Professional Documents

Culture Documents

Cost Allocation in Urban Infrastructure Funding

Uploaded by

Stevanus FebriantoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Allocation in Urban Infrastructure Funding

Uploaded by

Stevanus FebriantoCopyright:

Available Formats

COST ALLOCATION IN URBAN

INFRASTRUCTURE FuNDING

By Andrew R. Watkins!

ABSTRACT: This paper develops a methodology for allocating infrastructure costs

over the community, which uses it or in some way benefits from it. By allowing

in a quantitative fashion for the value judgments that form part of the allocation

process, and by establishing links between the various beneficiary groups and the

funding mechanisms available to the infrastructure provider, a consistent allocation

framework has been developed that provides clear-cut charging regimes for infra-

structure provision.

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

INTRODUCTION

The effects of urban infrastructure funding on communities or parts of

communities are matters of considerable interest to planners and govern-

ments. Distributional, efficiency, and other impacts of infrastructure funding

will be determined by the funding regime that is used-in other words, by

the split of infrastructure costs among the people who consume or in some

way benefit from the services it provides and the way in which these costs

are recovered.

Even though it frequently appears explicitly or implicitly in studies of

urban infrastructure funding, the question of deriving a sensible rationale for

this split has received surprisingly little attention in the literature on urban

infrastructure. The need to allocate costs among distinct groups has been

mentioned in a number of studies-for example, the allocation of arterial

road costs between the commuters to and from work, the industries that

employ the commuters, and other users (Watson 1996), or the allocation of

impact fees in Florida between the new development and individuals outside

the development (Nicholas 1985)-but has not been studied any further, here

or elsewhere (Rau 1985; Toft 1985; Nicholas and Nelson 1988; Spiller 1993;

Neutze 1995).

This lack of interest may be due to the fact that traditionally infrastructure

provision has been the role of government and its agencies, who have been

able to call on a range of well-established funding mechanisms (taxes, rates)

that spread the funding burden thinly over a large number of people and are

therefore relatively noncontroversial.

Recent developments in infrastructure provision have, however, made the

funding question at once more complex and more contentious. A wider range

of funding mechanisms (the most notable being "user pays" charging de-

vices) are now accepted by the community, and the increasing role of the

private sector in providing infrastructure has sharply reduced the reliance that

can be placed on relatively broad government taxes and charges to fund

infrastructure. The question of who needs the infrastructure and who should

pay for it has assumed an increasing importance, and the onus is now on the

IRes. Economist, Dept. of Infrastructure, Nauru House, 80 Collins St., Melbourne,

Victoria 3000, Australia.

Note. Discussion open until August I, 1998. To extend the closing date one month,

a written request must be filed with the ASCE Manager of Journals. The manuscript

for this paper was submitted for review and possible publication on October I, 1997.

This paper is part of the Journal of Urban Planning and Development, Vol. 124,

No.1, March, 1998. ©ASCE, ISSN 0733-9488/98/0001-0044-0053/$4.00 + $.25

per page. Paper No. 16713.

44/ JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998

J. Urban Plann. Dev. 1998.124:44-53.

infrastructure provider to identify those groups in the community who benefit

from the infrastructure and, in the light of this, to allocate the costs of the

infrastructure among these groups in some acceptable and defensible way

(see e.g., Moore and Muller 1991).

Justifying a particular cost allocation regime often involves assessing the

benefits that flow from the infrastructure. Traditionally, cost-benefit analysis

has been used to assess the benefits (as well as costs) of the infrastructure

projects (Squire and van der Tak 1975), but considerable controversy sur-

rounds the various methodologies available, and the difficulties are com-

pounded when the question of allowing for different individual preferences

arises in assessing benefits. A good discussion of this can be found in Pearce

and Nash (1981).

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

Under these circumstances, it seemed appropriate to take a somewhat dif-

ferent approach in looking at the allocation of infrastructure costs. Cost-

benefit studies typically focus on the variations in preferences of individuals

and assume that the benefit itself is uniformly distributed over all individuals.

In this paper I put the question of individual preferences to one side and

concern myself with benefits insofar as they define the individuals or groups

who can reasonably be expected to pay for the infrastructure, and as a guide

(but not the only one) to the share of costs they should pay, based on the

different levels of benefit (due to their location, age, family circumstances,

and so on) they receive.

For example, not all people in the community derive equal benefit from

the construction of a child care center or a library. Families with young

children and readers living in reasonable proximity to the library would log-

ically receive greater benefits from the facilities than those living farther

away, whereas those living in another city would derive no benefit at all. The

community-and hence the infrastructure authority-might take the view

that it would be unfair to burden these groups equally with the cost of the

facilities, and would allocate the costs, implicitly or explicitly, in accordance

with the benefits (if any) received by the various beneficiary groups; the

benefit principle (Bird 1976, Chapter 2).

However, this is not the only way of allocating infrastructure costs. Another

community might feel that different criteria, such as sharing the cost of the

facility equally over all members of the community regardless of benefit or

having only those beneficiaries who are direct users pay for it, are more

appropriate. This introduces the idea that community values, which reflect

the aims and perceptions of the community, will play an important part in

determining the way in which costs are allocated among the beneficiaries.

These value judgements are in effect a consensus, whether explicit or implicit,

of community attitudes and aspirations, tempered in some cases by the po-

litical and bureaucratic process, and will inevitably determine the choice of

allocation criteria or (equivalently) the respective weightings they receive in

the cost allocation process.

There is, furthermore, a second issue of almost equal importance that has

received no mention in the literature: in the real world, cost recovery mech-

anisms are imperfect, because they may fail to extract the appropriate pay-

ment from the appropriate people. Typically, infrastructure authorities have

available to them a range of possible cost recovery mechanisms; grants from

state and federal governments that come from taxes levied on the larger

community (including taxes earmarked for special projects, such as gasoline

taxes for road building), rates (including special rates and specific rates, such

as water rates), various types of user pays charges (such as access fees and

consumption fees for electricity and water), taxes on land development (de-

JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998/45

J. Urban Plann. Dev. 1998.124:44-53.

velopment contributions), and miscellaneous sources of income such as do-

nations, interest from invested funds, and special charges.

These cost recovery mechanisms will not necessarily be very effective in

targeting beneficiary groups of interest. Funding a road from federal taxes,

for example, spread the cost burden not only over the users of the road but

also over the whole community, an outcome that will not be desired by a

road authority wishing to base its infrastructure funding policies on user pays

principles. Again, funding a library through rates will not differentiate be-

tween users and nonusers of the library. The various cost-recovery mecha-

nisms available to infrastructure authorities for extracting money from the

community are thus not always effective ways of taxing specific beneficiary

groups, and funding policies should recognize this.

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

This paper sets out to explore these issues and, in doing so, develops a

cost allocation methodology with a strong practical focus that factors in the

two matters discussed in the preceding section; a community's value judg-

ments and imperfections in funding mechanisms.

METHODOLOGY

My approach in this paper was to break down the cost allocation decision

into a number of logical steps. The first of these was the identification of the

beneficiary groups. These are distinct groupings of people who in some way

benefit from the presence of the infrastructure (Nicholas et at. 1991, Chapter

II); these groups in the urban planning context are often equated with benefit

districts based on the rational nexus test (Roberts 1985). Included were those

who make direct use of the infrastructure, as well as those who benefit from

(or are disadvantaged by) the presence of the infrastructure without being

direct users. A road, for example, will confer benefits on several beneficiary

groups; on the people living in its immediate proximity and who can be

expected to be frequent users of the road, on people farther away who use

the road less frequently, and possibly on persons who, although they do not

use the road at all, nevertheless experience a rise in property values (benefits)

or an increase in noise (disbenefits) from the proximity of the road.

The second step was to assess the cost shares appropriate to each criterion

(Moore and Muller 1991). For each criterion there will be a different set of

shares covering the beneficiary groups, reflecting the different implications

of the criterion for the cost allocation process. For example, the infrastructure

costs can be distributed according to the size of the benefits received-the

rational nexus test (Roberts 1985; Moore and Muller 1991; Nelson et al.

1990) or, alternatively, they can be distributed on a user-pays criterion, where

costs are recovered solely from the direct users of the infrastructure facility

(whose consumption can be influenced by price signals), with nonusers con-

tributing nothing, even though they may derive some other benefit from the

presence of the infrastructure. Again, the infrastructure costs could be spread

evenly over all beneficiaries, regardless of the magnitude of the benefit they

receive or whether they are direct users or not. There are many possibilities,

and for each of these criteria there will be a different set of cost shares for

the beneficiary groups.

I designated the shares of the infrastructure cost to be met by each of N

beneficiary groups under the first criterion as: su, S2h ••• , SN\; the shares

under the second criterion as SI2, S22, ••• , Sm, and so on. These shares can

be summarized in an N X M matrix S, each element of which gives a measure

of the cost share of a particular beneficiary group for each one of the M

funding criteria

46/ JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998

J. Urban Plann. Dev. 1998.124:44-53.

S

[,,,

$21

= ~~~

$\2

$22

$32

$13

$23

$33

$14

$24

$34

'

$2M

$3M

..]

$N1 $HZ $NJ $N4 $NM

The relative importance of these criteria, however, will depend on the

community's values, as discussed above. The third step, therefore, is for the

infrastructure authority to take account of the relative importance to the com-

munity of the criteria by assigning weights w .. W 2, ••• , WM to the M criteria.

This can be represented as a vector w

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

Although I now have the means to decide which beneficiary groups bear

what part of the cost, in practice, as mentioned above, it is rarely possible

for the infrastructure authority to extract directly the required contribution

from each member of each beneficiary group. This is because the cost re-

covery mechanisms (rates, taxes, consumption charges, and so on) available

to the infrastructure authority single out specific groups of people or orga-

nizations that mayor may not be the same as the beneficiary groups of

interest. As a result, the cost recovery mechanisms will differ in their ability

to target the appropriate beneficiary groups.

In the fourth step, I derived a measure of how effective each cost recovery

mechanism is in terms of targeting the beneficiary groups of interest. One

way of defining such a measure is by determining the number of people who

receive some sort of benefit from the infrastructure and who also are targeted

by the cost recovery mechanism, in relation to the total number of people

targeted by the cost recovery mechanism. This measure is denoted as the

targeting ratio t, defined, for each cost recovery mechanism and beneficiary

group, as

t= BIT

Here, B = the number of people in the beneficiary group actually targeted by

the cost recovery mechanism; and T = the total number of people (whether

in the beneficiary group or not) targeted by the cost recovery mechanism.

This applies tothe case where B ::s; T, which might occur, for example, when

considering how well state taxes target the patients in a hospital.

Alternatively, t can be defined as the number of people on whom the cost

recovery mechanism impacts and who also receive a benefit from the infra-

structure, in relation to the total number of people who receive a benefit from

the infrastructure

t= TIB

This applies to the case where B ~ T; for example, where the wider com-

munity, which benefits from the presence of the hospital through improved

general health and the resulting economic and social benefits, is to be targeted

with a user pays funding option.

JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998/47

J. Urban Plann. Dev. 1998.124:44-53.

Values of the targeting ratio 1 will thus lie between zero and unity. A small

value of the targeting ratio indicates that the cost recovery mechanism under

consideration is relatively ineffective in targeting a particular beneficiary

group, whereas a value close to unity indicates that the cost recovery mech-

anism is highly effective in targeting the beneficiary group under consider-

ation.

Clearly, a beneficiary group could be affected by more than one cost re-

covery mechanism-in the preceding example, an individual who supports

a hospital through taxes could be a patient in the same hospital, paying di-

rectly for the medical services the hospital provides. This situation comes

about because the beneficiary in question consumes two types of benefits and

will therefore be targeted by two cost recovery mechanisms.

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

The complete set of targeting ratios for all groups and all cost recovery

mechanisms can be summarized in an F X N targeting matrix T

[,,,

t 21

t 12

t22

t 13

t23 'tO2NN]

= ~~~

t 32 133 t3N

T

tFI t F2 tn tFN

The first column of this matrix, for example, represents the effectiveness of

cost recovery mechanisms 1, 2, ... , F in targeting the members of the first

beneficiary group.

The first and final step was to calculate the final allocation of costs. This

is a vector f of cost shares!I,J2, ... ,IF' to be met through the F cost recovery

mechanisms available, and is given by

The vector f has F elements; each element specifying the proportion of the

total cost of the infrastructure that is to be recovered from each cost recovery

mechanism. The reason for couching the final solution in terms of the share

of cost to come from each cost recovery mechanism rather than from each

beneficiary group is that the former approach is of more practical relevance

to the infrastructure authority, which ultimately makes its decisions in terms

of the amounts to be collected using the various cost recovery mechanisms

(rates, taxes, user charges, and so on), rather than from particular beneficiary

groups.

In the event that a particular group suffers disbenefits rather than benefits

from the infrastructure project the same steps would be followed, including

defining a targeting ratio for the group in question. The end result would be

an additional term in the vector f, which would have a negative rather than

a positive sign, reflecting the payment of compensation to the group adversely

affected by the infrastructure project. Note that the methodology, concerned

as it is solely with the distribution of costs, is as equally applicable to private

sector projects as it is to public sector projects-the chief difference lies in

the range of cost recovery mechanisms available and the way in which they

are administered.

48/ JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998

J. Urban Plann. Dev. 1998.124:44-53.

The process can be summarized as follows: the shares to be paid by the

beneficiary groups under each criterion are modified by the weight the infra-

structure authority gives to each criterion, and the result of this is in turn

modified by the effectiveness of each cost recovery mechanism in reaching

each beneficiary group. This gives the final allocation of costs. The data that

are needed in applying this methodology are as follows:

• The size, location, and benefits received by the various beneficiary

groups. These can usually be estimated from records held by government

and other agencies, surveys to evaluate the value of the service to resi-

dents, traffic counts, official statistics, and so on.

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

• The relative importance or desirability of various funding criteria. In an

elected democracy the relative importance or weighting of the criteria

will be decided through the political process, which will reflect the values

of the community at large.

• The cost shares associated with each funding criterion. The infrastructure

authority calculates these shares using data gathered from surveys (to

determine the expected level of usage of the facility), financial data (to

estimate rises in property values), demographic data, and so on (Sugden

and Williams 1978).

• The targeting ratios for the cost recovery mechanisms that the infrastruc-

ture authority intends to use. These can be obtained relatively straight-

forwardly from data such as population distributions, catchments of the

facilities, surveys of usage of the facility, and so on.

APPLICATION

The application of this methodology can be illustrated by a case study.

The one I chose was based on the community facilities and services plan for

Freshwater Valley, an expanding community west of Cairns in Queensland,

which is part of Mulgrave Shire (Briggs 1992). At the time of the study,

Mulgrave Shire had a total population of 3,685, which was projected to grow

to 10,690 by the year 2000 as a result of the development at Freshwater

Valley. The population of Queensland, 3,034,700 in 1992 (Australian Bureau

of Statistics 1996a) is projected to be 3,634,000 in the year 2000 (Australian

Bureau of Statistics 1996b). In this study, a range of social infrastructures

was identified as being needed for this community, of which one type of

facility, multipurpose neighborhood centers, is discussed here. These centers

provide children's services, community and youth programs, and services for

ethnic groups and the aged in the form of community service information,

drop-in facilities, meeting rooms, location for activities such as play groups,

and offices for service providers. It is thus a reasonable assumption that the

centers will be used by the community almost regardless of age and sex.

The accepted standard for the provision of neighborhood centers is one

per 6,500 persons; ultimately, therefore, Freshwater Valley would need two

neighborhood centers. The capital costs of the centers (buildings and land)

are $200,000 for the smaller and $350,000 for the larger, for a total cost of

$550,000. This study identifies funding sources for the capital costs as local

(rates collected by the Mulgrave Shire council), state (through grants pro-

vided by the Queensland Department of Family Services and Aboriginal and

Islander Affairs), and from incoming residents (through development contri-

butions). The use of the facilities is to be shared by the existing population

and the incoming population.

JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998/49

J. Urban Plann. Dev. 1998.124:44-53.

I considered the analysis of the allocation problem using the methodology

described previously. There are three groups that benefit in some way from

the community centers; the users of the community centers, the Mulgrave

Shire community at large (through the increased attractiveness of their com-

munity due to the presence of the community centers), and the population of

the state (through the contribution of the community centers to the general

health and social welfare of Queensland). The share of the total benefit re-

ceived by each ot these groups is estimated by the council to be 70% for the

users of the facilities, 25% for the residents of the municipality, and 5% for

the state. The populations of the three beneficiary groups are estimated by

council to be 8,018 (estimated from surveys that show that about 75% of the

population of Freshwater Valley will use the facilities), 10,690 (the population

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

of Mulgrave Shire in the year 2000), and 3,634,000 (the population of the

state in the year 2000).

The criteria considered by the council, in consultation with the community,

in deciding on a funding policy for the community centers were the three

mentioned previously (allocation of infrastructure costs evenly over all ben-

eficiaries, regardless of the magnitude of the benefit they receive; allocation

according to the size of the benefits received; and allocation on a user pays

criterion-for convenience these criteria are designated A, B, and C in this

paper). The shares of costs payable by each beneficiary group under each of

these three criteria are

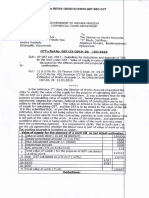

0.0022 0.7 1]

S= 0.0029 0.25 0

[

0.9949 0.05 0

where each column specifies the proportions of the costs to be allocated under

each criterion. Thus, the first column (A) allocates the share from each of

the three groups according to the populations in each group, spreading the

costs evenly across all persons in the groups; the second column (B) allocates

costs based on the benefit received by each group; and the third column (C)

allocates the shares to direct users of the facilities. Because only the first

beneficiary group comprises direct users of the facility, the element corre-

sponding to this group will be the only nonzero entry in the column.

The council then assigned weights to the criteria. It regarded criteria A and

B as less important than criterion C, giving (in this order) the vector of

weights:

0.1 ]

w = 0.21

[

0.8

The next step was to assess the effectiveness of each of the cost recovery

mechanisms (municipal rates, development contributions, and state taxes) in

targeting the beneficiary groups. The effectiveness of rates in targeting the

users of the community facilities was given by the total number of users

divided by the total number of people targeted by rates (the total population

of the shire, including the incoming residents; 10,690 people in the year

2000), so that

t21 = 8,018/10,690 = 0.75

As a second example, I considered the effectiveness with which state taxes

target the second beneficiary group (the residents of Mulgrave Shire). This

50 I JOURNAL OF URBAN PLANNING AND DEVELOPMENT I MARCH 1998

J. Urban Plann. Dev. 1998.124:44-53.

will be given by the ratio of the number of residents who are affected by

taxes and who are residents (10,690), divided by the total number of taxpay-

ers in the state (3,634,000), giving

132 = 10,690/3,634,000 = 0.00294

A third and slightly more complicated case arises in evaluating the effec-

tiveness of development contributions in targeting the direct users of the

infrastructure. Development contributions are levied only on the incoming

population [10,690 - 3,685 = 7,005 people by the year 2000 (Briggs 1992)],

not on the existing population (assuming that no significant development

occurs in already established areas). The effectiveness with which only the

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

users of the facilities in the group of incoming residents are targeted will be

given by the ratio of the number of users in this group to the total number

of people in this group or, 5,254n,050. The effectiveness with which all

users of the facilities are targeted by development contributions is obtained

by multiplying this by the ratio of the number of incoming residents (who

are the only residents to pay development contributions) to the total number

of people in the Shire of Mulgrave or, 7,005/10,690. The targeting ratio is

therefore

III =' (5,254/7,005) X (7,005110,690) =' 0.491

In this way we arrive at a targeting matrix

0.4915 0.6553 0.0019]

T =' 0.7500 1.ססoo 0.0029

[

0.0022 0.0029 1.ססOO

The solution to the allocation problem is then

0.444]

f = T X S X w ='

[0.106

0.678

The shares expressed as a percentage can be obtained by dividing by the

sum of the elements of this vector. The council will thus fund the community

centers by the following allocation: 36.2% by development contributions,

55.2% out of municipal rates, and 8.7% out of state government grants. This

allocation would, of course, change if the council decided, for example, to

give more weight to the first criterion than the third, or if it introduced an

additional cost recovery mechanism, such as a payment per visit by users of

the community centers. The same analysis can be applied to the other facil-

ities to be provided at Mulgrave Shire and the results added to give the total

charges to be levied.

The calculations above had been based on the population in the year 2000

and on current dollar values. In fact, the growth of the community over time

and the provision of the community centers at some stage in the future will

mean that some allowance should be made for the changing value of money

over time by using the net present values of the dollar amounts as the basis

for the allocation. This does not add anything materially new to the analysis,

and will not be further discussed here. One of the many discussions of the

use of net present values in calculating infrastructure costs can be found in

Chapter 9 of Nicholas et al. (1991) or in Peiser (1988).

JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998/51

J. Urban Plann. Dev. 1998.124:44-53.

CONCLUSION

The methodology proposed here, while not claiming to provide a complete

answer to all of the difficulties associated with cost allocation, deals directly

and, it is hoped, rigorously with two major difficulties in allocating infra-

structure costs; allowing for the value judgments of the community and for

the imperfections of real-life funding mechanisms. Equally significantly, it

provides a practical framework for dealing with the cost allocation problem.

The issue of practicality is important: infrastructure authorities need a ser-

viceable methodology capable of being applied directly to real-world infra-

structure funding problems.

The approach to cost allocation discussed in this paper also avoids the ad

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

hoc funding policies that can so easily arise from the lack of any effective

allocation methodology. There are problems with such funding policies in

that they often lack fairness, consistency, transparency, and accountability,

and are frequently open to error. As a result, they can be contentious and

vulnerable to legal challenge (see e.g., Bird 1976, Chapters 10 and 11). These

are dangers that the methodology developed here largely avoids.

In summary, the cost allocation methodology proposed here has three main

advantages:

1. It provides a logical and systematic template for cost allocation calcu-

lations that serve to guide the planner through all the steps involved in

developing a cost allocation scheme and, which is readily transferable

from one situation to another.

2. It provides a consistent structure for allocating costs-in other words,

the same basis for the calculations can be applied by different infra-

structure authorities to different situations, giving results which are

comparable-which is at the same time flexible enough to accommo-

date a diversity of aims.

3. It is particularly convenient in that it can be readily adapted for spread-

sheet use.

This method will, it is hoped, find application in the planning and funding

of urban infrastructure projects by providing a practical way of allocating

costs that systematizes the decision making process and resolves conflicting

aims in an equitable manner.

Finally, it should be remembered that, in the methodology proposed here,

no account has been taken of the different incomes, preferences, or other

circumstances of the individual consumers (Pearce and Nash 1981). In this

paper, individuals are differentiated purely by the different levels of benefits

they receive and by the differences in the effectiveness with which they can

be targeted by the cost recovery mechanisms that the infrastructure authority

has at its disposal. For this reason this allocation solution, while it builds in

many of the factors that influence the way costs are allocated, may not be in

economic terms the most efficient solution, even though it may represent the

best solution available in practical terms. The economically most efficient

solution may, however, be very difficult or impossible to arrive at in the real

world (pearce and Nash 1981).

APPENDIX. REFERENCES

Australian Bureau of Statistics. (l996a). "Australian demographic statistics, march

quarter 1996." Catalogue 3101.0, ABS, Canberra, Australia.

52/ JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998

J. Urban Plann. Dev. 1998.124:44-53.

Australian Bureau of Statistics. (1996b). "Projections of the populations of australia

states and territories, 1995-2051." Catalogue 3222.0. Series A, ADS, Canberra,

Australia.

Bird, R. M. (1976). Charging for public services: a new look at an old idea. Canadian

Tax Foundation, Toronto, Canada.

Briggs, S. (1992). The application ofdeveloper contributions for social infrastructure.

Australian Government Publishing Service, Canberra, Australia, 129-159.

Moore, W. B., and Muller, T. (1991). "Impacts of development and infrastructure

financing." J. Urban Ping. and Devel., 117(3),95-107.

Nelson, A. C., Nicholas, J. C., and Juergensmeyer, J. C. (1990). "Critical elements

of development fee programs." J. Urban Ping. and Devel., 116(1), 34-47.

Neutze, M. (1995). "Methods of funding urban infrastructure." Urban Policy and

Res., 13, 20-28.

Downloaded from ascelibrary.org by Tokyo Univ Seisan Gijutsu on 05/27/15. For personal use only.

Nicholas, J. c., and Nelson, A. C. (1988). "Determining the appropriate development

impact fee using the rational nexus test." J. Am. Ping. Assn., 54, 56-66.

Nicholas, J. C., Nelson, A. C., and Juergensmeyer, J. C. (1991). A practitioner's guide

to development impact fees. Planners Press (American Planning Association), Chi-

cago, Ill.

Pearce, D. W., and Nash, C. A. (1981). The social appraisal of projects. MacMillan,

London, England.

Peiser, R. (1988). "Calculating equity-neutral water and sewer impact fees." J. Am.

Ping. Assn., 54, 38-48.

Rau, J. G. (1985). "Paying for the costs of public services: methods and issues."

Proc.• Spec. Conf of ASCE, ASCE, New York, N.Y., 150-159.

Roberts, T. H. (1985). "Funding public capital facilities: how community planning

can help." The changing structure of infrastructure finance, Monograph 85-5, J.

C. Nicholas, ed., Lincoln Institute of Land Policy, Cambridge, Mass., 1-22.

Spiller, M. (1993). "Strategies for funding urban infrastructure." Urban Futures J.,

3,1-9.

Squire, Lyn., and van der Tak, H. G. (1975). Economic analysis of projects. Johns

Hopkins University Press, Baltimore, MD.

Sugden, R., and Williams, A. (1978). The principles ofpractical cost benefit analysis.

Oxford University Press, Oxford, England, Chapters 9 and 10.

Toft, G. S. (1985). "Designing infrastructure user charges strategies in infrastructure

for urban growth." Proc.• Spec. Conf of ASCE, ASCE, New York, N.Y., I-II.

Watson, C. (1996). "Calculating development charges." Plan Canada, January, 28-

29.

JOURNAL OF URBAN PLANNING AND DEVELOPMENT / MARCH 1998/53

J. Urban Plann. Dev. 1998.124:44-53.

You might also like

- Bus206 Case Analysis Lucy v. ZehmerDocument3 pagesBus206 Case Analysis Lucy v. ZehmerJosieNo ratings yet

- Slaughter - 1998 MODELS OF CONSTRUCTION INNOVATION PDFDocument6 pagesSlaughter - 1998 MODELS OF CONSTRUCTION INNOVATION PDFDébora BretasNo ratings yet

- Civil Law Review I Preliminary Examination October 18, 2021Document3 pagesCivil Law Review I Preliminary Examination October 18, 2021Mikes FloresNo ratings yet

- Critical Discourse AnalysisDocument28 pagesCritical Discourse AnalysisNamisha Choudhary100% (2)

- Sales AgreementDocument6 pagesSales Agreementrido wahyuNo ratings yet

- Book - Contributor - Non-OA - Normal - EN (Limited Version For Non-RG) v1.3 V2Document6 pagesBook - Contributor - Non-OA - Normal - EN (Limited Version For Non-RG) v1.3 V2Siddharth GosaviNo ratings yet

- Infrastructure Planning For Sustainable CitieDocument8 pagesInfrastructure Planning For Sustainable CitieAbdullah KhalilNo ratings yet

- Structural Health Monitoring of Civil InfrastructureDocument34 pagesStructural Health Monitoring of Civil InfrastructureM MushtaqNo ratings yet

- A Quantified System-of-Systems Modeling Framework For Robust National Infrastructure PlanningDocument12 pagesA Quantified System-of-Systems Modeling Framework For Robust National Infrastructure PlanningSartika EliyaNo ratings yet

- Fbuil 05 00061Document19 pagesFbuil 05 00061Rennan MedeirosNo ratings yet

- Assessment of Urban Flood Resilience in Barcelona For Current and Future Scenarios. The RESCCUE ProjectDocument25 pagesAssessment of Urban Flood Resilience in Barcelona For Current and Future Scenarios. The RESCCUE ProjectParker WaiNo ratings yet

- Icbelsh 2002Document4 pagesIcbelsh 2002International Jpurnal Of Technical Research And ApplicationsNo ratings yet

- RC00 FoxDocument30 pagesRC00 FoxAnto SutharshanNo ratings yet

- Gandy Et Al 2023 Social Equity of Bridge ManagementDocument11 pagesGandy Et Al 2023 Social Equity of Bridge Management55723110049No ratings yet

- Jcemd4 Coeng-12637Document13 pagesJcemd4 Coeng-12637til telNo ratings yet

- Distributed Energy Systems As Common Goods Socio-Political Acceptance of Renewables in Intelligent Microgrids PDFDocument14 pagesDistributed Energy Systems As Common Goods Socio-Political Acceptance of Renewables in Intelligent Microgrids PDFasrmltNo ratings yet

- Recommendation-Based Geovisualization Support For Reconstitution in Critical Infrastructure ProtectionDocument12 pagesRecommendation-Based Geovisualization Support For Reconstitution in Critical Infrastructure ProtectionSarraSarouraNo ratings yet

- A VIVESPPI-Risk-fiscalDocument17 pagesA VIVESPPI-Risk-fiscalManuel LozadaNo ratings yet

- Architectural Theory Review: Click For UpdatesDocument22 pagesArchitectural Theory Review: Click For UpdatesIzzac AlvarezNo ratings yet

- Toward Disaster-Resilient Cities: Characterizing Resilience of Infrastructure Systems With Expert JudgmentsDocument19 pagesToward Disaster-Resilient Cities: Characterizing Resilience of Infrastructure Systems With Expert JudgmentsMălíķ ĂsfęnđýårNo ratings yet

- Encryption-Based Solution For Data Sovereignty in Federated CloudsDocument6 pagesEncryption-Based Solution For Data Sovereignty in Federated CloudsKamal PratikNo ratings yet

- Brennan 2017Document23 pagesBrennan 2017Ian GeikeNo ratings yet

- Ops Link Zach MandDocument5 pagesOps Link Zach MandbehanchodNo ratings yet

- Lanau - Liu - 2020 - Developing An Urban Resource Cadaster For Circular EconomyDocument11 pagesLanau - Liu - 2020 - Developing An Urban Resource Cadaster For Circular EconomyemilNo ratings yet

- Global Sensitivity Analysis For The Evaluation of The Effects of Uncertainty of Transport Demand and Passenger Behavior On Planning Railway Services With Variable Train CompositionDocument8 pagesGlobal Sensitivity Analysis For The Evaluation of The Effects of Uncertainty of Transport Demand and Passenger Behavior On Planning Railway Services With Variable Train Compositiongetachew-hagos.geletaNo ratings yet

- Field Monitoring of RC-Structures Under Dynamic Loading Using Distributed Fiber-Optic SensorsDocument10 pagesField Monitoring of RC-Structures Under Dynamic Loading Using Distributed Fiber-Optic SensorsFaseen ibnu Ameer AhasenNo ratings yet

- Bristow 2019 How Spatial and Functional Dependencies Between Operations and Infrastructure Leads To Resilient RecoveryDocument8 pagesBristow 2019 How Spatial and Functional Dependencies Between Operations and Infrastructure Leads To Resilient RecoveryAiswarya.A.GNo ratings yet

- Machine LerningDocument15 pagesMachine LerningFadly SaputraNo ratings yet

- Infrastructure Rehabilitation Management Applying Life-Cycle Cost AnalysisDocument10 pagesInfrastructure Rehabilitation Management Applying Life-Cycle Cost AnalysisUmang UpadhyayNo ratings yet

- Wolfert Et Al 3C Method Multi-System Intervention Optimization For Interdependent InfrastructureDocument11 pagesWolfert Et Al 3C Method Multi-System Intervention Optimization For Interdependent InfrastructureshinNo ratings yet

- Managing Sustainability Assessment of Civil Infrastructure Projects Using Work, Nature, and FlowDocument13 pagesManaging Sustainability Assessment of Civil Infrastructure Projects Using Work, Nature, and FlowStevanus FebriantoNo ratings yet

- Underground Infrastructure of Urban AreasDocument302 pagesUnderground Infrastructure of Urban AreasErick Alan100% (1)

- Stakeholder AnalysisDocument1 pageStakeholder AnalysisCASTAÑETO REYNA M.No ratings yet

- Smart Cities With Digital Twin Systems For Disaster ManagementDocument10 pagesSmart Cities With Digital Twin Systems For Disaster ManagementSunny jagtapNo ratings yet

- Profitability Evaluation of Intelligent Transport System InvestmentDocument11 pagesProfitability Evaluation of Intelligent Transport System InvestmentСлаваNo ratings yet

- Critical Infrastructure Dependencies - ANADocument8 pagesCritical Infrastructure Dependencies - ANAGabriel DellerNo ratings yet

- Uncertainty Analysis of Rework Predictors in Post-Hurricane Reconstruction of Critical Transportation InfrastructureDocument9 pagesUncertainty Analysis of Rework Predictors in Post-Hurricane Reconstruction of Critical Transportation InfrastructureAh TinkNo ratings yet

- Sotsgorod: The Problem of Building Socialist CitiesDocument11 pagesSotsgorod: The Problem of Building Socialist CitiesjefferyjrobersonNo ratings yet

- Building and Environment: Benjamin P. Thompson, Lawrence C. BankDocument10 pagesBuilding and Environment: Benjamin P. Thompson, Lawrence C. Bankjhon EXTREMANo ratings yet

- Siemiatycki - 2008 - Managing Optimism Biases in The Delivery of LargeDocument6 pagesSiemiatycki - 2008 - Managing Optimism Biases in The Delivery of LargeSaad KhanNo ratings yet

- Water Environment Federation: Info/about/policies/terms - JSPDocument34 pagesWater Environment Federation: Info/about/policies/terms - JSPJhoel Yactayo GonzalesNo ratings yet

- FairnessDocument14 pagesFairnessAn RoyNo ratings yet

- Unified Theory Urban Living Bettencourt WestDocument3 pagesUnified Theory Urban Living Bettencourt WestSaltik_mehmetNo ratings yet

- Value of Information Analysis in Civil and Infrastructure Engineering: A ReviewDocument21 pagesValue of Information Analysis in Civil and Infrastructure Engineering: A ReviewRevall FauzyaNo ratings yet

- CFN - Design GuidelinesDocument108 pagesCFN - Design GuidelinesSushmaPallaNo ratings yet

- Design Thinking - Vito de BockDocument22 pagesDesign Thinking - Vito de BockMarco SilvaNo ratings yet

- 2016 VTM PDFDocument11 pages2016 VTM PDFtriple_patteNo ratings yet

- Ostrom. 1993. Design Principles in Irrigation SystemsDocument6 pagesOstrom. 1993. Design Principles in Irrigation Systemsacharya.venishaNo ratings yet

- Characterizing The Key Predictors of Renewable Energy Penetration For Sustainable and Resilient CommunitiesDocument12 pagesCharacterizing The Key Predictors of Renewable Energy Penetration For Sustainable and Resilient Communitieslaith.mohammad1994No ratings yet

- Energies 14 04451Document30 pagesEnergies 14 04451Angel MomitaNo ratings yet

- Modeling Urban Spatial EvolutionDocument22 pagesModeling Urban Spatial Evolutionস্বাগতাদাশগুপ্তারশ্মিNo ratings yet

- Advanced Engineering Informatics: SciencedirectDocument20 pagesAdvanced Engineering Informatics: SciencedirectHimanshuRanaNo ratings yet

- Guidebook For Adoption of Form Based Codes 4Document7 pagesGuidebook For Adoption of Form Based Codes 4Gabriel BarisnagaNo ratings yet

- The Resiliency Continuum: N. Placer and A.F. SnyderDocument17 pagesThe Resiliency Continuum: N. Placer and A.F. SnyderSudhir RavipudiNo ratings yet

- Resilience in Infrastructure Systems A Comprehensive ReviewDocument17 pagesResilience in Infrastructure Systems A Comprehensive ReviewcherrielNo ratings yet

- A Simple Network-Based Probabilistic Method For Estimating Recovery of Lifeline Services To Buildings After An EarthquakeDocument18 pagesA Simple Network-Based Probabilistic Method For Estimating Recovery of Lifeline Services To Buildings After An EarthquakeRay CTNo ratings yet

- Data Driven Energy Efficiency in BuildingsDocument21 pagesData Driven Energy Efficiency in BuildingsDipikaBadriNo ratings yet

- SREENIVAS UrbanTransportPlanning 2011Document7 pagesSREENIVAS UrbanTransportPlanning 2011Rajveer KohliNo ratings yet

- OSMSES 2023 Paper 03Document8 pagesOSMSES 2023 Paper 03Bogdan ZamfirNo ratings yet

- Inherent Costs and Interdependent Impacts of Infrastructure Network ResilienceDocument21 pagesInherent Costs and Interdependent Impacts of Infrastructure Network ResiliencetaharNo ratings yet

- 2009 - Kepaptsoglou - Transit Route Network Design Problem ReviewDocument15 pages2009 - Kepaptsoglou - Transit Route Network Design Problem ReviewJohn MorenoNo ratings yet

- Surviving Major Disruptions Building Supply Chain Re 2023 Sustainable ManufDocument13 pagesSurviving Major Disruptions Building Supply Chain Re 2023 Sustainable ManufTrung ThanhNo ratings yet

- Guardian Roundtable 2010Document1 pageGuardian Roundtable 2010peter235No ratings yet

- Journal of Building Engineering: Amir Ehsan Pouyan, Abdulhamid Ghanbaran, Amir ShakibamaneshDocument20 pagesJournal of Building Engineering: Amir Ehsan Pouyan, Abdulhamid Ghanbaran, Amir ShakibamaneshGiorno GiovannaNo ratings yet

- Framework For Stakeholder Management in Construction ProjectsDocument14 pagesFramework For Stakeholder Management in Construction ProjectsStevanus FebriantoNo ratings yet

- Managing Sustainability Assessment of Civil Infrastructure Projects Using Work, Nature, and FlowDocument13 pagesManaging Sustainability Assessment of Civil Infrastructure Projects Using Work, Nature, and FlowStevanus FebriantoNo ratings yet

- Innovation Management and Construction Phases in Infrastructure ProjectsDocument9 pagesInnovation Management and Construction Phases in Infrastructure ProjectsStevanus FebriantoNo ratings yet

- Determining The Probability of Project Cost OverrunsDocument10 pagesDetermining The Probability of Project Cost OverrunsStevanus FebriantoNo ratings yet

- Allocation and Management of Cost Contingency in ProjectsDocument11 pagesAllocation and Management of Cost Contingency in ProjectsStevanus FebriantoNo ratings yet

- 1995 (Kangari) Risk Management Perceptions and Trends of U.S. ConstructionDocument8 pages1995 (Kangari) Risk Management Perceptions and Trends of U.S. ConstructionStevanus FebriantoNo ratings yet

- The Social Contract and Constitutional RepublicsDocument10 pagesThe Social Contract and Constitutional RepublicsMichael A. BerturanNo ratings yet

- 2924-B120-13C67-DWG-0004 - R1.0 Electrical Cable Routing and Cable Tray RoutingDocument4 pages2924-B120-13C67-DWG-0004 - R1.0 Electrical Cable Routing and Cable Tray RoutingRonti ChanyangNo ratings yet

- The Brandon Simmons Group: Team GuideDocument4 pagesThe Brandon Simmons Group: Team GuideBrandon SimmonsNo ratings yet

- Case Law Condonation of Delay Accepted ICA PDFDocument4 pagesCase Law Condonation of Delay Accepted ICA PDFmuhammad_awan_49No ratings yet

- 7 Complaint For Specific Performance and DamagesDocument5 pages7 Complaint For Specific Performance and DamagesIanLightPajaroNo ratings yet

- 18 12th Accounts Important Formats English MediumDocument25 pages18 12th Accounts Important Formats English MediumJansi ArulNo ratings yet

- GasparDocument9 pagesGasparRaineir PabiranNo ratings yet

- Green Acres Holdings, Inc. v. CabralDocument16 pagesGreen Acres Holdings, Inc. v. CabralMark Anthony ViejaNo ratings yet

- AUDITING THEORY Quiz No. 3Document3 pagesAUDITING THEORY Quiz No. 3ROB101512No ratings yet

- Florendo V Paramount Insurance CorpDocument12 pagesFlorendo V Paramount Insurance CorpRed ConvocarNo ratings yet

- The Indian Heights School Class - Ix SUBJECT-Social Science (History) French Revolution Revision Worksheet 2 (PT 2) Name - DATE September 2,2021Document4 pagesThe Indian Heights School Class - Ix SUBJECT-Social Science (History) French Revolution Revision Worksheet 2 (PT 2) Name - DATE September 2,2021SURYANSHNo ratings yet

- MCQs On The Negotiable Instruments Act, 1881 Part 2Document10 pagesMCQs On The Negotiable Instruments Act, 1881 Part 2Aysha AlamNo ratings yet

- Chemistry in Context 7th Edition American Chemical Society Test BankDocument35 pagesChemistry in Context 7th Edition American Chemical Society Test Bankalborakinfect.ufid12100% (26)

- GST Pass Order PDFDocument4 pagesGST Pass Order PDFvenkat dNo ratings yet

- Unit 1 - The Crisis of The Ancien Régime and The EnlightenmentDocument2 pagesUnit 1 - The Crisis of The Ancien Régime and The EnlightenmentRebecca VazquezNo ratings yet

- Reyes V GlaucomaDocument1 pageReyes V GlaucomaAndrewNo ratings yet

- Easo Practical Guide: Evidence AssessmentDocument36 pagesEaso Practical Guide: Evidence AssessmentKonstantinos KaraoulanisNo ratings yet

- DPC Assignment - IIIDocument46 pagesDPC Assignment - IIIVinod Thomas EfiNo ratings yet

- Telecommunication Regulation in Bangladesh: An Overview: Anju Man Ara Begum Mohammad Hasan Murad Kazi Arshadul HoqueDocument16 pagesTelecommunication Regulation in Bangladesh: An Overview: Anju Man Ara Begum Mohammad Hasan Murad Kazi Arshadul HoqueTANVIR SADATNo ratings yet

- Tariff Regime in Pakistan - Sajid Akram NEPRADocument35 pagesTariff Regime in Pakistan - Sajid Akram NEPRASheraz azamNo ratings yet

- 1 NNPC Spiral Deal Spa Blco A1Document17 pages1 NNPC Spiral Deal Spa Blco A1Ralph Ajah100% (1)

- Payment Letter: Types of Letter Vocab & Expressions Structures & NotesDocument1 pagePayment Letter: Types of Letter Vocab & Expressions Structures & Notesnguyen khanh trinhNo ratings yet

- SK Reso. For Augmentation of ProjectsDocument3 pagesSK Reso. For Augmentation of ProjectsRobert Tayam, Jr.67% (3)

- People v. Garcia, C.T.A. Crim. Case Nos. O-572, O-573 & O-610, (February 15, 2021)Document51 pagesPeople v. Garcia, C.T.A. Crim. Case Nos. O-572, O-573 & O-610, (February 15, 2021)Kriszan ManiponNo ratings yet

- Product Design: Legal and Ethical Issues in DesignDocument29 pagesProduct Design: Legal and Ethical Issues in DesignSAI MAITREYA GANTI MAHAPATRUNINo ratings yet