Professional Documents

Culture Documents

Analyzing The Base Expense

Analyzing The Base Expense

Uploaded by

Hausland Const. Corp.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing The Base Expense

Analyzing The Base Expense

Uploaded by

Hausland Const. Corp.Copyright:

Available Formats

Analyzing the base expense versus the discounted in-house rate for equipment rental is crucial for

ensuring profitability, competitiveness, and effective cost management. Here's a critical thinking analysis

of this data:

Base Expense (Per Hour):

The "Base Expense" represents the minimum cost incurred by the company to operate and maintain

each piece of equipment. It includes factors like depreciation, maintenance, fuel, labor, and overhead

expenses.

Discounted In-House Rate Per Hour:

The "Discounted In-House Rate" is the price at which the company offers equipment rental services to

its customers. This rate is lower than the market rate (ACEL Rate) and might be designed to attract more

business from internal or loyal clients.

Now, let's dive into the analysis:

a. Profit Margins:

The "Default 15% Margin or 50% of ACEL Rate" represents the margin that the company aims for in its

pricing strategy. This suggests that the in-house rate is set based on this margin, but it might not be

consistent across all equipment types. For instance, some equipment has an in-house rate that's 50% of

the ACEL Rate, which may yield a higher margin than 15%.

b. Competitive Pricing:

To stay competitive, it's important to ensure that the discounted in-house rate is lower than the ACEL

Rate. This data shows that, in most cases, the in-house rate is indeed lower, which can help the

company attract customers. However, in some cases, it's identical or slightly higher.

c. Equipment-Specific Rates:

Different equipment types have varying rates and profit margins. Some equipment, such as "Backhoe

PC10" and "Boom Truck CAK2603," has an in-house rate equal to the default margin, while others are

set lower.

d. The Impact of Default Margins:

It's worth evaluating whether the "Default 15% Margin or 50% of ACEL Rate" is suitable for all

equipment types. If the company can achieve a higher margin on some equipment without losing

customers, it might consider adjusting the margin accordingly.

e. Customer Segmentation:

It's possible that the company's customers have varying price sensitivities. The company may choose to

apply different pricing strategies for different customer segments, such as loyal customers or large-scale

projects.

f. Cost Management:

The base expense and discounted in-house rate data allow the company to evaluate its cost

management and pricing strategies. It's essential to maintain a balance between competitive pricing and

ensuring profitability.

g. Data Accuracy:

To make informed decisions, the company should ensure the accuracy of the data, especially in cases

where in-house rates match or exceed ACEL Rates, as this could affect its competitive position.

h. Market Demand:

The company should continuously monitor market demand and adjust rates accordingly. Competitive

rates may attract more customers and lead to increased utilization of equipment.

In conclusion, this analysis emphasizes the importance of understanding the relationship between base

expenses and discounted in-house rates. Striking the right balance between competitive pricing and

profitability is crucial for the company's success in the equipment rental business. It also highlights the

need for ongoing evaluation and adjustment of pricing strategies based on market conditions and

specific equipment types.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Canva 5 Design Milestone BadgeDocument3 pagesCanva 5 Design Milestone BadgeHausland Const. Corp.No ratings yet

- Group 3 (MMPA) Chapter 8 CommunicationDocument66 pagesGroup 3 (MMPA) Chapter 8 CommunicationHausland Const. Corp.No ratings yet

- CH10 Foundations of Control (Group4 14-MMPA)Document16 pagesCH10 Foundations of Control (Group4 14-MMPA)Hausland Const. Corp.No ratings yet

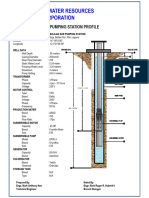

- Water Resources Inc - Pumping Station Profile - Well DesignDocument2 pagesWater Resources Inc - Pumping Station Profile - Well DesignHausland Const. Corp.No ratings yet

- TFOE Membership Application Form - FINAL2024Document3 pagesTFOE Membership Application Form - FINAL2024Hausland Const. Corp.No ratings yet

- 01.25.16 BOQ2 Civil EstimateDocument25 pages01.25.16 BOQ2 Civil EstimateHausland Const. Corp.No ratings yet

- 1.28.16 Coca Cola Femsa Commercial ProposalDocument4 pages1.28.16 Coca Cola Femsa Commercial ProposalHausland Const. Corp.No ratings yet

- The Diverse WorkforceDocument22 pagesThe Diverse WorkforceHausland Const. Corp.No ratings yet

- Le Ja COMPLTE ANALYSISDocument630 pagesLe Ja COMPLTE ANALYSISHausland Const. Corp.No ratings yet

- ExcavationDocument5 pagesExcavationHausland Const. Corp.No ratings yet

- Pamana Expenses NewDocument48 pagesPamana Expenses NewHausland Const. Corp.No ratings yet

- Report RCC DesignDocument21 pagesReport RCC DesignHausland Const. Corp.No ratings yet

- 02.01.16 Process Flow DiagramDocument1 page02.01.16 Process Flow DiagramHausland Const. Corp.No ratings yet

- Le JaDocument198 pagesLe JaHausland Const. Corp.No ratings yet

- Complete Colution CalcualtionDocument80 pagesComplete Colution CalcualtionHausland Const. Corp.No ratings yet

- Wall Footing Design 3-7-2024Document32 pagesWall Footing Design 3-7-2024Hausland Const. Corp.No ratings yet

- 11.90 Design ReprotDocument10 pages11.90 Design ReprotHausland Const. Corp.No ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryHausland Const. Corp.No ratings yet

- Layout & StakingDocument5 pagesLayout & StakingHausland Const. Corp.No ratings yet

- 8.75 DesignDocument26 pages8.75 DesignHausland Const. Corp.No ratings yet

- Engaging Theme - ReportDocument2 pagesEngaging Theme - ReportHausland Const. Corp.No ratings yet

- Weekly Accomplishment - Report - Format - HCCDocument1 pageWeekly Accomplishment - Report - Format - HCCHausland Const. Corp.No ratings yet

- Kpi OpsDocument2 pagesKpi OpsHausland Const. Corp.No ratings yet

- DEMOGRAPHICSDocument2 pagesDEMOGRAPHICSHausland Const. Corp.No ratings yet

- Org Chart 1Document2 pagesOrg Chart 1Hausland Const. Corp.No ratings yet

- Update ReportDocument2 pagesUpdate ReportHausland Const. Corp.No ratings yet

- MP OrgDocument2 pagesMP OrgHausland Const. Corp.No ratings yet

- Refined Process Flow-Concrete ProductsDocument2 pagesRefined Process Flow-Concrete ProductsHausland Const. Corp.No ratings yet

- PMBOK Compliant Project Management (By Sensei Project Solutions)Document20 pagesPMBOK Compliant Project Management (By Sensei Project Solutions)Hausland Const. Corp.No ratings yet

- BF Productivity RateDocument80 pagesBF Productivity RateHausland Const. Corp.No ratings yet