Professional Documents

Culture Documents

DXY Report 11 April 2010

Uploaded by

AndysTechnicalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DXY Report 11 April 2010

Uploaded by

AndysTechnicalsCopyright:

Available Formats

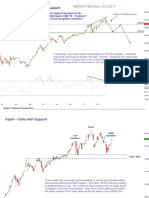

Dollar Index (Weekly) with 13/34 Weekly Moving Average

While I’m still not the biggest fan of MA analysis, we need to give these

indicators their “due.” The 13 and 34 Week simple moving averages have

done a good job of providing support and resistance for the DXY. The 13/34

“Cross” has also been good at “confirming” trend changes.

Trend change

confirmation

Trend change

confirmation?

Using the 34 Week MA as a “guide,” the DXY bulls won’t have a problem

Trend change until that blue line gets taken out (low 78) I would expect this average to

confirmation

provide good support on any dip. Additionally, as we will see on the

next pages, there are other technical reasons while the low 78 area will

be solid support…

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Weekly) Using “classic charting” techniques, it’s pretty clear that the 77.69 to 78.33

zone is now support for whatever “e” - wave decline we might witness. This

“b” area was the scene of several important inflection points in the past two years,

so the market will have memory of these prices. Additionally, 77.86 is the

(A) 61.8% retrace of the (A) wave advance--it’s amazing how many times (B)

waves eventually conclude around that retracement point.

“d”

z?

x y

w x

78.33

w x 77.69

“a” “e”

x (B)

y

74.33

z of “c”

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Daily)

“b” Over the last couple of months, we had two main targets for price and time. It was suggested that

89.62

because the “b” wave lasted a “brief” 54 days, it would be nice alternation for the “d” wave to last at

least 88 trading days. It was also suggested many times that 81.70 would be a nice target for the “d”

(A) because it would be 61.8% of the “b” wave. From the “orthodox” low on 12/3/09, the 88th trading day

was 4/8/10. The market close at 81.66 on that day, 4 ticks away from the price target. These price

and time projections rarely come out this perfect, so I’m expecting the market to surprise me in some

-b-

other way, but the fact is that counting this entire move as a triangle for the last several weeks

yielded a price and duration target of 81.70 on 4/8/10, exactly where the market finished.

Wild stuff….

“d”

z?

81.66

-a-

y?

x

-b- x?

w?

-a-

-c- x “e”

77.69 w -b- (B)

“a”

x?

-c-

y

-a-

74.33

-c-

z of “c”

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Daily) ~ A “Triple Combination” Concluded?

“d”

-c-

(c)

z

y -e-

-g- 81.91

81.34

If the “diametric” labeling of y-wave -a- (a)

makes one queasy, then consider -e-

it a “double” of some kind.

(b) -d- If a triangle did finish here, the

market MUST “collapse” now,

thrusting out of the triangle.

-c-

-f- x2?

w -b-

-a-

-c-

-d-

-b-

I’ll be the first to admit that the wave structure off the Dec ’09 lows is another strange and

unusual pattern, similar to the overall pattern on the S&P from the March ’09 lows. What

-a- 76.60 I can say for certain is that it is IMPOSSIBLE to label any of the larger advances as

-b- x1 “Impulsive” (five waves). Therefore, the move off the Dec ’09 lows MUST be a correction

of some sort, which fits quite well with the larger picture model (Slide 2).

I would like to end this “d” wave at the 81.91 high on 4/8/10 for the reasons cited on the

previous page. This would be the count that concludes the move on that point.

Admittedly, it’s a bit “forced,” but it actually works OK and does adhere to logical wave

counting principles. The overall wave structure would be considered a “triple

combination” in that it was a move containing two x-waves and concluded with a triangle.

This will be a very easy model to disprove: 81.91 must now hold as resistance.

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Daily)

“b” So, how can we synthesize these various thoughts into a trading strategy?

89.62

The longer term picture/trend on the DXY remains bullish, so longer term traders (er,

“investors”) should continue to hold bullish bets on the US Dollar. However, because of the

(A) short term risk of a correction to 78, it might make sense to be holding only 25-33% of a

maximum long position, with an eye toward adding length on any pullback to 78. Shorter (C)

term traders can attempt to short the DXY, but it would seem prudent to use 81.91 as a “stop

loss” on short trades.

“d”

z?

81.91

y?

x

x?

w?

w x “e”

77.69 (B)

“a”

x?

y

74.33

z of “c”

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Weekly)

“b”

89.62

This model has been excellent for giving us a feel for medium term direction,

so we will stick with it. While the DXY has clearly stopped going higher, one

(A) cannot say it has shown signs of a “reversal.” It looks like to be just

congesting nearer the highs, typically a signal that another new high is likely.

REPRINTED 3/10/2010

“d”

Z

81.70?

y

x

x

w

w x

77.69 “e”

“a” x (B)

y

74.33

z of “c”

The “b” wave lasted 11 weeks (54 trading days) on this chart and was very “brief” in comparison to the “c” wave

that followed. It would make sense for the “d” wave to be longer lasting to provide some “alternation.” For

instance, it if were to be 161.8% of “b”, that would make this “d” wave 88 trading days long for an 18 week move.

We’re currently on trading day 67, so maybe another 2-3 weeks to go?

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Daily) Wave “c” has ended and we’re are now in the middle of wave “d” of a

larger triangle. A good target for the “d” would be 81.70, which is

61.8% of the “b” wave. (As with most triangles, the alternating legs

will be related by a Fibonacci number.)

“b”

89.62

(A)

-b-

REPRINTED 1/17/2010

“d”

-a- 81.70

x

-b-

w/a

-c- -a- x

77.69 w -b-

“a” “e”

-c- x/b (B)

y -a-

74.33

-c-

z of “c”

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Scattering Theory for Automorphic Functions. (AM-87), Volume 87From EverandScattering Theory for Automorphic Functions. (AM-87), Volume 87No ratings yet

- From Pixels to Animation: An Introduction to Graphics ProgrammingFrom EverandFrom Pixels to Animation: An Introduction to Graphics ProgrammingRating: 1 out of 5 stars1/5 (1)

- Dollar Index 15 Feb 2010Document4 pagesDollar Index 15 Feb 2010AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Morning View 18 Feb 10Document6 pagesMorning View 18 Feb 10AndysTechnicalsNo ratings yet

- Course PDFDocument102 pagesCourse PDFRocket FireNo ratings yet

- Exponents and Radicals - Worksheet1Document4 pagesExponents and Radicals - Worksheet1Johnmar FortesNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Santos-Vector Calculus BookDocument204 pagesSantos-Vector Calculus BookEu gosto de cachorrosNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Essential Unit 04 Linear FunctionsDocument3 pagesEssential Unit 04 Linear FunctionsFatih HoxhaNo ratings yet

- alg07Document17 pagesalg07Mahamad AliNo ratings yet

- Regression Analysis ExplainedDocument9 pagesRegression Analysis ExplainedApef YokNo ratings yet

- Stream FNDocument3 pagesStream FNbrian5412No ratings yet

- MidcourseDocument27 pagesMidcourseNamory DOSSONo ratings yet

- mixed-geometry-reviewDocument2 pagesmixed-geometry-reviewdanielshen934No ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Exploring Raw Data Analysis FunctionsDocument17 pagesExploring Raw Data Analysis FunctionsdindinpatalamNo ratings yet

- #PR 5pointDocument4 pages#PR 5pointadamstanieckiNo ratings yet

- 1.vector Calculus (Santos) .JPGDocument108 pages1.vector Calculus (Santos) .JPGWaSifAliRajputNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Forecasting MethodsDocument38 pagesForecasting MethodsabrilNo ratings yet

- Problem Set 11Document3 pagesProblem Set 11ke QinNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Section Quiz 3-2 - Schools of The Sacred HeartDocument3 pagesSection Quiz 3-2 - Schools of The Sacred HeartAref DahabrahNo ratings yet

- Review Unit 8: Graph The Image of The Figure Using The Transformation GivenDocument5 pagesReview Unit 8: Graph The Image of The Figure Using The Transformation GivenFaith Rappe0% (1)

- Test 1 ESTDocument15 pagesTest 1 ESTshoushamoustafaNo ratings yet

- Torsion of Circular SectionsDocument10 pagesTorsion of Circular SectionsAbrham DubeNo ratings yet

- Regression and CorrelationDocument12 pagesRegression and CorrelationAbdul RehmanNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- R R y X y Y: Imple Inear EgressionDocument1 pageR R y X y Y: Imple Inear EgressionErwin BulahaoNo ratings yet

- Trading The GARTLEY 222Document5 pagesTrading The GARTLEY 222tanvirrahman100% (1)

- Multiple Linear Regression - Six Sigma Study GuideDocument9 pagesMultiple Linear Regression - Six Sigma Study GuideSunilNo ratings yet

- Multiple Linear Regression OverviewDocument9 pagesMultiple Linear Regression OverviewSunilNo ratings yet

- New SAT Math No Calculator Practice Section Ivy GlobalDocument6 pagesNew SAT Math No Calculator Practice Section Ivy GlobalJohn Thomas WatsonNo ratings yet

- Schirding H. - Stochastic Oscillator (1984)Document5 pagesSchirding H. - Stochastic Oscillator (1984)puran1234567890No ratings yet

- Isomorphism and the N-Queens Problem: Teaching concepts of isomorphism, transformation groups, and equivalence classesDocument16 pagesIsomorphism and the N-Queens Problem: Teaching concepts of isomorphism, transformation groups, and equivalence classeslizNo ratings yet

- Gold Report 7 Nov 2010Document8 pagesGold Report 7 Nov 2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- 02450ex_Spring2018_solDocument22 pages02450ex_Spring2018_solnavistoriesNo ratings yet

- Classification: 12.1 Discriminant AnalysisDocument21 pagesClassification: 12.1 Discriminant AnalysisМирјана МићевићNo ratings yet

- 2 - 5 Zeros of Poly FNDocument6 pages2 - 5 Zeros of Poly FNkaloy33No ratings yet

- TB Chapter 03Document12 pagesTB Chapter 03pranta sahaNo ratings yet

- SESM3004 Fluid Mechanics: DR Anatoliy VorobevDocument16 pagesSESM3004 Fluid Mechanics: DR Anatoliy VorobevRN Builder IpohNo ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- Transport GlossaryDocument48 pagesTransport GlossaryLeo Van Ezel ArcayNo ratings yet

- Transportglossary PDFDocument48 pagesTransportglossary PDFNeilRyanNo ratings yet

- Holt Algebra 1 - Chapter 5 TestDocument16 pagesHolt Algebra 1 - Chapter 5 TestStanley GuoNo ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- Let's Practise: Maths Workbook Coursebook 8From EverandLet's Practise: Maths Workbook Coursebook 8No ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- SP GSCI Agriculture Index FactsheetDocument2 pagesSP GSCI Agriculture Index Factsheetarend68No ratings yet

- E25 - Commodity FetishistDocument9 pagesE25 - Commodity FetishistMatt KellerNo ratings yet

- Unique Features of Commodity Market in IndiaDocument10 pagesUnique Features of Commodity Market in IndiaNaveen ChughNo ratings yet

- Afrinova Chemical Procurement Services-1Document12 pagesAfrinova Chemical Procurement Services-1Simbarashe MandikutseNo ratings yet

- InvestingDocument2 pagesInvestingDonnie PutinyNo ratings yet

- Mark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]Document35 pagesMark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]larrycruzer254No ratings yet

- Trading Rules English Growth SheraDocument31 pagesTrading Rules English Growth SheraMann MannNo ratings yet

- Options' Mechanics: Bto, STC, Sto, BTCDocument6 pagesOptions' Mechanics: Bto, STC, Sto, BTCpkkothariNo ratings yet

- 09-07-2020 - SR - LT - All - All INDIA - E-Test Series - Jee Main - MFT-07 - Key & Sol's (JJHFDJJNJNNCN)Document27 pages09-07-2020 - SR - LT - All - All INDIA - E-Test Series - Jee Main - MFT-07 - Key & Sol's (JJHFDJJNJNNCN)Sai GokulNo ratings yet

- 7 Step Blueprint: Key Steps High Probability Price Action TradingDocument11 pages7 Step Blueprint: Key Steps High Probability Price Action TradingNureka Rahayu50% (2)

- How To Succeed As A Sell Side Trader: Brent DonnellyDocument9 pagesHow To Succeed As A Sell Side Trader: Brent DonnellyAlvinNo ratings yet

- Wallstreetjournaleurope 20160817 The Wall Street Journal EuropeDocument22 pagesWallstreetjournaleurope 20160817 The Wall Street Journal EuropestefanoNo ratings yet

- BootcampX Day 6Document15 pagesBootcampX Day 6Vivek LasunaNo ratings yet

- Assignment2 PDFDocument4 pagesAssignment2 PDFWilson KhorNo ratings yet

- Intrinsic Values and Stock Prices PDFDocument2 pagesIntrinsic Values and Stock Prices PDFPhil Singleton100% (1)

- Nism Xvi - Commodity Derivatives Exam - Practice Test 6Document53 pagesNism Xvi - Commodity Derivatives Exam - Practice Test 6Sohel KhanNo ratings yet

- Multipurpose Tent for Storage, Hospital, School or Office UseDocument1 pageMultipurpose Tent for Storage, Hospital, School or Office UseMusharaf Hashim AwadNo ratings yet

- Hidden Liquidity in CME FuturesDocument7 pagesHidden Liquidity in CME FuturesIan DouglasNo ratings yet

- Methodology January 2020: MCX Icomdex MethodolologyDocument25 pagesMethodology January 2020: MCX Icomdex MethodolologySANCHIT DEKATE-IBNo ratings yet

- Derivatives Impact on Indian Stock ExchangesDocument77 pagesDerivatives Impact on Indian Stock Exchangessunny23_87No ratings yet

- Classroom - Understanding Technical AnalysisDocument3 pagesClassroom - Understanding Technical AnalysiskishkpNo ratings yet

- Guild System in South IndiaDocument4 pagesGuild System in South IndiaSheikh Mijanur RahamanNo ratings yet

- Understanding Elasticity and Its Impact on Supply and DemandDocument30 pagesUnderstanding Elasticity and Its Impact on Supply and Demandnisrina nursyianaNo ratings yet

- DMCC REG COMPANIES UpdatedDocument125 pagesDMCC REG COMPANIES UpdatedSajidZia75% (4)

- Price Variation Bid Project Cost in HAMDocument6 pagesPrice Variation Bid Project Cost in HAMUmesh Mishra100% (2)

- Elliott Waves - Fibonacci Application Click-By-Click - Forex Indicators GuideDocument1 pageElliott Waves - Fibonacci Application Click-By-Click - Forex Indicators GuideAgape Cahaya100% (1)

- Market Trend Line Strategy: 95% Win Rate MethodDocument14 pagesMarket Trend Line Strategy: 95% Win Rate MethodaIDa100% (1)

- Lecture 4 Law of SupplyDocument21 pagesLecture 4 Law of SupplyBLOODy aSSaultNo ratings yet

- The Market English - NEWDocument37 pagesThe Market English - NEWTHE BESTERNo ratings yet

![Mark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]](https://imgv2-1-f.scribdassets.com/img/document/721629517/149x198/97e796d250/1712706960?v=1)