Professional Documents

Culture Documents

Form16 1951051 17631 04570193K 2021 2022

Uploaded by

Ranjeet RajputOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form16 1951051 17631 04570193K 2021 2022

Uploaded by

Ranjeet RajputCopyright:

Available Formats

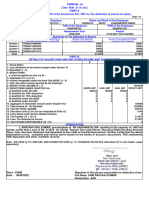

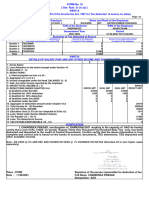

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 2

Employer - PAO Code Name and Rank of the Employee

72 VINOD SINGH

PAN of the Deductor TAN of the Deductor PAN of the Employee

BAFPM3766H JBPPO1639B BOOPS7094P

CIT(TDS) Address Assessment Year / Tax Option Period

1(2) 2021-2022/OLD 01/04/2020 TO 31/03/2021

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1 QUADIZCE 4226 4226

Quarter 2 QUDSWBFB 4439 4439

Quarter 3 QUJJHPME 14915 14915

Quarter 4 QUJJLPOD 14098 14098

Total 37678 37678

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary * 876619

2. Standard Deduction * 50000

3. Less Allowance to the extent exempt under Section 10 55296

4. BALANCE (1 - 2) 771323

5. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

6. Aggregate of 5 ( a to b ) 0

7. Income chargeable under the Head 'SALARIES' (3 - 5) 771323

8. Add: Any other income reported by the employee 0

9. GROSS TOTAL INCOME (6 + 7) 771323

10. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 222000 150000 150000

b) Qualified for 100% deduction 2687 2687 2687

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

11. Aggregate of deductible amount under Chapter VI-A 152687

12. Total Income (8 - 10) Rounded 618640

13. TAX ON TOTAL INCOME 36228

14. Health & Education Cess @4% (on tax computed at Sl.No.12) 1450

15. Tax Payable (12 + 13) 37678

16. Less: Relief under Section 89(attach Details) 0

17. Less : Tax Deducted 37678

18. TAX PAYABLE/REFUNDABLE (15 - 16) 0

VERIFICATION

I, KESH RAM MEENA, son/daughter of GIRWAR LAL MEENA working in the capacity of AAO do

hereby certify that a sum of Rs. 37678 (in words) Rupees Thirty Seven Thousand Six Hundred Seventy Eight

only. has been deducted and deposited to the credit of Central Government. I further certify that the above

information is true, complete and correct and is based on the books of account, documents, TDS statements,

TDS deposited and other available records.

Note : Health and Education Cess @4% Charged On Income Tax (Rounded off to next higher rupee)

Place : Signature of the person responsible for deduction of tax

Date : 18/06/2021 Full Name KESH RAM MEENA

Designation AAO

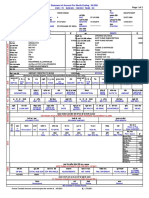

BREAK UP OF TAXABLE EMOLUMENTS FINANCIAL YEARWISE Page 2 2

Employer - PAO Code Name and Rank of the Employee

72 VINOD SINGH

For the financial year from 01/03/2017 to 28/02/2018 = -800.0

For the financial year from 01/03/2018 to 28/02/2019 = -1200.0

For the financial year from 01/03/2019 to 29/02/2020 = 54632.0

For the financial year from 01/03/2020 to 28/02/2021 = 823987.0

Total taxable emoluments 876619.0

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Power Bank of Empire City 15th PAYROLL: For The Period ofDocument3 pagesPower Bank of Empire City 15th PAYROLL: For The Period ofGas dela RosaNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- BPMN 3023strategic ManagementDocument48 pagesBPMN 3023strategic ManagementSiti Nabilah100% (1)

- CIR v. PBCOMDocument7 pagesCIR v. PBCOMcdacasidsidNo ratings yet

- CIR Vs CA Case DigestDocument1 pageCIR Vs CA Case DigestEbbe DyNo ratings yet

- Sap GSTDocument47 pagesSap GSTprchari1980No ratings yet

- Bdo V CirDocument20 pagesBdo V CirKrys MartinezNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Pradeep Form 16Document3 pagesPradeep Form 16keerthi vasanNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Bensingh Form 16 - SignedDocument2 pagesBensingh Form 16 - SignedGloryNo ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Sudhir Jagannath Belose 23-24Document3 pagesSudhir Jagannath Belose 23-24pankajyadav7410No ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- Sict College Sagar: in Partial Fulfillment of MBA Fourth Semester Project Session 2008-2010Document47 pagesSict College Sagar: in Partial Fulfillment of MBA Fourth Semester Project Session 2008-2010Ranjeet RajputNo ratings yet

- Rajneesh Tiwari CVDocument2 pagesRajneesh Tiwari CVRanjeet RajputNo ratings yet

- Statement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Document2 pagesStatement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Ranjeet RajputNo ratings yet

- Geography DepartmentDocument1 pageGeography DepartmentRanjeet RajputNo ratings yet

- On BlackberryDocument8 pagesOn BlackberryRanjeet Rajput100% (1)

- Indian Financial SystemDocument57 pagesIndian Financial SystemRanjeet RajputNo ratings yet

- Comparative Study of BS of Two Electronic CompanyDocument45 pagesComparative Study of BS of Two Electronic CompanyRanjeet RajputNo ratings yet

- PROJECT FINANCIAL ANALYSIS HDFC LifeDocument52 pagesPROJECT FINANCIAL ANALYSIS HDFC LifeRanjeet RajputNo ratings yet

- Ugroll Result PDFDocument164 pagesUgroll Result PDFRanjeet RajputNo ratings yet

- Deepak Memorial Academy: Summative Assessment-II 2014-2015 Class-II ComputerDocument2 pagesDeepak Memorial Academy: Summative Assessment-II 2014-2015 Class-II ComputerRanjeet RajputNo ratings yet

- Project On Bajaj AllianzDocument70 pagesProject On Bajaj AllianzRanjeet Rajput100% (1)

- Harshali HyundaiDocument37 pagesHarshali HyundaiRanjeet Rajput100% (1)

- Data Analysis of FastrackDocument12 pagesData Analysis of FastrackRanjeet Rajput0% (1)

- College: Online RegistrationDocument1 pageCollege: Online RegistrationRanjeet RajputNo ratings yet

- Monthly Travel Plan: Flair Pens LimitedDocument1 pageMonthly Travel Plan: Flair Pens LimitedRanjeet RajputNo ratings yet

- Finance UbiDocument36 pagesFinance UbiRanjeet RajputNo ratings yet

- Sbi Gopal Ganj SagarDocument42 pagesSbi Gopal Ganj SagarRanjeet RajputNo ratings yet

- Questionnaire: Name:-Age:. Gender: - OccupationDocument1 pageQuestionnaire: Name:-Age:. Gender: - OccupationRanjeet RajputNo ratings yet

- Environment Encompasses All Living andDocument12 pagesEnvironment Encompasses All Living andRanjeet RajputNo ratings yet

- Types of GlacierDocument17 pagesTypes of GlacierRanjeet RajputNo ratings yet

- TIEZA GuidelinesDocument39 pagesTIEZA GuidelinesYzabelle Reign HechanovaNo ratings yet

- 017 Strategy Chapter 9 Strategy Evaluation SlidesDocument32 pages017 Strategy Chapter 9 Strategy Evaluation SlidesNash AsanaNo ratings yet

- Reining In: Brazil's Informal EconomyDocument7 pagesReining In: Brazil's Informal EconomylugarxNo ratings yet

- 822 Taxation SQPDocument9 pages822 Taxation SQPIampro 3362No ratings yet

- 9 WP Irp PDF AngDocument22 pages9 WP Irp PDF AngAfrim AliliNo ratings yet

- Balance Sheet of Amara Raja BatteriesDocument11 pagesBalance Sheet of Amara Raja Batteriesashishgrover80No ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument21 pagesNon-Current Assets Held For Sale and Discontinued OperationsEshetie Mekonene AmareNo ratings yet

- Income Tax DepartmentDocument1 pageIncome Tax DepartmentMr. XNo ratings yet

- Abebe Project FinalDocument47 pagesAbebe Project FinalDagmawi TesfayeNo ratings yet

- Santos Vs LlamasDocument27 pagesSantos Vs LlamasCarina Amor Claveria100% (1)

- AEC 215 Week 3 HandoutsDocument7 pagesAEC 215 Week 3 HandoutsKeith Chea Pace CobradorNo ratings yet

- AR DJP 2014-Eng - 2Document192 pagesAR DJP 2014-Eng - 2HenryNo ratings yet

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATNitin ChoudharyNo ratings yet

- InvoiceDocument2 pagesInvoicevedavyas reddyNo ratings yet

- Topic 6 - Damages May 23Document90 pagesTopic 6 - Damages May 23LIM HAI CHENGNo ratings yet

- InstructionsDocument15 pagesInstructionsMarivicEchavezBulaoNo ratings yet

- 01 eLMS Activity 3 - ARGDocument2 pages01 eLMS Activity 3 - ARGJilliane MaineNo ratings yet

- EC0-PF Mid Sem NotesDocument71 pagesEC0-PF Mid Sem NotesSindhu ,No ratings yet

- Gmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGDocument3 pagesGmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGRoha JavidNo ratings yet

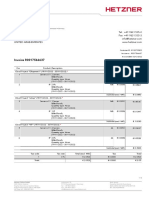

- Hetzner 2022-12-02 R0017566637Document2 pagesHetzner 2022-12-02 R0017566637گیزمیزموویNo ratings yet

- Deen Bandhu Chhotu Ram Thermal Power Project Yamuna Nagar (A Unit of Haryana Power Generation Corporation LTD)Document17 pagesDeen Bandhu Chhotu Ram Thermal Power Project Yamuna Nagar (A Unit of Haryana Power Generation Corporation LTD)Mark KNo ratings yet

- Tax LawDocument3 pagesTax LawAnkit KumarNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- EC Fiscal Policy Quiz ANSWERSDocument5 pagesEC Fiscal Policy Quiz ANSWERSRashid HussainNo ratings yet