Professional Documents

Culture Documents

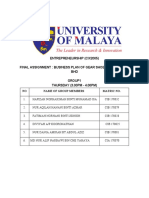

CB Assign Roll No-H402

Uploaded by

saketsuman1985Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CB Assign Roll No-H402

Uploaded by

saketsuman1985Copyright:

Available Formats

Bank manager Job Profile and Description

A bank manager is the head of the organization and supervises the activities of all the branch

banks. He works with a number of assistants and who help him coordinate activities among

different branches all over the country and also contribute towards policymaking. There are

different departments in a bank and every department and branch has a manager.

Duties and Responsibilities

A bank manager looks over the activities of one branch or more than one branch.

He is indirectly responsible for bringing in new customers and boosting the bank’s

profits.

He has to set targets and ensure they are met.

He must motivating and train his staff to keep up with a high standard and positively deal

with customer complaints.

He needs to create and analyze management information and reports, which are sent to

branch staff and also to the head office.

He must interact with local chambers of commerce, development agencies, solicitors,

accountants etc.

He must be involved with business planning and formulate bank policies by regularly

following the different changes in the financial regulations.

Skills and Specifications

Bank managers need to have good leadership qualities and must possess decision-making

ability.

They must be aware of the latest rules and follow government regulations during the

formation of their policies.

They must be organized, able to work under pressure and do overtime when necessary

They must be very good with numbers.

They must also have good communication and network skills and must be cordial

towards customers.

They must be discreet and understand the importance of client confidentiality.

Education and Qualifications

One interested in banking needs to have a bachelor’s and preferably a master’s degree in

business administration, accounting, or finance. Since managerial positions are senior level

positions, one needs to have adequate experience to reach this post.

A bank manager is responsible for handling banking operations and activities of the bank staff. A

bank manager functions to increase the number of deposit accounts, encourages the savings of

the existing customers and works to enhance the level of customer satisfaction by dealing with

potential clients. Assigning the day- to- day targets among the staff, preparing incentive

programs to attract the more customers and inspecting the encountered accounts issues are the

major job duties of a bank manager. Therefore, a bank manager should have the decision making

capabilities, excellent interpersonal skills and effective accounting knowledge to cope with the

regular issues.

Bank Manager Job Specifications:

Brilliant commendation skills to deal with the high profiles customers and ability to

advise the right banking products for increasing the amount of deposits in the bank

accounts.

Understanding of all banking terms, types of account, reports, records and ledger books

to investigate, if any accounts problem persists.

Ability to develop the new incentive programs, assigning daily targets to the marketing

team and coordinating with the regional bank office to discuss the serious financial &

customer issues.

Implementing and following the bank strategies & policies, initiated by the banking

board of directors to draw the expected outcome from the concerned bank individuals.

Taking care of NRI clients & teller banking areas to forward the customer requirements

to the higher authorities for introducing more creative and affordable banking products.

Skills to communicate with Solicitors, commerce development agencies and charted

accountants for further suggestions in legal banking cases.

You might also like

- Jobs AvailableDocument4 pagesJobs AvailablePragya TripathiNo ratings yet

- Grade III BranchDocument78 pagesGrade III BranchTibebu SeworeNo ratings yet

- Vacancies Tib CBL July 2017Document15 pagesVacancies Tib CBL July 2017Anonymous iFZbkNwNo ratings yet

- Branch Banking NotesDocument11 pagesBranch Banking NotessarasadiqNo ratings yet

- Role of A BMDocument2 pagesRole of A BMraj singhNo ratings yet

- Silk Bank: 1. Key Responsibilities (Customer Relationship Officer)Document5 pagesSilk Bank: 1. Key Responsibilities (Customer Relationship Officer)Muhammad_Usama92No ratings yet

- Boa Tanzania VacanciesDocument4 pagesBoa Tanzania Vacanciesghongoa1996No ratings yet

- Bank Manager Job Description For ResumeDocument6 pagesBank Manager Job Description For Resumeafdlxeqbk100% (1)

- branch manager M & TDocument3 pagesbranch manager M & TthomaidaNo ratings yet

- Greetings From ICICI BankDocument3 pagesGreetings From ICICI BankNitin MathurNo ratings yet

- Job Description Trade Finance OfficerDocument3 pagesJob Description Trade Finance OfficerSAIDI NYAHEGONo ratings yet

- Bank Manager CV TemplateDocument5 pagesBank Manager CV TemplateChemanthi RojaNo ratings yet

- Advert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Document4 pagesAdvert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Rashid BumarwaNo ratings yet

- ICICI Bank DescriptionDocument2 pagesICICI Bank DescriptionGOLDEN FIZZIK GYMNo ratings yet

- CRDB Vacancies NewDocument8 pagesCRDB Vacancies NewGodlineNo ratings yet

- CRDB Bank JanDocument2 pagesCRDB Bank JanKimeNo ratings yet

- Reza Pahlevi Fasha - CL and CVDocument3 pagesReza Pahlevi Fasha - CL and CVrezaNo ratings yet

- Advert Credit Officer NachingweaDocument4 pagesAdvert Credit Officer NachingweaRashid BumarwaNo ratings yet

- Bank Relationship Manager Resume SampleDocument8 pagesBank Relationship Manager Resume Samplepehygakasyk2100% (1)

- NBC New VacanciesDocument10 pagesNBC New VacanciesSamson Nyaitwang'aNo ratings yet

- CV SEEKING REGIONAL BUSINESS MANAGER ROLEDocument5 pagesCV SEEKING REGIONAL BUSINESS MANAGER ROLEAlfie Group of InvestmentNo ratings yet

- Branch Manager Job DescriptionDocument4 pagesBranch Manager Job DescriptionAsadvirkNo ratings yet

- Credit Officer Mwanza 2015Document3 pagesCredit Officer Mwanza 2015Rashid BumarwaNo ratings yet

- Branch Manager DutyDocument4 pagesBranch Manager DutyASHENAFI GIZAWNo ratings yet

- JD - SME Accelerated Relationship ManagerDocument1 pageJD - SME Accelerated Relationship ManagerKAR ENG QUAHNo ratings yet

- Job Advert - Relationship Officer KijitonyamaDocument3 pagesJob Advert - Relationship Officer KijitonyamaRashid BumarwaNo ratings yet

- Job Analysis Questionnaire With Answers, Assignment 1, Naveed Abbas 2011250Document5 pagesJob Analysis Questionnaire With Answers, Assignment 1, Naveed Abbas 2011250Naveed AbbasNo ratings yet

- ResumeDocument2 pagesResumeSoumick BhattacharyaNo ratings yet

- Bank of China: Personal Banking Business Officer (Credit Approval)Document3 pagesBank of China: Personal Banking Business Officer (Credit Approval)李颖达No ratings yet

- Syed Jibran Rufaie PH: (M), 07006085722, Kralsangri, Srinagar (J&K) EmailDocument5 pagesSyed Jibran Rufaie PH: (M), 07006085722, Kralsangri, Srinagar (J&K) EmailJibran RufaieNo ratings yet

- Assisstant To MDDocument3 pagesAssisstant To MDgrowmoneycNo ratings yet

- 1 Cover Latter&cvDocument3 pages1 Cover Latter&cvTEMNET ተምኔት TUBENo ratings yet

- Murali R: Personal SummaryDocument2 pagesMurali R: Personal SummaryLeslie WrightNo ratings yet

- Question Bank Promotion ExamDocument3 pagesQuestion Bank Promotion Examrajan chauhan singhNo ratings yet

- Nancy Polanco-Santiago: Professional SummaryDocument4 pagesNancy Polanco-Santiago: Professional Summaryapi-591185559No ratings yet

- CRDB Bank Job Opportunities Branch Managers 2Document4 pagesCRDB Bank Job Opportunities Branch Managers 2Rashid BumarwaNo ratings yet

- BiodataDocument3 pagesBiodataPavankumar GundlapalliNo ratings yet

- Sales ExecutiveDocument2 pagesSales ExecutiveHimanshu UpadhyayNo ratings yet

- (+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, OmanDocument3 pages(+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, Omanfaiza minhasNo ratings yet

- Job Description Bank of AmericaDocument3 pagesJob Description Bank of Americaedgar mejiaNo ratings yet

- Medium Enterprise Division: 1) Relationship Officer 2) Service OfficerDocument3 pagesMedium Enterprise Division: 1) Relationship Officer 2) Service Officeranon_541044338No ratings yet

- Bank Manager ResponsibilitiesDocument1 pageBank Manager ResponsibilitiesBidyut MajiNo ratings yet

- Branch Manager - JD - UpdatedDocument1 pageBranch Manager - JD - UpdatedAdam SNo ratings yet

- Y PEP Executive Value PropositionDocument6 pagesY PEP Executive Value PropositionSandeep GoudNo ratings yet

- Anking / Inancial Rofessional: Career ObjectiveDocument4 pagesAnking / Inancial Rofessional: Career ObjectivepraveenmpkNo ratings yet

- HRM Job DescriptionDocument4 pagesHRM Job DescriptionHitesh JainNo ratings yet

- BDOs 2023Document2 pagesBDOs 2023muhammadali667788990No ratings yet

- Resume Dipta Das - IndiaDocument3 pagesResume Dipta Das - Indiadipta1981No ratings yet

- Phone No: + 91 - 9650866999: Abhishek MukherjeeDocument6 pagesPhone No: + 91 - 9650866999: Abhishek MukherjeeAnand SinhaNo ratings yet

- How To Become A Bank ManagerDocument8 pagesHow To Become A Bank ManagersikandarNo ratings yet

- Personal Banker Job Description For ResumeDocument6 pagesPersonal Banker Job Description For Resumefsv5r7a1100% (1)

- HRM Assignment: Name-Keshav Kharbanda ENROLLMENT NO-02416659421 Mba Fa Finance Manager Job Description TemplateDocument9 pagesHRM Assignment: Name-Keshav Kharbanda ENROLLMENT NO-02416659421 Mba Fa Finance Manager Job Description TemplateKESHAV KHARBANDANo ratings yet

- Credit Union Branch Manager ResumeDocument8 pagesCredit Union Branch Manager Resumedud1nylofas2100% (1)

- Teller Resume SampleDocument4 pagesTeller Resume Samplebcqta9j6100% (2)

- ANUS1547@1Document18 pagesANUS1547@1apurv chauhanNo ratings yet

- Anne Chepkorir CVDocument4 pagesAnne Chepkorir CVnguyowinfred3No ratings yet

- Mahendra, ABH, MumbaiDocument4 pagesMahendra, ABH, MumbaiSuneel BhatiaNo ratings yet

- Commercial BankingDocument2 pagesCommercial Bankingsejaldesai585No ratings yet

- Job Description Proforma ProjectDocument3 pagesJob Description Proforma ProjectAniba ButtNo ratings yet

- Roi of Incentive Programs A Case Study For Channel Sales SuccessDocument8 pagesRoi of Incentive Programs A Case Study For Channel Sales Successsaketsuman1985No ratings yet

- Return On InvestmentDocument32 pagesReturn On Investmentsaketsuman1985No ratings yet

- Resume Name: Your Pic, Preferably in Professional AttireDocument2 pagesResume Name: Your Pic, Preferably in Professional Attiresaketsuman1985No ratings yet

- Managerial ExcellenceDocument1 pageManagerial Excellencesaketsuman1985No ratings yet

- GDPI ScheduleDocument1 pageGDPI Schedulesaketsuman1985No ratings yet

- The Most Discussing Macro Ethical Issue NowDocument32 pagesThe Most Discussing Macro Ethical Issue Nowsaketsuman1985No ratings yet

- Coorperative Business-Mishika AdwaniDocument8 pagesCoorperative Business-Mishika AdwaniMishika AdwaniNo ratings yet

- Marx v. Smith On CapitalismDocument5 pagesMarx v. Smith On CapitalismVernon SzalachaNo ratings yet

- International Financial Markets Chapter 3 SummaryDocument22 pagesInternational Financial Markets Chapter 3 SummaryFeriel El IlmiNo ratings yet

- Question 1: Write A Note On Decision Making in Management. How One Will Take Decision Under Risk and UncertaintyDocument14 pagesQuestion 1: Write A Note On Decision Making in Management. How One Will Take Decision Under Risk and UncertaintyAvinash IngoleNo ratings yet

- 03 - AM4B - Terjemahan 3Document3 pages03 - AM4B - Terjemahan 3muhammad syaifuddinNo ratings yet

- Feasibility OutlineDocument20 pagesFeasibility OutlineAlyyssa Julfa ArcenoNo ratings yet

- Tundra Services CompanyDocument1 pageTundra Services CompanyBluesinhaNo ratings yet

- Deloitte GCC PPT Fact SheetDocument22 pagesDeloitte GCC PPT Fact SheetRakawy Bin RakNo ratings yet

- ReportDocument2 pagesReportumaganNo ratings yet

- Eureka Forbes Case: Managing Sales EffortsDocument6 pagesEureka Forbes Case: Managing Sales EffortsPradeep PradeepNo ratings yet

- Business Plan Entrepreneurship PDFDocument71 pagesBusiness Plan Entrepreneurship PDFcourse hero100% (1)

- HRMP and ToiDocument29 pagesHRMP and ToiMuhammad Tanzeel Qaisar DogarNo ratings yet

- Financial CasesDocument64 pagesFinancial CasesMarwan MikdadyNo ratings yet

- International Trade 2 - Week 3Document15 pagesInternational Trade 2 - Week 3Ahmad Dwi Syaiful AmriIB102No ratings yet

- CSR by SBIDocument33 pagesCSR by SBIPooja MoreNo ratings yet

- Mankiw Chapter 4 (19) : The Monetary System, What It Is and How It WorksDocument39 pagesMankiw Chapter 4 (19) : The Monetary System, What It Is and How It WorksGuzmán Gil IglesiasNo ratings yet

- DeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremDocument23 pagesDeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremAndreas WidhiNo ratings yet

- Internship Co ListDocument10 pagesInternship Co ListEveline Lv EweNo ratings yet

- Accounting - Business Plan SampleDocument51 pagesAccounting - Business Plan SamplejohnpenoniaNo ratings yet

- OfferletterDocument2 pagesOfferletterpakada8460No ratings yet

- Background and Inception of The Company: OriginDocument3 pagesBackground and Inception of The Company: OriginEdvin S MavelilNo ratings yet

- IIT-Bombay WashU EMBA BrochureDocument28 pagesIIT-Bombay WashU EMBA Brochuregaurav_chughNo ratings yet

- Application Form for AccreditationDocument2 pagesApplication Form for AccreditationMary Jane Dultra100% (1)

- Factors Influencing Purchase Decisions at Bengkel Gaoel StoreDocument13 pagesFactors Influencing Purchase Decisions at Bengkel Gaoel StoreFiqih DaffaNo ratings yet

- Supply Chain Management of Big BazaarDocument49 pagesSupply Chain Management of Big Bazaarnilma pais67% (3)

- Genmath Exam FinalsDocument5 pagesGenmath Exam FinalsNi ValNo ratings yet

- Bad Hanim Ut Master ThesisDocument91 pagesBad Hanim Ut Master ThesisS DNo ratings yet

- AfarDocument128 pagesAfarlloyd77% (57)

- Appraisal Ce Exam 4 Review PDFDocument30 pagesAppraisal Ce Exam 4 Review PDFAmeerNo ratings yet

- Business Plan Cleaning ServiceDocument27 pagesBusiness Plan Cleaning ServiceShahfri ShafNo ratings yet