Professional Documents

Culture Documents

Associates: Definitions

Uploaded by

.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Associates: Definitions

Uploaded by

.Copyright:

Available Formats

STUDY NOTES

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 11: BASIC CONSOLIDATION AND CHANGES IN GROUP STRUCTURES

Remember, profit for the year and TCI for the year must be split between the group and the non-controlling

interest. The following proforma will help you to calculate the profit and TCI attributable to the non-

controlling interest.

Profit TCI

$000 $000

Profit/TCI of the subsidiary for the year (pro-rated for mid- X X

year acquisition)

PURP (if S is the seller) (X) (X)

Excess depreciation/amortization (X) (X)

Goodwill impairment (under FV model only) (X) (X)

––– –––

× NCI % X X

––– –––

Profit/TCI attributable to the NCI X X

––– –––

03. Associates

Definitions

An associate is defined as 'an entity over which the investor has significant influence and which is neither

a subsidiary nor a joint venture of the investor' (IAS 28, para 3).

Significant influence is the power to participate in, but not control, the financial and operating policy

decisions of an entity. IAS 28 states that:

• Significant influence is usually evidenced by representation on the board of directors, which allows the

investing entity to participate in policy decisions.

• A holding between 20% and 50% of the voting power is presumed to give significant influence, unless

it can be clearly demonstrated that this is not the case.

• It is presumed that a holding of less than 20% does not give significant influence, unless such influence

can be clearly demonstrated.

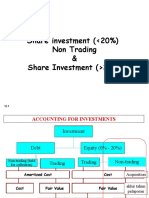

Accounting for associates

Associates are not consolidated because the parent does not have control. Instead they are accounted for using

the equity method.

Statement of financial position

IAS 28 requires that the carrying amount of the associate is determined as follows:

$000

Cost X

P% of post-acquisition reserves X/(X)

Impairment losses (X)

P% of unrealized profits if P is the seller (X)

P% of excess depreciation on fair value adjustments (X)

–––

Investment in associate X

–––

The investment in the associate is shown in the non-current assets section of the consolidated statement of

financial position.

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 69 of 445

You might also like

- Business Combination - Stock AcquisitionDocument6 pagesBusiness Combination - Stock AcquisitionEmma Mariz GarciaNo ratings yet

- Group Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesDocument58 pagesGroup Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- Principles of Consolidated Financial Statements: 1 The Concept of Group AccountsDocument58 pagesPrinciples of Consolidated Financial Statements: 1 The Concept of Group Accountssagar khadkaNo ratings yet

- AP 03 - REO Shareholders - Equity2Document10 pagesAP 03 - REO Shareholders - Equity2jeshiela mae biloNo ratings yet

- 3 Group Accounts and Business Combinations Lecture NotesDocument47 pages3 Group Accounts and Business Combinations Lecture NotesAKINYEMI ADISA KAMORU100% (4)

- Investment in AssociateDocument60 pagesInvestment in Associateadarose romaresNo ratings yet

- Responsibility AccountingDocument3 pagesResponsibility AccountingMilcah Deloso SantosNo ratings yet

- Investment in AssocociateDocument10 pagesInvestment in AssocociateShaina SamonteNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Consolidated Statement of Financial PositionDocument6 pagesConsolidated Statement of Financial PositionRameen FatimaNo ratings yet

- Group Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesDocument28 pagesGroup Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- Investments For Investments in Equity Securities (Shares)Document2 pagesInvestments For Investments in Equity Securities (Shares)Carms St ClaireNo ratings yet

- Basic Consol Acc2 & 3Document17 pagesBasic Consol Acc2 & 3fortuinpdNo ratings yet

- ACCA SBR Workbook 2018 Errata SheetDocument8 pagesACCA SBR Workbook 2018 Errata SheetdeltaeagleNo ratings yet

- Summary of EliminationsDocument7 pagesSummary of EliminationsSella DestikaNo ratings yet

- FAR 15 Investment in AssociatesDocument2 pagesFAR 15 Investment in AssociatesShaira Mae DausNo ratings yet

- Review of Financial Statement Preparation Lecture NotesDocument4 pagesReview of Financial Statement Preparation Lecture Noteslashy123booNo ratings yet

- The Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)Document5 pagesThe Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)illyanaNo ratings yet

- AUDIT OF INVESTMENTS - AssociateDocument4 pagesAUDIT OF INVESTMENTS - AssociateJoshua LisingNo ratings yet

- Consolidated Financial AccountingDocument3 pagesConsolidated Financial AccountingEmma Mariz GarciaNo ratings yet

- Ias 1Document7 pagesIas 1ADEYANJU AKEEMNo ratings yet

- Notes Chapter 3 FARDocument4 pagesNotes Chapter 3 FARcpacfa100% (7)

- 6 - Consolidated Financial Statements P2 PDFDocument5 pages6 - Consolidated Financial Statements P2 PDFDarlene Faye Cabral RosalesNo ratings yet

- Revision Notes Group Accounts PDFDocument11 pagesRevision Notes Group Accounts PDFEhsanulNo ratings yet

- AFR Revision - Qns-AnsDocument63 pagesAFR Revision - Qns-AnsDownloder UwambajimanaNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- 04 Group Financial StatementsDocument56 pages04 Group Financial StatementsHaris IshaqNo ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Summary of Basic Conso TechniquesDocument5 pagesSummary of Basic Conso Techniquesutary4s3No ratings yet

- Financial Statement AnalysisDocument46 pagesFinancial Statement AnalysisMusom BBANo ratings yet

- 3rd Sem AccountsDocument67 pages3rd Sem Accountsharamilanda2004No ratings yet

- LeveragesDocument9 pagesLeveragesShrinivasan IyengarNo ratings yet

- Alternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIDocument4 pagesAlternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIgeethNo ratings yet

- IFRS Notes December 2021Document12 pagesIFRS Notes December 2021AnnaNo ratings yet

- CFAP1+ +Study+Manual+ 67Document1 pageCFAP1+ +Study+Manual+ 67.No ratings yet

- Ias 28 AssociateDocument19 pagesIas 28 AssociateĐức DuyNo ratings yet

- CSEC English A 2023 P2 - 230111 - 163228 PDFDocument7 pagesCSEC English A 2023 P2 - 230111 - 163228 PDF27h4fbvsy8No ratings yet

- Formats For Consolidation Group StructureDocument4 pagesFormats For Consolidation Group StructureMuhammad3588No ratings yet

- CONSOLIDATIONDocument21 pagesCONSOLIDATIONVaishnavi ChaturvediNo ratings yet

- Ratio Analysis Theory and ProblemsDocument13 pagesRatio Analysis Theory and ProblemsPunit Kuleria100% (1)

- Joint ArrangementsDocument9 pagesJoint Arrangementscarlos antonio IbuanNo ratings yet

- Topic 6 Partnership: 6.1 FormationDocument5 pagesTopic 6 Partnership: 6.1 FormationxxpjulxxNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Question 2 Single Company AccountsDocument10 pagesQuestion 2 Single Company AccountsjbmggknbrxNo ratings yet

- Insolvency of PartnersDocument1 pageInsolvency of PartnersshabukrNo ratings yet

- BEACTG 03 REVISED MODULE 8 Components of Stockholder's Equity of Different Forms of Business OwnershipDocument7 pagesBEACTG 03 REVISED MODULE 8 Components of Stockholder's Equity of Different Forms of Business OwnershipJessica PangilinanNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- Intermediate Accounting - Investment in Associate (Pas 28)Document3 pagesIntermediate Accounting - Investment in Associate (Pas 28)22100629No ratings yet

- Financial Statements PDFDocument14 pagesFinancial Statements PDFArik HassanNo ratings yet

- Bcom PPT 4Document22 pagesBcom PPT 4dmangiginNo ratings yet

- 12.2 Share Investment Non Trading & Share Invesment Lebih 20%Document18 pages12.2 Share Investment Non Trading & Share Invesment Lebih 20%TIFFANNY SHELIANo ratings yet

- Statement of Cash Flows (IAS 7) : Reconciliation of Operating Profit To Net Cash Flow From OperationsDocument2 pagesStatement of Cash Flows (IAS 7) : Reconciliation of Operating Profit To Net Cash Flow From OperationspriyaNo ratings yet

- SHAREHOLDERSDocument13 pagesSHAREHOLDERSJanisseNo ratings yet

- Corporate Unit 3Document497 pagesCorporate Unit 3bhavu aryaNo ratings yet

- Business Finance Week 4 To 5 Without AnswerDocument13 pagesBusiness Finance Week 4 To 5 Without AnswerKristel Anne Roquero BalisiNo ratings yet

- The Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosDocument2 pagesThe Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosAayush AgrawalNo ratings yet

- Chapter 9 - BondsDocument6 pagesChapter 9 - BondsGABBY NACA STEVANYNo ratings yet

- Financial Statement Analysis & Ratio AnalysisDocument21 pagesFinancial Statement Analysis & Ratio Analysissriharsha5877454No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- Syed Atif Ali: ST HR SIC AC SC ECDocument1 pageSyed Atif Ali: ST HR SIC AC SC EC.No ratings yet

- Company Directors' SustainabilityDocument1 pageCompany Directors' Sustainability.No ratings yet

- DFSDDocument1 pageDFSD.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- DsasDocument1 pageDsas.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- Al - 62Document1 pageAl - 62.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- Chap 16 - Capital Structure - Basic ConceptsDocument37 pagesChap 16 - Capital Structure - Basic ConceptsAdiba IbnatNo ratings yet

- Nishat Cash FlowDocument2 pagesNishat Cash FlowomairNo ratings yet

- A.1. Financial Statements Part 2Document53 pagesA.1. Financial Statements Part 2Kondreddi SakuNo ratings yet

- Module 5 - Cost of CapitalDocument5 pagesModule 5 - Cost of Capitaljay-ar dimaculanganNo ratings yet

- M&A NotesDocument22 pagesM&A NotesБота ОмароваNo ratings yet

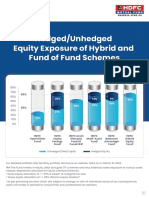

- Leaflet - Hedged and Unhedged Exposure of Hybrid FundsDocument2 pagesLeaflet - Hedged and Unhedged Exposure of Hybrid FundsDeepakNo ratings yet

- Investment Decision RulesDocument7 pagesInvestment Decision RulesQuỳnh Anh TrầnNo ratings yet

- CAIIB ABFM Module B Mini Marathon 2Document21 pagesCAIIB ABFM Module B Mini Marathon 2Nandagopal KannanNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing Modeljackie555No ratings yet

- Công ty Cổ Phần Vàng Bạc Đá Quý Phú Nhuận (PNJ)Document15 pagesCông ty Cổ Phần Vàng Bạc Đá Quý Phú Nhuận (PNJ)Thảo MaiNo ratings yet

- FinRep SummaryDocument36 pagesFinRep SummaryNikolaNo ratings yet

- Tutorial 7 - (Solution) Analysis of Financial StatementsDocument4 pagesTutorial 7 - (Solution) Analysis of Financial StatementsSamer LaabidiNo ratings yet

- Week 11 In-Class Exercise (Topic 9) - WORKSHEETDocument4 pagesWeek 11 In-Class Exercise (Topic 9) - WORKSHEETDương LêNo ratings yet

- CH10 ProblemDocument1 pageCH10 ProblemTrần Hoàng Thành DươngNo ratings yet

- Fundamentals of Corporate Finance 12th Edition Ross Test BankDocument35 pagesFundamentals of Corporate Finance 12th Edition Ross Test Bankadeliahue1q9kl100% (19)

- 5 Books Recommended by Paul Tudor JonesDocument4 pages5 Books Recommended by Paul Tudor Jonesjackhack220No ratings yet

- Solution To Quiz 1Document10 pagesSolution To Quiz 1HUANG WENCHENNo ratings yet

- SQB 1017020Document290 pagesSQB 1017020Екатерина ПетроваNo ratings yet

- 33 Investment StrategiesDocument9 pages33 Investment StrategiesAani RashNo ratings yet

- Ravi Kishore BookDocument3 pagesRavi Kishore BookZeeshan Sikandar0% (1)

- Dec 2022 - Strategic Financial ManagementDocument8 pagesDec 2022 - Strategic Financial ManagementindrakumarNo ratings yet

- 2016 Fund Industry in LuxembourgDocument104 pages2016 Fund Industry in LuxembourgShtutz IlianNo ratings yet

- Mutual Fund Report Jun-19Document45 pagesMutual Fund Report Jun-19muddasir1980No ratings yet

- B326 TMA 23-24 (Fall) V1Document5 pagesB326 TMA 23-24 (Fall) V1adel.dahbour9733% (3)

- Oacc - Pp&e P 1 - P3Document23 pagesOacc - Pp&e P 1 - P3Trixie Divine SantosNo ratings yet

- Accounting Last Push-GautengDocument26 pagesAccounting Last Push-GautengYolisa NkosiNo ratings yet

- AdmissionDocument23 pagesAdmissionPawan TalrejaNo ratings yet

- ACC3210Document6 pagesACC3210anba velooNo ratings yet