Professional Documents

Culture Documents

Financial Benchmark - Auto Parts Manufacturers - Vertical IQ

Uploaded by

fisehaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Benchmark - Auto Parts Manufacturers - Vertical IQ

Uploaded by

fisehaCopyright:

Available Formats

FINANCIAL BENCHMARK

Auto Parts Manufacturers

How do you stack up?

Here are average values of common financial benchmarks for US auto parts manufacturers and all manufacturing firms. This data is for 2020-21 and comes from the

Risk Management Association and Powerlytics, Inc.

It is based on a sample of 218 auto parts manufacturers and 9439

manufacturing firms.

CASH LIQUIDITY

Auto Parts Manufactur… All Manufacturers

2

1.81 Sales to OEMs and aftermarket customers are somewhat seasonal, and

cash flow can be irregular.

1.22

Current Ratio = Current Assets/Current Liabilities

1 Quick Ratio = (Cash + AR)/Current Liabilities

0.98

0.72

0

Current Ratio Quick Ratio

WORKING CAPITAL MANAGEMENT

Auto Parts Manufactur… All Manufacturers

75

70 Inventory levels are slightly lower than average, as auto parts

manufacturers implement lean manufacturing techniques.

50 52

46 47 Days Receivables = 365 x Accounts Receivable/Revenue

43 Days Inventory = 365 x Inventory/Cost of Sales

34 Days Payable = 365 x Payables/Cost of Sales

25

0

Days Receivables Days Inventory Days Payable

PROFITABILITY

Auto Parts Manufactur… All Manufacturers

40

The combination of low margins and high overhead makes most auto

33.15 parts manufacturers volume-dependent and vulnerable to variability in

demand.

20 23.34 Gross Margin % = (Operating Expenses + Operating Income)/Revenue

Operating Income % = Operating Income/Revenue

4.43 5.26

3.01

Pre Tax Return on Assets % = (Pre-tax Net Income/Total Assets)

8.65

0

Gross Margin % Operating Income % Pre Tax Return on

Assets %

You might also like

- Outreach Networks Case Study SolutionDocument2 pagesOutreach Networks Case Study SolutionEaston Griffin0% (1)

- Financial Modeling HandbookDocument43 pagesFinancial Modeling HandbookAkshay Chaudhry100% (5)

- 8e Ch3 Mini Case Planning MemoDocument8 pages8e Ch3 Mini Case Planning Memotom0% (3)

- MGMT 2023 Examination - Question - Paper S2 - 2012Document10 pagesMGMT 2023 Examination - Question - Paper S2 - 2012Lois AlfredNo ratings yet

- Understanding Basics of Financial StatementsDocument32 pagesUnderstanding Basics of Financial StatementsAparna PavaniNo ratings yet

- Analysing Financial StatementDocument9 pagesAnalysing Financial StatementHieu NguyenNo ratings yet

- Unit 2Document17 pagesUnit 2hassan19951996hNo ratings yet

- Income Statement PDFDocument4 pagesIncome Statement PDFMargarete DelvalleNo ratings yet

- Ratio Analysis ClassworkDocument4 pagesRatio Analysis ClassworkMo HachimNo ratings yet

- RMIT ACCT 2105 Financial Report AnalysisDocument6 pagesRMIT ACCT 2105 Financial Report AnalysisTrúc NguyễnNo ratings yet

- IBF Report P1Document14 pagesIBF Report P1Naveed AbbasNo ratings yet

- Exide Vs Amara Raja FinalDocument11 pagesExide Vs Amara Raja FinalNinad MaskeNo ratings yet

- JFCL Presentation MaterialsDocument21 pagesJFCL Presentation MaterialsSaimonNo ratings yet

- MA AssignmentDocument7 pagesMA Assignmenthassan mehdiNo ratings yet

- M&a - Retail StoresDocument186 pagesM&a - Retail Storesvaibhavsinha101No ratings yet

- FM.-Financial-analysis-bookDocument31 pagesFM.-Financial-analysis-bookahmedsoobi73No ratings yet

- Case 2 Ford MotorDocument4 pagesCase 2 Ford MotorNikki LabialNo ratings yet

- Ratio Analysis Template BreakdownDocument44 pagesRatio Analysis Template BreakdownrikitagujralNo ratings yet

- HCL Company Analysis - Udit GurnaniDocument7 pagesHCL Company Analysis - Udit GurnaniUdit GurnaniNo ratings yet

- WCM IndividualDocument9 pagesWCM IndividualSiddharth PoddarNo ratings yet

- Financial Modelling HandbookDocument76 pagesFinancial Modelling Handbookreadersbusiness99No ratings yet

- Accounting AssignmentDocument2 pagesAccounting AssignmentRomyah CornwallNo ratings yet

- CMA-MarkingPlan - AU 2017Document2 pagesCMA-MarkingPlan - AU 2017ShehrozSTNo ratings yet

- Estimate pure play betas by industryDocument11 pagesEstimate pure play betas by industryMario ObrequeNo ratings yet

- Bajaj Finserv and Manappuram Finance Acquisition IdeaDocument13 pagesBajaj Finserv and Manappuram Finance Acquisition IdeaRUSHIL GUPTANo ratings yet

- Strategic Financial Analysis and Design: Sensitivity: PublicDocument6 pagesStrategic Financial Analysis and Design: Sensitivity: PublicMuneeb GulNo ratings yet

- Leveraged Buyout ModelDocument31 pagesLeveraged Buyout ModelmilosevNo ratings yet

- Chapter 2 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallDocument47 pagesChapter 2 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallNur SyakirahNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- 2 Final Acc. Manu.Document24 pages2 Final Acc. Manu.caprerna2022No ratings yet

- RATIO ANALYSIS ProjectDocument14 pagesRATIO ANALYSIS ProjectwwvaibNo ratings yet

- Profitability Position of Aditya BirlaDocument10 pagesProfitability Position of Aditya BirlaPalmodiNo ratings yet

- Project GuidelinesDocument19 pagesProject GuidelinesShown Shaji JosephNo ratings yet

- FS and Ratios Addtl ExercisesDocument5 pagesFS and Ratios Addtl ExercisesRaniel PamatmatNo ratings yet

- Ladangku CFO New Models - External Circulation-V2Document15 pagesLadangku CFO New Models - External Circulation-V2syafiqfatNo ratings yet

- EbiiduDocument32 pagesEbiiduRicardo PárragaNo ratings yet

- CAP_EXPEND_TO_SALESDocument6 pagesCAP_EXPEND_TO_SALESDkNo ratings yet

- Pravin ChoudharyDocument14 pagesPravin Choudharypravinchoudhary740No ratings yet

- Stock Prediction-Fundamental AnalysisDocument9 pagesStock Prediction-Fundamental Analysischinmayaa reddyNo ratings yet

- Cement Ratio AnalysisDocument6 pagesCement Ratio AnalysisvikassinghnirwanNo ratings yet

- Thi ThiDocument26 pagesThi ThiNhật HạNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisArohiNo ratings yet

- Lecture 3Document44 pagesLecture 3felipeNo ratings yet

- Financial Model PRGFEE - 30-June-2015Document71 pagesFinancial Model PRGFEE - 30-June-2015AbhishekNo ratings yet

- You Exec - 2019 MidYear Report FreeDocument11 pagesYou Exec - 2019 MidYear Report FreePradeep ChandranNo ratings yet

- Financial Management FinalDocument14 pagesFinancial Management FinalNeal KNo ratings yet

- Financial Analysis - HomeworkDocument7 pagesFinancial Analysis - HomeworkTuan Anh LeeNo ratings yet

- FM 1Document3 pagesFM 1Diane Ronalene Cullado MagnayeNo ratings yet

- The Presentation MaterialsDocument28 pagesThe Presentation MaterialsValter SilveiraNo ratings yet

- Financial Statement AnalysisDocument76 pagesFinancial Statement AnalysisMinh Anh MinhNo ratings yet

- Financial Ratio Analysis of Star Cement PVT LTD: Presentation By: Aditi ChaudharyDocument16 pagesFinancial Ratio Analysis of Star Cement PVT LTD: Presentation By: Aditi ChaudharyGunjan ChaudharyNo ratings yet

- Accounting Measures & Firm Performance: Ratio CalculationDocument7 pagesAccounting Measures & Firm Performance: Ratio CalculationVítor Gularte de OliveiraNo ratings yet

- Pres Ratios DataDocument24 pagesPres Ratios Datasamarth chawlaNo ratings yet

- Profitability RatioDocument17 pagesProfitability Ratioaayushiji789No ratings yet

- 25.9 Working Capital Requirement: This Project Cost May Be Financed at A Debt Equity Ratio of 3:1 As FollowsDocument1 page25.9 Working Capital Requirement: This Project Cost May Be Financed at A Debt Equity Ratio of 3:1 As Followsk.g.thri moorthyNo ratings yet

- Beta CalculationDocument30 pagesBeta Calculationrksp99999No ratings yet

- Ch3 Income Statement - DVDocument44 pagesCh3 Income Statement - DVElf CanNo ratings yet

- Hitungan Untuk Ppa - SoftwareDocument27 pagesHitungan Untuk Ppa - SoftwareM. Satria Manggala Yudha, S. IkomNo ratings yet

- Week 6 - Introduction To Financial Statement AnalysisDocument23 pagesWeek 6 - Introduction To Financial Statement AnalysisObed Darko BaahNo ratings yet

- Otc Maksf 2021Document216 pagesOtc Maksf 2021Janet HarryNo ratings yet

- M-And-s Ar21 Strategic 210602Document59 pagesM-And-s Ar21 Strategic 210602Anjani SinghNo ratings yet

- Commercial Awareness and Business Decision Making Skills: How to understand and analyse company financial informationFrom EverandCommercial Awareness and Business Decision Making Skills: How to understand and analyse company financial informationNo ratings yet

- Receipt FT24055 P7 TYVDocument1 pageReceipt FT24055 P7 TYVfisehaNo ratings yet

- TMA Cover PageDocument2 pagesTMA Cover PagefisehaNo ratings yet

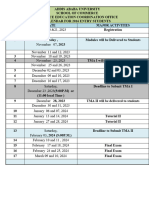

- Calendar - 2016 Entry - NewDocument1 pageCalendar - 2016 Entry - NewfisehaNo ratings yet

- TMA 1 Advanced Financial ManagementDocument4 pagesTMA 1 Advanced Financial ManagementfisehaNo ratings yet

- TMA 1 Advanced Financial ManagementDocument4 pagesTMA 1 Advanced Financial ManagementfisehaNo ratings yet

- StandardAndPoors Corporate Ratings Criteria PDFDocument114 pagesStandardAndPoors Corporate Ratings Criteria PDFAnonymous fjgmbzTNo ratings yet

- Part III-1 The IPO ProcessDocument13 pagesPart III-1 The IPO ProcessfisehaNo ratings yet

- ProposalDocument14 pagesProposalfisehaNo ratings yet

- Application To Buna Rev1Document2 pagesApplication To Buna Rev1fisehaNo ratings yet

- Project Proposal For Establishment of Coffee Processing PlantDocument48 pagesProject Proposal For Establishment of Coffee Processing Plantfiseha100% (4)

- 22 DPSA ES Admissions Brochure - Web - 0Document13 pages22 DPSA ES Admissions Brochure - Web - 0fisehaNo ratings yet

- Company ABC 2015 Strategic PlanDocument24 pagesCompany ABC 2015 Strategic PlanDaniellNo ratings yet

- Business Plan GashaDocument26 pagesBusiness Plan GashafisehaNo ratings yet

- Credit Structuring Model - COMPLETEDDocument9 pagesCredit Structuring Model - COMPLETEDfisehaNo ratings yet

- ProposalDocument14 pagesProposalfisehaNo ratings yet

- From Footing & 5th Floor Finishing Budget For YONA 230609 154459Document36 pagesFrom Footing & 5th Floor Finishing Budget For YONA 230609 154459fisehaNo ratings yet

- Gasha Application Wegagen 10m TLDocument1 pageGasha Application Wegagen 10m TLfisehaNo ratings yet

- Business Plan: 2.1 Company ProfileDocument7 pagesBusiness Plan: 2.1 Company ProfilefisehaNo ratings yet

- 2019 Analysis SAC Version 2 SolutionDocument6 pages2019 Analysis SAC Version 2 SolutionLachlan McFarlandNo ratings yet

- Classroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeDocument2 pagesClassroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeBianca JovenNo ratings yet

- Gratuity Report IND As 19Document25 pagesGratuity Report IND As 19Prashant GaurNo ratings yet

- IAS 20 Accounting For Government Grant and Disclosure of Govt AssistanceDocument3 pagesIAS 20 Accounting For Government Grant and Disclosure of Govt AssistanceYogesh BhattaraiNo ratings yet

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

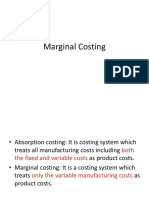

- Class - Marginal CostingDocument45 pagesClass - Marginal CostingAMBIKA MALIKNo ratings yet

- Relationship of Case and Financial AnalysisDocument10 pagesRelationship of Case and Financial AnalysisMohamed Zedan100% (1)

- Consolidated Financial Statements - 5. CFS (Subsidiaries)Document56 pagesConsolidated Financial Statements - 5. CFS (Subsidiaries)shubhamNo ratings yet

- Enager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, IncDocument5 pagesEnager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, IncVakul AgarwalNo ratings yet

- Questions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashDocument3 pagesQuestions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashPranav SharmaNo ratings yet

- The Following Transactions Were Completed by The Irvine Company DuringDocument1 pageThe Following Transactions Were Completed by The Irvine Company DuringAmit PandeyNo ratings yet

- Ar2011 Dairy FarmDocument68 pagesAr2011 Dairy Farmtenglumlow100% (1)

- 2652Document3 pages2652Alexis AlipudoNo ratings yet

- FM-2 Presentation on Sun Pharma's Beta CalculationDocument6 pagesFM-2 Presentation on Sun Pharma's Beta CalculationNeha SmritiNo ratings yet

- Financial Management Options EPSDocument3 pagesFinancial Management Options EPSVishal ChandakNo ratings yet

- ACCO 40013 IM - Lesson 2 Asset-Based ValuationDocument10 pagesACCO 40013 IM - Lesson 2 Asset-Based ValuationrylNo ratings yet

- Cost Concept and Behavior RaibornDocument40 pagesCost Concept and Behavior RaibornRJ MonsaludNo ratings yet

- Working Capital Management Set 2Document34 pagesWorking Capital Management Set 2Mohd FaizanNo ratings yet

- Fin661 - Lesson Plan - March2021Document2 pagesFin661 - Lesson Plan - March2021MOHAMAD ZAIM BIN IBRAHIM MoeNo ratings yet

- Partnership and CorpoDocument3 pagesPartnership and CorpoKing MacunatNo ratings yet

- Acc106 - Test 1 - May 2018 - SSDocument5 pagesAcc106 - Test 1 - May 2018 - SSsyahiir syauqiiNo ratings yet

- Exercises 20.4A Bad DebtsDocument1 pageExercises 20.4A Bad DebtsCarolnesa Dorie Tan Kar MeanNo ratings yet

- CPA REVIEW EXAMDocument14 pagesCPA REVIEW EXAMZiee00No ratings yet

- Account structure and balancesDocument3 pagesAccount structure and balancesarifuddinkNo ratings yet

- Dividend Discount Model - DDM Is A Quantitative Method Used ForDocument4 pagesDividend Discount Model - DDM Is A Quantitative Method Used ForDUY LE NHAT TRUONGNo ratings yet

- Chapter 4 Financial PlanningDocument46 pagesChapter 4 Financial PlanningMustafa EyüboğluNo ratings yet

- Chapter3aa1sol 2012Document28 pagesChapter3aa1sol 2012JudeNo ratings yet