Professional Documents

Culture Documents

Indian School of Business Competitive Strategy (CSTR) Assignment 1

Uploaded by

NAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian School of Business Competitive Strategy (CSTR) Assignment 1

Uploaded by

NACopyright:

Available Formats

Indian School of Business

Competitive Strategy (CSTR)

Assignment 1

Section J; Study Group J2:

Student ID Student Name

62111004 Akshat Pawar

62111016 Arishma Datta

62110487 Kanika Gupta

62110749 Navdeep Bajaj

62110813 Prashaant Kalra

Answer 1 The concentrate industry is a more attractive industry than the bottlers. There are multiple

reasons for this and using Porter’s five forces analysis we can clearly demonstrate how each force

contributes to the profitability of the industry. In the below table, fields highlighted in green denotes

the pros and red denotes the cons of each industry for each of the forces.

Five Sub- Concentrator Industry/ Bottling Industry/

Forces category Comments Comments

For new entrants costs

Higher Volumes gives

Economies such as Marketing

High High companies more negotiating

of scale Expense are higher per

power

unit

Demand As shown by ‘Pepsi There is no brand value

side benefits High Challenge,’ people are Low associated with the bottling

of scale motivated by brands units

Concentrators have

Customer contracts with bottling Switching costs are non-

switching High companies that prevent Low existent as it depends on

cost them from moving to shelf visibility of the brands

competitor brands

Requires high speed

Involves relatively little

Threat Initial production lines, which are

capital investment in

of New Capital Low High interchangeable only for

machinery, overhead and

Entrant Requirement products of similar type and

labor

size.

Existing Incumbents like New entrants are equally

Incumbency

High Pepsi & Coke enjoy a Low likely to get contracts from

advantage

dominant Market position concentrators

Unequal Distribution channels are Large no. of channels

access to highly controlled available – fast food chains,

High Low

distribution (exclusive contracts) by vending, convenience store,

channels the dominant players. fountain etc.

Laws such as ‘Soft Drink

Restrictive Due to health concerns, Interbrand

Government High taxes are high for High Competition Act’ prevents

Policy concentrators bottling units from switching

concentrators

All beverages other than

The majority of U.S. CSDs

CSD beverages are

were packaged in metal cans

Threat of Substitutes High substitutes and CSD Low

(56%), plastic bottles (42%)

consumption per beverage

and glass bottles (2%).

is declining.

It is easier for

concentrator companies Price sensitivity is high

Power of Buyer Low High because similar substitutes

to switch among bottling

are readily available.

units.

Concentrate business

requires basic Bottling units are highly

Power of Supplier Low commodities, hence its High dependent on concentrators

suppliers do not have contracts

much power

Intense competition High competition among

Existing Competition among the players to gain bottling companies for

High High

Rivalry higher market share hence contracts from top

high fear of retaliation concentrators.

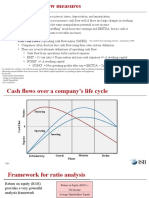

Answer 2: Price undercutting, increased advertisement expenditure, rising legal fees, higher R&D

expenditure should have reduced profitability of the industry. However, consolidation of supply chain,

expansion to new and healthier product lines, venturing to newer markets, increased innovation and

overall increase in market size led to sharp rise in top line while simultaneous optimizing costs leading

to increased profitability.

The below timeline analysis of the Cola wars includes the key factors that led to an increase in industry

profits:

All these strategies helped Coca Cola increase its profitability for 9% in 1975 to 21.1% in 2005 and

Pepsi to increase its profitability from 4.6% in 1975 to 12.5% in 2005*. It also led to increase in the

market consumption from 26.3 gallons/capita in 1975 to 53 gallons/capita in 2000. The decrease post

that is due to the shift of consumer behavior towards healthy drinks.

*(Pepsi and Coke contribute approx. 75% of the market. Thus, they have been considered as proxy for the overall industry)

You might also like

- Grow Initial Assessment Report for Plastic Bag CompanyDocument11 pagesGrow Initial Assessment Report for Plastic Bag CompanyAndiNo ratings yet

- Porter's Five Forces ModelDocument4 pagesPorter's Five Forces ModelJovelyn Cagatin Gella100% (1)

- Threat of New EntrantsDocument15 pagesThreat of New Entrantslokesh_bhatiya50% (2)

- Industry Five Forces AnalysisDocument26 pagesIndustry Five Forces AnalysisHồng Ánh LêNo ratings yet

- Week 6C-Porter's Five ForcesDocument14 pagesWeek 6C-Porter's Five Forces林泳圻No ratings yet

- The Diaper Industry in 1974 - GR - 7 - ADocument15 pagesThe Diaper Industry in 1974 - GR - 7 - AaabfjabfuagfuegbfNo ratings yet

- Bakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BDocument19 pagesBakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BThant Thandar100% (1)

- Industry Parameters IT ServicesDocument10 pagesIndustry Parameters IT ServicesSudikcha KoiralaNo ratings yet

- Strategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunDocument21 pagesStrategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunSandeep KumarNo ratings yet

- Porter's Five ForcesDocument10 pagesPorter's Five ForcesFazal RehmanNo ratings yet

- ICLA Session 2Document25 pagesICLA Session 2SHIVAM VARSHNEYNo ratings yet

- BS - Porters 5 ForcesDocument36 pagesBS - Porters 5 ForcesRidwan KabirNo ratings yet

- The Five Competitive Forces That Shape StrategyDocument10 pagesThe Five Competitive Forces That Shape StrategyDuong Do100% (1)

- Industry Analysis: CSD Group Assignment 1Document17 pagesIndustry Analysis: CSD Group Assignment 1UtsavNo ratings yet

- Fom Assignment MaDocument14 pagesFom Assignment MaadarshNo ratings yet

- Monsanto Case - Syndicate 6Document8 pagesMonsanto Case - Syndicate 6Damar HutomoNo ratings yet

- Analyzing the Lebanese Beer Market Using PESTLE and Five Forces ModelsDocument22 pagesAnalyzing the Lebanese Beer Market Using PESTLE and Five Forces Modelsayunda utariNo ratings yet

- B2B Selling Roles, Purchases and QualityDocument23 pagesB2B Selling Roles, Purchases and Qualityharisankar sureshNo ratings yet

- Mxes 0112 21Document14 pagesMxes 0112 21Alvi RownokNo ratings yet

- Porter 5 ForcesDocument6 pagesPorter 5 Forcesapi-3716002100% (3)

- Business Startup-Copy of Page-1Document1 pageBusiness Startup-Copy of Page-1Kamishetti SharanNo ratings yet

- Porter Five Forces Model Airlines Industry IndonesiaDocument7 pagesPorter Five Forces Model Airlines Industry IndonesiaJason ImmanuelNo ratings yet

- Disposable Diaper Industry Case Analysis: P&G's Strategies to Shape EvolutionDocument8 pagesDisposable Diaper Industry Case Analysis: P&G's Strategies to Shape EvolutionaabfjabfuagfuegbfNo ratings yet

- Supplier Power: Bargaining Power of Buyers: The Power of Buyers Is The Impact That Customers Have On ADocument3 pagesSupplier Power: Bargaining Power of Buyers: The Power of Buyers Is The Impact That Customers Have On Akishan kanojiaNo ratings yet

- Software Industry AnalysisDocument9 pagesSoftware Industry Analysiskjpatel991% (11)

- Porters 5 Forces-e-Wallet Industry (India) & Impact On Reliance JioDocument6 pagesPorters 5 Forces-e-Wallet Industry (India) & Impact On Reliance Jiosaq66No ratings yet

- Porter's Five ForcesDocument11 pagesPorter's Five ForcesSUMIT JANKARNo ratings yet

- Activity # 2 (Business Simulation) : Figure 1: Five Forces ModelDocument2 pagesActivity # 2 (Business Simulation) : Figure 1: Five Forces ModelJade BoadoNo ratings yet

- 5 ForcesDocument42 pages5 Forcesaksr27No ratings yet

- Porters Five Forces of ApDocument5 pagesPorters Five Forces of ApYah yah yahhhhhNo ratings yet

- Frameworks To Analyse A CompanyDocument4 pagesFrameworks To Analyse A CompanyCh Dileep VarmaNo ratings yet

- ITC: Paper and Packaging IndustryDocument7 pagesITC: Paper and Packaging IndustryAshutosh kumarNo ratings yet

- Porter's Five Forces ModelDocument18 pagesPorter's Five Forces ModelSuman PatraNo ratings yet

- Porters Five Forces - What It Means For Your BusinessDocument4 pagesPorters Five Forces - What It Means For Your Businessanil_baddi100% (10)

- Chapter 5Document41 pagesChapter 5Muhammad Saddam SofyandiNo ratings yet

- Tesco - Industry and Company AnalysisDocument26 pagesTesco - Industry and Company AnalysisMike rossNo ratings yet

- Porter Generic StrategiesDocument11 pagesPorter Generic StrategiesebustosfNo ratings yet

- Strategic Management Concurrent AssignmentDocument11 pagesStrategic Management Concurrent AssignmentDurant DsouzaNo ratings yet

- MKT 761 Individual AssignmentDocument1 pageMKT 761 Individual AssignmentWan KhaidirNo ratings yet

- External Audit NotesDocument3 pagesExternal Audit NotesPatricia May CayagoNo ratings yet

- Industry Analysis - TriconDocument5 pagesIndustry Analysis - TriconMarc Eric RedondoNo ratings yet

- Coffee Shop Chains: Business Costs and Industry ForcesDocument1 pageCoffee Shop Chains: Business Costs and Industry ForcesPaula de TorresNo ratings yet

- A Template For Structural Analysis of An IndustryDocument5 pagesA Template For Structural Analysis of An IndustryKingshuk MitraNo ratings yet

- Sectoral Analysis: Porter's 5 ForcesDocument1 pageSectoral Analysis: Porter's 5 ForcesIshan ShuklaNo ratings yet

- Jio Mart Industry and Competitive AnalysisDocument7 pagesJio Mart Industry and Competitive Analysisdiksha dagaNo ratings yet

- Entrepreneurship Final Presentation OutlineDocument13 pagesEntrepreneurship Final Presentation Outlineapi-525820170No ratings yet

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- Consultative Selling: The Hanan Formula for High-Margin Sales at High LevelsFrom EverandConsultative Selling: The Hanan Formula for High-Margin Sales at High LevelsRating: 5 out of 5 stars5/5 (1)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- CUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESFrom EverandCUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESNo ratings yet

- Management Systems in digital business Environments: Howto keep the balance of agility and stability while establishing governance frameworksFrom EverandManagement Systems in digital business Environments: Howto keep the balance of agility and stability while establishing governance frameworksNo ratings yet

- Creating and Maintaining Resilient Supply ChainsFrom EverandCreating and Maintaining Resilient Supply ChainsNo ratings yet

- Summary of Clayton M. Christensen, Jerome H. Grossman & Jason Hwang's The Innovator's PrescriptionFrom EverandSummary of Clayton M. Christensen, Jerome H. Grossman & Jason Hwang's The Innovator's PrescriptionNo ratings yet

- B4B: How Technology and Big Data Are Reinventing the Customer-Supplier RelationshipFrom EverandB4B: How Technology and Big Data Are Reinventing the Customer-Supplier RelationshipNo ratings yet

- Awareness: Profiles Characteristics Amazon's Value Prop. Priority RationaleDocument11 pagesAwareness: Profiles Characteristics Amazon's Value Prop. Priority RationaleNANo ratings yet

- Growth Strategy & Business Development: AchievementsDocument1 pageGrowth Strategy & Business Development: AchievementsNANo ratings yet

- #1 Leadership & Entrepreneurial MindsetDocument1 page#1 Leadership & Entrepreneurial MindsetNANo ratings yet

- HUL LIME 2021 - The Disruption EconomyDocument5 pagesHUL LIME 2021 - The Disruption EconomyNANo ratings yet

- EBITDA Earnings Before Interest, Taxes, Depreciation, and AmortizationDocument9 pagesEBITDA Earnings Before Interest, Taxes, Depreciation, and AmortizationNANo ratings yet

- FADM 2021 Session 3: Assets Part 2: Property Plant & Equipment (PPE)Document22 pagesFADM 2021 Session 3: Assets Part 2: Property Plant & Equipment (PPE)NANo ratings yet

- Sample Midterm Exam Questions EconomicsDocument3 pagesSample Midterm Exam Questions EconomicsNANo ratings yet

- Practice Set 1 Intro BS ISDocument19 pagesPractice Set 1 Intro BS ISAtul DarganNo ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- Backup Restore MysqlDocument8 pagesBackup Restore MysqlJesus Diaz GonzalezNo ratings yet

- Decision Models and Optimization: Indian School of Business Assignment 4Document8 pagesDecision Models and Optimization: Indian School of Business Assignment 4NANo ratings yet

- Session 2 Practice Set - Revenue Recognition, Accounts Receivable, InventoryDocument9 pagesSession 2 Practice Set - Revenue Recognition, Accounts Receivable, InventoryRamjiNo ratings yet

- Activate Xdebug for PHP debugging and profilingDocument3 pagesActivate Xdebug for PHP debugging and profilingcoolsinchanNo ratings yet

- Indian School of Business Decision Models and Optimization Assignment 1Document11 pagesIndian School of Business Decision Models and Optimization Assignment 1NANo ratings yet

- Gillette'S Energy Drain (A) : The Acquisition of DuracellDocument3 pagesGillette'S Energy Drain (A) : The Acquisition of DuracellNANo ratings yet

- Auto Start Xampp PDFDocument2 pagesAuto Start Xampp PDFCahya Bagus SanjayaNo ratings yet

- Access Phpmyadmin Remotely PDFDocument2 pagesAccess Phpmyadmin Remotely PDFcoolsinchanNo ratings yet

- (Python, Pandas, Selenium, & Firebase Analytics) Annual Revenue 1.9Cr and Expected Revenue of 3.6Cr in FY21 200+ Products 20+ Registered BrandsDocument1 page(Python, Pandas, Selenium, & Firebase Analytics) Annual Revenue 1.9Cr and Expected Revenue of 3.6Cr in FY21 200+ Products 20+ Registered BrandsNANo ratings yet

- Change Mysql Temp DirDocument2 pagesChange Mysql Temp DirNANo ratings yet

- Serverstartup PDFDocument6 pagesServerstartup PDFWezda KingstonNo ratings yet

- Meals in Britain: Reading ComprehensionDocument3 pagesMeals in Britain: Reading ComprehensionEstebanGiraldoNo ratings yet

- Gringo, O Square Greenhills, Greenhills, San Juan Booky PDFDocument1 pageGringo, O Square Greenhills, Greenhills, San Juan Booky PDFSabrina TesoroNo ratings yet

- Juices, Coffee and FlavorsDocument4 pagesJuices, Coffee and Flavorskkatryna.d100% (1)

- Marketing Strategy of Pepsi PDFDocument65 pagesMarketing Strategy of Pepsi PDFSparshRajNo ratings yet

- Category Study of Cheese in A Retail StoreDocument28 pagesCategory Study of Cheese in A Retail StoreTanyaNo ratings yet

- Moa PnocDocument3 pagesMoa Pnocsheryl himocNo ratings yet

- Working Paper of Buffer Solutions Grade 11Document11 pagesWorking Paper of Buffer Solutions Grade 11Winston LeonardNo ratings yet

- At The Restaurant: 2. Fill in Missing WordsDocument2 pagesAt The Restaurant: 2. Fill in Missing WordsAnabela SscNo ratings yet

- Food and Beverage Service OperationDocument42 pagesFood and Beverage Service OperationSanjib GhimireNo ratings yet

- 101 Great British Words To Speak Like A LocalDocument16 pages101 Great British Words To Speak Like A LocalmarcelaNo ratings yet

- Grade 8 12 Reading Materials For ORVDocument4 pagesGrade 8 12 Reading Materials For ORVanthonybrylecamarilloNo ratings yet

- On: Blow Moulding ProcessDocument7 pagesOn: Blow Moulding Processsatyam kumarNo ratings yet

- Colonoscopy Peg-Lyte InstructionsDocument1 pageColonoscopy Peg-Lyte InstructionsBill RNo ratings yet

- Bài tập các thì tiếng AnhDocument24 pagesBài tập các thì tiếng AnhChâu HoàngNo ratings yet

- 10 Best Strategy PapersDocument13 pages10 Best Strategy PapersIvo Sousa MartinsNo ratings yet

- The Perfect Crime U3 New Headway Pre IntDocument5 pagesThe Perfect Crime U3 New Headway Pre Intinas khalil100% (1)

- Underground architect's early elegiac contributionsDocument4 pagesUnderground architect's early elegiac contributionsMaki DonatoNo ratings yet

- Rural Marketing PepsiDocument30 pagesRural Marketing Pepsiabhasa100% (3)

- Water Brands - Rockstar Sell SheetsDocument4 pagesWater Brands - Rockstar Sell SheetsLi CarinaNo ratings yet

- 50 English Idioms Examples WorksheetDocument7 pages50 English Idioms Examples Worksheetx0rth0rnNo ratings yet

- Kattia Marisol Palacios GranadinoDocument6 pagesKattia Marisol Palacios GranadinoRonny Roy Villalta LizanaNo ratings yet

- Research Paper On Alcoholism OutlineDocument7 pagesResearch Paper On Alcoholism Outlinem0d1p1fuwub2100% (1)

- Little Red CapDocument5 pagesLittle Red CapDivya100% (1)

- Dhifufaru AIDocument2 pagesDhifufaru AIErnest DineshNo ratings yet

- Brian's Brains by Hugh MortimerDocument27 pagesBrian's Brains by Hugh MortimerLupe CastañedaNo ratings yet

- TIS - RAFLAMATT 90 WSA-FSC - RH30 - WHITE GLASSINE 85 - 6415788301715 - English - SIDocument2 pagesTIS - RAFLAMATT 90 WSA-FSC - RH30 - WHITE GLASSINE 85 - 6415788301715 - English - SICris AlexandrescuNo ratings yet

- QHS-2000 Beverage Machine InstructionDocument13 pagesQHS-2000 Beverage Machine InstructionCoteneanuIonutNo ratings yet

- The Packaging Industry in India: An Industry Presentation FromDocument23 pagesThe Packaging Industry in India: An Industry Presentation FromYogesh ßhujbal100% (1)

- Walkthrough Witch Hunter TrainerDocument42 pagesWalkthrough Witch Hunter TrainerChristan Saga60% (15)

- Starbucks 1Document15 pagesStarbucks 1Vân XuânNo ratings yet