Professional Documents

Culture Documents

Matematik TG4 (NM) - Bab 10

Matematik TG4 (NM) - Bab 10

Uploaded by

SOFIA IVYINNA AK ALBERT NYAWIN MoeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matematik TG4 (NM) - Bab 10

Matematik TG4 (NM) - Bab 10

Uploaded by

SOFIA IVYINNA AK ALBERT NYAWIN MoeCopyright:

Available Formats

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 10: Matematik Pengguna: Pengurusan Kewangan

Consumer Mathematics: Financial Management

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 272 – 273

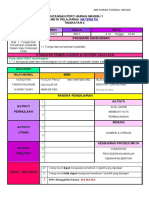

A. Lengkapkan lima langkah dalam proses pengurusan kewangan.

Pautan Digital

Complete the five steps in the financial management process. SP10.1.1 TP1

Menetapkan matlamat kewangan

Setting goals

Menilai kedudukan kewangan

Evaluating financial status

Mewujudkan pelan kewangan

Proses Pengurusan Kewangan

Financial Management Process Creating financial plan

Melaksanakan pelan kewangan

Carrying out financial plan

Mengkaji semula dan menyemak kemajuan

Reviewing and revising the progress

B. Kenal pasti matlamat kewangan jangka pendek dan matlamat kewangan jangka panjang daripada

senarai di bawah.

Identify short-term financial goals and long-term financial goals from the list below. SP10.1.1 TP1

Simpanan untuk pendidikan anak-anak Membeli rumah banglo Membeli telefon pintar

Savings for children’s education Buy a bungalow Buy a smartphone

Membuka restoran Membeli komputer riba Bercuti di Pulau Langkawi

Open a restaurant Buy a laptop Vacation in Pulau Langkawi

Matlamat kewangan jangka pendek Matlamat kewangan jangka panjang

Short-term financial goals Long-term financial goals

Membeli telefon pintar Simpanan untuk pendidikan anak-anak

Buy a smartphone Savings for children’s education

Membeli komputer riba Membeli rumah banglo

Buy a laptop Buy a bungalow

Bercuti di Pulau Langkawi Membuka restoran

Vacation in Pulau Langkawi Open a restaurant

143

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 143 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 273 – 274

Tulis matlamat kewangan bagi setiap individu berikut mengikut pendekatan SMART.

Write the financial goals for each individual according to the SMART approach. SP10.1.1 TP2

1. Puan Zuraida ingin membeli sebuah komputer untuk pembelajaran anaknya dalam tempoh 8 bulan.

Dia memilih untuk membeli sebuah komputer yang berharga RM4 800. Puan Zuraida perlu menyimpan

RM600 sebulan daripada pendapatan bulanannya RM4 500 untuk mencapai matlamat kewangannya.

Puan Zuraida wants to buy a computer for her child’s education within 8 months. She chooses to buy a computer that costs

RM4 800. Puan Zuraida needs to save RM600 a month from her monthly income of RM4 500 to achieve her financial goals.

Khusus Membeli sebuah computer.

Specific Buy a computer.

Boleh diukur Bernilai RM4 800 dan memerlukan simpanan bulanan RM600 untuk mencapai matlamat.

Measurable It costs RM4 800 and requires a monthly savings of RM600 to achieve the goal.

Boleh dicapai Boleh mencapai simpanan bulanan sebanyak RM600 daripada pendapatan bulanan RM4 500.

Attainable Can achieve a monthly savings of RM600 from a monthly income of RM4 500.

Bersifat RM600 daripada pendapatan bulanan sebanyak RM4 500 merupakan 13.3% daripada

realistik pendapatannya.

Realistic RM600 of the monthly income of RM4 500 represents 13.3% of her income.

8 bulan adalah cukup untuk megumpulkan RM4 800 dengan simpanan bulanan sebanyak

Tempoh masa RM600.

Time-bound

8 months is enough to accumulate RM4 800 with a monthly savings of RM600.

2. Encik Sham ingin membeli sebuah telefon bimbit baharu yang bernilai RM2 133. Dia mensasarkan untuk

membeli telefon bimbit itu dalam masa 9 bulan. Encik Sham perlu menyimpan RM237 daripada pendapatan

bulanannya RM2 400 untuk mencapai matlamat kewangannya.

Encik Sham wants to buy a new mobile phone worth RM2 133. He aims to buy the mobile phone within 9 months.

Encik Sham needs to save RM237 from his monthly income of RM2 400 to achieve his financial goals.

Khusus Membeli telefon bimbit.

Specific Buying a mobile phone.

Boleh diukur Bernilai RM2 133 dan memerlukan simpanan bulanan RM237 untuk mencapai matlamat.

Measurable Worth RM2 133 and requires a monthly savings of RM237 to achieve the goal.

Boleh dicapai Boleh mencapai simpanan bulanan sebanyak RM237 daripada pendapatan bulanan RM2 400.

Attainable Can achieve a monthly savings of RM237 from a monthly income of RM2 400.

Bersifat RM237 daripada pendapatan bulanan sebanyak RM2 400 merupakan 9.8% daripada

realistik pendapatannya.

Realistic RM237 of monthly income of RM2 400 represents 9.8% of his income.

9 bulan adalah cukup untuk mengumpulkan RM2 133 dengan simpanan bulanan sebanyak

Tempoh masa RM237.

Time-bound

9 months is enough to raise RM2 133 with a monthly savings of RM237.

144 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 144 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 274 – 276

A. Kenal pasti pendapatan aktif dan pendapatan pasif bagi setiap pendapatan berikut.

Identify the active and passive income for each of the following income. SP10.1.1 TP1

Pendapatan aktif Pendapatan pasif

• Dividen • Elaun Active income Passive income

Dividend Allowance

• Gaji • Komisen Gaji Dividen

Salary Commission Salary Dividend

• Sewa diterima • Faedah simpanan bank

Rent received Bank savings interest Elaun Sewa diterima

Allowance Rental received

Komisen Faedah simpanan bank

Comission Bank savings interest

B. Kenal pasti perbelanjaan tetap dan perbelanjaan tidak tetap bagi setiap perbelanjaan berikut.

Identify the fixed and variable expenses for each of the following expenses. SP10.1.1 TP1

Perbelanjaan tetap Perbelanjaan tidak tetap

• Sewa rumah • Bayaran insurans Fixed expenses Variable expenses

House rental Insurance payment

• Ansuran rumah • Pembayaran bil internet Sewa rumah Pembayaran bil internet

House instalment Internet bill payment House rental Internet bill payment

• Barangan dapur • Belanja petrol

Groceries Petrol expenses Ansuran rumah Belanja petrol

House instalment Petrol expenses

Bayaran insurans Barangan dapur

Insurance payment Groceries

C. Hitung aliran tunai bulanan bagi setiap individu berikut.

Calculate monthly cash flow for each of the following individual. SP10.1.1 TP3

1. Encik Abu 2. Cik Ainun

Pendapatan aktif Pendapatan aktif

Active income

RM1 800 Active income

RM2 000

Pendapatan pasif RM120 Pendapatan pasif RM200

Passive income Passive income

Perbelanjaan tetap RM700 Perbelanjaan tetap RM1 800

Fixed expenses Fixed expenses

Perbelanjaan tidak tetap RM250 Perbelanjaan tidak tetap RM500

Variable expenses Variable expenses

Aliran tunai/Cash flow Aliran tunai/Cash flow

= Jumlah pendapatan – Jumlah perbelanjaan = Jumlah pendapatan – Jumlah perbelanjaan

Total income – Total expenses Total income – Total expenses

= (RM1 800 + RM120) – (RM700 + RM250) = (RM2 000 + RM200) – (RM1 800 + RM500)

= RM970 (Aliran tunai positif/Positve cash flow) = –RM100 (Aliran tunai negatif/Negative cash flow)

4 145

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 145 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 276

Jawab setiap soalan berikut.

Answer each of the following questions. SP10.1.1 TP4 TP5

1. Encik Lee menerima pendapatan aktif sebanyak RM2 300 dan pendapatan pasif sebanyak RM300 dalam

sebulan. Dia menanggung perbelanjaan tetap sebanyak RM2 100 sebulan dan perbelanjaan tidak tetap

sebanyak RM800 sebulan. Hitung aliran tunai bulanan Encik Lee dan jelaskan jawapan anda.

Mr Lee receives an active income of RM2 300 and a passive income of RM300 per month. He bears fixed expenses of

RM2 100 per month and variable expenses of RM800 per month. Calculate Mr Lee’s monthly cash flow and explain your

answer.

Aliran tunai = Jumlah pendapatan – Jumlah perbelanjaan

Cash flow = Total income – Total expenses

= (RM2 300 + RM300) – (RM2 100 + RM800)

= –RM300 (Aliran tunai negatif/Negative cash flow)

A negative cash flow will burden Mr Lee and may cause him to use credit card to solve his financial problems.

Aliran tunai negatif akan membebankan Encik Lee dan mungkin menyebabkan penggunaan kad kredit bagi mengatasi

masalah kewangan.

2. Cik Siti ialah seorang kerani akaun di sebuah syarikat swasta. Dia menerima gaji bulanan sebanyak

RM3 500 dan juga menerima RM1 200 hasil daripada kerja sambilannya. Cik Siti perlu membayar

sebanyak RM1 800 untuk perbelanjaan bulanannya dan perbelanjaan tidak tetap sebanyak RM600 sebagai

pemberian kepada ibu bapanya.

Cik Siti is an account clerk at a private company. She receives a monthly salary of RM3 500 and also receives RM1 200

from her part-time job. Cik Siti has to pay RM1 800 for her monthly expenses and the variable expense of RM600 as an

allowance for her parents.

(a) Hitung aliran tunai bulanan Cik Siti. Jelaskan jawapan anda.

Calculate Cik Siti’s monthly cash flow. Explain your answer.

(b) Jelaskan aliran tunai Cik Siti jika pendapatan pasifnya tidak wujud dan jumlah perbelanjaan menurun

KBAT sebanyak 10%.

Explain Cik Siti’s cash flow if her passive income does not exist and total expenses decrease by 10%.

(a) Aliran tunai = Jumlah pendapatan – Jumlah perbelanjaan

Cash flow = Total income – Total expenses

= (RM3 500 + RM1 200) – (RM1 800 + RM600)

= RM2 300 (Aliran tunai positif/Positive cash flow)

Aliran tunai positif sebanyak RM2 300 adalah baik kerana Cik Siti boleh menyimpan pendapatan lebihan di

bank dan memperoleh faedah atas simpanan.

A positive cash flow of RM2 300 is good because Cik Siti can keep the surplus of income in the bank and earn

interest on savings.

(b) Aliran tunai = Jumlah pendapatan – Jumlah perbelanjaan

Cash flow = Total income – Total expenses

= RM3 500 – (90% × RM2 400)

= RM3 500 – RM2 160

= RM1 340 (Aliran tunai positif/Positive cash flow)

Aliran tunai positif sebanyak RM1 340 adalah baik kerana Cik Siti boleh melabur atau persediaan menghadapi

situasi kecemasan jika berlaku kelak.

A positive cash flow of RM1 340 is good as Cik Siti can invest or prepare with emergency situation in future. 146 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 146 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 277 – 281

Jawab setiap soalan berikut.

Answer each of the following questions. SP10.1.1 TP4 TP5

1. Jadual di bawah ialah pelan kewangan Encik Sharif, seorang eksekutif jualan di sebuah syarikat swasta.

Lengkapkan pelan kewangan itu dengan menghitung nilai P, Q, R, S dan T.

The following table is the financial plan of Encik Sharif as a sales executive in a private company. Complete the financial

plan by calculating the values of P, Q, R, S and T.

RM

Pendapatan bersih

Net income

Gaji bersih 8 500

Net salary

Pendapatan pasif (sewa diterima)

600

Passive income (rental received)

Jumlah pendapatan bulanan

P = 9 100

Total monthly income

Tolak simpanan tetap bulanan 850

Minus fixed monthly savings

Tolak simpanan untuk dana kecemasan

200

Minus savings for emergency fund

Baki pendapatan

Q = 8 050

Income balance

Tolak perbelanjaan tetap bulanan

Minus monthly fixed expenses

Ansuran pinjaman rumah 1 800

Housing loan instalment

Ansuran kereta

900

Car instalment

Jumlah perbelanjaan tetap bulanan

R = 2 700

Total monthly fixed expenses

Tolak perbelanjaan tidak tetap bulanan

Minus monthly variable expenses

Utiliti rumah

Home utilities

300

Belanja petrol

450

Petrol expenses

Premium insurans

150

Insurance premium

Bayaran tol

Toll payments

180

Barangan dapur

650

Groceries

Pemberian kepada ibu bapa

400

Allowance for parents

Jumlah perbelanjaan tidak tetap bulanan

S = 2 130

Total monthly variable expenses

Pendapatan lebihan T = 3 220

6 147 Surplus of income

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 147 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

2. Cik Aida bekerja sebagai akauntan di sebuah syarikat. Gaji bersihnya sebulan ialah RM3 500. Dia menetapkan

10% daripada gaji bersih setiap bulan sebagai simpanan tetap bulanan dan RM120 sebagai simpanan untuk

dana kecemasan. Jadual di bawah menunjukkan perbelanjaan tetap dan tidak tetap bulanan bagi Cik Aida.

Cik Aida works as an accountant at a company. Her monthly net salary is RM3 500. She sets aside 10% of her monthly

salary as a fixed monthly savings and RM120 as a savings for emergency fund. The table shows Cik Aida’s monthly fixed

and variable expenses.

RM

Ansuran kereta/Car instalment 500

Bayaran tol/Toll payments 180

Belanja petrol/Petrol expenses 450

Barangan dapur/Groceries 300

Sewa rumah/House rental 600

Utiliti rumah/Home utilities 240

Barangan penjagaan diri/Personal care expenses 200

Pemberian kepada ibu bapa/Allowance for parents 350

Lengkapkan pelan kewangan Cik Aida./Complete the financial plan for Cik Aida.

Pendapatan dan perbelanjaan/Income and expenditure RM

Pendapatan bersih/Net income

Gaji bersih/Net salary 3 500

Jumlah pendapatan bulanan/Total monthly income 3 500

Tolak simpanan tetap bulanan/Minus fixed monthly savings 350

Tolak simpanan untuk dana kecemasan 120

Minus savings for emergency fund

Baki pendapatan/Income balance 3 030

Tolak perbelanjaan tetap bulanan/Minus monthly fixed expenses

Ansuran kereta/Car instalment 500

Sewa rumah/House rental 600

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 1 100

Tolak perbelanjaan tidak tetap bulanan

Minus monthly variable expenses

Bayaran tol/Toll payments 180

Barangan dapur/Groceries 300

Belanja petrol/Petrol expenses 450

Utiliti rumah/Home utilities 240

Barangan penjagaan diri/Personal care items 200

Pemberian kepada ibu bapa/Allowance for parents 350

Jumlah perbelanjaan tidak tetap bulanan/Total monthly variable expenses 1 720

Pendapatan lebihan/Surplus of income 210

148 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 148 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

3. Gaji bersih bulanan Encik Chong dan isterinya masing masing ialah RM8 400 dan RM3 500. 10% daripada

gaji bersih mereka diperuntukkan sebagai simpanan tetap bulanan dan RM500 sebagai simpanan untuk

dana kecemasan. Jadual di bawah menunjukkan perbelanjaan tetap dan tidak tetap bulanan bagi keluarga

Encik Chong.

The monthly net salaries of Mr Chong and his wife are RM8 400 and RM3 500 respectively. 10% of their net salary is allocated as

a fixed monthly savings and RM500 as a savings for emergency fund. The table shows the monthly fixed and variable expenses

for Mr Chong’s family.

RM

Ansuran pinjaman rumah/Housing loan instalment 2 500

Ansuran kereta suami/Husband’s car instalment 1 800

Keperluan anak-anak/Children’s needs 400

Utiliti rumah/Home utilities 350

Belanja petrol/Petrol expenses 380

Barangan dapur/Groceries 1 000

Bayaran tol/Toll payments 240

Pemberian kepada ibu bapa/Allowance for parents 450

Taska/Nursery 500

Lengkapkan pelan kewangan keluarga Encik Chong.

Complete the financial plan for Mr Chong’s family.

Pendapatan dan perbelanjaan/Income and expenditure RM

Pendapatan bersih/Net income

Suami/Husband 8 400

Isteri/Wife 3 500

Jumlah pendapatan bulanan/Total monthly income 11 900

Tolak simpanan tetap bulanan/Minus fixed monthly savings 1 190

Tolak simpanan untuk dana kecemasan/Minus savings for emergency fund 500

Baki pendapatan/Income balance 10 210

Tolak perbelanjaan tetap bulanan/Minus fixed monthly expenses

Ansuran pinjaman rumah/Housing loan instalment 2 500

Ansuran kereta suami/Husband’s car instalment 1 800

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 4 300

Tolak jumlah perbelanjaan tidak tetap bulanan

Minus total monthly variable expenses

Keperluan anak-anak/Children’s needs 400

Utiliti rumah/Home utilities 350

Belanja petrol/Petrol expenses 380

Barangan dapur/Groceries 1 000

Bayaran tol/Toll payments 240

Pemberian kepada ibu bapa/Allowance for parents 450

Taska/Nursery 500

Jumlah perbelanjaan tidak tetap bulanan/Total monthly variable expenses 3 320

8 149 Pendapatan lebihan/Surplus of income 2 590

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 149 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 282 – 290

Jawab setiap soalan berikut.

Answer each of the following questions. SP10.1.2 TP4 TP5

1. Jadual di bawah menunjukkan pelan kewangan keluarga Encik Zaim.

The table shows Encik Zaim’s family financial plan.

Pendapatan dan perbelanjaan/Income and expenditure RM

Pendapatan bersih/Net income

Suami/Husband 4 500

Isteri/Wife 3 000

Pendapatan pasif/Passive income 300

Jumlah pendapatan bulanan/Total monthly income 7 800

Tolak simpanan tetap bulanan (10% daripada pendapatan bulanan)

780

Minus fixed monthly savings (10% of monthly income)

Tolak simpanan untuk dana kecemasan/Minus savings for emergency fund 200

Baki pendapatan/Income balance 6 820

Tolak perbelanjaan tetap bulanan/Minus monthly fixed expenses

Ansuran pinjaman rumah/Housing loan instalment 1 800

Ansuran kereta isteri/Wife’s car instalment 700

Premium insurans/Insurance premium 250

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 2 750

Tolak perbelanjaan tidak tetap bulanan/Minus monthly variable expenses

Pendidikan anak-anak/Children’s education 350

Utiliti rumah/Home utilities 300

Belanja petrol/Petrol expenses 400

Bayaran tol/Toll payments 150

Barangan dapur/Groceries 1 400

Pemberian kepada ibu bapa/Allowance for parents 500

Jumlah perbelanjaan tidak tetap bulanan/Total monthly variables expenses 3 100

Pendapatan lebihan/Surplus of income 970

Semasa melaksanakan pelan kewangan tersebut, Encik Zaim dapat mengurangkan perbelanjaan berikut.

While carrying out the financial plan, Encik Zaim was able to reduce the following expenses.

Jenis perbelanjaan/Type of expense Belanja petrol/Petrol expenses Barangan dapur/Groceries

Jumlah pengurangan/Total reduction RM80 RM300

(a) Hitung pendapatan lebihan yang baharu.

Calculate new surplus income.

Pendapatan lebihan baharu = Pendapatan lebihan asal + Jumlah pengurangan belanja

New surplus of income Original surplus of income + Total reduction of expenses

= RM970 + RM380

= RM1 350

150 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 150 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

(b) Matlamat kewangan Encik Zaim adalah ingin membeli sebuah motosikal yang berharga RM6 000 dalam

KBAT masa 8 bulan secara tunai. Adakah matlamat kewangan Encik Zaim boleh dicapai? Beri alasan anda.

Encik Zaim’s financial goal is to buy a motorcycle worth RM6 000 in 8 months in cash. Is Encik Zaim’s financial goal

achievable? Give your reasons.

Jumlah simpanan dalam tempoh 8 bulan/Total savings in 8 months = RM780 × 8 bulan/months = RM6 240

Encik Zaim boleh mencapai matlamat kewangannya untuk membeli sebuah motosikal baharu yang berharga

RM6 000 kerana jumlah simpanannya dalam tempoh 8 bulan berjumlah RM6 240.

Encik Zaim could achieve his financial goal of buying a new motorcycle worth RM6 000 because his savings over

8 months is RM6 240.

2. Cik Susan bekerja sebagai eksekutif kewangan di sebuah bank dengan gaji bersih bulanan sebanyak RM4 800.

Dia merancang bercuti di Filipina dalam masa 6 bulan dan perlu mengumpul RM3 500 untuk membiayai

kos percutian itu. Dia menyimpan 10% daripada gaji bulanan dan RM200 untuk dana kecemasan. Jadual

di bawah menunjukkan maklumat berkaitan dengan perbelanjaan bulanan Cik Susan.

Miss Susan works as a financial executive at a bank with a monthly salary of RM4 800. She plans to go on vacation in Philippines

in 6 months and have to save RM3 500 to cover the cost of the vacation. She saves 10% of her monthly salary and

RM200 for emergency fund. The table shows the information related to Miss Susan’s monthly expenses.

RM

Ansuran pinjaman rumah/Housing loan instalment 1 300

Hiburan/Entertaiment 100

Barangan penjagaan diri/Personal care items 250

Utiliti rumah/Home utilities 120

Tambang pengangkutan awam/Public transport fares 200

Barangan dapur/Groceries 500

Pemberian kepada ibu bapa/Allowance for parents 450

(a) Lengkapkan pelan kewangan Cik Susan.

Complete Miss Susan’s financial plan.

RM

Pendapatan bersih/Net income

Gaji bersih/Net salary 4 800

Jumlah pendapatan bulanan/Total monthly income 4 800

Tolak simpanan tetap bulanan/Minus fixed monthly savings 480

Tolak simpanan untuk dana kecemasan/Minus savings for emergency fund 200

Baki pendapatan/Income balance 4 120

Tolak perbelanjaan tetap bulanan/Minus monthly fixed expenses

Ansuran pinjaman rumah/Housing loan instalment 1 300

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 1 300

Tolak perbelanjaan tidak tetap bulanan/Minus monthly variable expenses

Hiburan/Entertainment 100

Barangan penjagaan diri/Personal care items 250

Utiliti rumah/Home utilities 120

Tambang pengangkutan awam/Public transport fares 200

Barangan dapur/Groceries 500

Pemberian kepada ibu bapa/Allowance for parents 450

Jumlah perbelanjaan tidak tetap bulanan/Total monthly variable expenses 1 620

0 151 Pendapatan lebihan/Surplus of income 1 200

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 151 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

(b) Bolehkah Cik Susan mencapai matlamat kewangan itu? Beri alasan anda.

KBAT Can Miss Susan achieve the financial goals? Give your reason.

Jumlah simpanan dalam masa 6 bulan/Total savings for 6 months

= RM480 × 6 bulan/months

= RM2 880

Cik Susan tidak boleh mencapai matlamat kewangannya untuk bercuti di Filipina yang memerlukan belanja

sebanyak RM3 500 kerana jumlah simpanannya dalam tempoh 6 bulan hanya RM2 880.

Miss Susan cannot achieve her financial goals to go on vacation in Philippines that cost her RM3 500 because her

savings over 6 months is only RM2 880.

3. Encik Fauzan bekerja sebagai jurutera yang berpendapatan bulanan RM8 000. Jadual di bawah menunjukkan

pelan kewangan Encik Fauzan.

Encik Fauzan works as an engineer with a monthly income of RM8 000. The table shows Encik Fauzan’s financial plan.

RM

Pendapatan bersih/Net income

Gaji bersih/Net salary 8 000

Pendapatan pasif/Passive income 0

Jumlah pendapatan bulanan/Total monthly income 8 000

Tolak simpanan tetap bulanan (10% daripada pendapatan bulanan) 0

Minus monthly fixed savings (10% of monthly income)

Tolak simpanan untuk dana kecemasan/Minus savings for emergency fund 300

Baki pendapatan/Income balance 7 700

Tolak perbelanjaan tetap bulanan/Minus monthly fixed expenses

Ansuran pinjaman rumah kedai/Shop lot loan instalment 2 500

Ansuran kereta/Car instalment 1 800

Premium insurans/Insurance premiums 800

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 5 100

Tolak perbelanjaan tidak tetap bulanan/Minus monthly variable expenses

Makanan dan minuman/Food and drinks 900

Pendidikan anak-anak/Children’s education 700

Belanja petrol/Petrol expenses 450

Bil telefon/Telephone bill 300

Bil utiliti/Utility bill 250

Jumlah perbelanjaan tidak tetap/Total monthly variable expenses 2 600

Pendapatan lebihan/Kurangan/Surplus of income/Deficit 0 152 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 152 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

(a) Encik Fauzan ingin membeli sebuah kerusi urut berjenama yang bernilai RM2 400 dalam masa 3 bulan.

Bolehkah Encik Fauzan mencapai matlamat kewangannya?

Encik Fauzan wants to buy a RM2 400 branded massage chair in 3 months. Will Encik Fauzan be able to achieve his

financial goals?

Encik Fauzan tidak boleh mencapai matlamat kewangannya kerana pelan kewangan Encik Fauzan tidak

menetapkan simpanan tetap bulanan sebanyak 10% daripada pendapatan bulanannya.

Encik Fauzan will not be able to achieve his financial goals because Encik Fauzan’s financial plan does not set aside

a fixed monthly savings that is 10% of his monthly income.

(b) Berapakah yang perlu disimpan oleh Encik Fauzan bagi mencapai matlamatnya?

How much does Encik Fauzan have to save to achieve his goals?

Simpanan bulanan/Monthly savings

RM2 400

=

3

= RM800

(c) Sediakan pelan kewangan baharu supaya Encik Fauzan dapat mencapai matlamatnya.

Prepare a new financial plan so that Encik Fauzan able to achieve his goals.

Pelan Kewangan/Financial Plan RM

Pendapatan bersih/Net income

Gaji bersih/Net salary 8 000

Pendapatan pasif/Passive income 0

Jumlah pendapatan bulanan/Total monthly income 8 000

Tolak simpanan tetap bulanan (10% daripada pendapatan bulanan) 800

Minus monthly fixed savings (10% of monthly income)

Tolak simpanan untuk dana kecemasan 300

Minus savings for emergency fund

Baki pendapatan/Income balance 6 900

Tolak perbelanjaan tetap bulanan/Minus monthly fixed expenses

Ansuran pinjaman rumah kedai/Shop lot loan instalment 2 500

Ansuran kereta/Car instalment 1 800

Premium insurans/Insurance premium 800

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 5 100

Tolak perbelanjaan tidak tetap bulanan/Minus monthly variable expenses

Makanan dan minuman/Food and drinks 600

Pendidikan anak-anak/Children’s education 400

Belanja petrol/Petrol expenses 350

Bil telefon/Telephone bill 200

Bil utiliti/Utility bills 250

Jumlah perbelanjaan tidak tetap/Total monthly variable expenses 1 800

2 153 Pendapatan lebihan/Surplus of income 0

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 153 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PBD 10.1 Perancangan dan Pengurusan Kewangan Buku Teks: m.s. 282 – 290

Jawab setiap soalan berikut.

Answer each of the following questions. SP10.1.2 TP3 TP4 TP5

1. Encik Linggam bekerja sebagai eksekutif bank dengan pendapatan bulanan sebanyak RM12 000. Dia ingin

membeli sebuah pangsapuri yang berharga RM768 000 selepas lapan tahun bekerja. Dia bercadang akan

membayar wang pendahuluan sebanyak RM76 800. Jumlah perbelanjaan tetap dan tidak tetap bulanan

Encik Linggam ialah RM8 800.

Mr Linggam works as a bank executive with a monthly income of RM12 000. He wants to buy an apartment worth

RM768 000 after eight years of work. He plans to pay a down payment of RM76 800. The total monthly fixed and variable

expenses of Mr Linggam’s is RM8 800.

(a) Hitung simpanan bulanan yang perlu disimpan oleh Encik Linggam bagi mencapai matlamatnya.

Calculate the monthly savings that Mr Linggam needs to save in order to achieve his goal.

(b) Adakah Encik Linggam bijaksana dari segi pembelian pangsapuri yang berharga RM768 000? Beri

KBAT justifikasi anda.

Is it wise for Mr Linggam to buy an apartment worth RM768 000? Justify your answer.

(a) Simpanan tahunan yang diperlukan (b) Tidak. Walaupun Encik Linggam boleh membayar wang

Annual savings needed pendahuluan RM76 800, ansuran bulanan pangsapuri

RM76 800 yang perlu dibayar itu membebankannya kerana jumlah

=

8 tahun/year perbelanjaan adalah tinggi.

= RM9 600 No. Although Mr Linggam is able to pay the down payment

of RM76 800, his monthly housing loan instalment can

Simpanan bulanan yang diperlukan burden him due to high expenses.

Monthly savings needed

RM9 600

=

12 bulan/months

= RM800

2. Encik Jamal dan isterinya ingin membeli sebuah kedai yang berharga RM1 200 000 dalam masa sepuluh

tahun selepas mereka berkahwin dengan wang pendahuluan sebanyak RM120 000. Jumlah pendapatan

mereka berdua ialah RM20 000 dan jumlah perbelanjaan tetap dan tidak tetap ialah RM3 000.

Encik Jamal and his wife want to buy a shop lot for RM1 200 000 within ten years of their marriage with a down payment

of RM120 000. Their total income is RM20 000 and their total fixed and variable expenses is RM3 000.

(a) Berapakah simpanan bulanan yang perlu disimpan oleh Encik Jamal dan isterinya bagi mencapai

matlamat itu?

How much monthly savings Encik Jamal and his wife must save in order to achieve their goal?

(b) Adakah Encik Jamal bijaksana dari segi pembelian kedai yang berharga RM1 200 000? Beri justifikasi

KBAT anda.

Is it wise for Encik Jamal to buy a shop lot worth RM1 200 000? Justify your answer.

(a) Simpanan tahunan yang diperlukan (b) Ya. Encik Jamal boleh membayar wang pendahuluan

Annual savings needed RM120 000 kerana jumlah simpanannya untuk tempoh

RM120 000 10 tahun ialah RM240 000 (10% × RM20 000 × 120

=

10 tahun/years bulan). Jumlah perbelanjaan tetap dan tidak tetap bulanan

= RM12 000 juga tidak begitu tinggi. Kedai yang dibeli itu juga boleh

disewakan kepada peniaga untuk menjana pendapatan

Simpanan bulanan yang diperlukan pasif kepada Encik Jamal.

Monthly savings needed Yes. Encik Jamal is able to pay the down payment of RM120 000

=

RM12 000 because the total savings in 10 years is RM240 000 (10% ×

12 bulan/months RM20 000 × 120 months). The total fixed and variable

= RM1 000 expenses is also not very high. The shop lot purchased may

also be leased to the trader to generate passive income for

Encik Jamal. 154 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 154 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PRAKTIS KE ARAH SPM KERTAS 1

1. Jadual di bawah menunjukkan pendapatan 4. Pendapatan aktif Puan Fatin ialah RM2 100.

Encik Kelvin. Perbelanjaan tetap dan perbelanjaan tidak tetapnya

The table shows Mr Kelvin’s income. masing-masing ialah RM3 600 dan RM1 400.

Gaji/Salary RM2 800 Berapakah pendapatan pasif Puan Fatin supaya

aliran tunai dalam bulan itu adalah positif?

Elaun/Allowance RM300 An active income of Puan Fatin is RM2 100. Her fixed

Sewa diterima/Rental received RM550 expenses and variable expenses are RM3 600 and

RM1 400 respectively. What is the passive income of Puan

Dividen/Dividend RM250 Fatin so the cash flow of the month is positive?

A RM2 200 B RM2 500

Hitung pendapatan aktif Encik Kelvin.

Calculate active income of Mr Kelvin. C RM2 900 D RM3 200

A RM2 800 B RM2 300

C RM3 100 D RM3 650 5. Pendapatan aktif dan pendapatan pasif Cik Mimi

masing-masing ialah RM3 250 dan RM1 860

2. Pendapatan aktif dan pendapatan pasif Encik Tan manakala perbelanjaan tetap dan perbelanjaan

pada bulan Januari masing-masing ialah RM4 350 tidak tetap masing-masing ialah RM2 820 dan

dan RM2 100. Perbelanjaan tetap dan perbelanjaan RM950. Pada bulan kedua, pendapatan aktif

tidak tetapnya dalam bulan yang sama masing- Cik Mimi kekal sama tetapi pendapatan pasif

masing ialah RM2 600 dan RM980. Berapakah berkurang sebanyak 20%. Pada masa yang sama,

aliran tunai bulanan Encik Tan? perbelanjaan tetap dan perbelanjaan tidak tetapnya

An active income and a passive income of Mr Tan in January masing-masing meningkat sebanyak RM320 dan

are RM4 350 and RM2 100 respectively. His fixed expenses

and variable expenses in the same month are RM2 600 RM400. Hitung aliran tunai bulanan Cik Mimi

and RM980 respectively. What is the monthly cash flow of pada bulan itu.

Mr Tan? An active income and a passive income of Cik Mimi are

RM3 250 and RM1 860 respectively while her fixed expenses

A RM1 050

and variable expenses are RM2 820 and RM950 respectively.

B RM1 480 For the second month, Cik Mimi’s active income is remained

C RM1 750 the same and her passive income decrease by 20%. At

D RM2 870 the same time, her fixed expenses and variable expenses

increase RM320 and RM400 respectively. Calculate

3. Jadual di bawah menunjukkan pendapatan dan Cik Mimi’s monthly cash flow of the month.

perbelanjaan bagi 4 orang individu. A RM178 B RM248

The table shows the income and expenses for 4 individuals. C RM278 D RM348

Pendapatan Perbelanjaan

Income Expenses 6. Jadual di bawah menunjukkan perbelanjaan

Individu keluarga Encik Alif.

Individual Aktif Pasif Tetap Tidak Tetap

Active Passive Fixed Variable The table shows the expenses of Encik Alif’s family.

(RM) (RM) (RM) (RM)

Sewa rumah/House rental RM750

Albert 3 000 600 1 800 350

Bayaran tol/Toll payment RM90

Salman 3 200 800 2 000 400

Barang runcit/Groceries RM500

Maniam 4 000 1 000 3 500 900

Ansuran kereta/Car instalment RM600

Raj Singh 4 800 700 3 900 600

Bil utiliti/Utility bills RM400

Siapakah yang mempunyai aliran tunai yang lebih

banyak? Hitung perbelanjaan tidak tetap Encik Alif.

Who has more cash flow? Calculate the variable expenses of Encik Alif.

A Albert A RM490

B Salman B RM990

C Maniam C RM1 250

4 155 D Raj Singh D RM1 350

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 155 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PRAKTIS KE ARAH SPM KERTAS 2

SPM Bahagian A

1. Jadual di bawah menunjukkan pendapatan dan perbelanjaan Puan Shima.

The table shows an income and expenses of Puan Shima.

Gaji/Salary RM5 000

Komisen/Commission RM400

Ansuran rumah/House instalment RM700

Makanan/Food RM800

Petrol RM300

Puan Shima menyimpan 10% daripada jumlah pendapatan dan RM200 untuk dana kecemasan. Hitung

pendapatan lebihan Puan Shima.

Puan Shima kept 10% of total income and RM200 for emergency fund. Calculate the surplus of income of Puan Shima.

[4 markah/4 marks]

Jawapan/Answer:

Baki pendapatan/Income balance

= RM5 400 – RM540 – RM200

= RM4 660

Lebihan/Surplus

= RM4 660 – RM700 – RM800 – RM300

= RM2 860

2. Maklumat di bawah berkaitan dengan pelan kewangan Puan Emelda.

The information below is related to Puan Emelda’s financial planning.

Pendapatan bersih/Net income

Gaji/Salary RM4 500

Bajet perbelanjaan/Expense budget

Ansuran rumah/Housing instalment RM900

Ansuran kereta/Car instalment RM600

Bil utiliti/Utility bills RM400

Bayaran tol/Tol payments RM150

Barangan dapur/Groceries RM1 000

Pemberian kepada ibu bapa/Allowances for parents RM500

Simpanan/Savings RM600

Hitung aliran tunai Puan Emelda. Jelaskan jawapan anda.

Calculate of Puan Emelda’s cash flow. Explain your answer.

[3 markah/3 marks]

Jawapan/Answer:

Aliran tunai = Jumlah pendapatan – Jumlah perbelanjaan

Cash flow Total income – Total expenses

= RM4 500 – (RM900 + RM600 + RM400 + RM150 + RM1 000 + RM500 + RM600)

= RM4 500 – RM3 650

= RM850

Aliran tunai positif sebanyak RM850 adalah baik kerana Puan Emelda boleh menyimpan wang itu dan menghadapi

situasi kecemasan.

A positif cash flow of RM850 is good because Puan Emelda can save the money and deal with emergency situations. 156 1

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 156 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

SPM Bahagian B

3. Encik Boon bekerja sebagai seorang pengurus hotel di sebuah hotel bertaraf 3 bintang dengan gaji bersih

bulanan RM4 500. Dia juga menjadi ejen jurujual minyak wangi dan menerima komisen jualan sebanyak

RM400. Anggaran perbelanjaan bulanannya adalah seperti berikut.

Mr Boon works as a hotel manager at a 3-star hotel with a monthly net salary of RM4 500. He also works as a perfume sales

agent and receive a sales commission of RM400. His estimated monthly expenses as the following.

Perbelanjaan bulanan/Monthly expenses RM

Makan di restoran mewah/Eat at a luxury restaurant 150

Melancong/Travel 900

Bil utiliti/Utility bills 170

Perbelanjaan tol dan petrol/Toll and petrol expenses 250

Bil internet/Internet bill 120

Ansuran pinjaman rumah/Housing loan instalment 800

Makanan dan minuman/Food and drinks 1 200

Insurans/Insurance 400

(a) Encik Boon menetapkan 10% daripada gajinya sebagai simpanan tetap bulanan untuk mencapai matlamat

kewangannya. Lengkapkan pelan kewangan peribadi bulanan Encik Boon di ruang jawapan.

Mr Boon set aside 10% of his salary as a fixed monthly savings in order to achieve his financial goals. Complete a monthly

personal financial plan of Mr Boon in the answer space.

(b) Berikan komen tentang lebihan atau kurangan yang dialami oleh Encik Boon berdasarkan pelan kewangan ini.

Give comment on the surplus or deficits that will be experienced by Mr Boon based on this financial plan.

[9 markah/9 marks]

Jawapan/Answer:

(a) Pelan Kewangan/Financial Plan RM

Pendapatan bersih/Net income

Gaji/Salary 4 500

Pendapatan pasif/Passive income 400

Jumlah pendapatan bulanan/Total monthly income 4 900

Tolak simpanan tetap bulanan/Minus fixed monthly savings 490

Baki pendapatan/Income balance 4 410

Jumlah perbelanjaan tetap bulanan/Total monthly fixed expenses 1 200

Jumlah perbelanjaan tidak tetap/Total monthly variable expenses 2 790

Pendapatan lebihan/kurangan/Surplus of income/Deficit 420

(b) Aliran tunai positif sebanyak RM420 adalah baik kerana Encik Boon boleh menyimpan wang tersebut di

bank dan menikmati faedah atas simpanan. Faedah ini merupakan pendapatan pasif bagi Encik Boon.

A positive cash flow of RM420 is good because Mr Boon can save the money into the bank and enjoy the interest

on savings. This interest is a passive income for Mr Boon.

6 157

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 157 11/25/20 9:16 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

4. Maklumat di bawah berkaitan dengan pelan kewangan Encik Ramli.

The information below is related to Encik Ramli’s financial planning.

Pendapatan bersih/Net income

Gaji/Salary RM3 200

Elaun/Allowance RM400

Sewa diterima/Rental received RM600

Bajet perbelanjaan/Expenses budget

Ansuran rumah/Housing instalment RM700

Ansuran kereta/Car instalment RM450

Premium insurans/Insurance premiums RM200

Makanan/Food RM400

Petrol RM200

Bayaran tol/Toll payments RM180

Bil utiliti/Utility bills RM300

Encik Ramli menyimpan 10% daripada jumlah pendapatan bulanannya.

Encik Ramli saves 10% of his total monthly income.

(a) Hitung/Calculate

(i) pendapatan aktif. (ii) pendapatan pasive.

the active income. the passive income.

(iii) perbelanjaan tetap. (iv) perbelanjaan tidak tetap.

the fixed expenses. the variable expenses.

(b) Berapakah aliran tunai bulanan Encik Ramli? Jelaskan jawapan anda.

What is the monthly cash flow of Encik Ramli? Explain your answer.

(c) Encik Ramli ingin menyimpan RM90 000 dalam masa empat tahun dari sekarang. Hitung simpanan

bulanan tambahan yang diperlukan.

Encik Ramli wants to save RM90 000 in 4 years since now. Calculate the additional monthly savings needed.

[10 markah/10 marks]

Jawapan/Answer:

(a) (i) Pendapatan aktif/Active income = RM3 200 + RM400

= RM3 600

(ii) Pendapatan pasif/Passive income = RM600

(iii) Perbelanjaan tetap/Fixed expenses = RM700 + RM450 + RM200

= RM1 350

(iv) Perbelanjaan tidak tetap/Variable expenses = RM400 + RM200 + RM180 + RM300

= RM1 080

(b) Simpanan bulanan 10%/Monthly savings 10%

= 10% × (RM3 200 + RM400 + RM600)

= RM420

Aliran tunai bulanan/Monthly cash flow

= RM4 200 – RM420 – RM1 350 – RM 1 080

= RM1 350

(Aliran tunai positif/Positive cash flow)

RM90 000

(c) Simpanan bulanan/Monthly savings needed = = RM1 875

48 bulan/months

Simpanan bulanan tambahan diperlukan/Additional monthly savings needed

= RM1 875 – (RM420 + RM1 350)

= RM105

158

10 MAMD MATEMATIK TG4 (NM)-BAB 10-Azie F.indd 158 11/25/20 9:16 AM

You might also like

- Form 4 Bab 10 Matematik Pengguna Pengurusan KewanganDocument3 pagesForm 4 Bab 10 Matematik Pengguna Pengurusan Kewanganazz100% (2)

- Bab 4 Pengurusan KewanganDocument22 pagesBab 4 Pengurusan Kewanganjokydin92100% (1)

- Bab 1 - Pengenalan Accounting 1Document11 pagesBab 1 - Pengenalan Accounting 1mohd firdaus muhamad hanafi91% (58)

- Latihan PDPR 8feb2022Document3 pagesLatihan PDPR 8feb2022Jun JunaiNo ratings yet

- 10 Buku Teks BM Mat KSSM Ting4 Bab 10 Matematik Pengguna PengurusanDocument23 pages10 Buku Teks BM Mat KSSM Ting4 Bab 10 Matematik Pengguna PengurusanMahadi HamidNo ratings yet

- Slide Chapter 10 Maths PresentationDocument12 pagesSlide Chapter 10 Maths PresentationSaahaana YuvarajanNo ratings yet

- Pengurusan Kewangan Bagi IndividuDocument2 pagesPengurusan Kewangan Bagi IndividuaisyahNo ratings yet

- Pengurusan Kew BerkesanDocument30 pagesPengurusan Kew Berkesannorlizakuak54No ratings yet

- Presentation 2Document10 pagesPresentation 2Sam Kit YapNo ratings yet

- Nota Matematik f4Document9 pagesNota Matematik f4Ummu HusnaNo ratings yet

- Tugasan 1Document1 pageTugasan 1NUR RAIHAN BINTI ABDUL RAHIM MoeNo ratings yet

- Kuliah 12 - Penyata Kewangan DiterbitkanDocument46 pagesKuliah 12 - Penyata Kewangan DiterbitkanMeshayu RenaNo ratings yet

- Bab 4 KewanganDocument17 pagesBab 4 KewanganDaughterOfMaLovelydadNo ratings yet

- Koperasi Penyata KewanganDocument15 pagesKoperasi Penyata Kewanganain sufizaNo ratings yet

- Bab 4 Kewangan TehahDocument13 pagesBab 4 Kewangan TehahNoorulMJNo ratings yet

- Rpt-P.akaun-T5-Smk-Smk HKDocument19 pagesRpt-P.akaun-T5-Smk-Smk HKPRAVINA A/P VADIVEL MURUGAN MoeNo ratings yet

- Penyediaan Penyata KewanganDocument21 pagesPenyediaan Penyata KewanganmahlidarkemoNo ratings yet

- Tajuk Kerja Projek ASK T3 SMKAS 2021Document2 pagesTajuk Kerja Projek ASK T3 SMKAS 2021eowyyNo ratings yet

- Pengurusan Kewangan KomprehensifDocument2 pagesPengurusan Kewangan Komprehensifnorazmi88100% (4)

- Kumpulan 3Document12 pagesKumpulan 3Buat KerjaNo ratings yet

- Prinsip Perakaunan Tingkatan 4Document40 pagesPrinsip Perakaunan Tingkatan 4Wan Hairulnisha Wan HassanNo ratings yet

- Akauntabiliti 1 2021Document80 pagesAkauntabiliti 1 2021Zainab Mustapa100% (1)

- Chantel - Laporan Tugasan Berkumpulan Pengurusan PerniagaanDocument7 pagesChantel - Laporan Tugasan Berkumpulan Pengurusan PerniagaanN Fatini FatahNo ratings yet

- Bab 4 - Pengurusan KewanganDocument22 pagesBab 4 - Pengurusan KewanganAnneMagdaleneNo ratings yet

- PBL Math Chap 10Document10 pagesPBL Math Chap 10RazyqNo ratings yet

- RPT Prinsip Akaun t5 2020Document17 pagesRPT Prinsip Akaun t5 2020Irfan AqilNo ratings yet

- Bab 1 Kewangan PerniagaanDocument23 pagesBab 1 Kewangan PerniagaanHilman LimNo ratings yet

- RPT P.akaun T5 2022Document19 pagesRPT P.akaun T5 2022ZackY AmpangNo ratings yet

- E-RPH MINGGU 3 NewDocument13 pagesE-RPH MINGGU 3 NewAkma JamaliNo ratings yet

- 4.0 Kewangan 2020Document33 pages4.0 Kewangan 2020RBT1-0623 Khaw Jia XinNo ratings yet

- Pengurusan KewanganDocument5 pagesPengurusan KewanganAerwin eusofNo ratings yet

- Tugasan 2 Bab 4Document4 pagesTugasan 2 Bab 4Sharmita SivalingamNo ratings yet

- Introductory FinanceDocument11 pagesIntroductory FinanceSobanah ChandranNo ratings yet

- Modul 1Document7 pagesModul 1NURUL SHAHRINI KASIANNo ratings yet

- RPH Cikgu Ija 2017Document7 pagesRPH Cikgu Ija 2017dien-dianNo ratings yet

- Perancangan Dan Ramalan Kewangan (Tajuk 4)Document26 pagesPerancangan Dan Ramalan Kewangan (Tajuk 4)Farhan PaanNo ratings yet

- MAKALAH M. KeuanganDocument12 pagesMAKALAH M. KeuanganDiana SalsabilaNo ratings yet

- Bab 1 Kewangan Perniagaan Updated 131106Document30 pagesBab 1 Kewangan Perniagaan Updated 131106Safwan ImanNo ratings yet

- RPH 1Document8 pagesRPH 1tsenwanyeeNo ratings yet

- Isi RP (DPK) LastDocument27 pagesIsi RP (DPK) LastakmalNo ratings yet

- AKAUNTABILITIDocument42 pagesAKAUNTABILITIammarsyahmiNo ratings yet

- Celik Wang - Bab 2 (Secured) PDFDocument24 pagesCelik Wang - Bab 2 (Secured) PDFNur IzzNo ratings yet

- LTKK 2014 - 0Document304 pagesLTKK 2014 - 0Irsyad QomarNo ratings yet

- T4 10matematik Pengguna - Pengurusan KewanganDocument14 pagesT4 10matematik Pengguna - Pengurusan KewanganNurrawaida Abdul ManapNo ratings yet

- Bab 4 Kewangan - Perancangan Dan Ramalan KewanganDocument12 pagesBab 4 Kewangan - Perancangan Dan Ramalan KewanganCu Are0% (1)

- Menetapkan Matlamat Kewangan Yang SDocument5 pagesMenetapkan Matlamat Kewangan Yang Salcf99No ratings yet

- Chapter 1Document4 pagesChapter 1Nor Hanisah IshakNo ratings yet

- PS 6 Garis Panduan Pemantapan Penubuhan PTJDocument16 pagesPS 6 Garis Panduan Pemantapan Penubuhan PTJYeeHueyYinoNo ratings yet

- 6.0 Penyata KewanganDocument4 pages6.0 Penyata KewanganNorzulsuriana YahayaNo ratings yet

- 3.4.1-3.4.3 - Penyata Kewangan PerniagaanDocument3 pages3.4.1-3.4.3 - Penyata Kewangan PerniagaanNoorlyda Abdul LatipNo ratings yet

- Tajuk 4 ProfromaDocument29 pagesTajuk 4 ProfromaJoseph Ignatius LingNo ratings yet

- Akauntabiliti Dalam Pengurusan Kewangan SekolahDocument46 pagesAkauntabiliti Dalam Pengurusan Kewangan SekolahDahlan HamNo ratings yet

- Kerja FaizDocument10 pagesKerja FaizVladimir PutinNo ratings yet

- Format Aspek Perincian Markah PenuhDocument1 pageFormat Aspek Perincian Markah PenuhjiaenNo ratings yet

- 1 Modul 1 Pengenalan Kepada PerakaunanDocument8 pages1 Modul 1 Pengenalan Kepada PerakaunanMidya Junick100% (1)

- SENARAI-KANDUNGAN-FAIL-PANITIA 2021 - Kemaskini 9 Nov 2021Document1 pageSENARAI-KANDUNGAN-FAIL-PANITIA 2021 - Kemaskini 9 Nov 2021SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- RPH Noorsyafiza Abdrahman Maths Form4 KSSMDocument2 pagesRPH Noorsyafiza Abdrahman Maths Form4 KSSMSOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Modul Kokurikulum MBK 2018Document63 pagesModul Kokurikulum MBK 2018SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Kertas Konsep Pertandingan Silat Seni KUCHING 2023Document7 pagesKertas Konsep Pertandingan Silat Seni KUCHING 2023SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- PPP (Persatuan Ibu Bapa-Guru) 1998Document10 pagesPPP (Persatuan Ibu Bapa-Guru) 1998SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Rancangan Jangka Panjang DLPDocument2 pagesRancangan Jangka Panjang DLPSOFIA IVYINNA AK ALBERT NYAWIN Moe100% (1)

- Susun Atur Calon Ujian Amali Sains SPM 2022Document1 pageSusun Atur Calon Ujian Amali Sains SPM 2022SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Laporan Emis Makmal Okt 2021Document21 pagesLaporan Emis Makmal Okt 2021SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Laporan Pembudayaan Amali Sains (Pass) 2021 - 24 Ogos 2021Document5 pagesLaporan Pembudayaan Amali Sains (Pass) 2021 - 24 Ogos 2021SOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet

- Penggunaan KalkulatorDocument14 pagesPenggunaan KalkulatorSOFIA IVYINNA AK ALBERT NYAWIN MoeNo ratings yet