Professional Documents

Culture Documents

LoanPaymentSchedule

Uploaded by

Jagan PandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LoanPaymentSchedule

Uploaded by

Jagan PandaCopyright:

Available Formats

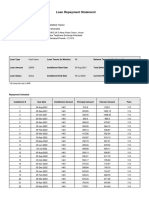

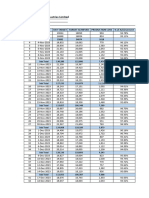

LOAN REPAYMENT SCHEDULE

Customer Details

Branch Id H5:13 Branch Name Bhadrak_Retail

Customer Name Bijay Kumar Behera Customer Code H5:13:C00002871951

Loan Account Number H5:13:C00002871951:P398:01 Loan Type CORE TYPE1-1

Loan Amount 50000.00 Interest Rate 28.00 %

Interest Type Diminishing Disbursement Date 12-Sep-2023

Instalment Amount 1143.00 No. Of Instalments 50

Mode Of Payment Weekly Purpose General store

Processing Fee 1475.00 CSIP 309.00

Nominee Name Sitarani behera Document Charges 1180.00

Loan Repayment Schedule Details

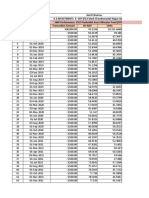

Installment Number Installment Date Installment Amount Principal Amount interest Amount Outstanding Amount

1 19-Sep-2023 1143.00 874.51 268.49 49125.49

2 26-Sep-2023 1143.00 879.20 263.80 48246.29

3 03-Oct-2023 1143.00 883.92 259.08 47362.37

4 10-Oct-2023 1143.00 888.67 254.33 46473.70

5 17-Oct-2023 1143.00 893.44 249.56 45580.25

6 24-Oct-2023 1143.00 898.24 244.76 44682.01

7 31-Oct-2023 1143.00 903.06 239.94 43778.95

8 07-Nov-2023 1143.00 907.91 235.09 42871.04

9 14-Nov-2023 1143.00 912.79 230.21 41958.25

10 21-Nov-2023 1143.00 917.69 225.31 41040.56

11 28-Nov-2023 1143.00 922.62 220.38 40117.94

12 05-Dec-2023 1143.00 927.57 215.43 39190.37

13 12-Dec-2023 1143.00 932.55 210.45 38257.81

14 19-Dec-2023 1143.00 937.56 205.44 37320.25

15 26-Dec-2023 1143.00 942.60 200.40 36377.66

16 02-Jan-2024 1143.00 947.66 195.34 35430.00

17 09-Jan-2024 1143.00 952.75 190.25 34477.26

18 16-Jan-2024 1143.00 957.86 185.14 33519.39

19 23-Jan-2024 1143.00 963.01 179.99 32556.39

20 30-Jan-2024 1143.00 968.18 174.82 31588.21

21 06-Feb-2024 1143.00 973.38 169.62 30614.84

22 13-Feb-2024 1143.00 978.60 164.40 29636.23

23 20-Feb-2024 1143.00 983.86 159.14 28652.38

24 27-Feb-2024 1143.00 989.14 153.86 27663.24

25 05-Mar-2024 1143.00 994.45 148.55 26668.78

26 12-Mar-2024 1143.00 999.79 143.21 25668.99

27 19-Mar-2024 1143.00 1005.16 137.84 24663.83

28 26-Mar-2024 1143.00 1010.56 132.44 23653.27

29 02-Apr-2024 1143.00 1015.99 127.01 22637.29

30 09-Apr-2024 1143.00 1021.44 121.56 21615.85

31 16-Apr-2024 1143.00 1026.93 116.07 20588.92

32 23-Apr-2024 1143.00 1032.44 110.56 19556.48

33 30-Apr-2024 1143.00 1037.98 105.02 18518.49

34 07-May-2024 1143.00 1043.56 99.44 17474.94

35 14-May-2024 1143.00 1049.16 93.84 16425.77

36 21-May-2024 1143.00 1054.80 88.20 15370.98

37 28-May-2024 1143.00 1060.46 82.54 14310.52

38 04-Jun-2024 1143.00 1066.15 76.85 13244.36

39 11-Jun-2024 1143.00 1071.88 71.12 12172.48

40 18-Jun-2024 1143.00 1077.64 65.36 11094.85

41 25-Jun-2024 1143.00 1083.42 59.58 10011.43

42 02-Jul-2024 1143.00 1089.24 53.76 8922.19

43 09-Jul-2024 1143.00 1095.09 47.91 7827.10

44 16-Jul-2024 1143.00 1100.97 42.03 6726.13

45 23-Jul-2024 1143.00 1106.88 36.12 5619.25

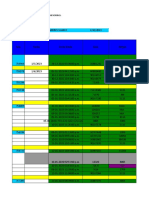

Loan Repayment Schedule Details

Installment Number Installment Date Installment Amount Principal Amount interest Amount Outstanding Amount

46 30-Jul-2024 1143.00 1112.83 30.17 4506.42

47 06-Aug-2024 1143.00 1118.80 24.20 3387.62

48 13-Aug-2024 1143.00 1124.81 18.19 2262.81

49 20-Aug-2024 1143.00 1130.85 12.15 1131.96

50 27-Aug-2024 1138.04 1131.96 6.08 0.00

CREDIT SHEILD INSURANCE GUIDELINES

1. The borrower agrees to pay the applicable non-refundable Credit Shield Insurance Premium as charged by the insurer.

2. Age of entry for Insurance coverage for applicant is 18-58 years.

3. In case of the death of the borrower/Co-applicant, the nominee as specified in the insurance policy should inform BFIL of the same at the earliest. The

intimation may be given in person at the BFIL branch or via telephone.

4. A nominee may claim the insurance amount after the death of the borrower/Co-applicant upon submission of the following documents to the BFIL Loan

Officer: -

a. Death certificate

b. KYC of deceased & Nominee

c. Nominee bank passbook/cancelled cheque

d. Authorization form Discharge form

e. FIR & Post-Mortem report (Applicable only in cases of accidental deaths)

5. Death claim settlement as approved by the insurer will only be paid to the nominee

6. The settlement of the claim shall be as per the authorization of the policy holder wherein, the insurer shall first settle the principal outstanding to IBL and

pay the remaining amount to the nominee, directly through NEFT to the bank account provided at the time of filing the claim.

7. This policy provides cover for death caused due to any reason other than standard exclusions like suicide AIDS/ HIV, Hepatitis B&C virus, and mental

disorder.

8. Prepayment- The Credit Shield Insurance Premium is refundable only if the prepayment is made within the first 30 days of disbursement of loan.

The borrower, upon submission of the documents may contact the Loan Officer for any queries at the BFIL toll free MHL helpline no. 1800-300-10000/ 1800-

599-10000/ 1800-572-6000 / 1800-300-10000. It is advised that the borrower should inform and update the nominee about the insurance policy and the

process for filing a claim in the unfortunate circumstances of their death

IBL/ BFIL Guidelines

1. We at IBL/ BFIL do not discriminate based on caste/ religion and disability.

2. We shall treat everyone with respect.

3. We will not visit the customer's house during odd hours

4. We shall not use abusive language with our customer or with anyone else.

5. We shall not use any arm - twisting tactics to collect money from our customers.

__________________________________________________________________________________________________________________________

Bharat Financial Inclusion Limited

Registered Office:

One India Bulls Centre, Tower 1

841, Senapati Bapat Marg, 8th Floor

Elphinstone, Mumbai – 400 013

Maharashtra, India

Corporate Identity Number: U65999MH2018PLC312539

You might also like

- Casting Record 07.02.2024Document1 pageCasting Record 07.02.2024nazam eubNo ratings yet

- DelhiDocument104 pagesDelhikebiebei2No ratings yet

- 06 Jun 2023Document331 pages06 Jun 2023josse0% (1)

- Reporte de Venta Del 01 de Marzo Del 2024 Al 06 de Abril Del 2024 CLIENTE: JHONNY VALLEDocument2 pagesReporte de Venta Del 01 de Marzo Del 2024 Al 06 de Abril Del 2024 CLIENTE: JHONNY VALLEAlbert H Garcia BlacidoNo ratings yet

- Etmoney CG Fy2023-24Document7 pagesEtmoney CG Fy2023-24KumarNo ratings yet

- DMD Jun 2023Document197 pagesDMD Jun 2023josseNo ratings yet

- Loan Repayment Schedule: Customer DetailsDocument3 pagesLoan Repayment Schedule: Customer DetailsJasbind yadavNo ratings yet

- Adobe Scan Jan 08, 2024Document2 pagesAdobe Scan Jan 08, 2024santhana arockiarajNo ratings yet

- ProjektDocument7 pagesProjekticzech1506No ratings yet

- Calculo Del Indicador RSIDocument49 pagesCalculo Del Indicador RSIJEAN MARCO CAJA ALVAREZNo ratings yet

- SWP Performance 20230602213032Document4 pagesSWP Performance 20230602213032mukulNo ratings yet

- Raport Scadentar: FB24.2243804.0100 v107898 LIVLAVI SRL 30-09-2022 17-05-2024 52084.00 Filbo 24Document1 pageRaport Scadentar: FB24.2243804.0100 v107898 LIVLAVI SRL 30-09-2022 17-05-2024 52084.00 Filbo 24Danessa PopaNo ratings yet

- EQProfitLossDetailsDocument2 pagesEQProfitLossDetailsVijaykumar D SNo ratings yet

- Summary Coal HaulingDocument12 pagesSummary Coal HaulingAryo Prastyo AjiNo ratings yet

- COBADocument4 pagesCOBA121890920No ratings yet

- Google Finance Investment TrackerDocument8 pagesGoogle Finance Investment Trackerleonapinon25No ratings yet

- Precios Medios Estacionales MEM y TDF 2019 2024 WEBDocument5 pagesPrecios Medios Estacionales MEM y TDF 2019 2024 WEBEduardo lopez garciaNo ratings yet

- Stock CheckerDocument18 pagesStock Checkerget nae nae'dNo ratings yet

- Papanasam JL-3Document1 pagePapanasam JL-3dummycircle43No ratings yet

- Total Summary Sales by Date Kks p1Document1 pageTotal Summary Sales by Date Kks p1hrcitraseleragroupNo ratings yet

- Gmmco Cat MurliDocument18 pagesGmmco Cat Murlisami abdulNo ratings yet

- LD 2133300003Document5 pagesLD 2133300003samphors navNo ratings yet

- 001 067000756769 0Document1 page001 067000756769 0Aristides Pardo CarhuapomaNo ratings yet

- ANTOniusDocument67 pagesANTOniusi damanikNo ratings yet

- Ref.: Loan No.:52874346: Yours Faithfully, Standard Chartered BankDocument3 pagesRef.: Loan No.:52874346: Yours Faithfully, Standard Chartered BankLoan LoanNo ratings yet

- Decay Tables-3674YGDocument10 pagesDecay Tables-3674YGlike saddamNo ratings yet

- Advanced EXCEL - Jan 2024 - Group 8 ProjectDocument273 pagesAdvanced EXCEL - Jan 2024 - Group 8 ProjectGuillermo De La RosaNo ratings yet

- Zaida Simulation ResultsDocument68 pagesZaida Simulation ResultsC 10 MeteringNo ratings yet

- 1-Control Détaille 2023Document66 pages1-Control Détaille 2023Dah ManNo ratings yet

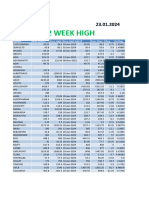

- 52 Week High Low-355Document7 pages52 Week High Low-355Vishal JainNo ratings yet

- 20230724002770.RAMESHpdfDocument17 pages20230724002770.RAMESHpdfImran SyedNo ratings yet

- BNM RateDocument3 pagesBNM RateKj LeeNo ratings yet

- 明细报表-1680451200000 1680537599999Document2 pages明细报表-1680451200000 16805375999991181002860No ratings yet

- Market Report 3rd Feb 203Document18 pagesMarket Report 3rd Feb 203Vipul MalapNo ratings yet

- Historicos PreciosDocument5 pagesHistoricos PreciosAraceli F. AcebeyNo ratings yet

- 998 UjjjDocument12 pages998 Ujjjovais kanojeNo ratings yet

- ForecastDocument2 pagesForecastviiind300No ratings yet

- Laporan Tanpa JudulDocument3 pagesLaporan Tanpa Judulrizkianizar310No ratings yet

- Amort Sched TCH SampleDocument1 pageAmort Sched TCH SampleJaypee AustriaNo ratings yet

- Amortization ScheduleDocument1 pageAmortization Schedulevishal2k5No ratings yet

- Navhist Us en BilDocument87 pagesNavhist Us en BilOneappNo ratings yet

- COMPARTAMOSDocument1 pageCOMPARTAMOSAristides Pardo CarhuapomaNo ratings yet

- REPORTE Foton 2023Document33 pagesREPORTE Foton 2023tractosolfoton313No ratings yet

- Loan Repayment StatementDocument3 pagesLoan Repayment StatementJasbind yadavNo ratings yet

- MIS ProductionDocument25 pagesMIS ProductionMd TarekNo ratings yet

- Loan Schedule StatementDocument4 pagesLoan Schedule StatementJAWED MOHAMMADNo ratings yet

- Flood Hydrology FrequencyDocument3 pagesFlood Hydrology FrequencydsanandaNo ratings yet

- LESCO Computer Centre, LahoreDocument1 pageLESCO Computer Centre, LahoreMubashir HussainNo ratings yet

- Regression StatisticsDocument10 pagesRegression StatisticsDieuu LinhhNo ratings yet

- Ac34306201 Prepaid 20231220045739Document2 pagesAc34306201 Prepaid 20231220045739nuruddin humayunNo ratings yet

- Cesar ParedesDocument1 pageCesar ParedesconsorciomagnoNo ratings yet

- 44240019933Document101 pages44240019933i damanikNo ratings yet

- KrishnaDocument1 pageKrishnaSwapnil ToraskarNo ratings yet

- Activities Feeder Collection 20231124180631 d3d5Document6 pagesActivities Feeder Collection 20231124180631 d3d5duomakers3dNo ratings yet

- Kundalia - LBC Ps-1-Pump Station Daily Volume ReportDocument1 pageKundalia - LBC Ps-1-Pump Station Daily Volume Reportsujit44No ratings yet

- NMreference 23Document1 pageNMreference 23Farid AsadiNo ratings yet

- Control Entregas Andres SuarezDocument34 pagesControl Entregas Andres SuarezJonathan IncaNo ratings yet

- Amort Sched TCH Sample 2Document1 pageAmort Sched TCH Sample 2Jaypee AustriaNo ratings yet

- 8###1-Money Market UnlockedDocument1 page8###1-Money Market Unlockeddavidwanjunji.dm5No ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- DocxDocument12 pagesDocxDianneNo ratings yet

- Financial InstitutionDocument31 pagesFinancial InstitutionManish KumarNo ratings yet

- Common Bankruptcy Questions and AnswersDocument1 pageCommon Bankruptcy Questions and AnswersTâm Anh MạcNo ratings yet

- Agrifoods Strategy WebDocument36 pagesAgrifoods Strategy WebThe Vancouver SunNo ratings yet

- Contracts, Torts, Family Law, Civil ProcedureDocument18 pagesContracts, Torts, Family Law, Civil ProcedureepravnaNo ratings yet

- General Conditions of Contract For Construction Works - 2004 & 2010 ClausesDocument18 pagesGeneral Conditions of Contract For Construction Works - 2004 & 2010 ClausesPaul Maposa40% (5)

- Accounts ReceivableDocument6 pagesAccounts ReceivableNerish PlazaNo ratings yet

- Strategic Business Planning For Succeeding at Scale: Industry: Computer Software Employees: 16Document2 pagesStrategic Business Planning For Succeeding at Scale: Industry: Computer Software Employees: 16SASI KUMAR SUNDARA RAJANNo ratings yet

- Abhinav Gupta - CVDocument5 pagesAbhinav Gupta - CVKiran ModiNo ratings yet

- Saadiyat Infra PKG 2 Tender BOQ - TA2 - 27062022015837Document514 pagesSaadiyat Infra PKG 2 Tender BOQ - TA2 - 27062022015837Ahmed BakrNo ratings yet

- Payslip NovDocument7 pagesPayslip Novthiwankaashi531No ratings yet

- Workcentre SchedulingDocument30 pagesWorkcentre Schedulingrohitgoyal207No ratings yet

- Individual Enterprise (Referred Individual) : I. Basic InformationDocument4 pagesIndividual Enterprise (Referred Individual) : I. Basic InformationKevin SiegbahnNo ratings yet

- Public Expenditure PFM handbook-WB-2008 PDFDocument354 pagesPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnNo ratings yet

- Aaa Replica Handbags Wallets Scarves Belts For Salekjaub PDFDocument1 pageAaa Replica Handbags Wallets Scarves Belts For Salekjaub PDFballe83rafnNo ratings yet

- Chapter1 Intro To Basic FinanceDocument28 pagesChapter1 Intro To Basic FinanceRazel GopezNo ratings yet

- Intercompany Profit Plant AssetDocument38 pagesIntercompany Profit Plant AssetIqbal Andri FirmansyahNo ratings yet

- Review of Related LiteratureDocument13 pagesReview of Related LiteratureLuven BoctotNo ratings yet

- Alm - IciciDocument6 pagesAlm - IciciKhaisarKhaisarNo ratings yet

- Cerberus StatementDocument2 pagesCerberus StatementDealBookNo ratings yet

- Functional Safety Assessment of Valve Assemblies Part 1Document6 pagesFunctional Safety Assessment of Valve Assemblies Part 1Serge RINAUDONo ratings yet

- E7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDocument3 pagesE7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDhiva Rianitha Manurung100% (1)

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalNo ratings yet

- Case Study 1 - Barings Bank, PLC. - EBF 301 - Global Finance For The Earth, Energy, and Materials IndustriesDocument3 pagesCase Study 1 - Barings Bank, PLC. - EBF 301 - Global Finance For The Earth, Energy, and Materials Industriescoseri5No ratings yet

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangNo ratings yet

- 21st Century Fox 5YR DCFDocument10 pages21st Century Fox 5YR DCFsoham sahaNo ratings yet

- Procedure of Conversion of Private LTDDocument4 pagesProcedure of Conversion of Private LTDNisha11sharmaNo ratings yet

- E-Stamp: Government of KarnatakaDocument21 pagesE-Stamp: Government of KarnatakaHarishNo ratings yet

- ERP Sales and DistributionDocument44 pagesERP Sales and DistributionALI ASGHAR MUSTAFANo ratings yet