Professional Documents

Culture Documents

Scheme of Work 2

Uploaded by

Pöþè'Dennis Köwrëäl Döwsh0 ratings0% found this document useful (0 votes)

2 views2 pagesThis document contains a schemes of work for a class on advanced capital budgeting decision making. The topic for week 2 is advanced capital budgeting, with objectives to understand advanced analysis methods like sensitivity analysis, scenario analysis, decision trees, simulation analysis, and risk adjusted discounting. Learners will apply these tools to capital budgeting appraisal and highlight the impact of financing on investment decisions. They will also incorporate capital rationing concepts into capital investment appraisal through class discussions and activities.

Original Description:

Original Title

scheme of work 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a schemes of work for a class on advanced capital budgeting decision making. The topic for week 2 is advanced capital budgeting, with objectives to understand advanced analysis methods like sensitivity analysis, scenario analysis, decision trees, simulation analysis, and risk adjusted discounting. Learners will apply these tools to capital budgeting appraisal and highlight the impact of financing on investment decisions. They will also incorporate capital rationing concepts into capital investment appraisal through class discussions and activities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesScheme of Work 2

Uploaded by

Pöþè'Dennis Köwrëäl DöwshThis document contains a schemes of work for a class on advanced capital budgeting decision making. The topic for week 2 is advanced capital budgeting, with objectives to understand advanced analysis methods like sensitivity analysis, scenario analysis, decision trees, simulation analysis, and risk adjusted discounting. Learners will apply these tools to capital budgeting appraisal and highlight the impact of financing on investment decisions. They will also incorporate capital rationing concepts into capital investment appraisal through class discussions and activities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

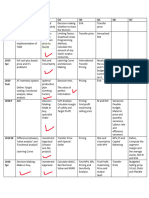

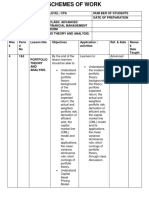

SCHEMES OF WORK

NAME: Dennis Korir LEVEL: CPA NUM BER OF STUDENTS

INSTITUTION: DATE OF PREPARATION

NYS(IBS)

SUBJECT: CLASS: ADVANCED FINANCIAL

RESEARCH PROJECT MANAGEMENT

TERM

SYLLABUS TOPIC: ADVANCED CAPITAL BUDGETING

DECISION

We Peri Lesson Objectives Application / activities Ref. & Rema

ek od title Aids rk

No Date

Taug

ht

2 1&2 ADVANC By the end of the lesson Learners to: Advance

ED learners should be able d

CAPITAL to: Incorporate Financial

BUDGETI risks in Manage

NG Understand capital ment

DECISIO Advanced budgeting (AFM)

N Methods of appraisal Essential

analysis; using the s Pack.

sensitivity following By

analysis, tools: Kaplan

scenario sensitivity

Publishin

analysis, g.

analysis,

decision scenario

trees, analysis,

simulation decision

analysis, trees,

utility simulation

analysis, risk analysis,

adjusted utility

discounting analysis, risk

rate (RADR) adjusted

and certainty discounting

equivalent rate (RADR)

method. and certainty

Highlight the equivalent

impact of method

financing on through class

investment discussions.

decisions - Highlight the

the concept impact of

of adjusted financing on

present value investment

(APV) decisions -

Incorporate the concept

capital of adjusted

rationing in present value

capital (APV)

investment through buzz

appraisal; groups.

Single period Incorporate

capital capital

rationing with rationing in

divisible capital

projects; investment

Multi-period appraisal;

capital Single period

rationing with capital

divisible rationing with

capital divisible

investments. projects;

Multi-period

capital

rationing with

divisible

capital

investments

through class

discussion.

You might also like

- Toyota Landcruiser 100 Series 1FZ-FE 4 - 5L 2BARDocument1 pageToyota Landcruiser 100 Series 1FZ-FE 4 - 5L 2BARedison patiño100% (3)

- A Portfolio of Reflections: Reflection Sheets for Curriculum AreasFrom EverandA Portfolio of Reflections: Reflection Sheets for Curriculum AreasNo ratings yet

- Cidam - Statistics FfinalDocument12 pagesCidam - Statistics FfinalKyle BersaloteNo ratings yet

- Research 2 CidamDocument6 pagesResearch 2 CidamMarra Ayaay100% (2)

- CIDAM EntrepreneurDocument3 pagesCIDAM EntrepreneurChristian100% (5)

- Flexible Instruction Delivery Plan: Notre Dame of Masiag, IncDocument7 pagesFlexible Instruction Delivery Plan: Notre Dame of Masiag, IncLANY T. CATAMIN100% (1)

- Fidp FabmDocument5 pagesFidp FabmEve Intapaya100% (1)

- Project Management Process Flow Diagram Fifth EditionDocument1 pageProject Management Process Flow Diagram Fifth EditionRyan WyattNo ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)

- Risk Analysis: Facilitating and Analysis Guidelines for Capital Expenditure ProjectsFrom EverandRisk Analysis: Facilitating and Analysis Guidelines for Capital Expenditure ProjectsNo ratings yet

- Cidam in Applied EconomicsDocument10 pagesCidam in Applied EconomicsRonalyn Gatela CajudoNo ratings yet

- DRRR FidpDocument11 pagesDRRR FidpCris SimonNo ratings yet

- Scheme of Work 1Document2 pagesScheme of Work 1Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Scheme of Work 3Document3 pagesScheme of Work 3Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Draft 1 1Document7 pagesDraft 1 1Jessa IlaoNo ratings yet

- ISA 520 MindMapDocument1 pageISA 520 MindMapA R AdILNo ratings yet

- Flexible Instructional Delivery Plan (FIDP) : What To Teach?Document12 pagesFlexible Instructional Delivery Plan (FIDP) : What To Teach?LANY T. CATAMINNo ratings yet

- Large Engineering Project Risk AnalysisDocument9 pagesLarge Engineering Project Risk AnalysiszhulingqianazNo ratings yet

- AACEiHGCS PC101 2018 - Risk Management vPRINTDocument60 pagesAACEiHGCS PC101 2018 - Risk Management vPRINTJames ArrowNo ratings yet

- Launching AM Policy DirKeuDocument8 pagesLaunching AM Policy DirKeuernaNo ratings yet

- CIDAM in Trends, Networks, and Critical Thinking in The 21st CenturyDocument7 pagesCIDAM in Trends, Networks, and Critical Thinking in The 21st CenturyJasonNo ratings yet

- Question PapersDocument3 pagesQuestion PapersAlii ArshadNo ratings yet

- FIDP Correlation AnalysisDocument2 pagesFIDP Correlation AnalysisJaneth AmorNo ratings yet

- Solve Business-Related Problems and To Apply Logic To Real-Life Situations. Making DecisionsDocument3 pagesSolve Business-Related Problems and To Apply Logic To Real-Life Situations. Making DecisionsEdelyn A. BergantinNo ratings yet

- Basic Concept of Disaster and Disaster Risk II. Exposur e and Vulnera Bility Iii. Basic Concept of HazardDocument2 pagesBasic Concept of Disaster and Disaster Risk II. Exposur e and Vulnera Bility Iii. Basic Concept of HazardAvelina P. De Vera0% (1)

- Classroom Instruction Delivery Alignment MapDocument5 pagesClassroom Instruction Delivery Alignment MapRose ann rodriguezNo ratings yet

- CIDAM Example Chapter 2Document6 pagesCIDAM Example Chapter 2angel dinglasaNo ratings yet

- Cidam - Research ProjectDocument3 pagesCidam - Research ProjectLany T. CataminNo ratings yet

- CIDAM in ENGLISH 7Document2 pagesCIDAM in ENGLISH 7Charry AltamiaNo ratings yet

- Risk Assessment Matrix: An Example For Project ManagersDocument21 pagesRisk Assessment Matrix: An Example For Project ManagersGabriela MogosNo ratings yet

- Flexible Instructional Delivery Plan (FIDP) : What To Teach?Document3 pagesFlexible Instructional Delivery Plan (FIDP) : What To Teach?Arniel LlagasNo ratings yet

- Beyond SegmentationDocument14 pagesBeyond SegmentationMiguel ÁngelNo ratings yet

- FIDP Correlation AnalysisDocument2 pagesFIDP Correlation AnalysisMeryll Joy P. MaaliwNo ratings yet

- Flexible Instruction Delivery Plan (FIDP) : What To Teach?Document2 pagesFlexible Instruction Delivery Plan (FIDP) : What To Teach?Rojane L. AlcantaraNo ratings yet

- Creating Evaluating Analyzing Applying Understandin G: Specific Teaching StrategiesDocument4 pagesCreating Evaluating Analyzing Applying Understandin G: Specific Teaching StrategiesAllira Clarion BarazonaNo ratings yet

- Cost of Capital - Risk AnalysisDocument25 pagesCost of Capital - Risk AnalysisAB D'oriaNo ratings yet

- Mutural FundsDocument4 pagesMutural FundsPooja VNo ratings yet

- B2B Slides-2 PDFDocument22 pagesB2B Slides-2 PDFShivam AryaNo ratings yet

- Revised How Plants SurviveDocument4 pagesRevised How Plants SurviveRonalyn Gatela CajudoNo ratings yet

- Region7 Business and Consumer Loans Group 5 PDFDocument3 pagesRegion7 Business and Consumer Loans Group 5 PDFKimberlyn GranzoNo ratings yet

- Western Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesDocument9 pagesWestern Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesJoyce Torres100% (1)

- Research 2 Aligned Classroom Instruction Delivery PlanDocument6 pagesResearch 2 Aligned Classroom Instruction Delivery PlanJohanna S-Nonato MapaNo ratings yet

- Cidam (Random - Hypo)Document12 pagesCidam (Random - Hypo)Myla Rose AcobaNo ratings yet

- Cidam PR2Document2 pagesCidam PR2rosanie remotinNo ratings yet

- UntitledDocument18 pagesUntitledTHAKUR SHUBHAM SINGHNo ratings yet

- CIDAM For Topic 5 - Final - GenMath - AmortizationDocument2 pagesCIDAM For Topic 5 - Final - GenMath - AmortizationMarie Antoinette Cadorna CadeliñaNo ratings yet

- Dezerv Investing WhitepaperDocument24 pagesDezerv Investing WhitepaperSachin VermaNo ratings yet

- CIDAM Group 1 Origin and Subsystem of The Earth (FINAL)Document12 pagesCIDAM Group 1 Origin and Subsystem of The Earth (FINAL)Venoc Hosmillo0% (1)

- Cidam Statistics FfinalDocument12 pagesCidam Statistics FfinalNelson MaraguinotNo ratings yet

- 1-FIDP TemplateDocument4 pages1-FIDP TemplateMeljoy TenorioNo ratings yet

- (AEco) Cidam Chapter 2Document6 pages(AEco) Cidam Chapter 2angel dinglasaNo ratings yet

- Random Variables and Probability DistributionsDocument15 pagesRandom Variables and Probability DistributionsJason Peña100% (1)

- Mohanty Sir - Inv - PropDocument22 pagesMohanty Sir - Inv - PropAshutos MohantyNo ratings yet

- Aurora, Zamboanga Del Sur: (Cebuano Barracks Institute)Document3 pagesAurora, Zamboanga Del Sur: (Cebuano Barracks Institute)Hassel AbayonNo ratings yet

- M5 AmaDocument3 pagesM5 Amazeeshan sikandarNo ratings yet

- Part A: Basic Details: Ns@xlri - Ac.inDocument12 pagesPart A: Basic Details: Ns@xlri - Ac.insdNo ratings yet

- CidamDocument3 pagesCidamCharrie Molinas Dela PeñaNo ratings yet

- BUS254 - Variance Analysis - 4slidesper PageDocument14 pagesBUS254 - Variance Analysis - 4slidesper PageyuviNo ratings yet

- EnntrepDocument7 pagesEnntrepDione SeñerisNo ratings yet

- CIDAM 9 - Animal ReproductionDocument2 pagesCIDAM 9 - Animal ReproductionDiether Mercado PaduaNo ratings yet

- Fixed-Income Portfolio Analytics: A Practical Guide to Implementing, Monitoring and Understanding Fixed-Income PortfoliosFrom EverandFixed-Income Portfolio Analytics: A Practical Guide to Implementing, Monitoring and Understanding Fixed-Income PortfoliosRating: 3.5 out of 5 stars3.5/5 (1)

- New Combined Brochure Campus 2022Document2 pagesNew Combined Brochure Campus 2022Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Verbit ExamDocument1 pageVerbit ExamPöþè'Dennis Köwrëäl DöwshNo ratings yet

- GTDocument1 pageGTPöþè'Dennis Köwrëäl DöwshNo ratings yet

- The Time Value of Money in Financial ManagementDocument1 pageThe Time Value of Money in Financial ManagementPöþè'Dennis Köwrëäl DöwshNo ratings yet

- Scheme of Work 5Document2 pagesScheme of Work 5Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Scheme of Work 4Document2 pagesScheme of Work 4Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- CPA 17 MOCK Exams 2021Document5 pagesCPA 17 MOCK Exams 2021Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Auditing and Assurance Block Revision Mock 1 (Merge)Document349 pagesAuditing and Assurance Block Revision Mock 1 (Merge)Pöþè'Dennis Köwrëäl DöwshNo ratings yet

- Motorola Phone Tools Test InfoDocument98 pagesMotorola Phone Tools Test InfoDouglaswestphalNo ratings yet

- Shaheed Suhrawardy Medical College HospitalDocument3 pagesShaheed Suhrawardy Medical College HospitalDr. Mohammad Nazrul IslamNo ratings yet

- Berghahn Dana ResumeDocument2 pagesBerghahn Dana ResumeAnonymous fTYuIuK0pkNo ratings yet

- Acute Conditions of The NewbornDocument46 pagesAcute Conditions of The NewbornCamille Joy BaliliNo ratings yet

- Emerging and Less Common Viral Encephalitides - Chapter 91Document34 pagesEmerging and Less Common Viral Encephalitides - Chapter 91Victro ChongNo ratings yet

- Certification Programs: Service As An ExpertiseDocument5 pagesCertification Programs: Service As An ExpertiseMaria RobNo ratings yet

- Lesson 2.4Document8 pagesLesson 2.4Tobi TobiasNo ratings yet

- Manipulation Methods and How To Avoid From ManipulationDocument5 pagesManipulation Methods and How To Avoid From ManipulationEylül ErgünNo ratings yet

- 0 - Danica Joy v. RallecaDocument2 pages0 - Danica Joy v. RallecaRandy Jake Calizo BaluscangNo ratings yet

- 61-Article Text-180-1-10-20170303 PDFDocument25 pages61-Article Text-180-1-10-20170303 PDFSOUMYA GOPAVARAPUNo ratings yet

- Ga-Ta10 (LHH)Document181 pagesGa-Ta10 (LHH)Linh T.Thảo NguyễnNo ratings yet

- Linguistic LandscapeDocument11 pagesLinguistic LandscapeZara NurNo ratings yet

- Light Design by Anil ValiaDocument10 pagesLight Design by Anil ValiaMili Jain0% (1)

- Diploma Thesis-P AdamecDocument82 pagesDiploma Thesis-P AdamecKristine Guia CastilloNo ratings yet

- Difference Between Dada and SurrealismDocument5 pagesDifference Between Dada and SurrealismPro FukaiNo ratings yet

- Water Quality MonitoringDocument3 pagesWater Quality MonitoringJoa YupNo ratings yet

- A. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFDocument4 pagesA. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFbiarrodNo ratings yet

- Interdisciplinary Project 1Document11 pagesInterdisciplinary Project 1api-424250570No ratings yet

- Eps 400 New Notes Dec 15-1Document47 pagesEps 400 New Notes Dec 15-1BRIAN MWANGINo ratings yet

- Unit 1 My Hobbies Lesson 1 Getting StartedDocument14 pagesUnit 1 My Hobbies Lesson 1 Getting StartedhienNo ratings yet

- FORM 2 Enrolment Form CTU SF 2 v.4 1Document1 pageFORM 2 Enrolment Form CTU SF 2 v.4 1Ivy Mie HerdaNo ratings yet

- Five Star Env Audit Specification Amp Pre Audit ChecklistDocument20 pagesFive Star Env Audit Specification Amp Pre Audit ChecklistMazhar ShaikhNo ratings yet

- Syllabus (2020) : NTA UGC-NET Computer Science and ApplicationsDocument24 pagesSyllabus (2020) : NTA UGC-NET Computer Science and ApplicationsDiksha NagpalNo ratings yet

- Class XI-Writing-Job ApplicationDocument13 pagesClass XI-Writing-Job Applicationisnprincipal2020No ratings yet

- Instrumentation Design BasicsDocument28 pagesInstrumentation Design BasicsCharles ChettiarNo ratings yet

- Bilge Günsel TEL531E Detection and Estimation Theory W #1-2Document25 pagesBilge Günsel TEL531E Detection and Estimation Theory W #1-2ahmetNo ratings yet

- April FoolDocument179 pagesApril FoolrogeraccuraNo ratings yet

- NM Integrative Wellness MRC Public Health Acupuncture JITTDocument40 pagesNM Integrative Wellness MRC Public Health Acupuncture JITTPrince DhillonNo ratings yet