Professional Documents

Culture Documents

Affidavit Income Not Exceeding 3M 2022 TEMPLATE

Affidavit Income Not Exceeding 3M 2022 TEMPLATE

Uploaded by

danilotinio2Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affidavit Income Not Exceeding 3M 2022 TEMPLATE

Affidavit Income Not Exceeding 3M 2022 TEMPLATE

Uploaded by

danilotinio2Copyright:

Available Formats

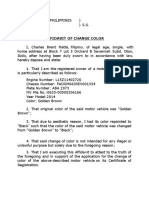

ANNEX “B-1”

INCOME PAYEE’S SWORN DECLARATION OF GROSS RECEIPTS/SALES

(For Self-Employed and/or Engaged in the Practice of Profession with Several Income Payors)

I, ___________________________________________, Filipino, of legal age, married to

________________________________________________ permanently residing at __________________________________________

with Tax Identification Number (TIN) 000-000-000, after having been duly sworn in accordance with law

hereby depose and state:

1. That I derived my professional income from various income payors, and my registered business address is at Baluarte, Gapan

City, Nueva Ecija.

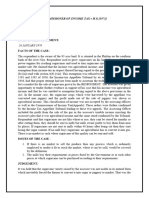

2. That for the current year 2022, my gross receipts will not exceed Three Million Pesos (₱3,000,000) and that I am a non-VAT

registered taxpayer. For this purpose, I opt to avail of either one of the income tax regime as follows:

Graduated Income Tax Rates under Section 24(A)(2)(a) of the Tax Code, as amended, based on the taxable

income. With this selection, I acknowledge that I am subject to creditable withholding tax at the prescribed

rate; subject to percentage tax and will file the required percentage tax returns or subject to withholding

percentage tax, in case of government money payments.

Eight Percent (8%) income tax rate under Section 24(A)(2)(b) of the Tax Code, as amended, based on gross

receipts/sales and other non-operating income - with this selection, I understand that this is in lieu of the

graduated income tax rates and the Percentage Tax under Section 116 of the Tax Code, as amended; thus,

only the creditable income withholding tax based on the prescribed rate shall be made;

3. That based on my selection above, if my gross sales/receipts and other non-operating income exceeds ₱3,000,000, my

income payor /withholding agents shall automatically withhold the higher rate of withholding of ten percent (10%) in

the case of income items with two (2) prescribed creditable withholding tax rate depending on the total amount of income

payment received:

a. In case of Graduated Income Tax Rates, I acknowledge that aside from income tax, I am subject to business

tax (VAT) unless expressly exempted; and consequently subject to withholding of income. Moreover, if the

payor is a government entity, business tax withholding applies; OR

b. In case of Eight Percent (8%) income tax rate, I acknowledge that I am no longer qualified to avail of this

option since my income exceeds ₱3,000,000 and thus, the graduated income tax rates above shall

automatically apply together with the consequent liability for business tax/es;

4. That I duly execute this SWORN DECLARATION in compliance with the requirement prescribed under Section 2.57.2 of

Revenue Regulations No. 11-2018;

5. That I declare, under the penalties of perjury, that this declaration has been made in good faith, and to the best of my

knowledge and belief to be true and correct.

IN WITNESS WHEREOF, I have hereunto set my hand this 6th day of January, 2022 at Gapan City, Philippines

NAME

__________________________________________

Signature over Printed Name of Individual Taxpayer

SUBSCRIBED AND SWORN to before me this _____ day of ____________, 20___ in _______________________________. Applicant

exhibited to me her Driver’s License Number C05-18-019600 with expiration date of March 14, 2023 issued at Cabanatuan City.

NOTARY PUBLIC

Doc. No.: __________

Page No.: __________

Book No.: __________

Series of ___________

Affix ₱30.00

Documentary

Stamp Tax

(To be filled-out by the withholding agent/lone payor)

Date Received: __________________ Received by:

(MM-DD-YYYY)

_____________________________________________________________

Signature over Printed Name of the Withholding Agent/Payor or Authorized Officer

_____________________________________________________________

Designation/Position of Authorized Officer

_____________________________________________________________

Name of Withholding Agent/Lone Payor

You might also like

- Annex B-2Document1 pageAnnex B-2Von Virchel VallesNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Petrovich100% (1)

- BIR Form 1906 - Application For ATPDocument1 pageBIR Form 1906 - Application For ATPMonica SorianoNo ratings yet

- RMC No. 15-2020 Annex ADocument3 pagesRMC No. 15-2020 Annex AKen Manacmul100% (1)

- The Revised Corporation Code of The Philippines. Book of Atty. Domingo 1Document75 pagesThe Revised Corporation Code of The Philippines. Book of Atty. Domingo 1Tricia Angel P. Bantigue100% (1)

- Deed of Absolute Sale Including FranchiseDocument2 pagesDeed of Absolute Sale Including FranchiseJOBS MANILATRANS100% (1)

- ARTA - Memorandum Circular 2020-05, Rules of Procedures For Complaints Handling and ResolutionDocument47 pagesARTA - Memorandum Circular 2020-05, Rules of Procedures For Complaints Handling and ResolutionLLDA PPIMD100% (3)

- Statement of ManagementDocument7 pagesStatement of ManagementlorraineNo ratings yet

- Affidavit: Renewal of Regular Contractor'S License ApplicationDocument2 pagesAffidavit: Renewal of Regular Contractor'S License ApplicationkitNo ratings yet

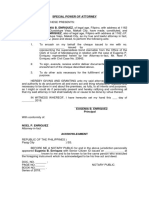

- Special Power of Attorney To All These PresentsDocument3 pagesSpecial Power of Attorney To All These PresentsJoyce Amara VosotrosNo ratings yet

- Onett Computation SheetDocument1 pageOnett Computation SheetBreahziel ParillaNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneyJhona BalerosNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyKatherine Janice De Guzman-Pine100% (1)

- Omnibus Sworn StatementDocument2 pagesOmnibus Sworn StatementMac Kevin Olivar100% (1)

- Release and QuitclaimDocument2 pagesRelease and QuitclaimMeg LeeNo ratings yet

- SPECIAL POWER OF ATTORNEY - Closure of BusinessDocument1 pageSPECIAL POWER OF ATTORNEY - Closure of Businesslizlieh dianne caneteNo ratings yet

- Affidavit of Change ColorDocument2 pagesAffidavit of Change ColorKatherine B. AquinoNo ratings yet

- Included Individual TAMP Dec 16 2019Document6 pagesIncluded Individual TAMP Dec 16 2019CROCS Acctg & Audit Dep'tNo ratings yet

- Special Power of Attorney: HEREBY GIVING AND GRANTING Unto My Said Attorney-In-Fact Full PowersDocument4 pagesSpecial Power of Attorney: HEREBY GIVING AND GRANTING Unto My Said Attorney-In-Fact Full Powersmarvin pulidoNo ratings yet

- F.1 Consumer Network (ConsumerNet) PDFDocument14 pagesF.1 Consumer Network (ConsumerNet) PDFFritz CarpenteroNo ratings yet

- SPECIAL POWER OF ATTORNEY Senior CitizenDocument1 pageSPECIAL POWER OF ATTORNEY Senior CitizenDave AguilarNo ratings yet

- DENREU Consti and by Laws FINALDocument10 pagesDENREU Consti and by Laws FINALVivian Escoto de BelenNo ratings yet

- ACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoDocument1 pageACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoLizanne GauranaNo ratings yet

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- Special Power of Attorney - TemplateDocument2 pagesSpecial Power of Attorney - TemplateDecyrose PapaNo ratings yet

- CHEM RAAC MARKETING RecieptDocument1 pageCHEM RAAC MARKETING RecieptPrecilla Halago100% (1)

- Lease Agreement For Parking in The PhilippinesDocument1 pageLease Agreement For Parking in The PhilippinesEmily Esguerra VerdeNo ratings yet

- Saln PPT 2018Document36 pagesSaln PPT 2018Prince Genesis G. Gunhuran100% (1)

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraNo ratings yet

- Appendix 42 - Lddap-AdaDocument1 pageAppendix 42 - Lddap-AdaRogie Apolo100% (1)

- Sworn Statement-Bir - Loose LeafDocument1 pageSworn Statement-Bir - Loose LeafEkeena LimNo ratings yet

- Statement of Willingness To Be AuditedDocument15 pagesStatement of Willingness To Be AuditedJImlan Sahipa IsmaelNo ratings yet

- Application-for-Business-Retirement in MuntinlupaDocument1 pageApplication-for-Business-Retirement in MuntinlupajoycegNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossAdvancekonek CorpNo ratings yet

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- COA Decision Re: Splitting of ContractsDocument9 pagesCOA Decision Re: Splitting of ContractsNadine DiamanteNo ratings yet

- Special Power of Attorney: Legal Age, American, Single, With Residence at 21535 Roscoe Blvd. 220, Canoga Park, CaDocument3 pagesSpecial Power of Attorney: Legal Age, American, Single, With Residence at 21535 Roscoe Blvd. 220, Canoga Park, CaLeo Archival ImperialNo ratings yet

- Omnibus Sworn Statement SampleDocument2 pagesOmnibus Sworn Statement SampleOj Eiram Socong100% (1)

- Certification by Company PresidentDocument1 pageCertification by Company PresidentSammy EscañoNo ratings yet

- CS Form No. 7 Clearance Form SampleDocument6 pagesCS Form No. 7 Clearance Form SampleAbigail BrillantesNo ratings yet

- Affidavit of ClosureDocument1 pageAffidavit of ClosureManny SandichoNo ratings yet

- SSS Condonation - Promissory NoteDocument1 pageSSS Condonation - Promissory NoteMary AnnNo ratings yet

- Decision No. 2018-294 DTD March 15 2018 PDFDocument6 pagesDecision No. 2018-294 DTD March 15 2018 PDFAnj EboraNo ratings yet

- Request LetterDocument1 pageRequest LetterDaryl YuNo ratings yet

- SPA For Noel Enriquez Encash CheckDocument1 pageSPA For Noel Enriquez Encash CheckPatrick PenachosNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyMA. JEANETTE TOLENTINO100% (1)

- Special Power of Attorney: Know All Men These PresentsDocument2 pagesSpecial Power of Attorney: Know All Men These Presentscris jaluageNo ratings yet

- Board Resolution Ack PDFDocument3 pagesBoard Resolution Ack PDFJassey Jane OrapaNo ratings yet

- SPA Tax DecDocument2 pagesSPA Tax DecPrince Conciso AgudoNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Deed of Sale of MotorcycleDocument1 pageDeed of Sale of MotorcycleKristianne SipinNo ratings yet

- Contract of SubscriptionDocument2 pagesContract of SubscriptionLei CGNo ratings yet

- TEMPLATE Certificate of No Pending CaseDocument1 pageTEMPLATE Certificate of No Pending CaseJazzera MustaphaNo ratings yet

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth InuiNo ratings yet

- Withdrawal Record Form-2018 PDFDocument1 pageWithdrawal Record Form-2018 PDFWillard FuchigamiNo ratings yet

- Special Power of Attorney: PagesDocument1 pageSpecial Power of Attorney: PagesAbel Montejo100% (1)

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneyJay Mark DimaanoNo ratings yet

- Temporary ReceiptsDocument2 pagesTemporary ReceiptsPatricia Nicole ElediaNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Jennilyn Eve ReyegNo ratings yet

- Special Civil Actions Cases (Full Texts)Document615 pagesSpecial Civil Actions Cases (Full Texts)April Lynn Ursal-BelciñaNo ratings yet

- Civil Law Review I (Case Digests)Document259 pagesCivil Law Review I (Case Digests)April Lynn Ursal-BelciñaNo ratings yet

- Evidence Case PrinciplesDocument18 pagesEvidence Case PrinciplesApril Lynn Ursal-BelciñaNo ratings yet

- Civil Procedure Case PrinciplesDocument33 pagesCivil Procedure Case PrinciplesApril Lynn Ursal-BelciñaNo ratings yet

- Criminal Procedure Case PrinciplesDocument17 pagesCriminal Procedure Case PrinciplesApril Lynn Ursal-BelciñaNo ratings yet

- Corporation Law (Notes)Document33 pagesCorporation Law (Notes)April Lynn Ursal-Belciña100% (1)

- Bir Form 1701Q: Creditable Income Taxes Withheld (Expanded) )Document3 pagesBir Form 1701Q: Creditable Income Taxes Withheld (Expanded) )April Lynn Ursal-BelciñaNo ratings yet

- AFFIDAVIT (Certification of Total Landholdings)Document2 pagesAFFIDAVIT (Certification of Total Landholdings)April Lynn Ursal-BelciñaNo ratings yet

- Affidavit of Termination of Employment (OFWs)Document7 pagesAffidavit of Termination of Employment (OFWs)April Lynn Ursal-BelciñaNo ratings yet

- Afpmbai Release, Waiver & QuitclaimDocument1 pageAfpmbai Release, Waiver & QuitclaimApril Lynn Ursal-BelciñaNo ratings yet

- AFFIDAVIT (Certification of No Improvement)Document1 pageAFFIDAVIT (Certification of No Improvement)April Lynn Ursal-BelciñaNo ratings yet

- AFFIDAVIT of UNDERTAKING (Softouch Property Development Corp.)Document1 pageAFFIDAVIT of UNDERTAKING (Softouch Property Development Corp.)April Lynn Ursal-BelciñaNo ratings yet

- Presented by Chinnu Gigi Roll No. 10 S1 Mtech CeDocument12 pagesPresented by Chinnu Gigi Roll No. 10 S1 Mtech Cechinnu gigiNo ratings yet

- Income Taxation PDFDocument103 pagesIncome Taxation PDFjanus lopezNo ratings yet

- Mega Marathon Direct Tax. YtDocument257 pagesMega Marathon Direct Tax. Ytsubroshakar gamerNo ratings yet

- Residential ChapterDocument34 pagesResidential ChapterManohar LalNo ratings yet

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarNo ratings yet

- Withholding Tax (Eng)Document10 pagesWithholding Tax (Eng)WN TV programsNo ratings yet

- Air Canada V CIR: This Code, A Corporation OrganizedDocument3 pagesAir Canada V CIR: This Code, A Corporation OrganizedJasper Alon100% (1)

- Ona v. CIRDocument2 pagesOna v. CIRCarlota Nicolas Villaroman100% (1)

- DST On Policy Holders Registered With PEZADocument5 pagesDST On Policy Holders Registered With PEZACkey ArNo ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- Tax Card Moldova EN 2023Document20 pagesTax Card Moldova EN 2023VNo ratings yet

- ITAD BIR Ruling 024-11 DirectorsfeesDocument3 pagesITAD BIR Ruling 024-11 DirectorsfeesKathyrn Ang-ZarateNo ratings yet

- Child Benefit - Getting Your Claim Right: Use These Notes To Help YouDocument8 pagesChild Benefit - Getting Your Claim Right: Use These Notes To Help YouolusapNo ratings yet

- Fit Income TaxDocument8 pagesFit Income TaxadrianoedwardjosephNo ratings yet

- Ramnani v. CTADocument6 pagesRamnani v. CTAhellomynameisNo ratings yet

- Fundamental TaxDocument82 pagesFundamental Taxjessejames.supangNo ratings yet

- BLT 2012 Final Pre-Board April 21Document17 pagesBLT 2012 Final Pre-Board April 21Lester AguinaldoNo ratings yet

- Tax 2 AndreaDocument54 pagesTax 2 AndreaIsidore Tarol IIINo ratings yet

- COMMISSIONER OF INCOME TAX V H.GDocument2 pagesCOMMISSIONER OF INCOME TAX V H.GroshaniNo ratings yet

- Tax Collection at SourceDocument17 pagesTax Collection at SourceAARCHI JAINNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- RR 15-2013Document4 pagesRR 15-2013crazykid12345No ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Tax 2 - Compilation - Case DigestDocument51 pagesTax 2 - Compilation - Case DigestAndrea Patricia DaquialNo ratings yet

- Module No 7 - Exclusions From Gross IncomeDocument6 pagesModule No 7 - Exclusions From Gross IncomeLysss Epssss100% (1)

- PGDT July 2006Document99 pagesPGDT July 2006Majanja AsheryNo ratings yet

- Tax AnswersDocument168 pagesTax AnswersukqrnnnjhfwsxqoykuNo ratings yet

- Institute of Chartered Accountants of Nigeria Taxation APRIL 2019 Pilot Questions Section A Multiple-Choice QuestionsDocument16 pagesInstitute of Chartered Accountants of Nigeria Taxation APRIL 2019 Pilot Questions Section A Multiple-Choice QuestionsEmmanuel ObafemmyNo ratings yet

- May 2018 SGV SDGSDDocument26 pagesMay 2018 SGV SDGSDBien Bowie A. CortezNo ratings yet

- Final Income Taxation: Lesson 5Document28 pagesFinal Income Taxation: Lesson 5lc50% (4)