Professional Documents

Culture Documents

Cedhist: Fartfadleis

Uploaded by

hayathayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cedhist: Fartfadleis

Uploaded by

hayathayaCopyright:

Available Formats

e)

Cedhist

Pasiey qeuodSTaewesal 9309

Mamoor h. RactherDalhr 3503

Whai

geneal SToye

Whai eads 3s0s

Zahoor Ah. Hajam a

(3

eon,ya wcanslof sSI0r

neen huT Batioe 3sA|

layan Ahmd wemikumyge 3?4

NooYoni vesTuonT kmme YrO3

(

Tkaclys kimec 9O02

losos

farTfadleis Ggsoe

Mkd sucTan wani losY89

YI329

Ohnd fhetk DYaU-9S9r VKuns

en's Laeom S>B09

Ayon hmot ha' 1305

bar KUNZER

T RG

(KAB)

Beijtgorealie CLadlnel0303 TTed.

eTet pue I9589

Torhuy geneal Sr ogny e 1903

Támee Ahd Jorgpey 14S2

Signăturg gfAuthorised O cer

BAIK

Rer(

Created with Scanner Pro

fi

Debl list

ot

CNew eanal

Yes eeenBJerrsea

oeshea OSOS

erlerpeiep CmeAlad -30939

Semdauei MaikeTing geny /39604

Co'

loco0

Meyom gat Ganfsiy (A00

SdeeeTerfrttesr I20c00

TáTal

'AB. SAisAM WANI & SO

KUNZER TANGNIARG (KN

SignătureofAuthorisedOf cer

KN

Created with Scanner Pro

fi

fi

Adv 25

JSK Bank

as46

To,

The President / Vice-President/ Executive Manager

inspection report of stocks hypothecated / pledged to the Bank

Name of the inspecting DffcerPeer

Of cer Mácnd

Designation Ssr. Manaser

Name of the of cer who last inspected. Cefcee

1. Borrower's Name ABdul Salsm ak Cons

2. Nature of Business

Retail tnde) halesale h kigan

3. Location of stock hypothecated

Cateamatfor

4.Limit

Sanctioned S a

5. Security held

Lay Stock (detail to be furnished at the end of report)

b) Particulars of collateral security, if any held

- Reneul/Aprat euelosed.

6. Value of stocks indicate whether

market Value / invoice value cost price

7. Margin Stipulated-

8. Drawing Power law.

9. Balance outstanding as on

10. Name of insurance company with whom

stock / collateral Security insured.

11. Amount of insurance

12. Expiry date of insurance policy / policies

13. Date of visit by Branch Head/lnspecting Of cer- \4.09. 2o

14. Findings of Branch Head/lnspecting Of cer in detail. SATISRATO

Slgnăture ofAuthorised Of cer

&AIKIS

Created with Scanner Pro

fi

fi

fi

fi

fi

Certi cate of the Inspecting Of cer

Whether

1. Bank's name board exhibited at the godown / shop

if waved by central of ce please quote

letter no. & date

2. Godown / shop does not contain stocks other

than those hypothecated to bank

3 Turnover in the stock is satisfactory and

re ected in the account

4. The stocks are of good quality and marketable

at a rate not less than quoted by the

borrower

5. Stocks are in the godown / shop in accordance

with the records of the borrowers

6. The stock held under hypothecation are not beyond the stipulled period ,.

mentioned in the sanction

7. The stock / collateral security have been insured

to be extend of the full value

Details of Security

Date of Particulars Quantity Rate Value

Storage

Kenwed eredosead

ghature ofAúthorisedOf cer

KunzesS

Created with Scanner Pro

fi

fl

fi

fi

fi

SUBJECTIVEPARAMETERSCORINGSHEETOF MS ABDULSALAM WANI &

SONS-

0546020100000052

MODEL: SBS ANNEXURE 1-B

FINANCIAL RISK SCORING SHEET

SELECT

APPROPRI

PARAMETER ATTRIBUTE REMARKS

ATE

OPTION

As peraccountíngstandards with no adverseremarks from

Excellent auditors

Minor deviations from Accounting Standards and has minor

Accounting Good impact on the companies nancial position

quality

Signi cant deviations from Accounting Standards and has

Marginal signi cant impact on the companies nancial position

Weak Accounts not reliable

Excellent Less than 25 percent

Contingent Good 25 to 50 percent

Liabilities/ Net

Worth Marginal 50 to 75 percent

Weak Greater than 75 percent

BUSINESS RISK SCORING SHEET

SELECT

APPROPRI

PARAMETER ATTRIBUTE REMARKS

ATE

OPTION

Product has no substitutes or regulatory threats. Therefore,

Growth demand will remain stable or grow

Sales Trend Product has limited substitutes (Other brands or products) and

Marginal regulatory threats; however, this will not pose a threat to the

(Product)

Growth borrower

Demand for product may be affected by lower priced

Uncertain substitutes and regulation;

Demand for product faces serious threat due to substitutes or

Decline regulation.

Product does not face any seasonality either from demand or

Low supplyside

Product

Marginal Product is seasonal from supply side but not from demand side

seasonality

High Product is seasonal from demand side but not from supply side

VeryHigh Product is seasonal from both demand and supply sides

Competition Current business scenario not expected to lead to decline in

impact on Gross Low Gross Margin

Margin Average Competition may result in marginal decline in Gross Margin.

Created with Scanner Pro

fi

fi

fi

fi

Competition has resulted/may result in signi cant decline in

High GrossMargin.

Gross Margin has declined signi cantly due to competition and

VeryHigh expected to decline further.

Thereare noforeseenchanges in the directindirect tax

structure or import/export restrictions which could impact the

Low pro tability of the product.

Some changes are foreseen in the direct/indirect tax structure

or import/export restrictions. These may have some impact on

Average the pro tability of the product.

Impact of duties Some changes are foreseen in the direct/in direct tax structure

(Product) or importlexport restrictions. These may have a major impact

on the pro tability of the product and affect viability of marginal

High players.

Signi cant changes are foreseen in the direct/indirect tax

structure and/or import/export restrictions. These may have a

signi cant impact on the pro tability of the product and viability

VeryHigh ofplayers.

Technology is not expected to change in the long run; or

Low technology risk is not relevant.

Technology Technology is unlikely to change in the medium term; or

Dependence Average Largely irelevant

(Product) High Technology likely to change in the medium term.

Outdated technology or technology subject to very fast

VeryHigh obsolescence.

Low Unlikelytofacepollution relatedproblems in future.

Environmental |Average Limited likelihood of facing pollution related problems in future.

impact (Product) Polluting product but complies with curent norms which are

High subject to change.

VeryHigh Polluting product and does not comply curent noms

Diversi ed customer base having reasonable size, stable

purchase patten from the rm and likely to pay outstanding

Excellent invoices on a timely basis.

Generally diversi ed customer base who may not have either a

reasonable size or a stable purchase pattem from the rm but

is likely to pay outstanding invoices on a timely basis. There

Customer quality Good maybe a few large customers.

& concentration

Customer base has neither reasonable size nor a stable

purchase pattem from the rm but is likely to pay outstanding

invoices on a timely basis. The n may have only a few

Marginal customers with little product diversi cation

Customers are not expected to pay on time. The n may

Unfavourable have only 1-2 customers.

Borrower has a choice of suppliers supplying quality goods &

Excellent services.

Borrower has a choice of suppliers supplying average quality

Supplier reliability Good goods & services.

& concentration

Borrower has very few suppliers supplying goods & services.

Marginal Quality of goods & services is not very good.

Weak Monopolistic situation with no control over quality.

9

Tgeo).

Created with Scanner Pro

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

MANAGEMENT RISK SCORING SHEET

SELECT

APPROPRI

PARAMETER ATTRIBUTE REMARKS

ATE

OPTION

Promoter has a well-established reputation and track record of

Excellent honouring its commitment even under adverse circumstances

Promoter has a good standing in the business community and

Good by and large, is known to honour its commitments

Integrity Promoter has a mixed reputation, and has reneged on some of

Marginal its business commitments in the past for a variety of reasons

Promoter has a history of willful default and/ or diverting

borrowed funds, or no positive information could be obtained

Doubtful about management'sintegrity

Promoter is highly involved in the business either because of

substantial nancial/reputational exposure to the business or

because the business contributes signi cantly to his overall

Excellent business investment

Promoter is fairly committed to this business but also has

substantial investment in other businesses, the relative fortunes

Business High of which could dilute his commitment to this business

Commitment This business occupies only a small portion of his time and

investment, and his most signi cant business interest lies

Marginal elsewhere

No involvement of the promoter, business merely a legacy or

promoter diversifying into other areas where his involvement

will increase in future; or unable to gauge commitment of

Low promoterto thisbusiness

Promoter is nancially very strong and has other independent

sOurces of income which could support this business in adverse

Excellent situations.

Promoter is nancially strong, but may have other businesses

that may not be doing well or could need funds for meeting

Financial Good personal expenses

Strength Promoter's nancial strength is reasonable: however fund

requirements from other business interests/personal needs

Marginal could affect thisbusinessadversely

Promoter has poorlquestionable nancial strength; Or widely

Weak differing opinions obtained

Management is very skilled, well organised and is

Excellent knowledgeable about the business

Management has reasonable skills but weakness in one or two

Good areas is evident.

Management

Management exhibits limited skills, and does not have a

competence

Marginal completeunderstanding of thebusiness.

Management exhibits a total lack of skill, with decisions

appeaning to be illogical. Consequently, loan repayment could

Inadequate be at risk

Business Excellent business acumen and experience in the line of

experience Excellent business

6. Conditions of present business and market reputation (give details)

Created with Scanner Pro

fi

fi

fi

fi

fi

fi

fi

Adequate business experience in the line of business or has

excellent credentials in another business, which could be

Good extrapolated in this line of business

Marginal Fair experience in the business, but not much success

Inadequate Little or no business experience

Internal Control is fairly good and is dependent on the

Excellent management's long standing relationship with employees.

Intermal Control is good, largely because of

Internal Control Good promoter's/manager'sphysicalparticipationinbusiness

Internal Control is not very tight and employees have too much

Marginal discretion.

No internal control at all - the management does not have a

Inadequate clue as to what is happening

Motivated and loyal employees who have a sound

Excellent understanding of the business

Employee Good Employees are loyal but do not have much experience

Relations/quality

Marginal Employees are not motivated and not very competent

Weak Employees are demotivated and incompetent.

Well-de ned succession plan in place; business not dependent

Excellent on oneperson

Business dependent on one person at present, but in the event

of incapacitation of that persorn a good succession plan is in

Good place

Succession Succession is not addressed adequately and hence dealing

planning with a change in the management team could adversely affect

the borrower's performance; however the damages can be

Marginal contained

Succession has not been addressed and in the event of

incapacitation of the key person, the business would suffer

Inadequate nancial setbacks

Promoter has never violated any terms or conditions of any of

its loan agreements in the past. In other words, management

Excellent has an impeccable track record

Promoter is known to have dishonoured or rernegotiated some

tens and conditions of its loan agreements, which are not

Credit Track signi cant breaches. Such actions can be attributed to reasons

Record Good that are beyond the management's control

Promoter has been known to renegotiate/breach signi cant

terms or conditions of its obligations, the reasons of which are

Marginal not entirely beyond the management's control

Promoter has a dubious record in honouing its credit contracts

Weak for all kinds of reasons

Above 10 Yrs Fimm in existence for more than 10 years

Firm's Age 5-10Years Firm in existence for between 5-10 years

2-5 Years Firm in existence for between 2-5 years

Below 2 Yrs Firm in existence for less than 2 years

General Excellent relationship with suppliers with no disruption of

Reputation supplies. Excellent reputation with customers resulting in

VeryHigh growth and timely payments.

Created with Scanner Pro

fi

fi

fi

fi

Good relationship with supplers with some disruption of

supplies. Good reputation with customers resulting in growth

High andgenerallytimelypayments.

Fair relationship with suppliers with frequent disruption of

supplies. Fair reputation with customers but increase in credit

Marginal period and some defaults.

Poor relationship with suppliers. Poor reputation with

customers with substantial increase in credit period and high

Low defaults.

ONDUCT OF ACCOUNTS

PARAMETER ATTRIBUTE REMARKS

Less than 4

4 to 7 times

Number of times DP/ imit

overdrawn 7 to 10 times

3 Greater than 10 times

Cumulative no of days DPAimit Less than 30

exceeded From 30 to 60 days

4. Greater than 60 days

1 Payments are received on or before due date

2 Payments are received within 1 month of the due date

Number of days interest overdue

3 Payments arereceived within 1 quarter of the due date

Payments are delayed more than 1 quarter from the due

4 date

None

Number of cheques/bills payatble by Lessthan 3 times

the borrower returmed 3 to 8 times

Greater than 8 times

None

Number of LG/BG issued in favour 1

of buyer devolved/invoked From 1 to 5

Greater than 5

e.g. Quaterly infommation Statements, Monthly Stock

Within due date Statementsetc.

Delay in submission of renewal Within 15 days

proposal/statements by borrower Within 30 days

Generaly received 30

days after due date

5. Cc

6. Conditions of present business and market reputation (give details)

Created with Scanner Pro

Actuals are within 10 percent of projected sales

2 Actuals are between 10 to 30 percent of projected sales

rance in projected sales versus

actual sales 3 Actuals are within 30 percent of projected sales

Wide variance - Actuals are more than 50 percent of

projected gures

Promptly

pelay in recti cation of inspection Within 15 days

iregularities by borower From 15 to 30 days

Over 30 days

Excellent Complied fully - Security and nancial covenants

Delay in compliance of sanction Good Complied with creation of security

order conditions by borrower Marginal Complied with nancial covenants only

The sanctioned/disbursement conditions have not been

Not complied complied

Greater than 90%

B.

Between 85% and

Credit summation/Sales (%)- 90%

excluding cheques returned

(percentage) Between 75% and

85%

Less than 75%

On time

Delay of less than 1

b Delay in submission of Audited month

Balance Sheet to Bank From 1 to 3 months

C

d) Greater than 3 months

e)

Con

onditions of present business and market reputation (give details)

Created with Scanner Pro

fi

fi

fi

fi

Individual/sole Proprietary Concern

J&K Bank CREDIT REPORT Adv-90

Business Unit....... Kun34.

1. Full name, age and address of the party: dul Salawwani eo kehmign

2. Particulars of occupation/business-

(in case of individuals in service indicate status and salary)

a) Head of ce & Branches Can.

b) Constitution. Dmdindual

c) Agriculturist/Non-Agriculturist Aerwtycit

d) Father's name Atyou! aed we~

e)

f)

Year established

Particulars of other business if any

05

3. Estimated net means details (oerleaf) See ias ove)ek

200. 200.

4. other Information: Rs. Rs.

a) Sales for the last two years

b) Purchase for the last two years Aaea erdose.

c) Pro t for the last two years

d) Income tax paid for the assessment

200

e) Observation on previous dealings

e.g ) Operation in the account and turnover of stocks

Amount Particulars

5. Contingent liabiligties on guarantees etc. Rs.

6. Conditions of present business and market reputation (give details)

Created with Scanner Pro

fi

fi

PARTICULARS OF MEANS (VIDE ITEMS 3)

1. Assetsof the rmindividualsas on...>l-3-o)9

a) Fixed assets (immovable properties, Plant and machinery etc.

Description Location Estimated Market

Value Rs.

1.

2.

3.

etc

b) Liquid Assets Rs. 1.47

I) Cash and Bank balance Rs. 2912

ii) Stocks

i) Sundrydebtors, billsreceivable (a+b)

Rs.

Rs

9.41

iv) Other Assets Sub Total (a) Rs.

c) Details of assets in the; personal name of the proprietor of the rm other those indicated above

Properties Description Estimated Value

a) Movable

b) Immovable Residetin Mrane cichmatipoa

ala

2

c) etc

Sub Total (b) Rs.

Total (a+b+c) Rs. (4S-ss

2. Less Liabilities:

1. From our bank

(give details)

es

2. From other banks

(Specify limit and security)

3. From Private persons etc. Rs. Rs.

4. Due to suppliers Rs..

Estimated net worth (-2) Rs.

7. The name and address of person/s bank from whom I have made inquiries are as follows:

Date of Name and address of party/ His/their address of the worth of Is the information given

Opinion bank from who opinion the partyy (verbatim reported oral or in writing

received or enquires made should be given, if from bank)

1

2 3 4

hsom

sel all

I have made independentenquires about the position above of the party and l am satis ed that the

information above furnished to the best of my knowledge and belief and is correct.

All the properties both immovable and movable detailed above are to be unencumbered.

Created with Scanner Pro

fi

fi

fi

Individual/sole Proprietary Concern

SJSK Bank CREDIT REPORT Adv-90

BusinessUnit.... *. uorente

1 Full name, age and address of the party

2. Particulars of occupation/business Capleyee

(in case of individuals in service indicate status and salary)

a) Head of ce & Branches Auealan Sept

b) Constitution nelidual

c) Agriculturist/Non-Agriculturist Amewkit

d) Father's name Au lat lone

e) Year established

f) Particulars of other business if any [poted,

3. Estimated net means details (overleaf) ee e4e

200. 200.

4. other Information: Rs. Rs.

a) Sales for the last two years

b) Purchase for the last two years

c) Pro t for the last two years

d) Income tax paid for the assessmént

200

e) Observation on previous dealings Stifaue

e.g ) Operation in the account and turnover of stocks Ldor

Amount Particulars

5. Contingent liabiligties on guarantees etc. Rs.

uennti

6. Conditions of present business and market reputation (give details)

Created with Scanner Pro

fi

fi

PARTICULARS OF MEANS (VIDE ITEMS 3)

1. Assets of the rm individuals as on

a) Fixed assets (immovable properties, Plant and machinery etc.

Description Location Estimated Market

Value Rs.

1

2

etc

b) Liquid Assets Rs.

I) Cash and Bank balance Rs.

ii) Stocks

iltand,

ii) Sundrydebtors, ls receivable (atb)

Rs.

Rs

iv) Other Assets Sub Total (a) Rs.

c) Details of assets in the; personal name of the proprietor of the rm other those indicated above

Properties Descriptio... Estimated Value

a) Movable

b) Immovable KWouse aly Chna.

c) etc

Unlemeal

Sub Total (b) Rs.

Total (a+b+c) Rs.

2. Less Liabilities:

1. From our bank Rs.

(givedetails)

2. From other banks Rs.

(Specify limit and security)

3. From Private persons etc. Rs. Rs.

4. Due to suppliers Rs. Rs.

Estimated

networth(-2)Rs. tot. lo

7. The name and address of person/s bank from whom I have made inquiries are as follows:

Date of Name and address of party/ His/their address of the worth of Is the information given

Opinion bank from who opinion the party (verbatim reported oral or in writing

received or enquires made should be given, if from bank)

1 2 3 4

rey a

as

I have made independent enquires about the position above of the party and I am satis ed that the

information above furnished to the best of my knowledge and belief and is correct.

All the properties both immovable and movable detailed above are to be unencumbered.

Created with Scanner Pro

fi

fi

fi

Individuallsole Proprietary Concern

JsKBank CREDIT REPORT Adv-90

Business Unit....

tuarsnty

1. Full name, age and address of the party : Mir aNeed Salee

2. Particulars of occupation/business

(in case of individuals in service indicate status and salary)

a) Head of ce & Branches ductiom Drpatnest

b) Constitution. hdiidusl

c) Agriculturist/Non-Agriculturist ksscuturist

d) Father's name

e) Year established.

f) Particulars of other business if any Na Icpoted.

3. Estimated net means details (overleaf) See Atel redet

200. 200.

4. other Information: Rs. Rs.

a) Sales for the last two years

b) Purchase for the last two years

c) Pro t for the last two years

d) Income tax paid for the assessment

200

e) Observation on prelous dealings

e.g ) Operation in the account and turnover of stocks

do

Amount Particulars

5 Contingent liabiligties on guarantees etc. Rs.

yuorte

do-

6. Conditions of present business and market reputation (give details)

Created with Scanner Pro

fi

fi

PARTICULARS OF MEANS (VIDE ITEMS 3)

1. Assets of the rm individuals as on ..

a) Fixed assets (immovable properties, Plant and machinery etc.

Description Location Estimated Market

Value Rs.

1.

2.

3.

etc

b) Liquid Assets Rs.

I) Cash and Bank balance Rs.

ii) Stocks Rs.

ii) Sundrydebtors,billsrepeivable (a+b) Rs

iv) Other Assets Sub Total (a) Rs.

c) Details of assets in the; personal name of the proprietor of the rm other those indicated above

Properties Description Estimated Value

a)Movable Reicletia Wewe

b) Immovablend arehad

c) etc

and.

Sub Total (b) Rs

5.las

Total (a+b+c) Rs. 8S-c lee.

2. Less Liabilities:

1.

(give

Fromourbank Do

details)or u

Rs. .c

2. Fromother bankąoc Rs. 3.6.

(Specifylimitand šeeity)

3. From Private persons etc.

4. Due to suppliers

Rs. / Rs

Rs. Rs.

Estimated net wo Rs.

7. S.wen

The name and address of person/s bank from whom I have made inquiries are as folows:

Date of Name and address of party/ His/theiraddress of the worth of Is the information given

Opinion bank from who opinion the party (verbatim reported oral or in writing

received or enquires made should be given, if from bank)

1 2 3 4

Mrey

enoum Grelly

Ihave made independent enquires about the position above of the party and I am satis ed that the

information above furnished to the best of my knowledge and belief and is correct.

All the properties both immovable and movable detailed above are to be unencumbered.

Created with Scanner Pro

fi

fi

fi

You might also like

- Managing The Finance FunctionDocument22 pagesManaging The Finance FunctionJohn Eddrien TubongbanuaNo ratings yet

- Man Rider Winch VisualDocument6 pagesMan Rider Winch VisualRanjithNo ratings yet

- 165-60400 ManualDocument68 pages165-60400 ManualTerry SmithNo ratings yet

- Opi SG Hse 043 Ups r01 - Confined Space EntryDocument31 pagesOpi SG Hse 043 Ups r01 - Confined Space Entrysaad_ur_rehman_ghouri100% (1)

- Monthly Report CCTVDocument19 pagesMonthly Report CCTVNazlie Nasir0% (1)

- CP Installation ManualDocument14 pagesCP Installation Manualjamal Alawsu100% (1)

- Aerodynamic Characteristics of .22LR Match AmmunitionDocument76 pagesAerodynamic Characteristics of .22LR Match Ammunitionwlou100% (3)

- Simple Discount: SolutionDocument3 pagesSimple Discount: Solutiondreamfever0323100% (1)

- Advanced Accounting: Partnership LiquidationDocument33 pagesAdvanced Accounting: Partnership LiquidationVeesNo ratings yet

- Asme-B18.31.1m-2008 - (2016) METRIC STUD PDFDocument25 pagesAsme-B18.31.1m-2008 - (2016) METRIC STUD PDFIndana Steel Pvt.LtdNo ratings yet

- Material Requisition OF Corrosion Inhibitor Injection UnitDocument20 pagesMaterial Requisition OF Corrosion Inhibitor Injection Unitnaveen_86100% (1)

- Foundations of Financial Management 17Th Edition Block Solutions Manual Full Chapter PDFDocument42 pagesFoundations of Financial Management 17Th Edition Block Solutions Manual Full Chapter PDFjavierwarrenqswgiefjyn100% (11)

- Pile Integrity TestDocument7 pagesPile Integrity TestRolly Marc G. SoteloNo ratings yet

- 03 Stryker Corporation ExhibitsDocument7 pages03 Stryker Corporation ExhibitsYo shuk singhNo ratings yet

- 772 Question of CPWDDocument56 pages772 Question of CPWDvijai bharathramNo ratings yet

- RFT - Vibration Analysis & Reporting Services - Scope of Work (SOW) PDFDocument15 pagesRFT - Vibration Analysis & Reporting Services - Scope of Work (SOW) PDFShiju100% (1)

- Coping With Financial and Ethical Risks at American International Group AigDocument11 pagesCoping With Financial and Ethical Risks at American International Group AigMoinuddin Khan Kafi0% (1)

- GB090-ZZZZ-250-IN-MR-004 - RFQ For Metering Systems Rev.a - 11162012Document12 pagesGB090-ZZZZ-250-IN-MR-004 - RFQ For Metering Systems Rev.a - 11162012abdelmalek boudjemaaNo ratings yet

- Type Certificate Data Sheet: No. EASA - IM.R.520Document8 pagesType Certificate Data Sheet: No. EASA - IM.R.520Oleksandr BalychevNo ratings yet

- DKT0/2020/J5110: Ships in Service Survey ReportDocument26 pagesDKT0/2020/J5110: Ships in Service Survey ReportLeonidas Galanis100% (1)

- Maamoura and Baraka Development ProjectDocument20 pagesMaamoura and Baraka Development ProjectAHMED AMIRANo ratings yet

- Bureau: MoneyDocument15 pagesBureau: MoneyChippa Chippa100% (1)

- GEN-RA7754-00004-R03 Specification For Cathodic ProtectionDocument33 pagesGEN-RA7754-00004-R03 Specification For Cathodic ProtectionNnamdi UmezuruikeNo ratings yet

- GEN-RA7754-00003-R03 Specification For External Field Joint CoatingDocument28 pagesGEN-RA7754-00003-R03 Specification For External Field Joint CoatingNnamdi UmezuruikeNo ratings yet

- Factory Acceptenc Test-12022023151439Document20 pagesFactory Acceptenc Test-12022023151439remarkhb.maintenanceNo ratings yet

- SK Pharma2-12022023151206Document10 pagesSK Pharma2-12022023151206remarkhb.maintenanceNo ratings yet

- Ny2.Nl BW Fib ZZ ZZ ZZ Mi Ar 00101Document24 pagesNy2.Nl BW Fib ZZ ZZ ZZ Mi Ar 00101Azam KhanNo ratings yet

- SK Pharma-12022023151112Document21 pagesSK Pharma-12022023151112remarkhb.maintenanceNo ratings yet

- Strategy Memo - Egwa PMS Storage TankDocument4 pagesStrategy Memo - Egwa PMS Storage TankOkezie Alaukwu EmekaNo ratings yet

- TMPRO CASABE 1318 Ecopetrol Full ReportDocument55 pagesTMPRO CASABE 1318 Ecopetrol Full ReportDiego CastilloNo ratings yet

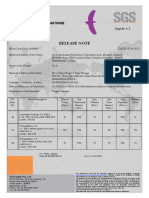

- Release Note N°: RN210607060EDocument3 pagesRelease Note N°: RN210607060ESantosh Iim LucknowNo ratings yet

- 6X Minus Earcup 8D Report EN - 0405Document18 pages6X Minus Earcup 8D Report EN - 0405ley manlovesyutNo ratings yet

- Submittal Transmittal: Date: 3/8/2016 Reference Number: 0483Document28 pagesSubmittal Transmittal: Date: 3/8/2016 Reference Number: 0483Raja RamarNo ratings yet

- SE070922176131662539172Document1 pageSE070922176131662539172Arjun ShuklaNo ratings yet

- CFTS Exep Ins Spe 00000 11 - R01Document16 pagesCFTS Exep Ins Spe 00000 11 - R01Kenneth EmbeleNo ratings yet

- Inspection Release Note: ChevronDocument3 pagesInspection Release Note: ChevronHassan M. OsmanNo ratings yet

- Frey-Fil Corporation: Pile Dynamic TestDocument7 pagesFrey-Fil Corporation: Pile Dynamic TestRolly Marc G. SoteloNo ratings yet

- IC Quality Inspection Certificate - SampleDocument3 pagesIC Quality Inspection Certificate - SampleRohit ChatarjeeNo ratings yet

- 1721-V-0905 A - MergedDocument5 pages1721-V-0905 A - MergedvivekNo ratings yet

- GEN-RA7754-00001-R03 Specification For PaintingDocument34 pagesGEN-RA7754-00001-R03 Specification For PaintingNnamdi UmezuruikeNo ratings yet

- MPMC Lab Student ManualDocument118 pagesMPMC Lab Student ManualNandhini ShreeNo ratings yet

- Zoltani, 1992 - Flow Resistance in Packed and Fluidized Beds - An Assessment of Current PracticeDocument75 pagesZoltani, 1992 - Flow Resistance in Packed and Fluidized Beds - An Assessment of Current PracticeianphilanderNo ratings yet

- BRL-MR-3733 - Aero Char of 7.62mm Match BulletsDocument73 pagesBRL-MR-3733 - Aero Char of 7.62mm Match BulletsRick GainesNo ratings yet

- Updates (Company Update)Document4 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- PO of Meenakshi EnterprisesDocument1 pagePO of Meenakshi EnterprisesNavin BNo ratings yet

- Manual For Metal Detector Fisher f2Document16 pagesManual For Metal Detector Fisher f2Nicolaie FlorinNo ratings yet

- Saudi Aramco Inspection ChecklistDocument3 pagesSaudi Aramco Inspection Checklistmkalidas2006No ratings yet

- Print Call Letter (11221100-24-10-23)Document1 pagePrint Call Letter (11221100-24-10-23)rajit kumarNo ratings yet

- VUL SEC Form 17-C AFS Approval Postponement of ASM AppointmentDocument3 pagesVUL SEC Form 17-C AFS Approval Postponement of ASM AppointmentJulius Mark Carinhay TolitolNo ratings yet

- Cover Sheet: Month Day Month DayDocument6 pagesCover Sheet: Month Day Month DayKenneth GarciaNo ratings yet

- Memo Pract - 2Document1 pageMemo Pract - 2Ulises TranquilinoNo ratings yet

- Ferrite ReportDocument1 pageFerrite ReportrameshwarmaNo ratings yet

- Indra: SonatrachDocument9 pagesIndra: Sonatrachmessari mohamedakliNo ratings yet

- Sinper Rif Re 22Document23 pagesSinper Rif Re 22sakhavsabinNo ratings yet

- Flat SoDocument1 pageFlat SoRamakant PatelNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SANS1200ADocument15 pagesSANS1200Ariaan.odendaal123No ratings yet

- 122 EpirbDocument1 page122 EpirbthỏaNo ratings yet

- SANS1200ADocument15 pagesSANS1200ANiyazudeen VakilNo ratings yet

- PRBCE Res#2023-09 Recommending A New List of Non-Programmable Calculators Allowed To Be Used in The Civil Engineering Licensure ExaminationsDocument3 pagesPRBCE Res#2023-09 Recommending A New List of Non-Programmable Calculators Allowed To Be Used in The Civil Engineering Licensure ExaminationsPRC BaguioNo ratings yet

- BCS /SS - CRM No. 405/2 Low Alloy Steel: B A S LDocument2 pagesBCS /SS - CRM No. 405/2 Low Alloy Steel: B A S LPeterson SudlabNo ratings yet

- Final Report - 1721-V-0905 BDocument5 pagesFinal Report - 1721-V-0905 BvivekNo ratings yet

- 2017 PH SSand Bucao + LMT BMaxDocument8 pages2017 PH SSand Bucao + LMT BMaxproscokeNo ratings yet

- Rites LTD, Southern Region, Chennai: S Sreenivasa RAODocument1 pageRites LTD, Southern Region, Chennai: S Sreenivasa RAORavi ChandraNo ratings yet

- Material Submittal No. 0003 r.01 For Mdpe Pipes & Fittings, Sdr-11 (Naffco Flow Control, U.a.e.)Document136 pagesMaterial Submittal No. 0003 r.01 For Mdpe Pipes & Fittings, Sdr-11 (Naffco Flow Control, U.a.e.)rheynavarro24No ratings yet

- Coagulation/ Flocculation Tank and Clarified Pond For WWT OperationDocument7 pagesCoagulation/ Flocculation Tank and Clarified Pond For WWT OperationKokian MckozenNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet

- 2 Ethics - Coram, Cheetah, Bunk - CarterDocument10 pages2 Ethics - Coram, Cheetah, Bunk - Cartersbracca1No ratings yet

- Chap.15 - Probs - Ia3 Odd and EvenDocument11 pagesChap.15 - Probs - Ia3 Odd and EvenMae Ann AvenidoNo ratings yet

- Individual Assignment 4 & 5 Financial Accounting & Analysis (Kmbn-103)Document2 pagesIndividual Assignment 4 & 5 Financial Accounting & Analysis (Kmbn-103)Peeush ShrivastavaNo ratings yet

- Synopsis ON Credit Risk Management IN: Pooja Arora 140423533Document6 pagesSynopsis ON Credit Risk Management IN: Pooja Arora 140423533Pooja AroraNo ratings yet

- 1.history of Banking LawDocument13 pages1.history of Banking LawneemNo ratings yet

- 15 Bank Management and Funds Transfer PricingDocument23 pages15 Bank Management and Funds Transfer PricingCalebNo ratings yet

- Philip Musyoka Proposal-FinalDocument42 pagesPhilip Musyoka Proposal-FinalphilipNo ratings yet

- Loan AgreementMITC - 1705588392880Document24 pagesLoan AgreementMITC - 1705588392880844501abhayNo ratings yet

- Econ 8200 Spring 2023Document6 pagesEcon 8200 Spring 2023Hugo SalasNo ratings yet

- Mildred PaytDocument1 pageMildred PaytAllanNo ratings yet

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanThanga PandiNo ratings yet

- Docshare - Tips - Finanance Project MbaDocument123 pagesDocshare - Tips - Finanance Project MbaSakshi Bakliwal100% (1)

- CH 20Document39 pagesCH 20ravimehta228984No ratings yet

- Suppose The Government Borrows 20 Billion More Next Year ThanDocument2 pagesSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiNo ratings yet

- AccountsDocument35 pagesAccounts053Mayank SharmaNo ratings yet

- How Bills Look Alike of A Pharma CompanyDocument1 pageHow Bills Look Alike of A Pharma CompanyPiyush JindalNo ratings yet

- Prospectus of First Security BankDocument123 pagesProspectus of First Security BankKhalid FirozNo ratings yet

- Monetary Policy in Times of Uncertainties Evidence From Tunisia Egypt and MoroccoDocument26 pagesMonetary Policy in Times of Uncertainties Evidence From Tunisia Egypt and MoroccoJiboye OlaoyeNo ratings yet

- Capital Adequacy Ratio (CAR) - Overview and ExampleDocument7 pagesCapital Adequacy Ratio (CAR) - Overview and ExampleOlmedo FarfanNo ratings yet

- Commercial BankingDocument36 pagesCommercial Bankingkhatiwada2005No ratings yet

- 1st Part of Loan AmortizationDocument3 pages1st Part of Loan AmortizationOptimistic ShanNo ratings yet

- Value Creation Opportunities For Renewable EnergyDocument14 pagesValue Creation Opportunities For Renewable Energyian joeNo ratings yet

- Impact of Payment Banks in Indian Financial SystemDocument6 pagesImpact of Payment Banks in Indian Financial SystemNithin JoseNo ratings yet