Professional Documents

Culture Documents

Market Discussion 12 Dec 10

Uploaded by

AndysTechnicalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Discussion 12 Dec 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

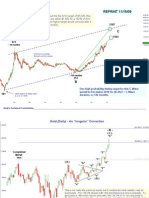

This is pretty much the only viable wave count at this point.

Interestingly, it’s the same one

we’ve been discussing for a few month now! (B)

“y”

c?

-5-

Wave -5- Targets:

a 1247: 61.8% of Wave -1- (b)

1261: 61.8% of Wave -3- (d)

1291: Wave -5- = -1- -3-

(b)

(c) (e)

(a) -4-

-x- -1-

(a) S&P 500 ~ Daily w/RSI

“x”

(c)

-w- -2-

-y-

Sharp RSI Divergence now. This is a

b

necessary ingredient for a reversal.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Weekly with Resistance Zone

The lines below reflect the first two resistance points highlighted on the previous page. These wave

count targets correspond quite well the nexus point of a major market battles in 2008 and is also

nearly the same price level as when Lehman Brothers failed.

Lehman Brothers failed here.

1261

1247

L. Shoulder R. Shoulder

Head

We highlighted the most recent Head and Shoulder

development at the time it was triggered. That target

R. Shoulder

level was 1250. This weekend, Daneric properly points

out the much larget Head and Shoulder pattern off the

March ’09 lows which also targeted the 1250 zone.

L. Shoulder

Head

Andy’s Technical Commentary__________________________________________________________________________________________________

Last week’s resistance levels become this week’s support. We were stopped out of all fresh shorts last week, which is why “stop loss”

strategies are the most important aspects of trading! This was a very explosive move out of what appears to have been a triangle

development from the 1227 high. The medium/longer term technical picture remains bearish, but it makes no sense to initiate any new shorts

until this market shows some sort of “peaking action.” For instance, if it were to “breakout” above 1227, drawing in new length, and then

reversed back below 1227, creating a “bear trap,” then that would be peaking action. Until then, the best posture is to be on the sidelines.

S&P 500 ~ 60 min: Weekly Support and Resistance

(b)

(d)

REPRINTED from 12/5/2010

(e)

(a) (c)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ 60 min: Weekly Support and Resistance

Despite the fact there is rather serious and important wave count targets just over head, we cannot

get overly bearish this market until it displays some weakness that would give us confirmation of a

“peak.” First level weekly support comes in at 1219.50. I will be putting in “sell-stops” just below

1219 to initiate new shorts on weakness.

Andy’s Technical Commentary__________________________________________________________________________________________________

COPPER ~ Monthly

There’s an old saying in technical circles: “Triple tops and bottoms never hold.” Until the

last 18 months, I was a big believer in this concept. However, we’ve recently seen several

instances of triple and quadruple tops/bottoms “holding” as resistance or support. So, we shall

see what becomes of Copper here. The $4.00 zone has been extremely major resistance this

decade--a solid break of this resistance would look very bullish. One of the things that’s readily

obvious about this chart is that Copper is extremely volatile--these are massive percentage

swings. This is a small market that is vulnerable to severe price/supply dislocations. In other

words, Copper is a commodity in which it’s better to view from the sidelines than participate.

Andy’s Technical Commentary__________________________________________________________________________________________________

COPPER ~ LME Warehouse Stocks

Look how violently Copper stocks can swing around. Needless to say, the steady fall in stocks is the

cause of concern for copper shorts. The metal is being used somewhere….

Andy’s Technical Commentary__________________________________________________________________________________________________

DXY 180 min. (Dec Futures) with Weekly Support and Resistance Levels

Here’s the reason for the “risk on” trading. The DXY broke down below trend support and looks destined to probe the 78-76.71 zone.

This is not a good picture for DXY bulls, with the move off the lows looking more corrective than anything else--and, not the

beginning of some kind of stronger move higher.

y

REPRINTED from 12/5/2010

Andy’s Technical Commentary__________________________________________________________________________________________________

DXY 180 min. (Dec Futures) with Weekly Support and Resistance Levels

a

-y-

-b-

-w-

-a-

-c-

-x-

The DXY continues to be a “mixed bag” here. The move off the lows from early November

wasn’t “impulsive,” which is not great news for bulls. The call for the next few weeks is

sideways/lower price action. In the very short term, there does appear to be a small triangle

forming which looks bullish for the beginning of the week; however, the 81.02 resistance should

hold. Notice how the market has struggled into our first level of resistance and 80.31

(highlighted last week).

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 10apr11Document12 pagesMarket Commentary 10apr11AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Copper Report 31 Jan 2010Document8 pagesCopper Report 31 Jan 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- NEoWave Apr 5 2020 MSNPDocument1 pageNEoWave Apr 5 2020 MSNPsemih kartalNo ratings yet

- S&P 500 Update 30 Nov 09Document8 pagesS&P 500 Update 30 Nov 09AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- ReportDocument6 pagesReportarun_algoNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Morning View 28jan2010Document7 pagesMorning View 28jan2010AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- 14 Structural Mechanics Assignment - Sem Ver 2017 18Document43 pages14 Structural Mechanics Assignment - Sem Ver 2017 18john_rutland6177No ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Morning View 25jan2010Document5 pagesMorning View 25jan2010AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- S&P 500 Update 1 Nov 09Document7 pagesS&P 500 Update 1 Nov 09AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Morning View 24 Feb 10Document4 pagesMorning View 24 Feb 10AndysTechnicalsNo ratings yet

- DXY Report 11 April 2010Document8 pagesDXY Report 11 April 2010AndysTechnicalsNo ratings yet

- NEoWave S&PDocument1 pageNEoWave S&PshobhaNo ratings yet

- Unit8 The Msey: 8.0 ObjectivesDocument14 pagesUnit8 The Msey: 8.0 ObjectivesnitikanehiNo ratings yet

- Use The Data in Exercises 9 27 and 9 28 To AnalyzeDocument1 pageUse The Data in Exercises 9 27 and 9 28 To AnalyzeM Bilal SaleemNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Point Estimates for Sample DataDocument36 pagesPoint Estimates for Sample DataPANKAJ PAHWANo ratings yet

- Gold Report 20 Dec 2009Document9 pagesGold Report 20 Dec 2009AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Gold Update 2 Nov 09Document4 pagesGold Update 2 Nov 09AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- CT MAF253 2017 Nov SSDocument4 pagesCT MAF253 2017 Nov SSHaniff HamzahNo ratings yet

- How To Make An Income From GoldDocument6 pagesHow To Make An Income From GoldpacynkaPLNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Late Eat Xchanger: HISAKA Web-Simulator (HWS)Document3 pagesLate Eat Xchanger: HISAKA Web-Simulator (HWS)Dika JanuarNo ratings yet

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighDocument7 pagesAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationNo ratings yet

- HEAT RESISTANT ALUMINIUM PAINTDocument3 pagesHEAT RESISTANT ALUMINIUM PAINTrumi_2kNo ratings yet

- Solenoid Valves Basics - 02Document1 pageSolenoid Valves Basics - 02renvNo ratings yet

- Engineers India - EIRI HiTech Magazine - May 2018Document17 pagesEngineers India - EIRI HiTech Magazine - May 2018Sunesh SharmaNo ratings yet

- SWCH 10aDocument2 pagesSWCH 10asujiyopptsrNo ratings yet

- Décembre 1995: Boutique AFNOR Pour: Solios Carbone Client 8319200 Commande N-20100112-383554-TA Le 12/1/2010 16:25Document15 pagesDécembre 1995: Boutique AFNOR Pour: Solios Carbone Client 8319200 Commande N-20100112-383554-TA Le 12/1/2010 16:25Mahesh Kumar BandariNo ratings yet

- Words Meanings Rattrap (By Selema Lagerlof)Document6 pagesWords Meanings Rattrap (By Selema Lagerlof)ananyaNo ratings yet

- Building Tech ReviewerDocument25 pagesBuilding Tech ReviewerKen MacNo ratings yet

- Teflon-Lined Magnetic and Centrifugal Pumps - SBMC CatalogDocument37 pagesTeflon-Lined Magnetic and Centrifugal Pumps - SBMC CatalogGarso Įrangos RemontasNo ratings yet

- Electrochemistry: Chemistry 30 WorksheetsDocument49 pagesElectrochemistry: Chemistry 30 Worksheetsdan anna stylesNo ratings yet

- Iso 5817 2023Document12 pagesIso 5817 2023Marcus GimenesNo ratings yet

- Inspection & Testing Requirements Scope:: Test and Inspection PerDocument2 pagesInspection & Testing Requirements Scope:: Test and Inspection PeraneeshjokayNo ratings yet

- Valves For Tailing Systems: C.G. Industrial Specialties LTDDocument8 pagesValves For Tailing Systems: C.G. Industrial Specialties LTDAnthonyNo ratings yet

- Foundry Technology: Reference BooksDocument34 pagesFoundry Technology: Reference BooksGowtham VishvakarmaNo ratings yet

- Calipers: - Vernier, Dial and DigitalDocument5 pagesCalipers: - Vernier, Dial and Digitalteguh_setionoNo ratings yet

- Tenax Panel-1Document13 pagesTenax Panel-1Εύη ΣαλταNo ratings yet

- Water Slides - Part 1: Safety Requirements and Test Methods: Irish Standard I.S. EN 1069-1:2010Document11 pagesWater Slides - Part 1: Safety Requirements and Test Methods: Irish Standard I.S. EN 1069-1:2010zoltanNo ratings yet

- 20a Torque CalculationDocument11 pages20a Torque CalculationRiyan EsapermanaNo ratings yet

- MHWirth lifting lug and bearing assembly detailsDocument2 pagesMHWirth lifting lug and bearing assembly detailsOstap SepykNo ratings yet

- Baddi-Barotiwala-Nalagarh Area Company DirectoryDocument43 pagesBaddi-Barotiwala-Nalagarh Area Company Directory01copy100% (3)

- Astm PDFDocument9 pagesAstm PDFFelipe Marçal MorgantiniNo ratings yet

- John Crane Seal Identification CodingDocument9 pagesJohn Crane Seal Identification CodingEloy Alejandro Justiniano Coimbra100% (1)

- MCQ 2Document36 pagesMCQ 2bavly waidyNo ratings yet

- Parallel Clamp Plans: Build Your Own Adjustable Woodworking ClampsDocument19 pagesParallel Clamp Plans: Build Your Own Adjustable Woodworking ClampsMartin MartinezNo ratings yet

- 3 Testing InspectionDocument78 pages3 Testing InspectionPablo ContrerasNo ratings yet

- 10 SteelDocument10 pages10 SteelSahiNo ratings yet

- Andy2 54340880355976a96126Document6 pagesAndy2 54340880355976a96126senku9512No ratings yet

- Info Lascaux Hard ResistDocument2 pagesInfo Lascaux Hard ResistMarcoNo ratings yet

- Asme Section Ii A Sa-423 Sa-423m PDFDocument6 pagesAsme Section Ii A Sa-423 Sa-423m PDFdavid perezNo ratings yet