Professional Documents

Culture Documents

Letter For Condonation of Delay

Letter For Condonation of Delay

Uploaded by

Goutham HOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter For Condonation of Delay

Letter For Condonation of Delay

Uploaded by

Goutham HCopyright:

Available Formats

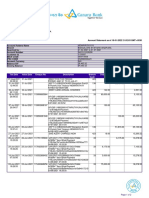

Date: January 16, 2024

To,

The Principal Commissioner Income Tax Department

Sub: Regarding condonation of delay of IT return filing for A.Y. 2021-22

Dear Sir,

I, Nikesh Krishna Agari, with PAN card no. CAJPA7599F, I am writing this letter

for condonation of delay for filing of Income Tax Return for the assessment year

2021-22.

I would like to bring to your notice that the delay in the filing of the return

happened because I had met with a sever accident as was on bed rest for three

long months. During this time, my focus was on my health and recovery and I

accidently missed on the last date of filing the return. Later I got carried away

with my work and missed filing ITR even after due date. Now, I realized that my

ITR is not filed for AY 2021-22 and therefore, I am writing this letter for the

same. I have computed the taxable income for the year at Rs.5,09,000 and I am

liable to pay tax, therefore, request you to please consider the situation and I

hope the delay may be condoned along with issuing of orders to file ITR for AY

2021-22.

Thanking in anticipation.

Sincerely,

(Nikesh Krishna Agari)

Sullia

Dakshina Kannada

8746850267

You might also like

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Adjournment LetterDocument2 pagesAdjournment LetterSagar Purkar100% (2)

- Letter-of-Request-for - Looseleaf 2Document1 pageLetter-of-Request-for - Looseleaf 2Pat Dela CruzNo ratings yet

- Request Bank StatementDocument1 pageRequest Bank StatementKamrul Hasan Khan Shatil100% (1)

- Legal Notice Narinder Singh (Pawan)Document11 pagesLegal Notice Narinder Singh (Pawan)Shubham BiswasNo ratings yet

- RE: Request For Manual PaymentDocument1 pageRE: Request For Manual PaymentJemrey Goles100% (5)

- Declaration For Rent DueDocument1 pageDeclaration For Rent DuesrikanthNo ratings yet

- Ranjit Singh Gill Re-ApplicationDocument4 pagesRanjit Singh Gill Re-ApplicationakshayNo ratings yet

- Promissory Note Legal NoticeDocument5 pagesPromissory Note Legal NoticeSagar BaluNo ratings yet

- Gstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErDocument2 pagesGstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErGoutham HNo ratings yet

- Letter Request - Certified True Copy of CarDocument1 pageLetter Request - Certified True Copy of CarKei Sha57% (7)

- OIC-Revenue District Officer: BIR Building, Macabulos Drive, San Roque, Tarlac CityDocument1 pageOIC-Revenue District Officer: BIR Building, Macabulos Drive, San Roque, Tarlac CityPat Dela CruzNo ratings yet

- The Principal Commissioner Income Tax Department DelhiDocument1 pageThe Principal Commissioner Income Tax Department Delhisantoshkumar011No ratings yet

- IT Refund Letter Manoram MahulkarDocument1 pageIT Refund Letter Manoram MahulkarMohit JainNo ratings yet

- Information Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Document3 pagesInformation Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Mangesh JoshiNo ratings yet

- Mannual Rectification ApplicationDocument2 pagesMannual Rectification ApplicationIshita shahNo ratings yet

- Bob Bank Manager LetterDocument1 pageBob Bank Manager Letterer.pratyushprasadNo ratings yet

- Tax Clearance - FAQDocument5 pagesTax Clearance - FAQSarmila RavichandranNo ratings yet

- New Microsoft Office Word Document2Document1 pageNew Microsoft Office Word Document2vivek pittaNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- FromDocument2 pagesFromlogancxNo ratings yet

- Regular Emails (TCCL)Document2 pagesRegular Emails (TCCL)Nazmul KhanNo ratings yet

- The Position of My APAR For The Year 2018Document1 pageThe Position of My APAR For The Year 2018GauravNo ratings yet

- TemplateDocument1 pageTemplateEyasin ArifNo ratings yet

- Certificate For Online VATDocument1 pageCertificate For Online VATSaad Hossain TapuNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- PaymentSlip PknicDocument1 pagePaymentSlip Pknicanon_222264122No ratings yet

- Income Tax Declaration FormDocument1 pageIncome Tax Declaration Formdiwakar1978No ratings yet

- Bank Statement Request Letter SbiDocument1 pageBank Statement Request Letter SbiMaddu Janak RaoNo ratings yet

- REquest For Manual PaymentDocument1 pageREquest For Manual PaymentRACHEL DAMALERIONo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- Request For Confirmation of BalanceDocument2 pagesRequest For Confirmation of BalanceGreenweiz Projects LtdNo ratings yet

- State Bank of Patiala: Rtgs/Neft/Application FormDocument2 pagesState Bank of Patiala: Rtgs/Neft/Application FormAnonymous wfgcPmJYNo ratings yet

- Classic Jewellers: 5/32 Sarvodaya Estate, GM Road, Near Rly Crossing, Mumbai - 400 071 Tel No.: 022 25220987Document1 pageClassic Jewellers: 5/32 Sarvodaya Estate, GM Road, Near Rly Crossing, Mumbai - 400 071 Tel No.: 022 25220987bipinNo ratings yet

- Mail - RE - Claim Status - YFAE950884YF PDFDocument3 pagesMail - RE - Claim Status - YFAE950884YF PDFSankalp Suman ChandelNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word Documentvivek pittaNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Sub: Regarding Adjustment of Medical Bill: (Ramesh Chand)Document2 pagesSub: Regarding Adjustment of Medical Bill: (Ramesh Chand)MRIDULA SHARMANo ratings yet

- 25 - MCQ Late Filing Fees and PenaltyDocument12 pages25 - MCQ Late Filing Fees and PenaltyParth UpadhyayNo ratings yet

- Remittance@manager - In.th: of June 2014, The Reserve Bank of India (RBI) Governor, Dr. Raghuram Rajan and Ban Ki-MoonDocument1 pageRemittance@manager - In.th: of June 2014, The Reserve Bank of India (RBI) Governor, Dr. Raghuram Rajan and Ban Ki-MoonShyam SunderNo ratings yet

- NitinDocument2 pagesNitinNitin RaiNo ratings yet

- 2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFDocument1 page2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFMadhabi MohapatraNo ratings yet

- Wa0002.Document3 pagesWa0002.duz thaNo ratings yet

- ANKIT DESAI - 7778044242: Naresh Tradelink Pvt. LTDDocument1 pageANKIT DESAI - 7778044242: Naresh Tradelink Pvt. LTDAnkit A DesaiNo ratings yet

- Income Tax LetterDocument1 pageIncome Tax LetterBritish ConstructionNo ratings yet

- Work ScheduleDocument12 pagesWork ScheduleDonesh VarshneyNo ratings yet

- Remittance@manager - In.th: Reserve Bank of India Official Payment NotificationDocument1 pageRemittance@manager - In.th: Reserve Bank of India Official Payment NotificationpawansinghNo ratings yet

- Ref No: - DatedDocument4 pagesRef No: - DatedMustafain RazaNo ratings yet

- Calcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)Document6 pagesCalcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)rigiyanNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- HDFC Gaurav Letter of ExtensionDocument1 pageHDFC Gaurav Letter of Extensionsks65No ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- SSY Account Opening FormDocument2 pagesSSY Account Opening Formparagaloni8365No ratings yet

- Leave Encashment DeclarationDocument1 pageLeave Encashment DeclarationAshrutKumarNo ratings yet

- TAN - Khidmat Tours & Travels PVT LTDDocument1 pageTAN - Khidmat Tours & Travels PVT LTDSahab Uddin Ahmed ChoudhuryNo ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- Taxpayer NameDocument1 pageTaxpayer NameNeil Joshua Joloc (JoshuaJ)No ratings yet

- Atr 3472126Document1 pageAtr 3472126Vijay Kumar ThakurNo ratings yet

- AP 18 GST Pratitioners and OthersDocument2 pagesAP 18 GST Pratitioners and OthersNiileshNo ratings yet

- GST Update125 PDFDocument6 pagesGST Update125 PDFTharun RajNo ratings yet

- Reserve Bank of IndiaDocument2 pagesReserve Bank of IndiaJohn StanleyNo ratings yet

- Ind As 20Document7 pagesInd As 20Goutham HNo ratings yet

- PrintDocument1 pagePrintGoutham HNo ratings yet

- Account Statement As of 18-01-2022 21:00:46 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:00:46 GMT +0530Goutham HNo ratings yet

- GST ChallanDocument2 pagesGST ChallanGoutham HNo ratings yet

- Account Statement As of 18-01-2022 21:02:03 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:02:03 GMT +0530Goutham HNo ratings yet

- Gstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErDocument6 pagesGstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErGoutham HNo ratings yet

- Gstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErDocument2 pagesGstin Trade Name Taxpayer Type PIN Code Last Checked Registration Status Buldin G Numb ErGoutham HNo ratings yet