Professional Documents

Culture Documents

DCF Modelling - WACC - Completed

DCF Modelling - WACC - Completed

Uploaded by

shivammishra492002Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF Modelling - WACC - Completed

DCF Modelling - WACC - Completed

Uploaded by

shivammishra492002Copyright:

Available Formats

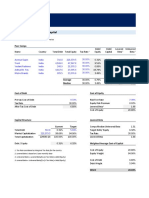

Weighted Average Cost of Capital

All figures are in INR unless stated otherwise.

Peer Comps

Debt/ Debt/ Levered Unlevered

Name Country Total Debt Total Equity Tax Rate 1 Equity Capital Beta 2 Beta 3

Hind. Unilever India 1,139.0 611,503.9 30.00% 0.19% 0.19% 1.00 1.00

Nestle India India 279.9 182,975.0 30.00% 0.15% 0.15% 1.00 1.00

Britannia Inds. India 3,037.7 110,690.0 30.00% 2.74% 2.67% 1.00 0.98

Godrej Consumer India 1,164.5 96,256.4 30.00% 1.21% 1.20% 1.00 0.99

Dabur India India 1,068.1 94,940.4 30.00% 1.13% 1.11% 1.00 0.99

Average 30.00% 1.08% 1.06% 1.00 0.99

Median 30.00% 1.13% 1.11% 1.00 0.99

Cost of Debt Cost of Equity

Pre-tax Cost of Debt 8.40% Risk Free Rate 6.50%

Tax Rate 30.00% Equity Risk Premium 8.00%

After Tax Cost of Debt 5.88% Levered Beta 4 1.51

Cost of Equity 18.54%

Capital Structure Levered Beta

Current Target Comps Median Unlevered Beta 0.99

Total Debt 17,440.0 35.09% 42.50% Target Debt/ Equity 73.91%

Market Capitalization 32,265.0 64.91% 57.50% Tax Rate 30.00%

Total Capitalization 49,705.0 100.00% 100.00% Levered Beta 1.51

Debt / Equity 54.05% 73.91% Weighted Average Cost of Capital

1. Tax Rate considered as Marginal Tax Rate for the country Total Cost Total Weight

2. Levered Beta is based on 5 year monthly data Debt Capital 5.88% 42.50%

3. Unlevered Beta = Levered Beta/(1+(1-Tax Rate) x Debt/Equity) Equity Capital 18.54% 57.50%

4. Levered Beta = Unlevered Beta*(1+(1-Tax Rate) x Debt/Equity) Weighted Average Cost of Capital 13.16%

You might also like

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- Restaurant RatiosDocument1 pageRestaurant Ratiosbaha_said7397No ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- Job Safety Analysis Foundation WorkDocument3 pagesJob Safety Analysis Foundation WorkMihirdutta75% (4)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Auditing & Assurance: Specialized Industries What Is A Specialized Industry?Document15 pagesAuditing & Assurance: Specialized Industries What Is A Specialized Industry?Phia Teo100% (1)

- Marriott Corporation - K - AbridgedDocument9 pagesMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- WACC CalculatorDocument4 pagesWACC CalculatormayankNo ratings yet

- Go To Market - FrameworkDocument1 pageGo To Market - FrameworkLaura Gleason KobyNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Valuation Methods and Shareholder Value CreationFrom EverandValuation Methods and Shareholder Value CreationRating: 4.5 out of 5 stars4.5/5 (3)

- Counter-Fraud Framework Saudi Central BankDocument64 pagesCounter-Fraud Framework Saudi Central BankMNA SiddikiNo ratings yet

- CA PDF 5Document222 pagesCA PDF 5ThabassumNo ratings yet

- Wacc ProjectDocument8 pagesWacc ProjectSubhash PandeyNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuveNo ratings yet

- Mergers and AcquisiotnsDocument1 pageMergers and AcquisiotnssudhirNo ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Financial Synergy Valuation TemplateDocument4 pagesFinancial Synergy Valuation TemplateAkshat PrakashNo ratings yet

- 3 6 1+Calculating+the+WACCDocument12 pages3 6 1+Calculating+the+WACCLeonardo VettorazzoNo ratings yet

- Particulars Amount ($ Millions) Interest Rate (%) Long Term DebtDocument10 pagesParticulars Amount ($ Millions) Interest Rate (%) Long Term DebtShrishti GoyalNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialKnightspageNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJim MacaoNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvane rondinaNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered BetajeganathanNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- Bank Modeling TryoutDocument11 pagesBank Modeling Tryoutcharlotte.zibautNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Funding Amount %age of Total Cost Amount Costs As Per Estimates in January, 2008 Final Cost in March 2010 Adopted by AERA %age of Total CostDocument2 pagesFunding Amount %age of Total Cost Amount Costs As Per Estimates in January, 2008 Final Cost in March 2010 Adopted by AERA %age of Total CostPulokesh GhoshNo ratings yet

- Cost OverrunsDocument2 pagesCost OverrunsPulokesh GhoshNo ratings yet

- Multiples AnalysisDocument113 pagesMultiples AnalysisAyesha ShaukatNo ratings yet

- Mariott Valuation in Corporate FinanceDocument5 pagesMariott Valuation in Corporate FinanceRasheeq RayhanNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosDocument2 pagesSR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosAYYAZ TARIQNo ratings yet

- FAP T11 KuralayDocument5 pagesFAP T11 KuralayKuralay TilegenNo ratings yet

- Total Liabilities / Assets (In Figures) RS.: Particulars 2009 1540319785 Shareholder's FundsDocument4 pagesTotal Liabilities / Assets (In Figures) RS.: Particulars 2009 1540319785 Shareholder's FundsShakti TokasNo ratings yet

- AccretionDilution AnalysisDocument14 pagesAccretionDilution AnalysisJayash KaushalNo ratings yet

- Master WACC Tvs 8Document2 pagesMaster WACC Tvs 8suraj pNo ratings yet

- Final AssignmentDocument54 pagesFinal AssignmentValentin PicavetNo ratings yet

- Calculadora WACCDocument2 pagesCalculadora WACCmarcos.hernandezNo ratings yet

- A B19049 Assignment 3Document9 pagesA B19049 Assignment 3Shrey BhalaNo ratings yet

- Liquidity FundDocument3 pagesLiquidity Fundtangkc09No ratings yet

- 15 Multiples AnalysisDocument100 pages15 Multiples AnalysisSkander lakhalNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Assignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Document9 pagesAssignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Maherban HaiderNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatNo ratings yet

- BetawaccDocument1 pageBetawaccDj (Dj)No ratings yet

- BetawaccDocument1 pageBetawaccSachin KulkarniNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- Cash Return On Invested CapitalDocument8 pagesCash Return On Invested CapitalMichael JacopinoNo ratings yet

- Team MembersDocument8 pagesTeam MembersUyen HoangNo ratings yet

- Ed213 - Financial Planning and ControlDocument22 pagesEd213 - Financial Planning and Controlsharon agustinNo ratings yet

- Literature Review On Cooperative BanksDocument7 pagesLiterature Review On Cooperative Banksafmzyywqyfolhp100% (1)

- Chapter - 29: Inventory ManagementDocument10 pagesChapter - 29: Inventory ManagementVishu choudharyNo ratings yet

- 1 CV Ricardo Jasso CV 2019Document1 page1 CV Ricardo Jasso CV 2019Carlos LopezNo ratings yet

- Activity Based Costing CH 11Document32 pagesActivity Based Costing CH 11shiellaNo ratings yet

- Developing New Approach For Measuring Construction Project PerformanceDocument10 pagesDeveloping New Approach For Measuring Construction Project PerformanceAhmed S. EldiebNo ratings yet

- Chapter 5 Job Order CostingDocument19 pagesChapter 5 Job Order CostingCelestaire LeeNo ratings yet

- Spec Age 1 March 2024Document145 pagesSpec Age 1 March 2024Krash KingNo ratings yet

- Smallcases Investment Performance: A Returns-Based Factor Analysis by RAJAN RAJUDocument18 pagesSmallcases Investment Performance: A Returns-Based Factor Analysis by RAJAN RAJUabhishekNo ratings yet

- Neville Clarke Training Calendar MalaysiaDocument3 pagesNeville Clarke Training Calendar MalaysiaAswad AzizNo ratings yet

- MC6 Matcha Creations: InstructionsDocument2 pagesMC6 Matcha Creations: InstructionsReza eka PutraNo ratings yet

- Safety and Operational Risk Update: Mark Bly Executive Vice President, S &ORDocument10 pagesSafety and Operational Risk Update: Mark Bly Executive Vice President, S &ORsaran985No ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Unit 8Document5 pagesUnit 8Assma ZarwalNo ratings yet

- Task For ImmersionDocument2 pagesTask For ImmersionAnamie EdnalganNo ratings yet

- Orange County Comptroller Audit On BridgesDocument44 pagesOrange County Comptroller Audit On BridgesDaniel R. DahmNo ratings yet

- Lesson PlanDocument12 pagesLesson PlanIeymarh FatimahNo ratings yet

- Af Cost Averaging WorksheetDocument150 pagesAf Cost Averaging WorksheetPanduNo ratings yet

- QUU Contractor WHS Management SOP PRO586Document23 pagesQUU Contractor WHS Management SOP PRO586Travis BakerNo ratings yet

- Essay - Cisco SystemsDocument2 pagesEssay - Cisco SystemsTahira YaseenNo ratings yet

- BA 7104 TQM Model QuestionDocument1 pageBA 7104 TQM Model QuestionSam RenuNo ratings yet

- Lucy D'Souza v. State of GoaDocument9 pagesLucy D'Souza v. State of Goasuhani sharmaNo ratings yet

- Reliance Industries Limited - Annual Report AnalysisDocument37 pagesReliance Industries Limited - Annual Report AnalysisRevanth KrNo ratings yet

- Chapter 7 - Activity-Based Costing and Management: ANSWER: FalseDocument42 pagesChapter 7 - Activity-Based Costing and Management: ANSWER: FalseBhumika PatelNo ratings yet

- Benson Enterprises Is Evaluating Alternative Uses For A Three Story ManufacturingDocument1 pageBenson Enterprises Is Evaluating Alternative Uses For A Three Story ManufacturingAmit PandeyNo ratings yet