Professional Documents

Culture Documents

DLP Fabm1

Uploaded by

Junar DesucatanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLP Fabm1

Uploaded by

Junar DesucatanCopyright:

Available Formats

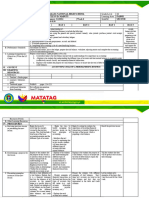

Republic of the Philippines

DEPARTMENT OF EDUCATION

Region VII Central Visayas

DIVISION OF CEBU

Learning Area: Detailed Lesson Plan (DLP)

DLP No.: Grade Level: Quarter: Duration: Date:

37 FABM1 11 2nd 120 MINUTES October 2, 2019

The learners prepare adjusting entries CODE

Learning Competency/ies:

ABM_FABM11-IVad-33-34

Key Concepts / Understandings to be

Developed The Accounting Cycle of a Service Business-Preparing an Adjusting Entry

Adapted Cognitive

Domain Process Dimensions OBJECTIVES:

(D.O. No. 8, s. 2015)

Knowledge Remembering Reproduce an adjusting entry

The fact or condition of knowing

something with familiarity gained

through experience or association

Understanding

Applying

Generate an adjusting entry

Skills Analyzing

The ability and capacity acquired

through deliberate, systematic, and sustained

effort to smoothly and adaptively carryout

complex activities or the ability, coming from

one's knowledge, practice, aptitude, etc., to Evaluating

do something

Creating

Receiving

Attitude Phenomena Displays open-mindedness

Values Valuing Love for truth

2. Content Business Transactions and Their Analysis

3. Learning Resources FABM 1 textbook, hand-outs, board work

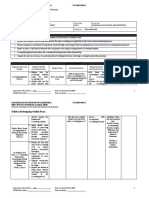

4. Procedures

4.1 Introductory Activity Realia. Show the learners a pencil and ask them to make a “hugot” line using the object

(5 minutes) pencil.

(The pencil has two ends. One end is for writing and the other is for erasure in case of

error).

4.2 Activity

Case for Group Discussion:

(15 minutes) Assume Company A has an outstanding receivable from various customers in the

amount of P80,000. At the end of accounting period, it is estimated that 5% of this is

doubtful of collection.

1. What is the amount of receivable is to be recorded?

2. Is the uncollectible account needs to be recorded? Why?

4.3 Analysis What are the transactions that require adjusting entry? Why do we need to have adjusting

(5 minutes) entries?

4.4 Abstraction

DISCUSSION

(10 minutes) Adjusting entries are journal entries which are to be recorded in the General Journal and

are usually prepared at the end of the accounting period of one year following the

preparation of a trial balance.

The purpose of adjusting entry is to bring records/balances of accounts up-dated and to

properly match revenues and expenses during the period. It is a primary objective to

present a correct financial statement which is truly “test meters” of the financial condition

of the business as of a particular date and the results of operation at the end of

accounting period.

Types of Adjusting Entries:

1. Accruals

2. Deferrals

3. Provision Of Uncollectible Accounts

4. Provision of Depreciation

5. Adjustment of inventory

6. Correction of erroneous journal entry

4.5 Application Board work.Transactions which requires adjusting entries:

(15 minutes) Accruals:

A building owned by Metro Cebu Hotel partly rented by PNB for P50 000 per month

payable every 5th day of the following month. The rental for the month of Dec. 2016 will

be paid on January 2017.

Deferrals:

On October 1, 2016, Cordon Realty Company collected P12 000 from a tenant

representing an advance collection from building rental for one year. The accounting

period ends on Dec. 31, 2016.

4.6 Assessment Ask the learners to reconstruct the wrong entries prepared, the correct

(20 minutes) entries that should be made, and the would-be correcting entries:

1. Payment of rental expense in the amount of P30 000 was erroneously

recorded at P20 000:

Wrong Entry: Correct Entry: Correcting Entry:

____________ ____________ ___________

____________ ____________ ___________

2. Of the recorded interest income amount of P5 000, P3 000 was

unearned at the end of the period:

Wrong Entry: Correct Entry: Correcting Entry:

____________ ____________ ___________

Tests ____________ ____________ ___________

3. 1% of the outstanding receivable account is estimated to be doubtful

of collections.

Wrong Entry: Correct Entry: Correcting Entry:

____________ ____________ ___________

____________ ____________ ___________

4.7 Assignment

Enhancing / improving the day’s lesson

4.8 Concluding Activity “When an engineer commits mistake, a building may collapse. When a lawyer commits

(3 minutes) mistake, his client may go to jail. When a doctor commits mistake, his patient may go 6 ft

below the ground. But when an accountant commits mistake, he must learn how make an

adjusting entry.” - Anonymous

5. Remarks

6. Reflections

A. No. of learners who earned 80% in the C. Did the remedial lessons work? No. of learners who have caught up with the

evaluation. lesson.

B. No. of learners who require additional

D. No. of learners who continue to require remediation.

activities for remediation.

E. Which of my learning strategies worked

well? Why did these work?

F. What difficulties did I encounter which

my principal or supervisor can help me solve?

G. What innovation or localized materials

did I use/discover which I wish to share with

other teachers?

Prepared by:

Name: JUNAR DEE School:

Position/ Designation: T3 Division:

Contact Number: Email address:

You might also like

- A Theory of Cognitive Dissonance (PDFDrive)Document203 pagesA Theory of Cognitive Dissonance (PDFDrive)Cristina NiculescuNo ratings yet

- p5 Module 1Document308 pagesp5 Module 1Md Mahamoodali100% (1)

- Multimodal Text DLPDocument9 pagesMultimodal Text DLPbryllecedric borabienNo ratings yet

- Accounting 11 - Standardized OBE Syllabus - 6 UnitsDocument11 pagesAccounting 11 - Standardized OBE Syllabus - 6 UnitsTess GalangNo ratings yet

- Fundamentals of ABM1Document27 pagesFundamentals of ABM1belle100% (3)

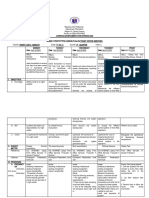

- Daily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayDocument5 pagesDaily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayJovelyn Ignacio VinluanNo ratings yet

- UNIT-2-NOTES - Self Management Skills-IXDocument8 pagesUNIT-2-NOTES - Self Management Skills-IXVaishnavi JoshiNo ratings yet

- Personal DevelopmentDocument29 pagesPersonal Developmentlemar aribalNo ratings yet

- Hca Blueprint SampleDocument11 pagesHca Blueprint Sampleapi-519919545No ratings yet

- DLP in ABMDocument3 pagesDLP in ABMA.No ratings yet

- UNIT PLAN - Principles of Accounts: Unit Topic: Double EntryDocument10 pagesUNIT PLAN - Principles of Accounts: Unit Topic: Double Entryapi-627345932No ratings yet

- Module 1 Packet: College OF CommerceDocument14 pagesModule 1 Packet: College OF CommerceCJ GranadaNo ratings yet

- DLP Fabm 1Document2 pagesDLP Fabm 1Junar DesucatanNo ratings yet

- DLP Business FinanceDocument2 pagesDLP Business FinanceJunar DesucatanNo ratings yet

- Financial Reporting and AnalysisDocument4 pagesFinancial Reporting and Analysisargie alccoberNo ratings yet

- Cot 2Document6 pagesCot 2anamayamigoNo ratings yet

- LANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Document3 pagesLANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Edna MingNo ratings yet

- Fabm1, Q2 WK6Document8 pagesFabm1, Q2 WK6Evelyn Dionisio MabutiNo ratings yet

- Mary The Queen College (Pampanga), Inc.: JASA, San Matias, Guagua, PampangaDocument12 pagesMary The Queen College (Pampanga), Inc.: JASA, San Matias, Guagua, PampangaEy GuanlaoNo ratings yet

- Intermediate Financial Accounting IntroductionDocument14 pagesIntermediate Financial Accounting Introductionyicunz8No ratings yet

- Module 7 Packet: College OF CommerceDocument13 pagesModule 7 Packet: College OF CommerceCJ GranadaNo ratings yet

- Tutoring Services TransactionsDocument2 pagesTutoring Services TransactionsJayMoralesNo ratings yet

- ACCT202 Accounting For Business CombinationsDocument8 pagesACCT202 Accounting For Business CombinationsMiles SantosNo ratings yet

- Accounting 12 Course OutlineDocument3 pagesAccounting 12 Course OutlineKenrose LaguyoNo ratings yet

- FAR 3 Intermediate Accounting I SyllabusDocument8 pagesFAR 3 Intermediate Accounting I SyllabusABMAYALADANO ,ErvinNo ratings yet

- ACCTG 1&2 - Fundamentals of Accounting Part 1Document6 pagesACCTG 1&2 - Fundamentals of Accounting Part 1Leslie Ann Elazegui UntalanNo ratings yet

- Lesson 1-1 - The Nature of Accounting - Q&A (Theories)Document2 pagesLesson 1-1 - The Nature of Accounting - Q&A (Theories)Eliza Jayne Princess VizcondeNo ratings yet

- M.3.1 Noncurrent Asset Held For SaleDocument15 pagesM.3.1 Noncurrent Asset Held For SaleMelita CarriedoNo ratings yet

- San Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentDocument4 pagesSan Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentKhristian Joshua G. JuradoNo ratings yet

- Proposed Review For CAT Level 1 FinalDocument3 pagesProposed Review For CAT Level 1 FinalRheneir MoraNo ratings yet

- 4th Quarter TVL WEEKLY-PROTOTYPE WEEK 2Document6 pages4th Quarter TVL WEEKLY-PROTOTYPE WEEK 2sheryl ann cejudoNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Financial Accounting 1 Course OutlineDocument4 pagesFinancial Accounting 1 Course OutlineFarman AfzalNo ratings yet

- DCP Financial AccountingDocument9 pagesDCP Financial AccountingIntekhab AslamNo ratings yet

- 37 Paper1AccountingModule2Document289 pages37 Paper1AccountingModule2neha mundra100% (1)

- SAP B1 On Cloud - Accounting Information Systems OutlineDocument2 pagesSAP B1 On Cloud - Accounting Information Systems OutlineChristine Jane LaciaNo ratings yet

- ELE UFR Course PlanDocument9 pagesELE UFR Course PlanJaimellNo ratings yet

- Module 4 Packet: College OF CommerceDocument18 pagesModule 4 Packet: College OF CommerceCJ GranadaNo ratings yet

- 15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2Document2 pages15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2sephranesabajoNo ratings yet

- Module Book-Financial AccountingDocument161 pagesModule Book-Financial AccountingJay LimNo ratings yet

- University Mission Statement: Fundamentals of Accountancy, Business & Management 2 Abm - Fabm2Document8 pagesUniversity Mission Statement: Fundamentals of Accountancy, Business & Management 2 Abm - Fabm2kieNo ratings yet

- FAR 1 Financial Accounting and Reporting Redesigning FormDocument6 pagesFAR 1 Financial Accounting and Reporting Redesigning FormJhane MarieNo ratings yet

- IC102 Accounting 1 (Week 7 M3-L3) - HandoutsDocument27 pagesIC102 Accounting 1 (Week 7 M3-L3) - HandoutsLj TvNo ratings yet

- FORE School of Management Course Outline & Session PlanDocument4 pagesFORE School of Management Course Outline & Session PlanAru RanjanNo ratings yet

- Mary The Queen College (Pampanga), Inc.: JASA, San Matias, Guagua, PampangaDocument11 pagesMary The Queen College (Pampanga), Inc.: JASA, San Matias, Guagua, PampangaAllain GuanlaoNo ratings yet

- Lesson Plan Accounting For A Service Proprietorship Stage 2 - 1Document5 pagesLesson Plan Accounting For A Service Proprietorship Stage 2 - 1adhikari.2861No ratings yet

- Basic Acctg - Course TitleDocument3 pagesBasic Acctg - Course TitleMerdzNo ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Accounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDocument2 pagesAccounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDING ZHONG JUNNo ratings yet

- 4th Quarter TVL WEEKLY-PROTOTYPE WEEK 1Document7 pages4th Quarter TVL WEEKLY-PROTOTYPE WEEK 1sheryl ann cejudoNo ratings yet

- Toaz - Info Ae 17 m8 Cash Amp Accrual Basis PRDocument15 pagesToaz - Info Ae 17 m8 Cash Amp Accrual Basis PRloyd smithNo ratings yet

- AEP101 Accounting Enhancement Program Financial Accounting and ReportingDocument6 pagesAEP101 Accounting Enhancement Program Financial Accounting and ReportingMiles SantosNo ratings yet

- Fundamentals of Accounting I Course OutlineDocument2 pagesFundamentals of Accounting I Course OutlineDuba JarsoNo ratings yet

- Chart of AccountsDocument4 pagesChart of AccountsSHIERY MAE FALCONITINNo ratings yet

- Work Program: Company Section Year: Risks Audit Objectives Audit Steps/Tests Working Paper RefDocument2 pagesWork Program: Company Section Year: Risks Audit Objectives Audit Steps/Tests Working Paper RefChinh Le DinhNo ratings yet

- Module 5 Packet: College OF CommerceDocument16 pagesModule 5 Packet: College OF CommerceCJ GranadaNo ratings yet

- Syllabus Principle AccountingDocument6 pagesSyllabus Principle AccountingdimazNo ratings yet

- SAS#5-ACC104 With AnswerDocument9 pagesSAS#5-ACC104 With AnswerartificerrrrNo ratings yet

- Daily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayDocument4 pagesDaily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayJovelyn Ignacio VinluanNo ratings yet

- Course Plan - CA51024 - AY2021-2022Document10 pagesCourse Plan - CA51024 - AY2021-2022Jaimell LimNo ratings yet

- Advanced Accounting 1Document4 pagesAdvanced Accounting 1Ronn CaiNo ratings yet

- Bacolod City College Bsit Department Course SyllabusDocument5 pagesBacolod City College Bsit Department Course SyllabusMarvin RamirezNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Crash Course Psychology #2Document30 pagesCrash Course Psychology #2Rocelle AlcaparazNo ratings yet

- Lesson 5 Methods of Collecting DataDocument12 pagesLesson 5 Methods of Collecting DatakateaubreydemavivasNo ratings yet

- Supervisor Obs 1 Level 4Document7 pagesSupervisor Obs 1 Level 4api-608952926No ratings yet

- DLL - Mathematics 5 - Q3 - W9.1Document9 pagesDLL - Mathematics 5 - Q3 - W9.1Mary Grace Amador Corto-VillanuevaNo ratings yet

- Listening 3Document11 pagesListening 3api-668040555No ratings yet

- Gestalt TheoryDocument39 pagesGestalt TheoryAl PilakNo ratings yet

- Psychology FY23-24 Class 12 Rehearsal Question PaperDocument4 pagesPsychology FY23-24 Class 12 Rehearsal Question PapervanshNo ratings yet

- Celf 5 Case Study ElisaDocument3 pagesCelf 5 Case Study ElisaT.K.D T.K.DNo ratings yet

- FS2 Le12Document2 pagesFS2 Le12Jorebell W. QuiminoNo ratings yet

- Psych Notes & Lecture From Chap 1Document8 pagesPsych Notes & Lecture From Chap 1annNo ratings yet

- Universal Human Values and Professional Ethics Unit 1 2023Document19 pagesUniversal Human Values and Professional Ethics Unit 1 2023GAURAV SHARMANo ratings yet

- Applied LinguisticsDocument6 pagesApplied LinguisticsMuhammad IbrahimNo ratings yet

- Decision Making SkillsDocument14 pagesDecision Making SkillssurNo ratings yet

- Oral CommunicationDocument1 pageOral CommunicationPASTEURSYNCH GELBOLINGO, ERNIE IINo ratings yet

- Module 2 Ed 10Document11 pagesModule 2 Ed 10Marnelle Joy VillanuevaNo ratings yet

- TPACKDocument13 pagesTPACKRabiatul AliahNo ratings yet

- LP 7HQ Unit 8 Speaking (p2)Document3 pagesLP 7HQ Unit 8 Speaking (p2)Huyen CanNo ratings yet

- Ep 2Document6 pagesEp 2Cyrille LaurinoNo ratings yet

- Semi Detailed Lesson Plan in English Lesson 7 Talented TooDocument5 pagesSemi Detailed Lesson Plan in English Lesson 7 Talented TooMarievic FabrosNo ratings yet

- INGLES DestrezasDocument39 pagesINGLES Destrezasdave stanley iguasnia palominoNo ratings yet

- Literacy Across The Curri ManualDocument18 pagesLiteracy Across The Curri ManualJoshua Mante Wilson JuniorNo ratings yet

- Kindergarten DLP Week 123455Document95 pagesKindergarten DLP Week 123455Jyrah PamaNo ratings yet

- Educ 61 Module 5 ActivityDocument4 pagesEduc 61 Module 5 ActivityMitchille GetizoNo ratings yet

- Review Quiz Key AnswersDocument3 pagesReview Quiz Key AnswersRovie John CordovaNo ratings yet

- ACTION RESEARCH Final Na UntaDocument9 pagesACTION RESEARCH Final Na UntaWilliam VincentNo ratings yet

- Checklist Example Completed Uk 2018Document14 pagesChecklist Example Completed Uk 2018Jo LiemNo ratings yet