Professional Documents

Culture Documents

Aa2709220990712 SCN30092022

Uploaded by

DHANU DANGIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aa2709220990712 SCN30092022

Uploaded by

DHANU DANGICopyright:

Available Formats

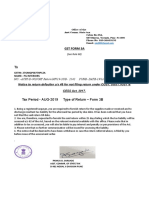

Form GST REG-03

[See Rule 9(2)]

Reference Number: ZA2709223574960 Date: 30/09/2022

To

PRAKASH BHANJIBHAI RATHOD

Brahman Wadi, Pipe Line Road, Kurla East, Mumbai, Mumbai Suburban, Maharashtra, 400070

Application Reference No. (ARN): AA2709220990712 Date: 22/09/2022

Notice for Seeking Additional Information / Clarification / Documents relating to

Application for Registration

This is with reference to your Registration application filed vide ARN AA2709220990712 Dated - 22/09/2022 The Department

has examined your application and is not satisfied with it for the following reasons:

1 Business Details - Details of your Business - Others (Please specify) - shop act registration certificate

not uploaded.

2 Promoters/Partners - Personal Information - Others (Please specify) - Contact number and email address

of authorize person/owner is mandatory

3 Promoters/Partners - Residential Address - Others (Please specify) - kindly give complete address i.e.

shop/flat/house no., floor name, building name, road name, nearby landmark, local area name etc. i.e.

complete postal address.

4 Principal Place of Business - Address - Others (Please specify) - kindly give complete address i.e.

shop/flat/house no., floor name, building name, road name, nearby landmark, local area name etc. i.e.

complete postal address.

5 Principal Place of Business - Document Upload - Others (Please specify) - 1. as per section 55 of the

maharashtra rent control act, 1999, the tenancy agreement to be compulsorily registered.- any agreement

for leave and license or letting of any premises shall be in writing and shall be registered under

theregistration act, 1908. 2.Kindly submit the recent proof of ownership /1.Please provide Proper

address POB & POB.

6 State Specific Information - State Specific Information - Others (Please specify) - PTEC / PTRC

Registration certificate not submitted

You are directed to submit your reply by 12/10/2022

If no response is received by the stipulated date, your application is liable for rejection. Please note that no further notice /

reminder will be issued in this matter

VAHID ABDULSATTAR ZARI

State Tax Officer

SHIVAJI-NAGAR_703

You might also like

- Aa270822083578o SCN29082022Document1 pageAa270822083578o SCN29082022Ashwet JadhavNo ratings yet

- A S Traders Aa270223154463f - SCN09032023Document1 pageA S Traders Aa270223154463f - SCN09032023GSTMS ANSARINo ratings yet

- Aa070224099922z SCN26032024Document1 pageAa070224099922z SCN26032024gkanand1944No ratings yet

- Aa271022129963b SCN01112022Document1 pageAa271022129963b SCN01112022ANISH SHAIKHNo ratings yet

- Aa241023038442t SCN09112023Document1 pageAa241023038442t SCN09112023ANISH SHAIKHNo ratings yet

- Aa270722014024q SCN12072022Document1 pageAa270722014024q SCN12072022Ashwet JadhavNo ratings yet

- Aa270124158480f SCN02022024Document1 pageAa270124158480f SCN02022024KrantiDigital SevaNo ratings yet

- Aa2409220915162 SCN06102022Document1 pageAa2409220915162 SCN06102022DHANU DANGINo ratings yet

- Aa270224183710d SCN27032024Document1 pageAa270224183710d SCN27032024sapkalniraj2005No ratings yet

- Aa240123134087p SCN03022023Document1 pageAa240123134087p SCN03022023ANISH SHAIKHNo ratings yet

- Aa330422032960n SCN22042022Document1 pageAa330422032960n SCN22042022Ravi FrankNo ratings yet

- Aa271223040008p SCN11122023Document1 pageAa271223040008p SCN11122023Aftab belimNo ratings yet

- Aa240324075986v SCN08042024Document1 pageAa240324075986v SCN08042024jadavbhimraj7810No ratings yet

- Aa1901230153000 SCN18012023Document1 pageAa1901230153000 SCN18012023ANISH SHAIKHNo ratings yet

- Aa090922099907d SCN22092022Document1 pageAa090922099907d SCN22092022birpal singhNo ratings yet

- Aa270124159569w SCN01022024Document1 pageAa270124159569w SCN01022024taxsachin16No ratings yet

- Aa270322047195e SCN13032022Document1 pageAa270322047195e SCN13032022Ashwet JadhavNo ratings yet

- Aa2409220707808 SCN26092022Document1 pageAa2409220707808 SCN26092022qureshi jonNo ratings yet

- Aa190123003767c SCN10012023Document1 pageAa190123003767c SCN10012023MD HASENNo ratings yet

- AA270224058013NR08022024Document1 pageAA270224058013NR08022024CSI ArticleNo ratings yet

- Aa240124035091y SCN10012024Document1 pageAa240124035091y SCN10012024tidarshprajapatiNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Aa241122052671q SCN22112022Document1 pageAa241122052671q SCN22112022mahayogiconsultancyNo ratings yet

- Aa241122105894k SCN06122022Document1 pageAa241122105894k SCN06122022ANISH SHAIKHNo ratings yet

- 'CL 2021 22 (1) 3Document24 pages'CL 2021 22 (1) 3aakash jainNo ratings yet

- Form GST REG-03: (See Rule 9 (2) )Document1 pageForm GST REG-03: (See Rule 9 (2) )Tukaram ChinchanikarNo ratings yet

- GST Registration ObjectionDocument1 pageGST Registration ObjectionManikanta rajaNo ratings yet

- Interest On Housing Loan Provisional Certificate 2020 21Document1 pageInterest On Housing Loan Provisional Certificate 2020 21tabrez khanNo ratings yet

- Aa241221037569c SCN17122021Document1 pageAa241221037569c SCN17122021sammy shergilNo ratings yet

- Aa241122108067u SCN28122022Document1 pageAa241122108067u SCN28122022ANISH SHAIKHNo ratings yet

- Aa240123026088o SCN07012023Document1 pageAa240123026088o SCN07012023Mansi patniNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- DeliveryOrder 20220914171635Document1 pageDeliveryOrder 20220914171635sukhpreet singhNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 50454183Document1 pageIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqNo ratings yet

- Aa2712220729156 SCN19122022Document1 pageAa2712220729156 SCN19122022ANISH SHAIKHNo ratings yet

- Aa190822050648v SCN30082022Document1 pageAa190822050648v SCN30082022DHANU DANGINo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- Aa090922099907d Ro29092022Document1 pageAa090922099907d Ro29092022birpal singhNo ratings yet

- RVM Infra Projects Private Limited NoticeDocument1 pageRVM Infra Projects Private Limited NoticeDharmendra ShashtryNo ratings yet

- AA271222071010ZR16122022Document1 pageAA271222071010ZR16122022mmmmNo ratings yet

- AA090221078402IR16022021Document1 pageAA090221078402IR16022021lalitkaushik0317No ratings yet

- Musthtaq Azeem Atl Challan PDFDocument1 pageMusthtaq Azeem Atl Challan PDFFarhan AliNo ratings yet

- Aa330823041958x SCN25082023Document1 pageAa330823041958x SCN25082023SuryaNo ratings yet

- Asad PsidDocument1 pageAsad Psidعمر عمیNo ratings yet

- Aa0910200298587 RC07112020Document3 pagesAa0910200298587 RC07112020Lakshay ChaudharyNo ratings yet

- Idt 5Document5 pagesIdt 5manan agrawalNo ratings yet

- 25 - LH221323101207 SCR LallagudaDocument3 pages25 - LH221323101207 SCR LallagudaAbhishek DahiyaNo ratings yet

- DeliveryOrder 20230405200131Document2 pagesDeliveryOrder 20230405200131Sahsola CSCNo ratings yet

- 2023721217646921CircularNo 1of2023-2024Document4 pages2023721217646921CircularNo 1of2023-2024krebs38No ratings yet

- Aa271122140663k SCN01122022Document1 pageAa271122140663k SCN01122022mmmmNo ratings yet

- Radar DisplayDocument5 pagesRadar DisplayPratik RamavatNo ratings yet

- 21 - 30221463102456 NCR JhansiDocument2 pages21 - 30221463102456 NCR JhansiAbhishek DahiyaNo ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- AA070224099922ZR27022024Document1 pageAA070224099922ZR27022024gkanand1944No ratings yet

- 3a Notice FormatDocument1 page3a Notice FormatPrakash sutharNo ratings yet

- Direct Tax Case Email No 212 - 2018Document4 pagesDirect Tax Case Email No 212 - 2018AbidRazaca0% (1)

- Digitally Signed by Pankaj Kapdeo Date: 2024.04.16 16:19:51 +05'30'Document2 pagesDigitally Signed by Pankaj Kapdeo Date: 2024.04.16 16:19:51 +05'30'ViJaY HaLdErNo ratings yet

- Aa070324007901l - SCN14032024 3PKS 1Document1 pageAa070324007901l - SCN14032024 3PKS 1Pankaj SinghNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Dt. 18.08.2020Document2 pagesDt. 18.08.2020DHANU DANGINo ratings yet

- Rathod PrakashDocument1 pageRathod PrakashDHANU DANGINo ratings yet

- Aa2409220915162 SCN06102022Document1 pageAa2409220915162 SCN06102022DHANU DANGINo ratings yet

- Aa190822050648v SCN30082022Document1 pageAa190822050648v SCN30082022DHANU DANGINo ratings yet

- Kukadiya VinabhaiDocument1 pageKukadiya VinabhaiDHANU DANGINo ratings yet

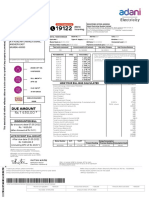

- VIMAL KUMAR Mumbai AdaniDocument1 pageVIMAL KUMAR Mumbai AdaniDHANU DANGINo ratings yet

- CHAUHANDocument1 pageCHAUHANDHANU DANGINo ratings yet

- Gohil Palabhai KolkataDocument2 pagesGohil Palabhai KolkataDHANU DANGINo ratings yet

- Solanki Harjibhai KanabhaiDocument2 pagesSolanki Harjibhai KanabhaiDHANU DANGINo ratings yet

- Shaikh Anish Kalkata Lightbill 2Document2 pagesShaikh Anish Kalkata Lightbill 2DHANU DANGINo ratings yet

- Padhiyar AshokDocument2 pagesPadhiyar AshokDHANU DANGINo ratings yet

- Baraiya KamalbhaiDocument1 pageBaraiya KamalbhaiDHANU DANGINo ratings yet

- 15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176Document1 page15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176DHANU DANGINo ratings yet

- Shambhau RamDocument1 pageShambhau RamDHANU DANGINo ratings yet

- EpaymentPrintCommonAction DoDocument1 pageEpaymentPrintCommonAction DoDHANU DANGINo ratings yet

- Chudasama RakeshbhaiDocument1 pageChudasama RakeshbhaiDHANU DANGINo ratings yet

- 7445 Additional 1Document157 pages7445 Additional 1DHANU DANGINo ratings yet

- Dt. 07.07.2020Document2 pagesDt. 07.07.2020DHANU DANGINo ratings yet

- The Assam Electricity Duty Rules 1964Document8 pagesThe Assam Electricity Duty Rules 1964DHANU DANGINo ratings yet

- Balance Sheet As at 30th Fu.t: SeptemberDocument3 pagesBalance Sheet As at 30th Fu.t: SeptemberDHANU DANGINo ratings yet

- The Assam Electricity Duty Amendment Bill 2021 1Document4 pagesThe Assam Electricity Duty Amendment Bill 2021 1DHANU DANGINo ratings yet

- Cross-Compilers: / / Running ARM Grub On U-Boot On QemuDocument5 pagesCross-Compilers: / / Running ARM Grub On U-Boot On QemuSoukous LoverNo ratings yet

- DS TEGO Polish Additiv WE 50 e 1112Document3 pagesDS TEGO Polish Additiv WE 50 e 1112Noelia Gutiérrez CastroNo ratings yet

- 1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersDocument12 pages1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersRichard LundNo ratings yet

- ADocument2 pagesAẄâQâŗÂlïNo ratings yet

- ITMC (International Transmission Maintenance Center)Document8 pagesITMC (International Transmission Maintenance Center)akilaamaNo ratings yet

- Ruggedbackbone Rx1500 Rx1501Document13 pagesRuggedbackbone Rx1500 Rx1501esilva2021No ratings yet

- Employee Involvement TQMDocument33 pagesEmployee Involvement TQMAli RazaNo ratings yet

- WCN SyllabusDocument3 pagesWCN SyllabusSeshendra KumarNo ratings yet

- MSA & Destructive TestDocument4 pagesMSA & Destructive Testanon_902607157100% (1)

- BS 7346-6-2005 Specifications For Cable SystemsDocument26 pagesBS 7346-6-2005 Specifications For Cable SystemsFathyNo ratings yet

- Questions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcDocument8 pagesQuestions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcshanecarlNo ratings yet

- BBA Lecture NotesDocument36 pagesBBA Lecture NotesSaqib HanifNo ratings yet

- Treatment of Textile Effluents by Low Cost Agricultural Wastes Batch Biosorption Study PDFDocument6 pagesTreatment of Textile Effluents by Low Cost Agricultural Wastes Batch Biosorption Study PDFimran24No ratings yet

- Comprehensive Drug Abuse Prevention and Control Act of 1970Document2 pagesComprehensive Drug Abuse Prevention and Control Act of 1970Bryan AbestaNo ratings yet

- Indian Institute of Technology (Indian School of Mines) DhabadDocument23 pagesIndian Institute of Technology (Indian School of Mines) DhabadAmit KumarNo ratings yet

- 1849 1862 Statutes at Large 601-779Document200 pages1849 1862 Statutes at Large 601-779ncwazzyNo ratings yet

- CreatorsXO JuneDocument9 pagesCreatorsXO JuneGaurav KarnaniNo ratings yet

- Asme 1417 WordDocument12 pagesAsme 1417 WordERIKA RUBIONo ratings yet

- Affidavit To Use The Surname of The FatherDocument2 pagesAffidavit To Use The Surname of The FatherGlenn Lapitan Carpena100% (1)

- EquisetopsidaDocument4 pagesEquisetopsidax456456456xNo ratings yet

- CRM (Coca Cola)Document42 pagesCRM (Coca Cola)Utkarsh Sinha67% (12)

- Pace 349 ScheduleDocument3 pagesPace 349 Schedulesaxman011100% (1)

- Mannitol For Reduce IOPDocument7 pagesMannitol For Reduce IOPHerryantoThomassawaNo ratings yet

- Solution Problem 1 Problems Handouts MicroDocument25 pagesSolution Problem 1 Problems Handouts MicrokokokoNo ratings yet

- Lab - Report: Experiment NoDocument6 pagesLab - Report: Experiment NoRedwan AhmedNo ratings yet

- Impact of Carding Segments On Quality of Card Sliver: Practical HintsDocument1 pageImpact of Carding Segments On Quality of Card Sliver: Practical HintsAqeel AhmedNo ratings yet

- Centaur Profile PDFDocument5 pagesCentaur Profile PDFChandra MohanNo ratings yet

- Frsky L9R ManualDocument1 pageFrsky L9R ManualAlicia GordonNo ratings yet

- Uncertainty-Based Production Scheduling in Open Pit Mining: R. Dimitrakopoulos and S. RamazanDocument7 pagesUncertainty-Based Production Scheduling in Open Pit Mining: R. Dimitrakopoulos and S. RamazanClaudio AballayNo ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet