Professional Documents

Culture Documents

06 Task Performance 1

Uploaded by

LunaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 Task Performance 1

Uploaded by

LunaCopyright:

Available Formats

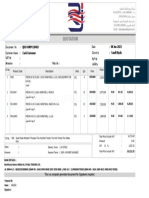

BM2008

NAME: DATE: SCORE:

TASK PERFORMANCE

Instructions: Determine the requirements for each independent case. Write your answers to the space

provided. Show your computations. (20 items x 5 points)

AUDIT OF INVENTORIES

Case No. 1: UMBRELLA ACADEMY

In testing the sales cut-off for the UMBRELLA ACADEMY in connection with an audit for the year ended

October 31, 201A, you find the following information. A physical inventory was taken as of the close of

business on October 31, 201A. All customers are within a three-day delivery area of the company’s plant.

The unadjusted balances of Sales and Inventories are P7,500,000 and P330,000, respectively.

Invoice Date Date

Number FOB Terms Shipped Recorded Sales Cost

6671 Destination Oct. 20 Oct. 31 P3,000 P2,700

6672 Shipping Point Oct. 31 Nov. 2 7,500 6,000

6673 Shipping Point Oct. 25 Oct. 31 5,400 3,600

6674 Destination Oct. 31 Oct. 29 12,600 9,300

6675 Destination Oct. 31 Nov. 2 27,600 24,000

6676 Shipping Point Nov. 2 Oct. 23 19,500 15,300

6677 Shipping Point Nov. 5 Nov. 6 22,500 17,400

6678 Destination Oct. 25 Nov. 3 11,700 6,000

6679 Shipping Point Nov. 4 Oct. 31 25,800 24,600

6680 Destination Nov. 5 Nov. 2 15,000 12,000

Based on the foregoing information, compute the October 31, 201A, adjusted balances of the following

accounts:

1. Sales ___________

2. Inventories _____________

Case No. 2 STRANGER THINGS

The following audited balances pertain to STRANGER THINGS Company.

Accounts payable:

January 1, 201A P286,924

December 31, 201A 737,824

Inventory balance:

January 1, 201A 815,386

December 31, 201A 488,874

Cost of goods sold-201A 1,859,082

3. How much was paid by STRANGER THINGS Company to its suppliers in 201A? _____________

06 Task Performance 1 *Property of STI

Page 1 of 5

BM2008

Case No. 3: HIMYM

The management of HIMYM, Inc. has engaged you to assist in the preparation of year-end (December 31)

financial statements. You are told that on November 30, the correct inventory level was 145,730 units.

During the month of December, sales totaled 138,630 units, including 40,000 units shipped on

consignment to TED Co. A letter received from TED Co. indicates that as of December 31, it has sold 15,200

units and was still trying to sell the remainder.

A review of the December purchase orders to various suppliers shows the following:

Purchase Invoice Quantity in Date Date

Terms

Order Date Date Units Shipped Received

12/31/1A 01/02/1B 4,200 01/02/1B 01/05/1B FOB Destination

12/05/1A 01/02/1B 3,600 12/17/1A 12/22/1A FOB Destination

12/06/1A 01/03/1B 7,900 01/05/1B 01/07/1B FOB Shipping point

12/18/1A 12/20/1A 8,000 12/29/1A 01/02/1B FOB Shipping point

12/22/1A 01/05/1B 4,600 01/04/1B 01/06/1B FOB Destination

12/27/1A 01/07/1B 3,500 01/05/1B 01/07/1B FOB Destination

HIMYM, Inc. uses the “passing of legal title” for inventory recognition.

4. How many units of goods were purchased during December? ___________

5. How many units were sold during December? ___________

6. How many units should be included in HIMYM, Inc.’s inventory at December 31, 201A? ________

Case No. 4: HAMILTON

Hamilton Company engaged you to examine its books and records for the fiscal year ended June 30, 201B.

The company’s accountant has furnished you not only a copy of the trial balance as of June 30, 201B but

also a copy of the company’s balance sheet and income statement as ofsaid date. The following data

appears in the cost of goods sold section of the income statement:

Inventory, July 1, 201A P500,000

Add Purchases 3,600,000

Total goods available for sale 4,100,000

Less Inventory, June 30, 201B 700,000

Cost of goods sold P3,400,000

The beginning and ending inventories of the year were ascertained thru physical count except that no

reconciling items were considered. Even though the books have been closed, your working paper trial

balance shows all account with activity during the year. All purchases are FOB shipping point. The

company is on a periodic inventory basis.

In your examination of inventory cut-offs at the beginning and end of the year, you took note of the

following:

July 1, 201A

a. June invoices totaling to P130,000 were entered in the voucher register in June. The corresponding

goods are not received until July.

b. Invoices totaling P54,000 were entered in the voucher register in July, but the goods received during

June.

06 Task Performance 1 *Property of STI

Page 2 of 5

BM2008

June 30, 201B

c. Invoices with an aggregate value of P186,000 were entered in the voucher register in July, and the

goods were received in July. The invoices, however, were dated June.

d. June invoices totaling P74,000 were entered in the voucher register in June, but the goods were not

received until July.

e. Invoices totaling P108,000 (the corresponding goods for which were received in June) were entered

the voucher register, July.

f. Sales on account in the total amount of P176,000 were made on June 30 and the goods delivered at

that time. Book entries relating to the sales were made in June.

Based on the above and the result of your cut-off tests, answer the following:

7. How much is the adjusted Inventory as of July 1, 201A? _______________

8. How much is the adjusted Purchases for the fiscal year ended June 30, 201B? _______________

9. How much is the adjusted Inventory as of June 30, 201B? _______________

10. How much is the adjusted Cost of Goods Sold for the fiscal year ended June 30, 201B?

______________

06 Task Performance 1 *Property of STI

Page 3 of 5

BM2008

AUDIT OF INVESTMENTS

Case No. 1: STRAWBERRY CORP.

STRAWBERRY CORP. invested its excess cash in equity securities during 201A. The business model for

these investments is to profit from trading on price changes.

a. As of December 31, 201A, the equity investment portfolio consisted of the following:

Investment Quantity Cost Fair Value

Avocado, Inc. 1,000 shares P90,000 P126,000

Mango Co. 2,000 shares 240,000 252,000

Orange Corp. 2,000 shares 432,000 360,000

1. In the December 31, 201A, statement of financial position, what should be reported as carrying

amount of investment? _________________

2. In the 201A income statement, what amount should be reported as unrealized gain or loss?

___________

b. During the year 201A, STRAWBERRY Corp. sold 2,000 shares of Mango Co. for P229,200 and purchased

2,000 more shares of Avocado, Inc. and 1,000 shares of Grapes Company. On December 31, 201A,

Strawberry’s equity securities portfolio consisted of the following.

Investment Quantity Cost Fair Value

Avocado, Inc. 1,000 shares P90,000 P126,000

Avocado, Inc. 2,000 shares 198,000 240,000

Grapes Company 1,000 shares 96,000 72,000

Orange Corp. 2,000 shares 432,000 132,000

3. What is the gain or loss on the sale of Mango Co. investment? ____________

4. What is the carrying amount of the investments on December 31, 201A? ___________

5. What amount of unrealized gain or loss should be reported in the income statement for the year

ended December 31, 201A? ____________

c. During the year 202A, STRAWBERRY sold 3,000 shares of Avocado, Inc. for P239,400 and 500 shares

of Grapes Company at a loss of P16,200. On December 31, 201A, Strawberry’s equity investment

portfolio consisted of the following.

Investment Quantity Cost Fair Value

Grapes Company 500 shares P48,000 P36,000

Orange Corp. 2,000 shares 432,000 492,000

6. What should be reported as loss on sale of trading securities in 201A? ____________

7. What amount of unrealized gain or loss should be reported in the income statement for the year

ended December 31, 201A? _______________

8. In the December 31, 201A statement of financial position, what should be reported as carrying

amount of the trading securities? ______________

06 Task Performance 1 *Property of STI

Page 4 of 5

BM2008

Case No. 2: KIMCHI CORP.

KIMCHI COMPANY buys and sells securities expecting to earn profits on short-term differences in price.

During 201A, Kimchi Company purchased the following trading securities:

Security Cost Fair Value, Dec. 31, 201A

A P585,000 P675,000

B 900,000 486,000

C 1,980,000 2,034,000

Before any adjustments related to these trading securities, Kimchi Company had net income of

P2,700,000.

9. What is Kimchi’s net income after making any necessary trading security adjustments? ___________

10. What would Kimchi’s net income be if the fair value of security B were P855,000? ____________

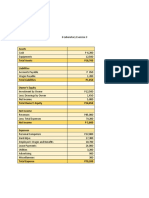

Rubric for problem solving:

Performance Indicators Points

Correct accounts and amounts used 3

Computed final amounts are correct/balanced 2

Total 5

06 Task Performance 1 *Property of STI

Page 5 of 5

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Homework On Inventories Problem 1 (Borrowing Cost ConceptsDocument3 pagesHomework On Inventories Problem 1 (Borrowing Cost ConceptsJazehl Joy ValdezNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Audit of InventoriesDocument4 pagesAudit of InventoriesMc Gavriel VillenaNo ratings yet

- Ap 1Document4 pagesAp 1Joseph PamaongNo ratings yet

- Quiz 03 Name: - Score: - Rating: - Problem 01Document3 pagesQuiz 03 Name: - Score: - Rating: - Problem 01Jom BuddyNo ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Audit of Inventory - SW6Document8 pagesAudit of Inventory - SW6d.pagkatoytoyNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- 10.14.2017 Quiz 1 (Audit of Inventory)Document5 pages10.14.2017 Quiz 1 (Audit of Inventory)PatOcampoNo ratings yet

- PRACTICE SET III Audit of InventoriesDocument9 pagesPRACTICE SET III Audit of InventoriesAldyn Jade GuabnaNo ratings yet

- Audit 2 - Topic3Document20 pagesAudit 2 - Topic3YUSUFNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesEdmar HalogNo ratings yet

- Audit of Inventories - Roque 2018Document60 pagesAudit of Inventories - Roque 2018Renelyn David69% (13)

- Auditing 2: Review Exercises - OLDocument7 pagesAuditing 2: Review Exercises - OLVip BigbangNo ratings yet

- (Problems) - Audit of InventoriesDocument22 pages(Problems) - Audit of Inventoriesapatos40% (5)

- Chapter 3Document10 pagesChapter 3Kristina Kitty100% (1)

- Audit 2 - Topic3BDocument20 pagesAudit 2 - Topic3BHerry SugiantoNo ratings yet

- MOCKBOARD With AnswersDocument12 pagesMOCKBOARD With AnswersAnonymous IFu8Wi1gHINo ratings yet

- Aec 22 - Take Home Long Quiz: Trading SecuritiesDocument4 pagesAec 22 - Take Home Long Quiz: Trading SecuritiesOriel Ricky GallardoNo ratings yet

- Computations MerchDocument5 pagesComputations MerchChayne Rodil100% (1)

- Auditing InventoriesDocument8 pagesAuditing InventoriesSabel FordNo ratings yet

- Audit of Inventories and Cost of Goods SoldDocument9 pagesAudit of Inventories and Cost of Goods SoldDita Indah0% (1)

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- Problem 3-1 Problem 3-1Document26 pagesProblem 3-1 Problem 3-1MichelleNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Chapter3 Students 1Document22 pagesChapter3 Students 1Leah Mae NolascoNo ratings yet

- FEU HO1 Audit of Inventories 2017 PDFDocument4 pagesFEU HO1 Audit of Inventories 2017 PDFJoshuaNo ratings yet

- ACCO 30053 - Audit of Inventories - MARPDocument6 pagesACCO 30053 - Audit of Inventories - MARPBanna SplitNo ratings yet

- AttachmentDocument22 pagesAttachmentchintya milathaniaNo ratings yet

- Cabigon Audit Inventories 5Document14 pagesCabigon Audit Inventories 5Rie CabigonNo ratings yet

- Ap-5905 Inventories PDFDocument9 pagesAp-5905 Inventories PDFKathleen Jane SolmayorNo ratings yet

- Substantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataDocument17 pagesSubstantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataPaul Anthony AspuriaNo ratings yet

- MODAUD1 UNIT 4 Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 Audit of Inventories PDFJoey WassigNo ratings yet

- AP03 Audit of Inventories QDocument6 pagesAP03 Audit of Inventories Qbobo kaNo ratings yet

- Audit of Inventories and Cost of Goods SDocument16 pagesAudit of Inventories and Cost of Goods SAira Nhaira MecateNo ratings yet

- Cebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1Document10 pagesCebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1PaupauNo ratings yet

- 2023 Aud A 03Document2 pages2023 Aud A 03geraldjakeNo ratings yet

- Chapter 3 InventoriesDocument68 pagesChapter 3 InventoriesMARY JANE ESCLAMADO CABALESNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- Audit of Inventory PDFDocument7 pagesAudit of Inventory PDFMae-shane SagayoNo ratings yet

- Audit of InventoryDocument7 pagesAudit of InventoryDianne Antoinette Basallo0% (1)

- AP 9206-1 InventoriesDocument5 pagesAP 9206-1 InventoriesmiobratataNo ratings yet

- FOA II AssignmentDocument5 pagesFOA II AssignmentYomif ChalchisaNo ratings yet

- Audit Problem Inventories Part 1Document4 pagesAudit Problem Inventories Part 1Rio Cyrel CelleroNo ratings yet

- AuditingDocument8 pagesAuditingChan LaguillesNo ratings yet

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- 112.inventory ExercisesDocument6 pages112.inventory ExercisesJalanur MarohomNo ratings yet

- AP - PrelimDocument7 pagesAP - PrelimJohn Aries Reyes100% (1)

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Lora Mae JuanitoNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocument76 pages3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyNo ratings yet

- Inventory Quiz 1 Part 2Document4 pagesInventory Quiz 1 Part 2Angelica PagaduanNo ratings yet

- PROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFODocument4 pagesPROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFOAnn SarmientoNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- FM 1acvity1Document3 pagesFM 1acvity1LunaNo ratings yet

- Child Age (Years) Atst (Minutes) XY X 2 Y 2Document4 pagesChild Age (Years) Atst (Minutes) XY X 2 Y 2LunaNo ratings yet

- 9labexer StatDocument4 pages9labexer StatLunaNo ratings yet

- Model Summary: A. Predictors: (Constant), ShelfspaceDocument3 pagesModel Summary: A. Predictors: (Constant), ShelfspaceLunaNo ratings yet

- Sa 10TP1Document6 pagesSa 10TP1LunaNo ratings yet

- FM !TP!Document2 pagesFM !TP!LunaNo ratings yet

- FM 7TP1Document2 pagesFM 7TP1LunaNo ratings yet

- Manozo, Pamela L. BSA3-A 8 Task Performance 1: Spss SolutionDocument3 pagesManozo, Pamela L. BSA3-A 8 Task Performance 1: Spss SolutionLunaNo ratings yet

- Q 1Document1 pageQ 1LunaNo ratings yet

- Aa 7TP1Document5 pagesAa 7TP1LunaNo ratings yet

- AA Manozo 6TP1Document1 pageAA Manozo 6TP1LunaNo ratings yet

- Aa 3HM1Document2 pagesAa 3HM1LunaNo ratings yet

- Q 3Document1 pageQ 3LunaNo ratings yet

- Manozo, Pamela L. BSA3-A: AssetsDocument1 pageManozo, Pamela L. BSA3-A: AssetsLunaNo ratings yet

- Ia3 6le1Document1 pageIa3 6le1LunaNo ratings yet

- IA3 Manozo 6LE2Document1 pageIA3 Manozo 6LE2LunaNo ratings yet

- Homework Company Analysis Summary Sheets: Property of STIDocument1 pageHomework Company Analysis Summary Sheets: Property of STILunaNo ratings yet

- Homework Answer The Following Independent Audit Cases On A Separate Sheet of Paper. Show Your Computations. Audit Case 1 (5 Items X 5 Points)Document2 pagesHomework Answer The Following Independent Audit Cases On A Separate Sheet of Paper. Show Your Computations. Audit Case 1 (5 Items X 5 Points)LunaNo ratings yet

- IA3 Manozo 4quiz1Document1 pageIA3 Manozo 4quiz1LunaNo ratings yet

- AA Manozo 6TP1Document1 pageAA Manozo 6TP1LunaNo ratings yet

- Invoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryDocument2 pagesInvoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryLunaNo ratings yet

- Task PerformanceDocument1 pageTask PerformanceLunaNo ratings yet

- Audit of Property, Plant, and EquipmentDocument15 pagesAudit of Property, Plant, and EquipmentLuna100% (1)

- IA3 Manozo 4TP1Document2 pagesIA3 Manozo 4TP1LunaNo ratings yet

- IA3 Manozo 5LE2Document1 pageIA3 Manozo 5LE2LunaNo ratings yet

- IA3 Manozo 5LE3Document1 pageIA3 Manozo 5LE3LunaNo ratings yet

- The Following Transactions Occurred During 201G:: Property of STIDocument2 pagesThe Following Transactions Occurred During 201G:: Property of STILunaNo ratings yet

- CRM BCBLDocument60 pagesCRM BCBLHasnat ShakirNo ratings yet

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Document2 pagesOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandNo ratings yet

- Skripsi NatashaDocument13 pagesSkripsi NatashaNatasyaNo ratings yet

- Circular 22-012 Increase of 2022 Association DuesDocument1 pageCircular 22-012 Increase of 2022 Association DuesJohn WickNo ratings yet

- Mgt400 Group Assignment 1 FinalDocument19 pagesMgt400 Group Assignment 1 FinalJoshua NicholsonNo ratings yet

- Strategic Factor Analysis SummaryDocument3 pagesStrategic Factor Analysis SummaryAhmad AliNo ratings yet

- UG JForce Agreement - Terms and ConditionsDocument8 pagesUG JForce Agreement - Terms and ConditionsALELE VINCENTNo ratings yet

- IFI - World BankDocument9 pagesIFI - World BankSagar AryalNo ratings yet

- Kaizen Sheet - Tamil & EngDocument6 pagesKaizen Sheet - Tamil & EngkrixotNo ratings yet

- Unit2TimeandMoneyB - Lavarias - Lorenz JayDocument4 pagesUnit2TimeandMoneyB - Lavarias - Lorenz JayCarmelo Janiza LavareyNo ratings yet

- Audit Work Program TemplateDocument64 pagesAudit Work Program TemplateleonciongNo ratings yet

- Account List PD. RachmadDocument4 pagesAccount List PD. Rachmadtuty asmurniNo ratings yet

- Gas DetectorDocument6 pagesGas DetectorYogesh BadheNo ratings yet

- L0MHisfvRWCrTnjwE9eiLA 2.-Durr Case Study PDFDocument9 pagesL0MHisfvRWCrTnjwE9eiLA 2.-Durr Case Study PDFJUAN CAMILO VALENCIA BELTRANNo ratings yet

- Pengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)Document16 pagesPengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)IrawanNo ratings yet

- Computerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachDocument6 pagesComputerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachHuu TienNo ratings yet

- Priciples of Commerce Short Long Questions I YearDocument4 pagesPriciples of Commerce Short Long Questions I YearMuhammad MuneebNo ratings yet

- Introduction To ManufacturingDocument5 pagesIntroduction To ManufacturingPutraNo ratings yet

- John Deere Standard: JDS-G173.1X1 Annex X1: Specifying Port Details On DrawingsDocument3 pagesJohn Deere Standard: JDS-G173.1X1 Annex X1: Specifying Port Details On DrawingsRicardo VitorianoNo ratings yet

- Substation - NoaraiDocument575 pagesSubstation - NoaraiShahriar AhmedNo ratings yet

- QTN FreonDocument1 pageQTN Freonsanad alsoulimanNo ratings yet

- Gregorio Ortega, Tomas Del Castillo, Jr. and Benjamin Bacorro v. CA, SEC and Joaquin Misa FactsDocument2 pagesGregorio Ortega, Tomas Del Castillo, Jr. and Benjamin Bacorro v. CA, SEC and Joaquin Misa FactsmerleNo ratings yet

- Mullins Pol 540 Rexaminling The Resource Curse EndnotesDocument13 pagesMullins Pol 540 Rexaminling The Resource Curse Endnotesapi-548598990No ratings yet

- 206131-2017-Metropolitan Bank and Trust Co. v. Liberty20211014-12-CgooftDocument18 pages206131-2017-Metropolitan Bank and Trust Co. v. Liberty20211014-12-CgooftKobe Lawrence VeneracionNo ratings yet

- The Role of Financial Management: Instructor: Ajab Khan BurkiDocument20 pagesThe Role of Financial Management: Instructor: Ajab Khan BurkiGaurav KarkiNo ratings yet

- Aggregate Planning PDFDocument13 pagesAggregate Planning PDFShimanta EasinNo ratings yet

- Status Code:-HK HL RR KL GK PN/NN TK/TL HX Uc/No SS LLDocument3 pagesStatus Code:-HK HL RR KL GK PN/NN TK/TL HX Uc/No SS LLLouise EngNo ratings yet

- Aakanksha C.VDocument2 pagesAakanksha C.VAakanksha GulatiNo ratings yet

- Module 4 Lesson 5 Transitional Word QuizDocument2 pagesModule 4 Lesson 5 Transitional Word QuizEm-Em Alonsagay DollosaNo ratings yet

- Upay - ProjectDocument19 pagesUpay - ProjectDevillz Advocate0% (2)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)