Professional Documents

Culture Documents

Sức Mạnh Tài Chính & Đỉnh Đáy Cổ Phiếu 22cty Dược

Sức Mạnh Tài Chính & Đỉnh Đáy Cổ Phiếu 22cty Dược

Uploaded by

Luân Nguyễn Thành0 ratings0% found this document useful (0 votes)

6 views8 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views8 pagesSức Mạnh Tài Chính & Đỉnh Đáy Cổ Phiếu 22cty Dược

Sức Mạnh Tài Chính & Đỉnh Đáy Cổ Phiếu 22cty Dược

Uploaded by

Luân Nguyễn ThànhCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 8

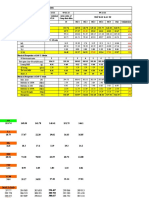

STT Mã CK Tổng TS 2022EPS PE ROA ROE P/B Đáy CP

97.6% 88.8% 98.8% 96.1% 14.1%

95 DGC 3.7 (10.73k) (5.5 lần) (29.82%) (35.11%) (2.3 lần) 20.7%

96.6% 50.4% 96.7% 91.9% 9.2%

809 DHG 2.5 (8.59k) (15.5 lần) (19.61%) (25.37%) (3.4 lần) 27.7%

89.2% 49.1% 88.5% 77.5% 13.8%

876 IMP 2.5 (4.38k) (16.1 lần) (11.58%) (15.04%) (2.3 lần) 34.4%

94.0% 52.3% 91.1% 81.7% 13.0%

969 TRA 2.4 (6.17k) (14.6 lần) (13.38%) (17.32%) (2.5 lần) 30.0%

92.9% 62.9% 87.7% 75.3% 23.0%

801 DMC 2.6 (5.78k) (11.1 lần) (11.23%) (14.16%) (1.7 lần) 19.7%

62.3% 50.5% 66.5% 53.7% 35.4%

568 DCL 2.8 (1.44k) (15.4 lần) (4.92%) (7.41%) (1.2 lần) 73.0%

93.1% 89.6% 93.4% 82.4% 43.2%

4 CSV 4.4 (5.85k) (5.2 lần) (15.37%) (17.70%) (1.0 lần) 64.7%

92.7% 84.4% 83.0% 87.4% 31.0%

608 VFG 2.8 (5.71k) (6.4 lần) (8.95%) (20.79%) (1.3 lần) 52.9%

74.1% 62.1% 88.6% 81.2% 20.8%

741 OPC 2.6 (2.19k) (11.3 lần) (11.78%) (16.96%) (1.8 lần) 47.5%

88.0% 87.9% 76.1% 72.0% 67.5%

529 DHT 2.9 (4.14k) (5.7 lần) (7.07%) (12.85%) (0.7 lần) 18.2%

96.6% 75.7% 94.8% 84.2% 26.2%

579 PMC 2.8 (8.73k) (8.0 lần) (16.48%) (18.70%) (1.5 lần) 28.6%

28.4% 52.7% 32.9% 24.7% 91.9%

49 AMV 3.8 (0.11k) (14.4 lần) (0.70%) (0.83%) (0.4 lần) 97.5%

98.8% 91.1% 96.4% 94.4% 33.7%

766 DP3 2.6 (14.76k) (4.8 lần) (19.42%) (28.29%) (1.2 lần) 3.6%

75.4% 71.0% 40.1% 57.7% 63.2%

649 VMD 2.7 (2.33k) (8.9 lần) (1.28%) (8.33%) (0.8 lần) 75.2%

29.5% 61.5% 36.9% 28.0% 97.6%

477 HAI 2.9 (0.13k) (11.5 lần) (0.97%) (1.37%) (0.2 lần) 90.1%

44.6% 47.6% 57.3% 43.6% 67.6%

503 VPS 2.9 (0.65k) (17.2 lần) (3.32%) (4.95%) (0.7 lần) 81.5%

56.8% 89.4% 48.9% 55.0% 56.4%

691 DBT 2.7 (1.16k) (5.3 lần) (2.23%) (7.78%) (0.8 lần) 63.5%

73.6% 82.5% 88.7% 76.5% 42.0%

519 PPP 2.9 (2.13k) (6.8 lần) (11.85%) (14.56%) (1.1 lần) 33.0%

4.4% 14.5% 3.1% 2.9% 38.8%

734 LDP 2.6 (-3.69k) (-2.5 lần) (-21.31%) (-44.19%) (1.1 lần) 93.9%

0.7% 17.5% 3.2% 1.3% 41.5%

1345 DNM 1.7 95.9%

1345 DNM 1.7 (-15.80k) (-1.2 lần) (-19.68%) (-110.91%) (1.1 lần) 95.9%

73.9% 70.6% 81.4% 66.6% 61.0%

505 CPC 2.9 (2.18k) (8.9 lần) (8.43%) (10.82%) (0.8 lần) 49.7%

60.5% 81.2% 74.4% 60.0% 76.2%

349 MKV 3.1 (1.34k) (7.0 lần) (6.59%) (8.95%) (0.6 lần) 89.0%

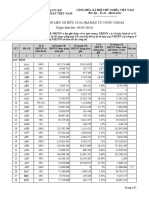

Hệ số nợ Beta Thanh khoản

76.2% 95.7%

82.3% (1.81 lần) (3,087,540)

22.8% 57.8%

76.5% (0.68 lần) -27.251

30.8% 50.3%

72.3% (0.86 lần) -10.159

15.8% 38.3%

83.4% (0.49 lần) -2.777

17.8% 59.4%

83.5% (0.56 lần) -14.261

20.4% 74.3%

67.0% (0.63 lần) -90.915

70.7% 90.1%

92.8% (1.68 lần) -392.095

40.1% 31.2%

53.3% (1.04 lần) -1.617

19.5% 51.2%

76.2% (0.60 lần) -10.557

16.6% 74.7%

52.0% (0.52 lần) -48.969

23.2% 43.7%

88.7% (0.68 lần) -1.991

91.3% 96.9%

92.7% (2.31 lần) (2,019,142)

27.0% 53.1%

67.8% (0.77 lần) -3.843

34.6% 63.4%

18.1% (0.95 lần) -11.899

23.7% 67.3%

69.2% (0.69 lần) -87.999

41.3% 42.4%

75.5% (1.06 lần) -2.922

43.4% 67.8%

15.5% (1.10 lần) -17.678

27.2% 45.5%

83.8% (0.77 lần) -2.327

80.9% 79.4%

50.9% (1.95 lần) -56.133

64.8% 30.5%

21.8%

21.8% (1.54 lần) -514

19.3% 28.0%

89.8% (0.60 lần) -386

30.3% 29.5%

71.0% (0.85 lần) -462

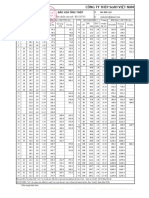

Giá bắt đầu Cao Nhất Thấp NhGiá HiệnTổng % Gía trị Nước ngoài

Mã CK 8/29/2022 (k) (k) (k) (+/-)k Tổng Khối Lượng

(Mua-Bán Tỉ VND)

-17.70%

DGC 91.3 96 47.3 75.1 767,642,800 188.7

-16.2

-8.20%

DHG 124.1 125 113.8 113.9 1,304,100 -1.2

-10.2

9.00%

IMP 62.4 73 46.2 68 2,514,600 -15.1

5.6

4.00%

TRA 83.7 95.8 83.5 87 683,200 50.1

3.3

46.00%

DMC 47.9 69.9 40.1 69.9 3,576,200 38.1

22

-7.20%

DCL 24.9 28.1 22.3 23.1 22,532,100 -3

-1.8

-24.90%

CSV 47.4 47.4 22.4 35.6 96,902,600 27.4

-11.8

-9.60%

VFG 40.4 43.5 31.1 36.5 398,300 1

-3.9

-0.30%

OPC 23.4 26.3 20.6 23.3 2,600,000 -1.4

-0.1

59.50%

DHT 13.9 29.4 13.1 22.2 12,213,038 -0.6

8.3

11.80%

PMC 63.6 83.2 58.8 71.1 489,694 -16.4

7.5

-41.30%

AMV 8 8 2.7 4.7 499,612,893 -0.2

-3.3

90.30%

DP3 33.2 79.5 32.7 63.2 950,535 1.5

30

-7.00%

VMD 22.6 27 16.3 21 2,949,400 -0.1

-1.6

-14.80%

HAI 1.8 1.8 1.5 1.5 21,559,700 -0.1

-0.3

-12.50%

VPS 10.9 11.7 7.8 9.5 722,200 1.4

-1.4

5.20%

DBT 12.5 14.4 8.7 13.1 4,366,300 -3

0.7

13.60%

PPP 13.6 16 11.3 15.4 573,147 3.2

1.8

-31.30%

LDP 15 15.2 4.4 10.3 14,068,295 0

-4.7

-30.70%

DNM 24.4 24.4 12.3 16.9 127,244 -0.1

-7.5

-4.10%

CPC 16.7 17.9 12 16 95,064 0.2

-0.7

-15.90%

MKV 11.3 12.8 8.9 9.5 113,975 0.1

-1.8

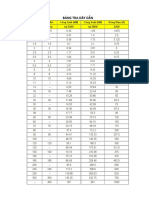

Giá Sổ EPS P/E

(k) (k) (lần)

30.6 10.7 5.5

33.9 8.6 15.5

29.1 4.4 16.1

35.6 6.2 14.6

40.8 5.8 11.1

19.5 1.4 15.4

33.1 5.9 5.2

27.5 5.7 6.4

12.9 2.2 11.3

32.2 4.1 5.7

46.7 8.7 8

12.8 0.1 14.4

52.2 14.8 4.8

27.9 2.3 8.9

9.8 0.1 11.5

13.2 0.7 17.2

15 1.2 5.3

14.6 2.1 6.8

8.4 -3.7 -2.5

14.3 -15.8 -1.2

20.2 2.2 8.9

14.9 1.3 7

You might also like

- 1 NgàyDocument14 pages1 NgàyTrần Xuân HợpNo ratings yet

- 20240120 - A35 - Vấn Đề ST Capa Chuyển Động OisDocument3 pages20240120 - A35 - Vấn Đề ST Capa Chuyển Động OisNhật Hồ VănNo ratings yet

- Chu I ICT: Biên Lãi G PDocument7 pagesChu I ICT: Biên Lãi G Pphuonganh301003No ratings yet

- tài chính doanh nghiệpDocument10 pagestài chính doanh nghiệp030138220404No ratings yet

- UntitledDocument4 pagesUntitledThanh VoNo ratings yet

- Excel KTVMDocument16 pagesExcel KTVMHoàng ViệtNo ratings yet

- Model IMPDocument112 pagesModel IMPHUY LÊ NHỰTNo ratings yet

- 90N-LV01-17.THỪ DẦU Si69- N07.12.22Document3 pages90N-LV01-17.THỪ DẦU Si69- N07.12.22ThanhNhựtNo ratings yet

- Dự thảo KQ xét danh hiệu gửi GCVN BCS cập nhật 29.9.2022Document204 pagesDự thảo KQ xét danh hiệu gửi GCVN BCS cập nhật 29.9.2022Ngọc LêNo ratings yet

- Bảng excel tính sức kéo của TOYOTA AVANZA EDocument16 pagesBảng excel tính sức kéo của TOYOTA AVANZA Edttung301No ratings yet

- số liệu chạy eviewsDocument1 pagesố liệu chạy eviewsyendh.ytgNo ratings yet

- FiinTrade BBC Financial Ratio 01042024Document12 pagesFiinTrade BBC Financial Ratio 01042024ngtthanhhthaoNo ratings yet

- Tính Độ Khả Dụng Tuabin VestasDocument2 pagesTính Độ Khả Dụng Tuabin VestasDanh ĐoànNo ratings yet

- Danh M C QuDocument10 pagesDanh M C QuHoàng TrầnNo ratings yet

- SSI NASB Financial Ratio 12072022Document6 pagesSSI NASB Financial Ratio 12072022Nguyen Nhu Ngoc DieuNo ratings yet

- Kt Quá Trình Lần 2 KtvĩmôDocument4 pagesKt Quá Trình Lần 2 KtvĩmôNHƯ TRẦN NGỌCNo ratings yet

- QLDMDTDocument7 pagesQLDMDT03- Vũ Thị Lan AnhNo ratings yet

- QTBL Test cuốiDocument6 pagesQTBL Test cuốiDiệp ThuỷNo ratings yet

- So Lieu Thong Ke 6 Vung KT Chien LuocDocument9 pagesSo Lieu Thong Ke 6 Vung KT Chien Luocgiangpt.infoNo ratings yet

- Hoàng Heli - Risk - 2023-04-23Document5 pagesHoàng Heli - Risk - 2023-04-23Hoang NguyenNo ratings yet

- Khối Lượng Chứng Khoán Đăng Ký Đến Tháng 03 Năm 2023 - 1682302950504Document7 pagesKhối Lượng Chứng Khoán Đăng Ký Đến Tháng 03 Năm 2023 - 1682302950504dovhoaNo ratings yet

- Thông Tin V Ề Số Liệu Sở Hữu Của Nhà Đầu Tư Nước Ngoài (Ngày hiệu lực: 04/03/2024)Document17 pagesThông Tin V Ề Số Liệu Sở Hữu Của Nhà Đầu Tư Nước Ngoài (Ngày hiệu lực: 04/03/2024)CDKT Cao Thang BM DTCNNo ratings yet

- Tồn AbcDocument4 pagesTồn Abc2000004552No ratings yet

- Hoàng Heli - Projections - 2023-04-23Document6 pagesHoàng Heli - Projections - 2023-04-23Hoang NguyenNo ratings yet

- Trade QuyDocument10 pagesTrade QuyLam Vi TuanNo ratings yet

- Thử nghiệm DSRDocument9 pagesThử nghiệm DSRvutnm94No ratings yet

- NHÓM21Document19 pagesNHÓM21Xaysit ChannelNo ratings yet

- UntitledDocument5 pagesUntitledThanh VoNo ratings yet

- TDM Technical SpecificationsDocument6 pagesTDM Technical SpecificationsPham Thanh doNo ratings yet

- Pia - lê Thị Vân Anh - d16 Nganhang2Document83 pagesPia - lê Thị Vân Anh - d16 Nganhang2vanhdayyy874No ratings yet

- bảng 5Document5 pagesbảng 5Anh Quốc TônNo ratings yet

- Thông Tin V Ề Số Liệu Sở Hữu Của Nhà Đầu Tư Nước Ngoài (Ngày hiệu lực: 20/02/2024)Document26 pagesThông Tin V Ề Số Liệu Sở Hữu Của Nhà Đầu Tư Nước Ngoài (Ngày hiệu lực: 20/02/2024)duongnguyenhtvNo ratings yet

- Exel Tham KhaoDocument27 pagesExel Tham KhaoKhải 11.Diêm đìnhNo ratings yet

- Bảng Mục Tiêu 200uDocument7 pagesBảng Mục Tiêu 200uPhong NguyenNo ratings yet

- ForecastingDocument5 pagesForecastingSrijan RoyNo ratings yet

- QTRR 2.2.1 - CH y CBDocument11 pagesQTRR 2.2.1 - CH y CBVan A HoangNo ratings yet

- Senkaku Official Store - Shopee Shop Stats.20220201 20220228Document13 pagesSenkaku Official Store - Shopee Shop Stats.20220201 20220228Nguyễn Văn KhánhNo ratings yet

- Bài Tập Phân Tích ABCDocument3 pagesBài Tập Phân Tích ABCLiễu Nguyễn ThúyNo ratings yet

- Taget Tháng 10Document9 pagesTaget Tháng 10Thanh Minh NguyenNo ratings yet

- Báo Cáo Thực Hành Vật Lí Đại CươngDocument1 pageBáo Cáo Thực Hành Vật Lí Đại Cươngtrâm nguyễnNo ratings yet

- Top35 2022 AlpCDocument1 pageTop35 2022 AlpCMinh Đặng NhậtNo ratings yet

- Bttylelamphat Sample 1Document12 pagesBttylelamphat Sample 1PHƯƠNG Anh Nguyễn NgocNo ratings yet

- Screenshot 3Document3 pagesScreenshot 3Đào Thị Thu HàNo ratings yet

- Chính Sách Bán Hàng 11-4-2023Document6 pagesChính Sách Bán Hàng 11-4-2023trunghai474747No ratings yet

- FM Ch04 - Portpolio-OptquestDocument2 pagesFM Ch04 - Portpolio-OptquestNhư Quỳnh ÂuNo ratings yet

- Kpi CH Lách M I T8Document16 pagesKpi CH Lách M I T8Thuy AnhNo ratings yet

- 4 3 3Document3 pages4 3 3My KidsNo ratings yet

- Các bước phân tích thống kê sinh viênDocument15 pagesCác bước phân tích thống kê sinh viênAn ĐỗNo ratings yet

- SeAH 2017 09.13 BsDocument1 pageSeAH 2017 09.13 BsDương HoàngNo ratings yet

- C4 Dinh Gia Co Phieu 1Document10 pagesC4 Dinh Gia Co Phieu 1Thư DươngNo ratings yet

- Midcaps Cơ Bản Tốt, Tăng Trưởng Ổn Định, Định Giá Hợp LýDocument3 pagesMidcaps Cơ Bản Tốt, Tăng Trưởng Ổn Định, Định Giá Hợp LýHưng NguyễnNo ratings yet

- Group6 QatarDocument5 pagesGroup6 QatarPhát NguyễnNo ratings yet

- SeAH 2017 09.13 KsDocument1 pageSeAH 2017 09.13 KsDương HoàngNo ratings yet

- ÐTSLL FFCDocument2 pagesÐTSLL FFCngochieun126No ratings yet

- KVK HoaDocument18 pagesKVK Hoareapers brebesNo ratings yet

- Bài Tập Tỷ Lệ Lạm Phát-italyDocument3 pagesBài Tập Tỷ Lệ Lạm Phát-italydatchungnguyenNo ratings yet

- Bảng tra tiết diện dâyDocument1 pageBảng tra tiết diện dâyĐình Tuấn NguyễnNo ratings yet

- bảng tínhDocument4 pagesbảng tínhbiledeptrai123No ratings yet

- Thesp San Tot NghiepDocument41 pagesThesp San Tot NghiepViệt HoàngNo ratings yet