Professional Documents

Culture Documents

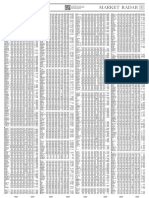

Pakistan Stock Rates 2015

Uploaded by

BencAoDeDeusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan Stock Rates 2015

Uploaded by

BencAoDeDeusCopyright:

Available Formats

10 BUSINESS RECORDER KARACHI MONDAY 2 MARCH 2015

YOUR SHARES LAST WEEK

(February 23 to 27, 2015)

ACTIVE ISSUES

KSE100

VOLUME

INDEX

K-Electric Ltd

Jahangir Sid.

Pak Elektron

Pak.Int.Bulk Ter

Maple Leaf

857,644,050

against

last

weeks

1,059,931,530

54,011,500

53,373,000

49,983,500

38,710,000

36,706,500

RISES

Colgate Palm.

Indus Motor

Philip Morris Ltd.

Murree Brewery

Pak Tob.

Rafhan Maize

Wyeth Pak.

Nestle Pak.

Bata (Pak)

Exide (PAK)

Total: 429; 115; 302;

COMPANIES

Previous

Friday

RATES

Last

Highest

Friday

Lowest

Difference

Turnover

(000)

COMPANIES

Oil and Gas Producers

Attock Petr.

539.61 534.69

545.00

532.00

-4.92

Attock Ref.

186.06 178.55

-7.51

Previous

Friday

36.900

743.900

785.00

39.20

36.450

Faisal Sp.

169.90 149.00

361.00

-5.38

28.200

Fateh Indus.

176.59 176.59

59.90

1.91

0.500

Fateh Sports

101.42

99.71

102.70

99.42

-1.71

2569.000

Bela Auto

Mari Petroleum

549.48 531.48

557.00

516.00 -18.00

1131.100

Dewan Motors

National Ref.

202.98 202.03

205.00

202.00

Exide (PAK)

Oil & Gas Dev.

212.05 211.15

212.99

208.25

-0.90

3016.200

403.36 383.25

406.90

382.51 -20.11

6750.900

Ghandhara Ltd.

Pak Oilfields

380.89 369.00

382.99

368.10 -11.89

1301.000

Ghani Auto

177.24

172.01

154.72

144.00

0.56

68.000

261.01

-4.16

-3.17

4252.600

168.200

Chemicals

A. Habib Corp.

35.31

33.32

35.50

33.19

-1.99

2536.500

8.15

7.80

8.20

7.80

-0.35

6.500

Agritech Non-voting4.00

4.00

Agritech

Archroma Pakistan568.31 531.09

Bawany Air

7.36

Biafo Ind.

D. Salman

7.35

204.94 192.71

207.00

1.84

Dawood Her.

574.00

7.00

528.00 -37.22

6.92

27.350

-0.36

General Tyre

88.300

-0.32

3004.500

Fatima Ent.

4.740

Fazal Cloth

146.39

140.05

0.06

124.500

66.74

62.66

67.00

58.80

-4.08

1519.500

5.37

5.46

6.30

5.30

0.09 14660.500

1.46

Gul Ahmed

61.78

58.24

61.98

58.00

-3.54

437.500

P.T.C.L.B

2.35

2.35

0.500

Telecard

3.22

2.98

3.28

2.95

-0.24

1.52

1.46

1.55

1.41

-0.06

Gulistan Sp.

2.35

2.35

996.47

58.27

70.040

Gulistan Tex.

15.00

15.00

19.08

-1.49

274.500

Gulshan Sp.

2.48

2.24

2.49

2.20

-0.24

49.500

Beverages

Murree Brewery 1040.33 1098.60 1101.38

Nirala Msr Foods 20.59

Shezan Int.

19.10

20.89

1292.50 1203.43 1357.12

1203.43 -89.07

2.550

A. Shah Ghazi

12.34

Adam

2.000

20.25

-0.45

35.500

Hakkim Tex.

175.00

1.10

0.300

Hamid Tex.

30.75

30.00

0.39

2.000

Hira Tex.

Ansari

8.01

7.40

-1.00

2.500

I.C.C. Tex.

30.00

8.40

7.40

290.50

113.38 101.72

113.75

101.00 -11.66

8.14 21497.500

Clover

83.80

0.78 21287.000

Colony Sug.

36.99

0.09

Data Agro

266.200

Idrees Tex.

5.65

5.70

5.35

-0.06

160.000

Indus Dyeing

16.90

17.45

14.00

3.40

231.500

Int. Knit.

3.11

3.25

2.60

0.06

48.500

Ishaq Tex.

132.59 129.19

135.30

128.00

-3.40

5787.700

Ishtaiq Tex

Island Tex.

2.58 25083.000

Dewan Sug.

136.38 141.03

144.21

136.50

4.65 11869.200

Engro Foods

170.00 162.00

162.00

162.00

-8.00

1.200

Extraction

15.10

15.10

34.65

32.55

-0.23

1982.500

Faran Sug.

43.86

3.05

44.25

45.50

43.00

0.39

30.500

Ittehad

46.34

43.01

45.70

40.70

-3.33

610.500

H. Waqas

6.01

5.94

6.00

5.56

-0.07

76.000

Leiner Gelatine

22.08

24.25

24.25

21.99

2.17

9.000

Habib ADM

30.25

29.50

30.15

29.50

-0.75

3.500

206.35 200.75

Habib Sug.

34.00

34.49

0.49

10.00

Jubilee Sp.

0.89

Grays Leas.

5.38

-0.94

23.500

88.82

90.90

87.50

1.66

3723.000

IGI Inv.Bank

2.20

1.83

2.16

1.75

-0.37

1831.000

5.75

5.50

5.65

5.25

-0.25

6.500

Invest&Fin.

18.35

18.15

18.99

18.15

-0.20

30.500

2.65

2.31

2.68

2.29

-0.34

2082.500

Invest. Cap.

1.56

1.58

1.67

1.47

0.02

-0.28 54011.500

Investec Sec.

0.42

0.42

0.77

Ist Nat.Equities

2.41

2.70

2.78

2.50

0.29

23.000

17.500

Ist.Cap.Sec.

2.05

2.00

2.10

2.00

-0.05

214.000

1.90

1.90

3.73

3.55

3.74

3.50

-0.18

10.000

K-Electric Ltd

8.34

8.06

8.41

8.02

79.48

83.00

83.00

79.00

3.52

18.000

Kohi. Energy

48.71

49.48

49.75

48.50

14.25

14.50

14.10

14.10

956.00 874.62

952.10

11.55

12.75

15.34

12.58

9.49

857.29

97.500

-2.21

764.500

65.00

71.23

68.00

6.23

60.500

2.31

2.29

2.35

2.21

-0.02

33.500

Kohinoor Ind.

3.00

3.02

3.20

3.00

0.02

51.000

567.70

521.50

-3.64

8.450

Kohinoor Sp.

18.99

18.28

19.25

17.99

-0.71

45.000

10.25

Land Mark Sp.

12.24

10.35

11.94

10.35

-1.89

7.500

394.01 377.79

395.00

375.00 -16.22

148.550

Leather Up.

12.80

11.80

14.59

11.80

-1.00

379.000

10500.0010200.00 10225.00

9975.00 -300.00

0.540

Libaas Tex.

17.10

17.60

17.60

17.60

0.50

2.000

M. Farooq

113.000

5.40

5.42

5.00

0.02

24.00

23.50

23.50

22.75

-0.50

11.500

152.31 144.70

154.40

140.12

-7.61

197.500

260.00

245.00 -22.90

1.600

44.82

6.54

75.000

10.73

276.500

Maqbool Tex.

26.18

0.28

37.000

Masood Tex.

2.10

0.24

16.500

Mehmood Tex.

269.90 247.00

96.73

99.85

106.36 128.27

165.500

-0.97

7.000

Aisha Steel(ConPS)R0.00

Cres.Steel

58.24

0.00

52.02

58.69

51.50

-6.22

462.500

5.50

104.78

91.90

3.12

9.000

Mehr Dast.

1.50

1.50

128.27

101.15

21.91

38.200

Mian Tex.

3.35

3.00

3.18

3.00

-0.35

12.500

Quice Food

7.87

7.42

7.90

7.40

-0.45

2302.500

Mohib Exp.

0.15

0.15

Quice Food (R)

0.00

0.00

22.00

22.00

Rafhan Maize 11200.0010701.11 10949.00 10655.00 -498.89

0.200

4.45

4.45

Premier Sug.

-0.88

8.03

88.000

553.64 550.00

71.01

Punjab Oil

Moonlite

Mubarak Tex.

S. S. Oil

39.51

36.01

39.99

35.70

-3.50

53.000

Mukhtar

2.09

2.00

2.27

1.90

-0.09

189.500

Huffaz Pipe

22.89

21.94

23.74

21.30

-0.95

42.000

Sakrand

2.80

2.50

2.80

2.50

-0.30

12.000

N. P. Sp.

33.71

33.71

Int. Ind.

77.70

80.13

83.28

76.70

2.43

787.000

Salim (O)

7.00

7.00

Nadeem Tex.

36.94

36.94

Int. Steel

29.88

28.68

30.00

28.52

-1.20

375.500

Salim (P)6%

55.90

55.90

Nagina Cot.

68.00

61.75

68.75

61.75

-6.25

32.000

10.00

10.00

25.30

25.30

Dost Steel

4.71

4.71

Metro Steel

18.65

18.65

Quality Steel

11.00

11.00

8.51

8.21

8.97

8.02

-0.30

1672.500

Siddiqsons Tin

Construction and Materials

0.15

42.87

43.08

44.99

42.90

Nishat Mills

128.11 124.02

129.40

123.50

-4.09

1754.000

39.500

Shakerganj S.

15.50

15.75

15.75

15.50

0.25

13.500

4.21

-0.08

48.000

Sind Abadgars

11.40

10.40

10.40

10.40

-1.00

1.500

130.90

107.00

15.92

1112.000

Suraj Ghee

10.00

10.00

126.00

124.00

-1.08

8.400

Tandlianwala

33.00

33.00

34.65

33.00

4.000

Thal Ind.

100.49

98.83

99.00

98.83

-1.66

8800.00 -145.00

0.300

4.85

Berger

110.09 126.01

Bestway

126.00 124.92

Buxly

39.25

41.25

41.87

39.00

2.00

7.000

Cherat

76.67

73.57

77.89

73.00

-3.10

3498.500

123.87 122.69

126.44

121.61

3.65

3.20

-0.26

AL-Abid

Casspak

0.08

0.08

41.16

45.60

41.16

-6.84

40.000

Dandot

10.49

10.10

10.71

10.10

-0.39

7.500

7.00

-0.23

3185.000

-0.15

288.000

7.55

3.85

3.70

4.00

3.61

Fauji Cem.

31.14

30.22

31.66

29.95

Fecto Cem.

88.08

77.90

89.94

Flying Cem.

7.60

7.10

7.65

-0.92 14502.000

73.52 -10.18

7.09

4737.000

-0.50

521.500

9595.00 9450.00 9450.00

Household Goods

206.000

48.00

EMCO Ind.

Unilever Food

-1.18 12540.500

Dadex Eternit

7.07

0.15

Nishat (Ch)

-3.49

4.45

7.30

Nazir Cot.

192.50

Dewan Cem.

19.000

198.98

Dadabhoy Const.

0.15

-6.44

196.54 193.05

3.34

36.00

70.29

Attock

3.60

38.50

73.99

4.40

26.50

7.00

356.00 -32.15

D.G. Khan

Nat. Silk

36.15

70.29

4.40

26.50

7.00

413.83

Dadabhoy

36.00

76.73

Sanghar

Shaker.(P)8.5%

396.68 364.53

4.53

Shahmurad

Shahtaj Sug.

296.700

AKZO Nobel

Bal. Glass

Nat. Fiber

Salim (PP)

39.00

Olympia Sp.

4.50

4.41

4.41

4.41

-0.09

0.500

Olympia Tex.

9.40

9.35

9.35

9.35

-0.05

Pak Leather

2.89

2.89

15.00

15.26

15.39

14.86

0.26

5.500

4.90

4.75

4.75

4.51

-0.15

2.500

Pak Synt.

Parmount Sp.

Premium Tex.

86.00

94.51

94.51

80.00

8.51

44.100

11.90

11.90

-0.10

Prosperity

39.90

37.00

39.90

36.96

-2.90

29.000

0.20

0.20

Quetta Textile

61.23

61.23

30.88

30.88

Ravi Textile

4.05

4.50

4.50

4.05

0.45

87.500

4.26

-0.15

20.000

Redco Tex.

4.70

4.55

Gauhar Eng.

20.52

21.26

21.70

18.05

0.74

167.500

Rel.Cotton

89.68

89.68

Hala Ent.

12.53

11.64

12.40

11.50

-0.89

29.000

Reliance Weav.

37.95

32.89

36.81

31.00

-5.06

75.500

7.40

7.40

Resham Tex

29.42

29.42

Ruby Tex.

6.30

6.30

6.43

6.00

5.500

13.95

13.10

13.10

12.95

-0.85

5.500

0.95

126.00 126.00

Feroze 1888

60.00

Hussain Ind.

Nina Ind.

Pak Elektron

60.00

1.01

1.01

60.66

60.50

61.84

58.10

-0.16 49983.500

Rupali

S. Denim

0.85

0.85

15.88

15.88

Saif Tex

26.15

23.65

27.72

23.35

-2.50

149.000

Sajjad Tex.

15.45

15.45

6.00

6.21

5.78

-0.23

4.500

Regal Cer.

3.80

3.80

12.60

14.75

12.40

-3.14

154.500

Singer Pak

20.69

18.28

20.94

18.20

-2.41

1875.000

S. G. Fiber

27.63

26.25

26.99

24.99

-1.38

27.500

Tariq Glass

59.71

54.39

61.00

54.22

-5.32

2239.500

Sadoon

1.98

1.80

1.94

1.80

-0.18

116.000

Towellers Ltd

42.00

42.00

26.50

26.30

27.24

25.23

-0.20

50.000

Javedan Corp.(Pref)14.42 15.41

15.41

15.41

0.99

Karam Cera.

22.50

Kohat Cem.

Lafarge

23.73

23.73

203.00 191.00

203.95

17.67

Lucky

Maple Leaf

18.02

18.20

522.01 501.77

525.00

55.06

Mineral Grind

53.52

56.90

1.23

3.000

190.00 -12.00

22.60

240.600

17.61

0.35 20662.500

501.00 -20.24

53.30

1714.200

-1.54 36706.500

Leisure Goods

G.O. Cambridge

A. Hassan

Adil Tex.

610.00

599.99 -10.00

2.800

580.00 550.55

551.00

550.55 -29.45

0.200

4.02

4.23

4.25

3.50

Ali Asghar

Allawasaya

Shabbir Tiles

10.31

9.59

10.65

9.55

-0.72

4.75

4.15

4.99

4.10

-0.60

207.98

196.74

-3.69

21.11

17.30

22.16

17.10

-3.81

95.000

77.60

81.40

76.75

-2.40

409.000

8.00

8.00

M. Packaging

23.01

20.83

23.25

20.76

-2.18

1024.500

18.35

19.00

19.00

18.00

0.65

13.500

671.01 650.50

698.89

646.00 -20.51

116.800

1103.88 1079.45 1130.00

1060.11 -24.43

3.720

100.00

-3.30

38.600

Service Tex.

16.48

16.10

17.49

15.75

-1.74

4.500

Shadab Tex.

40.00

40.00

Shadman Cot.

12.00

12.00

Shahtaj Tex.

90.00

80.00

85.50

26.50

26.50

30.72

32.25

32.25

30.30

1.53

2.500

244.15 244.15

233.00

233.00

0.500

18.49

16.75

12.00

12.00

9.60

9.50

9.90

9.50

-0.10

6.000

Associated Services8.00

8.00

Ayaz Tex.

0.20

Shams Textile

170.98 170.98

Shield Corp.

Ayesha Tex.

0.20

7.00

7.00

Sind Fine

9.80

Suhail Jute

Azgard Nine

5.65

5.41

5.72

5.38

-0.24

1804.500

Azmat Tex.

9.95

9.95

Babri Cot.

Bannu

Bata (Pak)

48.45

41.50

6.78

4827.500

Bhanero

315.00

299.99

-8.83

144.100

Bilal Fib.

Tri-Pack Films

246.22 241.99

249.00

240.02

-4.23

33.200

Blessed

50.80

42.28

48.50

55.00

50.75

55.50

4167.45 3900.17 4375.82

-4.26

4.400

0.71

10.500

500.00

472.00

-8.00

1.100

Tata Textile

34.50

33.60

34.00

32.00

-0.90

22.500

5.84

5.50

-0.40

4.500

Treet Corp(PTCs) 58.88

57.60

57.60

55.94

-1.28

3.000

153.90 135.23

147.00

135.01 -18.67

14.200

Treet Corp.

135.97 118.08

137.00

117.00 -17.89

1986.200

Tri-Star Poly

1.29

1.30

1.30

1.25

0.01

41.000

United Brand

82.65

82.65

6.00

24.500

9.00

8.90

9.00

8.00

-0.10

2.500

1.71

1.65

1.73

1.53

-0.06

406.500

Yousuf

4.30

4.07

4.30

3.99

-0.23

243.500

Zahid Jee Tex.

1725.00 145.00

2.400

10.50

10.50

-1.00

0.500

Colony Textile

4.01

4.09

4.36

3.75

0.08

274.000

Bolan Casting

78.86

68.28

80.00

67.69 -10.58

348.500

Colony Thal

5.05

5.05

Dewan Auto.

3.26

3.26

Cres. Jute

3.66

5.59

5.59

3.40

1.93

1661.000

48.16

45.25

49.00

43.55

-2.91

362.000

Cres. Tex.

19.04

19.32

20.72

19.10

0.28

355.500

370.33 356.75

372.00

355.00 -13.58

32.900

Crescent Cotton

43.00

43.00

34.10

36.94

132.50 127.75

2.64

25.350

1.61

11.800

-5.58

104.000

Pak Engg.

133.50 129.36

132.40

120.36

-4.14

10.800

Industrial Transportation

P. Int Cont.

304.99 290.00

P.N.S.C.

156.70 153.97

Pak.Int.Bulk Ter

Pan Isl.N

292.00

288.00 -14.99

162.00

153.50

38.56

34.39

38.88

34.39

3.95

3.95

-2.73

1.400

80.800

-4.17 38710.000

Support Services

TRG Pak.

14.97

14.40

15.10

13.90

-0.57 12151.000

Crescent Fib.

1750.00 1895.00 1900.00

Usman Textile

4.35

3.89

4.35

3.70

-0.46

50.000

15.30

14.50

15.79

14.40

-0.80

14.000

Zahur Cot.

0.06

0.06

Zephyr Tex.

9.52

9.00

9.35

8.70

-0.52

12.000

77.20

77.70

77.70

74.00

0.50

13.500

ZIL Ltd.

359.00 -19.47

0.400

Pak Tob.

951.05 997.50

997.50

903.50

46.45

1.100

Philip Morris Ltd.1040.00 1100.00 1100.00

1040.00

60.00

4.420

32.50

2.84

15.000

124.00

-4.75

93.200

59.00

51.65

-8.25

6.500

Medi Glass

D. Mushtaq

8.75

8.00

8.00

8.00

-0.75

0.500

Shifa Int.

D.S.Ind.

5.06

4.60

5.50

4.40

-0.46

2341.500

Dar-es-Salaam

5.25

6.15

7.15

6.15

Data Tex.

0.50

0.50

Dewan F. Sp.

3.50

3.38

3.88

3.21

-0.12

470.000

Dewan Kh.

8.10

7.94

8.94

7.94

-0.16

2.500

Dewan Tex.

7.70

7.70

134.69 121.57

127.96

121.57 -13.12

1.000

Al-Falah

32.50 31.66

AL-Habib

50.14 50.03

Allied Bank

109.00 108.50

Apna Microfin.Bank 5.62

5.30

Askari Bank

22.90 22.31

B.O. Khyber

9.89 10.00

B.O.Punjab

10.86 10.52

Bank Islami

10.29

9.90

Faysal Bank

18.08 18.71

Habib Bank

205.05 203.71

Habib Metro

36.11 36.98

JS Bank

7.45

7.09

KASB Bank

1.65

1.54

MCB Bank

314.48 303.95

Meezan Bank

49.97 48.67

Nat. Bank

67.71 67.62

NIB Bank

2.25

2.11

Samba

7.05

6.75

SILKBANK

1.99

1.88

Soneri Bank

13.77 13.97

Stand.Chart.

25.50 25.43

Summit Bank

4.24

4.15

Summit Bank(Con)A10.00 10.00

Summit Bank(Con)B10.00 10.00

United Bank

171.04 168.79

-1.24

-0.38

Pak Gulf

4868.000

5876.500

32.80

50.45

110.05

5.48

23.00

10.60

11.18

10.49

18.71

206.10

38.32

8.09

1.69

320.97

50.20

69.00

2.33

7.09

2.04

14.30

25.90

4.28

172.00

30.85 -0.84 7640.500

49.60 -0.11 2015.000

107.99 -0.50 2093.700

5.22 -0.32

241.500

22.27 -0.59 5203.000

9.75

0.11 17479.000

10.46 -0.34 31141.500

9.75 -0.39 1896.500

17.45

0.63 10168.000

195.00 -1.34

325.800

35.50

0.87

672.500

7.05 -0.36 7631.000

1.51 -0.11 1315.500

301.50 -10.53

646.600

47.50 -1.30

727.500

67.11 -0.09 23659.500

2.06 -0.14 10703.500

6.75 -0.30

73.500

1.85 -0.11 4024.500

13.32

0.20 3239.500

24.70 -0.07

36.500

4.10 -0.09 1269.000

165.65 -2.25 5783.300

54.08

20.00

33.00

76.30

2.30

3.60

24.46

4.50

98.34

145.12

166.09

22.74

6.20

255.34

90.00

4.75

10.01

31.79

11.53

23.68

1.13

13.00

6.69

9.38

44.00

21.50

52.74

20.00

31.50

75.16

2.30

3.60

23.75

4.41

125.41

149.33

166.09

22.37

6.20

241.42

86.70

4.75

11.01

31.54

10.63

22.49

1.13

13.00

6.50

10.00

44.00

21.43

54.60

33.00

78.72

25.00

4.83

125.41

151.19

23.11

256.80

92.00

11.04

32.10

10.65

22.61

13.25

9.11

10.00

21.45

52.20 -1.34

30.75 -1.50

74.00 -1.14

22.81 -0.71

4.41 -0.09

99.15 27.07

142.00

4.21

22.00 -0.37

228.83 -13.92

86.70 -3.30

9.01

1.00

30.61 -0.25

10.50 -0.90

21.51 -1.19

12.91

6.15 -0.19

9.95

0.62

20.43 -0.07

5.55

5.90

5.90

5.89

0.35

1.500

59.31

60.04

62.85

59.30

0.73

189.500

0.30

0.30

14.48

14.48

14.48

14.48

Pak.Comm.

0.10

0.10

Pervez A. Sec.

2.79

2.64

2.94

2.51

-0.15

6212.000

Prud. Inv.

4.00

4.00

S. Chart Lea.

9.27

9.00

9.56

9.00

-0.27

56.000

Saudi P. Leas.

2.27

2.22

2.30

2.11

-0.05

42.000

Sec. (P) 9.1%

7.00

7.00

Security Bank

2.33

2.33

2.28

0.33

1.000

2.85

3.28

3.28

3.28

0.43

0.500

82.64

82.64

Trust Invest. Bank 1.25

1.18

1.34

1.17

-0.07

49.000

Trust Sec.

4.20

5.25

2.13

1.95

200.000

Security Leas.

SFL Ltd

2.00

2.25

Equity Investment Instruments

1st. Fid.Leas

4289.000

87.000

73.000

88.500

2.000

899.000

116.900

482.500

215.300

15.000

99.000

2135.000

11.500

9.500

74.000

1726.000

6.000

2.000

3.11

3.05

3.05

3.05

-0.06

1st. Nat. Bank Mod. 4.00

3.70

4.10

3.60

-0.30

66.500

Al-Mali

2.40

2.85

3.07

2.30

0.45

418.000

AL-Noor

4.91

4.90

5.00

4.90

-0.01

2.000

5.500

Allied Rental

46.00

45.90

47.50

45.25

-0.10

25.500

Allied Rental (R)

27.00

27.00

B. F. Mod.

6.95

6.75

7.55

6.75

-0.20

12.500

B.R.R. Mod.

7.37

7.01

7.54

6.93

-0.36

1146.000

Constellation

1.19

1.19

Cres.Stand

2.11

2.01

2.10

2.01

-0.10

37.000

Dominion

0.34

0.34

Elite Cap.

4.01

4.06

4.15

3.80

0.05

22.500

Equity Mod.

5.15

5.10

5.11

5.10

-0.05

17.000

Golden Arrow

12.19

12.32

Habib Mod.

10.38

13.30

12.17

0.13 15504.500

10.59

10.65

10.20

0.21

117.000

I. B. L. Mod.

3.45

3.45

3.48

3.20

3.500

Imrooz Mod.

47.23

47.23

Investec 1st

0.20

0.20

Investec Mut.

0.17

0.17

Ist Dawood

7.00

7.00

15.10

14.90

15.00

14.90

-0.20

1.000

KASB Mod.

4.18

4.18

P.S. Fund

2.33

2.33

Pak Mod.

1.70

1.70

2.20

1.70

27.000

Ist Paramount

Pak Oman

9.70

9.70

28.98

28.25

29.30

27.75

-0.73

1286.000

PICIC Inv.

13.10

Prudential 1st.

1.60

Punjab Mod.

5.70

S.Chart M.

26.50

Sindh Modaraba 7.55

Tri-Star

4.24

Tri-Star 1st.

4.00

Trust Mod.

6.00

U.D.L. Mod.

29.99

Unicap

1.70

12.58

1.61

5.90

27.00

7.40

4.10

4.00

6.20

34.44

1.40

13.10

1.61

6.25

27.00

7.55

4.10

6.50

34.44

1.70

12.51

1.60

5.45

26.50

7.40

4.10

5.90

30.00

1.40

-0.52

0.01

0.20

0.50

-0.15

-0.14

0.20

4.45

-0.30

414.500

1.000

1131.500

42.000

4.000

10.000

91.000

1422.000

71.500

PICIC Growth

Software and Computer Services

Netsol Tech.

43.76

Systems Limited 56.27

43.58

53.25

44.70

57.74

43.10

53.00

-0.18

-3.02

2180.500

2644.000

Technology Hardware and Equipment

Avanceon Ltd

TPL Trakker

44.66

8.09

43.80

7.72

45.40

8.24

43.50

7.56

-0.86

-0.37

2839.500

231.500

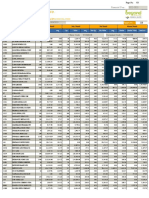

YOUR RUPEE LAST WEEK

Following currency fluctuations took place in foreign exchange rates during the last week.

(February 23 to 27, 2015)

T.T. CLEAN BUYING

AUTHORIZED DEALERS RATES PER ONE UNIT OF CURRENCY

20.2.2015

Previous

Week

Closing

Rate

Rs.

U.S

U.K

Japan

Euro

101.1

156.030

0.850400

114.930

+ Appreciation Depreciation

LAST WEEK RATES

23.2.2015

Opening

27. 2.2015

Closing

FLUCTUATIONS IN CLOSING RATES

Highest

Rs.

Rs.

Rate

Rs.

101.2

155.650

0.850700

115.210

101.3

156.380

0.849500

113.550

101.2

155.650

0.849500

113.550

Lowest

Date

Rate

Rs.

23/2/2015

23/2/2015

27/2/2015

27/2/2015

Over Previous Week

+Up

Amount

%

Down

Rs.

Date

101.3

157.510

0.853200

115.210

25/2/2015

26/2/2015

25/2/2015

23/2/2015

+

+

-

0.200000

0.350000

0.000900

1.380000

0.20

0.22

-0.11

-1.20

T.T. & O.D. SELLING

AUTHORIZED DEALERS RATES PER ONE UNIT OF CURRENCY

20.2.2015

Previous

Week

Closing

Rate

Rs.

U.S

U.K

Japan

Euro

101.3

156.340

0.852100

115.160

LAST WEEK RATES

23.2.2015

Opening

27. 2.2015

Closing

Rs.

Rs.

Rate

Rs.

101.4

155.950

0.852400

115.430

101.5

156.690

0.851200

113.780

101.4

155.950

0.851200

113.780

FLUCTUATIONS IN CLOSING RATES

Highest

Lowest

Date

Rate

Rs.

23/2/2015

23/2/2015

27/2/2015

27/2/2015

101.5

157.820

0.854900

115.430

Over Previous Week

+Up

Amount

%

Down

Rs.

Date

25/2/2015

26/2/2015

25/2/2015

23/2/2015

+

+

-

0.200000

0.350000

0.000900

1.380000

0.20

0.22

-0.11

-1.20

RETURNS ON PLS INVESTMENTS

(JULY TO DECEMBER 2014)

(PERCENT)

BANKS

NOTICE DEPOSIT SAVING

Bank of Khyber

days

above

3.00

4.00

TERM DEPOSITS

Acct

1 Mth

2 Mths

3 Mths

7.00

6 Mths

5.00

6.00

1 Yr

6.50

2 Yrs

3 Yrs

4 Yrs

7.00

7.30

7.60

5 Yrs

8.00

5.00

5.50

7.00

6.00

6.00

6.25

7.00

7.00

7.00

7.40

7.70

7.95

8.30

8.50

8.70

9.00

9.25

119.800

First Women Bank Limited

7.00

7.00

7.00

7.00

7.25

7.50

7.75

8.00

8.25

8.50

Habib Metro Bank

7.00

7.00

7.00

7.00

7.00

7.00

8.50

8.50

8.75

8.75

9.25

7.550

National Bank of Pakistan

7.00

7.00

7.00

7.10

7.40

7.60

7.90

8.20

8.40

7.00

7.00

7.00

7.00

7.40

7.60

7.80

8.00

7.69

7.96

7.00

7.71

8.40

9.10

8.58

7.00

270.07 273.04

292.90

268.80

2.97

Pharma and Bio Tech

Abbott

663.00 640.00

671.00

630.00 -23.00

Ferozsons

607.07 577.57

613.39

575.00 -29.50

216.16 218.78

223.10

207.15

2.62

1037.200

Highnoon

229.78 226.33

233.50

222.00

-3.45

71.700

IBL HealthCare. 128.00 126.37

130.98

122.00

-1.63

42.500

Deutsche Bank AG

98.40

91.50

-8.50

18.500

HSBC Bank Oman SAOG

91.50

24.00

36.00

Bank of Punjub

0.45

100.00

P.D.G.House

Non Life Insurance

Adamjee

Asia Ins.

Askari Gen.

Atlas Ins.

Beema

Business Ins.

Century Ins.

Crescent Star

CYAN Ltd

E.F.U.Gen.

East West

Habib Ins.

Hallmark

IGI Ins.

Jubilee Gen. Ins.

P.Guarantee

Pak Gen.

Pak Reins.

PICIC Ins.

Premier Ins.

Progressive

Reliance Ins.

Shaheen Ins.

Silver Star

Standard

TPL Direct Ins.

GlaxoSmith

Otsuka Pak.

Orix Leas.

Bank Alfalah Limited

Health Care Equipment and Services

0.45

26.30

37.85

7 to 29 30 days &

380.00

36.94

Din Textile

378.47 359.00

134.00

6.000

0.51

Khyber

51.65

0.90

0.51

24.83

37.09

0.10

NEXT Capital

Banks

Tobacco

59.90

D. Lawrencpur

D. M. Tex.

138.26 134.00

10.50

130.00

8.01

11.50

966.00

132.52

AL-K. Gadoon

645.00

Colgate Palm.

990.00

9.51

33.000

133.40

0.33

138.00

-3.62

669.00

0.500

0.41

44.37

981.96 984.60

41.500

7.78

9.51

48.50

130.25 131.86

0.500

5.00

0.41

44.38

650.71 645.13

14.30

220.50

8.80

-0.58

Chenab Ltd

10.29

20.00

242.55

Taj Textile

Chenab (P)

10.29

20.00

Taha Sp.

7.30

Chakwal Sp.

10.29

15.00

3.420

14.300

5.60

480.00 472.00

26.07

37.47

17.000

8.24

29.500

1.300

Nat. Assets

Gas Water and Multiutilities

Sui Northern

Sui Southern

62.000

220.000

0.65

-1.12

-8.52

7.42

23.01

-4.25

0.65

156.01 -11.00

10.29

-0.38

77.17 -10.00

42.28

8.00

15.98

50.13

48.00

Hinopak

Suraj Cotton

231.00 238.78

0.33

Caravan

K.S.B. Pumps

Sunshine

Brothers Tex.

Millat Tractors

Sunrays

17.34

3900.00 -267.28

Ados Pakistan

Ghazi Tractors

Shahzad Tex.

Azgard 9 (P) (8.95%)9.80

Azgard 9 (NV)

313.00 304.17

Industrial Engineering

107.75

Aruj Indus.

Thal LTD

Electronic and Electrical Equipment

Schon

Ashfaq Tex.

85.100

80.00

Ghandhara Ind

2.000

Service Ind.

G.Value

25.45

Service Fab.

Hashimi Can

170.00

893.00 -29.77

Ghani Glass

23.49

940.00

24.61

0.77

1576.000

174.43 163.43

0.77

925.10 895.33

54.00

John&Philips

11.38

-0.86

Pak Cables

67.500

54.00

1.000

-0.54

11.38

13.83

17.02

0.80

9.50

Apollo Tex.

17.02

11.80

9.98

0.65

Annoor

14.97

Climax Eng.

11.99

9.53

1127.000

7.00

Synthetic Prod.Enter.40.24 47.02

11.80

0.65

1578.000

14.97

Siemens

11.00

1025.000

105.80 102.50

9.500

10.07

-0.08

Asim Tex.

77.62 -12.38

Sargoda Sp.

2.56

15.000

86.25

Saritow Sp.

2.78

7.00

Packages

25.000

2.59

15.83

MACPAC Films

0.21

2.67

Artistic Den.

360.00 360.00

Sana Ind.

Amtex

ECOPACK

261.500

610.00 600.00

Sapphire Tex.

7.000

Cherat Packaging202.07 198.38

-0.63

13.00

Sapphire Fib.

Dada. Sack

12.00

77.62

0.60 27348.000

12.11

90.00

-0.59

7.000

12.74

12.000

7.61

-3.75

57.000

-0.23

7.36

-0.26

-4.39

5.55

13.20

6.20

8.00

5.60

17.00

5.77

8.95

26.24

13.50

6.00

0.00

General Industrials

17.89

7.61

Samin Tex.

154.33 154.33

8.02

6.52

Salman Noman

0.00

8.90

Sally Tex.

8.20

30.59

2.500

1.31

7.42

0.44

2.81

0.26

Safe Mix (R)

5.75

29.40

8.90

Safe Mix

26.24

30.87

28.03

Power Cement

0.44

0.50

30.81

1.31

7635.500

6.01

Salfi Textile

0.50

28.00

0.26

0.08

29.99

1.500

28.03

82.01

Thatta Cem.

-9.79

Al-Qaim

85.94

Zeal Pak

77.71

AL-Qadir

0.17

82.88

B.P Board

91.00

AL-Azhar

0.17

Shabbir Tiles (R)

77.71

Personal Goods

(Col.) Sarhad

82.80

Pioneer

87.50

0.95

4.59

Safa Textile

6.23

15.74

Gharibwal

Javedan Corp.

0.21 10368.500

39.00

Gammon Pak.

Frontier Cer.

Haydery Const.

11.90

12.00

Diamond Ind.

Noor Silk

Southern Elect.

Tri-Star Power

-1.60

2.55

8.07

1300.500

277.000

-1.99

54.40

9.00

-0.24

-0.12

48.35

29.45

9.08

1.75

1.30

16.55

88.54

8.03

2.00

1.50

13.01

2.55

8.20

1.78

1.34

53.28

49.23

2.02

1.46

19.40

27.83

27.500

15.50

80.13

-6.45

49.86

2.31

5.000

190.000

0.10

38.90

16.83

42.69

0.98

0.21

43.09

13.01

27.55

6974.500

8.00

28.00

38.90

52.07

69.40

-1.32

8.98

29.00

45.35

18.43

Noon Pak. (NV)

13.78

8.98

29.00

Sitara Energy

15.00

Pangrio

15.77

21.00

8.00

MCB-ARIF Habib 28.79

92.000

376.000

Kohi.Tex.

Noon Sug.

13.81

21.00

KASB Sec.

1418.500

Kohi. Mills

Noon Pakistan

15.13

KASB Corp.

4240.000

Kohat Tex.

JS Inv.

1.63

-1.97

1.000

17.000

3.500

-0.20

5.600

26.500

-0.25

-2.42

2.88

246.500

-1.16 53373.000

36.00

1.40

-1.05

21.05

37.40

38.93

20.18

-2.31

22.86

36.00

31.05

101.00

-1.66

21.12

36.25

51.11

20.18

-9.57

22.28

JS Global

1.65

104.00

61.10

Jahangir Sid.

5603.000

41.50

20.18

56.25

1491.000

-0.24

33.77

21.23

70.10

3880.000

-0.46

51.50

54.94

101.08 103.96

73.00

1.37

36.75

56.70

1.50

0.500

10.25

82.50

38.50

52.16

39.01

8.10

74.00

9.08

84.98

37.54

31.06

9.00

62.38

Industrial metals and Mining

84.01

38.00

51.47

1.500

82.64

1.70

180.000

82.500

Nishat (Ch) Power 52.40

40.98

110.00 -18.00

5.69

Lalpir Power

33.48

121.61

5.44

Kot Addu

49.84

128.00 110.00

6.38

J.O.V.& Co.

Saif Power

S.G. Power

-0.40

2.61

Pakgen Power

4.75

2.90

Nishat Power

4.95

2.89

5.25

4.75

2.89

5.25

5.15

Kohi. Power

168.000

7.500

-1.25

52.40 -11.91

Nestle Pak.

Aisha Steel(ConPS) 9.00

48.500

24.71

72.33

Aisha Steel

-2.76

26.02

71.95

12.58

850.00 -14.99

25.74

73.99

12.000

61.10

National Foods

59.25

1.20

52.40

Morafco Ind.

2.50

1.000

11.55

64.31

28.500

57.00

-0.15

874.62 -81.38

Khyber Tex.

13.500

2.50

14.10

-0.25

3.000

-2.85

59.31

15.50

9.49

14.50

26.99

Pak P. Prod.

Century Paper

12.83

864.99 850.00

Sec. Papers

Abson Ind.

14.50

-0.90

-5.63

4.500

0.89

8.10

33.40

-0.99

87.16

8.80

57.18

3.60

Jap. Power

36.00

6.00

Ideal Energy

63.00

4.50

Hub Power

34.15

5.49

Genertech

57.37

14.500

1.00

37.00

-0.31

1.00

63.00

30.000

1.63

Khurshid

72.00

-0.05

2.10

3779.500

6.100

Mithchells

2.55

2.10

3.00

Mirpurkhas

2.98

0.65

2.41

-0.89

275.10

Mirza Sug.

2.95

0.65

281.00

5.000

2.15

3.00

English Leas.

10.40

277.00 280.00

41.000

2.15

Dawood Equit.

J. D. W.

622.500

Dawood Cap.

1499.000

11.68

0.50

0.91

4324.500

0.97

0.72

1.000

-0.75

43.500

10.78

3.42

1.00

0.97

0.50

-1.00

12.90

6.05

11.67

342.00

6.05

Fir.Credit&Inv.

4.41

3.53

6.05

1500.500

14.00

5.05

1139.500

4.55

358.00

21.500

Cap. Assets

-1.19

4.41

3.51

407.000

5.00

-1.99

0.55

349.09 350.00

198.500

-0.36

41.96

11.10

Khairpur

-0.06

32.92

5.41

Mehran

1.08

14.70

43.44

0.55

2.000

1.20

60.11

36.00

11.10

55.000

1.14

42.03

Khalid Siraj

-0.90

1561.000

19.05

34.01

Karim Cot.

-0.08

-0.35

62.50

36.00

Kaiser Art

8.00

3.50

0.62

Engro Powergen 43.22

5.00

3.96

19.05

0.300

8.10

3.54

61.37

12.000

128.500

5.70

3.89

0.62

8.10

14.05

-0.10

-7.26

5.03

61.73

Jauharabad Sug.

Arpak Intl.

3.00

209.48

33.20

1.000

44.200

59.00

Arif Habib Ltd

34.79

-5.00

59.00

1.20

AL-Mal Sec.

3.01

225.00

9.00

Forestry and Paper

Janana D Mal

1st Dawood

3.00

10.00

5.11

United Dist.

141.08 -10.51

410.00

73.50

220.50 213.24

Sardar Chem.

Wah-Noble

J.A.Textile

150.00

3.10

Ismail Ind.

Hussein Sug.

Pak. P.V.C.

-0.31

499.00 499.00

J. K. Sp.

8.000

456.75

73.50

14.75

5.71

Fauji Fertilizer

13.02

Ideal Sp.

13.50

Gatron Ind.

Goodluck Ind.

Ibrahim Fibres

158.500

-5.50

Financial Services

Electricity

Altern Energy

-2.00

156.00 145.49

Pace (Pakistan)

Fixed Line Telecommunication

Worldcall

13.80

169.10

435.00 430.00

Escorts Bank

0.72

0.36

21.00

180.00

29.61

12.70

Hajra Tex.

11.34

20.25

176.40 177.50

20.70

12.70

H.Mohd.Ismail

Hafiz Ltd.

Food Producers

17.20

186.00

Real Estate Investment and Services

0.050

1.46

87.00

3.82

Transmission

38.05

13.77

470.00

5.000

307.00

Sitara Chem.

6.500

8863.500

85.82

Shaffi Chem.

17.70

IGI Life Ins.

AKD Capital

0.09 33061.500

0.48

37.35

Sitara Peroxide

-1.25

85.04

7.200

470.00

9.51

83.50 -10.45

23.25

37.26

-5.90

449.00 449.00

Pak.Services

10.32

75.00

294.74 302.88

299.00

93.00

403.00 402.50

10.00

24.80

Engro Fertilizers

318.85

83.50

Gillette Pak

9.91

82.00

Fatima Fert.Co.

319.85 313.95

6.00

93.95

23.32

22.500

Pak Gum

6.00

Pak Hotels

80.95

4076.000

P.I.A.C. (B)

24.57

26.89

1.46

P.I.A.C. (A)

2.000

80.47

28.30

21.05

0.700

77.900

-0.30

P.T.C.L.A

27.00

24.74

-6.95

7.00

P. Datacom

27.00

23.05

450.00

206.00 -17.90

7.10

Chashma

21.59

480.00

233.00

7.00

690.500

Nimir Ind.

462.00 455.05

226.77 208.87

15.70

175.00 169.50

Jub Life Ins.

-0.36

17.000

1008.500

10.47

70.200

-0.02

11.05

2736.000

2.38

10.52

-0.15

2.58

270.00 270.00

10.88

-0.13

2.41

EFU Life

Travel and Leisure

-0.50

E. Polymer

-5.60

2.43

Media Times

Dreamworld

3.75

9191.000

6.56

0.53

200.64

15.01

Fazal Tex.

7.30

East West Life

16.00

1.000

Life Insurance

0.020

15.84

Gadoon Tex.

Ghazi Fab.

3265.84 -355.16

Universal Ins.

Media

15.31

402.50

4.33

3621.00 3265.84 3618.65

Hum Network

24.66

6.85

Wyeth Pak.

24.66

213.00

0.88

Baba Farid

4.00

5.60

402.50

497.000

6.66

5.89

8.70

4.15

5.89

10.50

2638.500

6.79

1.000

5.01

62.00

0.24

Mandviwala

6.23

1837.700

8.70

4630.600

58.91

LINDE (Pak)

129.00

348.000

-6.05

10.50

5.25

Lotte Chemical

130.98

5.02

242.50

62.00

6.10

31.450

14.30

29.16

254.50

Globe Tex.

AL- Abbas

449.99 -12.50

74.00

14.30

35.08

Searle Company 250.72 244.67

Globe (OE)

AL-Noor

470.00

74.00

124.75 130.98

Turnover

(000)

35.03

Glamour

455.000

462.52 450.02

Difference

30.01

420.000

198.44 -10.28

63.00

I. C. I.

Lowest

United Ins.

321.800

363.500

51.50

-4.15

Previous

Friday

2.400

688.050

915.000

56.15

5.300

78.85

COMPANIES

27.03

1.26

-0.15

54.17

147.84 -20.90

78.85

78.85

Turnover

(000)

725.00

-3.89

-3.30

33.93

164.98

83.00

Difference

773.00

86.88

-0.13

51.59

11.500

Lowest

745.97 773.00

45.00

974.00

5.01

34.16

72.00 -11.00

RATES

Last

Highest

Friday

Previous

Friday

411.01

59.00

Fauji Fert. Bin

81.25

RATES

Last

Highest

Friday

COMPANIES

Sanofi-Aventis.

50.00

219.00

59.00

Ghani Gases

2.000

429.99

1.70

6764.000

Turnover

(000)

-4.12

45.13

Dynea Pak.

Engro Corp.

12

Difference

49.02

210.91 200.63

109.50

5.78

140.30 140.36

Fateh Tex.

6.71

1129.80 -228.11

424.14 425.40

5.40

5.54

7.60

998.89 1085.77 1139.00

1.86

Descon Chem.

6.78

H.Atlas Car

29.500

190.02 -12.23

1.30

7.10

Lowest

498.89

355.16

300.00

267.28

228.11

Sazgar Engg.

116.30

5.20

1.30

Pak Suzuki

1.71

5.35

59.90

Indus Motor

113.43 110.13

Descon

57.99

1358.64 1130.53 1348.00

P. S. O.

268.50

72.00

59.90

Hascol Petrol.

83.00

380.00

Bal. Wheel

Ellcot Sp.

872.76

5246.500

148.45 149.01

44.86

376.42 371.04

40.500

-0.13

267.08 262.92

47.90

797.70 836.90

1.86

9.16

Pak Ref.

44.86

Atlas Honda

54.20

Shell Pak.

48.98

Atlas Battery

178.00

9.58

122.400

Elahi Cot.

-3.90

59.85

-0.95

Previous

Friday

165.00

187.48

10.100

RATES

Last

Highest

Friday

COMPANIES

172.45

9.19

175.74 172.57

Turnover

(000)

173.90 170.00

59.85

Pak Petroleum

Difference

Agriautos

9.32

Pak Petr (P)

Lowest

Automobile and Parts

57.99

Burshane LPG

BYCO Petr.

RATES

Last

Highest

Friday

33632.19

down 360.81

from last

weeks close

at 33993.00

DROPS

145.00

86.88

60.00

58.27

46.45

55.750

ZTBL

FOREIGN BANKS

You might also like

- Semiconductor Data Book: Characteristics of approx. 10,000 Transistors, FETs, UJTs, Diodes, Rectifiers, Optical Semiconductors, Triacs and SCRsFrom EverandSemiconductor Data Book: Characteristics of approx. 10,000 Transistors, FETs, UJTs, Diodes, Rectifiers, Optical Semiconductors, Triacs and SCRsNo ratings yet

- BSE PSU Energy StocksDocument3 pagesBSE PSU Energy StocksYatrikNo ratings yet

- Ceramics for Energy Conversion, Storage, and Distribution SystemsFrom EverandCeramics for Energy Conversion, Storage, and Distribution SystemsThomas PfeiferNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 27, 2012)Manila Standard TodayNo ratings yet

- Japanese Miniature Electronic Components Data 1966—7: Pergmon Electronics Data SeriesFrom EverandJapanese Miniature Electronic Components Data 1966—7: Pergmon Electronics Data SeriesNo ratings yet

- FO Stock ListDocument6 pagesFO Stock Listshivanshu mishraNo ratings yet

- Advances in Solid Oxide Fuel Cells and Electronic CeramicsFrom EverandAdvances in Solid Oxide Fuel Cells and Electronic CeramicsNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayNo ratings yet

- Orb Plus Excel Call Generator1Document8 pagesOrb Plus Excel Call Generator1dewanibipin0% (2)

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 25, 2012)Manila Standard TodayNo ratings yet

- Dily Gainers and LosersDocument10 pagesDily Gainers and LosersAnshuman GuptaNo ratings yet

- Equity Portfolio Performance Overview: 1st JUL - 5th JUL, 2019Document2 pagesEquity Portfolio Performance Overview: 1st JUL - 5th JUL, 20194D EngineeringNo ratings yet

- Closingrates 202323novDocument20 pagesClosingrates 202323novsana.mba8120No ratings yet

- ZerodhaDocument89 pagesZerodhaAarti ParmarNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Markets and Commodity Figures: FTSE 100 Index (Pence) GlobalsDocument5 pagesMarkets and Commodity Figures: FTSE 100 Index (Pence) GlobalsTiso Blackstar GroupNo ratings yet

- KSE-30 Index KMI-30 Index 28683.84 28729.31 28496.33 122.11 KSE-100 Index All Share IndexDocument12 pagesKSE-30 Index KMI-30 Index 28683.84 28729.31 28496.33 122.11 KSE-100 Index All Share IndexSheikh WickyNo ratings yet

- SelectedGlobalStocks - February 1 2017Document5 pagesSelectedGlobalStocks - February 1 2017Tiso Blackstar GroupNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 18, 2013)Manila Standard TodayNo ratings yet

- UntitledDocument22 pagesUntitledvineetNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNo ratings yet

- Angel SuggestedDocument4 pagesAngel Suggestedmangalraj900No ratings yet

- Stock Vichhar 3day SheetDocument52 pagesStock Vichhar 3day Sheetudhaya kumarNo ratings yet

- KSL BL 11-02-2022 Chennai EPaper Stocks 01Document1 pageKSL BL 11-02-2022 Chennai EPaper Stocks 01CH BLESSINANo ratings yet

- KSL BL 04-06-2021 Chennai EPaper Stocks 01Document1 pageKSL BL 04-06-2021 Chennai EPaper Stocks 01tushar vermaNo ratings yet

- Peer Group GE Power India GEPIL CompanyDocument3 pagesPeer Group GE Power India GEPIL CompanyAbhijeetNo ratings yet

- Manila Standard Today - Business Daily Stock Review (September 26, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 26, 2012)Manila Standard TodayNo ratings yet

- Top 100 Stocks 1403Document5 pagesTop 100 Stocks 1403Srikanth MarneniNo ratings yet

- Equity StockDocument4 pagesEquity StockChaitanya EnterprisesNo ratings yet

- Nifty 500Document42 pagesNifty 500rohankhandare429No ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2013)Manila Standard TodayNo ratings yet

- Company Name % CHG 52 WK 52 WK High Low Last PriceDocument8 pagesCompany Name % CHG 52 WK 52 WK High Low Last PriceSrikanth MarneniNo ratings yet

- KSL BLDocument1 pageKSL BLBhargav PatelNo ratings yet

- Company NameDocument1 pageCompany NameMdIrshad KhanNo ratings yet

- 6th March Exp 7th Mar Spot 11053 Fut Mar 11081 CallsDocument169 pages6th March Exp 7th Mar Spot 11053 Fut Mar 11081 CallsdineshNo ratings yet

- Indices Data - 12.09.2023Document1 pageIndices Data - 12.09.2023PHC DUGGUDURRUNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- Indian MarketDocument13 pagesIndian Marketmangalraj900No ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 16, 2012)Manila Standard TodayNo ratings yet

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchNo ratings yet

- Info Gas Procurement EGC SummaryDocument2 pagesInfo Gas Procurement EGC SummaryDoina BuruianăNo ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- GlobalCash Cumulative V2260J1020220625190901683449Document3 pagesGlobalCash Cumulative V2260J1020220625190901683449lalit JainNo ratings yet

- Share Trading by DheerajDocument2 pagesShare Trading by DheerajSaurabh voicecoachNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 8, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 8, 2012)Manila Standard TodayNo ratings yet

- MW NIFTY MIDCAP 150 03 Apr 2023Document8 pagesMW NIFTY MIDCAP 150 03 Apr 2023SumitNo ratings yet

- Finwize Investment ServicesDocument2 pagesFinwize Investment Servicesapi-26063010No ratings yet

- MW Pre Open Market 05 Oct 2022Document7 pagesMW Pre Open Market 05 Oct 2022Anonymous Mw6J6ShNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 26, 2012)Manila Standard TodayNo ratings yet

- 7ik54 UpdateDocument8 pages7ik54 UpdatePragnesh ShahNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 21, 2012)Manila Standard TodayNo ratings yet

- Data For 2001Document6 pagesData For 2001Aadee MishoriNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 21, 2013)Manila Standard TodayNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- Historic Data Nifty50 9THJULYDocument3 pagesHistoric Data Nifty50 9THJULYsriniaithaNo ratings yet

- FEA - Group 2Document86 pagesFEA - Group 2Hitish SethiaNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 15, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 15, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayNo ratings yet

- Prof of Practice Implem Guidelines PDFDocument10 pagesProf of Practice Implem Guidelines PDFBencAoDeDeusNo ratings yet

- To Do ListDocument1 pageTo Do ListBencAoDeDeusNo ratings yet

- Graph-I: X-Axis: Percentage of ClayDocument2 pagesGraph-I: X-Axis: Percentage of ClayBencAoDeDeusNo ratings yet

- BreakfastDocument1 pageBreakfastBencAoDeDeusNo ratings yet

- "Beijing EAPS Consulting Inc.": A Case StudyDocument5 pages"Beijing EAPS Consulting Inc.": A Case StudyBencAoDeDeusNo ratings yet

- Value ChainDocument4 pagesValue ChainBencAoDeDeusNo ratings yet

- Final Engro Report 2013Document130 pagesFinal Engro Report 2013BencAoDeDeusNo ratings yet

- Chpt2trait TheoryDocument11 pagesChpt2trait TheoryBencAoDeDeusNo ratings yet

- Fulltext01 PDFDocument68 pagesFulltext01 PDFareebaNo ratings yet

- Banking Sep 12 OverviewDocument18 pagesBanking Sep 12 OverviewZubair MirzaNo ratings yet

- KPMGDocument15 pagesKPMGBencAoDeDeusNo ratings yet

- Hazrat Abu BakarDocument10 pagesHazrat Abu BakarBencAoDeDeusNo ratings yet

- Stock Values and Stock PricesDocument17 pagesStock Values and Stock PricesRui Isaac FernandoNo ratings yet

- Case Study Continental AgDocument2 pagesCase Study Continental AgGururajan VenkatakrishnanNo ratings yet

- Financial Modeling With Excel and VBADocument113 pagesFinancial Modeling With Excel and VBAakash_sugumaran100% (11)

- Engineering Economics Reviewer Part 1 PDFDocument88 pagesEngineering Economics Reviewer Part 1 PDFagricultural and biosystems engineeringNo ratings yet

- Mutual Funds in IndiaDocument8 pagesMutual Funds in IndiaSimardeep SinghNo ratings yet

- Module 1 - Canvas SlidesDocument40 pagesModule 1 - Canvas SlidesAniKelbakianiNo ratings yet

- Practice Final Bus331 Spring2023Document2 pagesPractice Final Bus331 Spring2023Javan OdephNo ratings yet

- LeasingDocument44 pagesLeasingpriyankamahale100% (5)

- 10 Buhat v. BesanaDocument1 page10 Buhat v. BesanaArlando G. ArlandoNo ratings yet

- AFM-Module 4 Part-B Ratio Analysis ProblemsDocument5 pagesAFM-Module 4 Part-B Ratio Analysis ProblemskanikaNo ratings yet

- Tito Nanding 2015Document8 pagesTito Nanding 2015Hanabishi RekkaNo ratings yet

- IB Chapter # 12Document22 pagesIB Chapter # 12Ma Quang ThinhNo ratings yet

- S.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateDocument2 pagesS.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateRajuNo ratings yet

- Bank Reconciliation StatementDocument39 pagesBank Reconciliation StatementinnovativiesNo ratings yet

- Ra 7722Document5 pagesRa 7722Niel A.No ratings yet

- Slaus 700Document36 pagesSlaus 700Charitha Lakmal100% (2)

- Consolidated Financial StatementsDocument25 pagesConsolidated Financial StatementsJoanne RomaNo ratings yet

- Knowledge Is Power, So Be As Powerful As You Can!Document27 pagesKnowledge Is Power, So Be As Powerful As You Can!Ahemad ShamimNo ratings yet

- General Banking Law of 2000 GBL R.A. 879Document13 pagesGeneral Banking Law of 2000 GBL R.A. 879ELIZSANo ratings yet

- IPP Report PDFDocument296 pagesIPP Report PDFMuhammad ZubairNo ratings yet

- Class11-Revenue MGT - Before ClassDocument37 pagesClass11-Revenue MGT - Before ClassxtheleNo ratings yet

- Behavioral FinanceDocument20 pagesBehavioral FinanceLAZY TWEETYNo ratings yet

- 231.720 Ay18-19Document10 pages231.720 Ay18-19Arindam MondalNo ratings yet

- Standard Costing EditedDocument13 pagesStandard Costing Editedking justinNo ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- FS of Infinity Adventure Farm and ResortDocument35 pagesFS of Infinity Adventure Farm and ResortbeldiansitsolutionsNo ratings yet

- Written Math Practice Part-01Document6 pagesWritten Math Practice Part-01JerinNo ratings yet

- ISA 510 MindMapDocument1 pageISA 510 MindMapA R AdILNo ratings yet

- Hotel AccountsDocument52 pagesHotel AccountsAbinavam Subramanian Mohan95% (22)

- Valuation of Equity ShareDocument11 pagesValuation of Equity ShareSarthak SharmaNo ratings yet

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (16)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverFrom EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverRating: 4.5 out of 5 stars4.5/5 (186)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoFrom Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoRating: 5 out of 5 stars5/5 (21)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Five Dysfunctions of a Team SummaryFrom EverandThe Five Dysfunctions of a Team SummaryRating: 4.5 out of 5 stars4.5/5 (58)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobFrom EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobRating: 4.5 out of 5 stars4.5/5 (36)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterFrom EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterRating: 5 out of 5 stars5/5 (1)

- Speaking Effective English!: Your Guide to Acquiring New Confidence In Personal and Professional CommunicationFrom EverandSpeaking Effective English!: Your Guide to Acquiring New Confidence In Personal and Professional CommunicationRating: 4.5 out of 5 stars4.5/5 (74)

- The First Minute: How to start conversations that get resultsFrom EverandThe First Minute: How to start conversations that get resultsRating: 4.5 out of 5 stars4.5/5 (57)

- Algorithms to Live By: The Computer Science of Human DecisionsFrom EverandAlgorithms to Live By: The Computer Science of Human DecisionsRating: 4.5 out of 5 stars4.5/5 (722)

- Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisFrom EverandSurrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)