Professional Documents

Culture Documents

10$ Free Bonus: Trading With Market Statistics X. Position Trading

Uploaded by

siddhant parkheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10$ Free Bonus: Trading With Market Statistics X. Position Trading

Uploaded by

siddhant parkheCopyright:

Available Formats

Existing user?

Sign In * Sign Up

( Forums 0 Activity * / Browse * 1 Guidelines Search... .

Home Technical Topics Market Profile Trading with Market Statistics X. Position Trading ! All Activity

" Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in #

touch with us, or offer suggestions please post to the Support forum here.

Welcome Guests / Topics

Insights from Learn2.trade

Welcome. You are currently viewing the forum as a guest which does not give you access to all the great features at

Traders Laboratory such as interacting with members, access to all forums, downloading attachments, and eligibility to

A By analyst75 86

win free giveaways. Registration is fast, simple and absolutely free. Create a FREE Traders Laboratory account here. Started August 18, 2019

Newbie looking to start investing

$ Sign In or + Sign Up S By shijuv 3

Started October 19, 2019

Learning FOREX

C By Chanell94 4

Started August 17, 2019

10$ Free Bonus ForexfastronEA

J By Jonh Smith 2

$10 Register Gift for new customer. 24/7 customer support Started January 7

walt equals forex profits

By mitsubishi 6

iokex.com OPEN Started January 31

( Posts

Trading with Market Statistics X. % Sign in to follow this Followers 24

Daily Analysis

Position Trading By HFblogNews · Posted 16 minutes ago

By jperl, September 9, 2007 in Market Profile

Date : 12th March 2020. Morning Update

– March 12 2020 12th MarchFX News

Today – Wednesday washout is

& & & & '' Start new topic ( Reply to this topic

becoming Thursday fallout. Equities

closed down 5% and now down 20%

1 2 3 4 NEXT ) Page 1 of 4 * from February peak and in a BEAR...

Never Lose Again!! TheRumpledOne

jperl Posted September 9, 2007 (edited) By TheRumpledOne · Posted 15 hours

ago

Position Trading is generally described as a trade which you enter and expect

to hold for a considerable period of time during the day. Such a trade can be Daily Analysis

By HFblogNews · Posted 23 hours ago

entered at any time after the open. My personal preference for a position trade

is at the beginning of the trading day using market statistics from the previous Date : 11th March 2020. Central Banks –

day as my guide for determining entry, profit target, stoploss and scale in Race to the Bottom – Again? 11th

MarchGBPUSD, H1The latest Central

points if necessary. The direction of the trade is based on interpretation given

Bank to act (in another surprise and

Members in the last 9 "Trading with Market Statistics" threads but using the previous

unscheduled announcement) is the Bank

+ 10 days statistics as the starting point. Position trading is thus no different than of England. The BoE slashed rates by...

363 posts

any other type of trading that I have previously described.

Understanding Forex Market

F By fxeconomist · Posted yesterday at

04:15 AM

Here is the idea:

I wonder why didn't they include such

popular and reliable brokers as Hotforex,

IB or Tickmill. They all have FCA license.

a)Set up a chart with yesterdays volume histogram, PVP, VWAP and SD's on it.

Leave sufficient room to the right of yesterdays close so that at the open you Become a Better Trader

can continue to add to the statistical data as todays market begins to unfold. In F By fxeconomist · Posted yesterday at

effect you are continuing to update yesterdays volume distribution as more 04:14 AM

data is added to the chart. Yes, you are right you should improve

your market analysis skills and you

should also learn how to trade using

demo account for example from

b)Before the open, decide on your trading plan. Pick a direction for the trade,

Hotforex. This should help you to enter

an entry point, profit target and stoploss based on what you see in the volume into the real world of Forex

distribution function. It will help to reread the previous threads to determine

what you should be looking for.

c)When the market opens, execute the plan.

In the following video on trading the ER2 (Emini Russell 2000), you will see that

the previous days volume distribution ended the day in a symmetric state with

the VWAP = PVP. I then concluded that I should look for a countertrend trade

back toward the VWAP as described in [thread=2285]"Trading with Market

Statistics Part VIII"[/thread].

Watch the video to see what I did on September 06, 2007.

ER2PostionTradeSep06

This trade was a good position trade which would have been even better if I

had traded more than one contract. After having climbed up to the 2nd SD

above the VWAP, the price action continued on down below the VWAP to the

1st SD and then evenutally to the 2nd SD, a very typical signature of a

symmetric distribution.

Edited February 17, 2008 by jperl

+ Quote

Ad

CVC Markets - Best Forex Broker

CVC Markets, Best Forex Broker, Sign-Up Today

cvcmarkets.com Visit Site

Soultrader Posted September 10, 2007

Very interesting video Jerry. Thank you very much. I will be spending some time

this week pouring and reviewing your threads so I can hopefully understand

your methodology better and have some good questions for you.

Market Wizard

+ 12

3710 posts

+ Quote

Ad

CVC Markets - Best Forex Broker

CVC Markets, Best Forex Broker, Sign-Up Today

cvcmarkets.com Visit Site

Soultrader Posted September 13, 2007

Hi Jerry,

Do you ever use the average of the past few trading sessions for the opening

play? Or do you only take the previous session data?

Market Wizard

+ 12

3710 posts

+ Quote

jperl Posted September 13, 2007

, Soultrader said:

Do you ever use the average of the past few trading sessions for the

opening play? Or do you only take the previous session data?

Members

+ 10

363 posts I usually use only the last trading session for a position trade. Once I decide on

a trade entry, I will then take a look at the VWAP and SD's from previous 2 days,

1 week, 1 month, 2 months and 1 yr data to see if there is anything that would

block the progress of the trade. I haven't gotten around to preparing a thread

on this for want of time. Probably do so when I get back from my China trip.

+ Quote

Dogpile Posted September 14, 2007

not much discussion in 'market profile' area.... thought I would point out that we

D

closed today with a reasonably 'normal' distribution, price closed right on

VWAP at 1498.50 and PVP was close by.

here is an example of combining statistics with a pattern or two. I put a short on

Market Wizard

very late in day at 1498.00 to play for an overnight gap. we've had 3 up days in

a row but I am unimpressed by the last few days. I did try a long this morning

+ 10

584 posts but it didn't fill (missed by a tick) so I took the day off. I came back and this

Head & Shoulder pattern had become evident but I did not want to fight the

market while it built higher value so I waited until very late in the day to enter as

the market appeared to find a home at 98.00 and could come out of this

balance to the downside overnight. Effectively, I want to find a short in the

morning and this trade is a hedge in case the short works overnight instead of

in the morning (both could still happen too).

+ Quote

darthtrader Posted September 14, 2007

, jperl said:

Once I decide on a trade entry, I will then take a look at the VWAP and

SD's from previous 2 days, 1 week, 1 month, 2 months and 1 yr data to see

if there is anything that would block the progress of the trade.

Members

+ 10

344 posts Jerry, does this apply to all your trades or just position/breakout/no skew to the

market trades?Or even just position trades/no skew?

Also, if yesterdays close is a HUP I take the high and low of yesterday is also a

HUP?

If I ask you any stupid questions I'm sorry. This is kind of why I never did good

in math classes in highschool or college. I get the first few videos but I learn

top down then fill in the details where your building on the details.

Have fun in china, I don't know how you could not. That should be an

interesting time to say the least.

When you get back though, HUP theory, please? I'm dieing to understand what

you see there.

+ Quote

jperl Posted September 15, 2007

, darthtrader said:

Jerry, does this apply to all your trades or just position/breakout/no skew

to the market trades?Or even just position trades/no skew?

Also, if yesterdays close is a HUP I take the high and low of yesterday is

Members also a HUP?

+ 10

363 posts When you get back though, HUP theory, please? I'm dieing to understand

what you see there.

You are right on track Darth. There are two kinds of HUP, static and dynamic.

The static ones are for example yesterdays high, low and close. The dynamic

ones are all the VWAP and SD's from yesterday, 2 days ago, 1 week, 2 weeks, 1

month 2 month, 1 year ago. I think you can see that how these cluster will be

important for determining price action. The rest of the story you will have to

wait until I come back.

+ Quote

Ad

10$ Free Bonus - World's Leading Exchange

$10 Register Gift for new customer. 24/7 customer support

iokex.com/BitcoinExchange Visit Site

Karish Posted October 28, 2007

Hi Jerry, great thread I hope you will find soon the time to explain us your HUP

concept.

In the meanwhile I invest the time to code the theory (I am using AMIBROKER)

and practicing, no doubt it improved my stats.

I wonder if and how we can implement Market statistics trading strategy to

Members

longer term trading style such as swing of several days?

+ 10

31 posts

Thx

Karish

+ Quote

BlowFish Posted October 28, 2007

Im glad someone mentioned HUP's again before I did! I have a broad idea what

B

they are but do wonder how Jerry uses them in trade decisions. Last I recall he

was not quite sure how to present this. I hope that he comes up with something

as I have enjoyed this series immensely and miss my Market Stats fix!

Market Wizard

Cheers.

+ 10

3308 posts

+ Quote

Ad

eToro.com - Trading OFcial - Investing Online

Choose from over 1,000 Assets & Manage Your Own Investments 24/7. Your

Capital is at Risk.

partners.etoro.com Visit Site

jperl Posted October 28, 2007

, Karish said:

Hi Jerry, great thread I hope you will find soon the time to explain us your

HUP concept.

I wonder if and how we can implement Market statistics trading strategy to

Members longer term trading style such as swing of several days?

+ 10

363 posts Thx

Karish

I'm still working on a presentation for HUP. Hope to have the beginning of it

sometime this week.

As far as swing trading goes, I don't do swing trading, but longer term stat

analyis should be useful for swing trading as for day trading. The standard

deviations will be considerably larger so you will have to have a larger risk

factor to do swing trades.

+ Quote

ckait Posted October 28, 2007

I dont know if this is the right place to ask but does anybody have a volume

C

histogram that prints on the Y axis intra day for trade station they would be

willing to share?

Members

+ 10

116 posts

+ Quote

darthtrader Posted October 29, 2007

, BlowFish said:

miss my Market Stats fix!

Members haha, yea maybe we need a little methadone maintance hit before the big HUP

+ 10 fix.

344 posts

Jerry, any chance you could do a video on how you use the longer time frame

stats? I think I remember you said you look at longer time frames stats even for

intraday, maybe that ties in with hups though.

+ Quote

jperl Posted October 29, 2007

, darthtrader said:

haha, yea maybe we need a little methadone maintance hit before the big

HUP fix.

Jerry, any chance you could do a video on how you use the longer time

Members frame stats? I think I remember you said you look at longer time frames

+ 10 stats even for intraday, maybe that ties in with hups though.

363 posts

Well if you read the position trading thread, you saw I used the previous days

volume distribution data to decide on a trade for today. That's an example of

using a longer time frame for today's trades.

You will see that HUP is an extension of that

+ Quote

Ad

Free PDF Book on Indian Stock - Art of Stock Investing

Checkout our Free videos at YouTube channel "bse2nse"

bse2nse.com Visit Site

Dogpile Posted October 29, 2007

, Quote

D I dont know if this is the right place to ask but does anybody have a

volume histogram that prints on the Y axis intra day for trade station they

would be willing to share?

Market Wizard

+ 10 I have inquired on the Tradestation forum about this and they don't have it.

584 posts They have an analysis study called 'activity bars' but they aren't any good. that

is what they reference though when you ask them about it.

what I do is screen-capture the daily intraday volume histogram from the

'matrix' window each day. I then put notes on it and save them in a folder for

future access.

I have actually found this process to be quite insightful. I summarize the daily

daily volume distributions by hand into an excel spreadsheet. Doing this

process every day really helps me understand 'value' (higher-volume) zones

that tend to get re-tested and imprints on your brain important pivots.

+ Quote

Ad

Free PDF Book on Indian Stock - Art of Stock Investing

Checkout our Free videos at YouTube channel "bse2nse"

bse2nse.com Visit Site

Râlex Posted November 15, 2007

Is it possible to put in relation the differents Market Profile openings and the

R

Jerry' strategy ?

Or, Jerry, would you have managed to use tools of your system to get ready for

types of days of trading (as Dalton) ?

Members

+ 10 As the hubs !

15 posts

With impatience, best regards.

bye Alex

+ Quote

jperl Posted November 15, 2007

, Râlex said:

Is it possible to put in relation the differents Market Profile openings and

the Jerry' strategy ?

Members

Or, Jerry, would you have managed to use tools of your system to get

+ 10

363 posts ready for types of days of trading (as Dalton) ?

As the hubs !

With impatience, best regards.

bye Alex

Alex,

The only tools I use to get ready for today's trading are the HUP lines from

previous trading days, weeks,month and year. I don't use anything else. These

are my support/resistance lines that will keep me in a trade or tell me to exit

+ Quote

Râlex Posted December 23, 2007

Hello to everybody and to you, jerry,

R I wondered how reacts jerry's system when the day is a trend day!

Members

+ 10 How react the standard deviations ? What are then the points of entry ?

15 posts

Is there a means to foresee this type of day and trade with it ?

Too, I wish you the good end of year and merry Christmas !

+ Quote

jperl Posted January 5, 2008

, Râlex said:

Or, Jerry, would you have managed to use tools of your system to get

ready for types of days of trading (as Dalton) ?

As the hubs !

Members

+ 10 bye Alex

363 posts

Other than putting the HUP lines on my chart, I don't do anything else to begin

the day. I just follow the statisitics and what the price action tells me.

I will be cautious around key economic events that usually come out around

10:00 EST, but other than that there is nothing else that I do premarket.

+ Quote

unicorn Posted February 5, 2008

, jperl said:

Well if you read the position trading thread, you saw I used the previous

days volume distribution data to decide on a trade for today. That's an

example of using a longer time frame for today's trades.

Members

+ 10

165 posts

Hello Jerry;

On certain days it appears that using the previous day's volume distribution

data, is better suited to the price action, to decide on a trade even in the

afternoon.

Have you developed a process to identify when this course of action is

appropriate

OR

do you have a means to recognize this fact early in the day, and thus not switch

to using today's volume distribution data?

Thank you.

Unicorn.

+ Quote

jperl Posted February 6, 2008

, unicorn said:

Hello Jerry;

On certain days it appears that using the previous day's volume

Members

distribution data, is better suited to the price action, to decide on a trade

+ 10

363 posts even in the afternoon.

Have you developed a process to identify when this course of action is

appropriate

OR

do you have a means to recognize this fact early in the day, and thus not

switch to using today's volume distribution data?

Thank you.

Unicorn.

Yesterdays distribution would always be more important than today's, early in

the trading day during the period when today's distribution is still developing. If

there is rapid price action early in the day, today's price action is not going to

help you much. You can tell this by comparing the range of each bar to the

standard deviation. When the bar range is the same size as the SD, you can't

tell much by looking at today's statistics. So you either have to go to a faster

time scale, or use a distribution that has developed over 1 or more days such

that the SD is larger than the bars range.

+ Quote

unicorn Posted February 8, 2008

, jperl said:

Yesterdays distribution would always be more important than today's,

early in the trading day during the period when today's distribution is still

developing.

Members

+ 10

165 posts Hi Jerry;

When watching yesterday's and today's probability function and statistics, and

both lead to the same trade assessment, the decision is easy.

How do you deal with situations when one trade assessment contradicts the

other?

Do you go with today's assessment or yesterday's ?

I guess yesterday's statistics over-ride during the morning and noon.

How do you decide in the afternoon?

Important Information

" I accept

By using this site, you agree to our Terms of Use.

What is your thought process?

You might also like

- Value Investing Bootcamp How to Invest Wisely: Learn the Secrets of the Best Stock Investors, Manage Your Own Portfolio, And Earn Market Beating ReturnsFrom EverandValue Investing Bootcamp How to Invest Wisely: Learn the Secrets of the Best Stock Investors, Manage Your Own Portfolio, And Earn Market Beating ReturnsNo ratings yet

- 9 Scalping PDFDocument1 page9 Scalping PDFsiddhant parkheNo ratings yet

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- 10$ Free Bonus: Trading With Market Statistics - II The Volume Weighted Average Price (VWAP)Document1 page10$ Free Bonus: Trading With Market Statistics - II The Volume Weighted Average Price (VWAP)siddhant parkheNo ratings yet

- Trading With Market Statistics VIII. Counter Trend Trades in Symmetric DistributionsDocument1 pageTrading With Market Statistics VIII. Counter Trend Trades in Symmetric Distributionssiddhant parkheNo ratings yet

- Trading With Market Statistics VII. Breakout Trades at The PVPDocument1 pageTrading With Market Statistics VII. Breakout Trades at The PVPsiddhant parkheNo ratings yet

- 13 April 16Document1 page13 April 16asifNo ratings yet

- 18 April 16Document1 page18 April 16asifNo ratings yet

- Forex Trading Sessions - Everything You Need To Know From Strategy To ExecutionDocument1 pageForex Trading Sessions - Everything You Need To Know From Strategy To ExecutionForex Master WorkNo ratings yet

- 20 April 16Document1 page20 April 16asifNo ratings yet

- Secret Formula of Intraday Trading Techniques StrategiesDocument7 pagesSecret Formula of Intraday Trading Techniques StrategiesJenny JohnsonNo ratings yet

- Secret Formula of Intraday Trading Techniques & StrategiesDocument7 pagesSecret Formula of Intraday Trading Techniques & Strategiesswetha reddy40% (5)

- 4oct 16Document1 page4oct 16asifNo ratings yet

- Nifty 5 Oct 16Document1 pageNifty 5 Oct 16asifNo ratings yet

- 9 Dec 16Document1 page9 Dec 16asifNo ratings yet

- Toshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFDocument54 pagesToshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFSyed Asad TirmazieNo ratings yet

- The Winning Ichimoku Trading System at Forex FactoryDocument10 pagesThe Winning Ichimoku Trading System at Forex Factoryhenrykayode4No ratings yet

- 12 Dec 16Document1 page12 Dec 16asifNo ratings yet

- Nifty Open Interest Analysis - Page 21Document6 pagesNifty Open Interest Analysis - Page 21Kiran KrishnaNo ratings yet

- 25 Nov16Document1 page25 Nov16asifNo ratings yet

- 5oct 16Document1 page5oct 16asifNo ratings yet

- Manual de Ejercicios Total Gym by Deportivo Algarrobo - IssuuDocument1 pageManual de Ejercicios Total Gym by Deportivo Algarrobo - IssuuAbel QuintanaNo ratings yet

- 22oct 16Document1 page22oct 16asifNo ratings yet

- Nifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiaDocument4 pagesNifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiasudhakarrrrrrNo ratings yet

- 10 Pips Per Day Scalping StrategyDocument7 pages10 Pips Per Day Scalping Strategyzooor100% (1)

- ALSO: The Sun Is Rising On Solar Stocks - Growing GreenDocument74 pagesALSO: The Sun Is Rising On Solar Stocks - Growing GreenrdrefsNo ratings yet

- Traders White BoardDocument3 pagesTraders White Boardjig3309No ratings yet

- Education of A Speculator - Stine NASI Signal and Stewart NotesDocument8 pagesEducation of A Speculator - Stine NASI Signal and Stewart NotesFaisal MahboobNo ratings yet

- How To Start A Forex Trading Business From HomeDocument6 pagesHow To Start A Forex Trading Business From Homemarshy bindaNo ratings yet

- CopyTrade Tickmill - Ranking Strategies Focus On ConsistencyDocument1 pageCopyTrade Tickmill - Ranking Strategies Focus On ConsistencyharissonrafandradeNo ratings yet

- Ggeb 1Document2 pagesGgeb 1evansparrowNo ratings yet

- Momentum PicksDocument29 pagesMomentum PicksSujoy SikderrNo ratings yet

- Support & ResistanceDocument19 pagesSupport & ResistanceThis ManNo ratings yet

- Hot Penny Stocks To Buy: Nifty 50Document1 pageHot Penny Stocks To Buy: Nifty 50asifNo ratings yet

- Uti Equity Portfolio Breakup PDFDocument8 pagesUti Equity Portfolio Breakup PDFSaiVamsiNo ratings yet

- Power of Small Consistent Efforts For COINBASE - BTCUSD by Pips-Collector - TradingViewDocument1 pagePower of Small Consistent Efforts For COINBASE - BTCUSD by Pips-Collector - TradingViewShahbaz SyedNo ratings yet

- BB 1Document20 pagesBB 1guyzess67% (3)

- I Want Start Trading in Philippine Currency - Google SearchDocument1 pageI Want Start Trading in Philippine Currency - Google SearchyakubusmoniNo ratings yet

- 1 Feb 2017Document1 page1 Feb 2017asifNo ratings yet

- Vera 7 Strategic MarketingDocument2 pagesVera 7 Strategic MarketingDorae MonNo ratings yet

- 4 Apr 16Document1 page4 Apr 16asifNo ratings yet

- IPO Update 最新孖展認購攻略 - Must Subscribe 必抽新股推介: 中慧 Check out IPO recommendation and year-to-date scorecard here: http://www.scribd.com/calvinchoi0Document4 pagesIPO Update 最新孖展認購攻略 - Must Subscribe 必抽新股推介: 中慧 Check out IPO recommendation and year-to-date scorecard here: http://www.scribd.com/calvinchoi0calvinchoi0No ratings yet

- What Are Covered & Naked Options Contracts - Kotak Securities®4Document5 pagesWhat Are Covered & Naked Options Contracts - Kotak Securities®4Palanisamy BalasubramaniNo ratings yet

- LT - Pole & Flag Break Out. For NSE - LT by SafeTrader1976 - TradingView IndiaDocument2 pagesLT - Pole & Flag Break Out. For NSE - LT by SafeTrader1976 - TradingView IndiaAbhiNo ratings yet

- Edukasi Analisa TA Pak Bowo Agustus 2018 PDFDocument23 pagesEdukasi Analisa TA Pak Bowo Agustus 2018 PDFIrfan YusufNo ratings yet

- Gmail - Welcome To Upstox. Your Account Is Now Active.Document3 pagesGmail - Welcome To Upstox. Your Account Is Now Active.manojsaini00.1978No ratings yet

- WINX Club On BehanceDocument1 pageWINX Club On BehanceGrandma JojoNo ratings yet

- 6 Apr 16Document1 page6 Apr 16asifNo ratings yet

- 24 Nov16 ThuDocument1 page24 Nov16 ThuasifNo ratings yet

- Gmail - The New Way To Trade BankNiftyDocument6 pagesGmail - The New Way To Trade BankNiftyNeil Potter0% (1)

- Betfair Unlocked-Concepts of The Betfair Secret ManualDocument20 pagesBetfair Unlocked-Concepts of The Betfair Secret ManualkwasNo ratings yet

- IONOSFERA MT4i Indicator - (Cost $50) Full VersionDocument7 pagesIONOSFERA MT4i Indicator - (Cost $50) Full Versionabdulalimvpm00No ratings yet

- 1 Minute Limited Martingale at Forex FactoryDocument11 pages1 Minute Limited Martingale at Forex FactoryzooorNo ratings yet

- Le 24 Regole Di GannDocument44 pagesLe 24 Regole Di GannRosNo ratings yet

- Jual RIDGID Roll Groover Berkualitas Di Lain-Lain - MonotaroDocument3 pagesJual RIDGID Roll Groover Berkualitas Di Lain-Lain - MonotarojajakaNo ratings yet

- Presentation CoinTech2u EnglishDocument15 pagesPresentation CoinTech2u EnglishbellatanamasNo ratings yet

- How Stock Market Index Is Calculated and It's MethodologyDocument11 pagesHow Stock Market Index Is Calculated and It's MethodologySRAVANNo ratings yet

- Mafang Etf - Google SearchDocument1 pageMafang Etf - Google Searchzmstkn1No ratings yet

- Swastika Investmart LTD.: Payment SuccessfulDocument3 pagesSwastika Investmart LTD.: Payment SuccessfulMd EjazzuddinNo ratings yet

- Renko TradingDocument25 pagesRenko TradingBors György88% (16)

- Important Links: Upcoming Class ScheduleDocument1 pageImportant Links: Upcoming Class Schedulesiddhant parkheNo ratings yet

- Class Handouts/Notes: Pt365 EnvironmentDocument1 pageClass Handouts/Notes: Pt365 Environmentsiddhant parkheNo ratings yet

- Important Links: Upcoming Class ScheduleDocument1 pageImportant Links: Upcoming Class Schedulesiddhant parkheNo ratings yet

- SCI1Document1 pageSCI1siddhant parkheNo ratings yet

- Class Handouts/Notes: Pt365 EnvironmentDocument1 pageClass Handouts/Notes: Pt365 Environmentsiddhant parkheNo ratings yet

- Class Handouts/Notes: Pt365 EnvironmentDocument1 pageClass Handouts/Notes: Pt365 Environmentsiddhant parkheNo ratings yet

- Class Handouts/Notes: PT - 365 - Social - IssuesDocument1 pageClass Handouts/Notes: PT - 365 - Social - Issuessiddhant parkheNo ratings yet

- Full VolActuarial TablesumeDocument138 pagesFull VolActuarial Tablesumemetr0123No ratings yet

- Inferential Statistics 101 - Part 3: Shweta DoshiDocument1 pageInferential Statistics 101 - Part 3: Shweta Doshisiddhant parkheNo ratings yet

- Important Links: Upcoming Class ScheduleDocument1 pageImportant Links: Upcoming Class Schedulesiddhant parkheNo ratings yet

- Cameos For Calculus Visualization in The First-Year Course by Roger B. Nelsen PDFDocument186 pagesCameos For Calculus Visualization in The First-Year Course by Roger B. Nelsen PDFsiddhant parkheNo ratings yet

- Cameos For Calculus Visualization in The First-Year Course by Roger B. Nelsen PDFDocument186 pagesCameos For Calculus Visualization in The First-Year Course by Roger B. Nelsen PDFsiddhant parkheNo ratings yet

- Quadratic Equations - JEE-Main Super RevisionDocument58 pagesQuadratic Equations - JEE-Main Super Revisionsiddhant parkheNo ratings yet

- Environmental Studies Project Work On Analysis of Rainfall Pattern of Konkan Region Over The Period of Last 5 Years Made byDocument17 pagesEnvironmental Studies Project Work On Analysis of Rainfall Pattern of Konkan Region Over The Period of Last 5 Years Made bysiddhant parkheNo ratings yet

- Financial Terms 2014 PDFDocument112 pagesFinancial Terms 2014 PDFChi100% (1)

- Differential Equations 10.11.06Document45 pagesDifferential Equations 10.11.06Ankit MittalNo ratings yet

- 10$ Free Bonus: Trading With Market Statistics X. Position TradingDocument1 page10$ Free Bonus: Trading With Market Statistics X. Position Tradingsiddhant parkheNo ratings yet

- Quadratic Equations - JEE-Main Super RevisionDocument58 pagesQuadratic Equations - JEE-Main Super Revisionsiddhant parkheNo ratings yet

- FRM PART - 1 - (7) P PDFDocument50 pagesFRM PART - 1 - (7) P PDFsiddhant parkheNo ratings yet

- Class 12 Maths Maha Sprint Chapter Wise RevisionDocument2 pagesClass 12 Maths Maha Sprint Chapter Wise Revisionsiddhant parkheNo ratings yet

- Inverse Trigonometric Functions in One ShotDocument55 pagesInverse Trigonometric Functions in One Shotsiddhant parkheNo ratings yet

- Environmental Studies Project Work On Analysis of Rainfall Pattern of Konkan Region Over The Period of Last 5 Years Made byDocument17 pagesEnvironmental Studies Project Work On Analysis of Rainfall Pattern of Konkan Region Over The Period of Last 5 Years Made bysiddhant parkheNo ratings yet

- Safari - 14-Apr-2020 atDocument1 pageSafari - 14-Apr-2020 atsiddhant parkheNo ratings yet

- Dickson G Watts-Speculation As A Fine Art and Thoughts On Life-EnDocument23 pagesDickson G Watts-Speculation As A Fine Art and Thoughts On Life-EnMohak GhelaniNo ratings yet

- Contact Information SourcingDocument1 pageContact Information Sourcingsiddhant parkheNo ratings yet

- Description: Packag eDocument4 pagesDescription: Packag eVicenteAlvarezNo ratings yet

- Chapter 2 - Formation DamageDocument51 pagesChapter 2 - Formation DamageKamran Haider Tunio100% (13)

- Skripsi IntiDocument153 pagesSkripsi IntiRIZKY FADILAHNo ratings yet

- Vermeer D7x11 SERIES II NavigatorDocument694 pagesVermeer D7x11 SERIES II NavigatorAbraham JohnsonNo ratings yet

- Rel Note-TC2X-01110900OGU00STD - 2 PDFDocument8 pagesRel Note-TC2X-01110900OGU00STD - 2 PDFÔngGiàChốngCâyNo ratings yet

- Introduction To Library Metrics: Statistics, Evaluation and AssessmentDocument13 pagesIntroduction To Library Metrics: Statistics, Evaluation and Assessmentgopalshyambabu767No ratings yet

- Aircraft Design 30Document23 pagesAircraft Design 30Paul GernahNo ratings yet

- Vapor IO Expands Its Edge Computing Grid To Europe Through A Partnership With CellnexDocument2 pagesVapor IO Expands Its Edge Computing Grid To Europe Through A Partnership With CellnexProcetradi MovilNo ratings yet

- Hungarian Algorithm For Solving The Assignment ProblemDocument10 pagesHungarian Algorithm For Solving The Assignment ProblemRavi GohelNo ratings yet

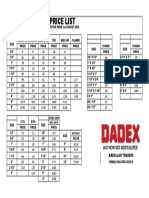

- Dadex Efast Price List 1ST August 2020Document1 pageDadex Efast Price List 1ST August 2020Jugno ShahNo ratings yet

- Apple Data Privacy SuitsDocument46 pagesApple Data Privacy SuitsTHROnlineNo ratings yet

- 02 NetNumen U31 Software Installation - 54PDocument54 pages02 NetNumen U31 Software Installation - 54PAppolenaire Alexis86% (7)

- Assignment On ERPDocument3 pagesAssignment On ERPMithan BhowmickNo ratings yet

- Challenges and Issues in e GovernanceDocument28 pagesChallenges and Issues in e GovernanceDaniel ReyesNo ratings yet

- Excavadora Hidraulica 336eDocument15 pagesExcavadora Hidraulica 336eOscar LosadaNo ratings yet

- Protocompiler WPDocument13 pagesProtocompiler WPajaysimha_vlsiNo ratings yet

- Guidelines of PBL - MBA (22-24) Sem IIDocument8 pagesGuidelines of PBL - MBA (22-24) Sem IIShivnath KarmakarNo ratings yet

- Nex TracDocument2 pagesNex TracZouhair WahbiNo ratings yet

- Fastboot-Transfer Files From PCDocument8 pagesFastboot-Transfer Files From PCBong PasawayNo ratings yet

- Bayesian Optimization With GradientsDocument17 pagesBayesian Optimization With Gradients刘明浩No ratings yet

- Product Data Sheet: iPRD40r Modular Surge Arrester - 1P - 350V - With Remote TransfertDocument3 pagesProduct Data Sheet: iPRD40r Modular Surge Arrester - 1P - 350V - With Remote TransfertLeonel Jesus Pareja MorenoNo ratings yet

- The Innovative Solution: Performance Determines DesignDocument5 pagesThe Innovative Solution: Performance Determines DesignKristína100% (1)

- DsersDocument15 pagesDsersT JNo ratings yet

- SHEHERAZADE - 1001 Stories For Adult LearningDocument4 pagesSHEHERAZADE - 1001 Stories For Adult LearningAntonella MariniNo ratings yet

- Flutek Swing MotorDocument2 pagesFlutek Swing Motorsunil0081No ratings yet

- Self-Dehydrating Breather Type SDBDocument39 pagesSelf-Dehydrating Breather Type SDBKHALID98No ratings yet

- Vix112 Vmrun Command PDFDocument20 pagesVix112 Vmrun Command PDFtrix337No ratings yet

- Fire Hazard QuizDocument1 pageFire Hazard QuizAna GreorNo ratings yet

- Nsec Btech Brochure 2022 ReDocument71 pagesNsec Btech Brochure 2022 ReFood RestorersNo ratings yet

- Test Plan and DocumentsDocument4 pagesTest Plan and DocumentsvimudhiNo ratings yet