Professional Documents

Culture Documents

Lab 110409

Uploaded by

Andre SetiawanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lab 110409

Uploaded by

Andre SetiawanCopyright:

Available Formats

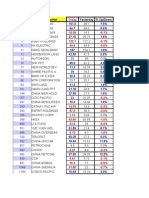

MARKET STATISTICS – TUESDAY, NOVEMBER 3RD 2009

HONG KONG - HANG SENG INDEX Open High Low Close Prv Dy Dy Chg

Bank of China 4.52 4.55 4.38 4.40 4.50 -2.22%

Bank of Communications 9.35 9.42 9.16 9.22 9.39 -1.81%

Bank of East Asia 26.90 27.50 26.65 26.70 27.10 -1.48%

BOC Hongkong Ltd 17.96 18.24 17.82 18.06 17.98 0.44%

Cathay Pacific Air 12.56 12.60 12.26 12.30 12.54 -1.91%

Cheung Kong Ltd 97.25 98.95 97.00 97.05 99.10 -2.07%

China Construction Bank Corp. 6.75 6.80 6.60 6.61 6.78 -2.51%

China Life Insurance Company Ltd. 37.25 37.30 36.00 36.20 37.10 -2.43%

China Merchants Holdings Co. Ltd. 25.30 25.40 24.85 25.00 25.50 -1.96%

China Mobile 73.50 73.65 72.50 72.50 73.80 -1.76%

China Overseas Land & Investment 17.02 17.02 16.40 16.42 17.00 -3.41%

China Petroleum & Chemical Corp. 6.70 6.79 6.61 6.61 6.70 -1.34%

China Resources Enterprise, Ltd. 25.90 26.00 25.55 25.70 25.70 0.00%

China Shenhua Energy Co. Ltd. 36.15 36.35 35.15 35.45 35.95 -1.39%

China Telecom Corporation Ltd. 3.48 3.48 3.40 3.42 3.47 -1.44%

CITIC Pacific Ltd. 19.90 20.25 19.76 19.88 20.15 -1.34%

COSCO Pacific Ltd. 10.92 10.96 10.72 10.72 11.02 -2.72%

Esprit Holdings 51.00 51.70 51.00 51.05 51.65 -1.16%

Foxconn International Holdings Ltd. 7.06 7.20 6.96 7.03 6.99 0.57%

Hang Lung Properties Ltd. 29.85 30.00 29.15 29.15 30.00 -2.83%

Hangseng Bank Ltd. 111.80 111.80 111.00 111.20 111.00 0.18%

Henderson Land Development Co. Ltd. 55.80 56.50 55.20 55.90 56.05 -0.27%

HK Electric Holdings Ltd. 41.30 41.55 41.20 41.20 41.40 -0.48%

HK Exchanges & Clearing Ltd. 137.60 138.30 136.10 136.20 138.80 -1.87%

Hong Kong & China Gas Company Ltd. 18.46 18.60 17.84 17.86 18.46 -3.25%

HSBC Holdings 86.45 86.90 85.40 85.70 86.35 -0.75%

Hutchison Whampoa Ltd. 55.00 55.35 53.70 53.70 54.65 -1.74%

Industrial & Commercial Bank of China Ltd. 6.33 6.35 6.17 6.17 6.28 -1.75%

MTR Corporation Ltd. 27.10 27.20 26.50 26.50 27.25 -2.75%

New World Development Company Ltd. 16.50 16.70 16.22 16.22 16.74 -3.11%

PetroChina Company Ltd. 9.51 9.57 9.28 9.29 9.49 -2.11%

Ping An Insurance Company of China Ltd. 69.75 70.75 68.15 68.40 70.00 -2.29%

Sino Land Co. Ltd. 14.76 14.76 14.04 14.08 14.70 -4.22%

Sun Hung Kai Properties Ltd. 117.60 117.80 113.30 113.40 118.00 -3.90%

Swire Pacific Ltd. 97.80 101.00 96.00 96.15 95.50 0.68%

Wharf Holdings Ltd. 41.85 42.30 41.20 41.70 42.50 -1.88%

Hang Seng Index 21,598.63 21,684.73 21,130.90 21,240.06 21,620.19 -1.76%

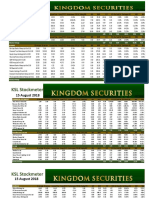

GERMANY - XETRA DAX Open High Low Close Prv Dy Dy Chg

Al l i anz AG 78.73 78.89 75.16 77.72 78.71 -1.26%

BASF AG 36.20 36.71 35.76 36.24 36.44 -0.55%

Ba yer AG 46.55 47.29 45.81 46.83 47.13 -0.64%

Ba yeri s che Motoren Werke AG 31.90 33.61 30.92 31.50 33.60 -6.25%

CommerzBa nk AG 6.94 7.19 6.78 6.90 7.19 -4.03%

Da i ml er AG 32.35 33.04 31.35 31.58 33.04 -4.42%

Deuts che Ba nk AG 48.53 49.46 46.80 47.40 49.46 -4.16%

Deuts che Bours e AG 54.85 55.58 54.10 54.70 55.58 -1.58%

Deuts che Pos t AG 11.42 11.48 11.25 11.36 11.48 -1.05%

Deuts che Te l ekom AG 9.26 9.33 9.19 9.19 9.32 -1.39%

Si emens Akti enges el ls cha ft 60.94 61.26 59.86 60.60 61.74 -1.85%

Thys s enKrupp AG 21.96 22.10 21.28 21.74 22.10 -1.63%

Vol ks wa gen AG 108.86 109.85 106.17 106.17 109.85 -3.35%

XETRA DAX 5410.61 5472.03 5376.63 5430.82 5430.82 0.00%

UK - LONDON STOCK EXCHANGE Open High Low Close Prv Dy Dy Chg

Ba rcla ys Plc 323.25 329.70 317.25 323.45 330.00 -1.98%

BP Plc 579.00 583.90 573.30 580.30 584.70 -0.75%

BT Group Pl c 133.00 133.60 131.90 132.30 133.90 -1.19%

Gl a xoSmi thKl i ne Pl c 1231.00 1234.00 1210.50 1228.50 1247.00 -1.48%

HSBC Hol di ngs Pl c 678.50 682.00 662.60 667.50 690.00 -3.26%

Ma rks & Spe ncer Group Pl c 335.00 342.10 332.50 341.00 339.70 0.38%

Prudenti a l Pl c 558.00 560.00 540.50 551.50 566.50 -2.65%

Rol l s-Royce Group Pl c 447.00 447.00 434.50 443.10 451.70 -1.90%

Uni l ever Plc 1828.00 1841.00 1790.00 1814.00 1844.00 -1.63%

Vodafone Group Pl c 135.50 135.55 133.60 134.20 136.20 -1.47%

FTSE 100 5082.18 5299.57 4985.09 5037.21 5104.5 -1.32%

NORTH AMERICA - DJIA & NASDAQ Open High Low Close Prv Dy Dy Chg

3M 74.01 74.63 73.64 74.06 74.28 -0.30%

Adobe Sys tems 32.72 33.08 32.37 33.00 32.87 0.40%

Advanced Mi cro Devi ces 4.49 4.65 4.33 4.64 4.60 0.87%

Al coa Inc. 12.11 12.85 12.06 12.66 12.48 1.44%

Amazon.com Inc. 117.66 118.88 116.63 118.37 118.84 -0.40%

Ameri ca n Express Co 35.24 36.15 34.80 36.04 35.68 1.01%

Apple Computer Inc 188.00 189.52 185.92 188.75 189.29 -0.29%

AT&T Corp 25.52 25.63 25.24 25.36 25.59 -0.90%

Ba nk of Ameri ca 14.25 14.93 14.21 14.80 14.63 1.16%

Boeing Co 48.17 48.35 47.46 48.10 48.27 -0.35%

Ci s co Sys tems , Inc. 22.82 23.04 22.55 22.91 23.00 -0.39%

Ci ti group Inc 3.88 4.05 3.84 4.04 3.99 1.25%

Coca Col a Company 53.65 53.68 52.77 53.12 53.72 -1.12%

Del l Inc. 14.25 14.60 14.22 14.59 14.45 0.97%

eBa y Inc 22.23 22.59 22.12 22.51 22.44 0.31%

ExxonMobil 71.32 72.30 71.16 71.74 72.15 -0.57%

Ford Motor Co 7.35 7.67 7.31 7.44 7.58 -1.85%

Genera l Electri c 14.20 14.47 14.17 14.32 14.47 -1.04%

Gol dma n Sa chs Group, Inc. 168.98 172.16 168.74 171.61 170.68 0.54%

Googl e Inc. 530.01 537.50 528.30 537.29 533.99 0.62%

Ha l l iburton Compa ny 28.74 30.50 28.63 30.31 29.26 3.59%

Hewl ett-Packa rd 47.79 48.00 47.30 47.51 48.16 -1.35%

Home Depot 24.91 25.28 24.47 25.00 25.06 -0.24%

Intel Corp 18.64 18.65 18.31 18.50 19.01 -2.68%

Interna ti ona l Bus i ness Ma chi nes 119.53 121.19 119.53 121.16 120.56 0.50%

Johns on & Johnson 60.04 60.04 58.80 58.93 59.49 -0.94%

JP Morga n Cha s e & Co. 42.09 42.96 41.98 42.70 42.58 0.28%

McDona l d's Corpora ti on 58.82 59.54 58.82 59.24 59.16 0.14%

Merck & Co., Inc. 31.09 31.28 30.29 30.67 31.26 -1.89%

Mi cros oft Corp 27.62 27.74 27.43 27.56 27.88 -1.15%

Motorol a Inc. 8.98 9.16 8.90 9.08 9.03 0.55%

Ora cl e Corp 21.02 21.06 20.65 20.89 21.09 -0.95%

Pfi zer, Inc. 16.90 16.95 16.72 16.89 16.95 -0.35%

Procter & Ga mble 58.45 58.92 58.20 58.58 58.95 -0.63%

Sta rbucks 19.33 19.57 18.96 19.42 19.38 0.21%

Texas Ins truments Inc. 23.22 23.64 23.01 23.47 23.45 0.09%

Wa l -Ma rt Stores, Inc. 50.16 50.57 49.52 49.90 50.28 -0.76%

Wa l t Di s ney Compa ny 27.26 27.73 27.10 27.62 27.41 0.77%

Ya hoo! Inc. 15.71 15.79 15.63 15.70 15.85 -0.95%

Dow Jones Industrial Average 9787.47 9787.47 9703.89 9771.91 9789.44 -0.18%

Nasdaq Composite 2034.09 2057.32 2031.25 2057.32 2049.2 0.40%

S&P 500 Index 1040.92 1046.36 1033.93 1045.41 1042.88 0.24%

TODAY’S OUTLOOK

Advantes t Corp.

Ca non Inc.

Da i ki n Indus trie s Ltd.

Honda Motor Co. Ltd

Kyocera Corp

Mi tsubi s hi Es ta te Co. Ltd

Ni kon Corp

Ni ppon Oil Corp

Ni ppon Ste el Corp

Ni s sa n Motor Co Ltd

Sony Corp

Sumi tomo Meta l Indus tri es Ltd

TDK Corp

Tokyo El ectron Ltd

Toyota Motor UK - Corp

LONDON STOCK EXCHANGE

Ba rcl a ys Pl c

HONG KONG - HANG BPSENG

Pl c INDEX

Ba nk of Chi na BT Group Pl c

Ba nk of Communi ca ti ons Gl a xoSmithKl i ne Pl c

Ba nk of Ea st As i a HSBC Hol di ngs Pl c

BOC Hongkong Ltd Ma rks & Spence r Group Pl c

Ca thay Pa ci fi c Ai r Prudenti al Pl c

Cheung Kong Ltd Rol ls -Royce Group Plc

Uni leve r Pl c

Chi na Cons tructi on Ba nk Corp.

Chi na Li fe Ins ura nce CompaVodafone

ny Ltd. Group Pl c

Chi na Mercha nts Hol di ngs Co. Ltd.

Chi na Mobi le

Chi na Oversea s Land & Inves tment

Chi na Petroleum & Chemi ca l Corp.

Chi na Res ources Enterpris e, Ltd.

Chi na Shenhua Energy Co. Ltd.

Chi na Tel ecom

CITIC Pa ci fi c Ltd.

COSCO Pa ci fi c Ltd.

Es prit Hol dings

Foxconn Interna ti ona l Hol di ngs Ltd.

Ha ng Lung Properties Ltd.

Ha ngs eng Ba nk Ltd.

Henders on La nd Devel opment Co. Ltd.

HK Electri c Hol di ngs Ltd.

HK Excha nges & Cl ea ri ng Ltd.

Hong Kong & Chi na Ga s Compa ny Ltd.

HSBC Hol di ngs

Hutchi s on Wha mpoa Ltd.

Industri a l & Commerci a l Ba nk of Chi na Ltd.

MTR Corporati on Ltd.

New Worl d Devel opment Company Ltd.

PetroChi na Company Ltd.

Pi ng An Ins ura nce Company of Chi na Ltd.

Si no La nd Co. Ltd.

Sun Hung Kai Properti es Ltd.

Swi re Pa ci fi c Ltd.

Wha rf Hol dings Ltd.

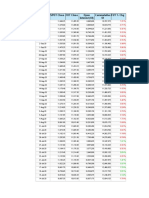

HITS & MISSES TABLES

Settled Trades

Date Companies Entry Type Last Exit P/L P/L % Status

20/10/2009 Daikin 3170.00 SHORT - 3180 -10 -0.32% Settled

20/10/2009 ICBC 6.30 LONG - 6.10 -0.20 -3.17% Settled

21/10/2009 Johnson & Johnson 60.60 SHORT - 60.86 -0.26 -0.43% Settled

21/10/2009 Kyocera 8170.00 LONG - 8040 -130 -1.59% Settled

21/10/2009 Procter & Gamble 57.92 LONG - 57.48 -0.44 -0.76% Settled

21/10/2009 Swire 93.30 LONG - 94.95 1.65 1.77% Settled

21/10/2009 Tokyo Electron 5670.00 LONG - 5580 -90 -1.59% Settled

22/10/2009 Bayer 47.75 LONG - 48.50 0.75 1.57% Settled

22/10/2009 China Shenhua 34.65 SHORT - 35.60 -0.95 -2.74% Settled

22/10/2009 CLP Holdings 52.55 LONG - 52.05 -0.50 -0.95% Settled

22/10/2009 HK Electric 42.00 SHORT - 41.55 0.45 1.07% Settled

22/10/2009 Motorola 8.33 SHORT - 8.41 -0.08 -0.96% Settled

22/10/2009 Texas Instruments 22.87 SHORT - 24.00 -1.13 -4.94% Settled

22/10/2009 Yahoo! 17.57 LONG - 17.03 -0.54 -3.07% Settled

23/10/2009 American Express 36.19 LONG - 34.99 -1.20 -3.32% Settled

23/10/2009 BOC Hong Kong 18.02 LONG - 17.40 -0.62 -3.44% Settled

23/10/2009 CITIC Pacific 20.85 SHORT - 20.45 0.40 1.92% Settled

23/10/2009 Hang Seng Bank 111.00 SHORT - 110.70 0.30 0.27% Settled

23/10/2009 McDonald's 59.50 LONG - 58.65 -0.85 -1.43% Settled

23/10/2009 Procter & Gamble 58.13 LONG - 57.65 -0.48 -0.83% Settled

23/10/2009 Swire 96.85 LONG - 96.35 -0.50 -0.52% Settled

23/10/2009 Walt Disney 29.36 LONG - 28.87 -0.49 -1.67% Settled

26/10/2009 Amazon 119.23 LONG - 117.66 -1.57 -1.32% Settled

26/10/2009 American Express 34.99 SHORT - 35.72 -0.73 -2.09% Settled

26/10/2009 AT&T 25.87 SHORT - 25.99 -0.12 -0.46% Settled

26/10/2009 Ford Motor 7.70 SHORT - 7.35 0.35 4.55% Settled

26/10/2009 Hewlett-Packard 48.47 LONG - 47.73 -0.74 -1.53% Settled

26/10/2009 Mitsubishi Estate 1430.00 SHORT - 1400 30 2.10% Settled

26/10/2009 Motorola 8.24 SHORT - 8.89 -0.65 -7.89% Settled

27/10/2009 Bank of Communications 10.38 LONG - 9.85 -0.53 -5.11% Settled

27/10/2009 Bayer AG 47.21 LONG - 48.14 0.93 1.97% Settled

27/10/2009 BP Plc. 590.90 LONG - 571.9 -19.00 -3.22% Settled

27/10/2009 China Life 37.20 LONG - 37.05 -0.15 -0.40% Settled

27/10/2009 HSBC Holdings 87.20 LONG - 86.80 -0.40 -0.46% Settled

27/10/2009 Marks & Spencer Group 344.50 SHORT - 346.30 -1.80 -0.52% Settled

27/10/2009 MTR Corporation 27.90 LONG - 28.00 0.10 0.36% Settled

28/10/2009 Exxon Mobil 74.52 LONG - 72.57 -1.95 -2.62% Settled

28/10/2009 Mitsubishi Estate 1365.00 SHORT - 1375 -10.00 -0.73% Settled

28/10/2009 TDK Corp 5190.00 SHORT - 5140 50.00 0.96% Settled

29/10/2009 American Express 35.12 SHORT - 36.13 -1.01 -2.88% Settled

29/10/2009 Deutsche Telekom 9.59 LONG - 9.56 -0.03 -0.31% Settled

29/10/2009 Marks & Spencer Group 337.00 SHORT - 341.3 -4.30 -1.28% Settled

29/10/2009 Nissan Motor 642.00 SHORT - 646 -4.00 -0.62% Settled

29/10/2009 Texas Instruments 23.60 SHORT - 24.09 -0.49 -2.08% Settled

30/10/2009 Exxon Mobil 73.37 LONG - 72.05 -1.32 -1.80% Settled

30/10/2009 Hewlett-Packard 48.23 LONG - 47.43 -0.80 -1.66% Settled

30/10/2009 Pfizer 17.46 LONG - 17.05 -0.41 -2.35% Settled

30/10/2009 Procter & Gamble 59.18 LONG - 58.39 -0.79 -1.33% Settled

30/10/2009 Wal-Mart Stores 50.39 LONG - 49.81 -0.58 -1.15% Settled

2/11/2009 BOC Hong Kong 18.00 LONG - 17.96 -0.04 -0.22% Settled

2/11/2009 Cheung Kong 97.75 SHORT - 97.25 0.50 0.51% Settled

2/11/2009 China Life 35.65 SHORT - 37.25 -1.60 -4.49% Settled

2/11/2009 China Resources 26.30 LONG - 25.90 -0.40 -1.52% Settled

2/11/2009 China Shenhua 35.00 SHORT - 36.15 -1.15 -3.29% Settled

2/11/2009 Wal-Mart Stores 49.81 SHORT - 50.16 -0.35 -0.70% Settled

Open Trades

Date Companies Entry Type Last Exit P/L P/L % Status

2/11/2009 Henderson Land 55.00 LONG 55.90 - 0.90 1.64% Hold LONG

2/11/2009 Motorola 8.97 LONG 9.08 - 0.11 1.23% Hold LONG

2/11/2009 3M 73.86 SHORT 74.06 - -0.20 -0.27% Hold SHORT

2/11/2009 Adobe Systems 32.81 SHORT 33.00 - -0.19 -0.58% Hold SHORT

2/11/2009 Advanced Micro Devices 4.68 SHORT 4.64 - 0.04 0.85% Hold SHORT

2/11/2009 Alcoa 12.54 SHORT 12.66 - -0.12 -0.96% Hold SHORT

2/11/2009 Apple Computer 189.81 SHORT 188.75 - 1.06 0.56% Hold SHORT

2/11/2009 AT&T 25.90 SHORT 25.36 - 0.54 2.08% Hold SHORT

2/11/2009 Bank of Communications 9.15 SHORT 9.22 - -0.07 -0.77% Hold SHORT

2/11/2009 BASF 36.40 SHORT 36.24 - 0.16 0.44% Hold SHORT

2/11/2009 BMW 33.13 SHORT 31.50 - 1.63 4.92% Hold SHORT

2/11/2009 Canon 3400.00 SHORT 3420.00 - -20.00 -0.59% Hold SHORT

2/11/2009 China Telecom 3.45 SHORT 3.42 - 0.03 0.87% Hold SHORT

2/11/2009 Cisco Systems 22.86 SHORT 22.91 - -0.05 -0.22% Hold SHORT

2/11/2009 Citigroup Inc. 4.10 SHORT 4.04 - 0.06 1.46% Hold SHORT

2/11/2009 Commerzbank 7.05 SHORT 6.90 - 0.15 2.13% Hold SHORT

2/11/2009 Daimler 32.70 SHORT 31.58 - 1.12 3.43% Hold SHORT

2/11/2009 Deutsche Bourse 55.38 SHORT 54.70 - 0.68 1.23% Hold SHORT

2/11/2009 Esprit Holdings 51.00 SHORT 51.00 - 0.00 0.00% Hold SHORT

2/11/2009 Hewlett-Packard 47.43 SHORT 47.51 - -0.08 -0.17% Hold SHORT

2/11/2009 HSBC Holdings 85.30 SHORT 86.45 - -1.15 -1.35% Hold SHORT

2/11/2009 Hutchison Whampoa 54.00 SHORT 53.70 - 0.30 0.56% Hold SHORT

2/11/2009 IBM 120.77 SHORT 121.16 - -0.39 -0.32% Hold SHORT

2/11/2009 MTR Corporation 26.95 SHORT 26.50 - 0.45 1.67% Hold SHORT

2/11/2009 New World 16.46 SHORT 16.22 - 0.24 1.46% Hold SHORT

2/11/2009 Oracle Corp. 21.05 SHORT 20.89 - 0.16 0.76% Hold SHORT

2/11/2009 PetroChina 9.32 SHORT 9.29 - 0.03 0.32% Hold SHORT

2/11/2009 Pfizer, Inc 17.05 SHORT 16.89 - 0.16 0.94% Hold SHORT

2/11/2009 Prudential Plc 551.50 SHORT 551.50 - 0.00 0.00% Hold SHORT

2/11/2009 Sino Land 14.80 SHORT 14.08 - 0.72 4.86% Hold SHORT

2/11/2009 Sun Hung Kai 116.60 SHORT 113.40 - 3.20 2.74% Hold SHORT

2/11/2009 Texas Instruments 23.38 SHORT 23.47 - -0.09 -0.38% Hold SHORT

2/11/2009 Tokyo Electron 5040.00 SHORT 5110.00 - -70.00 -1.39% Hold SHORT

2/11/2009 Vodafone Group Plc 134.15 SHORT 134.20 - -0.05 -0.04% Hold SHORT

2/11/2009 Walt Disney 27.38 SHORT 27.62 - -0.24 -0.88% Hold SHORT

2/11/2009 Yahoo! 15.78 SHORT 15.70 - 0.08 0.51% Hold SHORT

3/11/2009 Cathay Pacific 12.56 SHORT 12.30 - 0.26 2.07% Hold SHORT

3/11/2009 Marks & Spencer Group 335.00 SHORT 341.00 - -6.00 -1.79% Hold SHORT

21/10/2009 Barclays 365.05 SHORT 323.45 - 41.60 11.40% Hold SHORT

21/10/2009 Home Depot 26.89 SHORT 25.00 - 1.89 7.03% Hold SHORT

26/10/2009 BT Group 135.00 SHORT 132.30 - 2.70 2.00% Hold SHORT

26/10/2009 Johnson & Johnson 60.69 SHORT 58.93 - 1.76 2.90% Hold SHORT

27/10/2009 COSCO Pacific 11.30 SHORT 10.72 - 0.58 5.13% Hold SHORT

27/10/2009 Dell Inc. 15.36 SHORT 14.59 - 0.77 5.01% Hold SHORT

28/10/2009 China Merchants 26.50 SHORT 25.00 - 1.50 5.66% Hold SHORT

28/10/2009 HK Electric Holdings 41.80 SHORT 41.20 - 0.60 1.44% Hold SHORT

28/10/2009 Nippon Oil 450.00 SHORT 433.00 - 17.00 3.78% Hold SHORT

29/10/2009 CITIC Pacific 20.40 SHORT 19.88 - 0.52 2.55% Hold SHORT

29/10/2009 Daikin 3150.00 SHORT 3050.00 - 100.00 3.17% Hold SHORT

29/10/2009 GlaxoSmithKline 1250.50 SHORT 1228.50 - 22.00 1.76% Hold SHORT

29/10/2009 HK Exchanges 138.20 SHORT 136.20 - 2.00 1.45% Hold SHORT

2/11/2009 American Express 34.95 SHORT 36.04 - -1.09 -3.12% To EXIT @ 4/11/09 OPEN

2/11/2009 Honda 2810.00 LONG 2820.00 - 10.00 0.36% To EXIT @ 4/11/09 OPEN

2/11/2009 Nippon Steel 339.00 LONG 340.00 - 1.00 0.29% To EXIT @ 4/11/09 OPEN

2/11/2009 Sumitomo Metal 232.00 LONG 233.00 - 1.00 0.43% To EXIT @ 4/11/09 OPEN

2/11/2009 Wharf Holdings 42.15 LONG 41.70 - -0.45 -1.07% To EXIT @ 4/11/09 OPEN

3/11/2009 BP Plc. 579.00 LONG 580.30 - 1.30 0.22% To EXIT @ 4/11/09 OPEN

4/11/2009 Ping An 69.75 LONG 68.40 - -1.35 -1.94% To EXIT @ 4/11/09 OPEN

30/10/2009 Sony Corp 2780.00 LONG 2625.00 - -155.00 -5.58% To EXIT @ 4/11/09 OPEN

Planned Trades

Date Companies Entry Type Last Exit P/L P/L % Status

4/11/2009 Cheung Kong - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 China Life - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 China Shenhua - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 HSBC Holdings Plc - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 Mitsubishi Estate - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 TDK Corp - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 Toyota Motor - SHORT - - - - To ENTER @ 4/11/09 OPEN

4/11/2009 Wal-Mart Stores - SHORT - - - - To ENTER @ 4/11/09 OPEN

Any information contained in this document are based on or derived from information generally available to the public from sources believed

to be reliable. There’s no representation or warranty is made or implied that it is accurate or complete. Any opinions expressed are subject to

change without notice. This post has been prepared solely for information purposes and does not constitute any solicitation to buy or sell any

instrument, or to engage in any trading strategy.

You might also like

- Dialogue About Handling ComplaintDocument3 pagesDialogue About Handling ComplaintKarimah Rameli100% (4)

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- Coerver Sample Session Age 10 Age 12Document5 pagesCoerver Sample Session Age 10 Age 12Moreno LuponiNo ratings yet

- Lab 110309Document6 pagesLab 110309Andre SetiawanNo ratings yet

- Lab 110509Document6 pagesLab 110509Andre SetiawanNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- CFD - November 4th 2009Document3 pagesCFD - November 4th 2009Andre SetiawanNo ratings yet

- CFD - October 30th 2009Document3 pagesCFD - October 30th 2009Andre SetiawanNo ratings yet

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Document7 pagesMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanNo ratings yet

- CFD - November 3rd 2009Document3 pagesCFD - November 3rd 2009Andre SetiawanNo ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- CFD - October 29th 2009Document3 pagesCFD - October 29th 2009Andre SetiawanNo ratings yet

- Investment Ideas - High Growth Stocks Close To New HighsDocument8 pagesInvestment Ideas - High Growth Stocks Close To New HighsTom RobertsNo ratings yet

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Document3 pagesStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 12, 2013)Manila Standard TodayNo ratings yet

- CFD - November 2nd 2009Document4 pagesCFD - November 2nd 2009Andre SetiawanNo ratings yet

- Stock Screens 080217Document50 pagesStock Screens 080217sarav10No ratings yet

- Next 50Document631 pagesNext 50Kasthuri CoimbatoreNo ratings yet

- HK 12 9 2008Document4 pagesHK 12 9 2008jayloh724No ratings yet

- KSL StockmeterDocument5 pagesKSL StockmeterAn AntonyNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 27, 2012)Manila Standard TodayNo ratings yet

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- Date Ticker Shs Float Shs Float Numeric Short Float Market CapDocument8 pagesDate Ticker Shs Float Shs Float Numeric Short Float Market Capspajk6No ratings yet

- Waverly Advisors ScreenersDocument28 pagesWaverly Advisors Screenershecha82No ratings yet

- No of Stock 15Document35 pagesNo of Stock 15Arnab SadhukhanNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyNo ratings yet

- Date Tata Power Polycab Greenpanel Tata Elxsi Kotak Mahindra BankDocument15 pagesDate Tata Power Polycab Greenpanel Tata Elxsi Kotak Mahindra BankAayushi ChandwaniNo ratings yet

- Date Ticker Shs Float Shs Float Numeric Short Float Market CapDocument8 pagesDate Ticker Shs Float Shs Float Numeric Short Float Market Capspajk6No ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 21, 2013)Manila Standard TodayNo ratings yet

- Nifty Futre RulesDocument21 pagesNifty Futre RulessandNo ratings yet

- Date Ticker Shs Float Shs Float Numeric Short Float Market CapDocument12 pagesDate Ticker Shs Float Shs Float Numeric Short Float Market Capspajk6No ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- Hot-Accounts Google FinanceDocument5 pagesHot-Accounts Google Financerbp_1973No ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 31, 2012)Manila Standard TodayNo ratings yet

- Yahoo! Finance SpreadsheetDocument7 pagesYahoo! Finance SpreadsheetAnonymous 5lDTxtNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 18, 2013)Manila Standard TodayNo ratings yet

- ESG IndustriaDocument5 pagesESG IndustriaDiego PonceNo ratings yet

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDocument13 pagesNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 22, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 25, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 19, 2013)Manila Standard TodayNo ratings yet

- Dividend Yield Report June 2022 - Idbi CapDocument5 pagesDividend Yield Report June 2022 - Idbi CapcitisunNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 31, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 16, 2012)Manila Standard TodayNo ratings yet

- Nifty 500 COMPANY WITH ANALYSISDocument3 pagesNifty 500 COMPANY WITH ANALYSISVILAS KORKENo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 22, 2012)Manila Standard TodayNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 16, 2012)Manila Standard TodayNo ratings yet

- Company Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsDocument19 pagesCompany Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsSHIKHA CHAUHANNo ratings yet

- Year 2013 2014 2015 2016 2017 Latest: CompetitionDocument3 pagesYear 2013 2014 2015 2016 2017 Latest: CompetitionDahagam SaumithNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 21, 2012)Manila Standard TodayNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- DIVIDENDDocument11 pagesDIVIDENDSpace DriveNo ratings yet

- Enhanced Oil Recovery: Resonance Macro- and Micro-Mechanics of Petroleum ReservoirsFrom EverandEnhanced Oil Recovery: Resonance Macro- and Micro-Mechanics of Petroleum ReservoirsRating: 5 out of 5 stars5/5 (1)

- Calling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Document5 pagesCalling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Andre SetiawanNo ratings yet

- Powered The Dow: .DJI 12,810.54 (+47.23) .SPX 1,363.61 (+3.13) .IXIC 2,873.54 (+1.01)Document11 pagesPowered The Dow: .DJI 12,810.54 (+47.23) .SPX 1,363.61 (+3.13) .IXIC 2,873.54 (+1.01)Andre SetiawanNo ratings yet

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNo ratings yet

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDocument5 pagesSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanNo ratings yet

- Earnings Lifted The Street: UpbeatDocument6 pagesEarnings Lifted The Street: UpbeatAndre SetiawanNo ratings yet

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNo ratings yet

- Stays On Course: .DJI 12,690.96 (+95.59) .SPX 1,355.66 (+8.42) .IXIC 2,869.88 (+22.34)Document6 pagesStays On Course: .DJI 12,690.96 (+95.59) .SPX 1,355.66 (+8.42) .IXIC 2,869.88 (+22.34)Andre SetiawanNo ratings yet

- Season Greetings!: (Earnings)Document6 pagesSeason Greetings!: (Earnings)Andre SetiawanNo ratings yet

- For The Fed: WaitingDocument5 pagesFor The Fed: WaitingAndre SetiawanNo ratings yet

- Pulled The Rug: GoldmanDocument4 pagesPulled The Rug: GoldmanAndre SetiawanNo ratings yet

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Document4 pagesThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanNo ratings yet

- Penalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Document6 pagesPenalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Andre SetiawanNo ratings yet

- The Unthinkable: ThinkDocument5 pagesThe Unthinkable: ThinkAndre SetiawanNo ratings yet

- In Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Document6 pagesIn Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Andre SetiawanNo ratings yet

- Uneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Document3 pagesUneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Andre SetiawanNo ratings yet

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Document4 pagesOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanNo ratings yet

- Orporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Document4 pagesOrporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Andre SetiawanNo ratings yet

- To Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Document5 pagesTo Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Andre SetiawanNo ratings yet

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Document5 pagesOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanNo ratings yet

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Document5 pagesInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanNo ratings yet

- Strikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Document4 pagesStrikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Andre SetiawanNo ratings yet

- Lifted The Mood: PayrollsDocument5 pagesLifted The Mood: PayrollsAndre SetiawanNo ratings yet

- Orporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Document5 pagesOrporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Andre SetiawanNo ratings yet

- Deal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Document5 pagesDeal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Andre SetiawanNo ratings yet

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Document6 pages.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanNo ratings yet

- Oints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Document5 pagesOints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Andre SetiawanNo ratings yet

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Document4 pagesSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanNo ratings yet

- Of Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Document4 pagesOf Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Andre SetiawanNo ratings yet

- Orporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Document6 pagesOrporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Andre SetiawanNo ratings yet

- Day Ahead: .DJI 12,090.03 .SPX 1,310.13 .IXIC 2,745.63Document6 pagesDay Ahead: .DJI 12,090.03 .SPX 1,310.13 .IXIC 2,745.63Andre SetiawanNo ratings yet

- IAB Digital Ad Operations Certification Study Guide August 2017Document48 pagesIAB Digital Ad Operations Certification Study Guide August 2017vinayakrishnaNo ratings yet

- SBP Notes-1 PDFDocument7 pagesSBP Notes-1 PDFzeeshanNo ratings yet

- Bus Organization of 8085 MicroprocessorDocument6 pagesBus Organization of 8085 MicroprocessorsrikrishnathotaNo ratings yet

- Grammar: English - Form 3Document39 pagesGrammar: English - Form 3bellbeh1988No ratings yet

- ReproTech, LLC Welcomes New President & CEO, William BraunDocument3 pagesReproTech, LLC Welcomes New President & CEO, William BraunPR.comNo ratings yet

- Install GuideDocument64 pagesInstall GuideJorge Luis Yaya Cruzado67% (3)

- Highway Capacity ManualDocument13 pagesHighway Capacity Manualgabriel eduardo carmona joly estudianteNo ratings yet

- Isolated Foundation PDFDocument6 pagesIsolated Foundation PDFsoroware100% (1)

- Curriculum Vitae For Modern MutumwaDocument4 pagesCurriculum Vitae For Modern MutumwaKudakwashe QuQu MaxineNo ratings yet

- Tutorial Class 4: Finders As Bailee Right of A Bailee General LienDocument26 pagesTutorial Class 4: Finders As Bailee Right of A Bailee General Lienchirag jainNo ratings yet

- Cui Et Al. 2017Document10 pagesCui Et Al. 2017Manaswini VadlamaniNo ratings yet

- Novi Hervianti Putri - A1E015047Document2 pagesNovi Hervianti Putri - A1E015047Novi Hervianti PutriNo ratings yet

- The Rescue Agreement 1968 (Udara Angkasa)Document12 pagesThe Rescue Agreement 1968 (Udara Angkasa)Rika Masirilla Septiari SoedarmoNo ratings yet

- Economic Survey 2023 2Document510 pagesEconomic Survey 2023 2esr47No ratings yet

- Succession CasesDocument17 pagesSuccession CasesAmbisyosa PormanesNo ratings yet

- A Mercy Guided StudyDocument23 pagesA Mercy Guided StudyAnas HudsonNo ratings yet

- ANTH 222 Syllabus 2012Document6 pagesANTH 222 Syllabus 2012Maythe S. HanNo ratings yet

- January Payslip 2023.pdf - 1-2Document1 pageJanuary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- Daftar PustakaDocument6 pagesDaftar PustakaSeptian UtamaNo ratings yet

- Green IguanaDocument31 pagesGreen IguanaM 'Athieq Al-GhiffariNo ratings yet

- PEDIA OPD RubricsDocument11 pagesPEDIA OPD RubricsKylle AlimosaNo ratings yet

- Sycip v. CA (Sufficient Funds With The Drawee Bank)Document15 pagesSycip v. CA (Sufficient Funds With The Drawee Bank)Arnold BagalanteNo ratings yet

- Forensic BallisticsDocument23 pagesForensic BallisticsCristiana Jsu DandanNo ratings yet

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Document2 pagesLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossNo ratings yet

- E F Eng l1 l2 Si 011Document2 pagesE F Eng l1 l2 Si 011Simona ButeNo ratings yet

- Case 3 GROUP-6Document3 pagesCase 3 GROUP-6Inieco RacheleNo ratings yet

- Contoh Rancangan Pengajaran Harian (RPH)Document7 pagesContoh Rancangan Pengajaran Harian (RPH)Farees Ashraf Bin ZahriNo ratings yet

- Sussex Free Radius Case StudyDocument43 pagesSussex Free Radius Case StudyJosef RadingerNo ratings yet