Professional Documents

Culture Documents

JD - SR Analyst - Hyd 02

Uploaded by

the few of youOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JD - SR Analyst - Hyd 02

Uploaded by

the few of youCopyright:

Available Formats

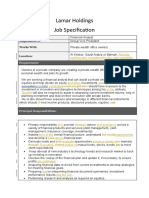

Company: Oxane Partners

Job Title: Sr. Analyst – Portfolio Management

Location: Hyderabad, India

Employment Type: Full Time

Experience: 0-2 Years

Website: www.oxanepartners.com

Company Oxane Partners is a fintech firm providing integrated portfolio management and

Description technology solutions to financial institutions globally within the alternative investments

landscape. Oxane’s clients include leading investment banks, private equity firms,

Pension Funds and structured credit players across US and Europe. Oxane is supporting

these clients on more than $300bn of investments through a unique combination of its

cutting-edge portfolio management platforms and deep asset class expertise from its

Portfolio Management Group, who work as an extension of our client’s asset

management teams.

Job Description The primary responsibility would involve working on certain client engagements where

Oxane is providing portfolio surveillance or reporting services to global institutional

investors investing in loan portfolios, asset backed financing or securitisation

transactions. The role would entail researching across various asset classes and work

independently on the day-to-day administration of loan servicing and portfolio

management across different geographies. He/she would also be required to interact

and coordinate with client on the performance of the assets and underlying collateral.

Key ▪ Onboarding the client’s investment portfolio on Oxane’s proprietary platform with the

Responsibilities help of IT team

▪ Work closely with the clients in supporting them for monitoring the performance of the

investment transactions across various asset classes

▪ Build financial models/reports as per client’s requirements and analyze historical

performance to identify the key drivers, to assess the performance

▪ Review and extract relevant data from financial statements, loan agreements,

amendment documents and other reports as required by clients or for analyzing the

credit

▪ Calculating and monitoring financial covenants and key metrics

▪ Review of the reports on the platform and need to ensure that the logics are accurate

and up to date

▪ Presenting the analytics to clients to match their expectations

Required ▪ Broad understanding of the corporate credit landscape and core financial concepts

Experience/ Skill ▪ Proficiency in financial modelling using MS Excel

Set ▪ Ability to work independently and collaboratively as part of a team in a fast-paced

environment

▪ Strong communication skills - written, verbal, and interpersonal

▪ Ability to work well under pressure to meet strict and aggressive deadlines

Desired Candidate ▪ Desired candidate must have graduated / MBA/ advanced degree in finance

Profile ▪ Prior experience with Investment Bank, Investment Management firm or Financial

Advisory firm, preferable

You might also like

- JD - Generic PMG - Analyst - Senior AnalystDocument1 pageJD - Generic PMG - Analyst - Senior AnalystSaubhagya SuriNo ratings yet

- JD Caspian Impact Investments Associate Manager Investments FI Sep 2022Document2 pagesJD Caspian Impact Investments Associate Manager Investments FI Sep 2022Tanmay AgrawalNo ratings yet

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- Northern Arc - JD0Document6 pagesNorthern Arc - JD0SDDDDNo ratings yet

- Analyst-Hedge Fund Reconciliation-2023 JDDocument2 pagesAnalyst-Hedge Fund Reconciliation-2023 JDAdarsh SinghNo ratings yet

- Vasudev RavikumarDocument2 pagesVasudev RavikumarVasudev RNo ratings yet

- WHLP AnalystAssociate Capital Management Jan 2023Document2 pagesWHLP AnalystAssociate Capital Management Jan 2023Brian LiNo ratings yet

- Iimc JD DeshawDocument3 pagesIimc JD DeshawVaishnaviRaviNo ratings yet

- Campus 22 - Finance JDDocument2 pagesCampus 22 - Finance JDAryan MaheshwariNo ratings yet

- Vacancies: Kenya Reinsurance Corporation LimitedDocument2 pagesVacancies: Kenya Reinsurance Corporation LimitedmautidavisNo ratings yet

- BlackRock 2023-2024 Finance Job DescriptionDocument2 pagesBlackRock 2023-2024 Finance Job Descriptionharikevadiya4No ratings yet

- Senior VP Debt Syndication At: Indcap Advisors Pvt. LTDDocument7 pagesSenior VP Debt Syndication At: Indcap Advisors Pvt. LTDvgupta5308No ratings yet

- Associate - Risk Monitoring (Mid Market)Document2 pagesAssociate - Risk Monitoring (Mid Market)sanket patilNo ratings yet

- Job Description - Acuity Knowledge PartnersDocument3 pagesJob Description - Acuity Knowledge PartnersSachin ShikotraNo ratings yet

- Ladrillo Investor PresentationDocument16 pagesLadrillo Investor PresentationMOVIES SHOPNo ratings yet

- BlackRock 2023-2024 Business Management Job DescriptionDocument2 pagesBlackRock 2023-2024 Business Management Job Descriptionbluelion638No ratings yet

- Banking & Payments SpecialistDocument4 pagesBanking & Payments SpecialistRahul kumarNo ratings yet

- CCG ConsultantDocument2 pagesCCG ConsultantHimanshu BohraNo ratings yet

- JDA - Analyst PEDocument1 pageJDA - Analyst PEchayanchandaliaNo ratings yet

- M&a Intern Analyst - Job DetailsDocument4 pagesM&a Intern Analyst - Job DetailsyhcdyhdNo ratings yet

- JD - Analyst - Senior Analyst - Investment ResearchDocument2 pagesJD - Analyst - Senior Analyst - Investment ResearchMontoo MonuNo ratings yet

- Suzanne Hone Is A Highly Accomplished Client Relationship Manager With An Outstanding Track Record of Success in Financial Services Organizations.Document2 pagesSuzanne Hone Is A Highly Accomplished Client Relationship Manager With An Outstanding Track Record of Success in Financial Services Organizations.smhbcdNo ratings yet

- JD - Treasury 1Document1 pageJD - Treasury 1Time-Lapse CamNo ratings yet

- Job Description - MSC SFG AssociateDocument2 pagesJob Description - MSC SFG AssociateMohd KamranNo ratings yet

- Vasudev RavikumarDocument2 pagesVasudev RavikumarVasudev RNo ratings yet

- Investment Management Brochure (Final)Document12 pagesInvestment Management Brochure (Final)cubanninjaNo ratings yet

- Investor Relations ManagerDocument2 pagesInvestor Relations ManagerMarshay HallNo ratings yet

- JD - Campus Placements 2023Document3 pagesJD - Campus Placements 2023BCom HonsNo ratings yet

- CFA Level 1 Cleared JDDocument1 pageCFA Level 1 Cleared JDsahilNo ratings yet

- T8 - Senior Process Specialist - Fund Reporting TeamDocument2 pagesT8 - Senior Process Specialist - Fund Reporting TeamAshu BediNo ratings yet

- Senior Investment Analyst or Investment Analyst or Research AnalDocument3 pagesSenior Investment Analyst or Investment Analyst or Research Analapi-78556480No ratings yet

- CV - Katie Louise WatsonDocument3 pagesCV - Katie Louise WatsonAnonymous MSqlCbw78No ratings yet

- Client Relationship ManagerDocument2 pagesClient Relationship ManagerMarshay HallNo ratings yet

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Portfolio Associate, CreditDocument2 pagesPortfolio Associate, CreditMarshay HallNo ratings yet

- JD LR Investment Associate-3Document1 pageJD LR Investment Associate-3Abcd123411No ratings yet

- Trading MentorDocument2 pagesTrading MentorShrikant DNo ratings yet

- CPB (EMEA) Business Analyst London August 2023Document2 pagesCPB (EMEA) Business Analyst London August 2023gtNo ratings yet

- Business Development ManagerDocument2 pagesBusiness Development ManagerMarshay HallNo ratings yet

- Fenwick Brands Associate - 2021 FinalDocument2 pagesFenwick Brands Associate - 2021 FinalbobNo ratings yet

- Position Preferred Relationship Manager Location - Mumbai Job ProfileDocument1 pagePosition Preferred Relationship Manager Location - Mumbai Job ProfileAshishDwivediNo ratings yet

- A. Saffer: RobertDocument5 pagesA. Saffer: Robertashish ojhaNo ratings yet

- Investment Manager - Spider ManagementDocument2 pagesInvestment Manager - Spider ManagementMarshay HallNo ratings yet

- JPMC How We Do Business' PrinciplesDocument2 pagesJPMC How We Do Business' Principlessumit sinhaNo ratings yet

- People Matters - India Junior Research SpecialistDocument2 pagesPeople Matters - India Junior Research SpecialistNaman JainNo ratings yet

- Lamar Holdings - Job Specification - Financial Analyst - 8 Nov 20Document3 pagesLamar Holdings - Job Specification - Financial Analyst - 8 Nov 20abhinavg_9No ratings yet

- GauriShankarAgarwal (26 0)Document3 pagesGauriShankarAgarwal (26 0)Vikas PundirNo ratings yet

- Boa Tanzania VacanciesDocument4 pagesBoa Tanzania Vacanciesghongoa1996No ratings yet

- RelationshipManager CorporateBanking (OG II OG I)Document1 pageRelationshipManager CorporateBanking (OG II OG I)WaqasNo ratings yet

- ARES-JD - VP Asset Management Ares AsiaDocument2 pagesARES-JD - VP Asset Management Ares AsiaHasik JainNo ratings yet

- Associate - EstanciaDocument2 pagesAssociate - EstanciaMarshay HallNo ratings yet

- JD - Capital Markets-OffshoreDocument4 pagesJD - Capital Markets-OffshoreAmit panditNo ratings yet

- Callahan Analyst 2021Document3 pagesCallahan Analyst 2021callahan.jonathan2727No ratings yet

- Iqg Job DescriptionDocument4 pagesIqg Job DescriptionJKET Sales South Vishnu HariNo ratings yet

- PCG Consultant Role JD-2Document2 pagesPCG Consultant Role JD-2Aashutosh KhandelwalNo ratings yet

- Treasurer ResumeDocument6 pagesTreasurer Resumeafjwfealtsielb100% (2)

- Real Estate ConsultantDocument2 pagesReal Estate ConsultantMarshay HallNo ratings yet

- JD - OXYZO - Investor RelationsDocument1 pageJD - OXYZO - Investor RelationsTimothy King LincolnNo ratings yet

- JD For Deloitte Advisory Usi - Valuation (Tangible Assets)Document3 pagesJD For Deloitte Advisory Usi - Valuation (Tangible Assets)vedangNo ratings yet

- Abshiek Social ProjectDocument7 pagesAbshiek Social Projectthe few of youNo ratings yet

- Social Project by MOHITH KUMAR LOCHARLADocument12 pagesSocial Project by MOHITH KUMAR LOCHARLAthe few of youNo ratings yet

- Corporate Overview Campus Hiring - Oxane Partners May2022Document11 pagesCorporate Overview Campus Hiring - Oxane Partners May2022the few of youNo ratings yet

- SDM-4 Course Quiz AnswersDocument3 pagesSDM-4 Course Quiz Answersthe few of youNo ratings yet

- g11 SLW CH 2 Forms of Business OrgDocument5 pagesg11 SLW CH 2 Forms of Business OrgShreya KhannaNo ratings yet

- Princ ch23 PresentationDocument43 pagesPrinc ch23 Presentation2700957414No ratings yet

- Assignment - Mandalika Land ConflictDocument3 pagesAssignment - Mandalika Land Conflictwahyu sulistya affarahNo ratings yet

- Tugas 1 Akuntansi PengantarDocument6 pagesTugas 1 Akuntansi PengantarblademasterNo ratings yet

- American Depository Receipts (Adr)Document9 pagesAmerican Depository Receipts (Adr)yashpoojaraiNo ratings yet

- Project Report FOR 1000 MT Cold Storage: Details of Project Cost and Means of FinanceDocument11 pagesProject Report FOR 1000 MT Cold Storage: Details of Project Cost and Means of FinancePraveenKDNo ratings yet

- Investment Analysis of Al-Arafah Islami Bank LimitedDocument53 pagesInvestment Analysis of Al-Arafah Islami Bank LimitedNewaz ShovonNo ratings yet

- Demanletter MabutinDocument6 pagesDemanletter MabutinMikko AcubaNo ratings yet

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Online Corporate Finance I Practice Exam 1 SolutionDocument14 pagesOnline Corporate Finance I Practice Exam 1 SolutionTien DuongNo ratings yet

- Chapter1 - Return CalculationsDocument37 pagesChapter1 - Return CalculationsChris CheungNo ratings yet

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Summer Internship Project - PGFB1622Document60 pagesSummer Internship Project - PGFB1622Mohammad ShoebNo ratings yet

- Midterm Exam - Esecon 1ST Sem. 2021-2022Document3 pagesMidterm Exam - Esecon 1ST Sem. 2021-2022raymond moscosoNo ratings yet

- Unit 6 - Financial Ratio AnalysisDocument22 pagesUnit 6 - Financial Ratio AnalysisLe TanNo ratings yet

- I Can Do Financial PlanningDocument143 pagesI Can Do Financial PlanningAbhinay KumarNo ratings yet

- The Nature Conservancy - 2023 Endowment Impact Report (40p)Document40 pagesThe Nature Conservancy - 2023 Endowment Impact Report (40p)Aza O'Leary - SEE The Change ProductionsNo ratings yet

- 7 3 6 PDFDocument7 pages7 3 6 PDFAnonymous ICaWn8100% (2)

- Bank Soal AC010Document8 pagesBank Soal AC010Mr. wNo ratings yet

- Silicon Valley Bank Fiasco Simply ExplainedDocument21 pagesSilicon Valley Bank Fiasco Simply ExplainedGoMarkhaArjNo ratings yet

- Asian Financial Crisis - The Domino Effect of ThailandDocument3 pagesAsian Financial Crisis - The Domino Effect of ThailandYovan OtnielNo ratings yet

- 2020 Cma P1 B SCFDocument37 pages2020 Cma P1 B SCFThasveer AvNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- Annual Report 2073-74-2074-2075Document116 pagesAnnual Report 2073-74-2074-2075Aayush ChauhanNo ratings yet

- JP Morgan Valuation Training MaterialsDocument49 pagesJP Morgan Valuation Training MaterialsAdam Wueger92% (26)

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992No ratings yet

- UNIVERSITY MALAYSIA PAHANG Final Project PaperDocument31 pagesUNIVERSITY MALAYSIA PAHANG Final Project PaperShaleeena AiharaNo ratings yet

- Business Studies Project On Credit CardsDocument10 pagesBusiness Studies Project On Credit CardsPiyush Setia0% (1)

- REVIEWERDocument3 pagesREVIEWERWayne GodioNo ratings yet

- Raising Venture Capital DermotBerkeryDocument17 pagesRaising Venture Capital DermotBerkeryolstNo ratings yet