Professional Documents

Culture Documents

Answer 02 (C) : CFAP-02 Corporate Laws Aamir Shahbaz, FCA

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer 02 (C) : CFAP-02 Corporate Laws Aamir Shahbaz, FCA

Uploaded by

SR TGCopyright:

Available Formats

B.

Company can issue redeemable term finance certificates by mortgaging the

property of the company to secure the said issue. The company shall need to

make an agreement in writing pursuant to the Companies Act, 2017 and after

fulfilling all the terms and conditions of the agreement, the company can obtain

loan from the said few identified individuals against the issuance of TFCs.

C. Pursuant to Section 199 of the Companies Act, 2017, a company can obtain loan

from the associated company. However, as per subsection 4 of Section 5 of

Companies (Investment in Associated Companies or Associated Undertakings)

Regulations, 2017, the company cannot have affordable mark-up rate rather it

shall not be less than Karachi Inter Bank Offered Rate (KIBOR) for the relevant

period or the borrowing cost of the investing company, whichever is higher.

D. The company can obtain the Loan from the Director on the basis of participation

term certificates where he shall participate in the profit and loss of the company

through an agreed mechanism. However, the same shall require the approval

of members through special resolution by not less than a majority of three-fourth

of the members present in the meeting in person or proxy as per section 66 of

Companies Act, 2017.

There shall be a proper written contract in this regard as well containing the

information required by that section.

Answer 02 (C)

No provision of Companies Act, 2017, refrains any trust to buy the shares of a listed company

to enhance its resources for the welfare activities. Section 121 of the Companies Act, 2017 only

prohibits to enter the name of the trust in the register of the members that is to say, when the

name of trustee is mentioned as a shareholder, the company does not need to mention the name

of the beneficiary of the shares as well for such shares. but does not, in any way, prohibit the

purchase of the shares of a Listed Company by a trust.

Therefore, Mir Taqi Trust can make investment in the securities of the listed companies.

(Section 5 of Central Depositary Act, 1997 can be considered for the sake of its reference as

the CDC is deemed not to be a member of the issuer when its name is included in the register

of members.)

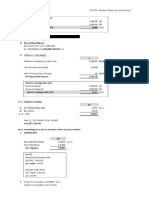

Answer 03 (A)

The equity of an NBFC includes paid-up ordinary share capital, preference shares which are

compulsory convertible into ordinary shares, general reserves, statutory reserves, balance in

shares premium account, reserves for issue of bonus shares, subordinated loans and un-

appropriated profits, excluding accumulated losses.

So, in our case the equity of Naseer Leasing Limited becomes: Rs. 2.8 Billion (assuming that

the Certificates of Deposits are compulsory to be converted into ordinary shares).

A). A maximum outstanding fund-based exposure by an NBFC to a single person

shall not at any time exceed fifteen percent of the equity of an NBFC which in

our case is equal to Rs. 420 Million. Since Akbar Associates had already

obtained the financing of Rs. 295 Million, therefore NLL can provide further

leasing facility to Akbar Associates up to Rs. 50 Million.

CFAP-02 Corporate Laws Aamir Shahbaz, FCA

You might also like

- CORPORATE LAWS & PRACTICES - ND-2022 - Suggested - AnswersDocument7 pagesCORPORATE LAWS & PRACTICES - ND-2022 - Suggested - AnswersadctgNo ratings yet

- Company Law Test Questions on Share Buyback and Financial AssistanceDocument8 pagesCompany Law Test Questions on Share Buyback and Financial AssistanceVasunNo ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Debentures - Meaning: The Attributes of A Debenture AreDocument3 pagesDebentures - Meaning: The Attributes of A Debenture AreAbhishek H.JNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument18 pagesDisclaimer: © The Institute of Chartered Accountants of IndiaSanjayNo ratings yet

- 31400sm DTL Finalnew Vol3 May Nov14 Cp1Document6 pages31400sm DTL Finalnew Vol3 May Nov14 Cp1sunitadklNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Corporate Laws & Practices - JA-2022 - Suggested AnswersDocument7 pagesCorporate Laws & Practices - JA-2022 - Suggested AnswersMd Ruhul AminNo ratings yet

- Company Law AssignmentDocument8 pagesCompany Law AssignmentDeepanshu AgrawalNo ratings yet

- Suggested Answers of Company Law June 2019 Old Syl-Executive-RevisionDocument15 pagesSuggested Answers of Company Law June 2019 Old Syl-Executive-RevisionjesurajajosephNo ratings yet

- Corporation-and-Basic-Securities-Law-QA-2024-examDocument6 pagesCorporation-and-Basic-Securities-Law-QA-2024-examjobelleann.labuguenNo ratings yet

- 3 The Bnak Companies Act, 1991 (AMENDEDUP TO 2003)Document20 pages3 The Bnak Companies Act, 1991 (AMENDEDUP TO 2003)IQBALNo ratings yet

- Section 372A of The Companies ActDocument19 pagesSection 372A of The Companies ActDeepanker SaxenaNo ratings yet

- MTP_19_49_ANSWERS_1712387474Document9 pagesMTP_19_49_ANSWERS_1712387474Nitin KumarNo ratings yet

- School of Business, Economics and Management Student Name: Alex Nkole MulengaDocument6 pagesSchool of Business, Economics and Management Student Name: Alex Nkole MulengaAlex Nkole MulengaNo ratings yet

- Company Law test: Share Capital, Charges, Deposits, Debentures and MembershipDocument26 pagesCompany Law test: Share Capital, Charges, Deposits, Debentures and MembershipShrikant RathodNo ratings yet

- The Companies (Amendment) Act 2015Document29 pagesThe Companies (Amendment) Act 2015Vikram PandyaNo ratings yet

- DebentureDocument5 pagesDebentureRon FlemingNo ratings yet

- Company Tutorial QuesDocument7 pagesCompany Tutorial QuesSIK CHING MEINo ratings yet

- Legal Spects of Business PresentationDocument55 pagesLegal Spects of Business PresentationHIMANI UPADHYAYNo ratings yet

- Topic 4 Shares Capital NotesDocument16 pagesTopic 4 Shares Capital NotesDanica DivyaNo ratings yet

- April 2018 - Company LawDocument8 pagesApril 2018 - Company LawHarshvardhan MelantaNo ratings yet

- Securities Law AssignmentDocument8 pagesSecurities Law AssignmentAngad SaharanNo ratings yet

- April, 2019 - Company LawDocument10 pagesApril, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- Sebi Regulations - Executive SummaryDocument25 pagesSebi Regulations - Executive SummaryChitra ParameswaranNo ratings yet

- Companies Act, 1956Document33 pagesCompanies Act, 1956ankit_coolheadNo ratings yet

- Course 1 The Commercial Corporate Credit Landscape in India PDFDocument57 pagesCourse 1 The Commercial Corporate Credit Landscape in India PDFShikha Sharma100% (1)

- 1992 Bar Examination Topic: Corporation Voting Trust Agreement (1992)Document2 pages1992 Bar Examination Topic: Corporation Voting Trust Agreement (1992)Dustin NitroNo ratings yet

- CA INTER LAW BOMB 2.0 REVISION HELPERDocument18 pagesCA INTER LAW BOMB 2.0 REVISION HELPERRishabh RudraNo ratings yet

- Amit Bachhawat: Quesɵ Ons and AnswerDocument22 pagesAmit Bachhawat: Quesɵ Ons and AnswerSwatish GuptaNo ratings yet

- Company LawDocument4 pagesCompany LawRaj KapoorNo ratings yet

- P13Document14 pagesP13sogoja2705No ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- Tutorial 8 IILDocument8 pagesTutorial 8 IILWinjie PangNo ratings yet

- Basics of Share AllotementDocument3 pagesBasics of Share AllotementshreerajpillaiNo ratings yet

- Non-Bank Sources of Short Term FinanceDocument16 pagesNon-Bank Sources of Short Term FinancePushpa RaniNo ratings yet

- Response To SGX Queries and Letter To The Editor of Business TimesDocument5 pagesResponse To SGX Queries and Letter To The Editor of Business TimesWeR1 Consultants Pte LtdNo ratings yet

- Companies Act Case StudyDocument7 pagesCompanies Act Case StudyAsif0786No ratings yet

- SSRN Id2400120Document11 pagesSSRN Id2400120aaradhyamandloi01No ratings yet

- Investment in Associated CompaniesDocument10 pagesInvestment in Associated CompaniesMuhammad IbrahimNo ratings yet

- Answer 03 (B) : CFAP-02 Corporate Laws Aamir Shahbaz, FCADocument1 pageAnswer 03 (B) : CFAP-02 Corporate Laws Aamir Shahbaz, FCASR TGNo ratings yet

- CA Inter Law Test 1Document6 pagesCA Inter Law Test 1SwAti KiNiNo ratings yet

- Law Question BankDocument104 pagesLaw Question BankSivakumaar NagarajanNo ratings yet

- GM Test Series: Top 50 QuestionsDocument46 pagesGM Test Series: Top 50 QuestionsShruti JhaNo ratings yet

- Safespace Bhd's Proposed Transactions and Share Capital ReductionDocument5 pagesSafespace Bhd's Proposed Transactions and Share Capital ReductionsofiaNo ratings yet

- October, 2019 - Company LawDocument10 pagesOctober, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- Company Law Lecture Notes-SharesDocument10 pagesCompany Law Lecture Notes-SharesSenelwa Anaya75% (4)

- Company Law and AllotmentDocument6 pagesCompany Law and Allotmentmahesh145m100% (1)

- Juridical Personality Under The RCCP That Is Separate and Distinct From Its Persons Composing ItDocument4 pagesJuridical Personality Under The RCCP That Is Separate and Distinct From Its Persons Composing ItEloise Coleen Sulla PerezNo ratings yet

- 2 - Corporate Law - Lecture 05 - Memorandum of AssociationDocument7 pages2 - Corporate Law - Lecture 05 - Memorandum of AssociationAl BastiNo ratings yet

- April, 2017 - Company LawDocument9 pagesApril, 2017 - Company LawHarshvardhan MelantaNo ratings yet

- PRLB Ojk 47pojk052020 2020 enDocument50 pagesPRLB Ojk 47pojk052020 2020 enkatering kokikuNo ratings yet

- Formation of Company StepsDocument10 pagesFormation of Company StepsFaisal NaqviNo ratings yet

- Collective Investment Scheme & SEBIDocument34 pagesCollective Investment Scheme & SEBIEquiCorp Associates, Advocates & SolicitorsNo ratings yet

- Advanced Auditing & Professional Ethics: Master MindsDocument17 pagesAdvanced Auditing & Professional Ethics: Master MindsMaroju RajithaNo ratings yet

- Example 2Document6 pagesExample 2Mohamad_Fazzar_2584No ratings yet

- Redemption of Debenture NEWDocument17 pagesRedemption of Debenture NEWGrave diggerNo ratings yet

- Redemption OF Debentures: After Studying This Unit, You Will Be Able ToDocument34 pagesRedemption OF Debentures: After Studying This Unit, You Will Be Able TodeepakNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- Martin CooneyDocument14 pagesMartin CooneyniallNo ratings yet

- MC 9 Equity A201 StudentDocument4 pagesMC 9 Equity A201 StudentKkk.sssNo ratings yet

- ANMs Multi Purpose Health Assistant (Female) (GR III) PDFDocument31 pagesANMs Multi Purpose Health Assistant (Female) (GR III) PDFNIKHIL MODINo ratings yet

- 2019 Os Parent Handbook Final 2Document44 pages2019 Os Parent Handbook Final 2api-573823749No ratings yet

- HR Executive - International HomewareDocument4 pagesHR Executive - International HomewareS.M. MohiuddinNo ratings yet

- Reliable Exports Lease DeedDocument27 pagesReliable Exports Lease DeedOkkishoreNo ratings yet

- Current Affairs Solved MCQsDocument12 pagesCurrent Affairs Solved MCQsmuhammad_sarwar_270% (1)

- Top 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Document10 pagesTop 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?FaizNo ratings yet

- Philippine Education and Development Throughout HistoryDocument107 pagesPhilippine Education and Development Throughout HistoryZiennard GeronaNo ratings yet

- Results Analysis Method 7, POC Method Based On Project Progress Value Determination - SAP BlogsDocument11 pagesResults Analysis Method 7, POC Method Based On Project Progress Value Determination - SAP BlogsMahesh pvNo ratings yet

- Banking Sector NPA AnalysisDocument53 pagesBanking Sector NPA AnalysischaruNo ratings yet

- Skripsi: Implementasi Kebijakan Disiplin Pegawai Negeri Sipil Di Distrik Navigasi Kelas I PalembangDocument25 pagesSkripsi: Implementasi Kebijakan Disiplin Pegawai Negeri Sipil Di Distrik Navigasi Kelas I PalembangsichluzNo ratings yet

- Loose Constructionism vs. Strict ConstructionismDocument4 pagesLoose Constructionism vs. Strict ConstructionismClaudia SilvaNo ratings yet

- JSE Letter COVID 19 Property Entities Trading Statements May 2020Document2 pagesJSE Letter COVID 19 Property Entities Trading Statements May 2020Kyle TauNo ratings yet

- Statement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRDocument1 pageStatement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRAottry MukherjeeNo ratings yet

- 018 005 WaterproofingDocument7 pages018 005 WaterproofingSujani MaarasingheNo ratings yet

- Efektifitas Program SIAK di Dinas Kependudukan GresikDocument10 pagesEfektifitas Program SIAK di Dinas Kependudukan GresikAhmad AgungNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument24 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Comparative Police System ReviewDocument34 pagesComparative Police System ReviewAngelo Vonn Villanueva86% (14)

- Capital Logic Interactive 224840Document12 pagesCapital Logic Interactive 224840nizarfeb0% (2)

- Dr. Faustus As Tragic HeroDocument2 pagesDr. Faustus As Tragic HeroNour FalasteenNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument4 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesJetro EspinasNo ratings yet

- Ashley Furniture Industries, Inc. Arcadia, Wisconsin 54612Document4 pagesAshley Furniture Industries, Inc. Arcadia, Wisconsin 54612picfixerNo ratings yet

- Foodpanda OrderDocument2 pagesFoodpanda OrderMohd Azfarin100% (1)

- Ubd Unit PlanDocument4 pagesUbd Unit Planapi-351329785No ratings yet

- Sample Motion To Dismiss Petition For Facial InsufficiencyDocument5 pagesSample Motion To Dismiss Petition For Facial InsufficiencybrandonNo ratings yet

- Certification of Container Securing Systems AbsDocument105 pagesCertification of Container Securing Systems AbsFederico BabichNo ratings yet

- Coca ColaDocument31 pagesCoca ColaAnmol JainNo ratings yet

- NAILTA's Amicus Curiae BriefDocument36 pagesNAILTA's Amicus Curiae BriefOAITANo ratings yet

- Chapter 1 Exercises 2Document7 pagesChapter 1 Exercises 2thtram03No ratings yet

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Business Buyout Agreements: Plan Now for All Types of Business TransitionsFrom EverandBusiness Buyout Agreements: Plan Now for All Types of Business TransitionsNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- How to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionFrom EverandHow to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionNo ratings yet

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2022From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2022No ratings yet

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet