Professional Documents

Culture Documents

Task 4 - Template - Revised

Task 4 - Template - Revised

Uploaded by

prathmesh KolteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 4 - Template - Revised

Task 4 - Template - Revised

Uploaded by

prathmesh KolteCopyright:

Available Formats

Provide an investment recommendation

Email to management

Dear Management Team,

Financial Impact of Supply Chain Interruption

• Minimal financial impact in the short-term given it has had minimal effect on the financial projections in the years following

FY21. Therefore, we do not see this as a strong reason to significantly lower your bid nor is it an indication of future financial

distress.

• Given the long-term nature of this investment and the intangible (synergy value) value of this investment, we do not see this

fire as a material issue either.

Bidding Dynamics

• The information regarding bidding on HappyHour Co. from the NY/HK Times to be credible. Due to several large strategic

firms searching for opportunities

to expand we can expect a highly competitive bidding environment.

• If WorldWide Brewing is expecting to extract higher vatue from synergies than some of the bidding competitors, this leaves

an opportunity to pay a higher

price.

Valuation Adjustments

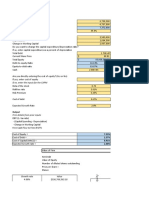

• FY21

Net Revenue

present of $1, on

value based 100mm (downgrowth

perpetuity ~4-5%)method

• 50% gross margin

• Management expects to revert

Preliminary to originally forecasted sales in FY22 and thereafter Revised valuation (post-fire)

valuation

This has resulted in a revised NPV of $738mm from $803mm, an equity value

Value Basedofon$654mm

8.5% WACC &from $718mm and

0.5% TGR offer

Amount ($m)share price of

% of NPV

Value Based on 8.5% WACC & 0.5% TGR Amount ($m) % of NPV

329 cents from 361

Present Value of Cash flows cents. 409 50.9% Present Value of Cash flows 345 46.7%

PV of Terminal Value 394 49.1% PV of Terminal Value 394 53.3%

Implied Firm NPV 803 100.0% Implied Firm NPV 738 100.0%

Net debt as of Mar-20E (85) Net debt as of Mar-20E (85)

Implied equity value 718

Implied offer share price (c) 361 Implied equity value 654

% premium to current 118.8% Implied offer share price (c) 329

Source: Company Business Plan (January 2020); Equity research; J.P. Morgan analysis % premium to current 99.1%

WORLDWIDE BREWING 1

You might also like

- Task 3 - Model Answer - NewDocument2 pagesTask 3 - Model Answer - NewNidhi Khandelwal100% (2)

- BATASNATIN Notes On SuccessionDocument7 pagesBATASNATIN Notes On SuccessionBerniceAnneAseñas-ElmacoNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedMathieu KasprzakNo ratings yet

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathanNo ratings yet

- Provide An Investment Recommendation: Email To ManagementDocument1 pageProvide An Investment Recommendation: Email To Managementdavin nathanNo ratings yet

- CPA Syllabus 2016Document188 pagesCPA Syllabus 2016athancox5837100% (1)

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowdavin nathan100% (2)

- Task 2 - AnswerDocument2 pagesTask 2 - Answersamueloyekoya445No ratings yet

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Task 1 - Email JP MorganDocument2 pagesTask 1 - Email JP MorganWilliam100% (1)

- Task 2 TemplateDocument2 pagesTask 2 TemplateMUHAMMED FARSIN ENo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art Euphoria100% (1)

- BA Boeing Stock SummaryDocument1 pageBA Boeing Stock SummaryOld School ValueNo ratings yet

- Task 2 - Company Overview - DavinDocument2 pagesTask 2 - Company Overview - Davindavin nathan100% (1)

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ritvik SharmaNo ratings yet

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- Task 4 - Model Answer - RevisedDocument1 pageTask 4 - Model Answer - RevisedRoshan GaikwadNo ratings yet

- Task 2 TemplateDocument2 pagesTask 2 TemplateAmardeep Tayade100% (2)

- Forage JP Morgan Ib Task 2 SolutionDocument2 pagesForage JP Morgan Ib Task 2 SolutionRohit Vasave100% (1)

- Task 2 - Process Letter Summary Model Answer v2Document1 pageTask 2 - Process Letter Summary Model Answer v2Siddhant AggarwalNo ratings yet

- Task 2 - Company Overview - DavinDocument2 pagesTask 2 - Company Overview - DavinDAVIN NATHANNo ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowSiddhant AggarwalNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Command Reference v1Document658 pagesCommand Reference v1anonNo ratings yet

- Task 5 AnswerDocument7 pagesTask 5 AnswerAjith VNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Task 2 - Notes On HappyHour Co v3Document3 pagesTask 2 - Notes On HappyHour Co v3Siddhant AggarwalNo ratings yet

- NBA ADVANCED - Happy Hour Co - DCF COMPLETEDDocument10 pagesNBA ADVANCED - Happy Hour Co - DCF COMPLETEDViinnii Kumar100% (1)

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2AKANSHA100% (1)

- Boiler Tube Failure Mechanisms - Case Studies-Springer (2023)Document136 pagesBoiler Tube Failure Mechanisms - Case Studies-Springer (2023)RDSetyawan100% (1)

- DynamoDocument8 pagesDynamoDany KpNo ratings yet

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowvikas100% (1)

- Overview of Auction Process and Key WorkstreamsDocument1 pageOverview of Auction Process and Key Workstreams055Nitish BhatiaNo ratings yet

- Task 2 - Company Overview v2Document2 pagesTask 2 - Company Overview v2Grace StylesNo ratings yet

- Task 2 - Company Overview Model Answer v2Document2 pagesTask 2 - Company Overview Model Answer v2Siddhant Aggarwal100% (4)

- Task 2 - Second SlideDocument1 pageTask 2 - Second SlideLouis P50% (2)

- Task 1 - Email Model Answer v2Document2 pagesTask 1 - Email Model Answer v2Siddhant Aggarwal100% (1)

- Calculating Fiber Optic Loss BudgetsDocument7 pagesCalculating Fiber Optic Loss Budgetsssantos_303882No ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedIshitaNo ratings yet

- JP Morgan Task 2 ForagerDocument3 pagesJP Morgan Task 2 ForagerVilhelm CarlssonNo ratings yet

- Task 2 TemplateDocument2 pagesTask 2 Templaterevanth t100% (1)

- Task 2 - Company Overview Model Answer v2Document2 pagesTask 2 - Company Overview Model Answer v2Pruthvi Shetty ShettyNo ratings yet

- Task 2 - Company Overview Template v2Document2 pagesTask 2 - Company Overview Template v2Louis P100% (2)

- Task 2 - Company Overview (Aman Upadhyay)Document2 pagesTask 2 - Company Overview (Aman Upadhyay)Aman UpadhyayNo ratings yet

- Task 3Document2 pagesTask 3Rohit SanghviNo ratings yet

- Task 1 - EmailDocument2 pagesTask 1 - EmailLouis P0% (1)

- Task 3 - Model AnswerDocument2 pagesTask 3 - Model AnswerVidehi Bajaj0% (1)

- Task 3 - Model Answer EmailDocument1 pageTask 3 - Model Answer EmailPruthvi Shetty ShettyNo ratings yet

- To: From: SubjectDocument3 pagesTo: From: SubjectHephzibah LeannaNo ratings yet

- Task 2 - Resource - NewDocument2 pagesTask 2 - Resource - NewShilpi KumariNo ratings yet

- Task 4 - Email Model AnswerDocument1 pageTask 4 - Email Model AnswerDeepak kumar SinghNo ratings yet

- Task 4 DavinDocument2 pagesTask 4 DavinKarpaga E SriramNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - Revisedyot7patelNo ratings yet

- J.P PPTCDocument1 pageJ.P PPTCkaddeabhijitNo ratings yet

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- K (D1/P0) + G: WockhardtDocument2 pagesK (D1/P0) + G: WockhardtYYASEER KAGDINo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Solution For Case 10 Valuation of Common StockDocument8 pagesSolution For Case 10 Valuation of Common StockHello100% (1)

- VALUING SYNERGIES IN M&A-Data Revised Jan 2020Document7 pagesVALUING SYNERGIES IN M&A-Data Revised Jan 2020Aninda Dutta100% (1)

- Inputs: If No, Enter The Inputs For The CAPMDocument7 pagesInputs: If No, Enter The Inputs For The CAPMTheris FlorenciaNo ratings yet

- Wipro Equity Research ReportDocument6 pagesWipro Equity Research ReportNaturallyNo ratings yet

- 100 Investment Banking TermsDocument20 pages100 Investment Banking TermsNaturallyNo ratings yet

- DefaultDocument1 pageDefaultNaturallyNo ratings yet

- 1.3 Guide Allocation-MBA-II 2023-24 EvenDocument4 pages1.3 Guide Allocation-MBA-II 2023-24 EvenNaturallyNo ratings yet

- Front PageDocument2 pagesFront PageNaturallyNo ratings yet

- Basic Economic PrinciplesDocument10 pagesBasic Economic PrinciplesNaturallyNo ratings yet

- SNEHADocument84 pagesSNEHANaturallyNo ratings yet

- Book 1Document1 pageBook 1NaturallyNo ratings yet

- Holiday ListDocument2 pagesHoliday ListNaturallyNo ratings yet

- Please Wait..Document1 pagePlease Wait..NaturallyNo ratings yet

- Document Nisha CaseDocument1 pageDocument Nisha CaseNaturallyNo ratings yet

- Nisha CNDDocument15 pagesNisha CNDNaturallyNo ratings yet

- AbhishekDocument4 pagesAbhishekNaturallyNo ratings yet

- Biketaxi Working RevenueDocument63 pagesBiketaxi Working RevenueNaturallyNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementNaturallyNo ratings yet

- 1007 1 Ad Lucknow 02-09-2022Document1 page1007 1 Ad Lucknow 02-09-2022NaturallyNo ratings yet

- Abrites Diagnostics For Toyota User Manual 12102020Document42 pagesAbrites Diagnostics For Toyota User Manual 12102020misternikiNo ratings yet

- Course Specs Pers Man CHEDDocument10 pagesCourse Specs Pers Man CHEDReymarr HijaraNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFkavin prasathNo ratings yet

- Day 3 Recapitulation Exercises R1 - Rico D.JDocument2 pagesDay 3 Recapitulation Exercises R1 - Rico D.JRico Danu JatmikoNo ratings yet

- BATANGAS STATE UNIVERSITY-Administrative Officer IDocument2 pagesBATANGAS STATE UNIVERSITY-Administrative Officer IEmmanuel De OcampoNo ratings yet

- Fabm1 Grade-11 Qtr4 Module5 Week-5Document6 pagesFabm1 Grade-11 Qtr4 Module5 Week-5Crestina Chu BagsitNo ratings yet

- REX521 Tech ENdDocument72 pagesREX521 Tech ENdm khNo ratings yet

- SM-800.11 TypeM Plus ValvesDocument13 pagesSM-800.11 TypeM Plus ValvesAdel AhmedNo ratings yet

- Annex VI - Final Narrative ReportDocument4 pagesAnnex VI - Final Narrative ReporttijanagruNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Green Chemistry: CHEM21 Selection Guide of Classical-And Less Classical-SolventsDocument9 pagesGreen Chemistry: CHEM21 Selection Guide of Classical-And Less Classical-SolventsFelipe PérezNo ratings yet

- WHMIS and Safety AssignmentDocument3 pagesWHMIS and Safety AssignmentClaireNo ratings yet

- Blackbook Project On Gold Flake CigarettesDocument75 pagesBlackbook Project On Gold Flake CigarettesChinmay Pawar0% (1)

- Project Equity Research Analysis Between ICICI Bank and HDFC BankDocument3 pagesProject Equity Research Analysis Between ICICI Bank and HDFC BankMalay ShahNo ratings yet

- Full Download Microeconomics 6th Edition Hubbard Solutions Manual PDF Full ChapterDocument36 pagesFull Download Microeconomics 6th Edition Hubbard Solutions Manual PDF Full Chapteriatricalremittalf5qe8n100% (18)

- A Common Frame of Reference For European Private LawDocument4 pagesA Common Frame of Reference For European Private LawswermarianaNo ratings yet

- d4753 15 Standard Guide For Evaluating Selecting and Specifying Balances and Standard Masses For Use in Soil Rock and Construction Materials TestingDocument6 pagesd4753 15 Standard Guide For Evaluating Selecting and Specifying Balances and Standard Masses For Use in Soil Rock and Construction Materials TestingAfra AliNo ratings yet

- Department of Electronics &telecommunication Engineering Sem:VIII Question Bank of Satellite CommunicationDocument4 pagesDepartment of Electronics &telecommunication Engineering Sem:VIII Question Bank of Satellite CommunicationPavan WaseNo ratings yet

- Section 5-5: Frequency Transformations: Lowpass To HighpassDocument84 pagesSection 5-5: Frequency Transformations: Lowpass To HighpasssmithNo ratings yet

- Anrlte782Document65 pagesAnrlte782Carlos CelisNo ratings yet

- Script - US Real Estate, Housing CrashDocument5 pagesScript - US Real Estate, Housing CrashMayumi AmponNo ratings yet

- Proline Promass 80E, 83E: Technical InformationDocument40 pagesProline Promass 80E, 83E: Technical Informationazzrizalz1470No ratings yet

- 12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalDocument3 pages12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalbarryNo ratings yet

- Refreshing Your Knowledge: Gender AnalysisDocument10 pagesRefreshing Your Knowledge: Gender AnalysisGianna Gayle S. FondevillaNo ratings yet