Professional Documents

Culture Documents

0605version1999 09.02.2022

0605version1999 09.02.2022

Uploaded by

Clark GuilasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0605version1999 09.02.2022

0605version1999 09.02.2022

Uploaded by

Clark GuilasCopyright:

Available Formats

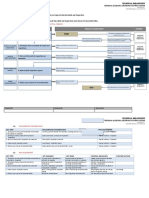

(To be filled up the BIR)

DLN: PSIC: PSOC:

BIR Form No.

Republika ng Pilipinas Kagawaran

ng Pananalapi

Kawanihan ng Rentas Internas Payment Form 0605

July 1999 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Calendar Fiscal 3 Quarter 4 Due Date ( MM / DD / YYYY) 5 No. of Sheets 6 ATC

2 Year Ended Attached

( MM / YYYY ) 1st 2nd 3rd 4th

7 Return Period ( MM / DD / YYYY ) 8 Tax Type Code BCS No./Item No. (To be filled up by the BIR)

Part I Background Information

9 Taxpayer Identification No. 10 RDO Code 11 Taxpayer Classification 12 Line of Business/Occupation

I N

13 Taxpayer's 14 Telephone Number

Name

(Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individuals)

15 Registered 16 Zip Code

Address

17 Manner of Payment 18 Type of Payment

Voluntary Payment Per Audit/Delinquent Account

Installment

Self-Assessment Penalties Preliminary/Final Assessment/Deficiency Tax

No. of Installment

Tax Deposit/Advance Payment Accounts Receivable/Delinquent Account Income

Partial

Tax Second Installment

Payment

(Individual)

Full

Others (Specify)

Payment

Part II Computation of Tax

19

19 Basic Tax / Deposit / Advance Payment

20 Add: Penalties Surcharge Interest Compromise

20A 20B 20C 20D

21 Total Amount Payable (Sum of Items 19 & 20D) 21

For Voluntary Payment For Payment of Deficiency Stamp of Receiving

Taxes From Audit/Investigation/ Office

I declare, under the penalties of perjury, that this document has been made in Delinquent Accounts and Date of Receipt

good faith, verified by me, and to the best of my knowledge and belief, is true and APPROVED BY:

correct, pursuant to the provisions of the National Internal Revenue Code, as

amended, and the regulations issued under authority thereof.

22A

22B

Signature over Printed Name of Taxpayer /Authorized Representative Title/Position of Signatory Signature over Printed Name of Head of Office

Part III D e t a i l s of P a y m e n t

Particulars Drawee Bank/Agency Number MM DD YYYY Amount

23 Cash/Bank 23

Debit Memo

24A 24B 24C 24D

24 Check

25 Tax Debit 25A

Memo 25B 25C

26A 26B 26C 26D

26 Others

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

Taxpayer Classification: I - Individual N - Non-Individual

BIR Form 0605 (ENCS) - PAGE 2

ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT

II 011 Pure Compensation Income Sweetened Products XP060 Premium (Unleaded) Gasoline

II 012 Pure Business Income XB010 Sweetened Juice Drinks XP080 Regular Gasoline

II 013 Mixed (Compensation and Business) XB020 Sweetened Tea XP090 & XP100 Naptha & Other Similar Products

MC 180 VAT/Non-VAT Registration Fee XB030 Carbonated Beverages XP 110 Aviation Gasoline

MC 190 Travel Tax XB040 Flavored Water XP140 Diesel Gas

MC 090 Tin Card Fees XB050 Energy and Sports Drinks XP180 Bunker Fuel Oil

MC010 & MC020 Tax Amnesty XB060 Powdered Drinks not Classified as Milk, Juice, Tea and Coffee XP120 Avturbo Jet Fuel

MC 040 Income from Forfeited Properties XB070 Cereal and Grain Beverages XP130 & XP131 Kerosene

MC 050 Proceeds from Sale of Rent Estate XB080 Other Non-Alcoholic Beverages that Contain Added Sugar XP170 Asphalts

MC 060 Energy Tax on Electric Power Consumption XB090 Using Purely High Fructose Corn Syrup XP150 & XP160 LPG Gas

MC 031 Deficiency Tax XB100 Using Purely Coconut Sap Sugar & Purely Steviol Glycosides XP010, XP020 & Basetocks, Lubes and

MC 030 Delinquent Accounts/Accounts Receivable Invasive Cosmetic Products XP190 Greases

FP 010 - FP 930 Fines and Penalties XC010 Performance of Services on Invasive Cosmetic Procedures XP040 Waxes and Petrolatum

MC 200 Others Tobacco Products XP030 Processed Gas

MC 210 Miscellaneous Taxes -Other Tax Revenue XT010 & XT020 Smoking and Chewing Tobacco Miscellaneous Products/Articles

MC 220 - MC 240 Advance Payment on Privilege Store XT030 Cigars XG020-XG090 Automobiles

VM 160 VAT on Manufacturing - Sugar XT040 Cigarettes Packed By Hand XG100-XG120 Non Essential Goods

IC 080 Income Tax on International Carriers XT050-XT130 Cigarettes Packed By Machine Mineral Products

PT 041 Percentage Tax on International Carriers Tobacco Inspection Fees XM010 Coal & Coke

DS 010 Documentary Stamp Tax - General XT080 Cigars XM020 Non Metallic & Quarry Resources

Excise Tax on Goods XT090 Cigarettes XM030 Gold and Chromite

Alcohol Products XT100 & XT110 Leaf Tobacco & Other Manufactured Tobacco XM040 Copper & Other Metallic Minerals

XA010-XA040 Distilled Spirits XT120 Monitoring Fees XM050 Indigenous Petroleum

XA061-XA090 Wines Petroleum Products XM051 Others

XA051-XA053 Fermented Liquor XP070 Premium (Leaded) Gasoline

TAX TYPE

Code Description Code Description Code Description

RF REGISTRATION FEE CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-COMPENSATION

TR TRAVEL TAX-PTA ES ESTATE TAX WE WITHHOLDING TAX-EXPANDED

ET ENERGY TAX DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

QP QUALIFYING FEES-PAGCOR VT VALUE-ADDED TAX WG WITHHOLDING TAX - VAT AND OTHER

MC MISCELLANEOUS TAX PT PERCENTAGE TAX PERCENTAGE TAXES

XV EXCISE-AD VALOREM ST PERCENTAGE TAX - STOCKS WO WITHHOLDING TAX-OTHERS (ONE-TIME TRAN-

XS EXCISE-SPECIFIC SO PERCENTAGE TAX - STOCKS (IPO) SACTION NOT SUBJECT TO CAPITAL

XF TOBACCO INSPECTION AND SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

MONITORING FEES DS DOCUMENTARY STAMP TAX WR WITHHOLDING TAX - FRINGE BENEFITS

IT INCOME TAX WB WITHHOLDING TAX-BANKS AND OTHER WW WITHHOLDING TAX - PERCENTAGE TAX

CG CAPITAL GAINS TAX - Real Property FINANCIAL INSTITUTIONS ON WINNING AND PRIZES

BIR Form No. 0605 - Payment Form

Guidelines and Instructions

Who Shall File One set of form shall be filled-up for each kind of tax and for

each taxable period.

Every taxpayer shall use this form, in triplicate, to pay

taxes and fees which do not require the use of a tax return Note:

such as second installment payment for income tax, • All background information must be properly filled-up.

deficiency tax, delinquency tax, registration fees, penalties,

advance payments, deposits, installment payments, etc. • For voluntary payment of taxes, BIR Form 0605 shall

be signed by the taxpayer or his authorized

When and Where to File and Pay representative.

This form shall be accomplished:

1. Everytime a tax payment or penalty is due or an • For payment of deficiency taxes at the Revenue District

advance payment is to be made; Office level and other investigating offices prior to the

2. Upon receipt of a demand letter/assessment notice issuance of Preliminary Assessment Notice

and/or collection letter from the BIR; and (PAN)/Final Assessment Notice (FAN), BIR Form

3. Upon payment of annual registration fee for new business 0605 shall be approved and signed by the Revenue

and for renewals on or before January 31 of every year. District Officer (RDO) or Head of the investigating

offices.

This form shall be filed and the tax shall be paid with

any Authorized Agent Bank (AAB) under the jurisdiction of • For payment of deficiency taxes with issued

the Revenue District Office where the taxpayer is required to Preliminary Assessment Notice/Final Assessment

register/conducting business/producing articles subject to Notice, BIR Form 0605 shall be signed by the taxpayer

excise tax/having taxable transactions. In places where there or his authorized representative.

are no AABs, this form shall be filed and the tax shall be paid

directly with the Revenue Collection Officer or duly • The last 3 digits of the 12-digit TIN refers to the branch

Authorized City or Municipal Treasurer of the Revenue code.

District Office where the taxpayer is required to register/

conducting business/producing articles subject to excise tax/ Attachments

having taxable transactions, who shall issue Revenue Official For Voluntary Payment:

Receipt (BIR Form No. 2524) therefor. 1. Duly approved Tax Debit Memo, if applicable;

2. Xerox copy of the return (ITR)/ Reminder Letter in

Where the return is filed with an AAB, the lower portion case of payment of second installment on income tax.

of the return must be properly machine-validated and

stamped by the Authorized Agent Bank to serve as the receipt For Payment of Deficiency Taxes from Audit/ Delinquent

of payment. The machine validation shall reflect the date of Accounts:

payment, amount paid and transaction code, and the stamp 1. Duly approved Tax Debit Memo, if applicable;

mark shall show the name of the bank, branch code, teller’s 2. Preliminary Assessment Notice (PAN)/ Final

name and teller’s initial. The AAB shall also issue an official Assessment Notice (FAN)’ Letter of Demand;

receipt or bank debit advice or credit document, whichever is 3. Post Reporting Notice, if applicable;

applicable, as additional proof of payment. 4. Collection letter of Delinquent/ Accounts Receivable.

ENCS

You might also like

- Waste Materials Report: Entity Name: Deped, Division of Ozamiz CityDocument2 pagesWaste Materials Report: Entity Name: Deped, Division of Ozamiz CityNestorJepolanCapiña100% (1)

- 5S Classroom Review ChecklistDocument1 page5S Classroom Review ChecklistAtul Sharma100% (1)

- 7S Workshop-Check-ListDocument11 pages7S Workshop-Check-Listsangitadipak1979No ratings yet

- Accomplishment Report: 7S Good HousekeepingDocument4 pagesAccomplishment Report: 7S Good Housekeepingyhanzer11100% (1)

- Office 5S ChecklistDocument15 pagesOffice 5S ChecklistRohit NegiNo ratings yet

- Plan To Achieve Objective 2021Document1 pagePlan To Achieve Objective 2021Bahar HasanNo ratings yet

- EEC Form 1 CEMDocument1 pageEEC Form 1 CEMcspolaNo ratings yet

- Swot Analysis For SY2018-2019Document1 pageSwot Analysis For SY2018-2019PhilipPe100% (1)

- Workplace Environment Measurement ProcedureDocument4 pagesWorkplace Environment Measurement ProcedureRonald SarillanaNo ratings yet

- LACE Recording of Work Hours - Computation of LC - COCDocument81 pagesLACE Recording of Work Hours - Computation of LC - COCMikee RañolaNo ratings yet

- Economic in Loss ControlDocument15 pagesEconomic in Loss ControlAviects Avie Jaro0% (1)

- Ciencia Y Virtud: The 7SDocument11 pagesCiencia Y Virtud: The 7SElle DyNo ratings yet

- Vehicle Weekly Inspection ChecklistDocument1 pageVehicle Weekly Inspection ChecklistakhmamNo ratings yet

- 5S Audit ChecklistDocument3 pages5S Audit ChecklistPaulus Herdyan BalleNo ratings yet

- Internal Auditing and Inspection ProcedureDocument2 pagesInternal Auditing and Inspection ProcedurednmuleNo ratings yet

- TUV NORD Questionnaire - QFDocument6 pagesTUV NORD Questionnaire - QFArun VivekNo ratings yet

- 7s PresentationDocument54 pages7s PresentationMish Lim67% (3)

- Calibration ScheduleDocument1 pageCalibration ScheduleMuhammad BabarNo ratings yet

- HACCP Food Safety System: Course Outline For Whom Other Details Related TrainingsDocument3 pagesHACCP Food Safety System: Course Outline For Whom Other Details Related TrainingsagentrinaNo ratings yet

- Combined EHS Management System Audit ChecklistDocument26 pagesCombined EHS Management System Audit ChecklistOjo OgboadayegbeNo ratings yet

- Housekeeping Inspection ChecklistDocument2 pagesHousekeeping Inspection ChecklistJheen Cruz100% (1)

- Injury Incident Report FormDocument3 pagesInjury Incident Report FormDave Joseph Conde100% (1)

- SHE-ECP-09-013 Portable Electrical Equipment Procedure Rev02Document5 pagesSHE-ECP-09-013 Portable Electrical Equipment Procedure Rev02grantNo ratings yet

- Procedure For Verification of Purchase DocumentationDocument2 pagesProcedure For Verification of Purchase Documentationmrugeshj100% (2)

- 9 Forklift Pre-Operational ChecklistDocument2 pages9 Forklift Pre-Operational ChecklistandrewhwNo ratings yet

- Rule 1020 Application FormDocument2 pagesRule 1020 Application FormraikNo ratings yet

- Letter of AuthorizationDocument1 pageLetter of AuthorizationRalna Dyan FloranoNo ratings yet

- China Huaneng Group - Dela Cruz & Delos ReyesDocument8 pagesChina Huaneng Group - Dela Cruz & Delos ReyesKimberly Dela CruzNo ratings yet

- Employee Training Tracking Log 2Document6 pagesEmployee Training Tracking Log 2Hiko AdillaNo ratings yet

- 7S Good Housekeeping Training-OfficialDocument66 pages7S Good Housekeeping Training-OfficialShielany Abad100% (1)

- 01 Housekeeping ScheduleDocument3 pages01 Housekeeping ScheduleDominic DizonNo ratings yet

- Dept. Order No. 57-04Document8 pagesDept. Order No. 57-04Almario Sagun100% (1)

- Breastfeeding PolicyDocument2 pagesBreastfeeding PolicyMark Adrianne CailaoNo ratings yet

- PDF Perfect Attendance ProgramDocument3 pagesPDF Perfect Attendance ProgramHR SyscoreNo ratings yet

- Jo Finance Assistant Budget Gl5Document4 pagesJo Finance Assistant Budget Gl5indus kingNo ratings yet

- Emergency Purchase FormDocument1 pageEmergency Purchase FormJay AnnNo ratings yet

- Safety in Heat Memo 2022Document2 pagesSafety in Heat Memo 2022ramodNo ratings yet

- ChecklistDocument1 pageChecklistmeenakshiNo ratings yet

- Toolbox Talks Forklift Safety EnglishDocument1 pageToolbox Talks Forklift Safety EnglishBayu Mandala PratamaNo ratings yet

- Accident Reporting ProcedureDocument7 pagesAccident Reporting ProcedureDavid J CRNo ratings yet

- Self Monitoring Report New FormatDocument17 pagesSelf Monitoring Report New FormatflorianNo ratings yet

- Self Monitoring Report System 3RD Quarter 2018Document13 pagesSelf Monitoring Report System 3RD Quarter 2018ARCHEMEDEZ RAMOSNo ratings yet

- 7S Ppt-Beena-170314183534 PDFDocument10 pages7S Ppt-Beena-170314183534 PDFJuan Salazar100% (1)

- Broker Commission Schedule-EDocument19 pagesBroker Commission Schedule-EErvin Fong ObilloNo ratings yet

- Endorsement To RXI 1Document6 pagesEndorsement To RXI 1DenSabioNo ratings yet

- 4.2 Understanding Interested Parties NeedsDocument3 pages4.2 Understanding Interested Parties NeedsYen Trang Vo NhiNo ratings yet

- A Project Feasibility Study For The Establishment of EDocument9 pagesA Project Feasibility Study For The Establishment of EAllan SanoriaNo ratings yet

- ASMI-OSHMS-PR-12 - Audits Inspections and Preventive - Corrective Actions Procedure.Document11 pagesASMI-OSHMS-PR-12 - Audits Inspections and Preventive - Corrective Actions Procedure.JHUPEL ABARIALNo ratings yet

- Written Lockout/Tagout Program University of South Carolina (Enter Department Name Here)Document13 pagesWritten Lockout/Tagout Program University of South Carolina (Enter Department Name Here)SaidNo ratings yet

- FIN-03. Receiving ProcedureDocument5 pagesFIN-03. Receiving ProcedureVu Dinh ThietNo ratings yet

- 15.1 Appendix 1 Internal Audit Checklist Preview ENDocument2 pages15.1 Appendix 1 Internal Audit Checklist Preview ENgheoda8926No ratings yet

- Amla MSDSDocument4 pagesAmla MSDSarvind kaushikNo ratings yet

- Vehicle Tracking Policy - CMT Approved 01.09.16Document6 pagesVehicle Tracking Policy - CMT Approved 01.09.16sethup_1No ratings yet

- Monthly Performance Output Report Form 2Document1 pageMonthly Performance Output Report Form 2clairealbertiniNo ratings yet

- Sort - SEIRI: Checklist Item Criteria Exist? Rating CommentsDocument2 pagesSort - SEIRI: Checklist Item Criteria Exist? Rating CommentsIL AguilarNo ratings yet

- Module 1-B Emergency PreparednessDocument11 pagesModule 1-B Emergency PreparednessRobin RubinaNo ratings yet

- Final - Print Adh Lam Slit - May 6 2010Document22 pagesFinal - Print Adh Lam Slit - May 6 2010Luis Miguel Blanco TovarNo ratings yet

- Sop For SopDocument11 pagesSop For SopMorsad AnamNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLandsNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasCeslhee AngelesNo ratings yet

- Cef1 Revised Regular NewDocument38 pagesCef1 Revised Regular NewCheRylNo ratings yet

- Extra-Judicial Settlement of Estate With Waiver and Renunciation of RightsDocument3 pagesExtra-Judicial Settlement of Estate With Waiver and Renunciation of RightsCheRylNo ratings yet

- Extrajudicial Settlement With Waiver of RightsDocument2 pagesExtrajudicial Settlement With Waiver of RightsCheRyl100% (1)

- Extra-Judicial-Settlement-with-Waiver Donation LicayanDocument3 pagesExtra-Judicial-Settlement-with-Waiver Donation LicayanCheRyl0% (1)

- SpeechDocument1 pageSpeechCheRylNo ratings yet

- CEF1 Revised KKDocument6 pagesCEF1 Revised KKCheRylNo ratings yet

- Annex DDocument1 pageAnnex DCheRylNo ratings yet

- Implementing Memo For Resos On Transfer of Vcs For 2022 Bske and 2025 Nle and Clustering of Precincts For 2022 Bske 080122Document3 pagesImplementing Memo For Resos On Transfer of Vcs For 2022 Bske and 2025 Nle and Clustering of Precincts For 2022 Bske 080122CheRylNo ratings yet

- Gerochi vs. Doe G.R. No. 159796 July 17, 2007Document7 pagesGerochi vs. Doe G.R. No. 159796 July 17, 2007John Mark RevillaNo ratings yet

- Matraxx Bank PresentationDocument23 pagesMatraxx Bank Presentationtt.socialimpactNo ratings yet

- Fortune Maxmizer One PagerDocument3 pagesFortune Maxmizer One PagerRam VNo ratings yet

- Test Bank For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDocument10 pagesTest Bank For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonEdwin Palmer100% (36)

- Class Activity 2 - Problems-Accounting-EquationDocument5 pagesClass Activity 2 - Problems-Accounting-EquationAfzaal AliNo ratings yet

- Annamalai UniversityDocument264 pagesAnnamalai UniversitySmiles PrintingNo ratings yet

- BSBMGT516 Assessment 1 - Written QuestionsDocument5 pagesBSBMGT516 Assessment 1 - Written QuestionsIvson SilvaNo ratings yet

- Waste To WealthDocument13 pagesWaste To Wealthprashant singhNo ratings yet

- This Study Resource Was: Correct!Document5 pagesThis Study Resource Was: Correct!Angelie De LeonNo ratings yet

- Argumentative Essay 1Document5 pagesArgumentative Essay 1api-582831274No ratings yet

- Stress Testing of Firm Level Credit RiskDocument34 pagesStress Testing of Firm Level Credit RiskjeganrajrajNo ratings yet

- Employee Retention For Economic StabilizDocument18 pagesEmployee Retention For Economic StabilizeffendyNo ratings yet

- Distribution Channels Management in Different RegionsDocument6 pagesDistribution Channels Management in Different RegionsZeelkumar PatelNo ratings yet

- International Marketing Assignment June 2022Document10 pagesInternational Marketing Assignment June 2022Vipul ShahNo ratings yet

- Integrated Logistics Is A Unique Business Management Process That Governs The Flow ofDocument13 pagesIntegrated Logistics Is A Unique Business Management Process That Governs The Flow ofMukesh SinghNo ratings yet

- Chapter 4Document10 pagesChapter 4allysa kaye tancioNo ratings yet

- Ac - Adeoti Sikiru Hammed - June, 2023 - 272234316 - FullstmtDocument2 pagesAc - Adeoti Sikiru Hammed - June, 2023 - 272234316 - FullstmtADEOTI HAMMED (Colt graphic)No ratings yet

- Project PDFDocument18 pagesProject PDFPartha Sarathi PalaiNo ratings yet

- The Government Role in Economic Development of South KoreaDocument9 pagesThe Government Role in Economic Development of South KoreaDave Sarmiento ArroyoNo ratings yet

- Research Chapters 12Document19 pagesResearch Chapters 12Paula CamitNo ratings yet

- Hitt, M.a., Keats, B.W., & DeMarie, S.M. 1998. Navigating in The New CompetitiveDocument22 pagesHitt, M.a., Keats, B.W., & DeMarie, S.M. 1998. Navigating in The New Competitivejack maNo ratings yet

- MGT 501 5Document4 pagesMGT 501 5AizazNo ratings yet

- DEVOPSv3.3 2 Day DOFD v3 3 Instructor Notes 01mar2021Document230 pagesDEVOPSv3.3 2 Day DOFD v3 3 Instructor Notes 01mar2021SamHamIINo ratings yet

- ReSA B44 AUD First PB Exam Questions Answers SolutionsDocument19 pagesReSA B44 AUD First PB Exam Questions Answers SolutionsWesNo ratings yet

- The Books OF AccountingDocument37 pagesThe Books OF AccountingediwowNo ratings yet

- Faculty of Management Studies: End Sem (Odd) Examination Dec-2019 MS5OE01 Mutual Fund ManagementDocument3 pagesFaculty of Management Studies: End Sem (Odd) Examination Dec-2019 MS5OE01 Mutual Fund ManagementMohit kumar sahuNo ratings yet

- ICMA Practical Module 3Document1 pageICMA Practical Module 3Syed FaizanNo ratings yet

- Elite Paint and Chemical Industries LimitedDocument52 pagesElite Paint and Chemical Industries Limitedtanthu nagNo ratings yet

- A Case Study of Inflation and Its Impact On Some Individuals in The PhilippinesDocument12 pagesA Case Study of Inflation and Its Impact On Some Individuals in The PhilippinesKAYLA MAE CANARIANo ratings yet

- S2021 Financial Accounting and Reporting UK GAAPDocument10 pagesS2021 Financial Accounting and Reporting UK GAAPChoo LeeNo ratings yet