Professional Documents

Culture Documents

Fanaka 8yrs - John Kamau

Fanaka 8yrs - John Kamau

Uploaded by

kevinsamuelnewversion0 ratings0% found this document useful (0 votes)

18 views2 pagesThis document summarizes a life insurance plan for John Kamau Njenga who is 46 years old. The plan provides a sum assured of 1,000,000 Kenyan Shillings. It has an 8 year policy term and premium term. On death during the premium paying term, 75% of the sum assured will be paid as a death benefit. There is also a guaranteed bonus of 100,000 Kenyan Shillings at the end of the term and projected bonuses totaling 400,000 Kenyan Shillings over the life of the policy. The estimated maturity value after 8 years is 1,500,000 Kenyan Shillings. The document also lists premium payment options and projected riders that could be added to the policy.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a life insurance plan for John Kamau Njenga who is 46 years old. The plan provides a sum assured of 1,000,000 Kenyan Shillings. It has an 8 year policy term and premium term. On death during the premium paying term, 75% of the sum assured will be paid as a death benefit. There is also a guaranteed bonus of 100,000 Kenyan Shillings at the end of the term and projected bonuses totaling 400,000 Kenyan Shillings over the life of the policy. The estimated maturity value after 8 years is 1,500,000 Kenyan Shillings. The document also lists premium payment options and projected riders that could be added to the policy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesFanaka 8yrs - John Kamau

Fanaka 8yrs - John Kamau

Uploaded by

kevinsamuelnewversionThis document summarizes a life insurance plan for John Kamau Njenga who is 46 years old. The plan provides a sum assured of 1,000,000 Kenyan Shillings. It has an 8 year policy term and premium term. On death during the premium paying term, 75% of the sum assured will be paid as a death benefit. There is also a guaranteed bonus of 100,000 Kenyan Shillings at the end of the term and projected bonuses totaling 400,000 Kenyan Shillings over the life of the policy. The estimated maturity value after 8 years is 1,500,000 Kenyan Shillings. The document also lists premium payment options and projected riders that could be added to the policy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

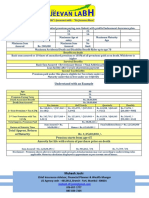

Plan: Fanaka Plan Layer 1

Name: John Kamau Njenga

Age Next Birthday: 46

Sum Assured: 1,000,000

Projected Bonus rate: 5.00% of Sum Assured

Policy Term: 8

Premium Term: 8

Survival Benefits Death Benefit

On death of the life assured by any cause during the premium paying term 75% of Sum Assured is

Basic Sum Assured 1,000,000/= paid to the beneficiary at the time of death 750,000/=

Guaranteed bonus at the end of the term of the policy 100,000/=

Projected Bonus from inception to Maturity 400,000/=

Estimated Maturity Value 1,500,000/=

Mode of Payment Premium Discounted premium Total Amount Paid Tax relief Benefit

Monthly 13,032/= 13,032/= 1,251,072/= 1,955/=

Quarterly 37,451/= 37,451/= 1,198,432/= 5,618/=

Semi-Annually 73,811/= 73,811/= 1,180,976/= 11,072/=

Annually 145,440/= 145,440/= 1,163,520/= 21,816/=

Single premium 1,026,490/= 1,026,490/= 1,026,490/= 60,000/=

Rider premium

Riders Rider Sum Assured Monthly Quarterly Semi-Annually Annually Single premium

Accidental Death Benefit

Total & Permanent Disability

Waiver of premium

Adult Accident Hospitalization Rider

Last Expense- Life Assured

Total 0/= 0/= 0/= 0/= 0/=

Total 13,032/= 37,451/= 73,811/= 145,440/= 1,026,490/=

The Illustration figures assume that your investment will grow at the indicated rate

The Estimated Maturity Value can be used to purchase a Single Premium Immediate Annuity (SPIA)

For clients who pay a single premium the estimated maturity value is 1,620,000/=

I confirm that I have read and understood the information provided in this illustration.

I have also received a copy of this illustration.

Signature of Applicant ……………………………………………. Date ……………………………………

Contact details: Mobile: Email:

You might also like

- Total 96,860/ 278,406/ 548,697/ 1,081,221Document2 pagesTotal 96,860/ 278,406/ 548,697/ 1,081,221JoelNo ratings yet

- Personalised Proposal For Securing Your Life Goals: Hi FatherDocument8 pagesPersonalised Proposal For Securing Your Life Goals: Hi FatherAbcNo ratings yet

- Premium Calculation: Juhi Sharma Rajat Gupta Deepak SinghDocument23 pagesPremium Calculation: Juhi Sharma Rajat Gupta Deepak SinghDeepak SinghNo ratings yet

- KFD New14102023114539156 E35Document8 pagesKFD New14102023114539156 E35saurabh.imbhuNo ratings yet

- Happiness.: Take Simple Steps Towards Wealth ofDocument12 pagesHappiness.: Take Simple Steps Towards Wealth ofnipat29bajajNo ratings yet

- FWAP LeafletDocument16 pagesFWAP LeafletsatishbhattNo ratings yet

- SWG Joint Life BrochureDocument19 pagesSWG Joint Life BrochureHardik BajajNo ratings yet

- Flexi Income Goal-Enhanced Benefit-11-03-2020Document10 pagesFlexi Income Goal-Enhanced Benefit-11-03-2020sibabrata chatterjeeNo ratings yet

- KFD New20012024140359061 E35Document17 pagesKFD New20012024140359061 E35msaurabh9142No ratings yet

- Diamond Savings Plan-BrochureDocument7 pagesDiamond Savings Plan-BrochureneerajishanNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201031235968496 1593829930513Document9 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201031235968496 1593829930513Rozel EncarnacionNo ratings yet

- Brochure DSPDocument8 pagesBrochure DSPCHANDRAKANT RANANo ratings yet

- Guarantee Growth: When Partners WithDocument7 pagesGuarantee Growth: When Partners WithMahadevaNo ratings yet

- Wilma Dapog Flexilink 1mDocument10 pagesWilma Dapog Flexilink 1mTweetie Borja DapogNo ratings yet

- Sun Maxilink PrimeDocument9 pagesSun Maxilink PrimeGracie Sugatan PlacinoNo ratings yet

- PDS Boost ProtectActiveDocument4 pagesPDS Boost ProtectActiveAizat HermanNo ratings yet

- Evelyn Sayson-AGENCY-Az - protect-PHP-03042023134157Document3 pagesEvelyn Sayson-AGENCY-Az - protect-PHP-03042023134157jasleh ann villaflorNo ratings yet

- Basilan R Startup 13092023140753Document4 pagesBasilan R Startup 13092023140753Rogelio EscobarNo ratings yet

- Smart WealthDocument8 pagesSmart WealthmilanNo ratings yet

- Presentation 28Document6 pagesPresentation 28Padma RamenNo ratings yet

- Retire Happy BIDocument17 pagesRetire Happy BIJsey TanNo ratings yet

- Smart Elite Brochure WebDocument16 pagesSmart Elite Brochure WebSaurabh RathodNo ratings yet

- Double Your Advantage: Savings With Regular Bonus AdditionsDocument7 pagesDouble Your Advantage: Savings With Regular Bonus AdditionsMitul Kumar JainNo ratings yet

- Risk Chapter 5Document29 pagesRisk Chapter 5Wonde BiruNo ratings yet

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201025037831941 1593829524713Document9 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201025037831941 1593829524713Rozel EncarnacionNo ratings yet

- LIC Jeevan LabhDocument1 pageLIC Jeevan LabhMukesh JoshiNo ratings yet

- C Endowment 25 YrsDocument5 pagesC Endowment 25 YrsSaurabh GargNo ratings yet

- The Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDocument3 pagesThe Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDeny KosasihNo ratings yet

- FWAP ULIP Leaflet RevisedDocument16 pagesFWAP ULIP Leaflet Revisedmantoo kumarNo ratings yet

- Health Start: Ms. Mariam Castalla SoloDocument13 pagesHealth Start: Ms. Mariam Castalla SolokeithNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201037590899392 1593830302546Document9 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201037590899392 1593830302546Rozel EncarnacionNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Bajaj Allianz: Future GainDocument17 pagesBajaj Allianz: Future GainPawan KumarNo ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Variable Life Insurance ProposalDocument11 pagesVariable Life Insurance ProposalRoumel GalvezNo ratings yet

- VIVENCIA PRIME All RidersDocument12 pagesVIVENCIA PRIME All RidersRalph RUzzelNo ratings yet

- 313 PCDRDocument3 pages313 PCDRkahwai ngNo ratings yet

- Sun Acceler8Document7 pagesSun Acceler8Princessa Lopez Masangkay100% (1)

- Jubilee Life Investment PlanDocument2 pagesJubilee Life Investment PlanMuwanyi Philly100% (1)

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?dinesh tiwariNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - BrochureSanjeev KulkarniNo ratings yet

- Retire Smart Product GuideDocument2 pagesRetire Smart Product GuideKathirrvelu SubramanianNo ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- HNB Assurance PLCDocument4 pagesHNB Assurance PLCakpirasanna1989No ratings yet

- Bajaj Allianz Isecure LoanDocument9 pagesBajaj Allianz Isecure LoanSuresh MouryaNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Icici Lakshya - 10kDocument5 pagesIcici Lakshya - 10kManjunath RNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsMcnet WideNo ratings yet

- Sun Smarter Life ClassicDocument7 pagesSun Smarter Life Classicpaul jan sarachoNo ratings yet

- Cashflow Protection Plus - EnglishDocument2 pagesCashflow Protection Plus - EnglishJagdeesh ShettyNo ratings yet

- Loan SecureDocument22 pagesLoan SecureDayana DawnieNo ratings yet

- Ulip BrochureDocument20 pagesUlip BrochureTelus InternationalNo ratings yet

- SunlifeDocument11 pagesSunlifeAsisclo CastanedaNo ratings yet

- Flexi Income Goal: Bajaj Allianz LifeDocument10 pagesFlexi Income Goal: Bajaj Allianz LifeSudhirGajareNo ratings yet

- CeylincoQuoteDocument3 pagesCeylincoQuotejulani pabasariNo ratings yet

- Variable Life Insurance ProposalDocument6 pagesVariable Life Insurance ProposalJayson BorlagdatanNo ratings yet

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- Quality Inspectors - Job DescriptionDocument3 pagesQuality Inspectors - Job DescriptionMurugan.SubramaniNo ratings yet

- Volume 22 Issue 1 - January-February 2019 PDFDocument88 pagesVolume 22 Issue 1 - January-February 2019 PDFedgar palomino fernandezNo ratings yet

- Chapter 1 - Intro To ElectroDocument46 pagesChapter 1 - Intro To ElectroCraigNo ratings yet

- Carbon Fiber vs. Metal FrameworkDocument14 pagesCarbon Fiber vs. Metal FrameworkDental Del NorteNo ratings yet

- Expressing Apology: SMP Islam Nurus Sunnah SemarangDocument9 pagesExpressing Apology: SMP Islam Nurus Sunnah SemaranganggaNo ratings yet

- Cleaning Weekly CleaningDocument3 pagesCleaning Weekly CleaningDonahue Wellness-House of GraceNo ratings yet

- The Impact of Improved Road Infrastructure On The Livelihoods of Rural Residents in Lesotho: The Case of PhamongDocument11 pagesThe Impact of Improved Road Infrastructure On The Livelihoods of Rural Residents in Lesotho: The Case of PhamongEng MatanaNo ratings yet

- Control Self Assessment (CSA) : JUNI 2020Document18 pagesControl Self Assessment (CSA) : JUNI 2020Frissca PrawithaNo ratings yet

- Chapter 3Document41 pagesChapter 3ali baltazarNo ratings yet

- Art 29Document14 pagesArt 29lisa aureliaNo ratings yet

- LHO Form 5 - CERTIFICATE OF POSTING COMPLIANCE Brgy. SecretaryDocument2 pagesLHO Form 5 - CERTIFICATE OF POSTING COMPLIANCE Brgy. SecretaryTIMMY BOYNo ratings yet

- MG3 Circuit Diagram-11-07-22 PDFDocument145 pagesMG3 Circuit Diagram-11-07-22 PDFmehdi89% (9)

- Finish WRDocument2 pagesFinish WRTejinder KumarNo ratings yet

- Jeffrey Weeks - FriendshipDocument26 pagesJeffrey Weeks - FriendshipMarcelo CamargoNo ratings yet

- Alkaline Earth Metals and Their Uses Chemistry ProjectDocument9 pagesAlkaline Earth Metals and Their Uses Chemistry ProjectINo ratings yet

- Cake IndustryDocument77 pagesCake IndustryAlok Pandey100% (3)

- Lead Better, Start Younger: The Course DescriptionDocument4 pagesLead Better, Start Younger: The Course DescriptionBfp Rsix Maasin FireStationNo ratings yet

- 4 Intelligence Vs Non-IntelligenceDocument28 pages4 Intelligence Vs Non-IntelligenceSani BlackNo ratings yet

- CHLORPYRIPHOSDocument7 pagesCHLORPYRIPHOSLarissa SavadogoNo ratings yet

- Character Name Generator - Gloomspite GitzDocument1 pageCharacter Name Generator - Gloomspite GitzWhite Dragon CompanyNo ratings yet

- Prayer Power Series Week 1Document2 pagesPrayer Power Series Week 1INSIDEOUT GCAFNo ratings yet

- The Environmental Protection ActDocument48 pagesThe Environmental Protection ActEco Electrotech SolutionsNo ratings yet

- 11 - Topic 20 Organic Chemistry AnswersDocument60 pages11 - Topic 20 Organic Chemistry AnswersNeen NaazNo ratings yet

- Service Manual: TransformerDocument18 pagesService Manual: TransformerPierre EyebeNo ratings yet

- The Effect of Internal Auditor Competence andDocument14 pagesThe Effect of Internal Auditor Competence andDeva Putri R.KNo ratings yet

- Final Programme 2016 WEB ADDocument204 pagesFinal Programme 2016 WEB ADNahui IcatlNo ratings yet

- Jamun 1Document3 pagesJamun 1Umesh HbNo ratings yet

- The Affective Filter and Reading AcquisitionDocument7 pagesThe Affective Filter and Reading Acquisitionapi-400078361No ratings yet

- Essential Vocabulary For IELTS (2nd Edition)Document5 pagesEssential Vocabulary For IELTS (2nd Edition)Garry100% (1)

- s6 Unit 11. SolubilityDocument44 pagess6 Unit 11. Solubilityyvesmfitumukiza04No ratings yet