Professional Documents

Culture Documents

Market Update 27 June 10

Uploaded by

AndysTechnicalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Update 27 June 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

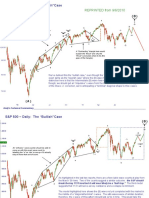

S&P 500 Daily - The 23.6%/61.

8% Retracements and Possible H&S

Head?

Left

Right

Shoulder?

Shoulder

Forming?

I’ve now seen this Head and Shoulder setup talked about in many different “widely-viewed”

blogs, which makes me very nervous about it’s prospects. That stated, the 23.6%

retracement has been violated, which opens the door for a full-blown 61.8% retracement to

878. Interestingly, that level lines up with previous important inflection points.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Weekly - 13, 34 and 55 Week Exponential Moving Averages

Bearish

“cross”

The “blunt” tool of moving average analysis gives us a similar picture of a market trend that

has turned lower. The 13 and 34 weekly EMAs have crossed in a bearish way and the 55

Bullish Week EMA is now being violated again to the downside. This whole picture looks bearish.

“cross”

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 June e-Minis ~ (60 min.): One More Rush before Collapse

“y” At this point, there are various possible models that are all legitimate.

Therefore, clarity in the short term is going to be lacking. Presented here is

the most straightforward counting of the price action. A “ b ” wave following a

zig-zag (or flat) should retrace 60-80% of the “ a ” wave. Therefore, price

targets of 1138 and 1159 are not a “reach” under this model. They are

b targets that SHOULD be reached if this count is correct.

-2-

-1-

-2-

“b”

-4-

Reprinted from 6/13/10

-1-

a -b-

-3-

-3-

-5-

a -4-

-1-

TARGETS

1111 for 100% of a=c

-a-

1138 for 138% of a=c

-3-

1159 for 162% of a=c

-2-

-c-

-5-

b

c

“a”

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (180 min.)

“y”

b

-2-

-1- “b”

-2- w y

-4- -c-

-1-

-3- (b)

-a-

-4-

-5-

a

(a)

x

-3-

This doesn’t count well

-5- (c) as an “impulse.”

-b-

c

“a”

Because the most recent decline (x-wave here) does not count out well as an “impulse,” I must go with this type of

model. It suggest that this current “b” wave has a little more time before completed. This seems consistent with the “c”

tendency of the market not to collapse right before the end or beginning of the quarter. Afterall, why would the

market collapse before the new fund flows come in? Mr. Market seeks maximum pain for the most number of

people.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (180 min.)

“y”

b

-2-

-1-

“x”

-2- c

-4-

b

-3-

-1- a

-4-

-5-

a

a

-3-

-5- b

c

“w”

c

“y”

(A)

This would also be a completely legitimate account of the price action. I favor the previous slide, though, because it

calls for more price action. If there’s a way for a wave to last longer, then it’s probably best to assume it will. What’s

interesting about this model is that it would SCREW everyone counting on the Head and Shoulders scenario. This

price action would break the neckline and trigger the proposed H&S top, only to disappoint all the new shorts as we

would likely be completing an Intermediate (A) Wave.

Andy’s Technical Commentary__________________________________________________________________________________________________

This less bullish count cannot be ruled out. In many ways it reaches a similar

Dollar Index (Daily) conclusion to the other model in the sense that we have a larger pattern conclusion

coming. However this count implies that the move should be over very soon and

does not target anywhere near the 92-94 zone. In the longer term, both of these

models remain bullish.

“b” “d”

89.62 e?

(A) Bears will be hoping for a “double top” to hang their hat on.

WIDE SPREAD

PANIC (C)

Reprinted from 6/6/10

The clear a-c line break required of

an “expanding” triangle.

“e”

x c (B)

d

a

w x

77.69

“a”

b

y

74.33

z of “c”

Andy’s Technical Commentary__________________________________________________________________________________________________

This is my primary count on the DXY at this point. The “c” wave down was very difficult to count

Dollar Index (Weekly) as an impulse. The individual legs of the of the “d” wave up were very difficult to count as

impulses as well. Therefore, this is the model that remains. It suggests we should see a

corrective move lower, with the high 82 area looking like a decent target. When this completes,

we should see a very powerful move higher.

“b” “d” WIDE SPREAD

89.62 PANIC (C)

(A) e

88.71

c 82.87??

x “e”

d

(B)

a

x

w

77.69

“a”

b

y

74.33

z of “c”

82.87 would be a 38.2% of “c”=“e” target.

Andy’s Technical Commentary__________________________________________________________________________________________________

The risk to the previous count is that DXY simply does not make for “clean” impulsions due to it’s

Dollar Index (Weekly) composition and hours of trading.* If we were to abandon stricter counting principles, we might

come up with a count like this one. The implications here are that we only finished the first wave of

an Intermediated (C) wave. Because the Wave “1” was a fifth extension, the Wave-4 low should be

considered key support. The implications of this count and the previous page are very similar.

“b” “1” WIDE SPREAD

89.62 PANIC “3” of (C)

(A) 5

88.71

3

x “2”

4 This zone must hold.

1

x

w

77.69

“a”

2

y

74.33

“c”

(B)

* I don’t actually believe this to be true, but it’s an idea that must be considered.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Globalization: A Threat to Cultural Diversity in Southern Ethiopia?From EverandGlobalization: A Threat to Cultural Diversity in Southern Ethiopia?No ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- S&P 500 Update 18 Apr 10Document10 pagesS&P 500 Update 18 Apr 10AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- B2015 C2 AnswerSheetsLRDocument8 pagesB2015 C2 AnswerSheetsLRgiorgio40No ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- For Listening Paper: NOCN ESOL International Level C2 Independent User Listening & Reading Mark SheetDocument2 pagesFor Listening Paper: NOCN ESOL International Level C2 Independent User Listening & Reading Mark Sheetangelos1apostolidisNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- A2017 C1 AnswerSheetsLRWDocument8 pagesA2017 C1 AnswerSheetsLRWapostolou4No ratings yet

- Market Discussion 23 Jan 11Document10 pagesMarket Discussion 23 Jan 11AndysTechnicalsNo ratings yet

- Listening Paper: Instructions: Draw A Line Through Either A, B, or C To Answer Each Question. B BDocument8 pagesListening Paper: Instructions: Draw A Line Through Either A, B, or C To Answer Each Question. B BLila LilakNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Emotive MelodyDocument8 pagesEmotive MelodySilvano AndradeNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- 40 Techniques Full TabDocument8 pages40 Techniques Full TabGiannis KarambatsosNo ratings yet

- Market Commentary 10apr11Document12 pagesMarket Commentary 10apr11AndysTechnicalsNo ratings yet

- JSA - GeneralDocument6 pagesJSA - GeneralM Waqas HabibNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Patterns For Ii-V-I in BB: BB BB F7 CDocument6 pagesPatterns For Ii-V-I in BB: BB BB F7 CcarololopezNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Clip 50Document1 pageClip 50zuhairahmed07No ratings yet

- Modulation PWDocument1 pageModulation PWTown-C AviationNo ratings yet

- Mand Tact Listener VP - Mts Play Social Imitation Echoic VocalDocument2 pagesMand Tact Listener VP - Mts Play Social Imitation Echoic VocalEstima CGNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Liczby RzeczywisteDocument13 pagesLiczby RzeczywisteGabi CzapskaNo ratings yet

- NOCN ESOL International Level C2 Proficient Paper AA Sample Listening Mark SheetDocument1 pageNOCN ESOL International Level C2 Proficient Paper AA Sample Listening Mark SheetRania NerNo ratings yet

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Fanuc 0i-M ManualDocument58 pagesFanuc 0i-M Manualrastaegg75% (4)

- Nova Planta Baixa - ReformadaDocument1 pageNova Planta Baixa - ReformadaelderlemosandradeNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Transformation 2. Draw The Point Image For All The Following Points Under An Anticlockwise Rotation of 90 About The OriginDocument6 pagesTransformation 2. Draw The Point Image For All The Following Points Under An Anticlockwise Rotation of 90 About The OriginSharvinder SinghNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- NHW Quick Tick TestsDocument18 pagesNHW Quick Tick TestsLuciaNo ratings yet

- The Wave Principle Blueprint by Peter PelDocument37 pagesThe Wave Principle Blueprint by Peter PelKyawSwarLinNo ratings yet

- 1 STOREY WAREHOUSE STORAGE AR-1Document1 page1 STOREY WAREHOUSE STORAGE AR-1Emorej GameplayNo ratings yet

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Mechanisms and Machines Kinematics Dynamics and Synthesis SI Edition 1st Edition Stanisic Solutions Manual DownloadDocument82 pagesMechanisms and Machines Kinematics Dynamics and Synthesis SI Edition 1st Edition Stanisic Solutions Manual DownloadAlice Jones100% (20)

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Lines of Sym.metry in ShapesDocument8 pagesLines of Sym.metry in ShapesMonika TNo ratings yet

- Jazz Exercices, Technique and Patterns: Cmaj7 D-7 E-7 Fmaj7 G7 A-7 B-7b5Document2 pagesJazz Exercices, Technique and Patterns: Cmaj7 D-7 E-7 Fmaj7 G7 A-7 B-7b5AlexandreNo ratings yet

- Estructuras Cimientacion: Aula Aprestamiento S.H.V. S.H.MDocument1 pageEstructuras Cimientacion: Aula Aprestamiento S.H.V. S.H.MCarlos MezaNo ratings yet

- E A B C D F: Plot For-Mr. Vivek Mishra On Plot No:334 Sector 104 S.A.S Nagar MohaliDocument1 pageE A B C D F: Plot For-Mr. Vivek Mishra On Plot No:334 Sector 104 S.A.S Nagar MohaliPrdeep SinghNo ratings yet

- In Experimental MoodDocument1 pageIn Experimental MoodAntonio CarusoNo ratings yet

- Writing and Graphing Equations of HyperbolasDocument9 pagesWriting and Graphing Equations of HyperbolasMOHSANH SALEM ABDALLRAHMAN AL HAMEDNo ratings yet

- Identifying Angles 1Document1 pageIdentifying Angles 1Sir AronNo ratings yet

- CIMENTACION ModelDocument1 pageCIMENTACION ModelAlejandro Richard TICONA MAMANINo ratings yet

- Scarified PDFDocument6 pagesScarified PDFEarl Tomada Dela TongaNo ratings yet

- V-In KPVDocument4 pagesV-In KPVSEYED ISMAIL Nadra Aishah S1C25No ratings yet

- Single Variable Calculus Early Transcendentals 7th Edition Stewart Test BankDocument26 pagesSingle Variable Calculus Early Transcendentals 7th Edition Stewart Test BankRobertCookdktg100% (30)

- Mechanisms and Machines Kinematics Dynamics and Synthesis 1st Edition Stanisic Solutions Manual DownloadDocument84 pagesMechanisms and Machines Kinematics Dynamics and Synthesis 1st Edition Stanisic Solutions Manual DownloadAlice Jones100% (25)

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- FA-502 Apr 2014Document19 pagesFA-502 Apr 2014EdmarVazCarraretoNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- How to Read Stock Charts GuideDocument11 pagesHow to Read Stock Charts GuideKillerman King50% (2)

- 1 4976997257812377719Document264 pages1 4976997257812377719Dhrubojyoti Sinha100% (10)

- Ielts Writing Task 1 Cheat Sheet - CompressDocument29 pagesIelts Writing Task 1 Cheat Sheet - Compresshalima.elouazzani.2004No ratings yet

- Price Action Red Zone StrategyDocument19 pagesPrice Action Red Zone StrategysudhakarrrrrrNo ratings yet

- Pivot Point Trading StrategyDocument8 pagesPivot Point Trading StrategyBadrul 'boxer' Hisham50% (4)

- Candlestick PatternDocument6 pagesCandlestick Patterntraining division100% (1)

- Results Reporter: Multiple Choice QuizDocument2 pagesResults Reporter: Multiple Choice QuizBinod ThakurNo ratings yet

- Scotland tourist attraction trends 1980-2010 by castle, zoo, aquarium & festivalDocument4 pagesScotland tourist attraction trends 1980-2010 by castle, zoo, aquarium & festivalKhanh LinhNo ratings yet

- Unit1 Graphs With Trend 2Document6 pagesUnit1 Graphs With Trend 2manhtuan15a100% (1)

- How To Win at Forex Trading StrategiesDocument75 pagesHow To Win at Forex Trading Strategiesapi-3819672100% (1)

- Lesson 4 Mastering Technical Analysis: by Adam KhooDocument57 pagesLesson 4 Mastering Technical Analysis: by Adam Khoosesilya 14No ratings yet

- Trading With Pivot Points - Understanding The Ins, Outs and Formulas - VantagePointDocument7 pagesTrading With Pivot Points - Understanding The Ins, Outs and Formulas - VantagePointluca pilottiNo ratings yet

- Double Tops: Patterns Show A Reversal From An Uptrend To A DowntrendDocument3 pagesDouble Tops: Patterns Show A Reversal From An Uptrend To A DowntrendShamil PsNo ratings yet

- Language TrendsDocument2 pagesLanguage TrendsFERNANDEZ VELASCO JOCELYNNo ratings yet

- Barry Burns - Using Relative Strength To Make More MoneyDocument8 pagesBarry Burns - Using Relative Strength To Make More MoneyRemmy TaasNo ratings yet

- FADS VS TRENDS: SPOT THE DIFFERENCEDocument17 pagesFADS VS TRENDS: SPOT THE DIFFERENCEJaye GayaniloNo ratings yet

- E Mini MasterDocument35 pagesE Mini MasterTheOdysseyNo ratings yet

- CHAPTER 5 - Support and ResistanceDocument25 pagesCHAPTER 5 - Support and ResistanceHirai Gary100% (1)

- Technical Analysis BasicsDocument9 pagesTechnical Analysis BasicsrupaliNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Quasimodo Pattern PDF Guide - Trading PDFDocument7 pagesQuasimodo Pattern PDF Guide - Trading PDFPrecious OwokereNo ratings yet

- Realistic Trading & Investing Technical Analysis With Chart ExamplesDocument195 pagesRealistic Trading & Investing Technical Analysis With Chart Examplesgetmedude100% (3)

- Technical Analysis For TradingDocument16 pagesTechnical Analysis For TradingLaura Mur100% (3)

- Trends, Networks, and Critical Thinking in The 21st Century Midterm ExamDocument5 pagesTrends, Networks, and Critical Thinking in The 21st Century Midterm ExamJasonNo ratings yet

- Line GraphDocument6 pagesLine GraphLuna ShimizuNo ratings yet

- Developing Low Risk Trading IdeasDocument5 pagesDeveloping Low Risk Trading IdeasSteve EvetsNo ratings yet

- HANDOUTS in Trends Networks and Critical Thinking in The 21st CenturyDocument78 pagesHANDOUTS in Trends Networks and Critical Thinking in The 21st CenturyJonalyn Eunice PacioNo ratings yet

- Harmonic Pattern Bat - How To Trade The Bat PatternDocument6 pagesHarmonic Pattern Bat - How To Trade The Bat PatternSonarat MoulnengNo ratings yet

- HOW TO ANALYZE AND PRESENT VISUAL AIDSDocument4 pagesHOW TO ANALYZE AND PRESENT VISUAL AIDSAnderNo ratings yet

- MarketTechnicianNo68 PDFDocument16 pagesMarketTechnicianNo68 PDFLampooka100% (1)