Professional Documents

Culture Documents

Benefit Illustration for HDFC Life Sanchay Fixed Maturity Plan

Uploaded by

Nisha GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration for HDFC Life Sanchay Fixed Maturity Plan

Uploaded by

Nisha GoyalCopyright:

Available Formats

01-11-2021

Quote No : qavfzg4r83kdq

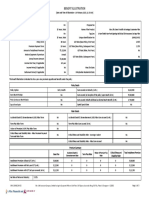

Benefit Illustration for HDFC Life Sanchay Fixed Maturity Plan

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Fixed Maturity Plan

DETAILS

Name of the Prospect/Policyholder: suis Proposal No: NA

Age: 32 Name of Product: HDFC Life Sanchay Fixed Maturity Plan

A Non-Linked,Non-

Name of Life Assured 1: suis Tag Line: Participating,Individual,Savings,Life

Insurance Plan

Age: 32 Unique Identification No: 101N142V01

Sex: M GST Rate: 18%

Name of Life Assured 2: NA

Age: NA

Sex: NA

Policy Term: 10

Premium Paying Term: Single Premium

Amount of Instalment Premium

Rs.1000000

(Without GST):

Amount allocated for savings: 955100

Mode of Payment of Premium: Single

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Policy Details

Death Benefit/ Death Benefit (First Death) in case of

Policy Option Single Life Joint Life- 1396000

(at inception of the policy) Rs.

Death Benefit-Second Death-

Life Assured 1 (at NA

Sum Assured on Maturity inception of the policy) Rs.

1723100

Rs. Death Benefit-Second Death-

Life Assured 2 (at NA

inception of the policy) Rs.

Premium Summary

PP PP Total

Base Plan CI Rider IB Rider PP Rider (PAC) Rider Rider Instalment

(ADC) (CC) Premium

Instalment Premium without GST 10,00,000 0 0 0 0 0 10,00,000

Instalment Premium with First Year GST* 10,08,082 0 0 0 0 0 10,08,082

Instalment Premium with GST 2nd Year Onwards 0 0 0 0 0 0 0

(Amount in Rupees)

Policy Single/ Guaranteed Non-Guaranteed

Year Annualized

Survival Benefits / Other benefits Maturity Benefit Death Benefit/ Death Benefit Death Benefit Death Benefit Min Special Surrender Value

Premium

Loyalty Additions (if any) (First Death) in case (Second Death- (Second Death- Guaranteed

of Joint Life Life Assured 1) Life Assured 2) Surrender

Value

1 10,00,000 0 0 0 13,96,000 NA NA 10,00,000 10,08,388

2 0 0 0 0 13,96,000 NA NA 10,00,000 10,39,527

3 0 0 0 0 13,96,000 NA NA 10,00,000 10,95,135

4 0 0 0 0 13,96,000 NA NA 10,00,000 11,66,012

5 0 0 0 0 13,96,000 NA NA 10,00,000 13,12,200

6 0 0 0 0 13,96,000 NA NA 10,00,000 13,85,100

7 0 0 0 0 14,61,400 NA NA 10,00,000 14,61,400

8 0 0 0 0 15,43,400 NA NA 10,00,000 15,43,400

9 0 0 0 0 16,30,600 NA NA 10,00,000 16,30,600

10 0 0 0 17,23,100 17,23,100 NA NA 0 0

Notes:

1. Single Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax. Refer Sales

Literature for explanation of terms used in this illustration.

2. The maturity benefit is payable at the end of the policy year. Upon payment of the maturity benefit, the policy terminates and no further benefits become payable.

3. The death benefits shown above are at the end of the year. Upon payment, of death benefit the policy terminates and no further benefit is payable.

4. The surrender benefits shown above are at the end of the year. Upon payment of surrender benefit, the policy terminates and no further benefit becomes payable.

5. The Premium and the Sum Assured on Maturity stated above is based on the information provided. They may vary as a result of underwriting.

6. Any statutory levy or charges (such as Goods and Service tax) including any indirect tax may be charged to the Policyholder either now or in future by the company and such

amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to payment of premium.

*GST amount is calculated by multiplying GST rate with the gross amount of premium charged minus the amount allocated for savings (where such amount is informed to the

policyholder at the time of supply)

I SUJAL AGARWAL, have explained the premiums and benefits under the policy I suis ,having received the information with respect to the above, have understood

fully to the prospect / policyholder. the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

You might also like

- Trading Rules Strategies William F EngDocument290 pagesTrading Rules Strategies William F EngDheeraj Suntha100% (10)

- The Champion Legal Ads: 03-30-23Document49 pagesThe Champion Legal Ads: 03-30-23Donna S. SeayNo ratings yet

- Mathematics Form 1Document339 pagesMathematics Form 1JacintaRajaratnam67% (9)

- Firelights PDFDocument2 pagesFirelights PDFEFG EFGNo ratings yet

- Rubric in Poster Making PDFDocument1 pageRubric in Poster Making PDFSerolf IanNo ratings yet

- Industrial Attachment ReportDocument82 pagesIndustrial Attachment ReportNiyibizi Promesse100% (8)

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- IllustrationnDocument3 pagesIllustrationnBLOODY ASHHERNo ratings yet

- Tata AIA Life Insurance Fortune Guarantee Plus for Kanta Rajeshi PatelDocument3 pagesTata AIA Life Insurance Fortune Guarantee Plus for Kanta Rajeshi Patelkishor patelNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusAniruddha DasNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- HDFC Life Click 2 Protect Life Benefit IllustrationDocument3 pagesHDFC Life Click 2 Protect Life Benefit IllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Illustration - 2022-08-31T154243.769Document3 pagesIllustration - 2022-08-31T154243.769Soumen BeraNo ratings yet

- Illustration - 2022-08-31T155906.546Document3 pagesIllustration - 2022-08-31T155906.546Soumen BeraNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- Guaranteed Return Insurance PlanDocument3 pagesGuaranteed Return Insurance PlanVijay BhaskarNo ratings yet

- Dummy Please IgnoreDocument4 pagesDummy Please IgnoreShivam SoniNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- Tata AIA Life Insurance Fortune Guarantee Plus: Benefit IllustrationDocument3 pagesTata AIA Life Insurance Fortune Guarantee Plus: Benefit IllustrationvijayNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusSrk ShivaNo ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Tata 7-12-1Document2 pagesTata 7-12-1Sudi R ThakurNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusRenju GeorgeNo ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- Tata AIA Life Guaranteed Return Insurance Plan benefitsDocument3 pagesTata AIA Life Guaranteed Return Insurance Plan benefitsntn2709No ratings yet

- Illustration - 2022-08-31T164229.106Document3 pagesIllustration - 2022-08-31T164229.106Soumen BeraNo ratings yet

- Guaranteed Return Insurance PlanDocument3 pagesGuaranteed Return Insurance PlanScribbydooNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- HDFC Life Click 2 Protect SuperDocument3 pagesHDFC Life Click 2 Protect SuperABISHKAR SARKARNo ratings yet

- Tata AIA Life Insurance Plan DetailsDocument2 pagesTata AIA Life Insurance Plan Detailsashutosh chaturvediNo ratings yet

- CZ 56256 BN 564788Document2 pagesCZ 56256 BN 564788aman khatriNo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusbabukcdNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- Illustr NewDocument2 pagesIllustr NewHar DonNo ratings yet

- Policy DetailsDocument2 pagesPolicy DetailsMyeduniya MEDNo ratings yet

- IllustrationDocument3 pagesIllustrationSai SumanthNo ratings yet

- Illustration Qbyuu7muxf1cvDocument3 pagesIllustration Qbyuu7muxf1cvajayNo ratings yet

- IllustrationDocument3 pagesIllustrationMahesh AgrawalNo ratings yet

- Plan/Benefit Options Benefit Description: Dear Udayan PandeyDocument4 pagesPlan/Benefit Options Benefit Description: Dear Udayan PandeyudayanNo ratings yet

- Illustration (33) (22)Document3 pagesIllustration (33) (22)amrutadonNo ratings yet

- Guaranteed Return Insurance PlanDocument2 pagesGuaranteed Return Insurance PlanbabukcdNo ratings yet

- Illustration - 2022-08-31T122247.414Document3 pagesIllustration - 2022-08-31T122247.414Soumen BeraNo ratings yet

- Illustration (33) (21)Document3 pagesIllustration (33) (21)amrutadonNo ratings yet

- Tata AIA Life Insurance Plan DetailsDocument2 pagesTata AIA Life Insurance Plan DetailsRb BNo ratings yet

- Illustration 3Document2 pagesIllustration 3Satyaki DuttaNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- IllustrationDocument3 pagesIllustrationSiddharth GoenkaNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- IllustrationDocument3 pagesIllustrationpraharshafciNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- I Am RedDocument3 pagesI Am RedSudeep MandalNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- IllustrationDocument2 pagesIllustrationAbhijeet DhobleNo ratings yet

- IllustrationDocument2 pagesIllustrationTushar ChaudhariNo ratings yet

- Bajaj Allianz Life eTouch Term Plan BenefitsDocument5 pagesBajaj Allianz Life eTouch Term Plan BenefitsSaurabh GoreNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- Package Policy Details for Maruti CELERIODocument4 pagesPackage Policy Details for Maruti CELERIONisha GoyalNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountNisha GoyalNo ratings yet

- IllustrationDocument3 pagesIllustrationNisha GoyalNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNisha GoyalNo ratings yet

- Package Policy Details for Maruti CELERIODocument4 pagesPackage Policy Details for Maruti CELERIONisha GoyalNo ratings yet

- Benefit Illustration for HDFC Life Sanchay Fixed Maturity PlanDocument3 pagesBenefit Illustration for HDFC Life Sanchay Fixed Maturity PlanNisha GoyalNo ratings yet

- IllustrationDocument3 pagesIllustrationNisha GoyalNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNisha GoyalNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountNisha GoyalNo ratings yet

- Best Clinical Embryology Courses in MaduraiDocument8 pagesBest Clinical Embryology Courses in MaduraiVaramreprogenesisNo ratings yet

- Business and Tech Mock Exam (8Document11 pagesBusiness and Tech Mock Exam (8Jack PayneNo ratings yet

- Smoothed Bootstrap Nelson-Siegel Revisited June 2010Document38 pagesSmoothed Bootstrap Nelson-Siegel Revisited June 2010Jaime MaihuireNo ratings yet

- Economic and Eco-Friendly Analysis of Solar Power Refrigeration SystemDocument5 pagesEconomic and Eco-Friendly Analysis of Solar Power Refrigeration SystemSiddh BhattNo ratings yet

- Certif Icate of Motor Insurance: MmencementDocument2 pagesCertif Icate of Motor Insurance: MmencementSarfraz ZahoorNo ratings yet

- E-Learning - Learning For Smart GenerationZ-Dr.U.S.pandey, Sangita RawalDocument2 pagesE-Learning - Learning For Smart GenerationZ-Dr.U.S.pandey, Sangita RawaleletsonlineNo ratings yet

- Diease LossDocument10 pagesDiease LossGeetha EconomistNo ratings yet

- The Definition of WorkDocument2 pagesThe Definition of WorkCarlton GrantNo ratings yet

- From The Caves and Jungles of Hindostan by Blavatsky, H. P. (Helena Petrovna), 1831-1891Document173 pagesFrom The Caves and Jungles of Hindostan by Blavatsky, H. P. (Helena Petrovna), 1831-1891Gutenberg.org100% (1)

- Man 040 0001Document42 pagesMan 040 0001arturo tuñoque effioNo ratings yet

- Reg0000007635187Document2 pagesReg0000007635187Amal JimmyNo ratings yet

- Aluminio 2024-T3Document2 pagesAluminio 2024-T3IbsonhNo ratings yet

- Manual Panasonic AG-DVC7Document4 pagesManual Panasonic AG-DVC7richercitolector01No ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewDeepak Jindal67% (3)

- KUBOTA MU5501 4WD Tractor - T-1037-1562-2016Document9 pagesKUBOTA MU5501 4WD Tractor - T-1037-1562-2016Prashant PatilNo ratings yet

- Aluminum Wire Data and PropertiesDocument31 pagesAluminum Wire Data and PropertiesMaria SNo ratings yet

- Eamon Barkhordarian June 6, 2006Document1 pageEamon Barkhordarian June 6, 2006Eamon BarkhordarianNo ratings yet

- Registered Unregistered Land EssayDocument3 pagesRegistered Unregistered Land Essayzamrank91No ratings yet

- Med - Leaf - Full ReportDocument31 pagesMed - Leaf - Full ReportAdithya s kNo ratings yet

- Dual Band DAB Pocket Radio: User Manual Manuel D'utilisation Manual Del Usuario Benutzerhandbuch GebruikershandleidingDocument21 pagesDual Band DAB Pocket Radio: User Manual Manuel D'utilisation Manual Del Usuario Benutzerhandbuch Gebruikershandleidingminerva_manNo ratings yet

- What is Strategic Human Resource ManagementDocument8 pagesWhat is Strategic Human Resource ManagementYashasvi ParsaiNo ratings yet

- Seven Tips For Surviving R: John Mount Win Vector LLC Bay Area R Users Meetup October 13, 2009 Based OnDocument15 pagesSeven Tips For Surviving R: John Mount Win Vector LLC Bay Area R Users Meetup October 13, 2009 Based OnMarco A SuqorNo ratings yet

- How Do I Create An Import DC ApplicationDocument10 pagesHow Do I Create An Import DC ApplicationPeter CheungNo ratings yet

- 4 Ways to Improve Your Strategic ThinkingDocument3 pages4 Ways to Improve Your Strategic ThinkingJyothi MallyaNo ratings yet