Professional Documents

Culture Documents

The Impact of Religious Obligation, Sharia Financial Literacy, and Promotion On Decision To Use The BSI Hasanah Card in Millenials Through Customer Awareness As A Mediation Variable

Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Impact of Religious Obligation, Sharia Financial Literacy, and Promotion On Decision To Use The BSI Hasanah Card in Millenials Through Customer Awareness As A Mediation Variable

Copyright:

Available Formats

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Impact of Religious Obligation, Sharia Financial

Literacy, and Promotion on Decision to Use the BSI

Hasanah Card in Millenials Through Customer

Awareness as a Mediation Variable

Abyan Naufal Asyhar Dudi Permana

Postgraduate Student, Faculty of Economics and Business Postgraduate Lecturer, Faculty of Economics and Business

Universitas Mercu Buana, Jakarta, Indonesia Universitas Mercu Buana, Jakarta, Indonesia

Abstract:- The purpose of this study is to investigate the One of the most significant increases is seen in the

effects of Religious Obligation, Sharia Financial increase in assets at Bank Syariah Indonesia as a result of

Literacy, and Promotion on the Decision to Use the BSI the merger of three banks. On February 1, 2021, the largest

Hasanah Card in millennials, using Customer Sharia in Indonesia, namely Bank Syariah Mandiri, BNI

Awareness as a Mediation Variable. The population of Syariah, and BRI Syariah, will be established. This asset

this study consists of 184,400 millennial consumers who increase to 270 trillion makes BSI the 10th largest bank in

use the BSI Hasanah Card financial product. 384 people Indonesia. The following is an initial description of the

were interviewed. As a data source, primary data is increase in BSI assets when they merge in early February

used, and questionnaires are used as a survey method. 2021. (The Finance, 2021).

The SEM-PLS analysis technique is used in this study.

The study's findings show that: (1) Religious Obligation BSI provides a variety of services and products to

has a positive and significant effect on Customer contribute to society and have aided many community

Awareness. (2) Sharia Financial Literacy has been activities in the form of savings, both individual and

demonstrated to have a positive and significant impact corporate, investments, digital banking, money transfers,

on Customer Awareness. (3) Promotion has been shown payments to lending (bankbsi, 2021). Credit card issuance

to have a significant and positive impact on customer is one of the products offered by both Islamic and

awareness. (4) Customer awareness has a significant conventional banks (Raharjo and Kristyanto, 2019).

and positive influence on the decision to use. (5)

Religious Obligation has been shown to have a positive A Sharia Credit Card cannot be used for transactions

and significant influence on Customer Awareness- that are not Sharia compliant. Transactions that are

mediated Decision to Use. (6) Sharia Financial Literacy prohibited by Islamic Sharia, both in terms of goods and

has a positive and significant impact on the decision to services, are not permitted to use a Sharia credit card. Then,

use, which is mediated by Customer Awareness. (7) for two main reasons, the prohibition of interest (riba)

Promotion has been shown to have a positive and becomes a critical point in Islamic banking. First, the

significant impact on user decisions that are mediated exchange of monetary values on the subject of monetary

by Customer Awareness. values has been prohibited, and both asset suppliers have

been asked to share the risks that their capital users face.

Keywords:- Religious Obligation, Sharia Financial More specifically, usury refers to the addition, Increase,

Literacy, Promotion, Decision to Use. growth, and expansion to be paid money borrower. To

lenders other than the loan's principal or money maturity

I. INTRODUCTION extension (Jamshidi and Hussin, 2018). Increases in money

in exchange for this are strictly prohibited in Sharia, and

Islamic banking is currently expanding. Islamic economic institutions must comply.

banking is rapidly expanding (Marimin, Romdhoni and

Fitria, 2015). This trend can be seen in a number of Currently, the Sharia credit card is one of the most

countries, and it is accelerating. One of them is in popularly used banking products for payment. The BSI

Indonesia, where the community's economic activities are Hasanah Card is a sharia-compliant financing card provided

inextricably linked to the role of financial institutions. by PT Bank Syariah Indonesia Tbk (bankbsi, 2021). BSI

Based on data, the graph below depicts an increase in Hasanah Card users currently number 478,000, with

Islamic Banking Assets in Indonesia. In 2021, recorded approximately 184,400 being Millennials (bankbsi, 2022).

assets owned by Islamic Banking totaled 676,753 billion

Rupiah. According to OJK data (2021), there is growth. It

grows and improves year after year. It is very intriguing to

use Islamic banks for muamalah.

IJISRT23FEB797 www.ijisrt.com 1053

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

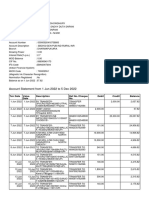

Table 1 BSI Hasanah Card Users by Ages

KATEGORI USIA TAHUN

2017 2018 2019 2020 2021 2022

21-24 10 30 250 1.100 3.100 3.500

25-40 75.400 84.700 103.250 127.000 174.700 184.400

41-56 146.800 156.000 166.800 176.600 206.300 215.400

57> 62.800 64.300 65.700 66.300 73.000 74.700

TOTAL 285.010 305.030 336.000 371.000 458.000 478.000

Source : Bank Syariah Indonesia (Data diolah)

According to the above phenomenon, there is an influences the decision to purchase Islamic financial

increase in the use of credit cards. This demonstrates a shift products.

in millennials' habits from traditional modes of exchange to

E-Wallets, credit cards, debit cards, and so on. It is referred Based on the foregoing, a study titled "The Influence

to as a cashless society (Rif'ah, 2019). Millennial behavior, of Religious Obligation, Sharia Financial Literacy, and

on the other hand, is currently quite consumptive and Promotion on the Decision to Use the BSI Hasanah Card

lacking in financial management. Because of their lack of for Millennials Through Customer Awareness as a

financial literacy, millennials tend to fail to manage their Mediation Variable" was conducted.

finances (Azizah, 2020).

II. THEORITICAL REVIEW AND HYPOTHESIS

Consumers' decisions to choose Islamic financial DEVELOPMENT

institutions and their products are influenced by their

religious beliefs. According to Usman et al. (2017)'s Consumer Behaviour:

research, Religious Obligation influences the selection of According to Schiffman (2015), is a consumer activity

Islamic banks for traditional groups, but not for that involves searching for, purchasing, using, evaluating,

contemporary groups. and spending money on products and services that are

expected to meet consumer needs. An individual who

Furthermore, Sharia Financial Literacy adequacy is an makes decisions to produce available resources of goods or

important factor in the decision to use Islamic banking services offered for sale in marketing is referred to as a

products. According to the 2016 Financial Services consumer. Consumer behavior or customer behavior,

Authority Regulation (POJK), financial literacy is an effort according to Park and Tran (2018), is a response to

to achieve prosperity. Knowledge, beliefs, and skills are consumer behavior toward employee performance and

required to improve the quality of decision making and behavior that can be customer-oriented originating from

financial management, which can influence attitudes and internal marketing.Maintaining the Integrity of the

behavior. Panghayo and Musdolifah (2018) contend that Specifications.

knowledge influences the selection of Islamic financial

services. Then, according to Margaretha and Sari (2015), Religious Obligation:

financial literacy has a significant influence on credit card It is defined by Rois (2016) as a condition that exists

use. This is consistent with the findings of Scheresberg within a person that encourages them to behave in

(2013), who discovered differences in financial literacy accordance with their level of obedience to their religion.

among postgraduate, undergraduate, and only high school Each individual's level of religiosity raises an understanding

graduates. As a result, the higher one's level of education, of the existence of Maslahah for the goods or services they

the greater one's level of financial literacy. use, which may be different. Beliefs, religious practices,

experience, religious knowledge, and religious practices are

Furthermore, the promotion factor becomes a all indicators of religious commitment, according to Ayu

decision-making factor when using Sharia Credit Card (2020).

products. Alfiyyah, Suryani, and Nugraheni claim (2021).

Promotion has a significant impact on Hasanah Card usage. Sharia Financial Literacy:

Then, according to Hasibuan, Saparudin, and Sugianto's Azizah (2020) defines financial literacy as the

(2022) research, promotion has a positive and significant possession of knowledge, skills, and beliefs that influence

effect on Hasanah Card usage. Ulfa and Sulistyorini (2018) attitudes and behavior in order to improve the quality of

agree that promotion has a positive and partially significant decision making and financial management in order to

influence on the decision to use financial products. achieve wealth. Islamic financial literacy, according to

Rahim (2016), is a person's ability to use financial

Customer awareness is another factor that influences knowledge, skills, and attitudes to manage their financial

whether or not to use Islamic financial products. Customer resources in accordance with Islamic teachings.

Awareness was added as a moderating variable by Jamshidi

and Hussin (2015) to determine the use of Islamic credit Promotion:

card products. Customers will use a product if they are According to Kotler, Philip, and Armstrong (2018),

aware of its features and benefits, according to him. promotional activities are activities that function to

Tajudin and Mulazid (2017) contend that awareness persuade customers to buy a product or service by

IJISRT23FEB797 www.ijisrt.com 1054

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

displaying it to them. According to Hermawan in Bulan and products. According to Ramli et al (2020), customer

Azmi (2019), promotion is a marketing activity that awareness influences the decision to use a product.

informs customers that a company is launching new

products and encourages them to buy. Promotion has an Decision to Use:

effect on service quality in the Islamic banking industry, The decision to use is associated with the purchasing

according to Bruin et al (2021). Customer satisfaction is decision theory, according to which Kotler and Armstrong

influenced by service quality. (2018) state that this purchase decision is a stage in making

a purchase decision where consumers carry out actual

Customer Awareness: buying activities. Purchasing decisions, according to Alma

According to Raj and Rajan (2018), Customer (2016), are consumer decisions influenced by economics,

Awareness is a component of a company's marketing and finance, technology, politics, culture, products, prices,

communications strategy. It's a process that helps locations, promotions, physical evidence, people, and

entrepreneurs educate customers about their company, its process.

performance, and the products or services they offer. A

well-designed awareness program ensures better customer Theoretical Framework and Hypothesis:

engagement and protects welfare consumers. Then, Based on the above description, the following

according to Basheer et al. (2017), increased customer Theoretical Framework was developed:

awareness will increase the use of Islamic banking

Fig 1 Theoretical Framework

The following is the structured hypothesis based on the III. METHODOLOGY

model:

H1: Religious Obligation has a positive and statistically This study employs a quantitative survey research

significant effect on Customer Awareness. method. The study's goal is to determine the effect of

H2: Sharia Financial Literacy has a positive and religious obligation, promotion, and Sharia financial

statistically significant impact on Customer Awareness. literacy on the decision to use the BSI Hasanah Card in

H3: Promotion has a significant and positive impact on Millennials using customer awareness as a moderator

customer awareness. variable. The population used is millennial BSI Hasanah

H4: Customer awareness influences the decision to use Card Users, with a sample size of 384 samples based on the

the BSI Hasanah Card in a positive and significant way. Krejcie and Morgan (1970) table. SmartPLS 3.2.9 software

H5: Through customer awareness, religious obligation was used to test the research hypothesis using the Partial

has a positive and significant effect on the decision to Least Square (PLS) based Structural Equation Model

use the BSI Hasanah Card. (SEM) method.

H6: Through customer awareness, Islamic Financial

Literacy has a positive and significant influence on the IV. RESULT AND DISCUSSION

decision to use the BSI Hasanah Card.

H7: Through customer awareness, promotion has a Characteristics of Respondents:

positive and significant effect on the decision to use the Based on the questionnaire distributed in accordance

BSI Hasanah Card. with the necessary respondent criteria. The questionnaire

was completed by 384 respondents in the millennial age

group. It is well known that the characteristics of

IJISRT23FEB797 www.ijisrt.com 1055

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

respondents are based on their gender, income, profession, employees dominated respondents' occupations, accounting

and place of residence. Of the 384 respondents, 229 were for up to 240 (or 62%). Domicile respondents are

male, accounting for 59.6%, with the remaining 40.4% dominated by those who live in Jabodetabek Regions 1 and

being female. The majority of respondents, 241 or 63%, 2, accounting for 223 (58.07%).

earn between Rp. 5,000,001 and Rp. 10,000,000. Private

Outer Model:

According to the loading factor if the value is 0.6, the results are considered valid. If the Outer Loading value is 0.50 and the

AVE value in each construct is greater than 0.5, the PLS model is declared convergently validated (Ghozali and Latan, 2015)

Table 2 Convergent Validity Test Result

Variable Indicators Outer Loading Value AVE Value

Religious Obligation X1.1-X1.5 0.825-0863 0,717

Sharia Financial Literacy X2.1-X2.6 0.633-0.818 0,504

Promotion X3.1-X3.5 0.625-0.799 0,515

Customer Awareness Z1.1-Z1.3 0.634-0.842 0,574

Decision to Use Y1.1-Y1.5 0.657-0.839 0,537

Source : Data processed using SmartPLS, 2022

This variable who were in reliability test also showed that all research variables have Cronbach's Alpha > 0.6 and Composite

Reliability > 0.7, so it can be interpreted that all variables have a high level of reliability.

Table 3 Construct Reliability Test

Variable Cronbach’s Alpha Composite Reliability

Religious Obligation (X1) 0.902 0,927

Sharia Financial Literacy (X2) 0,752 0,834

Promotion (X3) 0,766 0,841

Customer Awareness (Y) 0,647 0,796

Decision to Use (Z) 0,786 0,850

Source : Data processed using SmartPLS, 2022

Inner Model Evaluation:

Determinant Coefficient (R2)

Table 4 Construct Reliability Test

Variable R-Square R-Square Adjusted

Customer Awareness 0.358 0.353

Decision to Use 0.155 0.153

Source : Data processed using SmartPLS, 2022

According to the R2 test results, the value of R Square Customer Awareness and Decision to Use has a low influence.

Effect Size (f2)

f-Square is used to find out whether endogenous latent variables are significantly influenced by exogenous latent variables.

Based on data processing, the f-Square value is obtained as follows:

Table 5 f-Square Test Result

f-Square Effect Size

Customer Awareness -> Decision to Use 0.184 Moderate

Promotion -> Customer Awareness 0.12 Moderate

Religious Obligation -> Customer Awareness 0.02 Low

Sharia Financial Literacy -> Customer Awareness 0.073 Moderate

Source : Data processed using SmartPLS, 2022

Based on the table above, it can be stated that the Religious Obligation variable on the Customer Awareness variable

produces a f2 value of 0.019, indicating that it has a low influence. The Sharia Financial Literacy variable on the Customer

Awareness variable has a f2 value of 0.065, indicating that the effect is Moderate. The Promotion variable on the Customer

Awareness variable yields a f2 value of 0.114, indicating that the effect is Moderate. The Customer Awareness variable on the

Purchased Decision variable has a moderate effect, with a f2 of 0.188.

IJISRT23FEB797 www.ijisrt.com 1056

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Prediction Relevance (Q2):

If Q2> 0, the model has Predictive Relevance; otherwise, Q2<0 indicates that the model does not have Predictive Relevance

(Sarstedt, M., et al, 2019). The Q2 values are 0.188 and 0.076, as shown in the table below. Because the value is greater than zero,

the model is predictive.

Table 6 Cross-Validated Redudancy Test Result

Variable SSO SSE Q2=(1-SSE/SSO)

Customer Awareness 1152.000 935.909 0.188

Decision to Use 1920.000 1774.321 0.076

Source : Data processed using SmartPLS, 2022

Fit Test Model:

Table 7 Fit Test Result

Saturated Model Estimated Model

SRMR 0.081 0.13

d_ULS 1.809 4.674

d_G 0.492 0.582

Chi-Square 1096.177 1228.783

NFI 0.728 0.695

Source : Data processed using SmartPLS, 2022

Table VII shows that the SRMR value of 0.081 is less than 0.90, indicating that the model meets the Model Fit criteria.

Meanwhile, the NFI value is greater than 0.5, implying that the model is appropriate or meets the Model Fit criteria.

Hypothesis Test:

At this stage of hypothesis testing, an analysis was performed to determine whether the dependent variable had a significant

effect on the independent variable. The path coefficients that show the parameter coefficients and t-statistic values are used to test

hypotheses. The influence between variables is said to be significant if it has a t-statistic value greater than the t-table or a P value

less than 0.05. Meanwhile, the mediating effect is being tested. Meanwhile, the procedure developed by Baron and Kenny

(Ghozali and Latan, 2015) is used to test the mediating effect, where the effect of exogenous variables is on the mediating variable

and must have a t-statistic value greater than 1.96. which is significant.

Table 8 Path Analysis

Hypothesis Original Sample (O) T Statistics (|O/STDEV|) P Values Result

H1 Religious Obligation -> Customer 0.137 2.760 0.006 Supported

Awareness

H2 Financial Literacy -> Customer 0.260 4.959 0.000 Supported

Awareness

H3 Promotion -> Customer Awareness 0.334 6.064 0.000 Supported

H4 Customer Awareness -> Decision to Use 0.394 9.124 0.000 Supported

H5 Financial Literacy -> Customer 0.102 4.255 0.000 Supported

Awareness -> Decision to Use

H6 Promotion -> Customer Awareness -> 0.132 4.833 0.000 Supported

Decision to Use

H7 Religious Obligation -> Customer 0.054 2.451 0.015 Supported

Awareness -> Decision to Use

Source : Data processed using SmartPLS, 2022

V. RESEARCH RESULT DISCUSSION effect on Customer Awareness. These findings are

consistent with previous research by Saputra and

The first hypothesis (H1) states that Religious Rahmatia (2021), as well as Iskamto and Yulihardi

Obligation has a positive and significant influence on (2017), which found that Sharia Financial Literacy has a

Customer Awareness, which has been demonstrated and positive and significant relationship with Customer

can be accepted. These findings are consistent with Awareness and solve the Milenial’s Consumption

Pertiwi, Maslichah, and Mawardi's (2022) and Problems.

Hasanah's (2019) findings that the Religious Obligation The third hypothesis (H3) asserts that promotion has a

strategy has a positive and significant impact on positive and significant impact on customer awareness,

Customer Awareness. which has been demonstrated and accepted. The

The second hypothesis (H2) proves and declares that findings of this study are consistent with the findings of

Sharia Financial Literacy has a positive and significant Shrestha (2020), as well as Setiawati and Lumbantobing

IJISRT23FEB797 www.ijisrt.com 1057

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

(2017), who found that promotion in the form of the greater the influence of religious obligation on the

promotional activities can increase customer awareness. decision to use the BSI Hasanah Card.

The fourth hypothesis (H4) demonstrates that Customer Customer Awareness, according to the sixth hypothesis

Awareness has a positive and significant effect on the (H6), mediates the relationship between Sharia

Decision to Use the BSI Hasanah Card, which has been Financial Literacy and Decisions. The use of the BSI

proven and declared acceptable. These findings support Hasanah Card has been demonstrated and declared

the findings of Jamshidi and Hussin (2018), Tajudin and acceptable. Customer Awareness mediates the

Mulazid (2017), and Jamshidi and Kazemi (2020), who relationship between Sharia Financial Literacy and the

found that customer awareness has a positive and Decision to Use the BSI Hasanah Card, according to

significant influence on the decision to use the BSI Ganesan, Pitchay, and Nasser (2020).

Hasanah Card. The seventh hypothesis (H7) asserts that Customer

The fifth hypothesis (H5) asserts that Customer Awareness mediates the relationship between

Awareness mediates the effect of Religious Obligation Promotion and the Decision to Use the BSI Hasanah

on the Decision to Use the BSI Hasanah Card. This Card and has been proven and accepted. These findings

hypothesis has been proven and declared accepted. are consistent with Muhammad, Basha, and AlHafidh

These findings support the findings of Jamshidi and (2019) research, which found that Promotion can

Hussin (2018) and Sari, Rohimat and Ahmad (2021), increase Customer Awareness perceptions, resulting in

who discovered that the greater the customer awareness, an increase in Decisions to Use the BSI Hasanah Card.

SEM Model Development:

The theoretical model created at the hypothesis stage is described in the SEM model diagram, which makes it easy to see the

causal relationship to be tested. In this diagram, the relationship between constructs is indicated by arrows. Straight arrows

indicate direct causality between one construct and another (Figure 2.).

Fig 2 SEM Model Development Output Model PLS

VI. CONCLUSIONS AND SUGGESTIONS Customer Awareness, Sharia Financial Literacy has an

effect on Customer Awareness, and Customer Awareness

Conclusion: has an effect on Decisions on Use. Customer Awareness

The purpose of this research is to determine the serves as a bridge between Religious Obligation and Usage

impact of variables such as Religious Obligation, Sharia Decisions. Customer Awareness acts as a bridge between

Financial Literacy, Promotion, and Customer Awareness. Sharia Financial Literacy and Use Decisions. Promotion

So, according to the research, Religious Obligation has an and usage decisions are mediated by customer awareness.

effect on Customer Awareness, Promotion has an effect on

IJISRT23FEB797 www.ijisrt.com 1058

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Suggestion: Third, this study expected that future research will be

able to add or replace other mediating variables that

User Advices: have not yet been studied.

First, consumers are more aware of the BSI Hasanah

Card business process is suitable from Islamic Law, or REFERENCES

vice versa. However, what was there when Customers

can assess and feel whether the BSI Hasanah Card is in [1]. Alfiyyah, R. N, Suryani, Nugraheni, S. (2021).

accordance with Sharia or not based on the MUI Fatwa Pengaruh Citra Perusahaan, Harga, Dan Promosi

regarding Sharia Financing Cards and Banking Sharia Terhadap Minat Menggunakan Hasanah Card Bank

has a Sharia Supervisory Board. Bni Syariah Depok, Vol 6 No 2 (2021): Adz-

Second, customers should exercise caution when using Dzahab Volume 6 Nomor 2 Oktober Tahun 2021.

the BSI Sharia Financing Card Hasanah Card. To be [2]. Azizah, N. S (2020), “Pengaruh Literasi Keuangan,

able to create a BSI Hasanah Card as a tool for meeting Gaya Hidup Pada Perilaku Keuangan Pada Generasi

needs and being wise in transactions, rather than a tool Milenial”. Prisma (Platform Riset Mahasiswa

for millennials to be more consumptive. Akuntansi)Volume 01 Nomor 02 Tahun 2020 (Hal:

Third, customers are more cautious about information 92-101)https://ojs.stiesa.ac.id/index.php/prisma ,

from BSI, particularly about the Hasanah Card and Subang, Indonesia.

other BSI products. Furthermore, receiving information [3]. Basheer, M.F., Hussain T., Hussan, S. G., Javed, M.

and promotions from media outlets not owned by BSI. (2017) Impact Of Customer Awareness,

The goal is to make BSI Hasanah Card users more Competition And Interest Rate On Growth Of

comfortable using existing products and to maximize Islamic Banking In Pakistan, International Journal

promotional opportunities. Of Scientific & Technology Research Volume 6,

Issue 04, April 2017 ISSN 2277-8616

Mangerial Advices: [4]. Buchari Alma., 2016 Manajemen Pemasaran dan

First, management of the BSI Hasanah Card must Pemasaran Jasa. Bandung. Alfabeta

improve users' and potential users' overall [5]. De Bruin, L., Roberts-Lombard, M. and De Meyer-

understanding of syar'i law. To avoid discrimination Heydenrych, C. (2021), "Internal marketing, service

between Sharia and conventional products. For quality and perceived customer satisfaction: An

example, holding Sharia economic study events and Islamic banking perspective", Journal of Islamic

reaching out via social media about the differences Marketing, Vol. 12 No. 1, pp. 199-224

between the BSI Hasanah Card and conventional credit [6]. Ganesan, Y., Allah Pitchay, A.B. and Mohd Nasser,

cards. M.A. (2020), "Does intention influence the financial

Secondly, improving Islamic Financial Literacy through literacy of depositors of Islamic banking? A case of

collaboration with educational institutions that have Malaysia", International Journal of Social

Organizations, Study Programs, and Concentrations Economics, Vol. 47 No. 5, pp. 675- 690.

focusing on the Development of Islamic Banking in https://doi.org/10.1108/IJSE-01-2019-0011

Indonesia. So that customers and prospective customers [7]. Ghozali, Imam, Hengky Latan. 2015. Konsep,

can obtain Financial Literacy Sharia more easily. Teknik, Aplikasi Menggunakan Smart PLS 3.0

Untuk Penelitian Empiris. BP Undip.

Third, improving Facilities and Transaction Ease with SemarangHarnanto. 2017. Akuntansi Biaya: Sistem

BSI Hasanah Card to Satisfied Customers so that Biaya Historis. Yogyakarta: BPFE.

customers can take advantage of the current promotions [8]. Hasibuan H. L, Saparuddin, S., Sugianto (2022)

to meet their needs. For instance, the Hasanah transfer Pengaruh Citra Perusahaan dan Promosi terhadap

limit feature Card to Cash, the Remaining Limit Check Minat Menggunakan Hasanah Card Pada BSI KC

Feature at BSI Mobile, the Points Feature or Medan, Vol 3 No 3 (2022): Februari 2022

Transaction Rewards, collaborating with strategic https://doi.org/10.47065/ekuitas.v3i3.1164

merchants, and so on. [9]. Hasanah, F., 2019, Pengaruh Tingkat Religiusitas,

Pengetahuan, Kualitas Produk Dan Kualitas

Theoretical Suggestions: Pelayanan Terhadap Preferensi Menabung

Additional research interested in discussing Islamic Mahasiswa Universitas Muhammadiyah Palembang

Banking Products can re-test with variables already Pada Bank Syariah, Volume 4 Nomor 1 Juni 2019

present in the study, or replace and can add some of the DOI:10.32502/jab.v4i1.1815

variables studied with Social Factors, Ease of [10]. Iskamto, D., & Yulihardi. (2017). Analisis peranan

Transactions, Features, Trust, Intention to Use, Brand religiusitas terhadap kepercayaan kepada perbankan

Image, Corporate Image, and so on. syariah. Maqdis: Jurnal Kajian Ekonomi Islam -

Second, increasing the number of respondents and Volume 2, Nomor 2, Juli-Desember 2017, 2(2).

broadening the scope of the study. To be more effective [11]. Jamshidi, D. and Hussin, N. (2018), "An integrated

in research relating to the decision to use the BSI adoption model for Islamic credit card: PLS-SEM

Hasanah Card. based approach", Journal of Islamic Accounting and

Business Research, Vol. 9 No. 3, pp. 308-335.

https://doi.org/10.1108/JIABR-07-2015-0032

IJISRT23FEB797 www.ijisrt.com 1059

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[12]. Jamshidi, D. and Kazemi, F. (2020), "Innovation [23]. Sari, D. R, Rohimat, A. M, Ahmad, Z.A, (2020),

diffusion theory and customers’ behavioral intention Apakah Ekuitas Merek dan Kesadaran Halal Mampu

for Islamic credit card: Implications for awareness Memediasi Religiusitas dan Akulturasi terhadap

and satisfaction", Journal of Islamic Marketing, Vol. Keputusan Pembelian?, Jurnal Ekonomi Syariah

11 No. 6, pp. 1245-1275. Indonesia, Vol. XI No. 1, Juni 2020/1442 H : 51-66

https://doi.org/10.1108/JIMA-02-2018-0039 ISSN 2089-3566 (Print), 2503-1872 (Online) DOI:

[13]. Kotler, Philip dan Keller, Kevin Lane, 2018, https://doi.org/10.21927/jesi.2021.11(1).51-66

Manajemen Pemasaran. Edisi 12, Jilid 2, Jakarta: PT [24]. Tajudin, M.H., Mulazid, S., 2017, Pengaruh

Indeks. Promosi, Kepercayaan Dan Kesadaran Merek

[14]. Lumbantobing, R., Setiawati, M, 2017, Pengaruh Terhadap Keputusan Nasabah Menggunakan Produk

Promosi Dan Kemasan Terhadap Keputusan Tabungan Haji (Mabrur) Bank Syariah Mandiri Kcp.

Pembelian Produk Chitato Yang Dimediasi Oleh Sawangan Kota Depok, ISLAMICONOMIC Jurnal

Brand Awareness, Kompetensi - Jurnal Manajemen Ekonomi Islam 8(1), DOI:10.32678/ijei.v8i1.64

Bisnis, Vol. 12, No. 1, Januari - Juni 2017 [25]. Saputra A. D., Rahmatia, A. (2021), Islamic

[15]. Marimin, A. , Romdhoni, A.H , dan Fitria, T.N Financial Literacy Index of Students: Bridging

(2015), Perkembangan Bank Syariah di Indonesia, SDGs of Islamic Finance, Economics and Finance in

STIE-AAS Surakarta, Jurnal Ilmiah Ekonomi Islam Indonesia Vol. 67 No. 1, June 2021 : 34–50 p-ISSN

- Vol. 01, No. 02, Juli 2015 0126-155X; e-ISSN 2442-9260

[16]. Muhammad, A.M., Basha, M.B. and AlHafidh, G. [26]. Schiffman, Leon. & Kanuk, Leslie. 2015. Consumer

(2020), "UAE Islamic banking Promotional Behaviour Eighth Edition: International Edition.

strategies: an empirical review", Journal of Islamic New Jersey: Pearson Prentice Hall. (Alih Bahasa

Marketing, Vol. 11 No. 2, pp. 405-422. Rio, Yulihar, dan Reni.

https://doi.org/10.1108/JIMA-10-2018-0205 [27]. Usman H., Tjiptoherijanto P., Balqiah T. E., Agung

[17]. Panghayo,N.A., Musdholifah (2018) Pengaruh I.G.N., (2017) "The role of religious norms, trust,

Literasi Keuangan Terhadap Pemilihan Layanan importance of attributes, and information sources in

Keuangan Syariah, al-Uqud: Journal of Islamic the relationship between religiosity and selection of

Economics Volume 2 Nomor 2, Juli 2018 Hal. 152- the Islamic bank", Journal of Islamic Marketing,

167 Vol. 8 Issue: 2, doi: 10.1108/JIMA-01-2015-000.

[18]. Raharjo, U., Kristiyanto, S. (2019) Sharia Credit

Card, Rules and Reality, Universitas Wijaya

Kusuma Surabaya, ECONOMIE Vol. 01, No. 1,

Juni 2019

[19]. Raj, P., Rajan, P (2018), A Study On The Customer

Awareness On Green Banking Initiatives,

Intercontinental Journal Of Finance Research

Review ISSN:2321- 0354 - ONLINE ISSN:2347-

1654 - Print - Impact Factor:4.236 Volume 5, Issue

7, July 2017 - Ugc Approved Journal - S.No:48817

DOI:10.11224/IUJ.07.02.14

[20]. Ramli, Y., Permana, D,. Soelton, M., Hariani, S.,

Syah, T. Y. R, 2020, The Implication Of Green

Marketing That Influence The Customer Awareness

Towards Their Purchase Decision, MIX: Jurnal

Ilmiah Manajemen, Volume 10, No. 3, Oktober

2020, 385-399

[21]. Rois, E. L. H. (2016). Pengaruh Religiusitas, Norma

Subyektif Dan Perceived Behavioral. Skripsi

Fakultas Ekonomi Universitas Yogyakarta.

[22]. Shrestha S. K., 2020, mpact of Social Media

Promotion on Customer Purchase Intentionof

Commercial Banks Services,

https://doi.org/10.3126/batuk.v6i1.32654 THE

BATUK : A Peer Reviewed Journal of

Interdisciplinary Studies Vol. 6, Issue No.1, Jan

2020, Page: 42-52ISSN 2392-4802.

IJISRT23FEB797 www.ijisrt.com 1060

You might also like

- Unit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDocument9 pagesUnit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkThanh TúNo ratings yet

- 2008 CrisisDocument60 pages2008 CrisisShreyansh SanchetiNo ratings yet

- Microfinance and Poverty Reduction: New Evidence From PakistanDocument11 pagesMicrofinance and Poverty Reduction: New Evidence From PakistanMisal e FatimaNo ratings yet

- Keputusan Menjadi Nasabah Bank Syariah: Peran Literasi Keuangan Syariah, Kepercayaan, Dan Citra Bank SyariahDocument12 pagesKeputusan Menjadi Nasabah Bank Syariah: Peran Literasi Keuangan Syariah, Kepercayaan, Dan Citra Bank Syariahsetiawan irsyadNo ratings yet

- 2786-Article Text-14046-1-10-20230209Document8 pages2786-Article Text-14046-1-10-20230209nurharenaNo ratings yet

- 2020 - Jurnal Riset - Bisnis - IAIN Kudus - Ida Syafrida Et AlDocument18 pages2020 - Jurnal Riset - Bisnis - IAIN Kudus - Ida Syafrida Et AlTaufik AwaludinNo ratings yet

- The Perception of Customer Value and Its Influence To Self Consept in Using Credit CardDocument9 pagesThe Perception of Customer Value and Its Influence To Self Consept in Using Credit CardPutriasihNo ratings yet

- 5416 17585 1 PBDocument9 pages5416 17585 1 PBPutri nicornNo ratings yet

- Sana DessertationDocument80 pagesSana DessertationNaghul KrishnaNo ratings yet

- JbraksgasDocument21 pagesJbraksgasMohamed MustefaNo ratings yet

- Journal of Consumer Affairs - 2023 - Koskelainen - Financial Literacy in The Digital Age A Research AgendaDocument22 pagesJournal of Consumer Affairs - 2023 - Koskelainen - Financial Literacy in The Digital Age A Research AgendaMuhAzrilAryaKusumaNo ratings yet

- (AJIM) Indonesian Young Consumers' Intention To Donate Using Sharia FintechDocument11 pages(AJIM) Indonesian Young Consumers' Intention To Donate Using Sharia FintechchintiaarchivesNo ratings yet

- A Study On Consumer Perceptions Towards Digital Finance and Its Impact On Financial Inclusion - Indian ScenarioDocument12 pagesA Study On Consumer Perceptions Towards Digital Finance and Its Impact On Financial Inclusion - Indian ScenarioIAEME PublicationNo ratings yet

- Assignment 3 Part ADocument6 pagesAssignment 3 Part AALEN AUGUSTINENo ratings yet

- Jurbal InternasionalDocument15 pagesJurbal InternasionalAriesha nurulNo ratings yet

- India'S Credit Ecosystem: A Review ofDocument27 pagesIndia'S Credit Ecosystem: A Review ofMohit BoralkarNo ratings yet

- Determinants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014Document11 pagesDeterminants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014helloNo ratings yet

- The Relationship Between Microfinance Institutions and Group Lending Model in Uttar Pradesh, IndiaDocument7 pagesThe Relationship Between Microfinance Institutions and Group Lending Model in Uttar Pradesh, IndiaEditor IJTSRDNo ratings yet

- A Comparative Study of Bancassurance Products in Banks - SynopsisDocument8 pagesA Comparative Study of Bancassurance Products in Banks - Synopsisammukhan khan100% (1)

- Jiefes: Islamic Banks: Study of Financial Literacy, Digital Marketing, Accessibility, Age, and EducationDocument17 pagesJiefes: Islamic Banks: Study of Financial Literacy, Digital Marketing, Accessibility, Age, and EducationTheodore SebastianNo ratings yet

- An Investigation of Customers Awareness Level and Customers Service Utilization Decision in Islamic BankingDocument17 pagesAn Investigation of Customers Awareness Level and Customers Service Utilization Decision in Islamic BankingTutugo SwasonoNo ratings yet

- 3 Ijmres 10012020Document12 pages3 Ijmres 10012020International Journal of Management Research and Emerging SciencesNo ratings yet

- Islamic Finance: Financial Inclusion or Migration?: Ahmed Tahiri JoutiDocument12 pagesIslamic Finance: Financial Inclusion or Migration?: Ahmed Tahiri Joutisidra swatiNo ratings yet

- Islamic Financial Literacy Among Sharia Bankers in Bandar LampungDocument18 pagesIslamic Financial Literacy Among Sharia Bankers in Bandar LampungyahyaNo ratings yet

- Islamic Banking Topics Research Good For PHD ThesisDocument9 pagesIslamic Banking Topics Research Good For PHD Thesisvotukezez1z2No ratings yet

- How Has Digital Lending ImpactedDocument11 pagesHow Has Digital Lending ImpactedrofirheinNo ratings yet

- Improving Savings Mobilization of Micro and Small Enterprises Through Entrepreneurial Financial Literacy1Document18 pagesImproving Savings Mobilization of Micro and Small Enterprises Through Entrepreneurial Financial Literacy1Roel SisonNo ratings yet

- Impact of Digital Wallets On Consumer Behavior in IndiaDocument17 pagesImpact of Digital Wallets On Consumer Behavior in IndiaIJAR JOURNALNo ratings yet

- Rural BankDocument5 pagesRural BankRobby FajarNo ratings yet

- Vision of Microfinance in IndiaDocument31 pagesVision of Microfinance in IndiaBobby ShrivastavaNo ratings yet

- 1 PBDocument9 pages1 PBibraheem alaniNo ratings yet

- The Effect of Product, Promotion, Location, and Reputation On Saving Decision On Village Credit Institution in Kuta BaliDocument7 pagesThe Effect of Product, Promotion, Location, and Reputation On Saving Decision On Village Credit Institution in Kuta BaliaijbmNo ratings yet

- Journal Innovation Knowledge: Digital-Only Banking Experience: Insights From Gen Y and Gen ZDocument10 pagesJournal Innovation Knowledge: Digital-Only Banking Experience: Insights From Gen Y and Gen Zninhtieuthat251No ratings yet

- International Journal of Economics and Financial Issues Consumers' Attitude Towards Usage of Debit and Credit Cards: Evidences From The Digital Economy of PakistanDocument10 pagesInternational Journal of Economics and Financial Issues Consumers' Attitude Towards Usage of Debit and Credit Cards: Evidences From The Digital Economy of PakistanSummamNo ratings yet

- Universitas Islam Negeri Imam Bonjol Padang E-Mail: Yentiafrida@uinib - Ac.idDocument10 pagesUniversitas Islam Negeri Imam Bonjol Padang E-Mail: Yentiafrida@uinib - Ac.idIzzatul kamilaNo ratings yet

- Impact of Technological Changes On Customer: Experience in Banking Sector-A Study of Select Banks in Madhya PradeshDocument12 pagesImpact of Technological Changes On Customer: Experience in Banking Sector-A Study of Select Banks in Madhya PradeshSiddharthJainNo ratings yet

- Study of Factors Affecting Use of Plastic MoneyDocument5 pagesStudy of Factors Affecting Use of Plastic MoneyArafat IslamNo ratings yet

- BRM ResearchDocument11 pagesBRM ResearchAryan SrivastavNo ratings yet

- The Effect of Mudharabah Financing and Musyarakah Financing On Profitability (ROE) Through Profit-Sharing Income in Islamic Banks in 2015-2018Document7 pagesThe Effect of Mudharabah Financing and Musyarakah Financing On Profitability (ROE) Through Profit-Sharing Income in Islamic Banks in 2015-2018International Journal of Innovative Science and Research TechnologyNo ratings yet

- 304 1120 1 PBDocument28 pages304 1120 1 PBchintiaarchivesNo ratings yet

- The Effect of Islamic Financial Inclusion On Economic Growth: A Case Study of Islamic Banking in IndonesiaDocument10 pagesThe Effect of Islamic Financial Inclusion On Economic Growth: A Case Study of Islamic Banking in IndonesiaAnhara FarhanNo ratings yet

- Thesis Microfinance IndiaDocument5 pagesThesis Microfinance IndiaHelpWithPaperWritingAlbuquerque100% (2)

- 1 s2.0 S1877042814029760 MainDocument9 pages1 s2.0 S1877042814029760 MainVittaya RiaNo ratings yet

- 10 1108 - SRJ 05 2020 0174Document30 pages10 1108 - SRJ 05 2020 0174abdillah u. djawahirNo ratings yet

- Pengaruh Literasi Keuangan Syariah Dan Religiusitas Terhadap Keputusan Pengambilan Pembiayaan Usaha Rakyat Di Bank Syariah Indonesia Malang SoettaDocument11 pagesPengaruh Literasi Keuangan Syariah Dan Religiusitas Terhadap Keputusan Pengambilan Pembiayaan Usaha Rakyat Di Bank Syariah Indonesia Malang SoettaHansNo ratings yet

- The Influence of Personality, Motivation and Social Class Toward Costumers 'Decision Making in Choosing Bank Riau Kepri Sharia Tembilahan KotaDocument8 pagesThe Influence of Personality, Motivation and Social Class Toward Costumers 'Decision Making in Choosing Bank Riau Kepri Sharia Tembilahan KotaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Essay 2024Document6 pagesEssay 20244th zenz starNo ratings yet

- The Awareness and Attitude of Muslim Consumer Preference The Role of ReligiosityDocument20 pagesThe Awareness and Attitude of Muslim Consumer Preference The Role of ReligiosityNasir AliNo ratings yet

- Credit CardsDocument10 pagesCredit CardsMadhur GuptaNo ratings yet

- 495 18 PBDocument11 pages495 18 PBAgung SaputraNo ratings yet

- Bank Marketing: Dr. Ram SinghDocument34 pagesBank Marketing: Dr. Ram SinghDrRam Singh KambojNo ratings yet

- 7823 26351 1 PBDocument20 pages7823 26351 1 PBmizzdylaNo ratings yet

- Factors Influencing Adoption of Islamic Banking: A Study From PakistanDocument16 pagesFactors Influencing Adoption of Islamic Banking: A Study From PakistanamatulmateennoorNo ratings yet

- Literature Review Extract 1Document6 pagesLiterature Review Extract 1Ekom JollyNo ratings yet

- Bancassurance Model and Its Impact On Financial Inclusion 26Document1 pageBancassurance Model and Its Impact On Financial Inclusion 26Preetam ParabNo ratings yet

- Ins510 - Individual AssignmentDocument6 pagesIns510 - Individual Assignmentummi syafiqahNo ratings yet

- Digital Banking Regulations A Comparative Review BDocument25 pagesDigital Banking Regulations A Comparative Review BadivwadhwaNo ratings yet

- Dissertation On Credit CardsDocument8 pagesDissertation On Credit CardsPaperWritingServicesBestSingapore100% (1)

- Determinants of Muslim Entrepreneurs Decisions On Sharia Bank Financing and Its Effect On Business PerformanceDocument14 pagesDeterminants of Muslim Entrepreneurs Decisions On Sharia Bank Financing and Its Effect On Business PerformanceyahyaNo ratings yet

- Daya Tarik E-Banking Di Kalangan Civitas Akademika Institut Agama Islam Negeri Samarinda Angrum PratiwiDocument14 pagesDaya Tarik E-Banking Di Kalangan Civitas Akademika Institut Agama Islam Negeri Samarinda Angrum PratiwiHaykal RivaldiNo ratings yet

- 1545-Article Text-5441-1-10-20230403Document14 pages1545-Article Text-5441-1-10-20230403Pramudita DinantiNo ratings yet

- Interkoneksi Bank Syariah Dengan Lembaga Filantropi IslamDocument20 pagesInterkoneksi Bank Syariah Dengan Lembaga Filantropi IslamatsarisfatihNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Reading Intervention Through “Brigada Sa Pagbasa”: Viewpoint of Primary Grade TeachersDocument3 pagesReading Intervention Through “Brigada Sa Pagbasa”: Viewpoint of Primary Grade TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study to Assess the Knowledge Regarding Teratogens Among the Husbands of Antenatal Mother Visiting Obstetrics and Gynecology OPD of Sharda Hospital, Greater Noida, UpDocument5 pagesA Study to Assess the Knowledge Regarding Teratogens Among the Husbands of Antenatal Mother Visiting Obstetrics and Gynecology OPD of Sharda Hospital, Greater Noida, UpInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Application of Game Theory in Solving Urban Water Challenges in Ibadan-North Local Government Area, Oyo State, NigeriaDocument9 pagesApplication of Game Theory in Solving Urban Water Challenges in Ibadan-North Local Government Area, Oyo State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Firm Size as a Mediator between Inventory Management Andperformance of Nigerian CompaniesDocument8 pagesFirm Size as a Mediator between Inventory Management Andperformance of Nigerian CompaniesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PHREEQ C Modelling Tool Application to Determine the Effect of Anions on Speciation of Selected Metals in Water Systems within Kajiado North Constituency in KenyaDocument71 pagesPHREEQ C Modelling Tool Application to Determine the Effect of Anions on Speciation of Selected Metals in Water Systems within Kajiado North Constituency in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Post-Annealing Influence on Stannous Oxide Thin Films via Chemical Bath Deposition Technique: Unveiling Structural, Optical, and Electrical DynamicsDocument7 pagesExploring the Post-Annealing Influence on Stannous Oxide Thin Films via Chemical Bath Deposition Technique: Unveiling Structural, Optical, and Electrical DynamicsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Consistent Robust Analytical Approach for Outlier Detection in Multivariate Data using Isolation Forest and Local Outlier FactorDocument5 pagesConsistent Robust Analytical Approach for Outlier Detection in Multivariate Data using Isolation Forest and Local Outlier FactorInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Music on Orchid plants Growth in Polyhouse EnvironmentsDocument5 pagesThe Impact of Music on Orchid plants Growth in Polyhouse EnvironmentsInternational Journal of Innovative Science and Research Technology100% (1)

- Esophageal Melanoma - A Rare NeoplasmDocument3 pagesEsophageal Melanoma - A Rare NeoplasmInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mandibular Mass Revealing Vesicular Thyroid Carcinoma A Case ReportDocument5 pagesMandibular Mass Revealing Vesicular Thyroid Carcinoma A Case ReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Vertical Farming System Based on IoTDocument6 pagesVertical Farming System Based on IoTInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Sustainable Energy Consumption Analysis through Data Driven InsightsDocument16 pagesSustainable Energy Consumption Analysis through Data Driven InsightsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection of Phishing WebsitesDocument6 pagesDetection of Phishing WebsitesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDocument6 pagesDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- Osho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)Document8 pagesOsho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Review on Childhood Obesity: Discussing Effects of Gestational Age at Birth and Spotting Association of Postterm Birth with Childhood ObesityDocument10 pagesReview on Childhood Obesity: Discussing Effects of Gestational Age at Birth and Spotting Association of Postterm Birth with Childhood ObesityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Realigning Curriculum to Simplify the Challenges of Multi-Graded Teaching in Government Schools of KarnatakaDocument5 pagesRealigning Curriculum to Simplify the Challenges of Multi-Graded Teaching in Government Schools of KarnatakaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Efficient Cloud-Powered Bidding MarketplaceDocument5 pagesAn Efficient Cloud-Powered Bidding MarketplaceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDocument10 pagesEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Overview of Lung CancerDocument6 pagesAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDocument6 pagesImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Influence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaDocument13 pagesInfluence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaInternational Journal of Innovative Science and Research Technology100% (1)

- Auto Tix: Automated Bus Ticket SolutionDocument5 pagesAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ambulance Booking SystemDocument7 pagesAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Utilization of Waste Heat Emitted by the KilnDocument2 pagesUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDocument8 pagesDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDocument13 pagesEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Examining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedDocument8 pagesExamining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDocument5 pagesPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Offer Letter UG2307994-pages-4Document1 pageOffer Letter UG2307994-pages-4Ojasvi KumarNo ratings yet

- UCC 1 InformationDocument3 pagesUCC 1 InformationTracey L Smith100% (3)

- DD Mon YyyyDocument194 pagesDD Mon Yyyyvenkatksr1987No ratings yet

- Internship Report-FuadDocument46 pagesInternship Report-Fuadsourov shahaNo ratings yet

- MCQ Central BankingDocument5 pagesMCQ Central BankingYogesh GharpureNo ratings yet

- Chiron Projects B.V Deed of Agreement PurchaseDocument24 pagesChiron Projects B.V Deed of Agreement PurchaseroyaleliontradingaccNo ratings yet

- HSBC Case StudyDocument2 pagesHSBC Case StudyRyan Cornista50% (2)

- CABLE and WIRELESS JAMAICA FLOW Fiduciary Appointment + Sharon Ann Peart JohnsonDocument1 pageCABLE and WIRELESS JAMAICA FLOW Fiduciary Appointment + Sharon Ann Peart Johnsonshasha ann beyNo ratings yet

- Soriano vs. People and BSP GR NO. 162336, FEB. 1, 2010Document2 pagesSoriano vs. People and BSP GR NO. 162336, FEB. 1, 2010Julio100% (1)

- 1564884379516rKqdKBHRJBbCdElz PDFDocument1 page1564884379516rKqdKBHRJBbCdElz PDFChiranjibi Behera ChiruNo ratings yet

- Caroline C. Microfinance and Financial Inclusion Latest Sep4 EveningDocument41 pagesCaroline C. Microfinance and Financial Inclusion Latest Sep4 Eveningportalift rentals100% (1)

- MCQs - Retail Asset ProductsDocument91 pagesMCQs - Retail Asset ProductsRaghvendra SinghNo ratings yet

- Statement MithunDocument2 pagesStatement Mithunbiswa chakrabortyNo ratings yet

- Januarita Yanda Arroihana Karolin Host Live Streaming ResumeDocument7 pagesJanuarita Yanda Arroihana Karolin Host Live Streaming Resumealvian katiwandaNo ratings yet

- Information Systems Information Systems Used in ICICI BANKDocument24 pagesInformation Systems Information Systems Used in ICICI BANKGagan Preet SinghNo ratings yet

- Ssbdepositrates 1Document3 pagesSsbdepositrates 1Zachary VidaNo ratings yet

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraNo ratings yet

- Fa I Chapter 2Document4 pagesFa I Chapter 2Abdi Mucee TubeNo ratings yet

- SSGC Duplicate Bill20210323 132303Document1 pageSSGC Duplicate Bill20210323 132303toseef ul islamNo ratings yet

- Standing Instruction Format: Mortgages/DVRA/Ver5.0/July2013Document5 pagesStanding Instruction Format: Mortgages/DVRA/Ver5.0/July2013Yudhi OctoraNo ratings yet

- Creditreport 2555930042Document60 pagesCreditreport 2555930042nischal.khatri07No ratings yet

- Internship ReportDocument32 pagesInternship ReportZIA UL REHMANNo ratings yet

- Project On Retail BankingDocument44 pagesProject On Retail BankingabhinaykasareNo ratings yet

- Excel - Class 1 RevisionDocument29 pagesExcel - Class 1 RevisionJison SamuelNo ratings yet

- Indian Financial System An IntroductionDocument4 pagesIndian Financial System An IntroductionRonan FerrerNo ratings yet

- Banking System Black BookDocument39 pagesBanking System Black BookhaddyNo ratings yet

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDocument2 pagesSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)