Professional Documents

Culture Documents

4 - VRM 3 - Var - Ssei

4 - VRM 3 - Var - Ssei

Uploaded by

DIVYANSHU GUPTA0 ratings0% found this document useful (0 votes)

13 views1 pageThis document discusses approaches for calculating value at risk (VAR) for derivative positions. It outlines the delta normal and full revaluation methods. The delta normal method approximates VAR using deltas and gammas and is suitable for linear derivatives. The full revaluation method uses Monte Carlo simulation to regularly revalue positions and is needed for non-linear derivatives and those with cross-partial effects. The document provides examples of calculating VAR for an option position and bond position using both approaches.

Original Description:

Original Title

4_VRM 3_VAR_SSEI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses approaches for calculating value at risk (VAR) for derivative positions. It outlines the delta normal and full revaluation methods. The delta normal method approximates VAR using deltas and gammas and is suitable for linear derivatives. The full revaluation method uses Monte Carlo simulation to regularly revalue positions and is needed for non-linear derivatives and those with cross-partial effects. The document provides examples of calculating VAR for an option position and bond position using both approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 page4 - VRM 3 - Var - Ssei

4 - VRM 3 - Var - Ssei

Uploaded by

DIVYANSHU GUPTAThis document discusses approaches for calculating value at risk (VAR) for derivative positions. It outlines the delta normal and full revaluation methods. The delta normal method approximates VAR using deltas and gammas and is suitable for linear derivatives. The full revaluation method uses Monte Carlo simulation to regularly revalue positions and is needed for non-linear derivatives and those with cross-partial effects. The document provides examples of calculating VAR for an option position and bond position using both approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

VALUATION & RISK MODEL

PUTTING VAR TO WORK

VAR Approaches

LOCAL FULL REVALUATION

DELTA NORMAL DELTA GAMMA FULL REVALUATION

VAR of a VAR= Delta Approach± Gamma Effect Got to specify a pricing function (like Black Scholes Model) and

derivative= As per Tailor’s approximation, then use SMS( Structured Montecarlo Simulation) to regularly

2

Delta* VAR of Risk ∆y=f ‘(x) ∆x +1/2f ‘’(x)( ∆x) revalue the position.

Factor To be used in the case of Non-Linear misbehaved series like

To be used in the Gamma Effect option-embedded bonds i.e. callable bonds,puttable bonds &

rd

case of linear For well-behaved non-linear derivatives,the 3 & mortgagebacked securities.Also to be used when we use

derivatives like higher order terms are negligible. cross-partial effects.

fwd,futures & So,gamma effect= Suppose,assume that stock-prices are log-normally distributed.

2

swaps. 1/2*Gamma*(VAR of risk factor) St+1=Steµ+zσ ( where µ=drift & σ is shock)

Delta- Where z=Random draw from the standard normal distribution

Normal To be used in the case of non-linear derivatives & time steps = daily for 100 days.

VAR of a which are well-behaved like options, non-option Now calculate stock price using the above equation for 1

long- embedded bonds. run(i.e. 100 days)& the computer is made to carry out 10,000

position is For C+,Gamma effect is in our favour.So, runs.

always VAR=VAR by Delta Approach-Gamma S

overstated Effect.

. For C-, Gamma effect is against us.So,

VAR=VAR by Delta Approach+Gamma 22.75

Effect.

For P+,Gamma effect is in our favour.So, 20.19

VAR=VAR by Delta Approach-Gamma

18.22

Effect.

For P-,Gamma effect is against us.So, Days

VAR=VAR by Delta Approach+Gamma Now, out of 10,000 terminal stock prices,arrange them from worst to

Effect. best.Thus, the 99% VAR=Loss corresponding to the 100

th

th

The answers provided by this approach are NOT observation.Suppose 100 obs=18.64

100% accurate. ∴ = 20 − 18.64 = 1.36

But, since call & put are egs of well-behaved non- NOTE: For a long straddle position i.e. P+ & C+ at the same E,the risk

linear derivatives,it gives a reasonable of this strategy is Share Price not changing too much.So,we cannot

approximation of the true ans that can be calculate VAR using Delta-Normal Approach.Instead use Full

manufactured by the full-revaluation approach. Revaluation Approach using SMC i.e. assume S follows a certain

µ+zσ

distribution say Log Normal.So, St+1=Ste . Using random draws of

CALCULATING VAR OF A BOND POSITION Z,we have various possible (St+1)’s.Value the straddle at each of the

Delta –Normal Method ( at 99% confidence level) possible Share Prices.Now, arrange straddle values from worst to best

=z* yield volatility*Modified Duration* Price & then slice away the required quartile to get VAR.

(where Modified Duration= Duration/(1+r/m)

Suppose ytm is compounded semi-annually,Higher the frequency of Price

compounding,higher the volatility and higher the VAR.

Full

Full Revaluation Method

Revaluation

At a 99% confidence level,yield can change by z*yield volatility.

So,new yield=old yield+( z*yield volatility)

Calculate old price(by using old yield) & new price(using new yield).

637.63 Delta Normal

So, VAR=Old Price-New Price

Method

Delta-Normal gives a higher answer for a long position,since actual VAR

enjoys gamma effect(enjoys convexity which means lower risk/VAR).

Delta-Normal gives a lower answer for a short position,since actual VAR 5% 6.63% Yield

suffers gamma effect(negative convexity i.e. higher risk/VAR)

Page 4

You might also like

- The Confluence of Racial Politics Book ReportDocument8 pagesThe Confluence of Racial Politics Book Reportapi-510702979100% (1)

- Ce Board Exam Formula Mathgeohydro 1Document92 pagesCe Board Exam Formula Mathgeohydro 1ELLE WEENo ratings yet

- Comparison of Juice Extractors: Enzymes: Michael Donaldson, PH.DDocument0 pagesComparison of Juice Extractors: Enzymes: Michael Donaldson, PH.DRobert RomanNo ratings yet

- MGT657-Top Glove CorporationDocument14 pagesMGT657-Top Glove CorporationreSTART StudioNo ratings yet

- Exam Formula SheetDocument2 pagesExam Formula SheetEmma WorkmanNo ratings yet

- AmplifierDocument3 pagesAmplifierArslan AslamNo ratings yet

- 5 - VRM 4 - Var - SseiDocument1 page5 - VRM 4 - Var - SseiDIVYANSHU GUPTANo ratings yet

- 5 - VRM 4 - Var - SseiDocument1 page5 - VRM 4 - Var - SseiDIVYANSHU GUPTANo ratings yet

- FRM Part 1 Quants 2023 MLDocument8 pagesFRM Part 1 Quants 2023 MLIshika ParasrampuriaNo ratings yet

- Voltage Standing Wave Ratio PatternDocument16 pagesVoltage Standing Wave Ratio PatternnairvipinNo ratings yet

- Lecture 2 Really NewDocument9 pagesLecture 2 Really Newhasib_07No ratings yet

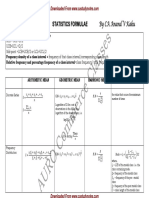

- Statistics Formulae For CPT by Anand Kaku UnlockedDocument7 pagesStatistics Formulae For CPT by Anand Kaku UnlockedOmkar SawantNo ratings yet

- Chapter3 LinearLeastSquaresDocument52 pagesChapter3 LinearLeastSquaresEda Deniz DemirelNo ratings yet

- Dynamic Shear Modulus of Soils Foundation Stiffness and Damping For Seismic Analysis of Jack-Ups-ForSCRIBDDocument13 pagesDynamic Shear Modulus of Soils Foundation Stiffness and Damping For Seismic Analysis of Jack-Ups-ForSCRIBDjosephk29No ratings yet

- PS2 Equation Sheet ExamsDocument4 pagesPS2 Equation Sheet ExamsWilliam ShenNo ratings yet

- Odf 10lecture6Document2 pagesOdf 10lecture6i wNo ratings yet

- Alternator Efficiency: Equation 8Document2 pagesAlternator Efficiency: Equation 8Josh'z LlamesNo ratings yet

- Template Relation Diff and IntDocument3 pagesTemplate Relation Diff and IntIr_tuxedoNo ratings yet

- Jonwin Fidelis Fam - Assignment 1&2Document22 pagesJonwin Fidelis Fam - Assignment 1&2125Jonwin Fidelis FamNo ratings yet

- Statistics Formulae For FoundationDocument7 pagesStatistics Formulae For Foundationanon_127497276100% (1)

- Digital Communications: Pulse Amplitude Modulation and Basics of Detection - Part 1Document20 pagesDigital Communications: Pulse Amplitude Modulation and Basics of Detection - Part 1Zunair KhanNo ratings yet

- 3.2 Reflection Coefficient Calculations: Chapter 3 Transmission Line CalculationsDocument5 pages3.2 Reflection Coefficient Calculations: Chapter 3 Transmission Line CalculationsHubert CordonnierNo ratings yet

- Navigational Autopilot SystemsDocument4 pagesNavigational Autopilot SystemsTushar SharmaNo ratings yet

- Hagan AdjustersDocument4 pagesHagan Adjustersblork98No ratings yet

- Tut 2,3 - InvertersDocument5 pagesTut 2,3 - InvertersMahmoud A. AboulhasanNo ratings yet

- Power Transmission and Distribution Ee368: IndexDocument11 pagesPower Transmission and Distribution Ee368: IndexeloiNo ratings yet

- SIL, Ferranti Effect and Power Circle Diagram PDFDocument6 pagesSIL, Ferranti Effect and Power Circle Diagram PDFdubuli123No ratings yet

- 2015 Iut MathDocument2 pages2015 Iut MathNodirbek SobirjonovNo ratings yet

- All FormulasDocument32 pagesAll Formulasuzairazizsuria1No ratings yet

- Power Electronics (1) - ELE221: DR./ Abdelhady GhanemDocument25 pagesPower Electronics (1) - ELE221: DR./ Abdelhady GhanemAhmad Ash SharkawiNo ratings yet

- Andrei Ibay-Tesla-Q3-Bas Cal-Performance Task#2Document17 pagesAndrei Ibay-Tesla-Q3-Bas Cal-Performance Task#2DEAN ANDREI IBAYNo ratings yet

- Module-2 Fundamentals of SurveyingDocument2 pagesModule-2 Fundamentals of Surveyingnonononoway100% (1)

- Sensityvity AnalysisDocument44 pagesSensityvity AnalysisArnab ShyamalNo ratings yet

- 02 Efficient FrontierDocument31 pages02 Efficient FrontierVarun VamosNo ratings yet

- Lecture 13Document27 pagesLecture 13dewanshu soniNo ratings yet

- c/2 (1-d) /A (This Is Periodic) Then Multiply The Above Answer With 2Document1 pagec/2 (1-d) /A (This Is Periodic) Then Multiply The Above Answer With 2pare121No ratings yet

- ReturnDocument1 pageReturnNahidul Islam IUNo ratings yet

- EE 419 BEE Lec Module 8Document3 pagesEE 419 BEE Lec Module 8Jhun Lucky SadsadNo ratings yet

- College Physics: Machine LearningDocument30 pagesCollege Physics: Machine LearningSimarpreetNo ratings yet

- TND352 DDocument79 pagesTND352 DMind of BeautyNo ratings yet

- Lecture 03 Amplitude Modulation PDFDocument9 pagesLecture 03 Amplitude Modulation PDFRobert MudzongaNo ratings yet

- 8 de CFD FVM For Diffusion ProblemsDocument45 pages8 de CFD FVM For Diffusion ProblemsAmey LandgeNo ratings yet

- Unit 7Document1 pageUnit 7api-553443352No ratings yet

- Chapter 9 - Common Probability DistributionsDocument2 pagesChapter 9 - Common Probability Distributionsdar shilNo ratings yet

- Chapter 3Document21 pagesChapter 3alemu assefaNo ratings yet

- Jackel 2006 - ByImplication PDFDocument6 pagesJackel 2006 - ByImplication PDFpukkapadNo ratings yet

- Functions For Integers: Randrange RandrangeDocument138 pagesFunctions For Integers: Randrange Randrangelibin_paul_2No ratings yet

- CH 15-1 - Series and Parallel Ac CircuitsDocument34 pagesCH 15-1 - Series and Parallel Ac Circuitsعبدالله المعتقNo ratings yet

- SolutionDocument5 pagesSolutionsaalimNo ratings yet

- Gm-Boosting Using Neg ResistanceDocument15 pagesGm-Boosting Using Neg Resistanceashik anuvarNo ratings yet

- Correlation & RegressionDocument21 pagesCorrelation & RegressionResulto, Reylyn T.No ratings yet

- 28.statistics Formulae - by Anand Kaku-1Document7 pages28.statistics Formulae - by Anand Kaku-1Nikhil AdhavanNo ratings yet

- Sharpe, Treynor and Jensen MeasuresDocument17 pagesSharpe, Treynor and Jensen MeasuresAbhijeetNo ratings yet

- Formula Sheet - LargeDocument4 pagesFormula Sheet - LargeThomas MorganNo ratings yet

- CS Unit-3Document16 pagesCS Unit-3auchthram143No ratings yet

- Confidence Intervals For Michaelis-Menten ParametersDocument10 pagesConfidence Intervals For Michaelis-Menten ParametersscjofyWFawlroa2r06YFVabfbajNo ratings yet

- Eetop - CN - GM - Over - Id ExampleDocument2 pagesEetop - CN - GM - Over - Id ExampleW.M. FNo ratings yet

- Normal DistributionDocument2 pagesNormal DistributionJackleen Rose JubeleaNo ratings yet

- Binomial GreeksDocument11 pagesBinomial Greeksjshew_jr_junkNo ratings yet

- A-level Maths Revision: Cheeky Revision ShortcutsFrom EverandA-level Maths Revision: Cheeky Revision ShortcutsRating: 3.5 out of 5 stars3.5/5 (8)

- Hadamard Transform: Unveiling the Power of Hadamard Transform in Computer VisionFrom EverandHadamard Transform: Unveiling the Power of Hadamard Transform in Computer VisionNo ratings yet

- Understanding Vector Calculus: Practical Development and Solved ProblemsFrom EverandUnderstanding Vector Calculus: Practical Development and Solved ProblemsNo ratings yet

- Bayesian Analysis (Probability Distribution) : Types of QuestionsDocument1 pageBayesian Analysis (Probability Distribution) : Types of QuestionsDIVYANSHU GUPTANo ratings yet

- QM Hypothesis Testing SSEIDocument1 pageQM Hypothesis Testing SSEIDIVYANSHU GUPTANo ratings yet

- Fixed Income Part IV SSEIDocument1 pageFixed Income Part IV SSEIDIVYANSHU GUPTANo ratings yet

- FMP Interest Rates SSEIDocument1 pageFMP Interest Rates SSEIDIVYANSHU GUPTANo ratings yet

- Foundations ERM SSEIDocument1 pageFoundations ERM SSEIDIVYANSHU GUPTANo ratings yet

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- FMP Intro To Derivatives SSEIDocument1 pageFMP Intro To Derivatives SSEIDIVYANSHU GUPTANo ratings yet

- QM Hypothesis Testing SSEIDocument1 pageQM Hypothesis Testing SSEIDIVYANSHU GUPTANo ratings yet

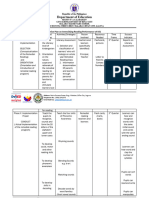

- Kinder Catch Up Friday Action PlanDocument4 pagesKinder Catch Up Friday Action PlanAriane PimentelNo ratings yet

- Numericals - Demand Supply.1Document3 pagesNumericals - Demand Supply.1Anonymous sMqylHNo ratings yet

- Policy Brief Food Advertising To ChildrenDocument4 pagesPolicy Brief Food Advertising To Childrenapi-267120287No ratings yet

- Glycolysis ProcessDocument7 pagesGlycolysis ProcessBlister CountNo ratings yet

- CMM Galley g3 25-35-78 Rev 01Document395 pagesCMM Galley g3 25-35-78 Rev 01VassilisNo ratings yet

- ABEM Terraloc Pro User ManualDocument101 pagesABEM Terraloc Pro User ManualMichael KazindaNo ratings yet

- 2019 Sleep Apnea Detection Based On Rician Modelling of Feature Variations in Multi Band EEGDocument9 pages2019 Sleep Apnea Detection Based On Rician Modelling of Feature Variations in Multi Band EEGYasrub SiddiquiNo ratings yet

- Planning A House PDFDocument21 pagesPlanning A House PDFchetanNo ratings yet

- 1 s2.0 S0167732217315696 MainDocument10 pages1 s2.0 S0167732217315696 MainMayaGhazaNo ratings yet

- 1st Semester Book List 2018Document18 pages1st Semester Book List 2018then lai hongNo ratings yet

- Altai C2s Catalog Eng 170224Document2 pagesAltai C2s Catalog Eng 170224glocallNo ratings yet

- Catalogo Olson InstrumentsDocument44 pagesCatalogo Olson InstrumentsJuanNo ratings yet

- MSE250 Syllabus Fall2013Document4 pagesMSE250 Syllabus Fall2013AlekNo ratings yet

- Final BrochureDocument24 pagesFinal BrochureSania LokhoNo ratings yet

- Rap + Keb. Bahan. Hit 1Document173 pagesRap + Keb. Bahan. Hit 1ChairilSaniNo ratings yet

- ANSYS Ncode DesignLife v13Document20 pagesANSYS Ncode DesignLife v13j_c_garcia_dNo ratings yet

- MTU16V4000DS2000 2000kW StandbyDocument4 pagesMTU16V4000DS2000 2000kW Standbyalfan nashNo ratings yet

- Mbamca - Exam Centre n10Document2 pagesMbamca - Exam Centre n10Indhumathi SubbiahNo ratings yet

- Internal FlowDocument6 pagesInternal FlowdenisarissetiajiNo ratings yet

- CattsDocument39 pagesCattsMel SeoaneNo ratings yet

- Horoscope ExplorerDocument54 pagesHoroscope ExplorerchiralatNo ratings yet

- Versuri Muzica Anii 80 - 90Document25 pagesVersuri Muzica Anii 80 - 90Mia DutuNo ratings yet

- Intersection A Curve and A LineDocument16 pagesIntersection A Curve and A LineIr HeriawanNo ratings yet

- Grammar of PaintingDocument366 pagesGrammar of PaintingKarla Mollinedo100% (1)

- An Introduction To Organizational Communication PDFDocument524 pagesAn Introduction To Organizational Communication PDFMihaela Badea100% (1)

- Julien at Al. 2022Document9 pagesJulien at Al. 2022VanessaNo ratings yet

- SAT Refresher ManualDocument200 pagesSAT Refresher ManualJake Girman100% (1)