.

Once the above module is operational, management elects to construct another module(B) for the

system that issues an email reminder for employees to complete their timesheets. This represents

significant added functionality.

The following costs are incurred:

Labor type Labor cost Payroll taxes Benefits Total cost

Software developers CU11,000 CU842 CU1,870 CU13,712

Quality assurance testers 7 ,000 536 1,190 8,726

Totals CU18,000 CU1,378 CU3,060 CU22,438

By the time this additional work is completed, the original system has been in operation for one

year,

The Hy-Tech management then authorizes the development of an additional module(C) that allows

employees to enter time data into the system from their cell phones using text messaging. Despite

successfully passing through the concept design stage, the development team cannot resolve

interface problems on a timely basis. Management elects to shut down the development project.

CU13,000 of programming and testing costs already incurred for the project.

Discuss the accounting treatment and recognition method of various cost incurred by Hy-Tech.

Response:

Let us segregate those costs of main project which can be capitalised.

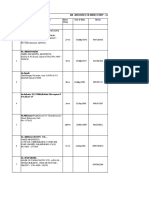

Cost type Charged to expense (CU) Capitalized(CU)

Concept design 2,500

Evaluation of design alternatives 3,700

Determination of required technology 8,100

Final selection of alternatives 1,400

Software design 28,000

Software coding 42,000

Quality assurance testing 30,000

Data conversion costs 3,900

Training 14,000

Overhead allocation 6,900

General and administrative costs 11,200

Ongoing maintenance costs 6,000

Totals CU57,700 CU100,000

Thus, the total capitalized cost of this development project is CU100,000. The estimated useful life

of the timekeeping system is five years. As soon as all testing is completed, Hy-Tech’s controller

should begin amortizing using a monthly charge of €1,666.67. The calculation is as follows:

CU100,000 capitalized cost ÷ 60 months = CU1,666.67 amortization charge

For Module B The full CU22,438 amount of these costs can be capitalized. By the time this module

is completed, the original system has been in operation for one year, thereby reducing the

amortization period for the new module to four years. The calculation of the monthly straight-line

amortization follows:

CU22,438 capitalized cost ÷ 48 months = CU467.46 amortization charge

For Module C all of the CU13,000 of programming and testing costs to be expensed in the current

period.

You might also like

- Charles SchawabDocument3 pagesCharles SchawabAmar VermaNo ratings yet

- Credit and Collection PrelimsDocument7 pagesCredit and Collection PrelimsMeloy ApiladoNo ratings yet

- Benchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationDocument14 pagesBenchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationJenny BascunaNo ratings yet

- Essentials of Human Resource ManagementDocument17 pagesEssentials of Human Resource Managementashbak2006#zikir#scribd#2009No ratings yet

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet

- Google Cloud Platform for Data Engineering: From Beginner to Data Engineer using Google Cloud PlatformFrom EverandGoogle Cloud Platform for Data Engineering: From Beginner to Data Engineer using Google Cloud PlatformRating: 5 out of 5 stars5/5 (1)

- Cost Benefit Summary - Technology SimplificationDocument25 pagesCost Benefit Summary - Technology SimplificationKevin PorterNo ratings yet

- 2 Use of Construction Productivity and Capability Fund (CPCF) To Enhance Productivity 12jan17Document83 pages2 Use of Construction Productivity and Capability Fund (CPCF) To Enhance Productivity 12jan17Jan Kristoffer Aguilar UmaliNo ratings yet

- Trading The Ichimoku WayDocument4 pagesTrading The Ichimoku Waysaa6383No ratings yet

- 30 Sample Essays Band 9 IELTS of SimonDocument29 pages30 Sample Essays Band 9 IELTS of SimonKhang TranNo ratings yet

- Main AssesmentDocument16 pagesMain Assesmentsamwel100% (1)

- Ankit AWSDocument36 pagesAnkit AWSamit thakurNo ratings yet

- Identity Services Engine Implementation Subscription ServiceDocument6 pagesIdentity Services Engine Implementation Subscription ServiceAhmed HusseinNo ratings yet

- Iia Architects Directory - Calicut CentreDocument32 pagesIia Architects Directory - Calicut Centreakash advisors100% (1)

- A Review of Production Planning and ControlDocument32 pagesA Review of Production Planning and ControlengshimaaNo ratings yet

- Strategic Costing and Management SystemsDocument21 pagesStrategic Costing and Management Systemsambrosia96No ratings yet

- MCI Communications CorporationDocument6 pagesMCI Communications Corporationnipun9143No ratings yet

- Cost Accounting Quiz Activity Based CostingDocument6 pagesCost Accounting Quiz Activity Based CostingSheenNo ratings yet

- Pa 214 - Cost Benefit AnalysisDocument18 pagesPa 214 - Cost Benefit AnalysisBakang NalaropNo ratings yet

- Gnolos Restaurant Point of Sale Project Proposal Final Output. 2Document16 pagesGnolos Restaurant Point of Sale Project Proposal Final Output. 2Kristine Medina GelbolingoNo ratings yet

- End-of-Semester Exam PreparationDocument6 pagesEnd-of-Semester Exam PreparationMukmin ShukriNo ratings yet

- Financial Accounting Reviewer - Chapter 68Document5 pagesFinancial Accounting Reviewer - Chapter 68Coursehero PremiumNo ratings yet

- Cost Benefi Analysis PDFDocument7 pagesCost Benefi Analysis PDFShivani SoniNo ratings yet

- SP21 CH5 Practice QuizDocument4 pagesSP21 CH5 Practice QuizJudith GarciaNo ratings yet

- CA - AML - 1 & 2 - Genap 2018-2019Document18 pagesCA - AML - 1 & 2 - Genap 2018-2019ImeldaNo ratings yet

- Project Cost Management: Estimating, Budgeting and Controlling for Project SuccessDocument26 pagesProject Cost Management: Estimating, Budgeting and Controlling for Project SuccessAtik FebrianiNo ratings yet

- Management Advisory Services: 2017 Search For The NCR FrontlinersDocument11 pagesManagement Advisory Services: 2017 Search For The NCR FrontlinersRojohn ValenzuelaNo ratings yet

- Lab Report - 1: Green University of BangladeshDocument3 pagesLab Report - 1: Green University of BangladeshIkhtiar Uddin ShaHinNo ratings yet

- Estimating service costs in a consulting firmDocument11 pagesEstimating service costs in a consulting firmPat0% (1)

- Law On Obligations and Contracts in TheDocument15 pagesLaw On Obligations and Contracts in TheRojohn ValenzuelaNo ratings yet

- Activity-Based Costing and Life Cycle Costing for ManufacturingDocument15 pagesActivity-Based Costing and Life Cycle Costing for ManufacturingNikki San GabrielNo ratings yet

- Answer Key Chapter 22Document2 pagesAnswer Key Chapter 22Jannelle SalacNo ratings yet

- An Approach On Quality Assurance in Computational ElectromagneticsDocument7 pagesAn Approach On Quality Assurance in Computational ElectromagneticsJohann BarcelosNo ratings yet

- Chapter Two: Planning PhaseDocument10 pagesChapter Two: Planning PhaseTino MubururuNo ratings yet

- Project Cost ManagementDocument28 pagesProject Cost ManagementGebeyehuNo ratings yet

- Computer Training Institute: Project Report ofDocument9 pagesComputer Training Institute: Project Report ofEMMANUEL TV INDIANo ratings yet

- E TMS ReportDocument81 pagesE TMS ReportBirinchi MedhiNo ratings yet

- Lab No. 01 Title: Project Assignment, Proposal Preparation and PlanningDocument6 pagesLab No. 01 Title: Project Assignment, Proposal Preparation and PlanningMufizul islam NirobNo ratings yet

- Unit Five (5) Slides Feasibility StudyDocument24 pagesUnit Five (5) Slides Feasibility Studysajal koiralaNo ratings yet

- Improving Decision MakingDocument2 pagesImproving Decision MakingSajanSthaNo ratings yet

- Final Output Final VmsDocument11 pagesFinal Output Final VmsRosedeliza V. VillanuevaNo ratings yet

- Online Assignment Cost Sheet AnalysisDocument10 pagesOnline Assignment Cost Sheet AnalysisNirmal SinghNo ratings yet

- Lab Manual 01 CSE 324 Project ProposalDocument6 pagesLab Manual 01 CSE 324 Project ProposalShimul Chandra DasNo ratings yet

- Project Title: Project Start Date: Project Finish DateDocument4 pagesProject Title: Project Start Date: Project Finish DatedashuoNo ratings yet

- Module 2 - Activity Based CostingDocument3 pagesModule 2 - Activity Based CostingFrancis Ryan PorquezNo ratings yet

- 6 Acct2112 Week 6 Tute Qns ABC s2 2023Document4 pages6 Acct2112 Week 6 Tute Qns ABC s2 2023z8gss49hf4No ratings yet

- Math Problem Chapter 1 (L 1 & 2)Document7 pagesMath Problem Chapter 1 (L 1 & 2)rajeshaisdu009No ratings yet

- Presented by Sidra Batool Qureshi & Zunaira AroojDocument26 pagesPresented by Sidra Batool Qureshi & Zunaira AroojWaleed Tahir ChNo ratings yet

- Managerial Accounting - Mid Term Exam PDFDocument4 pagesManagerial Accounting - Mid Term Exam PDFNavya AgrawalNo ratings yet

- Overhead Analysis8Document14 pagesOverhead Analysis8AberraNo ratings yet

- ProposalDocument5 pagesProposalsakshi.choudhary.260104No ratings yet

- Lec4 ABCDocument31 pagesLec4 ABCnathan panNo ratings yet

- Personal Assignment 4 Session 8Document8 pagesPersonal Assignment 4 Session 8Windi ArmandaNo ratings yet

- Cost PresentationDocument8 pagesCost PresentationMJ jNo ratings yet

- ANDREI Mihai Iulian ProjectINTERMODALDocument11 pagesANDREI Mihai Iulian ProjectINTERMODALMihai AndreiNo ratings yet

- Canadian Clean Up CrewDocument4 pagesCanadian Clean Up CrewVu Khanh LeNo ratings yet

- Software Quality Managememt Project CoSQ NotesDocument9 pagesSoftware Quality Managememt Project CoSQ NotesFaria ZohoraNo ratings yet

- c4 Chapter 4Document17 pagesc4 Chapter 4Pamela AmitNo ratings yet

- Activity Based Costing Notes and ExerciseDocument6 pagesActivity Based Costing Notes and Exercisefrancis MagobaNo ratings yet

- Chapter 7 ExplanationDocument24 pagesChapter 7 ExplanationCatherine OrdoNo ratings yet

- senirio 5Document15 pagessenirio 5joshi saumyaNo ratings yet

- Proposal For Services For EGB ConstructionDocument7 pagesProposal For Services For EGB ConstructionJaydwin T. LabianoNo ratings yet

- Project TitleDocument27 pagesProject TitleNikeel JagunNo ratings yet

- ABC Costing Questions and ExercisesDocument6 pagesABC Costing Questions and ExerciseslinhttisvnuNo ratings yet

- Project Processing Time Optimization in Broadband Service CompanyDocument25 pagesProject Processing Time Optimization in Broadband Service CompanyArvin SinghNo ratings yet

- Ansys Discovery - Quantifying The ROI in Simulation Led Design ExplorationDocument13 pagesAnsys Discovery - Quantifying The ROI in Simulation Led Design ExplorationA LettristeNo ratings yet

- Lesson 4 ActbasedcostingDocument13 pagesLesson 4 ActbasedcostingAnj BautistaNo ratings yet

- Acc116 G7Document6 pagesAcc116 G7ABDUL HAFIZ ABDULLAHNo ratings yet

- Activity BasedDocument5 pagesActivity BasedKarl Wilson GonzalesNo ratings yet

- MACRO ENVIRONMENTAL AND INDUSTRY ANALYSIS OF PAKISTAN'S TEXTILE INDUSTRYDocument90 pagesMACRO ENVIRONMENTAL AND INDUSTRY ANALYSIS OF PAKISTAN'S TEXTILE INDUSTRYFarooqChaudharyNo ratings yet

- Value Chain Analysis Template 17Document80 pagesValue Chain Analysis Template 17akash advisorsNo ratings yet

- MACRO ENVIRONMENTAL AND INDUSTRY ANALYSIS OF PAKISTAN'S TEXTILE INDUSTRYDocument90 pagesMACRO ENVIRONMENTAL AND INDUSTRY ANALYSIS OF PAKISTAN'S TEXTILE INDUSTRYFarooqChaudharyNo ratings yet

- Lean TestsDocument9 pagesLean Testsakash advisorsNo ratings yet

- Pestel Analysis of Textile IndustryDocument7 pagesPestel Analysis of Textile IndustryAakash Khurana0% (3)

- Deasra Business Planning Checklist PDFDocument5 pagesDeasra Business Planning Checklist PDFGary SAMUELNo ratings yet

- RM Group 9 - Research PaperDocument25 pagesRM Group 9 - Research Paperakash advisorsNo ratings yet

- Indian Carpet IndustryDocument22 pagesIndian Carpet IndustryPratik Kothari50% (2)

- What Is A WhyDocument3 pagesWhat Is A WhySrini VasanNo ratings yet

- Value Chain Analysis Template 02Document1 pageValue Chain Analysis Template 02Fuad KhairyNo ratings yet

- Case StudyDocument2 pagesCase Studyakash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 7Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 7akash advisorsNo ratings yet

- Assignment - Opportunity Identification - Idea GenerationDocument5 pagesAssignment - Opportunity Identification - Idea Generationakash advisors100% (1)

- Disaster Management - Session 3Document8 pagesDisaster Management - Session 3akash advisorsNo ratings yet

- Main Jobs To Be DoneDocument1 pageMain Jobs To Be Doneakash advisorsNo ratings yet

- Book 2Document4 pagesBook 2akash advisorsNo ratings yet

- Goals of CJMDocument1 pageGoals of CJMakash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 6Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 6akash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 13Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 13akash advisorsNo ratings yet

- Strategy to profit from bullish and bearish market scenariosDocument5 pagesStrategy to profit from bullish and bearish market scenariosakash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 7Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 7akash advisorsNo ratings yet

- IAPMDocument1 pageIAPMakash advisorsNo ratings yet

- List of Special Features: Best PracticesDocument1 pageList of Special Features: Best Practicesakash advisorsNo ratings yet

- CFDocument1 pageCFakash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 4Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 4akash advisorsNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 4Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 4akash advisorsNo ratings yet

- Introduction To OBDocument50 pagesIntroduction To OBakash advisorsNo ratings yet

- Due To Political Turmoil at The Centre As Well As The Global Economic Changes and Fiscal Imbalances of The Country in Late 80Document4 pagesDue To Political Turmoil at The Centre As Well As The Global Economic Changes and Fiscal Imbalances of The Country in Late 80Shivam AroraNo ratings yet

- A01 - TABL4303 - 04 - SE - FM - Indd 6Document1 pageA01 - TABL4303 - 04 - SE - FM - Indd 6akash advisorsNo ratings yet

- Audit 2023Document18 pagesAudit 2023queenmutheu01No ratings yet

- Traphaco Reviews Distribution Restructuring and 2019 Business PlanDocument4 pagesTraphaco Reviews Distribution Restructuring and 2019 Business PlanHai YenNo ratings yet

- ACCRUALSDocument2 pagesACCRUALSLiLi LemonNo ratings yet

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- Term Paper IN Theories and Practices of Ecological TourismDocument2 pagesTerm Paper IN Theories and Practices of Ecological Tourismkristel jadeNo ratings yet

- C1 Introduction To AuditDocument24 pagesC1 Introduction To AuditTan Yong Feng MSUC PenangNo ratings yet

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet

- Financial Literacy SACCO ManualDocument38 pagesFinancial Literacy SACCO ManualMukalele RogersNo ratings yet

- Muhammad Farooq Safdar: Core CompetenciesDocument2 pagesMuhammad Farooq Safdar: Core CompetenciesNasir AhmedNo ratings yet

- Joint VentureDocument2 pagesJoint VentureAries Gonzales CaraganNo ratings yet

- Organizational Strategies and The Sales FunctionDocument25 pagesOrganizational Strategies and The Sales FunctionHriday PrasadNo ratings yet

- Operations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionDocument7 pagesOperations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionQuynhLeMaiNo ratings yet

- Certificate in Islamic Finance SyllabusDocument4 pagesCertificate in Islamic Finance SyllabusJMF2020No ratings yet

- A Quick Guide To The Program DPro PDFDocument32 pagesA Quick Guide To The Program DPro PDFstouraNo ratings yet

- Audit and Auditors Under Company LawDocument11 pagesAudit and Auditors Under Company LawShatakshi SinghNo ratings yet

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- Presentation On Internship Program Done at The Enq: Subhankar BhattacharjeeDocument28 pagesPresentation On Internship Program Done at The Enq: Subhankar BhattacharjeeSubhankar BhattacharjeeNo ratings yet

- Marketing Vocabulary: Term MeaningDocument3 pagesMarketing Vocabulary: Term MeaningSudarmika KomangNo ratings yet

- EIA System in EthiopiaDocument11 pagesEIA System in Ethiopiafasika girmaNo ratings yet

- The State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaDocument3 pagesThe State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaSanu RanjanNo ratings yet

- Communication Strategies For The Asia PacificDocument25 pagesCommunication Strategies For The Asia PacificfahadaijazNo ratings yet