Professional Documents

Culture Documents

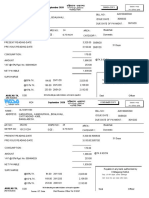

Taxation Report of Nichole John Ernieta

Uploaded by

N-jay Ernieta0 ratings0% found this document useful (0 votes)

10 views11 pagesOriginal Title

Taxation-report-of-Nichole-John-Ernieta

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views11 pagesTaxation Report of Nichole John Ernieta

Uploaded by

N-jay ErnietaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

NICHOLE JOHN C.

ERNIETA

CREDIT TRANSACTIONS Kinds:

1. Commodatum – when the bailor (lender) delivers

CREDIT TRANSACTIONS to the bailee (borrower) a non-consumable thing

All transactions involving the purchase or loan of so that the latter may use it for a certain time

goods, services, or money in the present with a and return the identical thing.

promise to pay or deliver in the future Kinds of commodatum:

a. Ordinary Commodatum – use by the borrower

Contracts of security of the thing is for a certain period of time

Types: b. Precarium - one whereby the bailor may

1. Secured transactions or contracts of real security demand the thing loaned at will and it exists

- supported by a collateral or an encumbrance of in the following cases:

property i. neither the duration nor purpose of the

2. Unsecured transactions or contracts of personal contract is stipulated

security - supported only by a promise or ii. the use of the thing is merely tolerated

personal commitment of another such as a by the owner

guarantor or surety

Security 2. Simple loan or mutuum – where the lender

Something given, deposited, or serving as a delivers to the borrower money or other

means to ensure fulfillment or enforcement of an consumable thing upon the condition that the

obligation or of protecting some interest in latter shall pay the same amount of the same

property kind and quality.

Types of Security

a. personal – when an individual becomes Commodatum Mutuum

surety or guarantor Key: COPS-LOTR

b. real or property – when a mortgage, pledge, 1. Object

antichresis, charge or lien or other device Non-consumable Consumable

used to have property held, out of which the 2. Cause

person to be made secure can be Gratuitous May or may not be

compensated for loss gratuitous

3. Purpose

Bailment Use or temporary Consumption

The delivery of property of one person to another possession

in trust for a specific purpose, with a contract, 4. Subject Matter

express or imgratutitou splied, that the trust Real or personal Only personal

property property

shall be faithfully executed and the property

5. Ownership of the thing

returned or duly accounted for when the special

6. Thing to be returned

purpose is accomplished or kept until the bailor

Exact thing loaned Equal amount of the

claims it. same kind and

quality

Parties: 7. Who bears risk of loss

1. bailor - the giver; one who delivers property Bailor Debtor

2. bailee- the recipient; one who receives the 8. When to return

custody or possession of the thing thus delivered In case of urgent Only after the

need, even before expiration of the

the expiration of the term

term

LOAN (Articles 1933 – 1961)

A contract wherein one of the parties delivers to Loan Credit

another, either something not consumable so that Delivery by one party Ability of a person to

the latter may use the same for a certain time and the receipt of borrow money or

and return it or money or other consumable thing, other party of a things by virtue of

given sum of money the trust or

upon the condition that the same amount of the

or other consumable confidence reposed

same kind and quality shall be paid. (Art 1933) thing upon an by the lender that he

agreement, express will pay what he

Characteristics: or implied, to repay promised.

1. Real Contract – delivery of the thing loaned is the same.

necessary for the perfection of the contract

NOTE: An accepted promise to make a future

loan is a consensual contract, and therefore Loan Credit

binding upon the parties but it is only after 1. Interest taken at Interest is taken in

delivery, will the real contract of loan arise. (Art the expiration of the advance

1934) credit

2. Always on a Always on a single

2. Unilateral Contract - once the subject matter has double name paper name paper (i.e.

been delivered, it creates obligations on the part (two signatures promissory note with

appear with both no indorse-ment

of only one of the parties (i.e. borrower).

parties held liable other than the

for payment) maker)

COMMODATUM (Articles 1935 – 1952)

Nature: shall be borne equally by both the bailor and the

bailee, even though the bailee acted without

1. PURPOSE: Bailee in commodatum acquires the fault, unless there is a stipulation to the contrary

temporary use of the thing but not its fruits (Art 1949 par 2)

(unless stipulated as an incidental part of the 5. To return the thing loaned

contract).(Art 1935) The bailee has no right to retain the thing

Use must be temporary, otherwise the loaned as security for claims he has against

contract may be a deposit. the bailor even for extraordinary expenses

except for a claim for damages suffered

2. CAUSE: Essentially gratuitous; it ceases to be a because of the flaws of the thing loaned.

commodatum if any compensation is to be paid

by the borrower who acquires the use, in such NOTES:

case there arises a lease contract. However, the bailee’s right extends no

Similar to a donation in that it confers a further than retention of the thing loaned

benefit to the recipient. The presumption is until he is reimbursed for the damages

that the bailor has loaned the thing for suffered by him.

having no need therefor. He cannot lawfully sell the thing to

satisfy such damages without court’s

3. SUBJECT MATTER: Generally non-consumable approval.

whether real or personal but if the consumable In case there are two or more bailees,

goods are not for consumption as when they are their obligation shall be solidary.

merely for exhibition, consumable goods may be

the subject of the commodatum. (Art 1936) Obligations of the bailor (Art 1946 – Art 1952):

1. To respect the duration of the loan

4. Bailor need not be the owner of the thing owned GENERAL RULE: Allow the bailee the use of the

(Art. 1938) since by the loan, ownership does not thing loaned for the duration of the period

pass to the borrower. stipulated or until the accomplishment of the

A mere lessee or usufructuary may lend but purpose for which the commodatum was

the borrower or bailee himself may not lend instituted.

nor lease the thing loaned to him to a third EXCEPTIONS:

person (Art 1932[2]) a. In case of urgent need in which case

bailee may demand its return or temporary

5. Purely Personal (Art 1939): use;

Death of either party terminates the contract b. The bailor may demand immediate

unless by stipulation, the commodatum is return of the thing if the bailee commits any

transmitted to the heirs of either or both act of ingratitude specified in Art. 765.

parties.

Bailee can neither lend nor lease the object 2. To refund to the bailee extraordinary expenses

of the contract to a third person. for the preservation of the thing loaned, provided

the bailee brings the same to the knowledge of

the bailor before incurring them, except when

they are so urgent that the reply to the

NOTE:Use of the thing loaned may extend to notification cannot be awaited without danger.

members of the bailee’s household except:

a. contrary stipulation; 3. To be liable to the bailee for damages for known

b. nature of the thing forbids such use hidden flaws.

Requisites:

Obligations of the Bailee: (Arts 1941 – 1945) a. There is flaw or defect in the thing loaned;

1. To pay for the ordinary expenses for the use and b. The flaw or defect is hidden;

preservation of the thing loaned. (Art 1941) c. The bailor is aware thereof;

2. To be liable for the loss of the thing even if it d. He does not advise the bailee of the same;

should be through a fortuitous event in the and

following cases: (KLAS D) e. The bailee suffers damages by reason of said

a. when he keeps it longer than the period flaw or defect

stipulated, or after the accomplishment of its

use

b. when he lends or leases it to third persons

who are not members of his household

c. when the thing loaned has been delivered NOTES:

with appraisal of its value

d. when, being able to save either of the thing

If the above requisites concur, the bailee has

the right of retention for damages.

borrowed or his own things, he chose to save

the latter; or The bailor cannot exempt himself from the

e. when the bailee devoted the thing for any payment of expenses or damages by

purpose different from that for which it has abandoning the thing to the bailee.

been loaned (Art 1942)

3. To be liable for the deterioration of thing loaned

(a) if expressly stipulated; (b) if guilty of fault or

negligence; or (c) if he devotes the thing to any SIMPLE LOAN OR MUTUUM (Art 1953 – 1961)

purpose different from that for which it has been A contract whereby one party delivers to another,

loaned money or other consumable thing with the

4. To pay for extraordinary expenses arising from understanding that the same amount of the same

the actual use of the thing by the bailee, which kind and quality shall be paid. (Art. 1953)

borrowed when the received

NOTES: time has expired or

The mere issuance of the checks does not result purpose served

in the perfection of the contract of loan. The

3. Mutuum may be Onerous, actually a

Civil Code provides that the delivery of bills of gratuitous and mutual sale

exchange and mercantile documents, such as commodatum is

checks, shall produce the effect of payment only always gratuitous

when they have been encashed (Gerales vs. CA

218 SCRA 638). It is only after the checks have

produced the effect of payment that the contract

of loan may be deemed perfected.

The obligation is “to pay” and not to return

because the consumption of the thing loaned is Form of Payment (Art 1955):

the distinguishing character of the contract of 1. If the thing loaned is money - payment must be

mutuum from that of commodatum. made in the currency stipulated, if it is possible;

No estafa is committed by a person who refuses otherwise it is payable in the currency which is

to pay his debt or denies its existence. legal tender in the Philippines and in case of

extraordinary inflation or deflation, the basisi of

Simple Loan/Mutuum Rent payment shall be the value of the currency at the

time of the creation of the obligation

1. Delivery of money Delivery of some 2. If what was loaned is a fungible thing other than

or some consumable non-consumable money - the borrower is under obligation to pay

thing with a promise thing in order that the lender another thing of the same kind,

to pay an equivalent the other may use it quality and quantity. In case it is impossible to do

of the same kind and during a certain

so, the borrower shall pay its value at the time of

quality period and return it

to the former. the perfection of the loan.

2. There is a transfer There is no transfer Interest

of ownership of the of ownership of the The compensation allowed by law or fixed by the

thing delivered thing delivered parties for the loan or forbearance of money,

goods or credits

Requisites for Demandability: (ELI)

3. Relationship Relationship is that 1. must be expressly stipulated

between the parties of a landlord and Exceptions:

is that of obligor- tenant

obligee

a. indemnity for damages

b. interest accruing from unpaid interest

4. Creditor receives Owner of the 2. must be lawful

payment for his loan property rented 3. must be in writing

receives

compensation or Compound Interest

price either in GENERAL RULE: Unpaid interest shall not earn

money, provisions, interest.

chattels, or labor EXCEPTIONS:

1. when judicially demanded

from the occupant

thereof in return for 2. when there is an express stipulation (must be

its use (Tolentino vs in writing in view of Art. 1956)

Gonzales, 50 Phil 558

1927) Guidelines for the application of proper interest

rates

Loan Sale 1. If there is stipulation: that rate shall be applied

2. The following are the rules of thumb for the

1. Real contract Consensual contract application/imposition of interest rates:

a) When an obligation, regardless of its source,

2. Generally Bilateral and i.e., law, contracts, quasi-contracts, delicts

unilateral because reciprocal or quasi-delicts is breached, the contravenor

only borrower has can be held liable for damages.

obligations

b) With regard particularly to an award of

interest in the concept of actual and

NOTE: If the property is “sold”, but the real intent is

compensatory damages, the rate of interest,

only to give the object as security for a debt – as

as well as the accrual thereof, is imposed, as

when the “price” is comparatively small – there really

follows:

is a contract of loan with an “equitable mortgage.”

i. When the obligation breached consists of

payment of a sum of money (loan or

Commodatum/ forbearance of money), the interest shall

Barter

Mutuum be that which is stipulated or agreed

upon by the parties. In absence of an

1. Subject matter is Subject matter is

money or fungible non-fungible, (non agreement, the rate shall be the legal

things consumable) things rate (i.e. 12% per annum) computed from

default.

2. In commodatum, The thing with NOTE: The interest due shall itself earn

the bailee is bound equivalent value is legal interest from the time it is judicially

to return the given in return for demanded

identical thing what has been

ii. In other cases, the rate of interest shall

be six percent (6%) per annum. Deposit Mutuum

NOTE: No interest, however, shall be 1. Purpose

adjudged on unliquidated claims or Principal purpose is Principal purpose is

damages except when or until the safekeeping or consumption

demand can be established with custody

reasonable certainty. When the demand 2. When to Return

cannot be established, the interest shall Depositor can The lender must wait

demand the return of until the expiration

begin to run only from the date of the

the subject matter at of the period granted

judgment of the court is made. will to the debtor

iii. When the judgment of the court awarding 3. Subject Matter

a sum of money becomes final and Subject matter may Subject matter is

executory, the rate of legal interest, be movable or only money or other

whether the case falls under paragraph i immovable property fungible thing

or ii above, shall be 12% per annum from 4. Relationship

such finality until its satisfaction, this Relationship is that Relationship is that

interim period being deemed to be by of lender (creditor) of depositor and

then an equivalent to a forbearance of and borrower depositary.

(debtor).

credit. (Eastern Shipping Lines vs. CA,

July 12, 1994)

5. Compensation

There can be NO compensation of

NOTES: compensation of things deposited with

Central Bank Circular No. 416 fixing the rate of credits. each other (except

interest at 12% per annum deals with loans, by mutual

forbearance of any money, goods or credits and agreement).

judgments involving such loans, or forbearance in

the absence of express agreement to such rate Deposit Commodatum

Interest as indemnity for damages is payable only

in case of default or non-performance of the 1. Purpose is 1. Purpose is the

Safekeeping transfer of the use

contract. As they are distinct claims, they may be

demanded separately. (Sentinel Insurance Co., 2. May be gratuitous 2. Essentially and

Inc. vs CA, 182 SCRA 517) always gratuitous

Central Bank Circular No. 905 (Dec. 10, 1982)

removed the Usury Law ceiling on interest rates 3. Movable/corporeal 3. Both movable and

for secured and unsecured loans, regardless of things only in case of immovable may be

maturity. extrajudicial deposit the object

Validity of unconscionable interest rate in a loan Kinds of Deposit:

Supreme Court in Sps. Solangon vs. Jose 1. Judicial (Sequestration) –takes place when an

Salazar, G.R. No. 125944, June 29, 2001, said that attachment or seizure of property in litigation is

since the usury law had been repealed by CB Cir. No. ordered.

905 there is no more maximum rate of interest and

the rate will just depend on the mutual agreement of 2. Extra-judicial

the parties (citing Lim Law vs. Olympic Sawmill Co., a. Voluntary – one wherein the delivery is made

129 SCRA 439). But the Supreme Court said that by the will of the depositor or by two or more

nothing in said circular grants lenders carta blanche persons each of whom believes himself

authority to raise interest rates to level which will entitled to the thing deposited. (Arts 1968 –

either enslave their borrowers or lead to a 1995)

hemorrhaging of their assets (citing Almeda vs. CA, b. Necessary – one made in compliance with a

256 SCRS 292). In Medel vs. CA, 299 SCRA 481, it was legal obligation, or on the occasion of any

ruled that while stipulated interest of 5.5% per month calamity, or by travellers in hotels and inns

on a loan is usurious pursuant to CB Circular No. 905, (Arts 1996 - 2004), or by travellers with

the same must be equitably reduced for being common carriers (Art 1734 – 1735).

iniquitous, unconscionable and exorbitant. It is NOTE: The chief difference between a voluntary

contrary to morals, (contra bonos mores). It was deposit and a necessary deposit is that in the

reduced to 12% per annum in consonant with justice former, the depositor has a complete freedom in

and fair play. choosing the depositary, whereas in the latter,

there is lack of free choice in the depositor.

DEPOSIT (Articles 1962 – 2009)

Judicial Extra-judicial

A contract constituted from the moment a person 1. Creation

receives a thing belonging to another, with the Will of the court Will of the parties

obligation of safely keeping it and of returning or contract

the same. 2. Purpose

Security or to insure Custody and

Characteristics: the right of a party safekeeping

1. Real Contract - contract is perfected by the to property or to

delivery of the subject matter. recover in case of

2. Unilateral (gratutitous deposit) - only the favorable judgment

depositary has an obligation. 3. Subject Matter

3. Bilateral (onerous deposit) - gives rise to

obligations on the part of both the depositary

and depositor.

Movables or Movables only attached while in the depositary’s possession

immovables, or should he have been notified of the

but generally opposition of a third person to the return or

immovables the removal of the thing deposited. (Art 1998)

4. Cause b. If deposit gratuitous, the depositary may

Always onerous May be compen- return the thing deposited notwithstanding

sated or not, but that a period has been fixed for the deposit if

generally gratuitous justifiable reasons exists for its return.

c. If the deposit is for a valuable

5. When must the thing be returned consideration, the depositary has no right to

Upon order of the Upon demand of return the thing deposited before the

court or when depositor expiration of the time designated even if he

litigation is ended should suffer inconvenience as a

6. In whose behalf it is held consequence.(Art 1989)

Person who has a Depositor or third

right person designated What to return: product, accessories, and

accessions of the thing deposited (Art 1983)

GENERAL RULE: Contract of deposit is gratuitous 3. Not to deposit the thing with a third person

unless authorized by express stipulation (Art 1973)

(Art 1965)

EXCEPTIONS: The depositor is liable for the loss of the

1. when there is contrary stipulation thing deposited under Article 1973 if:

2. depositary is engaged in business of storing a. he transfers the deposit with a third

goods person without authority although there is no

3. property saved from destruction without negligence on his part and the third person;

knowledge of the owner b. he deposits the thing with a third

person who is manifestly careless or unfit

NOTES: although authorized even in the absence of

Article 1966 does not embrace incorporeal negligence; or

c. the thing is lost through the

property, such as rights and actions, for it follows

the person of the owner, wherever he goes. negligence of his employees whether the

latter are manifestly careless or not.

A contract for the rent of safety deposit boxes 4. If the thing deposited should earn interest (Art

is not an ordinary contract of lease of things but

1975):

a special kind of deposit; hence, it is not to be

a. to collect interest and the capital itself as it

strictly governed by the provisions on deposit.

fall due

The relation between a bank and its customer is

b. to take steps to preserve its value and rights

that of a bailor and bailee. (CA Agro vs CA, 219

corresponding to it

SCRA 426)

5. Not to commingle things deposited if so

stipulated (Art 1976)

Obligations of the Depositary (Art 1972 –1991):

6. Not to make use of the thing deposited unless

1. To keep the thing safely (Art 1972)

authorized (Art 1977)

Exercise over the thing deposited the same

GENERAL RULE: Deposit is for safekeeping of

diligence as he would exercise over his

the subject matter and not for use. The

property

unauthorized use by the depositary would make

2. To return the thing (Art 1972)

him liable for damages.

Person to whom the thing must be returned:

EXCEPTIONS:

a. Depositor, to his heirs and successors, or the

1. When the preservation of the thing deposited

person who may have been designated in the

requires its use

contract

2. When authorized by the depositor

b. If the depositary is capacitated - he is subject

to all the obligations of a depositary whether

NOTE: The permission to use is NOT presumed

or not the depositor is capacitated. If the

except when such use is necessary for the

depositor is incapacitated, the depositary

preservation of the thing deposited.

must return the property to the legal

representative of the incapacitated or to the

Effect if permission to use is given (Art 1978):

depositor himself if he should acquire

1. If thing deposited is non-consumable,

capacity (Art 1970).

the contract loses the character of a deposit

c. If the depositor is capacitated and the

and acquires that of a commodatum despite

depositary is incapacitated - the latter does

the fact that the parties may have

not incur the obligation of a depositary but

denominated it as a deposit, unless

he is liable:

safekeeping is still the principal purpose.

i..to return the thing deposited while still

2. If thing deposited consists of

in his possession;

money/consumable things, the contract is

ii.to pay the depositor the amount which he

converted into a simple loan or mutuum

may have benefited himself with the

unless safekeeping is still the principal

thing or its price subject to the right of

purpose in which case it is called an irregular

any third person who acquired the thing

deposit. Example: bank deposits are irregular

in good faith (Art 1971)

deposits in nature but governed by law on

loans.

Time of return:

7. When the thing deposited is delivered sealed and

a. Upon demand even though a specified

closed :

period or time for such return may have been

a. to return the thing deposited in the same

fixed except when the thing is judicially

condition

b. to pay for damages should the seal or lock be one of the solidary depositors may do whatever

broken through his fault, which is presumed may be useful to the others but not anything

unless proved otherwise which may be prejudicial to the latter, (Art. 1212)

c. to keep the secret of the deposit when the and the depositary may return the thing to

seal or lock is broken with or without his fault anyone of the solidary depositors unless a

(Art 1981) demand, judicial or extrajudicial, for its return

NOTE: The depositary is authorized to open has been made by one of them in which case,

the thing deposited which is closed and delivery should be made to him (Art. 1214).

sealed when (Art 1982): 3. Return to one of depositors stipulated. The

i. there is presumed authority (i.e. when depositary is bound to return it only to the person

the key has been delivered to him or the designated although he has not made any demand

instructions of the depositor cannot be for its return.

done without opening it)

ii. necessity NOTES:

8. To change the way of the deposit if under the The depositary may retain the thing in pledge

circumstances, the depositary may reasonably until full payment of what may be due him by

presume that the depositor would consent to the reason of the deposit (Art 1994).

change if he knew of the facts of the situation, The depositor’s heir who in good faith may have

provided, that the former notifies the depositor sold the thing which he did not know was

thereof and wait for his decision, unless delay deposited, shall only be bound to return the price

would cause danger he may have received or to assign his right of

9. To pay interest on sums converted to personal action against the buyer in case the price has not

use if the deposit consists of money (Art 1983) been paid him (Art 1991).

10. To be liable for loss through fortuitous event

(SUDA): (Art 1979): Obligations of the Depositor (Art 1992 – 1995):

a. if stipulated 1. To pay expenses for preservation

b. if he uses the thing without the depositor's a. If the deposit is gratuitous, the depositor is

permission obliged to reimburse the depositary for

c. if he delays its return expenses incurred for the preservation of the

d. if he allows others to use it, even though he thing deposited (Art 1992)

himself may have been authorized to use the b. If the deposit is for valuable consideration,

same expenses for preservation are borne by the

depositary unless there is a contrary

NOTES: stipulation

Fixed, savings, and current deposits of money in 2. To pay loses incurred by the depositary due to

banks and similar institutions shall be governed the character of the thing deposited

by the provisions concerning simple loan. (Art

1980) GENERAL RULE: The depositor shall reimburse the

The general rule is that a bank can compensate depositary for any loss arising from the character of

or set off the deposit in its hands for the payment the thing deposited.

of any indebtedness to it on the part of the EXCEPTIONS:

depositor. In true deposit, compensation is not 1. at the time of the deposit, the depositor was

allowed. not aware of the dangerous character of the

thing

Irregular deposit Mutuum 2. when depositor was not expected to know the

dangerous character of the thing

1. The consumable 1. Lender is bound 3. when the depositor notified the depository of

thing deposited may by the provisions of the same

be demanded at will the contract and 4. the depositary was aware of it without advice

by the depositor cannot demand

from the depositor

restitution until the

time for payment, as

provided in the Extinguishment of Voluntary Deposit (Art 1995)

contract, has arisen 1. Loss or destruction of the thing deposited

2. In case of gratuitous deposit, upon the death of

2. The only benefit is 2. Essential cause for either the depositor or the depositary

that which accrues the transaction is 3. Other causes, such as return of the thing,

to the depositor the necessity of the novation, merger, expiration of the term

borrower fulfilment of the resolutory condition, etc (Art

1231)

3. The irregular 3. Common creditors

depositor has a enjoy no preference

preference over in the distribution of

Necessary Deposits

other creditors with the debtor’s 1. Made in compliance with a legal obligation

respect to the thing property 2. Made on the occasion of any calamity such as fire,

deposited storm, flood, pillage, shipwreck or other similar

events (deposito miserable)

3. Made by travellers in hotels and inns or by

Rule when there are two or more depositors (Art travellers with common carrier

1985):

1. If thing deposited is divisible and depositors are

not solidary: Each depositor can demand only his

proportionate share thereto.

2. If obligation is solidary or if thing is not divisible: Deposit by Travellers in hotels and inns:

Rules on active solidarity shall apply, i.e. each

The keepers of hotels or inns shall be responsible A contract whereby a person (surety) binds

as depositaries for the deposit of effects made by himself solidarily with the principal debtor

travellers provided: A relation which exists where one person

a. Notice was given to them or to their (principal) has undertaken an obligation and

employees of the effects brought by the another person (surety) is also under a direct and

guest; and primary obligation or other duty to the obligee,

b. The guests take the precautions which said who is entitled to but one performance, and as

hotel-keepers or their substitutes advised between the two who are bound, the second

relative to the care and vigilance of their rather than the first should perform (Agro

effects. Conglomerates, Inc. vs. CA, 348 SCRA 450)

NOTES: NOTES:

Liability extends to vehicles, animals and articles The reference in Article 2047 to solidary

which have been introduced or placed in the obligations does not mean that suretyship is

annexes of the hotel. withdrawn from the applicable provisions

Liability shall EXCLUDE losses which proceed from governing guaranty. A surety is almost the same

force majeure. The act of a thief or robber is not as a solidary debtor, except that he himself is a

deemed force majeure unless done with the use principal debtor.

of arms or irresistible force. In suretyship, there is but one contract, and the

The hotel-keeper cannot free himself from the surety is bound by the same agreement which

responsibility by posting notices to the effect binds the principal. A surety is usually bound with

that he is not liable for the articles brought by the principal by the same instrument, executed

the guest. Any stipulation to such effect shall be at the same time and upon the same

void. consideration (Palmares vs CA, 288 SCRA 422)

Notice is necessary only for suing civil liability but It is not for the obligee to see to it that the

not in criminal liability. principal debtor pays the debt or fulfill the

contract, but for the surety to see to it that the

GUARANTY (Articles 2047 – 2084) principal debtor pays or performs (Paramount

Insurance Corp vs CA, 310 SCRA 377)

A contract whereby a person (guarantor) binds

himself to the creditor to fulfil the obligation of Nature of Surety’s undertaking:

the principal debtor in case the latter fail to do 1. Liability is contractual and accessory but direct

so. NOTE: He directly, primarily and equally binds

himself with the principal as original promisor,

Classification of Guaranty: although he possesses no direct or personal

1. In the Broad sense: interest over the latter’s obligation, nor does he

a. Personal - the guaranty is the credit given by receive any benefits therefrom. (PNB vs CA, 198

the person who guarantees the fulfilment of SCRA 767)

the principal obligation. 2. Liability limited by the terms of the contract.

b. Real - the guaranty is the property, movable NOTE: It cannot be extended by implication

or immovable. beyond the terms of the contract (PNB vs CA, 198

SCRA 767)

3. Liability arises only if principal debtor is held

liable.

NOTES:

2. As to its Origin The creditor may sue separately or together

a. Conventional - agreed upon by the parties. the principal debtor and the surety. Where

b. Legal - one imposed by virtue of a provision there are several sureties, the obligee may

of a law. proceed against any one of them.

c. Judicial - one which is required by a court to In the absence of collusion, the surety is

guarantee the eventual right of one of the bound by a judgment against the principal

parties in a case. even though he was not a party to the

3. As to Consideration proceedings. The nature of its undertaking

a. Gratuitous - the guarantor does not receive makes it privy to all proceedings against its

any price or remuneration for acting as such. principal (Finman General Assurance Corp. vs.

b. Onerous - the guarantor receives valuable Salik, 188 SCRA 740)

consideration.

4. As to the Person guaranteed 4. Surety is not entitled to the benefit of

a. Single - one constituted solely to guarantee exhaustion

or secure performance by the debtor of the NOTE: He assumes a solidary liability for the

principal obligation. fulfilment of the principal obligation (Towers

b. Double or sub-guaranty - one constituted to Assurance Corp vs. Ororama Supermart, 80 SCRA

secure the fulfilment by the guarantor of a 262) as an original promissory and debtor from

prior guaranty. the beginning.

5. As to Scope and Extent 5. Undertaking is to creditor and not to debtor.

a. Definite - the guaranty is limited to the NOTE: The surety makes no covenant or

principal obligation only, or to a specific agreement with the principal that it will fulfil

portion thereof. the obligation guaranteed for the benefit of the

b. Indefinite or simple - one which not only principal. Such a promise is not implied by law

includes the principal obligation but also all either; and this is true even where under the

its accessories including judicial costs contract the creditor is given the right to sue the

principal, or the latter and the surety at the

SURETYSHIP same time. (Arranz vs. Manila Fidelity & Surety

Co., Inc., 101 Phil. 272)

6. Surety is not entitled to notice of principal’s become binding until it is accepted and

default until notice of such acceptance by the

NOTE: The creditor owes no duty of active creditor is given to, or acquired by, the

diligence to take care of the interest of the guarantor, or until he has notice or

surety and the surety is bound to take notice of knowledge that the creditor has

the principal’s default and to perform the performed the condition and intends to

obligation. He cannot complain that the creditor act upon the guaranty.

has not notified him in the absence of a special But in any case, the creditor is not

agreement to that effect. (Palmares vs CA, 288 precluded from waiving the requirement

SCRA 422) of notice.

7. Prior demand by the creditor upon principal is The consideration of the guaranty is the same

not required as the consideration of the principal

NOTE: As soon as the principal is in default, the obligation.

surety likewise is in default. The creditor may proceed against the

8. Surety is not exonerated by neglect of creditor to guarantor although he has no right of action

sue principal against the principal debtor.

7. Not presumed. It must be expressed and reduced

Characteristics of Guaranty and Suretyship: in writing.

1. Accessory - It is indispensable condition for its NOTE: A power of attorney to loan money does

existence that there must be a principal not authorize the agent to make the principal

obligation. liable as a surety for the payment of the debt of

NOTES: a third person. (BPI vs. Coster, 47 Phil. 594)

Guaranty may be constituted to guarantee 8. Falls under the Statute of Frauds since it is a

the performance of a voidable or “special promise to answer for the debt, default

unenforceable contract. It may also or miscarriage of another”.

guarantee a natural obligation. (Art 2052) 9. Strictly interpreted against the creditor and in

The guarantor cannot bind himself for more favor of the guarantor/surety and is not to be

than the principal debtor and even if he does, extended beyond its terms or specified limits.

his liability shall be reduced to the limits of (Magdalena Estates, Inc. vs Rodriguez, 18 SCRA

that of the debtor. 967) The rule of strictissimi juris commonly

2. Subsidiary and Conditional - takes effect only in pertains to an accommodation surety because the

case the principal debtor fails in his obligation. latter acts without motive of pecuniary gain and

hence, should be protected against unjust

NOTES: pecuniary impoverishment by imposing on the

The guarantor cannot bind himself for more principal, duties akin to those of a fiduciary.

than the principal debtor and even if he does,

his liability shall be reduced to the limits of NOTES:

that of the debtor. But a guarantor may bind The rule will apply only after it has been

himself for less than that of the principal (Art definitely ascertained that the contract is

2054) one of suretyship or guaranty. It cannot be

A guaranty may be given as security for used as an aid in determining whether a

future debts, the amount of which is not yet party’s undertaking is that of a surety or

known; there can be no claim against the guarantor. (Palmares vs CA, 288 SCRA 292)

guarantor until the debt is liquidated. A It does not apply in case of compensated

conditional obligation may also be secured. sureties.

(Art 2053) 10. It is a contract which requires that the guarantor

3. Unilateral - may be entered even w/o the must be a person distinct form the debtor

intervention of the principal debtor, in which because a person cannot be the personal

case Art. 1236 and 1237 shall apply and it gives guarantor of himself.

rise only to a duty on the part of the guarantor in NOTE: However, in a real guaranty, like pledge

relation to the creditor and not vice versa. and mortgage, a person may guarantee his own

4. Nominate obligation with his personal or real properties.

5. Consensual

6. It is a contract between the guarantor/surety and Guaranty Suretyship

creditor.

1. Liability depends 1. Surety assumes

NOTES: upon an independent liability as regular

Acceptance of guaranty by creditor and agreement to pay the party to the

notice thereof to guarantor: obligation if primary undertaking

debtor fails to do so

In declaring that guaranty must be

express, the law refers solely and 2. Collateral under- 2. Surety is an

exclusively to the obligation of the taking original promisor

guarantor because it is he alone who

binds himself by his acceptance. With 3. Guarantor is 3. Surety is

respect to the creditor, no such secondarily liable primarily liable

requirement is needed because he binds

himself to nothing. 4. Guarantor binds 4. Surety undertakes

himself to pay if to pay if the principal

However, when there is merely an offer the principal DOES NOT PAY

of a guaranty, or merely a conditional CANNOT PAY

guaranty, in the sense that it requires

action by the creditor before the 5. Insurer of 5. Insurer of the

obligation becomes fixed, it does not solvency of debtor debt

6. Guarantor can 6. Surety cannot

avail of the benefit avail of the benefit

of excussion and of excussion and

division in case division

Double or sub-guaranty (Art 2051 2nd par)

creditor proceeds

against him One constituted to guarantee the obligation of a

guarantor

Indorsement Guaranty

Continuing guaranty (Art 2053)

1. Primarily of 1. Contract of One which is not limited to a single transaction

transfer security but which contemplates a future course of

dealings, covering a series of transactions

2. Unless the note is 2. Failure in either or generally for an indefinite time or until revoked.

promptly presented both of these

for payment at particulars does not

maturity and due generally work as an NOTES:

notice of dishonor absolute discharge of Prospective in operation (Diño vs CA, 216 SCRA 9)

given to the indorser a guarantor’s Construed as continuing when by the terms

within a reasonable liability, but his is thereof it is evident that the object is to give a

time he will be discharged only to standing credit to the principal debtor to be used

discharged abso- the extent of the loss from time to time either indefinitely or until a

lutely from all which he may have

certain period, especially if the right to recall the

liability thereon, suffered in

whether he has consequence thereof guaranty is expressly reserved (Diño vs CA, 216

suffered any actual SCRA 9)

damage or not “Future debts” may also refer to debts existing at

the time of the constitution of the guaranty but

3. Indorser does not 3. Guarantor the amount thereof is unknown and not to debts

warrant the solvency. warrants the solvency not yet incurred and existing at that time.

He is answerable on a of the promisor

strict compliance

Exception to the concept of continuing guaranty

with the law by the is chattel mortgage. A chattel mortgage can

holder, whether the only cover obligations existing at the time the

promisor is solvent or mortgage is constituted and not those contracted

not subsequent to the execution thereof (The Belgian

Catholic Missionaries, Inc. vs. Magallanes Press,

4. Indorser can be 4. Guarantor cannot Inc., 49 Phil 647). An exception to this is in case

sued as promisor be sued as promisor of stocks in department stores, drug stores, etc.

(Torres vs. Limjap, 56 Phil 141).

Extent of Guarantor’s liability: (Art 2055)

1. Where the guaranty definite: It is limited in

whole or in part to the principal debt, to the

Guaranty Warranty exclusion of accessories.

A contract by which a An undertaking that the 2. Where guaranty indefinite or simple: It shall

person is bound to title, quality, or comprise not only the principal obligation, but

another for the quantity of the subject

fulfilment of a promise matter of the contract is

also all its accessories, including the judicial

or engagement of a third what it has been costs, provided with respect to the latter, that

party represented to be, and the guarantor shall only be liable for those costs

relates to some incurred after he has been judicially required to

agreement made pay.

ordinarily by the party

who makes the warranty Qualifications of a guarantor: (Arts 2056-2057)

1. possesses integrity

NOTES: 2. capacity to bind himself

A guaranty is gratuitous, unless there is a 3. has sufficient property to answer for the

stipulation to the contrary. The cause of the obligation which he guarantees

contract is the same cause which supports the

obligation as to the principal debtor. NOTES:

The peculiar nature of a guaranty or surety The qualifications need only be present at the

agreement is that is is regarded as valid despite time of the perfection of the contract.

the absence of any direct consideration received The subsequent loss of the integrity or property

by the guarantor or surety either from the or supervening incapacity of the guarantor would

principal debtor or from the creditor; a not operate to exonerate the guarantor or the

consideration moving to the principal alone will eventual liability he has contracted, and the

suffice. contract of guaranty continues.

It is never necessary that the guarantor or surety However, the creditor may demand another

should receive any part or benefit, if such there guarantor with the proper qualifications. But he

be, accruing to the principal. (Willex Plastic

Industries Corp. vs. CA, 256 SCRA 478)

may waive it if he chooses and hold the guarantor The above rule shall not be applicable unless the

to his bargain. payment has been made in virtue of a judicial

demand or unless the principal debtor is insolvent.

Benefit of Excussion (Art 2058) The right to contribution or reimbursement from

The right by which the guarantor cannot be his co-guarantors is acquired ipso jure by virtue

compelled to pay the creditor unless the latter of said payment without the need of obtaining

has exhausted all the properties of the principal from the creditor any prior cession of rights to

debtor, and has resorted to all of the legal such guarantor.

remedies against such debtor. The co-guarantors may set up against the one

who paid, the same defenses which have

NOTE: pertained to the principal debtor against the

Not applicable to a contract of suretyship (Arts creditor and which are not purely personal to the

2047, par. 2; 2059[2]) debtor. (Art 2074)

Cannot even begin to take place before judgment

has been obtained against the debtor (Baylon vs Procedure when creditor sues: (Art. 2062)

CA, 312 SCRA 502) The creditor must sue the principal alone; the

guarantor cannot be sued with his principal,

When Guarantor is not entitled to the benefit of much less alone except in Art. 2059.

excussion: (PAIRS)

1. If it may be presumed that an execution on the 1. Notice to guarantor of the action

property of the principal debtor would not result The guarantor must be NOTIFIED so that he

in the satisfaction of the obligation may appear, if he so desires, and set up

Not necessary that the debtor be judicially defenses he may want to offer.

declared insolvent or bankrupt If the guarantor appears, he is still given the

2. When he has absconded, or cannot be sued within benefit of exhaustion even if judgment should

the Philippines unless he has left a manager or be rendered against him and principal debtor.

representative His voluntary appearance does not constitute

3. In case of insolvency of the debtor a renunciation of his right to excussion (see

Must be actual Art. 2059(1)).

4. If the guarantor has expressly renounced it Guarantor cannot set up the defenses if he

5. If he has bound himself solidarily with the debtor does not appear and it may no longer be

possible for him to question the validity of

Other grounds: (BIPS) the judgment rendered against the debtor.

6. If he is a judicial bondsman or sub-surety 2. A guarantor is entitled to be heard before and

7. If he fails to interpose it as a defense before execution can be issued against him where he is

judgment is rendered against him not a party in the case involving his principal

8. If the guarantor does not set up the benefit (procedural due process).

against the creditor upon the latter’s demand for

payment from him, and point out to the creditor

available property to the debtor within Philippine

territory, sufficient to cover the amount of the

debt (Art 2060) Guarantor’s Right of Indemnity or Reimbursement

Demand can be made only after judgment on (Art 2066)

the debt GENERAL RULE: Guaranty is a contract of indemnity.

Demand must be actual; joining the guarantor The guarantor who makes payment is entitled to be

in the suit against the principal debtor is not reimbursed by the principal debtor.

the demand intended by law

9. Where the pledge or mortgage has been given by NOTE: The indemnity consists of: (DIED)

him as special security 1. Total amount of the debt – no right to

demand reimbursement until he has actually

Benefit of Division (Art 2065) paid the debt, unless by the terms of the

Should there be several guarantors of only one contract, he is given the right before making

debtor and for the same debt, the obligation to payment. He cannot collect more than what

answer for the same is divided among all. he has paid.

Liability: Joint 2. Legal interest thereon from the time the

payment was made known (notice of payment

NOTES: in effect a demand so that if the debtor does

The creditor can claim from the guarantors only not pay immediately, he incurs in delay) to

the shares they are respectively bound to pay the debtor, even though it did not earn

except when solidarity is stipulated or if any of interest for the creditor. Guarantor’s right to

the circumstances enumerated in Article 2059 legal interest is granted by law by virtue of

should take place. the payment he has made.

The right of contribution of guarantors who pays 3. Expenses incurred by the guarantor after

requires that the payment must have been made having notified the debtor that payment has

(a) in virtue of a judicial demand, or (b) because been demanded of him by the creditor; only

the principal debtor is insolvent (Art 2073). those expenses that the guarantor has to

If any of the guarantors should be insolvent, his satisfy in accordance with law as a

share shall be borne by the others including the consequence of the guaranty (Art. 2055) not

paying guarantor in the same joint proportion those which depend upon his will or own acts

following the rule in solidary obligations. or his fault for these are his exclusive

personal responsibility and it is not just that

they be shouldered by the debtor.

4. Damages if they are due in accordance

with law. General rules on damages apply. Right of Guarantor to proceed against debtor

before payment

EXCEPTIONS: GENERAL RULE: Guarantor has no cause of action

1. Where the guaranty is constituted without against debtor until after the former has paid the

the knowledge or against the will of the obligation

principal debtor, the guarantor can recover EXCEPTION: Article 2071

only insofar as the payment had been

beneficial to the debtor (Art. 2050). NOTES:

2. Payment by a third person who does not Article 2071 is applicable and available to the

intend to be reimbursed by the debtor is surety. (Manila Surety & Fidelity Co., Inc. vs Batu

deemed to be a donation, which, however, Construction & Co., 101 Phil 494)

requires the debtor’s consent. But the Remedy of guarantor:

payment is in any case valid as to the creditor (a) obtain release from the guaranty; or

who has accepted it (Art. 1238). (b) demand a security that shall protect him

3. Waiver of the right to demand reimbursement. from any proceedings by the creditor, and

against the danger of insolvency of the debtor

Guarantor’s right to Subrogation (ART.2067)

Subrogation transfers to the person subrogated, Art. 2066 Art. 2071

the credit with all the rights thereto appertaining Provides for the Provides for his

either against the debtor or against third persons, enforcement of the protection before he

be they guarantors or possessors of mortgages, rights of the has paid but after he

subject to stipulation in conventional subrogation. guarantor/surety has become liable

against the debtor

NOTE: This right of subrogation is necessary to after he has paid the

enable the guarantor to enforce the indemnity given debt

Gives a right of Protective remedy

in Art. 2066.

action after payment before payment.

It arises by operation of law upon payment by the Substantive right Preliminary remedy

guarantor. It is not necessary that the creditor

cede to the guarantor the former’s rights against Extinguishment of guaranty: (RA2CE2)

the debtor. 1. Release in favor of one of the guarantors, without

It is not a contractual right. The right of the consent of the others, benefits all to the

guarantor who has paid a debt to subrogation extent of the share of the guarantor to whom it

does not stand upon contract but upon the has been granted (Art 2078);

principles of natural justice. 2. If the creditor voluntarily accepts immovable or

The guarantor is subrogated by virtue of the other properties in payment of the debt, even if

payment to the rights of the creditor, not those he should afterwards lose the same through

of the debtor. eviction or conveyance of property (Art 2077);

Guarantor cannot exercise the right of 3. Whenever by some act of the creditor, the

redemption of his principal (Urrutia & Co vs guarantors even though they are solidarily liable

Morena and Reyes, 28 Phil 261) cannot be subrogated to the rights, mortgages

and preferences of the former (Art 2080);

Effect of Payment by Guarantor 4. For the same causes as all other obligations (Art

1. Without notice to debtor: (Art 2068) 1231);

The debtor may interpose against the 5. When the principal obligation is extinguished;

guarantor those defenses which he could have 6. Extension granted to the debtor by the creditor

set up against the creditor at the time the without the consent of the guarantor (Art 2079)

payment was made, e.g. the debtor can set

up against the guarantor the defense of BOND

previous extinguishment of the obligation by An undertaking that is sufficiently secured, and

payment. not cash or currency

2. Before Maturity (Art 2069) Bondsman (Art 2082)

Not entitled to reimbursement unless the A surety offered in virtue of a provision of law or

payment was made with the consent or has a judicial order. He must have the qualifications

been ratified by the debtor required of a guarantor and in special laws like

the Rules of Court.

Effect of Repeat Payment by debtor: (Art 2070)

GENERAL RULE: Before guarantor pays the creditor, NOTES:

he must first notify the debtor (Art. 2068). If he fails Judicial bonds constitute merely a special class of

to give such notice and the debtor repeats payment, contracts of guaranty by the fact that they are

the guarantor can only collect from the creditor and given “in virtue… of a judicial order.”

guarantor has no cause of action against the debtor If the person required to give a legal or judicial

for the return of the amount paid by guarantor even bond should not be able to do so, a pledge or

if the creditor should become insolvent. mortgage sufficient to cover the obligation shall

admitted in lieu thereof (Art 2083)

EXCEPTION: The guarantor can still claim A judicial bondsman and the sub-surety are NOT

reimbursement from the debtor in spite of lack of entitled to the benefit of excussion because they

notice if the following conditions are present: (PIG) are not mere guarantors, but sureties whose

a. guarantor was prevented by fortuitous event liability is primary and solidary. (Art 2084)

to advise the debtor of the payment; and

b. the creditor becomes insolvent;

c. the guaranty is gratuitous.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNo ratings yet

- Law On Credit TransactionDocument35 pagesLaw On Credit TransactionCj OngNo ratings yet

- REY ALMON T. ALIBUYOG CREDIT TRANSACTIONSDocument4 pagesREY ALMON T. ALIBUYOG CREDIT TRANSACTIONSRey Almon Tolentino AlibuyogNo ratings yet

- CREDIT TRANSACTION ReviewerDocument35 pagesCREDIT TRANSACTION ReviewerMari BiscochoNo ratings yet

- Multi Member LLC Operating Agreement FLDocument17 pagesMulti Member LLC Operating Agreement FLPGG Drive100% (1)

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Credit Transactions ReviewerDocument12 pagesCredit Transactions ReviewerKyle HernandezNo ratings yet

- Credit Transactions Midterms ReviewerDocument16 pagesCredit Transactions Midterms ReviewerChristiane Marie Bajada100% (6)

- Credit Transactions ReviewerDocument35 pagesCredit Transactions ReviewerSime SuanNo ratings yet

- Summer Reviewer: A C B O 2007 Civil LawDocument46 pagesSummer Reviewer: A C B O 2007 Civil LawMiGay Tan-Pelaez90% (20)

- HW5e Int International WordlistDocument34 pagesHW5e Int International WordlistAnastasia100% (1)

- Pilgreen Joshua Model CFI FinMoDocument217 pagesPilgreen Joshua Model CFI FinMoGargNo ratings yet

- Credit Transactions Memory AidDocument35 pagesCredit Transactions Memory AidGloria Cruz RevitaNo ratings yet

- CreditTransactionsReviewer CompleteDocument43 pagesCreditTransactionsReviewer CompleteFrancess Mae AlonzoNo ratings yet

- Credit TransDocument25 pagesCredit TransPete Bayani CamporedondoNo ratings yet

- Beda Notes - Credit TransactionsDocument18 pagesBeda Notes - Credit TransactionsMaan ElagoNo ratings yet

- CREDIT TRANSACTIONS PREMIDTERM REVIEWDocument23 pagesCREDIT TRANSACTIONS PREMIDTERM REVIEWSam SumaNo ratings yet

- Reviewer Civil Procedure Ateneo 2007Document35 pagesReviewer Civil Procedure Ateneo 2007Sheena ValenzuelaNo ratings yet

- Extrajudicial Settlement of Estate TemplateDocument3 pagesExtrajudicial Settlement of Estate TemplateMhaye Arabit GaylicanNo ratings yet

- Precautions in Case of Special CustomersDocument6 pagesPrecautions in Case of Special CustomersPoke clips100% (2)

- Article 1933-1940Document4 pagesArticle 1933-1940Maricon AsidoNo ratings yet

- Credit Transactions ReviewerDocument34 pagesCredit Transactions ReviewerIan De DiosNo ratings yet

- Credit Transactions by Pineda PDFDocument12 pagesCredit Transactions by Pineda PDFNyl John Caesar GenobiagonNo ratings yet

- Credit Transactions GuideDocument12 pagesCredit Transactions GuidermelizagaNo ratings yet

- Reviewer in Credit Transactions by Ateneo 2007 EditionDocument47 pagesReviewer in Credit Transactions by Ateneo 2007 Editionsoyoung kimNo ratings yet

- San Beda ReviewerDocument33 pagesSan Beda Reviewermerren bloomNo ratings yet

- HOMEWORK NO. 2 Baste Civ Law Review 2Document4 pagesHOMEWORK NO. 2 Baste Civ Law Review 2Brigette DomingoNo ratings yet

- Credit-Transaction SanbedaDocument21 pagesCredit-Transaction SanbedawewNo ratings yet

- Credit TransactionDocument22 pagesCredit TransactionAnalynNo ratings yet

- Credit Transaction Memory Aid PDF FreeDocument36 pagesCredit Transaction Memory Aid PDF FreeGnairah Agua AmoraNo ratings yet

- Fabm 2 Module 1Document14 pagesFabm 2 Module 1Marilyn Nelmida TamayoNo ratings yet

- Business Law Multiple ChoiceDocument28 pagesBusiness Law Multiple ChoiceRj ArevadoNo ratings yet

- Credit Transaction Reviewer - CompressDocument34 pagesCredit Transaction Reviewer - CompressFelicity Jane BarcebalNo ratings yet

- Chapter 19: Audit of Owners' Equity: Review QuestionsDocument18 pagesChapter 19: Audit of Owners' Equity: Review QuestionsReznakNo ratings yet

- CBNotes: Credit Transactions ExplainedDocument7 pagesCBNotes: Credit Transactions ExplainedJimcris Posadas HermosadoNo ratings yet

- Credit CasesDocument22 pagesCredit CasesKatrina San MiguelNo ratings yet

- Credit Transactions: San Beda College of LawDocument33 pagesCredit Transactions: San Beda College of LawAejay BariasNo ratings yet

- Partnership Formation Problems SolvedDocument3 pagesPartnership Formation Problems Solvedai kawaiiNo ratings yet

- Law On Sales, Agency and Credit Transactions Part 4Document60 pagesLaw On Sales, Agency and Credit Transactions Part 4PierreNo ratings yet

- Nahiyan PDFDocument1 pageNahiyan PDFAfzal MahmudNo ratings yet

- Cred Trans NotesDocument26 pagesCred Trans NotesBuen LibetarioNo ratings yet

- Sectrans Notes For Finals PDFDocument137 pagesSectrans Notes For Finals PDFjeffdelacruzNo ratings yet

- Management of The Office EnvironmentDocument36 pagesManagement of The Office EnvironmentN-jay Ernieta100% (1)

- Open Pdfcoffee - Com San Beda Credit Transactions PDF FreeDocument33 pagesOpen Pdfcoffee - Com San Beda Credit Transactions PDF FreeMark OrlinoNo ratings yet

- Credit Transactions: San Beda College of LawDocument35 pagesCredit Transactions: San Beda College of LawGela Bea BarriosNo ratings yet

- Credit Transactions: Notes On BailmentDocument16 pagesCredit Transactions: Notes On BailmentChristiane Marie BajadaNo ratings yet

- Docshare - Tips Credit TransactionDocument23 pagesDocshare - Tips Credit Transactionstargazer0732No ratings yet

- Credit Transaction ReviewerDocument35 pagesCredit Transaction ReviewerLily RonshakuNo ratings yet

- Meaning and Scope of Credit TransactionsDocument2 pagesMeaning and Scope of Credit TransactionsZhaira AbainzaNo ratings yet

- BLAWDocument6 pagesBLAWschoolfiles1209No ratings yet

- Regulatory Framework For Business TransactionsDocument6 pagesRegulatory Framework For Business TransactionsKatharsisNo ratings yet

- Delivers non-consumable thingDocument2 pagesDelivers non-consumable thingIno RoniNo ratings yet

- CREDIT TRANSACTIONS - 4 Jan '19Document6 pagesCREDIT TRANSACTIONS - 4 Jan '19Raffy AdanNo ratings yet

- credit-transactions_compressDocument12 pagescredit-transactions_compressjobelleann.labuguenNo ratings yet

- Mid's Credits and Transaction ReviewerDocument5 pagesMid's Credits and Transaction ReviewerAMIDA ISMAEL. SALISANo ratings yet

- Week 5 - Credit Transactions_AADLDocument11 pagesWeek 5 - Credit Transactions_AADLkristinasarinas4No ratings yet

- Part 3 Credit TransactionsDocument8 pagesPart 3 Credit TransactionsClint AbenojaNo ratings yet

- CreditTransactions PDFDocument42 pagesCreditTransactions PDFjbandNo ratings yet

- CreditTransactions Reviewer IncompleteDocument41 pagesCreditTransactions Reviewer IncompleteMary Ann Isanan0% (1)

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- IV.Geneva Convention relative to the Protection of Civilian Persons in Time of War, 1949From EverandIV.Geneva Convention relative to the Protection of Civilian Persons in Time of War, 1949No ratings yet

- Strategic ManagementDocument8 pagesStrategic ManagementN-jay ErnietaNo ratings yet

- Strategic ManagementDocument21 pagesStrategic ManagementN-jay ErnietaNo ratings yet

- Office Records Management EssentialsDocument83 pagesOffice Records Management EssentialsN-jay ErnietaNo ratings yet

- Strategy FormulationDocument15 pagesStrategy FormulationN-jay ErnietaNo ratings yet

- Professional Safety and Health Training: - Construction Industry - Group 3Document10 pagesProfessional Safety and Health Training: - Construction Industry - Group 3N-jay ErnietaNo ratings yet

- Strategic ManagemntDocument7 pagesStrategic ManagemntN-jay ErnietaNo ratings yet

- Strategic ManagementDocument29 pagesStrategic ManagementN-jay ErnietaNo ratings yet

- Different Kinds of Obligation 1Document13 pagesDifferent Kinds of Obligation 1N-jay ErnietaNo ratings yet

- To Achieve Its Mission, Vision and Objectives To Establish A Favorable Competitive PositionDocument17 pagesTo Achieve Its Mission, Vision and Objectives To Establish A Favorable Competitive PositionN-jay ErnietaNo ratings yet

- Joint and Solidary Obligations 1Document8 pagesJoint and Solidary Obligations 1N-jay ErnietaNo ratings yet

- History of AccountingDocument13 pagesHistory of AccountingN-jay ErnietaNo ratings yet

- 6 Science: Quarter 1 - Module 2 Solution and Suspension MixturesDocument17 pages6 Science: Quarter 1 - Module 2 Solution and Suspension MixturesN-jay ErnietaNo ratings yet

- St. Ignatius Technical Institue of Business and Art: Republic of The Philippines Balibago, Sta. Rosa City LagunaDocument36 pagesSt. Ignatius Technical Institue of Business and Art: Republic of The Philippines Balibago, Sta. Rosa City LagunaN-jay ErnietaNo ratings yet

- Report in Business Law PDF RevisedDocument16 pagesReport in Business Law PDF RevisedN-jay ErnietaNo ratings yet

- August 20Document11 pagesAugust 20N-jay ErnietaNo ratings yet

- Limited partnership dissolution and winding upDocument8 pagesLimited partnership dissolution and winding upN-jay ErnietaNo ratings yet

- True False 1 5 0 2 5 0 3 0 5 4 5 0 5 0 5 6 0 5 7 5 0 8 5 0 9 0 5 10 0 5 11 5 0 12 0 5 13 0 5 14 5 0 15 5 0 16 0 5 17 5 0 18 5 0 19 0 5 20 0 5 2Document2 pagesTrue False 1 5 0 2 5 0 3 0 5 4 5 0 5 0 5 6 0 5 7 5 0 8 5 0 9 0 5 10 0 5 11 5 0 12 0 5 13 0 5 14 5 0 15 5 0 16 0 5 17 5 0 18 5 0 19 0 5 20 0 5 2N-jay ErnietaNo ratings yet

- The Administrative Office Management: Work Office Efficiency ProductivityDocument10 pagesThe Administrative Office Management: Work Office Efficiency ProductivityN-jay ErnietaNo ratings yet

- Admin Office Mgt.Document2 pagesAdmin Office Mgt.N-jay ErnietaNo ratings yet

- Business LW and TaxDocument4 pagesBusiness LW and TaxN-jay ErnietaNo ratings yet

- BUSINESS LAW AND TAXATION First LessonDocument13 pagesBUSINESS LAW AND TAXATION First LessonN-jay ErnietaNo ratings yet

- COMP-4 - Publisher Lesson 2Document6 pagesCOMP-4 - Publisher Lesson 2N-jay ErnietaNo ratings yet

- ELIZE Food Catering ServicesDocument56 pagesELIZE Food Catering ServicesN-jay ErnietaNo ratings yet

- BSOA 3B1 Nichole John Ernieta (Event 5)Document1 pageBSOA 3B1 Nichole John Ernieta (Event 5)N-jay ErnietaNo ratings yet

- Legal ResearchDocument154 pagesLegal ResearchN-jay ErnietaNo ratings yet

- BSOA 3B1 Nichole John Ernieta (Event 4)Document2 pagesBSOA 3B1 Nichole John Ernieta (Event 4)N-jay ErnietaNo ratings yet

- BSOA 3B1 Nichole John Ernieta (Event 3)Document2 pagesBSOA 3B1 Nichole John Ernieta (Event 3)N-jay ErnietaNo ratings yet

- BSOA 3B1 Nichole John Ernieta (Event 2)Document2 pagesBSOA 3B1 Nichole John Ernieta (Event 2)N-jay ErnietaNo ratings yet

- With a Period (1193): Key ConceptsDocument39 pagesWith a Period (1193): Key ConceptsTanya KimNo ratings yet

- 7227 Bullet ReviewDocument8 pages7227 Bullet ReviewJohair BilaoNo ratings yet

- Journal EntriesDocument6 pagesJournal EntriesJermaine M. SantoyoNo ratings yet

- CA Foundation Accounts Module I Average Due Date Without AnswersDocument19 pagesCA Foundation Accounts Module I Average Due Date Without AnswersVivek ChauhanNo ratings yet

- 109 20 Twitter LBODocument5 pages109 20 Twitter LBObellabell8821No ratings yet

- Week 2 Learning Material - ACCT 1073 Financial MarketsDocument6 pagesWeek 2 Learning Material - ACCT 1073 Financial MarketsMark Angelo BustosNo ratings yet

- ProblemDocument48 pagesProblemArsenio RojoNo ratings yet

- Factors Affecting ReceivablesDocument3 pagesFactors Affecting ReceivablesNavneet KaurNo ratings yet

- ABC Sample ProbDocument4 pagesABC Sample ProbangbabaeNo ratings yet

- One-Liner (Def Acc Code) - 01Document6 pagesOne-Liner (Def Acc Code) - 01nagarjuna_upscNo ratings yet

- Iapm Unit 3 PDFDocument69 pagesIapm Unit 3 PDFHaripriya VNo ratings yet

- Insolvency and Bankruptcy ActDocument37 pagesInsolvency and Bankruptcy ActKartikay BhargavaNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement AnalysisQaisar BasheerNo ratings yet

- AE 112 Finals Summative Assessment #1 Partnership Dissolution & Liquidation MCQsDocument12 pagesAE 112 Finals Summative Assessment #1 Partnership Dissolution & Liquidation MCQsmercyvienhoNo ratings yet

- 2 1 Annabel Is A Wholesaler. She Maintains A Three Column Cash BookDocument16 pages2 1 Annabel Is A Wholesaler. She Maintains A Three Column Cash Booksshyam3No ratings yet

- SLM Module in Fabm2 Q1Document53 pagesSLM Module in Fabm2 Q1Fredgy R BanicoNo ratings yet

- Global CityDocument16 pagesGlobal CityDaisy MallariNo ratings yet

- Accounting Process by NavkarDocument44 pagesAccounting Process by NavkarShlok JainNo ratings yet

- Bca PDFDocument574 pagesBca PDFJeetin KumarNo ratings yet