Professional Documents

Culture Documents

Managerial Accounting

Uploaded by

Lune Noire0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesManagerial Accounting

Uploaded by

Lune NoireCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

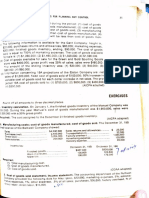

Problem I

The accounting department of the Blanche Corporation provided the following data for March 2021:

Sales Php 1,200,000

Marketing expenses 5% of sales

Administrative expenses 1% of sales

Purchases 400,000

Factory overhead 2/3 of DL costs

Direct labor 210,000

Inventories: March 1 March 31

Finished goods Php 100,000 Php 82,500

Work in process 102,350 117,135

Materials 50,000 47,485

Required:

1. Statement of Comprehensive Income

2. Cost of goods sold statement

Problem II

A manufacturing company shows the following amounts in the cost of goods sold statement and income

statement for the year 2021

January 1, 2021 December 31, 2021

Materials Php 100,000 Php 150,000

Work in Process 87,000

Finished goods 80,000

Materials used 590,000

Cost of goods sold 750,000

Cost of goods manufactured 800,000

Total manufacturing costs 790,000

Required:

1. Work in process, January 1, 2021

2. Finished goods, December 31, 2021

3. Amount of materials purchased in 2021

Problem III

The following is available for Alonzo Company:

Raw materials inventory increased by Php 15,000

Work in process inventory decreased by Php 8,500

Finished goods inventory decreased by Php 5,000

Materials purchased Php 180,000

Direct labor 220,000

Manufacturing overhead 200,000

Sales 980,000

Required:

1. Compute cost of goods sold

2. Cost per unit manufactured

3. Compute for the gross profit

Problem IV

The following were from the books of Janice Company for March 2021

March 1, 2021 March 31, 2021

Inventories

Raw Materials ? Php 20,000

Work in process 90,000 100,000

Finished goods 120,000 180,000

Raw materials purchased 100,000

Factory overhead, 75% of direct labor cost, 126,000

Selling & administrative expense, 10% of sales, 50,000

Net income for March, 2021 50,000

Required:

1. Cost of goods sold for March.

2. Cost of goods manufactured for March.

3. Inventory of raw materials as of March 1.

4. Assuming 50,000 units were manufactured, compute the cost of goods manufactured per unit.

You might also like

- Quiz 1 - Cost Terms, Inventory - PrintableDocument8 pagesQuiz 1 - Cost Terms, Inventory - PrintableEdward Prima KurniawanNo ratings yet

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- NormalDocument2 pagesNormalPatrisha0% (2)

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Test 1Document2 pagesTest 1farsi786100% (1)

- Cost of Goods SoldDocument14 pagesCost of Goods Soldmuhammad irfan50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- BS ME Programme Specification 2019Document23 pagesBS ME Programme Specification 2019Lune NoireNo ratings yet

- HRD DilemmaDocument4 pagesHRD DilemmaAjay KumarNo ratings yet

- Cost Accounting 1 ACT201 InstructorsDocument4 pagesCost Accounting 1 ACT201 InstructorsAdhamNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Budgeting AnswerDocument7 pagesBudgeting AnsweraddsNo ratings yet

- Cost 1 Sample ProblemsDocument3 pagesCost 1 Sample ProblemsCatherine OrdoNo ratings yet

- MGT 308Document2 pagesMGT 308HasnainNo ratings yet

- Problem 12 27Document4 pagesProblem 12 27Bella RonahNo ratings yet

- Cost Concepts Class ExercisesDocument7 pagesCost Concepts Class ExercisesAngel Alejo AcobaNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Cost Accounting: InstructionsDocument2 pagesCost Accounting: InstructionsSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Discussion Problems Job Order CostingDocument5 pagesDiscussion Problems Job Order CostingEl AgricheNo ratings yet

- Product CostDocument10 pagesProduct CostApple BaldemoroNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- Cost Accounting1.2Document9 pagesCost Accounting1.2ASHJAEE MANSIB CHOWDHURYNo ratings yet

- Acct1 8Document5 pagesAcct1 8kutipan raraNo ratings yet

- Activity No. 1 September 2Document1 pageActivity No. 1 September 2Catherine OrdoNo ratings yet

- Chapter 5 Additional ExercisesDocument2 pagesChapter 5 Additional ExercisesThe sorcererNo ratings yet

- Tutorial 1.2 QDocument4 pagesTutorial 1.2 QDashania GregoryNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- 10E - Build A Spreadsheet 02-44Document2 pages10E - Build A Spreadsheet 02-44MISRET 2018 IEI JSCNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Managerial Set 2Document5 pagesManagerial Set 2Dan OrbisoNo ratings yet

- AP InventoriesDocument7 pagesAP InventorieswingNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Audit of InventoriesDocument4 pagesAudit of InventoriesVel JuneNo ratings yet

- Assignment #2Document5 pagesAssignment #2MarkJoven BergantinNo ratings yet

- Job OrderDocument7 pagesJob OrderFrances Alandra SorianoNo ratings yet

- Job Costing: Problem 1. The Showa Manufacturing Company Recorded The Following Transactions DuringDocument3 pagesJob Costing: Problem 1. The Showa Manufacturing Company Recorded The Following Transactions DuringMaria BeatriceNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Financial and Managerial ExercisesDocument5 pagesFinancial and Managerial ExercisesBedri M Ahmedu50% (2)

- Assignment ProblemDocument7 pagesAssignment ProblemAnantha KrishnaNo ratings yet

- Cost Activity 3 (Quiz)Document2 pagesCost Activity 3 (Quiz)Erica FlorentinoNo ratings yet

- Asynchronous - 01Document8 pagesAsynchronous - 01Joshua SantiagoNo ratings yet

- Lecture 3 Job Order CostingDocument20 pagesLecture 3 Job Order CostingTheresa RoqueNo ratings yet

- Job Order CostingDocument2 pagesJob Order CostingMahnoor MujahidNo ratings yet

- CGI - 20-21 - Exercise Book 1Document14 pagesCGI - 20-21 - Exercise Book 1Beatriz RodriguesNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- COGSDocument4 pagesCOGSJomar VillenaNo ratings yet

- To PQDocument4 pagesTo PQSaher KhanNo ratings yet

- Assignment1 CostAccountingDocument2 pagesAssignment1 CostAccountingSyed Adnan Hussain ShahNo ratings yet

- Topic 1 - Assignment 1 CostDocument4 pagesTopic 1 - Assignment 1 CostAnna Cabrera0% (1)

- Required: Prepare A Variable-Costing Income Statement For The Same PeriodDocument2 pagesRequired: Prepare A Variable-Costing Income Statement For The Same PeriodFarjana AkterNo ratings yet

- Job Order Costing ExercisesDocument2 pagesJob Order Costing ExercisesLUCYDHARYLL JOHN E. SEJALBONo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- RA9003Document2 pagesRA9003Lune NoireNo ratings yet

- Enterprise NotesDocument6 pagesEnterprise NotesLune NoireNo ratings yet

- Risk and ReturnDocument28 pagesRisk and ReturnLune NoireNo ratings yet

- NotesDocument4 pagesNotesLune NoireNo ratings yet

- Enterprise NotesDocument1 pageEnterprise NotesLune NoireNo ratings yet

- Company Profile Analysis - Changi Airport (20230311140317)Document1 pageCompany Profile Analysis - Changi Airport (20230311140317)Lune NoireNo ratings yet

- Solar Fan PDFDocument1 pageSolar Fan PDFLune NoireNo ratings yet

- Application of Cognitive Ergonomics in Highly Reliable SystemDocument5 pagesApplication of Cognitive Ergonomics in Highly Reliable SystemLune NoireNo ratings yet

- JeepneyDocument1 pageJeepneyLune NoireNo ratings yet

- How Not Following Solid Waste Management Can Affect WaterDocument2 pagesHow Not Following Solid Waste Management Can Affect WaterLune NoireNo ratings yet

- Thermal ExpansionDocument12 pagesThermal ExpansionLune NoireNo ratings yet

- Citation 333748514Document1 pageCitation 333748514Lune NoireNo ratings yet

- Signal Detection TheoryDocument27 pagesSignal Detection TheoryLune NoireNo ratings yet

- 2nd Law of ThermodynamicsDocument15 pages2nd Law of ThermodynamicsLune NoireNo ratings yet

- Ben and I'M The Creator of Tiny Eco Home Life: Fbclid Iwar29Jwsyl2Lw26Nrldvtphokinx8Raccujq0Tyli9Xpregqvac7Ubuyg3PsDocument1 pageBen and I'M The Creator of Tiny Eco Home Life: Fbclid Iwar29Jwsyl2Lw26Nrldvtphokinx8Raccujq0Tyli9Xpregqvac7Ubuyg3PsLune NoireNo ratings yet

- Process FlowDocument2 pagesProcess FlowLune NoireNo ratings yet

- MaterialsDocument7 pagesMaterialsLune NoireNo ratings yet

- Or 1 Assignment 2Document4 pagesOr 1 Assignment 2Lune NoireNo ratings yet

- Sensation and Perception: A Unit Lesson Plan For High School Psychology TeachersDocument46 pagesSensation and Perception: A Unit Lesson Plan For High School Psychology TeachersLune NoireNo ratings yet

- RRL and Process FlowDocument3 pagesRRL and Process FlowLune NoireNo ratings yet

- Costs-Concepts and ClassificationsDocument12 pagesCosts-Concepts and ClassificationsLune NoireNo ratings yet

- Holy Angel University: 19/02/2020 1:00 PM Curriculum Code: Bs Medtech2018 Page 1 of 2Document2 pagesHoly Angel University: 19/02/2020 1:00 PM Curriculum Code: Bs Medtech2018 Page 1 of 2Lune NoireNo ratings yet

- Google Template #4Document8 pagesGoogle Template #4Lune NoireNo ratings yet

- Lesson 1Document30 pagesLesson 1Lune NoireNo ratings yet

- BSIE - 2018: Course Code Description Units Pre-RequisiteDocument1 pageBSIE - 2018: Course Code Description Units Pre-RequisiteLune NoireNo ratings yet

- Welcome: Here Is Where Your Presentation BeginsDocument7 pagesWelcome: Here Is Where Your Presentation BeginsLune NoireNo ratings yet

- Rebar Coupler: Barlock S/CA-Series CouplersDocument1 pageRebar Coupler: Barlock S/CA-Series CouplersHamza AldaeefNo ratings yet

- Sample Annual BudgetDocument4 pagesSample Annual BudgetMary Ann B. GabucanNo ratings yet

- A320 TakeoffDocument17 pagesA320 Takeoffpp100% (1)

- Delta AFC1212D-SP19Document9 pagesDelta AFC1212D-SP19Brent SmithNo ratings yet

- Resume Jameel 22Document3 pagesResume Jameel 22sandeep sandyNo ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- Shubham Tonk - ResumeDocument2 pagesShubham Tonk - ResumerajivNo ratings yet

- The Rise of Populism and The Crisis of Globalization: Brexit, Trump and BeyondDocument11 pagesThe Rise of Populism and The Crisis of Globalization: Brexit, Trump and Beyondalpha fiveNo ratings yet

- Linux For Beginners - Shane BlackDocument165 pagesLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Electrical ConnectorsDocument5 pagesElectrical ConnectorsRodrigo SantibañezNo ratings yet

- An RambTel Monopole Presentation 280111Document29 pagesAn RambTel Monopole Presentation 280111Timmy SurarsoNo ratings yet

- Pneumatic Fly Ash Conveying0 PDFDocument1 pagePneumatic Fly Ash Conveying0 PDFnjc6151No ratings yet

- Oracle Exadata Database Machine X4-2: Features and FactsDocument17 pagesOracle Exadata Database Machine X4-2: Features and FactsGanesh JNo ratings yet

- Loading N Unloading of Tanker PDFDocument36 pagesLoading N Unloading of Tanker PDFKirtishbose ChowdhuryNo ratings yet

- Dry Canyon Artillery RangeDocument133 pagesDry Canyon Artillery RangeCAP History LibraryNo ratings yet

- Polytropic Process1Document4 pagesPolytropic Process1Manash SinghaNo ratings yet

- Rofi Operation and Maintenance ManualDocument3 pagesRofi Operation and Maintenance ManualSteve NewmanNo ratings yet

- Cdi 2 Traffic Management and Accident InvestigationDocument22 pagesCdi 2 Traffic Management and Accident InvestigationCasanaan Romer BryleNo ratings yet

- Underwater Wellhead Casing Patch: Instruction Manual 6480Document8 pagesUnderwater Wellhead Casing Patch: Instruction Manual 6480Ragui StephanosNo ratings yet

- Tinplate CompanyDocument32 pagesTinplate CompanysnbtccaNo ratings yet

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocument2 pagesAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNo ratings yet

- Final ExamSOMFinal 2016 FinalDocument11 pagesFinal ExamSOMFinal 2016 Finalkhalil alhatabNo ratings yet

- Case Assignment 2Document5 pagesCase Assignment 2Ashish BhanotNo ratings yet

- Process States in Operating SystemDocument4 pagesProcess States in Operating SystemKushal Roy ChowdhuryNo ratings yet

- Government of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Document2 pagesGovernment of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Satyaki Prasad MaitiNo ratings yet

- Lending OperationsDocument54 pagesLending OperationsFaraz Ahmed FarooqiNo ratings yet

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Document20 pagesSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoNo ratings yet

- IPO Ordinance 2005Document13 pagesIPO Ordinance 2005Altaf SheikhNo ratings yet

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Document9 pages(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarNo ratings yet