Professional Documents

Culture Documents

Concept in National Income Accounting

Concept in National Income Accounting

Uploaded by

Nor Dalila0 ratings0% found this document useful (0 votes)

17 views35 pagesOriginal Title

Concept in National Income Accounting.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views35 pagesConcept in National Income Accounting

Concept in National Income Accounting

Uploaded by

Nor DalilaCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 35

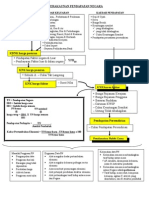

Topic 2: National Income Accounting

At the end of this chapter, the student should be able to:

Define concepts in national income accounting

Gross Domestic Product (GDP)

Gross National Product (GNP)

Net National Product (NNP)

Market Price and Factor Cost

Personal Income (PI)

Disposable Personal Income (DPI)

Per Capita Income

Calculated the national income accounting

Expenditure Approach

Income Approach

Product Approach

Explain the problems related to national income

Difficulties in calculating national income

Difficulties in compare national income

The uses of national income data

National income or national product or national

expenditure is the total value of all goods or services

produced or created by a nation within a certain period

of time, usually one year.

Pendapatan negara atau keluaran negara atau

perbelanjaan negara adalah jumlah nilai semua barang

atau perkhidmatan yang dikeluarkan atau yang dicipta

oleh negara dalam tempoh masa tertentu, biasanya satu

tahun.

National income also refers to the total value of

expenditure by all groups of a population on goods and

services produced by an economy in one year.

Pendapatan negara juga merujuk kepada jumlah nilai

perbelanjaan oleh semua golongan penduduk ke atas

barangan dan perkhidmatan yang dihasilkan oleh

ekonomi dalam satu tahun.

National income is also the total value of income

received by all factors of production such as labour, land,

capital, and entrepreneurs in a nation in a certain period

of time, usually one year.

Pendapatan negara juga adalah jumlah nilai pendapatan

yang diterima oleh semua faktor pengeluaran seperti

buruh, tanah, modal, dan usahawan di sesebuah negara

dalam tempoh masa tertentu, biasanya satu tahun.

Gross Domestic Product (GDP)/

Keluaran Dalam Negara Kasar (KDNK)

GDP is the total value of all final goods and services

produced by factors of production in the country

within a year.

KDNK ialah jumlah nilai semua barang dan

perkhidmatan akhir yang dihasilkan oleh faktor

pengeluaran yang terdapat di dalam negara dalam

tempoh setahun.

The value of GDP does not take into account whether

the factors of production are owned by local citizens or

by citizens of other nations.

Nilai KDNK tidak mengambil kira sama ada faktor-faktor

pengeluaran itu dimiliki oleh warga tempatan atau warga

negara-negara lain.

GDP excludes goods and services produced by

Malaysian citizens working overseas as well as

intermediate goods.

KDNK tidak termasuk barangan dan perkhidmatan yang

dihasilkan oleh rakyat Malaysia yang bekerja di luar

negara dan juga barangan perantaraan.

The output produced by foreign workers in Malaysia

such as by Indonesians or Nepalese will be included in

the GDP Malaysia.

Output yang dihasilkan oleh pekerja asing di Malaysia

seperti pekerja asing dari Indonesia atau Nepal akan

dimasukkan ke dalam KDNK Malaysia.

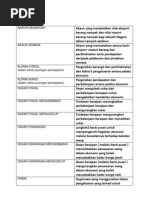

Final goods – are goods that are ready to be used by

the end user.

Barangan akhir - adalah barang-barang yang sedia

untuk digunakan oleh pengguna akhir.

Atau: Barang yang dikeluarkan untuk penggunaan unit

ekonomi dengan tujuan mendapat utiliti atau kepuasan,

bukan untuk tujuan mengeluarkan barang-barang lain.

Contoh: roti dan kereta, yang penggunaannya bertujuan

untuk mendapatkan kepuasan.

Intermediate goods – are goods that are used as input

to produce final goods.

Barang perantaraan - adalah barang-barang yang

digunakan sebagai input untuk mengeluarkan barangan

akhir.

Contoh: tepung gandum untuk membuat roti, besi dan

keluli untuk membuat kereta.

Gross National Product (GNP) /

Keluaran Negara Kasar

GNP is the total final value of goods and services

produced by factors of production owned by citizens

of the nation, regardless of where they are located,

within one year.

KNK ialah jumlah nilai semua barang dan perkhidmatan

akhir yang dihasilkan oleh faktor pengeluaran yang

dimiliki oleh rakyat negara ini, tidak kira di mana mereka

berada, dalam masa satu tahun.

For example, income earned by Malaysians working

abroad in countries like Singapore, Japan, United

States, etc, will be included in the GNP Malaysia.

Sebagai contoh, pendapatan yang diperolehi oleh rakyat

Malaysia yang bekerja di luar negara di negara-negara

seperti Singapura, Jepun, Amerika Syarikat, dan lain-

lain, akan dimasukkan ke dalam KNK Malaysia.

However, the income earned by foreign workers working

in Malaysia will not be included in the GNP Malaysia.

Walau bagaimanapun, pendapatan yang diperolehi oleh

pekerja asing yang bekerja di Malaysia tidak akan

dimasukkan ke dalam KNK Malaysia.

While calculating the GNP, only final goods and services

that satisfy consumption needs will be included and the

value of intermediate goods and inputs will be excluded

to avoid double counting.

Walaupun mengira KNK, hanya barangan dan

perkhidmatan akhir yang memenuhi keperluan

penggunaan akan dimasukkan dan nilai barang-barang

perantaraan dan input akan dikecualikan untuk

mengelakkan pengiraan dua kali.

The difference in value between GDP and GNP is due to

the net factor income from abroad.

The net factor income from abroad is calculated by

subtracting the factor income paid abroad from the factor

income received from abroad.

Net factor income from abroad =

Factor income received from abroad – Factor

income paid abroad

Factor income paid abroad is the payment made to

foreign citizens for the use of factors of production

owned by foreign citizens within the nation.

Pendapatan faktor dibayar ke luar negara ialah bayaran

yang dibuat kepada warga asing untuk penggunaan

faktor pengeluaran yang dimiliki oleh warganegara asing

di dalam negara.

Factor income received from abroad is the income

received by citizens of the nation for the use of factors of

production owned by the nation that are located abroad.

Pendapatan faktor yang diterima dari luar negara adalah

pendapatan yang diterima oleh rakyat negara ini untuk

kegunaan faktor pengeluaran yang dimiliki oleh negara

yang terletak di luar negara.

Net factor income from abroad will be included in the

calculation of GNP. Net factor income paid abroad will be

included in the calculation of GDP.

Therefore, the relationship between GDP and GNP can

be shown as:

GNP = GDP + net factor income from abroad

or

GNP = GDP + (factor income received from abroad –

factor income paid abroad)

Net National Product (NNP) is obtained when the value

of depreciation is subtracted from the GNP.

Keluaran Negara Bersih diperolehi apabila nilai susut

nilai ditolak daripada KNK.

Depreciation occurs when capital equipment used in the

production process becomes obsolete after a certain

period of usage.

Susut nilai berlaku apabila peralatan modal yang

digunakan dalam proses pengeluaran menjadi usang

selepas tempoh tertentu penggunaan.

NNP = GNP – depreciation

Market Price and Factor Cost

Market price refers to the current price in the market

through the forces of demand and supply. Market prices

are the actual prices paid by consumers. Market prices

includes indirect taxes and excludes subsidies given to

producers.

Harga pasaran merujuk kepada harga semasa dalam

pasaran melalui kuasa-kuasa permintaan dan bekalan.

Harga pasaran adalah harga sebenar yang dibayar oleh

pengguna. Harga pasaran termasuk cukai tidak

langsung dan tidak termasuk subsidi yang diberikan

kepada pengeluar.

Therefore, the factor cost is the real price that is earned

by producers or sellers.

Oleh itu, kos faktor adalah harga sebenar yang

diperolehi oleh pengeluar atau penjual.

The difference between gross domestic product at

market price and the factor cost are due to indirect

taxes and subsidies.

Indirect taxes are levied on goods such as excise duty,

import duty and sales tax.

Cukai tidak langsung dikenakan ke atas barangan

seperti duti eksais, duti import dan cukai jualan.

Subsidy is an incentive from the government to

encourage producers to produce more.

Subsidi adalah insentif daripada kerajaan untuk

menggalakkan pengeluar untuk menghasilkan lebih

banyak.

In order to obtain the GDP at market price, we have to

include indirect taxes and excludes the subsidies given

by the government. However, to obtain the GDP at factor

cost, we have subtract indirect taxes and add subsidies

to GDP at market price.

GDPfc = GDPmp – Indirect taxes + subsidies

The same calculation can also be applied to find the

GNP at factor cost.

GNPfc = GNPmp – Indirect taxes + subsidies

National income is also known as Net National Product

at factor cost.

National income consists of wages and salaries, rent,

net interest, corporate profit, and private income

(individual income).

National income includes subsidies but excludes

depreciation and indirect taxes.

National Income can be derived from the net national

product (NNP) at market price by including subsidies

and subtracting indirect taxes.

The difference between NNP and NI is the market price

and factor cost.

National Income / NNPfc = GNPfc – depreciation

Or

National Income at factor cost

= NNP at market price + Subsidies – Indirect taxes

Or

National Income at market price

= NNP at factor cost - Subsidies + Indirect taxes

Personal Income (PI) or private income is the income

received by an individual as payment for factors of

production or as payment for items other than factors of

production.

Pendapatan Peribadi (PI) atau pendapatan peribadi

adalah pendapatan yang diterima oleh seseorang

individu sebagai bayaran untuk faktor pengeluaran atau

sebagai pembayaran untuk item selain daripada faktor-

faktor pengeluaran.

Income from factors of production consists of wages and

salaries, rent, interest, profits, and dividends. Income for

item other than factors of production consists of transfer

payments such as financial assistance, scholarships,

donations, and unemployment allowance.

Pendapatan daripada faktor pengeluaran terdiri daripada

gaji dan upah, sewa, faedah, keuntungan dan dividen.

Pendapatan untuk item selain daripada faktor

pengeluaran terdiri daripada bayaran pindahan seperti

bantuan kewangan, biasiswa, derma, dan elaun

pengangguran.

Personal income consists of the following elements:

a) National income, less undistributed corporate profit,

taxes on corporate profit and employees provident

fund (EPF) contributions.

Pendapatan negara, tolak keuntungan korporat tidak

diagihkan, cukai keuntungan korporat dan

sumbangan Kumpulan Wang Simpanan Pekerja

(KWSP).

b) Transfer payments, including parments to retired,

unemployed, disabled, and senior citizens.

Bayaran pindahan, termasuk bayaran kepada

pesara, penganggur, orang kurang upaya dan warga

tua.

Interest on government loans and consumer loans are

included in personal income, because personal income

consists of income received, regardless of whether the

income is generated from contributions to national

production or not.

Faedah ke atas pinjaman kerajaan dan pinjaman

pengguna termasuk dalam pendapatan peribadi, kerana

pendapatan peribadi terdiri daripada pendapatan yang

diterima, tidak kira sama ada pendapatan dijana

daripada sumbangan kepada pengeluaran negara atau

tidak.

There are two methos to calculate personal income:

Personal income = Wages and salaries + Rent + Interest + Profit + Dividens + Transfer

payments + Interest on government loans + Interest on consumer

loans – Taxes on corporate profit – Undistributed corporate profit

(Retained earning) – EPF contributions

And,

Personal income = National Income + Transfer payments + Interest on government

loans + Interest on consumer loans – Taxes on corporate profit –

Undistributed corporate profit (Retained earning) – EPF contributions

Disposable income or disposable personal income (DPI)

is the total income received and available for an

individual to spend on goods and services produced by

an economy.

Pendapatan boleh guna atau pendapatan boleh guna

peribadi (DPI) adalah jumlah pendapatan yang diterima

dan boleh digunakan oleh individu untuk berbelanja ke

atas barangan dan perkhidmatan yang dihasilkan oleh

ekonomi.

Not all personal income is available to be spent or

saved, as a portion must be used to pay personal

income tax to the government.

Tidak semua pendapatan peribadi yang ada boleh

dibelanjakan atau disimpan, sebahagian perlu

digunakan untuk membayar cukai pendapatan

perseorangan kepada kerajaan.

Thus, the Disposable Personal Income can be obtained

by deducting personal income tax from personal income.

Disposable Personal Income (DPI) =

Personal Income – Personal income tax

Per capita income is the average income of the citizens

of a nation, calculated by dividing the national income for

a certain year by the population at that year.

Pendapatan per kapita adalah pendapatan purata rakyat

sesebuah negara, dikira dengan membahagikan

pendapatan negara bagi tahun tertentu dengan jumlah

penduduk pada tahun itu.

Per capita income = National Income / Total Population

Per capita income is influenced by the standard of living,

and is not suitable to be used to measure the growth of

an economy over time.

Pendapatan per kapita dipengaruhi oleh taraf hidup, dan

tidak sesuai digunakan untuk mengukur pertumbuhan

ekonomi dari masa ke masa.

Real per capita income is the per capita income derived

from the value of national income calculated using fixed

prices.

Pendapatan per kapita benar adalah pendapatan per

kapita yang diperolehi daripada nilai pendapatan negara

yang dikira menggunakan harga tetap.

Therefore, real per capita income is usually used to

measure the growth of an economy.

Oleh itu, pendapatan per kapita benar biasanya

digunakan untuk mengukur pertumbuhan ekonomi.

Economic growth rate = RPCI2 – RPCI1

RPCI1 X 100

* RPCI – Real Per Capita Income

Example:

The real per capita income for Malaysia for the years

2010 and 2011 are RM3369 and RM3461 respectively.

What is the rate of economic growth in 2011?

You might also like

- Nota Ringkas Eko Sem 2Document14 pagesNota Ringkas Eko Sem 2KENNY CHONG SOON JIE Moe100% (6)

- Makro - Bab 2 Perakaunan Pendapatan NegaraDocument10 pagesMakro - Bab 2 Perakaunan Pendapatan NegaraMAS AZRA ZAKIRAH BINTI MOHD AZAHARI MoeNo ratings yet

- Bab 2.1Document13 pagesBab 2.1fatimahNo ratings yet

- 2 Perakaunan Pendapatan NegaraDocument41 pages2 Perakaunan Pendapatan NegaraSiElah IEla100% (1)

- Combine JKE216 1 PDFDocument234 pagesCombine JKE216 1 PDFmohamad yusopNo ratings yet

- Laela Silfiani Aksi 1 Bahan AjarDocument6 pagesLaela Silfiani Aksi 1 Bahan AjarSilfiani SubechiNo ratings yet

- Wk1-t1-Pendapatan Negara Bah 1Document12 pagesWk1-t1-Pendapatan Negara Bah 1chittran313No ratings yet

- Pendampr21 - Eko - Xi - 01 - Bab - 1 - Komponen Dan Penghitungan Pendapatan NasionalDocument2 pagesPendampr21 - Eko - Xi - 01 - Bab - 1 - Komponen Dan Penghitungan Pendapatan NasionalTaufiqqq RohmannnNo ratings yet

- Indian Economic PlanningDocument27 pagesIndian Economic Planninganeesh trade7No ratings yet

- Nota Bab 2 Makro 2018Document114 pagesNota Bab 2 Makro 2018NUR HANA KHALILAH BINTI NOOR AZHA MoeNo ratings yet

- Bab 2Document9 pagesBab 2Baghya LakshimeNo ratings yet

- Perakaunan Pendapatan NegaraDocument50 pagesPerakaunan Pendapatan NegaraPaRaDoX eLaKSaMaNa100% (4)

- Bab 2 Pendapatan NegaraDocument8 pagesBab 2 Pendapatan NegaraSubramaniam PerinanNo ratings yet

- Jke TugasanDocument3 pagesJke TugasanJayanthi MadhavanNo ratings yet

- Definisi Bab 2 (Ekonomi P2)Document2 pagesDefinisi Bab 2 (Ekonomi P2)wenwen18No ratings yet

- Bab 2 - Perakaunan Pendapatan NegaraDocument36 pagesBab 2 - Perakaunan Pendapatan NegaraX Wei Ling100% (1)

- Bab 2 Perakaunan Pendapatan Negara PDFDocument149 pagesBab 2 Perakaunan Pendapatan Negara PDFBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Ekonomi Asas Tingkatan 5 Bab 2Document3 pagesEkonomi Asas Tingkatan 5 Bab 2sally_chiew100% (3)

- Ekonomi Malaysia Bab 2Document23 pagesEkonomi Malaysia Bab 2Muhammad FirhanNo ratings yet

- 01 Akaun NegaraDocument34 pages01 Akaun NegaraJoey EngNo ratings yet

- BAB01 Sektor EkonomiDocument29 pagesBAB01 Sektor EkonomiXea OneNo ratings yet

- Bab 1 Pengenalan MakroekonomiDocument6 pagesBab 1 Pengenalan Makroekonomixiaolook12No ratings yet

- KDNK EkonomiDocument15 pagesKDNK EkonomiNyx AveriaNo ratings yet

- Bab 2.2Document14 pagesBab 2.2fatimahNo ratings yet

- Belanjawan NegaraDocument50 pagesBelanjawan Negarayangshah86% (7)

- Metodologi Dan Sumber DataDocument15 pagesMetodologi Dan Sumber DataHERBERT MUSLIM LAMBUK (MARINE-SABAH)No ratings yet

- MakroDocument54 pagesMakroIkhmal HamidNo ratings yet

- MakroekonomiDocument50 pagesMakroekonomiYangNarimah100% (1)

- Belanjawan NegaraDocument19 pagesBelanjawan NegaraSeilemi JamaludinNo ratings yet

- 5 6068787483577942267Document16 pages5 6068787483577942267Aqlan Shahamir UltraNo ratings yet

- Formula Ekonomi MalaysiaDocument2 pagesFormula Ekonomi MalaysiakibinbrightNo ratings yet

- Perakaunan Pendapatan NegaraDocument16 pagesPerakaunan Pendapatan NegaraSARA SHARMILA BINTI ABDULLAH MoeNo ratings yet

- 01akaun NegaraDocument29 pages01akaun NegaraSazaki SallehNo ratings yet

- Bab 3 Perdagangan A 4Document41 pagesBab 3 Perdagangan A 4FATIN HAFIZAH MOHAMMAD SUKRI100% (1)

- Bab 1.3 - Petunjuk MakroekonomiDocument3 pagesBab 1.3 - Petunjuk MakroekonomiaidaNo ratings yet

- Nota STPM Ekonomi Sem 2 Bab 1Document17 pagesNota STPM Ekonomi Sem 2 Bab 1Nur Farhanah Mohd TahirNo ratings yet

- Belanjawan NegaraDocument50 pagesBelanjawan NegaraSepth Bay Jia EnNo ratings yet

- EKO Bab 1 PENGENALANDocument11 pagesEKO Bab 1 PENGENALANNG SHIN RHU MoeNo ratings yet

- Bab 3 Belanjawan Negara StartingDocument4 pagesBab 3 Belanjawan Negara StartingSu KhengNo ratings yet

- Makroekonomi - FormulaDocument1 pageMakroekonomi - FormulaLee Bella50% (2)

- Definisi Bab 1 Ekonomi Penggal 2Document4 pagesDefinisi Bab 1 Ekonomi Penggal 2wenwen18No ratings yet

- Ekonomi Nota Sem 2Document12 pagesEkonomi Nota Sem 2xxian hhuiNo ratings yet

- Bab 5 Dasar KerajaanDocument31 pagesBab 5 Dasar KerajaanNakoe MansurNo ratings yet

- Perakaunan Pendapatan NegaraDocument15 pagesPerakaunan Pendapatan NegaraHanisah HashimNo ratings yet

- Hp-Proses - IDocument68 pagesHp-Proses - IYusuf NugrahaNo ratings yet

- Bab8 Ekonomi Asas Ting.5Document20 pagesBab8 Ekonomi Asas Ting.5laura_gomis100% (1)

- Eko Sem 2Document9 pagesEko Sem 2Shahlini VelaythumNo ratings yet

- Istilah EkonomiDocument8 pagesIstilah EkonomiAlbertNo ratings yet

- Aliran PendapatanDocument4 pagesAliran PendapatanSiti Hamizah Mohd HalekNo ratings yet

- Keseimbangan Pendapatan Negara Bagi Ekonomi Dua SektorDocument15 pagesKeseimbangan Pendapatan Negara Bagi Ekonomi Dua Sektor8t6zgb6j92No ratings yet

- Penulisan Esei Sem 2Document13 pagesPenulisan Esei Sem 2bellaNo ratings yet

- 7 IMBANGAN PEMBAYARAN DAN KADAR PERTUKARAN ASING TerkiniDocument56 pages7 IMBANGAN PEMBAYARAN DAN KADAR PERTUKARAN ASING TerkiniSiElah IElaNo ratings yet

- Ringkasan PERAKAUNAN PENDAPATAN NEGARADocument1 pageRingkasan PERAKAUNAN PENDAPATAN NEGARAAhmadazams SulaimanNo ratings yet

- Belanjawan Negara MalaysiaDocument12 pagesBelanjawan Negara Malaysiaaprilia100% (1)

- Bab 1 MikroekonomiDocument39 pagesBab 1 MikroekonomiWAN FATIN IZZATI BINTI WAN NOOR AMAN Moe100% (1)

- Soalan Temubual Company SwiftDocument1 pageSoalan Temubual Company SwiftNor DalilaNo ratings yet

- Pengajian Malaysia: Persatuan Bangsa-Bangsa Bersatu (PBB)Document21 pagesPengajian Malaysia: Persatuan Bangsa-Bangsa Bersatu (PBB)Nor DalilaNo ratings yet

- Persatuan Bangsa-Bangsa BersatuDocument18 pagesPersatuan Bangsa-Bangsa BersatuNor DalilaNo ratings yet

- 4.1.2 Rangka Rancangan Jangka Panjang Panjang (RRJP) Dan Rancangan Malaysia (RM) - 2Document21 pages4.1.2 Rangka Rancangan Jangka Panjang Panjang (RRJP) Dan Rancangan Malaysia (RM) - 2Nor Dalila0% (1)

- Sejarah Penggubalan MalaysiaDocument18 pagesSejarah Penggubalan MalaysiaNor DalilaNo ratings yet

- 2.5 Kontrak SosialDocument6 pages2.5 Kontrak SosialNor DalilaNo ratings yet

- 2.4 Peruntukan Utama Dalam Perlembagaan MalaysiaDocument15 pages2.4 Peruntukan Utama Dalam Perlembagaan MalaysiaNor DalilaNo ratings yet

- Pengajian Malaysia - Proses KemerdekaanDocument59 pagesPengajian Malaysia - Proses KemerdekaanNor Dalila100% (1)