Professional Documents

Culture Documents

SEN Antuko Wind Solar Vol 9 Num 3 20220812

Uploaded by

HERNAN ALVAREZ CABRERACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEN Antuko Wind Solar Vol 9 Num 3 20220812

Uploaded by

HERNAN ALVAREZ CABRERACopyright:

Available Formats

Aug 12th, 2022

Weekly Report Year. 9 – Num. 3

Aug 1st, 2022 – Aug 7th, 2022

Prices increased from Pan de Azúcar to the South due to congestions and multiple thermal units unavailable.

Global SEN Operation Marginal Cost Evolution in Polpaico during past years

Prices in Polpaico were 9% higher than

last week and 3% higher compared to

one year ago.

[USD/MWh]

Total demand went down by 0.4% this

week. The most relevant change in the

mix came from renewables: regarding

hydro, as dam increased its share in

2.5 pp, run-of-river decreased by 1.8 Generation mix Power range by energy sources (average prices) Variation

pp; likewise, solar and wind had

reductions of 2.5 pp and 1 pp,

respectively. This lower overall

renewable generation was

compensated with coal and gas

(+1.1 pp each).

The unavailability from Wed. onwards

of the first or second circuit (depending

on the moment) of Cumbre – N. P. de

Azúcar 500 kV corridor led average

prices to fall from D. de Almagro to the

North (with daily falls to cero) and to

rise from P. de Azúcar to the South. Marginal Cost Evolution

Congestions in Charrúa – Ancoa 500 kV

line and limitations in Ventanas area Crucero

coal units' injections on Monday USD 122.6 /MWh

originated by high concentrations of D. de Almagro

sulfur dioxide, worsened the situation USD 118.8 /MWh

in the Center and caused a decoupling

of up to USD 267/MWh. Pan de Azúcar

[USD/MWh]

USD 144.6 /MWh

High day-night spreads during some

days were also a consequence of Polpaico

multiple thermal units out due to faults USD 143.0 /MWh

(Angamos and Nehuenco) and Charrúa

maintenances (Andina and Norgener). USD 121.5 /MWh

Prices in Puerto Montt went up by 180 Puerto Montt

USD/MWh approx. due to an increase USD 327.3 /MWh

in congestions of Tineo – Puerto Montt

and a low wind production.

Wind & Solar production PV spot(1):

Hourly Solar Production

PV generation was 18% lower than last Crucero

week (-41.7 GWh), reaching 186 GWh. USD 35.6 /MWh

Every zone showed diminutions, being D. de Almagro

the most relevant those in Crucero USD 36.3 /MWh

(-16.7 GWh, -17%) and D. de Almagro Polpaico

USD 100.7 /MWh

(-16.1 GWh, -20%). Due to the high

curtailment, daily average plant factors Wind spot(2):

in these zones were around 15% from Crucero

(1)Energy weighted average SPOT Price using global SEN PV production

Wednesday onwards. USD 114.7 /MWh

D. de Almagro Hourly Wind Production

USD 127.6 /MWh

Wind generation went down by 10% Pan de Azúcar

(-17.2 GWh), totaling 164 GWh. USD 129.9 /MWh

Production [MWh/h]

Plant Factor [%]

Reductions observed in Crucero (-6.8 Polpaico

GWh), Charrúa (-23.4 GWh) and P. USD 145.0 /MWh

Montt (-2.4 GWh) prevailed over Charrúa

USD 115.6 /MWh

increases in D. de Almagro (+5.4

Puerto Montt

GWh) and P. de Azúcar (+9.9 GWh). USD 327.1 /MWh

Average plant factor in P. Montt was

barely 5.9%. (2)Energy weighted average SPOT Price using wind production by zone

Hourly Wind & Solar Production

This week CEN reported curtailment

of 6,3 GWh for wind and 12 GWh for

solar, respectively. This represents

weekly variations of +96% and

+594%. There was non reported

curtailment for run-of-river

generation on Tuesday, which was a

consequence of congestion in

Charrúa – Mulchén 2 x 220 kV line.

Antuko – Enrique Foster 0115, Las Condes, Santiago, Chile • www.antuko.com • weekly@antuko.com

Antuko Comercialización S.p.A. publishes this weekly report using public information from CEN, CNE & SEIA. This document is for information purposes only. Its partial or total reproduction is authorized while mentioning its

source as Antuko. Opinions herein expressed are proprietary. Subscribe with this link.

You might also like

- Type Design of CausewayDocument35 pagesType Design of Causewayseprwgl86% (14)

- Student: Derrick Westlund Mentor: Ben Vanrootselaar, P.EngDocument25 pagesStudent: Derrick Westlund Mentor: Ben Vanrootselaar, P.EngRonak KapadiaNo ratings yet

- Profitability of Plasma-Arc-Flow™ Total RecyclersDocument20 pagesProfitability of Plasma-Arc-Flow™ Total Recyclersfmolina625No ratings yet

- 30 DorraAbdeljalil 2Document26 pages30 DorraAbdeljalil 2Mohamed AbdeljalilNo ratings yet

- Mercado en Panama 1Document10 pagesMercado en Panama 1Susana Lopez LopezNo ratings yet

- Feasibility Study For Indonesia LNG Gas PlantDocument18 pagesFeasibility Study For Indonesia LNG Gas PlantMocha Setia100% (1)

- Overcoming The Reliance On Natural Gas in QatarDocument12 pagesOvercoming The Reliance On Natural Gas in Qatarapi-721728715No ratings yet

- FV2 Parte 2 PDFDocument11 pagesFV2 Parte 2 PDFjotasccNo ratings yet

- Electrical Wind Turbine SystemsDocument101 pagesElectrical Wind Turbine SystemsAnna BNo ratings yet

- Bgrim 1q2022Document56 pagesBgrim 1q2022Dianne SabadoNo ratings yet

- First Oil Amp Gas Application of A Hybrid Power Plant Integrating Solar PV - Energy Storage Conventional Power Generation GTGDocument7 pagesFirst Oil Amp Gas Application of A Hybrid Power Plant Integrating Solar PV - Energy Storage Conventional Power Generation GTGBORIS KAPLANNo ratings yet

- The Wind Energy Status and The Technology Transfer Activities in EgyptDocument26 pagesThe Wind Energy Status and The Technology Transfer Activities in EgyptYasser BahaaNo ratings yet

- 0 KazimiDocument10 pages0 KazimiankitNo ratings yet

- 2019 Electricity Supply Plan GhanaDocument87 pages2019 Electricity Supply Plan GhanaGajendra SinghNo ratings yet

- 2021 Texas Power Outages: Facts and Initial Thoughts: February 22, 2021Document20 pages2021 Texas Power Outages: Facts and Initial Thoughts: February 22, 2021James JosephNo ratings yet

- Wind Turbin - WindPowerDocument23 pagesWind Turbin - WindPowerIqbal Al FuadyNo ratings yet

- Modeling and Performance Analysis of An Integrated Wind/Diesel Power System For Off-Grid LocationsDocument6 pagesModeling and Performance Analysis of An Integrated Wind/Diesel Power System For Off-Grid LocationsramprabhakarjNo ratings yet

- MTN Ghana New 1Document5 pagesMTN Ghana New 1Samuel Mawutor GamorNo ratings yet

- The ESI Bulletin Q2 2022Document13 pagesThe ESI Bulletin Q2 2022Nurul HawaNo ratings yet

- Novato MicrogridDocument10 pagesNovato Microgridapi-375192547No ratings yet

- Ghana Energy SolutionsDocument44 pagesGhana Energy SolutionsBrahim HouariNo ratings yet

- Sadiq (2018) Solar Water HeaterDocument11 pagesSadiq (2018) Solar Water HeaterUmair IqbalNo ratings yet

- Journal of Cleaner Production: M. Ozonoh, T.C. Aniokete, B.O. Oboirien, M.O. DaramolaDocument15 pagesJournal of Cleaner Production: M. Ozonoh, T.C. Aniokete, B.O. Oboirien, M.O. DaramolaMuhammad Farizan PraeviaNo ratings yet

- Annex ADocument34 pagesAnnex ASarahMoutaouakilNo ratings yet

- PLTMG 30Mw Floating LNG Power Plant: Seram IslandDocument32 pagesPLTMG 30Mw Floating LNG Power Plant: Seram IslandSumantri Yudha WibawaNo ratings yet

- Article - Wind - and - Solar - KopieDocument3 pagesArticle - Wind - and - Solar - KopieHui WangNo ratings yet

- Overview of Renewables & Solar Technologies: World Institute of Sustainable EnergyDocument27 pagesOverview of Renewables & Solar Technologies: World Institute of Sustainable EnergyPallavi ChNo ratings yet

- Investment Analysis DG WHRDocument19 pagesInvestment Analysis DG WHRFeroz Baig0% (1)

- Financial Model For JVDocument14 pagesFinancial Model For JVYan LaksanaNo ratings yet

- Sdarticle 15Document12 pagesSdarticle 15Desu MihretuNo ratings yet

- Possible Climate Change Impacts On Large Hydroelectricity Schemes in Southern Africa (1852)Document6 pagesPossible Climate Change Impacts On Large Hydroelectricity Schemes in Southern Africa (1852)benildomacaringueNo ratings yet

- Radwan Almasri PresentationDocument29 pagesRadwan Almasri PresentationHamza KhanNo ratings yet

- Simulador para Paneles SolaresDocument4 pagesSimulador para Paneles SolaresHarry MonsonNo ratings yet

- MERIT - Merit Order Despatch of Electricity For Rejuvenation of Income and Transparency - Ministry of Power, IndiaDocument7 pagesMERIT - Merit Order Despatch of Electricity For Rejuvenation of Income and Transparency - Ministry of Power, IndianagarjunyajamanNo ratings yet

- Session 3B, Solar EngineeringDocument110 pagesSession 3B, Solar Engineeringlmn_grssNo ratings yet

- Rebuilding Trust and Mainstreaming Renewable EnergyDocument20 pagesRebuilding Trust and Mainstreaming Renewable EnergyyaksmartNo ratings yet

- ZambiaDocument22 pagesZambiaMuhi UddinNo ratings yet

- Sustainable Electrical Energy Supply Chain SystemDocument18 pagesSustainable Electrical Energy Supply Chain SystemaarivalaganNo ratings yet

- 10Mw Solar Power Assessment & Synopsis (Spans) Report: Client Name: Tecsok, Bangalore Project Location: BagaloreDocument4 pages10Mw Solar Power Assessment & Synopsis (Spans) Report: Client Name: Tecsok, Bangalore Project Location: BagaloreAmar BayasgalanNo ratings yet

- Bayan Muna GR 210245Document32 pagesBayan Muna GR 210245Carlota VillaromanNo ratings yet

- Fertilizer Offtake Aug-23Document4 pagesFertilizer Offtake Aug-23amirmalik6040No ratings yet

- Solar Thermal Power GenerationDocument101 pagesSolar Thermal Power GenerationAvnish Narula100% (5)

- Green Hydrogen: Opportunities in The Energy SystemDocument11 pagesGreen Hydrogen: Opportunities in The Energy SystemAdhi ErlanggaNo ratings yet

- Test and Commissioning ReportsDocument33 pagesTest and Commissioning ReportsRaging FayahNo ratings yet

- VRA ProposalDocument25 pagesVRA ProposalFuaad DodooNo ratings yet

- Eco NicalDocument13 pagesEco Nicalluizfellipe95No ratings yet

- ESDM - Renewable Energy and Energy Conservation by IGN Wiratmadja PDFDocument27 pagesESDM - Renewable Energy and Energy Conservation by IGN Wiratmadja PDFAryttNo ratings yet

- Practical Case 6. Photovoltaic Solar EnergyDocument8 pagesPractical Case 6. Photovoltaic Solar EnergyScribdTranslationsNo ratings yet

- Cost Calculation TCG 2020 V16K With CNGDocument2 pagesCost Calculation TCG 2020 V16K With CNGR_afflyNo ratings yet

- 17,500 DWT / 3 X 80 MT: Ship's Basics Hold and HatchDocument2 pages17,500 DWT / 3 X 80 MT: Ship's Basics Hold and HatchJannik PanckeNo ratings yet

- Introduction To The Residential Wind Industry Residential Wind IndustryDocument21 pagesIntroduction To The Residential Wind Industry Residential Wind IndustryDennyHalim.comNo ratings yet

- Concept Badogra Afs - DG SetDocument2 pagesConcept Badogra Afs - DG Setlaxmidhar sutarNo ratings yet

- The Blackouts On 30 and 31 July 2012: A.M.Kulkarni IIT BombayDocument55 pagesThe Blackouts On 30 and 31 July 2012: A.M.Kulkarni IIT Bombayjigyesh sharmaNo ratings yet

- Quick Chilled Water EstimationDocument2 pagesQuick Chilled Water EstimationSami Khoury100% (5)

- Energy Commission - 2018 Energy Outlook - 2018Document93 pagesEnergy Commission - 2018 Energy Outlook - 2018Albert AwoponeNo ratings yet

- Bahala Kayo JanDocument1 pageBahala Kayo JanBinig WasanNo ratings yet

- Offshore Wind Energy Generation: Control, Protection, and Integration to Electrical SystemsFrom EverandOffshore Wind Energy Generation: Control, Protection, and Integration to Electrical SystemsNo ratings yet

- SmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2From EverandSmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2No ratings yet

- The Switch: How solar, storage and new tech means cheap power for allFrom EverandThe Switch: How solar, storage and new tech means cheap power for allNo ratings yet

- Global hydrogen trade to meet the 1.5°C climate goal: Part III – Green hydrogen cost and potentialFrom EverandGlobal hydrogen trade to meet the 1.5°C climate goal: Part III – Green hydrogen cost and potentialNo ratings yet

- 11U Evolution NotesDocument8 pages11U Evolution NotesAshikka SaseekaranNo ratings yet

- Confined Space ProcedureDocument15 pagesConfined Space ProcedureGothy GamingNo ratings yet

- 1 s2.0 S2095263518300384 Main PDFDocument17 pages1 s2.0 S2095263518300384 Main PDFDendy WahyudiNo ratings yet

- Philippine Architectural AcronymsDocument3 pagesPhilippine Architectural AcronymsRusscel MarquesesNo ratings yet

- Rain Water HarvestingDocument24 pagesRain Water Harvestingrocking sharathNo ratings yet

- Materi Sosialisasi Juknis PTB - 0021 - 18102022 - ShareDocument50 pagesMateri Sosialisasi Juknis PTB - 0021 - 18102022 - ShareUtomo FebbyNo ratings yet

- Health 6 Module 2 - Quarter 3Document24 pagesHealth 6 Module 2 - Quarter 3Justine Leigh FloresNo ratings yet

- DSJKB SDKKD SK FDF MDocument20 pagesDSJKB SDKKD SK FDF MhwhenfbsjNo ratings yet

- Topic 1 Planet Earth (Intensive Notes) by Ricky Tsui - IssuuDocument1 pageTopic 1 Planet Earth (Intensive Notes) by Ricky Tsui - IssuuTU YUZE TU BILLY (4L27)No ratings yet

- Natural Wonders (1) : Full Name: . Time: SAT (16H30), SUN (16H30)Document4 pagesNatural Wonders (1) : Full Name: . Time: SAT (16H30), SUN (16H30)Ngọc BíchNo ratings yet

- Science-Based Net-Zero: Scaling Urgent Corporate Climate Action WorldwideDocument43 pagesScience-Based Net-Zero: Scaling Urgent Corporate Climate Action WorldwidePonglert ChanthornNo ratings yet

- IB-Academy nl+Environmental+Systems+&+SocietiesDocument84 pagesIB-Academy nl+Environmental+Systems+&+Societiesarwa salaimeh100% (1)

- Summer On The Icefields Parkway Guide 2019Document2 pagesSummer On The Icefields Parkway Guide 2019dolla partonNo ratings yet

- A4 Arnhem-Central-Transfer-Terminal-StationDocument8 pagesA4 Arnhem-Central-Transfer-Terminal-StationAnshika SinghNo ratings yet

- Final Action Plan in NSTPDocument3 pagesFinal Action Plan in NSTPAngelo GarciaNo ratings yet

- Gain Granular Laundry DetergentDocument6 pagesGain Granular Laundry DetergentAshta VakrNo ratings yet

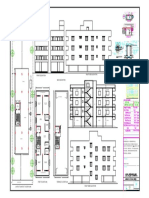

- Plan of Uttara 2-Model PDFDocument1 pagePlan of Uttara 2-Model PDFSabita PadhyNo ratings yet

- Method 29 Compliance Source TestDocument771 pagesMethod 29 Compliance Source TestĐại Việt Quốc XãNo ratings yet

- Distinguish Between Indirect and Direct Water UsesDocument3 pagesDistinguish Between Indirect and Direct Water Usesapi-302391957No ratings yet

- STEM401 Group 3 Business PlanDocument58 pagesSTEM401 Group 3 Business PlanPrecious FaithNo ratings yet

- Essay On SelfishnessDocument4 pagesEssay On Selfishnesstxmvblaeg100% (2)

- Architectural Science (HVAC) Lecture 2Document15 pagesArchitectural Science (HVAC) Lecture 2ezakbelachewNo ratings yet

- A Sociotechnical Model For Understanding Organizational Technology and Knowledge TransferDocument19 pagesA Sociotechnical Model For Understanding Organizational Technology and Knowledge TransferGlobal Research and Development ServicesNo ratings yet

- Influence of Learning Motivation, Cognitive Strategy, Prior Knowledge and School Environment On Learning Satisfaction. Dr. Osly Usman, M. BusDocument17 pagesInfluence of Learning Motivation, Cognitive Strategy, Prior Knowledge and School Environment On Learning Satisfaction. Dr. Osly Usman, M. BusCut AzraNo ratings yet

- TLE-IA 6 - Module 12 - Recyclable Products Waste MaterialsDocument23 pagesTLE-IA 6 - Module 12 - Recyclable Products Waste MaterialsAdrian MarmetoNo ratings yet

- Tils, Pgdla, SociologyDocument18 pagesTils, Pgdla, SociologyDhananjayan GopinathanNo ratings yet

- Department of Education: Assessment Test in Science-4 Quarter I Week-4Document4 pagesDepartment of Education: Assessment Test in Science-4 Quarter I Week-4Nick Mabalot100% (1)

- Unit III - BiodiversityDocument23 pagesUnit III - Biodiversitycrazy ULTRON gamingNo ratings yet

- Basic Principles of EcologyDocument115 pagesBasic Principles of EcologyElvin Pol EscribirNo ratings yet