Professional Documents

Culture Documents

(อ.มาโนช) CUTIxTSRI Rail Seminar

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(อ.มาโนช) CUTIxTSRI Rail Seminar

Copyright:

Available Formats

หัวขอ “ทําไม?

การขนสงทางรางจึงสูทางถนนไมได”

วันพุธ ที่ 9 พฤศจิกายน พ.ศ. 2565

เวลา 09.00 – 12.00 น.

ณ Activity Hall ชั้น 1 สภาหอการคาแหงประเทศไทย

Chulalongkorn University Transportation Institute

Freight transport

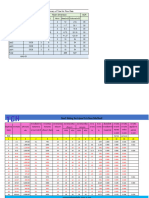

ปริมาณขนสงสินคาในประเทศ จําแนกตามรูปแบบการขนสง (หนวย: พันตัน)

รูปแบบ 2557 2558 2559 2560 2561 2562 2563 สัดสวน

ทางถนน 465,020 482,358 484,884 482,596 483,760 483,168 450,800 80%

ทางราง 10,802 11,388 11,937 11,695 10,232 10,262 11,510 2%

ทางแมนํ้า 50,113 50,907 50,327 53,026 55,739 55,999 49,248 9%

ทางทะเล 46,673 51,872 50,894 60,850 61,798 61,772 54,023 10%

ทางอากาศ 116 118 122 116 95 78 32 0%

รวม 572,723 596,643 598,165 608,283 611,624 611,279 565,613 100%

ที่มา สํานักงานนโยบายและแผนการขนส่งและจราจร, 2563

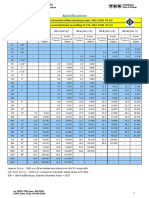

Transportation Modes Share per Countries in 2017

The research : Brazil Railway

Source : Frederico & Cavenagh, 2017

Chulalongkorn University Transportation Institute

Freight transport

สัดสวนปริมาณการขนสงสินคาภายในประเทศ ปริมาณการขนสงสินคาทางราง (หนวย: พันตัน)

แบงตามวิธีการขนสง ป พ.ศ. 2564 16,000

(ราง) 14,000

2% 11,965 11,456

(ทางนํ้า) 12,000

11% 10,232 10,262 10,510

10,000

0.003%

(ทางอากาศ) 8,000

6,000

4,000

2,000

-

2560 2561 2562 2563 2564

87% (ทางถนน)

ปริมาณการขนสงสินคาทางรางมีอัตราการเติบโตเฉลี่ยตอปลดลงที่รอยละ 0.51

ที่มา : การรถไฟแหงประเทศไทย และ PrimeStreet Analysis, 2565

Chulalongkorn University Transportation Institute

Financial

ตนทุนการขนสงสินคาของการขนสงแตละรูปแบบ (บาท/ตัน - กิโลเมตร) ป 2562 รายไดของการขนสงสินคาของการรถไฟฯ ป 2557 - 2564

รายไดขนสงสินคา อัตราการเติบโต

30 < 28เทา ป (ลานบาท) (YoY) CAGR

25 2557 1833.6 -14.40%

20

20 2558 1892.1 3.20%

< 2เทา

15 2559 1953.5 3.20%

2560 2130.1 9.00%

10 -0.10%

2561 2066.8 -3.00%

5 1.38 0.71 0.52 2562 1981.3 -4.10%

0

2563 1853.1 -6.50%

ทางอากาศ ทางถนน รฟท. ทางนํ้า

2564 1825.5 -1.50%

ที่มา : การรถไฟแหงประเทศไทย และ PrimeStreet Analysis, 2565

Chulalongkorn University Transportation Institute

Capacity Utilization

หนวย: ขบวน

14000 13058

12000

10000

8000

• ความจุทางสูงสุดทางคูยังมี capacity ที่เหลืออยู

6000 ในสัดสวนที่มากในแตละสาย

3900 3885 • ความจุทางยังมี capacity ที่สามารถนํามาสราง

4000 2882 2391 รายไดในการขนสงแบบตางๆได

2000

0

อัตราการใชประโยชน

15% 25% 21% 35% 23%

(Utilization)

ที่มา : การรถไฟแหงประเทศไทย และ PrimeStreet Analysis, 2565

Chulalongkorn University Transportation Institute

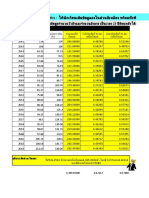

ผลการประเมินตัวชี้วัดวิสัยทัศนในระดับองคกรของการรถไฟแหงประเทศไทย

2560 2561 2562 2563 2564 2565

ตัวชี้วัด หนวยวัด

Actual Target Actual Target Actual Target Actual Target Actual Target Target

EBITDA มีการปรับตัวที่ดีขึ้น ลานบาท (5,105) (5,891) (3,483) (5,350) (5,352) (7,039) (4,291) (7,358) (6,107) (5,494) (5,475)

จํานวนผูโดยสาร ลานคน 34.9 33 36.9 33 37.09 34.5 26.32 26.5 35.5 20.4

สัดสวนปริมาณการขนสงทางรางตอปริมาณการ

รอยละ 1.9 1.75 1.67 1.75 - - - - - -

ขนสงสินคาทั้งหมดภายในประเทศ

ปริมาณการขนสงสินคาทางราง ลานตัน - - - - 10.59 17.5 11.03 10 12.5 12.5

ความตรงตอเวลา รอยละ - 70 75 - - - - - -

- โดยสาร รอยละ 69.9 68.95 70.24 80 73.13 70 70.5 73

- สินคา รอยละ 43.3 33.28 48.53 43 59.89 48 60

ความพึงพอใจของผูใชบริการ รอยละ N/A 80 88.4 80 85 80 - - - -

ความพึงพอใจของผูใชบริการ

- ขบวนรถเชิงพาณิชย ระดับ - - - - - - 4 4 4 4

- ขบวนรถเชิงสังคม ระดับ - - - - - - 4 4 4 4

- ขบวนรถสินคา ระดับ - - - - - - 3 3 3 4

ครั้ง/ลาน

- - - - - - - - 1.5 1.09

อัตราการเกิดอุบัติเหตุตอการเดินรถ 1 ลาน กม. กม.

ที่มา : การรถไฟแหงประเทศไทย และ PrimeStreet Analysis, 2565

Chulalongkorn University Transportation Institute

THANK YOU

Chulalongkorn University Transportation Institute

SMART-RAIL

The SMART-RAIL project aims to improve the freight rail services offered to the shippers by focusing on making

improvements on the five main aspects.

SMART-RAIL focuses on innovative solutions and their implementation in the rail freight sector.

SMART-RAIL focuses on the perspective of shippers and logistics providers, for whom a reliable transport

system and a closed information chain are at the center of the drive for more competitiveness.

Accordingly, the performance of the rail system was considered in the development of the KPIs.

Smart-Rail aims to achieve improvements

• Reliability

• Lead Time

• Costs

• Flexibility

• Visibility.

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure reliability

KPI Title KPI Description Stakeholder

- IM

% of trains departing/arriving on time or within defined tolerance

- RU

Punctuality

% of cancelled services – due to reasons on whatever side (IM, RU, terminal)

Average delay time (hours)

- IM

Downtime on railway infrastructure

- RU

Reliability of the train paths No. of disrupting events and their impact (as delay)

Train path availability (% of successful satisfaction vs. rejections)

Time deviation of the demanded train path (demanded vs. assigned)

- IM

Average and maximum delay of a train

- Terminal

Delays Average and maximum delay of the loading/unloading process in terminal - Port

- Logistic operator

Delay in various services, as transloading from/to a ship

Reasons for delay: Classification (e.g. caused by customer, by the

infrastructure manager, by the operator)

Overall reliability - RU, Logistic

% of the transports meeting the scheduled and promised time operator

IM = Infrastructure manager, RU = Railway Undertaking Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure lead time

KPI Title KPI Description Stakeholder

Time to load/unload Average and maximum time necessary to load/unload a wagon or a train in

-RU, Terminal

a terminal or in an end point

Time to assemble train Average and maximum time necessary to get wagons coupled to form a

-RU, Terminal

train

Average and maximum idle time (or exceeded idle time):

- waiting in terminal - RU

- waiting for departure - Terminal

Idle times

- waiting for handling in the port - IM

- waiting for the equipment (engine) - Port

- etc.

General availability of the equipment

Time to wait for assigning equipment or resources (engine, driver) - RU

Waiting for equipment

Time to wait with an assembled train for physical equipment - Terminal

Waiting for another train to assume the wagons/cargo

IM = Infrastructure manager, RU = Railway Undertaking Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure lead time (continue)

KPI Title KPI Description Stakeholder

Handover time between the partners

- RU

Operations in transit Various other services (technical inspections, customs, commercial - Terminal

inspections etc.)

Total transit time between terminals - Terminal

Total delivery time Total transit time door-to-door - Terminal

- RU, Logistic

Average transit speed

operator

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure costs and revenues

KPI Title KPI Description Stakeholder

Type of commodities on a train

No. of different commodities on a train

Cargo composition - RU

No. of different customers on a train

Specific cargo transport (dangerous goods, oversize cargo etc.)

Fees for accessing the railway infrastructure - RU

- for different train services - IM

Railway access fees - for different daytime and weekdays

- for different routes

Unit fee for 1 tonne, for 1 wagon

Costs of the railway leg, road leg, shortsea leg - RU,

- Logistic operator

Shipment costs Mileage costs of each leg

Total transit costs (terminal-terminal, or door-to door), mileage costs

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure effectiveness

KPI Title KPI Description Stakeholder

Average and maximum train capacity in the service, the really utilized

capacity

No. of wagons/containers/transport units on a train - RU

Train capacity

- Logistic operator

Tonnage and % of the maximum allowed tonnage of the trains

Length and % of the maximum allowed length of the trains

- RU, Logistic

Utilization of the train capacity

operator

Utilization of the engine power (of the maximum tonnage)

Efficiency of resources

- RU

% of empty runs of wagons

- Terminal

Average movements of empty wagons or containers

No. of cancellations of a train service - RU

Cancellations - Logistic operator

No show % on a train

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure effectiveness (continue)

KPI Title KPI Description Stakeholder

Utilization of train capacity by direction

Planned loading rate percentage of the trip (one direction) - RU

Directional Balance

Payload tonnes per train/gross tonnes per train - Logistic operator

Actual loading rate percentage of the trip

Planned utilisation rate % of the marshalling yard

Marshalling - RU

Actual utilisation rate % of the marshalling yard - Logistic operator

Time used for loading at terminals - RU

Terminals - Logistic operator

Time used for discharging at terminals

Energy Consumption Energy consumption; kWh/year or kWh/train - RU

Locomotive availability, Blockades of locomotives for maintenance - RU

Management and utilization

Locomotive productivity; tonnekm per locomotive per unit time

of rolling stock

Empty engine runs. Distance per week, month or year

IM = Infrastructure manager, RU = Railway Undertaking Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure flexibility

KPI Title KPI Description Stakeholder

No. of departures per day, per week - RU

Service frequency or quality

No. of destinations served by the terminal or by the whole network - Logistic operator

Additional capacity available on the existing train services

Service parameters Availability of an additional services in case of special needs (e.g. additional - RU

train load)

The shortest time necessary to book a slot on a train - Terminal

Last-minute booking

Cut-off time – when the transport unit needs to come to the terminal - Logistic operator

Rebooking and changing the Ability to rebook or change transport (its destination or parameters)

- RU

transport The shortest time necessary to rebook or change

Number of times the actual plan of the rail service is altered prior to - RU

Rail services altered

departure and why?

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure visibility

KPI Title KPI Description Stakeholder

Infrastructure visibility Scope of information on infrastructure provided - IM

% of cargo for which the information in transit are available

- RU

Visibility of service % of mileage on which the information in transit are available - Logistic operator

No or % of partners who provide data

Availability of the precise tracking - RU

Tracking and tracing

Availability of the tracing

Availability of information in case of disruptions - IM

Disruption visibility Idle time between arising an event and getting informed

Visibility of the alternate or diverted route

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure visibility (continue)

KPI Title KPI Description Stakeholder

No. of different messages, processes, and communication dialogues covered by

the data exchange

- IM

Data exchange Alternatively, number of correct messages (or ratio correct/corrupt messages) - RU

Data exchange standards supported by the ICT systems

No. of messages exchanged

- RU

Data traffic Network throughput used

- Logistic operator

Overall system load

IM = Infrastructure manager, RU = Railway Undertaking

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

KPIs to measure overall satisfaction

KPI Title KPI Description Stakeholder

Perceived availability of How much the customers perceive the service as "available", i.e. to what

- Customers

service extent are their requirements met and not rejected or postponed.

How much the customers perceive the service as "reliable", i.e. to what

Perceived reliability of service extent they feel their transit requirements to be fulfilled with the specified - Customers

time and quality.

How much the customers perceive the service as "available", i.e. to what

Perceived visibility of service - Customers

extent they feel that they have enough information on position and status

Overall satisfaction from the How the customers feel the service as satisfying their requirements and

- Customers

service needs

Claims Percentage of shipments with claims - Customers

Inclination to using the rail How the customers trust the transport services which include railway leg - Customer

Source : Melia, 2017 ; Horizon 2020

Chulalongkorn University Transportation Institute

The research : Brazil Railway

Transportation Modes Share per Countries in 2017

• Brazilian railroad transportation has poor performance when compared with other similar countries.

• The rail transportation production has 25% of participation within total transportation matrix.

Brazil need to improve significantly its railroad transportation in order to achieve a more balanced transportation

matrix. This poor performance impacts directly the country in the world trade, mainly because the country has a

large dependency in commodities production which most of needs to be transported by train. It is clear that the

infrastructure issues have a huge impact on this poor performance but management is also the key.

Source : Frederico & Cavenagh, 2017

Chulalongkorn University Transportation Institute

The research on Brazil's railway aims to present a Performance Measurement Systems framework to be used by

railroad companies.

Balanced Scorecard for Railroad Companies

railway performance Unit

Accomplishment of contracts %

Customers’ satisfaction %

Retention of customers %

Prospection of customers %

customer Market share in current business %

Entrance in news business %

Attendance flexibility to additional demand %

Increase of product mix %

Commercial average speed km/h

EBITDA $

Profit per stock $

ROI (Return on investment) %

Financial EVA (Economic value added) $

TSR (Total shareholder return) %

Reduction of costs %

Flows profitability $/tkm

Implementation in Information technology %

Implementation of training %

Retention in formation programs %

Employees’ satisfaction %

Learn & Growth

Turn-over of employees %

Work accident %

Occupational health %

Absenteeism %

Source : Frederico & Cavenagh, 2017

Chulalongkorn University Transportation Institute

Balanced Scorecard for Railroad Companies (continue)

Railway performance Unit

Locomotives productivity tkm/kgf

Wagons productivity tkm/kgf

Rail Productivity tku/(km.km/h)

Terminals utilization %

Locomotives availability %

Wagons availability %

Terminals availability %

Rail availability %

Timeline accomplishment of recovery rolling materials projects %

Timeline accomplishment of construction and recovery of rail projects %

Locomotives Reliability %

Internal Process

Transit-time of trains hour

Cycle time of wagons hour

Utilization of the traction capacity %

Utilization of wagon capacity %

Accidents -

Unloading efficiency %

Permanence time wagons in terminals hour

Waiting time of trucks in transhipment hour

Production of transportation efficiency %

Energy efficiency of transport l/tkm

Accuracy of production monthly planning %

Source : Frederico & Cavenagh, 2017

Chulalongkorn University Transportation Institute

You might also like

- (คุณทยากร) PPT กรมรางDocument21 pages(คุณทยากร) PPT กรมรางSaraburi Construction Technology Company LimitedNo ratings yet

- รายงานพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศDocument12 pagesรายงานพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศkasidis.saNo ratings yet

- IO Hotel 221125 TH EXDocument23 pagesIO Hotel 221125 TH EXGNo ratings yet

- Q4 2021Document12 pagesQ4 2021thitimaNo ratings yet

- 1 ร่างแผนพัฒนากำลังผลิตไฟฟ้าในไทย 2Document63 pages1 ร่างแผนพัฒนากำลังผลิตไฟฟ้าในไทย 2พิทักษ์ ธนาภรณ์No ratings yet

- ประเทศไทยกับเป้าหมายการลด GHG - Nareerat 21082023 LCA TrainingDocument35 pagesประเทศไทยกับเป้าหมายการลด GHG - Nareerat 21082023 LCA TrainingmercurybkkNo ratings yet

- ความก้าวหน้า รูปแบบการเสริมทรายDocument29 pagesความก้าวหน้า รูปแบบการเสริมทรายKumpanart ChewapreechaNo ratings yet

- รู้จักหนทางสอบติด - Admission Planning โปรแกรมวางแผนอนาคตDocument2 pagesรู้จักหนทางสอบติด - Admission Planning โปรแกรมวางแผนอนาคต15ภาวิตา ดีแป้นNo ratings yet

- Project S CurveDocument21 pagesProject S Curveคนธรรมดา เท่าเทียมกันNo ratings yet

- BCCT-NTCC Brief Briefing On 'Bangkok Is Sinking'Document40 pagesBCCT-NTCC Brief Briefing On 'Bangkok Is Sinking'gourav_gogoNo ratings yet

- EQD1504Document11 pagesEQD1504wannisaphupanchit260042No ratings yet

- 01 แนวโน้มการลงทุนเด่นในเอเชียใต้ - กองพัฒนาผู้ประกอบการไทย - BOIDocument51 pages01 แนวโน้มการลงทุนเด่นในเอเชียใต้ - กองพัฒนาผู้ประกอบการไทย - BOIChakri BoonyanarutheeNo ratings yet

- Sonic PLDocument5 pagesSonic PLkidNo ratings yet

- PW GE2102 กฎหมายที่เกี่ยวข้องกับการตั้งครรภ์ในวัยรุ่นDocument32 pagesPW GE2102 กฎหมายที่เกี่ยวข้องกับการตั้งครรภ์ในวัยรุ่นnutakita.04No ratings yet

- KPT PDFDocument1 pageKPT PDFSurat WaritNo ratings yet

- KTISDocument29 pagesKTISsozodaaaNo ratings yet

- ผลการพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศ รายท่าอากาศยานDocument37 pagesผลการพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศ รายท่าอากาศยานkasidis.saNo ratings yet

- สถิติการขนส่งประจำไตรมาส 1-66Document86 pagesสถิติการขนส่งประจำไตรมาส 1-66saran.bNo ratings yet

- Opp DayDocument24 pagesOpp DaysozodaaaNo ratings yet

- ตาราง ติวช่องหายDocument10 pagesตาราง ติวช่องหายโจโค โบะNo ratings yet

- ประมาณการค่าใช้จ่ายในการบริหารโครงการDocument4 pagesประมาณการค่าใช้จ่ายในการบริหารโครงการapi-3835337No ratings yet

- แลปสุดท้ายยยยDocument3 pagesแลปสุดท้ายยยยWitthawat ChaiwongNo ratings yet

- File 1441790239Document1 pageFile 1441790239narathon.pmpNo ratings yet

- ข้อมูลจาก excel new ใส่ Cash flow ใส่ sensitivity แล้วDocument20 pagesข้อมูลจาก excel new ใส่ Cash flow ใส่ sensitivity แล้วPacharapol NokphoNo ratings yet

- แลปสุดท้ายยยยDocument3 pagesแลปสุดท้ายยยยWitthawat ChaiwongNo ratings yet

- Issuer First 20190429103243878Document11 pagesIssuer First 20190429103243878077-7 ธีรทัศน์ ปานกันNo ratings yet

- 50Document10 pages50Naiyana PhruekphikunNo ratings yet

- หุ้นDocument2 pagesหุ้น109รัฐพล เนื่องจํานงค์No ratings yet

- DW 13Document6 pagesDW 13Piyatharo69 RushaponNo ratings yet

- FINSTREET HomeLoan CalculationwDocument34 pagesFINSTREET HomeLoan CalculationwMim RompruksaNo ratings yet

- กราฟชีวิต ดูดวงกราฟชีวิต เกิด 16 กันยายน 2547 เวลา 1111น. ฟรีDocument1 pageกราฟชีวิต ดูดวงกราฟชีวิต เกิด 16 กันยายน 2547 เวลา 1111น. ฟรีSarisa IttisakulchaiNo ratings yet

- สกรูมอก TIS 291-2530 and 672-2530 Bolt 8.8 Metric Datasheet by ABPONDocument1 pageสกรูมอก TIS 291-2530 and 672-2530 Bolt 8.8 Metric Datasheet by ABPONKnowledge we shareNo ratings yet

- Nov Strategy - 12Document36 pagesNov Strategy - 12kidNo ratings yet

- ตารางกรอกข้อมุล งบเเละผลการดำเนินงาน (ใช้Document20 pagesตารางกรอกข้อมุล งบเเละผลการดำเนินงาน (ใช้กันณิกา อุ่นเรือนNo ratings yet

- ใบแก้จุดผิด vaccine+Document10 pagesใบแก้จุดผิด vaccine+ศักดิ์ชัย พูนศรีเจริญกุลNo ratings yet

- .6 - .3 - 1Document38 pages.6 - .3 - 1Suphaphit NhupanNo ratings yet

- Tis - 982 2548 - Pe63 80 100Document27 pagesTis - 982 2548 - Pe63 80 100Chotiwan RattanasatienNo ratings yet

- ASEFADocument8 pagesASEFAตุ๊กตุ่น โชกุนNo ratings yet

- ข้อคิดการใช้พลังงานประเทศไทยDocument30 pagesข้อคิดการใช้พลังงานประเทศไทยChanade WichasilpNo ratings yet

- ผลการพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศ รายท่าอากาศยาน ระยะที่ 2Document26 pagesผลการพยากรณ์ความต้องการการเดินทางทางอากาศของประเทศ รายท่าอากาศยาน ระยะที่ 2kasidis.saNo ratings yet

- ราคากลางอาคารสิ่งปลูกสร้างDocument3 pagesราคากลางอาคารสิ่งปลูกสร้างRanger KingguardNo ratings yet

- Inventory ListDocument6 pagesInventory Listpetch.pimjanNo ratings yet

- เวิร์กบุ๊ก1Document2 pagesเวิร์กบุ๊ก1sonofoga1No ratings yet

- สอบไฟนอลDocument9 pagesสอบไฟนอลTiwaNon KongkaewNo ratings yet

- ประเมินยอดขายในประเทศ+ต่างประเทศ ประจำเดือนตุลาคม 2566Document1 pageประเมินยอดขายในประเทศ+ต่างประเทศ ประจำเดือนตุลาคม 2566Phankaew OniNo ratings yet

- การแปลง น็อต เป็น กิโลเมตรต่อชั่วโมงDocument2 pagesการแปลง น็อต เป็น กิโลเมตรต่อชั่วโมงPhraisin PinthanaNo ratings yet

- Kpi-gis2-กฟฟ รายละเอียด - 30 มิ.ย. 66Document3 pagesKpi-gis2-กฟฟ รายละเอียด - 30 มิ.ย. 66อานนท์ มันทะเลNo ratings yet

- CarbonCredits101 October2022 FinalDocument60 pagesCarbonCredits101 October2022 FinalkidNo ratings yet

- Duct Sizing EqualFriction 05052021Document19 pagesDuct Sizing EqualFriction 05052021Rider ThailandNo ratings yet

- 613040465 9 นายฌานปกรณ์ เดชอุดมพร โจทย์ Work PrepareDocument4 pages613040465 9 นายฌานปกรณ์ เดชอุดมพร โจทย์ Work PrepareArty ChanpakornNo ratings yet

- ใบกำกับ ใบส่งของDocument1 pageใบกำกับ ใบส่งของIcee SinlapasertNo ratings yet

- 4-3 TEST 20 Data Analytics Techno2Document6 pages4-3 TEST 20 Data Analytics Techno2เด ฮายNo ratings yet

- ท่อเหล็กดำ Sch 40 PDFDocument1 pageท่อเหล็กดำ Sch 40 PDFsakdaNo ratings yet

- ท่อเหล็กดำ Sch 40 PDFDocument1 pageท่อเหล็กดำ Sch 40 PDFsakdaNo ratings yet

- 3.รายงานภาวะเศรษฐกิจการคลัง เดือนตุลาคม 2566Document8 pages3.รายงานภาวะเศรษฐกิจการคลัง เดือนตุลาคม 2566สํานักงาน ฝึกอบรมNo ratings yet

- BK - ประมาณการงบกำไรขาดทุน 2Document5 pagesBK - ประมาณการงบกำไรขาดทุน 2wipada wanlopsiriNo ratings yet

- ใบงานDocument41 pagesใบงานyf4hjpsswmNo ratings yet

- O12all 2023Document16 pagesO12all 2023Ron HemNo ratings yet

- FreightTransport04 Select3PLDocument8 pagesFreightTransport04 Select3PL65090193No ratings yet