Professional Documents

Culture Documents

Legacy Employee Benefits 2019

Uploaded by

MCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Legacy Employee Benefits 2019

Uploaded by

MCopyright:

Available Formats

BENEFITS

EM P LOY E E

that make a difference

Create your legacy with us

Legacy Health is one of the finest health care systems in the country — with six hospitals; more

than 70 primary care, specialty care, and urgent care clinics; plus lab, research, and hospice facilities.

A leader in quality and patient safety, Legacy is not just a great place to work, but we’re also in a

great place to live — Portland, Oregon — named America’s “Best Big City” by Money Magazine.

Our focus on good health is just one of many reasons Legacy is an exceptional place to work. Each day,

dedicated employees move us forward on our care transformation journey, helping patients get and

stay healthy.

Legacy is proud of our total rewards program, which reflects our

compensation and benefit philosophy to:

Join our team and help lead one of the largest

nonprofit, locally owned health systems in the • Align with and support Legacy goals and culture

Portland-Vancouver area and Mid-Willamette Valley. • Attract and retain the highest-qualified employees

Legacy Employment Services • Establish Legacy as a preferred employer

503-415-5405

employment@lhs.org • Maintain a competitive position in the defined labor market

www.legacyhealth.org • Be financially feasible

Affirmative Action/Equal Opportunity Employer Pay

Rewarding performance is a fundamental part of Legacy’s culture.

When it comes to your pay, our goal is to:

• Be competitive – We check to be sure your pay range is in line

with similar jobs at other healthcare organizations.

• Be fair – Your pay fits into our overall structure. Similar jobs at

Legacy have similar pay ranges.

• Value your experience – Your pay reflects your experience and training.

In addition to your base pay, Legacy offers the STRIVE team-based

incentive program, which provides you an annual award of up to $1,000

per year if you meet program requirements. The payout amount depends

on organizational, site/division, and team performance.

EMPLOYEE, JANUARY 2019

RESPECT SERVICE QUALITY EXCELLENCE RESPONSIBILITY INNOVATION LEADERSHIP

Staying healthy

1. You do NOT need to meet an annual deductible (pay for care out of your own pocket) before the Plan begins to pay.

2. Your care is only covered when you use Legacy + Network providers. Emergency and urgent care are covered outside

the network.

a. Preventive care is covered at 100 percent.

b. Office visits and specialist visits are covered at 90 percent.

c. Office visits, prescriptions, and lab work related to chronic conditions (asthma, diabetes, coronary artery disease,

congestive heart failure, or chronic obstructive pulmonary disease) are covered at 90 percent when you

participate in the chronic conditions program.

Compare Legacy’s health care benefits

Medical care benefits (Preferred Provider Organization in-network comparison)

Coverage Legacy benefit Average comparable benefit How Legacy compares

Individual deductible No deductible $300–$600 Stronger

Family deductible No deductible $500–$1,000 Stronger

Individual out-of-pocket maximum $2,000 $2,500–$5,000 Stronger

Family out-of-pocket maximum $6,000 $5,000–$10,000 Equal

Facility co-insurance Plan pays 80%* 75%–90% Equal

Office visit co-insurance Plan pays 90% PCP: $15–$25 co-pay Equal

Specialist: $30–$40 co-pay

Preventive care Plan pays 100% Plan pays 100% Equal

Emergency room visit $100 co-pay** $100–$150 co-pay** Equal

Generic drugs $10 co-pay $10–$20 co-pay Equal

Brand formulary drugs $25 co-pay $30–$50 co-pay Stronger

Brand non-formulary drugs $50 co-pay + 20% $50–$120 co-pay Equal

* Co-insurance is 90% for those participating in the chronic conditions program with qualifying conditions.

** Emergency room co-pay is waived if you are admitted.

Dental care benefits (Preferred Provider Organization in-network comparison)

Coverage Legacy benefit Average comparable benefit How Legacy compares

Deductible per person $25 $50 Stronger

Annual maximum $1,500 per person $1,000–$1,500 Equal

Preventive care co-insurance Plan pays 100% Plan pays 100% Equal

Basic co-insurance Plan pays 80% Plan pays 80% Equal

Major co-insurance Plan pays 70% Plan pays 50% Stronger

Orthodontia deductible No deductible No deductible Equal

Orthodontia co-insurance* Plan pays 60% Plan pays 50% Stronger

Orthodontia lifetime maximum $3,000 per person $1,500 per person Stronger

* One-year waiting period applies

Vision care benefits (Preferred Provider Organization in-network comparison)

Coverage Legacy benefit Average comparable benefit How Legacy compares

Exam Plan pays 100% after $15 co-pay Plan pays 100% after $10–$15 co-pay Equal

Frames $200 allowance, 20% off remaining $100–$150 hardware Stronger

balance every 1 or 2 calendar years allowance every 24 months

Lenses (except progressive lenses) Plan pays 100% Plan pays 100% after $10–$25 co-pay Stronger

Contacts $200 allowance every 1 calendar year $100–$150 allowance every 12 months Stronger

in lieu of frames and lenses in lieu of frames and lenses

EMPLOYEE, JANUARY 2019

Health Care FSA Being socially responsible

The Health Care Flexible Spending Account saves you

money by using pre-tax dollars to pay for eligible health Part of Legacy’s mission is good health for our community.

care expenses (up to $2,650). Reimbursement is simple We take this seriously by offering over $3.5 million

when you use Easy Pay; enrollment details are available annually in care and programmatic support to our local

from PacificSource. Oregon and Washington community organizations with

a focus on :

Wellness • Youth development (Boys and Girls Club, Native

American Youth and Family Center, Children’s

• LA Fitness membership discount – Multi-club access

Cancer Association)

for $26.99 per month (no initiation fee)

• Equity and diversity (Urban League of Portland,

• Tobacco cessation program – Access unlimited

Familias En Acccion, Pride NW)

member-initiated counseling sessions, plus nicotine

replacement therapy and coaching • Community health (safety net clinics, care for uninsured

and underinsured, Project Access NOW, Virginia Garcia,

• Massage Envy discount – $5 off monthly memberships

Central City Concern)

• Weight management – 100 percent coverage for Weight

• Safety programs (helmet fittings, car seat clinics,

Watchers and Live It!, a six-month, medically supervised

Safety Center, teen driving safety)

nutrition program

• Pregnancy and newborn classes – Reimbursed at

100 percent

Protecting your income

Legacy offers the following benefits as a valuable

EAP safeguard for you and your family.

The Employee Assistance Program through Cascade • Basic employee life of one times your base pay

Centers is a free, confidential service available to all (Legacy paid)

employees and their family members. The wide variety of

• Supplemental employee life of up to five times

assistance available includes the following (with examples

your base pay

in parentheses):

• Short-term income supplement of 60 percent of

• Financial resources (webinars, budgeting tools,

weekly budgeted earnings, up to $500, with an option

tax calculators)

to buy up to a maximum of $1,000 per week

• Legal resources (interactive online will program,

• Long-term income supplement of 60 percent of

legal forms, FAQs)

monthly budgeted earnings, up to $3,000, with an

• Elder care services (information on skilled nursing, option to buy up to 66 2/3 percent and $10,000

assisted living, medical equipment) per month

• Home ownership program (loan programs, real estate • Accidental death & dismemberment coverage

representation, moving services) up to $250,000

• Telephone and in-person counseling (marital problems,

financial matters, crisis management, drug or alcohol Family coverage

abuse) You can elect the following coverage for your family:

• Spouse/domestic partner life of $100,000 as

Legacy covers three counseling sessions per incident per guarantee issue during the initial eligibility period,

year. There are no limits on other advice sessions, such up to $500,000

as those for financial issues.

• Dependent life for child dependents of $2,000,

$5,000, or $10,000

EMPLOYEE, JANUARY 2019

Preparing for your future Leaves

Legacy offers leave benefits to support you outside of work.

Legacy offers the following ways to accumulate savings

and prepare for your future. • Leave of absence (for overnight hospitalization or

absences longer than three days)

• 403(b) Savings Plan – Pre-tax and after-tax (Roth)

salary reduction defers income into your choice of • Family medical leave (to care for ill family or parental

available investment options; 2019 IRS limit is $19,000 leave for new babies/adoptions/foster children)

($25,000 for age 50 and older) • Bereavement leave (in the case of a family member’s

• 401(a) Employer Match – When you contribute to death)

the 403(b) Savings Plan, Legacy matches 50 percent, • Jury duty leave

60 percent, or 70 percent of the first 5 percent of your

contributions, depending on your years of service;

available after the first year of employment with

Dependent Care Flexible Spending

1,000 hours worked Account (FSA)

• Employer Contribution Account – Legacy contributes The Dependent Care FSA saves you money by using

a percentage of your income (2.5 percent — 7 percent) pre-tax dollars to pay for certain day care expenses

based on your years of service up to IRS limits; available (up to $5,000) including adult care.

after the first year of employment with 1,000 hours worked

Advancing your education

Balancing your life Legacy is committed to helping you advance your

education and stay at the top of your game.

Time off • Educational Assistance Program – Tuition reimbursement

We all need time off for holidays, relaxation, family, and of up to $2,000 annually for benefit-eligible employees.

during illness. Annual Paid Leave (APL) is an account of

available hours you accrue for paid time off. During Annual Commute perks

Enrollment, you may elect a cash payout of your APL balance

in excess of 100 hours, to be paid the following year. • Subsidized TriMet passes

• Bike buddy commuting program

Annual Paid Leave (APL) accrual • Zipcar discount

Months Accrual Annual days Maximum Maximum • Free Portland streetcar access

of per accrued annual balance

service hour (1.0 FTE) accrual

0 0.0962 25 200

Discounts

60 0.1154 30 240 • Cellular service (Verizon)

120 0.1347 35 280 480

• Portland Trailblazers tickets

180 0.1424 37 296

240 0.1462 38 304 • Life Uniform products

• Rose Quarter event tickets

• Linfield College tuition

• Access to certain retail employee-only stores

(e.g., Adidas)

The information in this document is only a summary of available benefits. Refer to the current Legacy Employee Benefits Guide and any applicable

Summary of Material Modifications or relevant insurance policy contracts for benefit details. Provisions of the official plan documents and contracts

will govern in case of any discrepancy. While we intend to continue these programs, Legacy Health reserves the right to change and/or terminate any

portion of the benefit plans at any time for any reason with or without notice. Participation in the benefit program does not give anyone the right to

continued employment with Legacy. The Legacy Employee Medical Plan is not considered a grandfathered plan for the purposes of health care reform.

EMPLOYEE, JANUARY 2019

Premiums

Benefit premiums are deducted from the first two paychecks of the month. Contributions to the

403(b) Savings Plan and 457(b) Deferred Compensation Plan are deducted from all paychecks.

In addition to the premiums noted below:

• Employees and enrolled spouses/domestic partners who use tobacco are charged an additional

$25 per person per deduction for medical coverage.

• The domestic partner portion of the total health premium is taxable.

• There is a higher premium on Legacy medical and dental coverage for your spouse/domestic

partner if he or she is eligible for coverage through his or her employer.

Semi-monthly premiums for full-time employees Medical1 Dental Vision

base I buy-up

Employee only $19.51 $4.59 $3.22 I $4.88

Employee plus spouse/domestic partner2 $82.40 $14.44 $6.44 I $9.75

Employee plus spouse/domestic partner2 with other coverage3 $306.51 $28.70 $6.44 I $9.75

Employee plus child(ren) $74.78 $25.45 $6.00 I $9.09

Family $129.34 $34.98 $9.66 I $14.63

Family plus spouse/domestic partner2 with other coverage $369.08 $48.22 $9.66 I $14.63

Semi-monthly premiums for part-time employees Medical1 Dental Vision

base I buy-up

Employee only $35.70 $9.19 $3.22 I $4.88

Employee plus spouse/domestic partner 2

$105.97 $19.27 $6.44 I $9.75

Employee plus spouse/domestic partner2 with other coverage3 $324.55 $33.30 $6.44 I $9.75

Employee plus child(ren) $96.17 $31.81 $6.00 I $9.09

Family $183.53 $43.72 $9.66 I $14.63

Family plus spouse/domestic partner2 with other coverage $398.67 $54.58 $9.66 I $14.63

1 Medical premiums listed do not include the additional $25 per person per deduction charge for tobacco users.

2 The domestic partner portion of both the employee and employer premiums is taxable.

3 You pay a higher premium if your spouse/domestic partner is eligible for medical or dental coverage through their employer and they choose Legacy coverage.

EMPLOYEE, JANUARY 2019

RESPECT SERVICE QUALITY EXCELLENCE RESPONSIBILITY INNOVATION LEADERSHIP

You might also like

- Generic Open Enrollment KitDocument22 pagesGeneric Open Enrollment KitSteve BarrowsNo ratings yet

- EmblemHealth Benefits 2019Document7 pagesEmblemHealth Benefits 2019Jorge Luis Rivera AgostoNo ratings yet

- Benefits HighlightsDocument1 pageBenefits HighlightsRobert AvramescuNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- 2010 UnitedHealthcare Benefits SummaryDocument1 page2010 UnitedHealthcare Benefits Summaryapi-27017317No ratings yet

- Calculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014Document2 pagesCalculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014frabziNo ratings yet

- Benefits Summary 2021 - Employee - Fixed TermDocument17 pagesBenefits Summary 2021 - Employee - Fixed TermJohn SmihNo ratings yet

- M2A1 US Census Data SearchDocument6 pagesM2A1 US Census Data SearchragcajunNo ratings yet

- OE Powerpoint PresentationDocument35 pagesOE Powerpoint PresentationAnonymous ibpKT07GNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Summary of 2022 Benefit Changes: MedicalDocument5 pagesSummary of 2022 Benefit Changes: MedicalChinnu SalimathNo ratings yet

- Habasit 2017 Benefits GuideDocument2 pagesHabasit 2017 Benefits GuideBlackBunny103No ratings yet

- 2022 Steven Charles BAG - CODocument4 pages2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaNo ratings yet

- Enterprise Holdings Benefits 2022Document2 pagesEnterprise Holdings Benefits 2022meganNo ratings yet

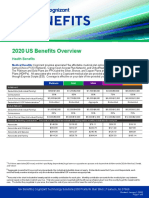

- 2020 US Benefits OverviewDocument5 pages2020 US Benefits OverviewrdmNo ratings yet

- Benefits Highlights 2018Document5 pagesBenefits Highlights 2018Marcus CosmeNo ratings yet

- 2020 Ankura Benefits GuideDocument20 pages2020 Ankura Benefits GuidegpperkNo ratings yet

- 2021 Team Member Support GuideDocument7 pages2021 Team Member Support GuideKhazid HaronNo ratings yet

- Benefits Summaries-Health Dental VisionDocument6 pagesBenefits Summaries-Health Dental VisionNiña MoradaNo ratings yet

- SeKON Employee Benefits Summary 2016Document3 pagesSeKON Employee Benefits Summary 2016Ali HajassdolahNo ratings yet

- Employee Benefits-Wellness Guide 2023-24Document30 pagesEmployee Benefits-Wellness Guide 2023-24shanzeh2609No ratings yet

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Welcome - Embrace QuoteEngineDocument3 pagesWelcome - Embrace QuoteEnginegabyNo ratings yet

- 2021 - Life, Dental, Vision PacketDocument12 pages2021 - Life, Dental, Vision PacketEberNo ratings yet

- Wilo BenefitsDocument25 pagesWilo BenefitsscottjsterlingNo ratings yet

- Benefit Highlights: Health Plan Is Through BCBSNC Health AdvocateDocument4 pagesBenefit Highlights: Health Plan Is Through BCBSNC Health AdvocateMaríaMadridNo ratings yet

- Eb 2019 Oe Guideplussbc GenericDocument19 pagesEb 2019 Oe Guideplussbc GenericCybernaughtNo ratings yet

- 2024 - US Healthcare One PagerDocument14 pages2024 - US Healthcare One PagerAsad AllibhoyNo ratings yet

- United Healthcare UHC Premier 1500 CEFP GoldDocument14 pagesUnited Healthcare UHC Premier 1500 CEFP GoldSteveNo ratings yet

- So Cal Kaiser GuideDocument13 pagesSo Cal Kaiser GuideWai DaiNo ratings yet

- Group Project 1Document21 pagesGroup Project 1api-547174770No ratings yet

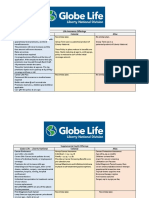

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina Hughes0% (1)

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesNo ratings yet

- Cash Plan 100 Table+of+coverDocument8 pagesCash Plan 100 Table+of+covermuthukumaran.tdr2969No ratings yet

- Personal FinanceDocument10 pagesPersonal FinanceJovilyn WatinNo ratings yet

- Photon Benefits SummaryDocument7 pagesPhoton Benefits SummarysojithesouljaNo ratings yet

- 2022 Grad Benefits SummaryDocument13 pages2022 Grad Benefits SummaryZeeshan Khalid ChaudheryNo ratings yet

- VEBA Plan PresentationDocument19 pagesVEBA Plan PresentationMitchell BigleyNo ratings yet

- 2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeDocument1 page2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeCT NguonNo ratings yet

- First Help PlanDocument1 pageFirst Help PlanIvan QuevedoNo ratings yet

- GMS - Group Advantage Benefit ProgramDocument10 pagesGMS - Group Advantage Benefit ProgramMikaila BurnettNo ratings yet

- Your guide to 70% back on included extras with black 70 boostDocument6 pagesYour guide to 70% back on included extras with black 70 boostSaifuddin SidikiNo ratings yet

- HA ZONE-Ben Cov Details PlanComp-EnglishApril12019DDocument4 pagesHA ZONE-Ben Cov Details PlanComp-EnglishApril12019DGilad RozenbergNo ratings yet

- PhonePe Benefits Handbook NewDocument30 pagesPhonePe Benefits Handbook NewbeniwalsanketNo ratings yet

- 2021 BENEFIT OVERVIEW FOR US ASSOCIATESDocument7 pages2021 BENEFIT OVERVIEW FOR US ASSOCIATESJNo ratings yet

- Guardian - Dental PPO Plan Summary 2022Document4 pagesGuardian - Dental PPO Plan Summary 2022Jessi ChallagullaNo ratings yet

- DWN HV Brochure 0829Document7 pagesDWN HV Brochure 0829Marquis C Jones Sr.No ratings yet

- Ins Flex Guideon 17Document1 pageIns Flex Guideon 17api-97071804No ratings yet

- How Actuaries See The WorldDocument43 pagesHow Actuaries See The WorldBen HarrisNo ratings yet

- Kaiser Permanente: Good Health Is No SecretDocument6 pagesKaiser Permanente: Good Health Is No SecretThomas Dominic CazneauNo ratings yet

- Your EWAO-ATEO Benefits Plan OverviewDocument2 pagesYour EWAO-ATEO Benefits Plan OverviewDan OhNo ratings yet

- EZ1C0J003030Document16 pagesEZ1C0J003030landon.palmerNo ratings yet

- Kaiser Permanente Compare Plans CA 2011 KPIFDocument1 pageKaiser Permanente Compare Plans CA 2011 KPIFDennis AlexanderNo ratings yet

- Navia - Fsa Dcfsa 01Document7 pagesNavia - Fsa Dcfsa 01api-252555369No ratings yet

- Insurance Benefits Comparison List 2011 v3Document1 pageInsurance Benefits Comparison List 2011 v3parthg18No ratings yet

- Summary of Benefits: Quartz Medicare Advantage (HMO), in Partnership With UW HealthDocument20 pagesSummary of Benefits: Quartz Medicare Advantage (HMO), in Partnership With UW HealthChris CoulmanNo ratings yet

- Benefits Enrollment InformationDocument7 pagesBenefits Enrollment Informationjaiden woodNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Demo Language Arts Leveled Daily Curriculum BUNDLE2001081Document21 pagesDemo Language Arts Leveled Daily Curriculum BUNDLE2001081MNo ratings yet

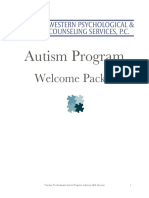

- Autism Program: Welcome PacketDocument17 pagesAutism Program: Welcome PacketMNo ratings yet

- Here Is The Beehive Counting FlashcardsDocument11 pagesHere Is The Beehive Counting FlashcardsMNo ratings yet

- Your 2020 Benefits Offer More Coverage Options Than Ever. It's Time To Enroll!Document4 pagesYour 2020 Benefits Offer More Coverage Options Than Ever. It's Time To Enroll!MNo ratings yet

- Color: 0 - White, 1 - Yellow, 2 - Red, 3 - Pink, 4 - Brown. Describe What It IsDocument3 pagesColor: 0 - White, 1 - Yellow, 2 - Red, 3 - Pink, 4 - Brown. Describe What It IsMNo ratings yet

- Improving Lives of Those With DisabilitiesDocument1 pageImproving Lives of Those With DisabilitiesMNo ratings yet

- Nonverbal Imitation: ObjectivesDocument4 pagesNonverbal Imitation: ObjectivesMNo ratings yet

- Demo Boom Cards Alignedtothe VBMAPPMatching Milestones 6025404Document2 pagesDemo Boom Cards Alignedtothe VBMAPPMatching Milestones 6025404MNo ratings yet

- Basic Plus WaiverDocument1 pageBasic Plus WaiverMNo ratings yet

- Community Resources for Child Development Support in OregonDocument2 pagesCommunity Resources for Child Development Support in OregonMNo ratings yet

- Applying DD in WaDocument1 pageApplying DD in Waapi-267207001No ratings yet

- IEP Blueprint: Areas of The IEP Ideal Situation For Your ChildDocument4 pagesIEP Blueprint: Areas of The IEP Ideal Situation For Your ChildMNo ratings yet

- Overnight Planned Respite Services (OPRS)Document1 pageOvernight Planned Respite Services (OPRS)MNo ratings yet

- Autism Parent Packet CDRCDocument90 pagesAutism Parent Packet CDRCMNo ratings yet

- VBMAPP Matching Bundle: Click Here For PreviewDocument2 pagesVBMAPP Matching Bundle: Click Here For PreviewMNo ratings yet

- Child Developmental ServicesDocument1 pageChild Developmental ServicesMNo ratings yet

- Fall Interactive Work Binder: Aligned To Vb-MappDocument6 pagesFall Interactive Work Binder: Aligned To Vb-MappM100% (1)

- DocumentDocument3 pagesDocumentMNo ratings yet

- Letter Confirming Informal Negotiation ResultsDocument2 pagesLetter Confirming Informal Negotiation ResultsMNo ratings yet

- Functional Life Skills CurriculumDocument8 pagesFunctional Life Skills CurriculumMNo ratings yet

- Request For Joint IEP Eligibility/Program MeetingDocument2 pagesRequest For Joint IEP Eligibility/Program MeetingMNo ratings yet

- Letter Requesting Due ProcessDocument2 pagesLetter Requesting Due ProcessMNo ratings yet

- Class Visitation Checklist: Student DescriptionDocument3 pagesClass Visitation Checklist: Student DescriptionMNo ratings yet

- Community First ChoiceDocument1 pageCommunity First ChoiceMNo ratings yet

- Forms: AppendixDocument26 pagesForms: AppendixMNo ratings yet

- Letter Requesting Evaluation ReportDocument2 pagesLetter Requesting Evaluation ReportMNo ratings yet

- Progress Chart: Key Goals Current Status CommentsDocument2 pagesProgress Chart: Key Goals Current Status CommentsMNo ratings yet

- DocumentDocument2 pagesDocumentMNo ratings yet

- Program Visitation Request LetterDocument2 pagesProgram Visitation Request LetterMNo ratings yet

- GSN April Meeting Explores Tasiast Gold Deposit DiscoveryDocument18 pagesGSN April Meeting Explores Tasiast Gold Deposit DiscoveryarisNo ratings yet

- (Robert Pfund PT OMT MAppSc (PT), Fritz Zahnd PT) (B-Ok - Xyz) PDFDocument589 pages(Robert Pfund PT OMT MAppSc (PT), Fritz Zahnd PT) (B-Ok - Xyz) PDFGeorge Ciuca100% (1)

- Kinsey Crimes and ConsequencesDocument370 pagesKinsey Crimes and ConsequencesMirela ZahNo ratings yet

- Acacia School Development Plan Proposal v4Document40 pagesAcacia School Development Plan Proposal v4Tim EburneNo ratings yet

- Action PlanDocument3 pagesAction PlanMaki BalisiNo ratings yet

- "A Study On Inventory Management" Statement of ProblemDocument3 pages"A Study On Inventory Management" Statement of ProblemSandhiya GovindNo ratings yet

- IST Charter Sept18 EN FinalDocument16 pagesIST Charter Sept18 EN Finalnabil raiesNo ratings yet

- Describing LearnersDocument29 pagesDescribing LearnersSongül Kafa67% (3)

- UBL Internship UOGDocument35 pagesUBL Internship UOGAhsanNo ratings yet

- PaliLossy PDFDocument408 pagesPaliLossy PDFtemp100% (2)

- VOL. 208, MAY 7, 1992 487 Perla Compania de Seguros, Inc. vs. Court of AppealsDocument9 pagesVOL. 208, MAY 7, 1992 487 Perla Compania de Seguros, Inc. vs. Court of AppealsdanexrainierNo ratings yet

- Picasso's Blue Period - WikipediaDocument24 pagesPicasso's Blue Period - WikipediaDinesh RajputNo ratings yet

- The Last Lie Told (Debra Webb)Document259 pagesThe Last Lie Told (Debra Webb)Fikir HailegiorgisNo ratings yet

- Bioworld Naruto Classic Uzumaki Naruto Cosplay Zip-Up Hoodie, Multicolored, Medium Amazon - Ca Clothing, Shoes & AccessoriesDocument1 pageBioworld Naruto Classic Uzumaki Naruto Cosplay Zip-Up Hoodie, Multicolored, Medium Amazon - Ca Clothing, Shoes & AccessoriestonydidlyNo ratings yet

- Roles of ManagerDocument14 pagesRoles of ManagerNurul Ain AisyaNo ratings yet

- Well Construction Journal - May/June 2014Document28 pagesWell Construction Journal - May/June 2014Venture PublishingNo ratings yet

- Crabtree-Industrial Circuit ProtectionDocument104 pagesCrabtree-Industrial Circuit ProtectionAbhyuday Ghosh0% (1)

- ENTEL Microwave MW330 Project - Training PDFDocument73 pagesENTEL Microwave MW330 Project - Training PDFRaul EliseoNo ratings yet

- Energy Conservation Techniques For Manufacturing IndustriesDocument11 pagesEnergy Conservation Techniques For Manufacturing IndustriesIJRASETPublicationsNo ratings yet

- Process Analyzer Sampling System TrainingDocument3 pagesProcess Analyzer Sampling System TrainingPhilNo ratings yet

- Honors World History: World War II Unit TestDocument8 pagesHonors World History: World War II Unit Testapi-354932590No ratings yet

- SAP ABAP Training: String Manipulation and Simple Classical ReportDocument33 pagesSAP ABAP Training: String Manipulation and Simple Classical ReportpraveengkumarerNo ratings yet

- Indofood Dynamic Strategic.Document7 pagesIndofood Dynamic Strategic.Cha IndraNo ratings yet

- Computerized Scholarship Monitoring SystemDocument11 pagesComputerized Scholarship Monitoring SystemCharles VegasNo ratings yet

- Module 9 PresentationDocument28 pagesModule 9 PresentationJerico CastilloNo ratings yet

- Step by Step Automation Using Zerodha Api Python VersionDocument156 pagesStep by Step Automation Using Zerodha Api Python VersionRasel more100% (1)

- Grammar Course SkeletonDocument2 pagesGrammar Course Skeletonapi-105107785No ratings yet

- PTQM 3 Merged-CombinedDocument562 pagesPTQM 3 Merged-Combined6804 Anushka GhoshNo ratings yet

- Company Profile ToureziaDocument22 pagesCompany Profile ToureziaIstato HudayanaNo ratings yet

- ManuaisDocument53 pagesManuaisJose Carlos KappNo ratings yet