Professional Documents

Culture Documents

Enterprise Holdings Benefits 2022

Uploaded by

meganCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enterprise Holdings Benefits 2022

Uploaded by

meganCopyright:

Available Formats

FOR U.S.

EMPLOYEES

Benefiotwsledge

kn is power.

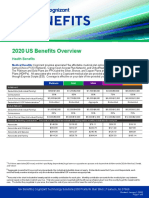

MEDICAL COVERAGE OPTIONS

HSA PPO Traditional PPO High Deductible PPO

ANNUAL DEDUCTIBLE ANNUAL DEDUCTIBLE ANNUAL DEDUCTIBLE

$1,500/individual; $700/individual; $2,100/individual;

$3,000/family $1,400/family $4,200/family

(Medical/RX deductible combined) (Medical deductible only) (Medical/RX deductible combined)

OFFICE VISITS OFFICE VISITS OFFICE VISITS

90% paid after deductible is met $25 primary | $40 specialty 80% paid after deductible is met

COINSURANCE COINSURANCE COINSURANCE

90% paid after deductible is met 80% paid after deductible is met 80% paid after deductible is met

ANNUAL OUT-OF-POCKET MAX ANNUAL OUT-OF-POCKET MAX ANNUAL OUT-OF-POCKET MAX

$3,000/individual; $5,000/individual; $4,000/individual;

$6,000/family $10,000/family $8,000/family

Qualifies for health savings account with

Optum Bank

DENTAL VISION

PRESCRIPTION DRUG COVERAGE DEDUCTIBLE ANNUAL VISION EXAM

$50 for one member $0 copay

HSA PPO Traditional PPO High Deductible PPO $100 for family FRAMES

PPO PLAN PAYS $150 plan allowance

GENERIC GENERIC

Member pays GENERIC 100% of preventive care + 20% off remaining balance

Member pays

full cost until $12.50 copay 80% of basic care STANDARD LENSES

full cost until

deductible is PREFERRED deductible is 50% of major care $10 copay

met, then 10% 30% with $50 met, then 20% 50% of orthodontic care for

CONTACTS

min/$75 max dependent children

Conventional $150 allowance

through age 18 up to a

NONPREFERRED + 15% discount off remaining

$1,500 lifetime maximum

50% with $75 charge

per dependent

min/$100 max Disposable $150 allowance

ANNUAL MAXIMUM

$1,000 per member

LIFE INSURANCE LONG-TERM DISABILITY

Basic Life and AD&D Employee Optional Life Dependent Life BASIC LONG-TERM DISABILITY

No cost to Funded through Funded through No cost to employee

employee after-tax payroll after-tax payroll 50% of your pre-disability pay

deductions deductions

1.5 x annual pay OPTIONAL LONG-TERM DISABILITY

Employee can Coverage for

AD&D Benefit = spouse: Option to purchase additional

purchase 1x, 2x,

Doubles the basic 3x, 4x, 5x, or 6x $25,000 or $50,000 10% of your pre-disability pay

life insurance annual pay Coverage for Pay LTD premium with after-tax dollars and receive

benefits for

children: optional LTD benefits tax-free

accidental death

$10,000 or $20,000

©2020 Enterprise Holdings, Inc. K04536.09/20

Make sure you are

reaping the benefits.

MY PURPOSE, MY TIME RETIREMENT SAVINGS PLAN

A new benefit that gives employees paid volunteer time

(one day for full-time employees and a half-day for part-time

401(k) Profit Sharing

employees) each year toward an organization or cause of their Full-time and part-time Employees become eligible

choice. employees are eligible to on the first day of the month

participate on the first day of the following completion of one year

PAID TIME OFF month following two months of of continuous service AND 1,000

continuous employment. hours of service during the

Holidays Anniversary Vacation Days first year of employment, or any

1–4 = 10 Company matches employee subsequent calendar year.

6

contributions, dollar for dollar,

Choice Time* 5–9 = 15 up to 3% of compensation Contribution is discretionary,

7 10 – 19 = 20 each pay period. determined by company

profitability, and is allocated to

20 + = 25

eligible participants employed on

*5 at hire + 7 (1 earned per month Part-time employees should last day of plan year based on

up to a maximum of 12 days) reach out to their HR Department eligible compensation.

during first year of employment. for information on paid time off.

FLEXIBLE SPENDING ACCOUNTS HEALTH SAVINGS ACCOUNT*

HEALTH CARE EMPLOYER CONTRIBUTION

Pay for qualifying out-of-pocket health care expenses $400/employee only coverage

with pretax dollars $800/all other coverage levels

DEPENDENT CARE EMPLOYEE CONTRIBUTION

Pay for qualifying out-of-pocket Optional funding through pretax payroll deductions

dependent day care expenses with pretax dollars *only available through HSA PPO option

OTHER BENEFITS

Rental & Car Sales

Employee Assistance Discounts

Program

Quit For Life

Travel Assistance Be tobacco free or complete the Quit For

Life tobacco cessation program to qualify

for reduced medical premiums.

For complete benefits information, visit youdrive.enterpriseholdings.com

Employees who are classified by the company as Full-time are eligible to enroll and participate in health and welfare benefits

after completing a required waiting period. Employees who are not classified as Full-time may become eligible to enroll and

participate in health and welfare benefits if they average 30 or more hours of work per week during a particular measurement period.

All employees, regardless of Full-time or Part-time status, are eligible to enroll and participate in retirement savings and profit

sharing after completing a required waiting period.

Employees who are covered by a collective bargaining agreement are not eligible to participate in the benefits and perquisites

outlined above unless such agreement, by specific reference, provides for such eligibility. Please refer to the applicable collective

bargaining agreement, if any.

Effective January 1, 2022 for Full-time U.S. Employees

GREAT COMPANY HAS ITS REWARDS

Equal Opportunity Employer/Disability/Veterans

©2021 Enterprise Holdings, Inc. K06280 9.21

You might also like

- EmblemHealth Benefits 2019Document7 pagesEmblemHealth Benefits 2019Jorge Luis Rivera AgostoNo ratings yet

- Summary of 2022 Benefit Changes: MedicalDocument5 pagesSummary of 2022 Benefit Changes: MedicalChinnu SalimathNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Habasit 2017 Benefits GuideDocument2 pagesHabasit 2017 Benefits GuideBlackBunny103No ratings yet

- 2020 Ankura Benefits GuideDocument20 pages2020 Ankura Benefits GuidegpperkNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- 2022 Steven Charles BAG - CODocument4 pages2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaNo ratings yet

- 2023 Talent BAAGDocument3 pages2023 Talent BAAGThi HanNo ratings yet

- Generic Open Enrollment KitDocument22 pagesGeneric Open Enrollment KitSteve BarrowsNo ratings yet

- 2010 UnitedHealthcare Benefits SummaryDocument1 page2010 UnitedHealthcare Benefits Summaryapi-27017317No ratings yet

- Photon Benefits SummaryDocument7 pagesPhoton Benefits SummarysojithesouljaNo ratings yet

- Legacy Employee Benefits 2019Document5 pagesLegacy Employee Benefits 2019MNo ratings yet

- Kaiser Permanente Compare Plans CA 2011 KPIFDocument1 pageKaiser Permanente Compare Plans CA 2011 KPIFDennis AlexanderNo ratings yet

- Group Critical Illness Insurance CoverageDocument2 pagesGroup Critical Illness Insurance CoverageAndrewNo ratings yet

- Benefits HighlightsDocument1 pageBenefits HighlightsRobert AvramescuNo ratings yet

- 2021 - Life, Dental, Vision PacketDocument12 pages2021 - Life, Dental, Vision PacketEberNo ratings yet

- M2A1 US Census Data SearchDocument6 pagesM2A1 US Census Data SearchragcajunNo ratings yet

- AISD - Dental - Cigna - PPO & HMO Plan Information - 2019-2020Document1 pageAISD - Dental - Cigna - PPO & HMO Plan Information - 2019-2020Jordin TumlinsonNo ratings yet

- Aetna California Managed Choice Open Access 1750 CA 2011Document1 pageAetna California Managed Choice Open Access 1750 CA 2011Dennis AlexanderNo ratings yet

- 2017 Employee Benefit Highlights - Support StaffDocument8 pages2017 Employee Benefit Highlights - Support StaffJohn AcardoNo ratings yet

- 2022 Benefits Enrollment/Change FormDocument3 pages2022 Benefits Enrollment/Change FormChristian DeKnockNo ratings yet

- Benefits Highlights 2018Document5 pagesBenefits Highlights 2018Marcus CosmeNo ratings yet

- 2020 US Benefits OverviewDocument5 pages2020 US Benefits OverviewrdmNo ratings yet

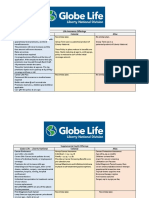

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina Hughes0% (1)

- Candidate Facing Benefits Sheet 2Document4 pagesCandidate Facing Benefits Sheet 2brendaNo ratings yet

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesNo ratings yet

- Harmonic ScalpelDocument2 pagesHarmonic ScalpelHerman HalimNo ratings yet

- Welcome - Embrace QuoteEngineDocument3 pagesWelcome - Embrace QuoteEnginegabyNo ratings yet

- Benefits Summary 2021 - Employee - Fixed TermDocument17 pagesBenefits Summary 2021 - Employee - Fixed TermJohn SmihNo ratings yet

- Choice MVDocument1 pageChoice MVGowell SupportNo ratings yet

- 愛升息特選理財壽險計劃 - 產品小冊子Document8 pages愛升息特選理財壽險計劃 - 產品小冊子TNo ratings yet

- LTIM_USA Employees Benefits Overview_2024Document20 pagesLTIM_USA Employees Benefits Overview_2024Ramesh Kumar KNo ratings yet

- Wilo BenefitsDocument25 pagesWilo BenefitsscottjsterlingNo ratings yet

- Pet Insurance ComparisonsDocument2 pagesPet Insurance ComparisonsHSVC50% (2)

- Medical Comparison Chart 2020Document3 pagesMedical Comparison Chart 2020hollingermikeNo ratings yet

- IQOR PHILIPPINES HEALTH INSURANCE RATESDocument12 pagesIQOR PHILIPPINES HEALTH INSURANCE RATESJoanna MariketNo ratings yet

- First Help PlanDocument1 pageFirst Help PlanIvan QuevedoNo ratings yet

- UserDocument5 pagesUserAldieno PribadiNo ratings yet

- Cardea Schedule of Benefits Effective Jan 1st 2021Document4 pagesCardea Schedule of Benefits Effective Jan 1st 2021Wayne GajadharNo ratings yet

- Kaiser Permanente: Good Health Is No SecretDocument6 pagesKaiser Permanente: Good Health Is No SecretThomas Dominic CazneauNo ratings yet

- 2010 UHC Medical Plan ComparisonDocument2 pages2010 UHC Medical Plan Comparisonapi-20618861No ratings yet

- Benefits Overview 2018Document5 pagesBenefits Overview 2018Joby JoNo ratings yet

- 2024 - US Healthcare One PagerDocument14 pages2024 - US Healthcare One PagerAsad AllibhoyNo ratings yet

- Plan Details and LimitsDocument3 pagesPlan Details and LimitsLuis EscobarNo ratings yet

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Investment Linked ProductsDocument15 pagesInvestment Linked ProductsMay BucagNo ratings yet

- What You Pay in The PPO PlanDocument2 pagesWhat You Pay in The PPO Plannathan wongNo ratings yet

- Trevor Kernan - LifeHappensDocument3 pagesTrevor Kernan - LifeHappensTrevor KernanNo ratings yet

- Cash Plan 100 Table+of+coverDocument8 pagesCash Plan 100 Table+of+covermuthukumaran.tdr2969No ratings yet

- Sponsored By: Hanover College Accident Insurance Coverage Provides A Cash Benefit When An Insured Is Injured Due To A Covered AccidentDocument3 pagesSponsored By: Hanover College Accident Insurance Coverage Provides A Cash Benefit When An Insured Is Injured Due To A Covered AccidentGabriel VanoverNo ratings yet

- EZ1C0J003030Document16 pagesEZ1C0J003030landon.palmerNo ratings yet

- 2023 Open Enrollment Benefit Presenation - 11142022Document30 pages2023 Open Enrollment Benefit Presenation - 11142022margreen5No ratings yet

- 2021 Sweet Express Benefit GuideDocument20 pages2021 Sweet Express Benefit GuideCameron WolfNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- The Lincoln Term Life and AD&D Insurance Plan:: Benefits At-A-GlanceDocument4 pagesThe Lincoln Term Life and AD&D Insurance Plan:: Benefits At-A-GlanceAngel MansillaNo ratings yet

- Manu 3Document4 pagesManu 3Temp RoryNo ratings yet

- UPMC Small Business Advantage Gold PPO $1,500 $35/$50 BenefitsDocument7 pagesUPMC Small Business Advantage Gold PPO $1,500 $35/$50 BenefitsTim ZNo ratings yet

- BCBS Enrollment GuideDocument6 pagesBCBS Enrollment GuideAnonymous Lri40PrlkNo ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- G.R. No. 201302 Hygienic Packaging Corporation, Petitioner Nutri-Asia, Inc., Doing Business Under The Name and Style of Ufc Philippines (FORMERLY NUTRI-ASIA, INC.), Respondent Decision Leonen, J.Document5 pagesG.R. No. 201302 Hygienic Packaging Corporation, Petitioner Nutri-Asia, Inc., Doing Business Under The Name and Style of Ufc Philippines (FORMERLY NUTRI-ASIA, INC.), Respondent Decision Leonen, J.SK Fairview Barangay BaguioNo ratings yet

- Elsie Kundai Mapeto Final DraftDocument74 pagesElsie Kundai Mapeto Final DraftAnonymous yEPScmhs2qNo ratings yet

- Bibicoff Ic Resume 2022 09 For WebsiteDocument3 pagesBibicoff Ic Resume 2022 09 For Websiteapi-633250343No ratings yet

- GEC 6 Lesson 12Document19 pagesGEC 6 Lesson 12Annie CabugNo ratings yet

- Statement-Jan 2019 PDFDocument4 pagesStatement-Jan 2019 PDFPatricio Rodriguez Jr100% (1)

- IGBC Certified BldgsDocument26 pagesIGBC Certified BldgsNidhi Chadda MalikNo ratings yet

- Tcds Easa A 359 Dornier 228 Issue 7Document53 pagesTcds Easa A 359 Dornier 228 Issue 7INFO WORKLINKNo ratings yet

- BCom Seminar Topics Professors Economics CommerceDocument3 pagesBCom Seminar Topics Professors Economics CommerceShaifali ChauhanNo ratings yet

- W.C. Hicks Appliances: Client Name SKU Item Name Delivery Price Total DueDocument2 pagesW.C. Hicks Appliances: Client Name SKU Item Name Delivery Price Total DueParth PatelNo ratings yet

- Permalex CatalogDocument24 pagesPermalex CataloggbricksphNo ratings yet

- Department of Commerce Delhi School of Economics: Mba International BusinessDocument10 pagesDepartment of Commerce Delhi School of Economics: Mba International BusinessAmit SemwalNo ratings yet

- Navy Submarine Battery ManualDocument84 pagesNavy Submarine Battery ManualTrap CanterburyNo ratings yet

- PDFDocument21 pagesPDFClarice Ilustre GuintibanoNo ratings yet

- The Tamil Nadu Municipal General Service Rules, 1970Document13 pagesThe Tamil Nadu Municipal General Service Rules, 1970urbangovernance99100% (1)

- MKT202 - Group 6 - Marketing Research ProposalDocument9 pagesMKT202 - Group 6 - Marketing Research ProposalHaro PosaNo ratings yet

- Creating and Opening WorkbooksDocument20 pagesCreating and Opening WorkbooksCon SiosonNo ratings yet

- SBI PO Exam Call LetterDocument2 pagesSBI PO Exam Call LetterswaroopbhujbalNo ratings yet

- CSCPAPERSDocument54 pagesCSCPAPERSABHISHEK ANANDNo ratings yet

- Easychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadDocument24 pagesEasychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadSneha Elizabeth VivianNo ratings yet

- BatchGenerator UserReferenceDocument13 pagesBatchGenerator UserReferenceLuis OrtizNo ratings yet

- STD 2 ComputerDocument12 pagesSTD 2 ComputertayyabaNo ratings yet

- MCIAA Tax Exemption CaseDocument4 pagesMCIAA Tax Exemption CaseJep Echon TilosNo ratings yet

- Protocol for Qualitative Research InterviewsDocument19 pagesProtocol for Qualitative Research InterviewsZeeshan AkhtarNo ratings yet

- Waymo LetterDocument14 pagesWaymo LetterSimon AlvarezNo ratings yet

- Biosafety and Lab Waste GuideDocument4 pagesBiosafety and Lab Waste Guidebhramar bNo ratings yet

- Sumo Safari SpicerDocument3 pagesSumo Safari SpicerAbishek MongaNo ratings yet

- Chapter 4 Review QuestionsDocument5 pagesChapter 4 Review Questionschiji chzzzmeowNo ratings yet

- Final Project at NucsoftDocument97 pagesFinal Project at NucsoftmainasshettyNo ratings yet

- The Effective Length of Columns in MultiDocument12 pagesThe Effective Length of Columns in MulticoolkaisyNo ratings yet

- Unit 13Document28 pagesUnit 13Tinh NguyenNo ratings yet