Professional Documents

Culture Documents

Topic 5

Uploaded by

sofianasery28Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 5

Uploaded by

sofianasery28Copyright:

Available Formats

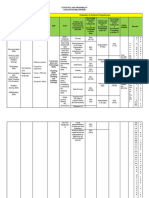

Process of Public Financial Administration .

Stage 1 :

Planning Stage 4 :

Auditing Stages of Budget (Budgetary Process .

·

Audit is an independant assessment

To program's details 1 4) Implementation

organize Preparation Execution and

·

the .

of the fairness and formulation .

↳ company's financial statements and budget has become law , it is implemented in the fiscal year

A are involves preparing estimates of revenue once

- -

·

Financial plan - achieve strategic goals & objectives -

presented by its management.

expenditure for a specific future period , normally by various agencies .

·

performed to ascertain the &

validity a year. -

Budget law (the supply Act) contains

·

Describe the program in detail reliability of information -

Instruction to prepare the budget :

call circular ↳ appropriations on programs and activities

↳ activities ↳ also to provide an assessment of a ↳ issued before the new fiscal year ↳includes such items as salaries ,

↳ ↳ no of

system's internal control In the circular personnel and rank

.

:

resources

-

·

Auditors of financial statement · state of economy ↳ equipment

↳ time frames involved

) carried out by internal auditors

↳ ·

rate of growth ↳ other

are given operating expenditures

established by the organization ( allowed to spend beyond what is

forecast of revenue Agencies .

appropriated

·

-

are not

Produce final output

·

: BUDGET STATEMENT ↳ external auditor in the

spread throughout fiscal year and

coming year -

spending is the is subject

can independant audit firms also states examination by internal and external audits

-

to .

·

Before planning , a study is done to analyze · maximum percentage in the increase or ceiling by each agency -

supplementary expenditure is only allowed :

↳ country's demand ↳ depending on whether times are good or otherwise · in case of emergency or

↳ political Stage 5 : Reviewing · Due to unforeseen circumstances (must go through the same process again)

Assessment achievement of Whatever the state of always reminded

outside) on the economy , agencies

·

Stability (of the country are As for revenue from

-

- social tax :

-

a new

↳ economic

an organization/agency to be prudent in their

budget submission n. ·

separate legislation or amended legislation has had to be passed

↳ in terms of financial performance before it can be collected .

Government agencies involved : that has been achieved throughout 2) Submission to and Examination by Central Agencies. For new source of revenue

the

-

a

totally ,

↳ prime Minister's office year. proposed budget is submitted to the central established for

agencies administrative structure machinery

-

· an must be

↳) the Ministries ·

Reviewing report can highlight responsible for finance and personnel its collection and .

.

management

↳ Economic Planning Unit CEPU) ↳ achievements weaknesses of the -

In Malaysia : -

There is also a system of monitoring the implementation of

↳ MAMPY ↳

shortcoming current financial

plan- · personnel : Public

Service Department Operating Budget .

↳ Bank Negara . ·

financial review report can be used as ↳ to keep track of the amount of fund expended under each standard

·

finance :

Treasury

↳ basis for

preparing future budget plan .

object of expenditures

.

with the latter having the final is responsible

say as it

-

↳ for financial purpose rather than to measure the progress or performance

Stage 2 :

Budgeting Revenues of PFA or Budget for the budget as a whole .

of the agencies·

1) Taxes Cland taxes , business corporate taxes proposed budget of ↳ All agencies submit

or

,

-

agency are required to to the Accountant general a quarterly

Show intended /estimated revenues [expenditures

·

personal taxes , service taxes) (direct . tax) ↳ is scrutinized examined by the central agencies report on the Operating Budget

.

of the government 2) customs duties or tariffs Clevy , import & export which normally prune them down to within the

ceiling

↳ financial resources can be appropriately allocated .

duties) (indirect tax ( set earlier-

3)

Penalties and fines traffic summons) The whole budget covering all the agencies is

-

·

To allow political process 4) Gifts (public donations wakaf international donations) then submitted to of Finance for

5) Audit or Review

political

:

, ,

the minister

5) International

executivebody dy> involves

loans from international organizations and other input prior to submission to the Cabinet,

2 major branches of gov

.

final stage

-

Clmf , World Bank , Asean Bank) Or

the final .

policy-making authority involves

auditing or reviewing the execution or implementation

·

A document that outlined the estimate expenditure & return foreign countries (the Us Japan

, , People

for particular Republic of China) 3) Cabinet and Legislative Approval of the approve budget.

year.

· National finance :

period covered by a budget : a year 6) Quid Pro Quo payment such as fees

, charges . -

National budget proposal is then presented to the

Paka cabinet

designed

-

:

financial / fiscal year

year .

(medical fees in public hospitals, payment for by the Minister of Finance . Reviews of budget implementation are to

·

Government annual budget : statement that explains the renewing driving licence , payment to renew

passports) -

The Cabinet will carefully consider the proposal , · see the effectiveness

:

expected amount of: especially ·

check compliance by the organizations of the authorization to spend

↳ country's expenditure return gains by ·

new programs & taxes for ·

Whether the objectives had been achieved

.

↳ types of ↳ political

expenditure the -

country Expenses of P F

. .

Expenditure (Budget)

· enables the actual financial operation of the gov . 1) Development expenditure : unrepeatable ↳ economic ~ advice of PM

stated G other Auditor General YDPA) concurrence of Conference of pulers

-

in monetary terms . Capital expenditure (to create return) ramifications .

Cappointed by the

=

·

↳ defrayed through 2 financial resources The budget is then , presented to the legislature in the

oresponsible for examining

-

Stage 3 :

Accounting : current account and loan .

form of law

.

· Art of recording , & summarizing

classifying in a signicant 2) operating expenditure repeatable :

-

A budget is more than a revenue and expenditure

·

enquiring into and auditing the accounts of all federal and state agencies.

manner and in terms of expense it contains

↳ money 4)

salary allowances ↳ rents ↳ fiscal deconomic policies of the ruling party

↳ ↳ utilities He submits

trans acti ons and events ↳ ambitious programs annual audit report to the Dewan

Rakyat

-

.

an

Prepared to provide financial information report about the ↳ new taxes/reduction or abolition of some

·

or

2

parts of managing expenses ↳ refers it CPAC)

to its Public Accounts Committee

outside

.

government business to people inside the government entity .

Under legislature is Parliament

Go examine any irregularities

Professional

9) Defrayal expenditure the Westminster model

accountante

:

carried out

by

: -

·

in the of public monies or public stores

Financial procedures

defrayed by Kumpulan Wang accounting .

budget will easily passed ruling party has

·

-

expenditure be as long as the a

Gestablished by the Accountant General Offices

.

Disatukan (Federal consolidated Fund) sizeable majority

·

objective of Accountant General => does not need to

get approval from the When

·

majority is slim

, however an the ruling party

↳ to enhance accountability transparency in the Federal Parliament every year (Royal Allotment ,

is a shaky coalition , budget will face a difficult process.

government's allotment Chief Justice, passed

accounting and financial management. ~ emuneration or for the when a budget law is not or is defeated by

-

↓ or a for the Auditor General .

Legislature

b) supply expenditure expenditure for every ↳ gov cannot function in the fiscal as there are no

year

: ·

Service except that is defrayed by funds to pay for services , salaries and

Consolited Fund other operational costs

·

-

This expenditure is defrayed by Akann

Hasil Disatukan (Consolidated Revenue ACC ) .

Sofia Solehah .

You might also like

- Value Stream Improvement Plan TemplateDocument4 pagesValue Stream Improvement Plan TemplatemilandivacNo ratings yet

- Flowchart of Project Management Process As Applied To PDPDocument2 pagesFlowchart of Project Management Process As Applied To PDPsamerric100% (1)

- Waterfall Large LC QuickRef v1.2Document1 pageWaterfall Large LC QuickRef v1.2Swarup NakkaNo ratings yet

- One Page Teaser For FundingDocument1 pageOne Page Teaser For FundingSrikanth GopalanNo ratings yet

- Business Process DRI V4 14-Apr-21Document5 pagesBusiness Process DRI V4 14-Apr-21PRANAV KUMAR GAUTAMNo ratings yet

- Annual business planning and budgeting processesDocument1 pageAnnual business planning and budgeting processesvivekcp87No ratings yet

- Appraisal Ce Exam 4 Review PDFDocument30 pagesAppraisal Ce Exam 4 Review PDFAmeerNo ratings yet

- To Be Process Flow CAPEX V2-0aDocument11 pagesTo Be Process Flow CAPEX V2-0ams accessNo ratings yet

- Financial ModelingDocument6 pagesFinancial Modelingyousafkhalid48675% (4)

- Business Plan Entrepreneurship PDFDocument71 pagesBusiness Plan Entrepreneurship PDFcourse hero100% (1)

- PMP IttoDocument1 pagePMP IttoSwift_Wang_4779100% (3)

- GAM Road MapDocument1 pageGAM Road MapsamaanNo ratings yet

- Amazon Seller Blueprint: Vendlab, 2 Spring Valley Business Centre, Porters Wood, ST Albans, AL3 6PD, UK EmailDocument3 pagesAmazon Seller Blueprint: Vendlab, 2 Spring Valley Business Centre, Porters Wood, ST Albans, AL3 6PD, UK EmailKhansa025No ratings yet

- Sap PmoDocument15 pagesSap PmonovaNo ratings yet

- Citystate Savings Bank V TobiasDocument2 pagesCitystate Savings Bank V TobiasBurnok SupolNo ratings yet

- Summary - Cost AccountingDocument43 pagesSummary - Cost AccountingNESIBE ERBASNo ratings yet

- Audit PlanningDocument2 pagesAudit Planninglied27106No ratings yet

- Chapter 2 Formulation and Verification of Accounting TheoryDocument1 pageChapter 2 Formulation and Verification of Accounting Theoryammar beatlesNo ratings yet

- BPM - TD Bank-3Document1 pageBPM - TD Bank-3frostbitexysNo ratings yet

- Sustainable Coffee Trade Platform Work Plan 2014-2015Document8 pagesSustainable Coffee Trade Platform Work Plan 2014-2015carlosisazaNo ratings yet

- Agile Devops Planning Transition TransformationDocument1 pageAgile Devops Planning Transition TransformationAdrian des RotoursNo ratings yet

- Budgeting HandbookDocument1 pageBudgeting HandbookTamer ŞenerNo ratings yet

- Bank Reports and StatementsDocument39 pagesBank Reports and StatementsLogan ThakurNo ratings yet

- PM One Page FlowchartDocument1 pagePM One Page FlowchartbenNo ratings yet

- Mop Bicycle Heny PortmanDocument1 pageMop Bicycle Heny Portmanamir sedighiNo ratings yet

- Budget Cycle NotesDocument15 pagesBudget Cycle NotesSnehdeep KaurNo ratings yet

- 0021-Performance Review ProcessDocument1 page0021-Performance Review Processals1508No ratings yet

- 2009-SUPPORT Tools For Evidence-Informed Health Policymaking (STP) 8 - Deciding How Much Confidence To Place in A Systematic ReviewDocument13 pages2009-SUPPORT Tools For Evidence-Informed Health Policymaking (STP) 8 - Deciding How Much Confidence To Place in A Systematic ReviewJULIO CESAR MATEUS SOLARTENo ratings yet

- 14 - Integration Management - 2013 V5Document5 pages14 - Integration Management - 2013 V5DougNo ratings yet

- 5 - Scope Management - 2013 - V5Document4 pages5 - Scope Management - 2013 - V5DougNo ratings yet

- CSU2021 Audit ReportDocument155 pagesCSU2021 Audit ReportMiss_AccountantNo ratings yet

- MotivationMeans IPDA LCI ReportDocument255 pagesMotivationMeans IPDA LCI Reportsuman samratNo ratings yet

- 01SMR Ses1 Ver 1-2Document37 pages01SMR Ses1 Ver 1-2Marlin DasNo ratings yet

- Code of Practice on Safe Lifting OperationsDocument6 pagesCode of Practice on Safe Lifting Operationss_bharathkumarNo ratings yet

- Lecture Note 4 (Colour)Document16 pagesLecture Note 4 (Colour)Zhihao WangNo ratings yet

- BUS-200 Chapter 17 Notes Accounting & Financial InformationDocument6 pagesBUS-200 Chapter 17 Notes Accounting & Financial InformationAmmar YasserNo ratings yet

- Week 4 Chapter 11Document4 pagesWeek 4 Chapter 11CIA190116 STUDENTNo ratings yet

- Accounts Intro 4Document1 pageAccounts Intro 4manishchd81No ratings yet

- Basic Cy ProDocument1 pageBasic Cy Promalith kmlNo ratings yet

- BHM MappingDocument3 pagesBHM MappingJagbeer SinghNo ratings yet

- Consulting ModuleDocument1 pageConsulting ModuleArtoToroNo ratings yet

- Value Chain Map ITIL4Document2 pagesValue Chain Map ITIL4Belem PianaNo ratings yet

- Perform Substantive Procedures L1Document10 pagesPerform Substantive Procedures L1archanaanuNo ratings yet

- UNIT 2 - Accounting Concepts and PrinciplesDocument2 pagesUNIT 2 - Accounting Concepts and PrinciplesSean Michael TanChuaNo ratings yet

- FSM Planning From A To Z: Activities OutcomesDocument1 pageFSM Planning From A To Z: Activities OutcomesIftita RahmatikaNo ratings yet

- Ims-Dc: Power and Water Utility Company For Jubail and Yanbu Project Construction and Pre-Commissioning ProcedureDocument1 pageIms-Dc: Power and Water Utility Company For Jubail and Yanbu Project Construction and Pre-Commissioning ProcedurekapsarcNo ratings yet

- Description: Tags: 08cfoDocument9 pagesDescription: Tags: 08cfoanon-696737No ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- CFP BrochureDocument2 pagesCFP BrochureAnupam Sinha100% (2)

- Memo 097.7 - 073123 - Inclusion To DPCR of Finance Division Chief and IPCR of Finance Section ChiefDocument2 pagesMemo 097.7 - 073123 - Inclusion To DPCR of Finance Division Chief and IPCR of Finance Section ChiefJay VillalobosNo ratings yet

- Description: Tags: 08polliaisDocument3 pagesDescription: Tags: 08polliaisanon-457528No ratings yet

- Maruti IR 2021-22Document3 pagesMaruti IR 2021-22jivin bNo ratings yet

- Strategic Planning of Socio-Economic Development of Service EnterprisesDocument4 pagesStrategic Planning of Socio-Economic Development of Service EnterprisesCentral Asian StudiesNo ratings yet

- Topic 3Document2 pagesTopic 3sofianasery28No ratings yet

- Ciap Aapsi 2016Document12 pagesCiap Aapsi 2016Hoven MacasinagNo ratings yet

- Relationship Between GDP SDG Goals and SEEA IndicatorsDocument5 pagesRelationship Between GDP SDG Goals and SEEA IndicatorsVikin JainNo ratings yet

- TPP of HEP PDFDocument39 pagesTPP of HEP PDFNayeem HossainNo ratings yet

- 5 Critical Appraisal - Kilminister, Taylo - SnipeDocument7 pages5 Critical Appraisal - Kilminister, Taylo - Snipesbracca1No ratings yet

- Individual Performance Commitment and Review (Ipcr) : Bataan Peninsula State UniversityDocument34 pagesIndividual Performance Commitment and Review (Ipcr) : Bataan Peninsula State UniversityAnonymous XlIK0zM5No ratings yet

- Fem Pacayo AizaDocument3 pagesFem Pacayo AizaRikk LozanoNo ratings yet

- Handle Handover Project To End UserDocument41 pagesHandle Handover Project To End UserSALAH HELLARANo ratings yet

- Health Check Process Flowchart 0Document1 pageHealth Check Process Flowchart 0mynalawalNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Compensation Management PDFDocument14 pagesCompensation Management PDFNarendiran SrinivasanNo ratings yet

- TDS Return Late Fee Tax DeductibilityDocument5 pagesTDS Return Late Fee Tax DeductibilityDivyaNo ratings yet

- Case Study in Industrialized Building System (IBS)Document17 pagesCase Study in Industrialized Building System (IBS)Mohamed A. SattiNo ratings yet

- BancomundialpaperDocument32 pagesBancomundialpaperpaulo.bessa.antunesNo ratings yet

- Tim Winter - Clarifying The Critical in Critical Heritage StudiesDocument15 pagesTim Winter - Clarifying The Critical in Critical Heritage StudiesHappy_DoraNo ratings yet

- Pain Relievers Trigger QuestionsDocument1 pagePain Relievers Trigger QuestionsAndrew ShinnNo ratings yet

- Forecasting Methods and ImportanceDocument37 pagesForecasting Methods and ImportanceFaizan TafzilNo ratings yet

- Pitch Deck: Mirjam NilssonDocument21 pagesPitch Deck: Mirjam NilssonHIRAWATI BINTI ABDUL RAHMAN (IPGM-SARAWAK)No ratings yet

- OfferletterDocument2 pagesOfferletterpakada8460No ratings yet

- Elements of Cost and Cost Sheet - FYBBA-IBDocument25 pagesElements of Cost and Cost Sheet - FYBBA-IBSakuraNo ratings yet

- CharmiDocument8 pagesCharmiRavi ParmarNo ratings yet

- Startups and Sources of Funding-Janaji SA-Ismail K-Ibrahim FDocument6 pagesStartups and Sources of Funding-Janaji SA-Ismail K-Ibrahim FEdison ChandraseelanNo ratings yet

- Gap Strategic AnalysisDocument10 pagesGap Strategic AnalysishesanehNo ratings yet

- Financial Statement AnalysisDocument59 pagesFinancial Statement AnalysisRishu SinghNo ratings yet

- Employment Offer Ram Ashish Rigger IIIDocument1 pageEmployment Offer Ram Ashish Rigger IIIHaleemUrRashidBangashNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- IIT-Bombay WashU EMBA BrochureDocument28 pagesIIT-Bombay WashU EMBA Brochuregaurav_chughNo ratings yet

- Business Ethics and Corporate Social ResponsibilityDocument5 pagesBusiness Ethics and Corporate Social ResponsibilityKarl Jason Dolar CominNo ratings yet

- Disclosures For Confirmation With Legal DepartmentDocument9 pagesDisclosures For Confirmation With Legal Departmentlito77No ratings yet

- Test AssignmentDocument6 pagesTest AssignmentAmardeep SinghNo ratings yet

- The Contemporary World: GlobalizationDocument20 pagesThe Contemporary World: GlobalizationAna0% (1)

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- Logistics Requisition FormDocument2 pagesLogistics Requisition FormJaime PinedaNo ratings yet

- 5 Hocevar Jaklic FinalDocument35 pages5 Hocevar Jaklic FinalRaghuram SeshabhattarNo ratings yet

- Coorperative Business-Mishika AdwaniDocument8 pagesCoorperative Business-Mishika AdwaniMishika AdwaniNo ratings yet