Professional Documents

Culture Documents

Market Commentary 27mar11

Uploaded by

AndysTechnicalsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Commentary 27mar11

Uploaded by

AndysTechnicalsCopyright:

Available Formats

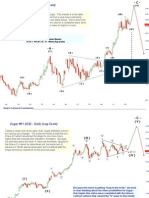

Apple ~ Daily with RSI and Support REPRINTED from 2/21/2011

The reason why we occasionally think about Apple is because it is the Maybe a H&S forming here?

“vanguard” of the large corrective move that began in Mar ‘09. “Everyone”

is long Apple and the company has 100% Brand recognition--nobody is

unfamiliar with the Apple “story.”

A month ago, we pointed out the critical support at 320-322 for Apple. It held that

area nicely and produced another new high. However, it triggered very sharp Daily

RSI divergence in doing so and is now on short term support at 348. A break of

348 should cause AAPL to trade down to 326, the next level of support.

Andy’s Technical Commentary__________________________________________________________________________________________________

Apple ~ Daily with Support

Head?

Right

Left Shoulder?

Shoulder?

$326 - $318

Over a month ago we brought up the possibility of a Head and Shoulder pattern

forming and pointed out the $326 support. Since then, APPLE has done nothing

to disappoint that concept. We continue to keep a sharp on eye on Apple as the

“vanguard” of the entire Stock Market. There is no point in getting very bearish

the equity markets UNTIL Apple takes out the key support zone of $326-318.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500: Weekly (Log Scale)

We continue to believe that the 1344 concluded a Minor degree “y” wave and that an “x” wave will be

unfolding for at least the next several weeks. The exact “wave form” of the “x” wave cannot yet be

determined. Over the last few months, the 1226 level has been highlighted as important technical ( B )?

support. That level was nearly tested a few weeks ago with the SP500 bottoming at 1249 on the cash “y” “z”?

index. 1226 will ultimately be tested again, but that level is probably a “buy” on the first go around. 1344

1226

“w” “x”

“x”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

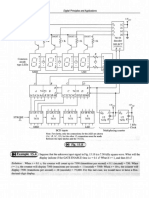

S&P 500: Daily (Log Scale)

“y”

1344 b

-c-

-b-

-a-

-a-

-b-

1226 -c-

a

c

“x”

As was pointed out on the previous slide, the exact wave pattern of the “x” wave is

open to debate as it’s early in the progression. Highlighted above would be my

“guess” as to the future. Though, confidence is low in this wave count.

“x”

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500: 60 minute with Weekly Support and Resistance

Highlighted here is a closer look at my “guess” at the wave count down from 1344--it looks like a classic

“y” zig-zag lower. The recent move higher has been very sharp and powerful which suggests it’s only the first

1344 wave up of a larger correction. In the very short term, the S&P 500 seems vulnerable to a large degree of

sideways “choppiness.”

-b-

(2) -a-

(1) (4)

[2]

(3)

-a- [4]

[1]

-b-

[3]

[5]

(5)

-c-

a

Andy’s Technical Commentary__________________________________________________________________________________________________

Silver - Monthly (Log Scale)

This much longer term picture sums up the story of Silver for now. $41.50 was the high tick and $35.75 was the high ‘monthly

close’ from the Hunt Brothers’ “trade.” Silver is currently hanging out in the middle of a HUGE zone of longer term resistance. It

would be a surprise if Silver doesn’t experience some kind of decent retracement from this important zone.

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold - Weekly (Log Scale)

This is just a “quick” glance at Silver’s more revered brother, Gold. It’s been

maintaining a very nice trend line (green dashed) since early 2009 but might be

running out of steam (last close $1426/oz). A weekly close that either breaks

that green trendline or the $1,339/oz level should be considered bearish longer

term. Until then, though, stay away.

1339

Andy’s Technical Commentary__________________________________________________________________________________________________

Copper - Weekly (Log Scale)

Copper has taken some body blows recently, but the pattern lower can best be described as

“corrective.” Also, as long as Copper can continue to close above $4.00, this is a bullish picture.

Longer term copper “believers” might want to use $4.00 and $3.59 as major longer term support,

with $4.00 being much more important support.

$4.00/lb

$3.59/lb

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil - 120 minute continuation Head?

Left Shoulder?

This is just a quick glance at Crude oil’s intraday patterns. There is nothing bearish here. This

market appears to be congesting nearer the highs. Bears will be hoping for a “double top,” but

given the choppiness near the highs, my bet would be a “new high” near $110/bbl. Bulls should use

$103.35 area as support for “stop loss” strategies because there isn’t another good level of support

until $96.22.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Market Commentary 10apr11Document12 pagesMarket Commentary 10apr11AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Market Update 27 June 10Document9 pagesMarket Update 27 June 10AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- S&P 500 Update 18 Apr 10Document10 pagesS&P 500 Update 18 Apr 10AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Writing and Graphing Equations of HyperbolasDocument9 pagesWriting and Graphing Equations of HyperbolasMOHSANH SALEM ABDALLRAHMAN AL HAMEDNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Market Commentary 27feb11Document12 pagesMarket Commentary 27feb11AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- CGR MicroprojectDocument21 pagesCGR MicroprojectAbhijit KulkarniNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- Market Discussion 23 Jan 11Document10 pagesMarket Discussion 23 Jan 11AndysTechnicalsNo ratings yet

- Digital Principles and Application by Leach & Malvino-586-612Document27 pagesDigital Principles and Application by Leach & Malvino-586-612Awalia RahmanNo ratings yet

- NEoWave S&PDocument1 pageNEoWave S&PshobhaNo ratings yet

- FOIA Unmasking Gen FlynnDocument217 pagesFOIA Unmasking Gen FlynnBenjamin HobbsNo ratings yet

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- +2 Unit 8 Combo TMDocument27 pages+2 Unit 8 Combo TMKeerthana EasunathanNo ratings yet

- Jaideep Singh 300196010Document19 pagesJaideep Singh 300196010vrdikshitNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- Type-Finder: InternationalDocument256 pagesType-Finder: Internationalalciragra100% (1)

- 40 Techniques Full TabDocument8 pages40 Techniques Full TabGiannis KarambatsosNo ratings yet

- SSC Junior Engineer Civil & Structural Engineering RecruitmentDocument430 pagesSSC Junior Engineer Civil & Structural Engineering Recruitmentసురేంద్ర కారంపూడిNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- Column & Wall Ground Floor Plan: Mặt Bằng Cột Vách Tầng TrệtDocument1 pageColumn & Wall Ground Floor Plan: Mặt Bằng Cột Vách Tầng TrệtLê Minh HiếuNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- MAGNAT MA800 Stereo Hybrid-Amplifier SchematicDocument11 pagesMAGNAT MA800 Stereo Hybrid-Amplifier SchematicGlenn DharminNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Emotive MelodyDocument8 pagesEmotive MelodySilvano AndradeNo ratings yet

- Chapter 11 Project Risk ManagmentDocument24 pagesChapter 11 Project Risk ManagmentFutaim RashidNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Test Bank For Money Banking and The Financial System 3rd Edition R Glenn Hubbard Anthony Patrick ObrienDocument39 pagesTest Bank For Money Banking and The Financial System 3rd Edition R Glenn Hubbard Anthony Patrick Obrienleightonlandf6gr5No ratings yet

- Foreign Exchange RiskDocument18 pagesForeign Exchange RiskAyush GaurNo ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- Mark Property Tax ReceiptDocument2 pagesMark Property Tax Receiptpeterson greyNo ratings yet

- Abhishek Blackbook FinalDocument95 pagesAbhishek Blackbook Final8784No ratings yet

- CAPE U1 Preparing Financial Statemt IAS 1Document34 pagesCAPE U1 Preparing Financial Statemt IAS 1Nadine DavidsonNo ratings yet

- Government and Legal Environment (Part-2)Document14 pagesGovernment and Legal Environment (Part-2)Darshan MNo ratings yet

- Production and Cost Analysis BreakdownDocument24 pagesProduction and Cost Analysis BreakdownSandara beldoNo ratings yet

- Test Bank For Retailing Management 8th Edition LevyDocument41 pagesTest Bank For Retailing Management 8th Edition Levydelphianimpugnerolk3gNo ratings yet

- Property, Plant and Equipment (IAS-16)Document2 pagesProperty, Plant and Equipment (IAS-16)Raneem BilalNo ratings yet

- g1 - Hss3013 Presentation in English (British Presence To India)Document26 pagesg1 - Hss3013 Presentation in English (British Presence To India)veniNo ratings yet

- What is GLOBALIZATIONDocument112 pagesWhat is GLOBALIZATIONChelsa BejasaNo ratings yet

- ENGG ECON Part1Document32 pagesENGG ECON Part1ShaneP.HermosoNo ratings yet

- Labeling, Packaging, Packing and Marking GoodsDocument18 pagesLabeling, Packaging, Packing and Marking GoodsAreej Aftab SiddiquiNo ratings yet

- Trade Finance Pricing GuideDocument4 pagesTrade Finance Pricing GuideKhangNo ratings yet

- Hp3eoutest Unit 9Document5 pagesHp3eoutest Unit 9Minh ThiệnNo ratings yet

- International Trade Theories in 40 CharactersDocument22 pagesInternational Trade Theories in 40 Characterskirthi nairNo ratings yet

- Modren Quantity Theory of Money Ugc Net Economics IAS Economics Mains Ma Entrance Econ9micsDocument7 pagesModren Quantity Theory of Money Ugc Net Economics IAS Economics Mains Ma Entrance Econ9micsNaresh SehdevNo ratings yet

- P&G Distribution Channel System ExplainedDocument13 pagesP&G Distribution Channel System Explainedmaaz ahmedNo ratings yet

- Invoice 5432Document1 pageInvoice 5432FourBugNo ratings yet

- Adeola Full ChaptersDocument66 pagesAdeola Full ChaptersStanley DavidNo ratings yet

- BIVAC N.A. - BUREAU VERITAS (Louisiana) - VOCDocument2 pagesBIVAC N.A. - BUREAU VERITAS (Louisiana) - VOCSCOOPER9No ratings yet

- Freight Forwarding AgreementDocument47 pagesFreight Forwarding AgreementJonathan StrassbergNo ratings yet

- Zrvi 39Document254 pagesZrvi 39tjordNo ratings yet

- Money Market Hedges-PaymentDocument3 pagesMoney Market Hedges-PaymentMoud KhalfaniNo ratings yet

- Direct Finance Lease - LessorDocument16 pagesDirect Finance Lease - LessorChuckay SealedNo ratings yet

- The Contemporary World NotesDocument10 pagesThe Contemporary World NotesKate ClomaNo ratings yet

- 5&6. Measuring Nation's IncomeDocument44 pages5&6. Measuring Nation's IncomeJoan KeziaNo ratings yet

- Trade War Between US and China - Docx-2Document32 pagesTrade War Between US and China - Docx-2Khanh Linh HoangNo ratings yet

- ResearchhhhDocument21 pagesResearchhhhRomnel SeguiNo ratings yet